Does TV sports have a future? Bet on it TMT Predictions 2019

21 minute read

11 December 2018

The more often someone bets on sports, the more likely he or she is to watch sports on TV. How could TV sports broadcasters and the gambling industry turn this “gambling effect” to their advantage?

Deloitte Global predicts that in 2019, 60 percent of North American men aged 18–34 who watch sports on TV will also bet on sports—and the more often they bet, the more TV sports they’ll watch.

Why should that matter to the broadcasting industry? Read on to find out.

Much of the up-front discussion in this chapter focuses exclusively on the United States, and sometimes Canada, because those are the countries for which we have recent data from a large Deloitte survey. But we look at the global implications and angles in the chapter’s “Bottom line” section.

TV sports: An island of strength in an industry under pressure

Young people around the world are watching less traditional TV (live or time-shifted TV, on any device) these days, but the sports category is an island of relative strength. One of the reasons for this is that young people, especially young men, are betting on sports matches, and watching on TV those contests where they have “skin in the game.” In the United States, in fact, we predict that about 40 percent of all TV watching by men 25–34 years old will be driven by this factor.1

As an example of the relative resilience of TV sports, consider that, although 16–34-year-old men in the United Kingdom watched 42 percent fewer minutes of traditional TV per day in 2018 than in 2010—almost exactly the same percentage decline as among 18–34-year-olds of both genders in the US—traditional TV sports watching went down only 24 percent for the same demographic.2 We expect roughly the same pattern to continue in many countries in addition to the United States and the United Kingdom, with variations in years that have the Olympic Games and the FIFA World Cup.

More of what we think will happen: 15 further predictions about TV, TV sports, and sports betting

The scope of our research related to TV watching, TV sports watching, and sports betting makes it hard to resist formulating more opinions about what is likely to happen around these activities in the year ahead. For simplicity, we have categorized these 15 further predictions into those about TV watching in general, TV sports watching, sports betting, and the relationship between sports betting and TV sports watching.

TV watching in general

- Deloitte Global predicts that more than 80 percent of US 18–34-year-olds will watch at least some TV in 2019 (that is, TV will have a “reach” of 80 percent among this demographic). Within this age group, men will be more likely to watch TV (more than 85 percent) than women (less than 80 percent).

- Deloitte Global predicts, based on the multi-year downward trend for US 18–34-year-olds, that this demographic will watch fewer minutes of traditional TV per day (live and time-shifted) in 2019 than in 2018—but they will still watch an average of around 120 minutes, or two hours, per day. The number of people who watch traditional TV will be about the same as in 2018 ... they will just watch about 10 minutes less of it per day, on average.

- Deloitte Global predicts that not only will more 18–34-year-old US men than women watch TV in 2019, but they also will watch mre hours of TV than women of the same age. The median 18–34-year-old US male will watch about four hours more TV per week in 2019 than similarly aged US women—or approximately 16 hours for men and 12 hours for women.

- Deloitte Global predicts that, although the average US man aged 18–34 will watch about 16 hours of TV per week in 2019, roughly one in four men age 18–24 will watch more than 30 hours per week, as will about one in three men age 25–34.

TV sports watching

- Deloitte Global predicts that TV sports watching by US men age 18–34 will decline in 2019 compared to 2018—but only by about 5–7.5 percent.

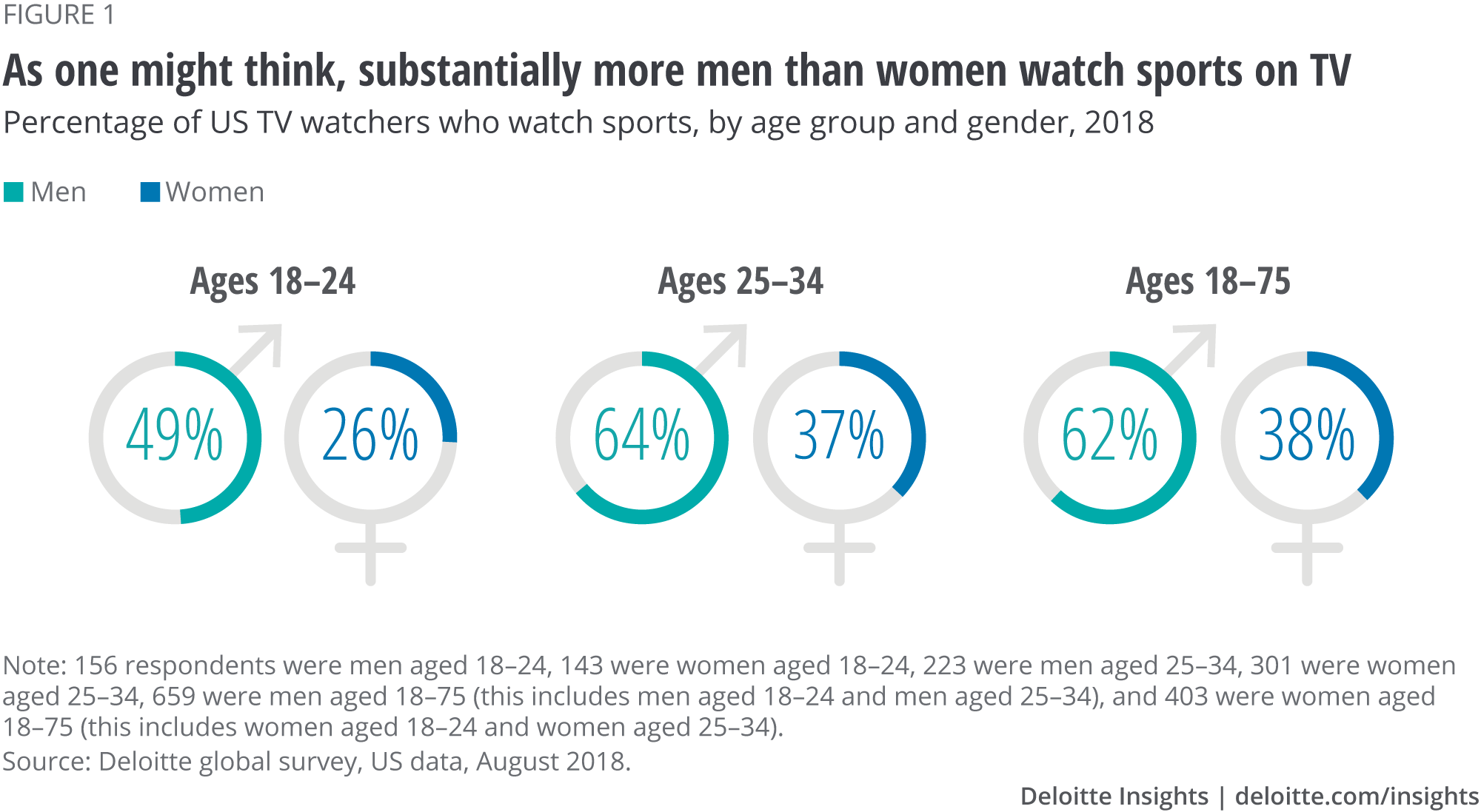

- Deloitte Global predicts that more than 60 percent of adult US men who watch TV will regularly watch sports on TV in 2019; around 40 percent of the US women who watch TV will do the same. We further predict that these proportions will be lower among younger individuals, both men and women. “Only” half of US men age 18–24 who watch TV will regularly watch sports—and only a quarter of women that age who watch TV will regularly watch sports. However, proportionately as many TV watchers age 25–34 of both genders will watch about as much TV sports, on average, as all adults.

- Deloitte Global predicts that, of those who watch TV sports, the average US man age 18–24 will watch more than 11 hours of sports TV per week in 2019, while US men age 25–34 will watch about 16 hours of TV sports weekly. Based on total TV watching rates, this suggests that TV sports will represent about two-thirds of all TV watching among men age 18–24, and more than three-quarters of all TV watching for men age 25–34 who watch TV sports.

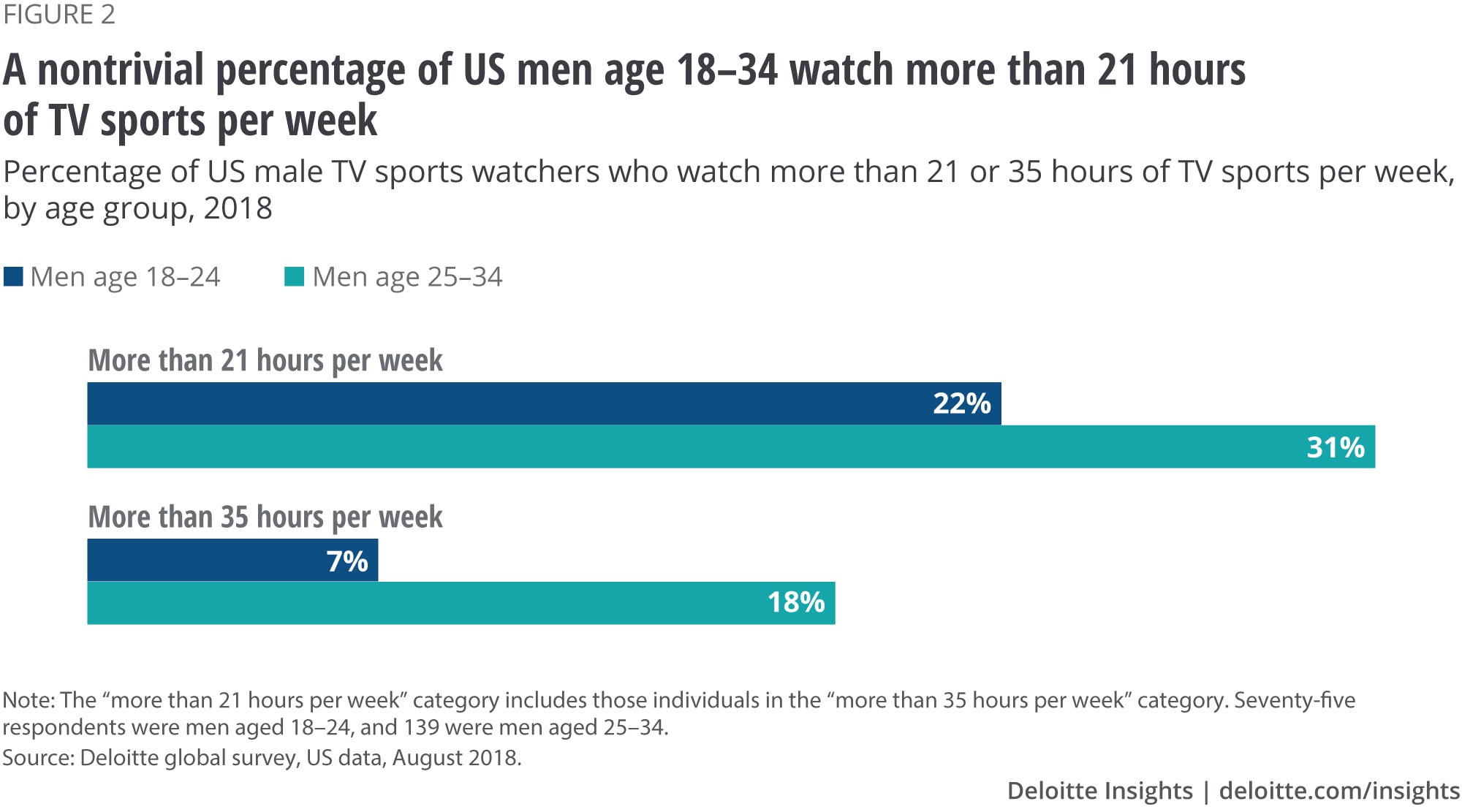

- Deloitte Global predicts that about 30 percent of US TV sports viewers aged 25–34 will be “superfans” in 2019, watching more than 21 hours of sports per week, and nearly 20 percent will be “super-superfans,” watching more than 35 hours of TV sports per week (five hours daily).

Sports betting

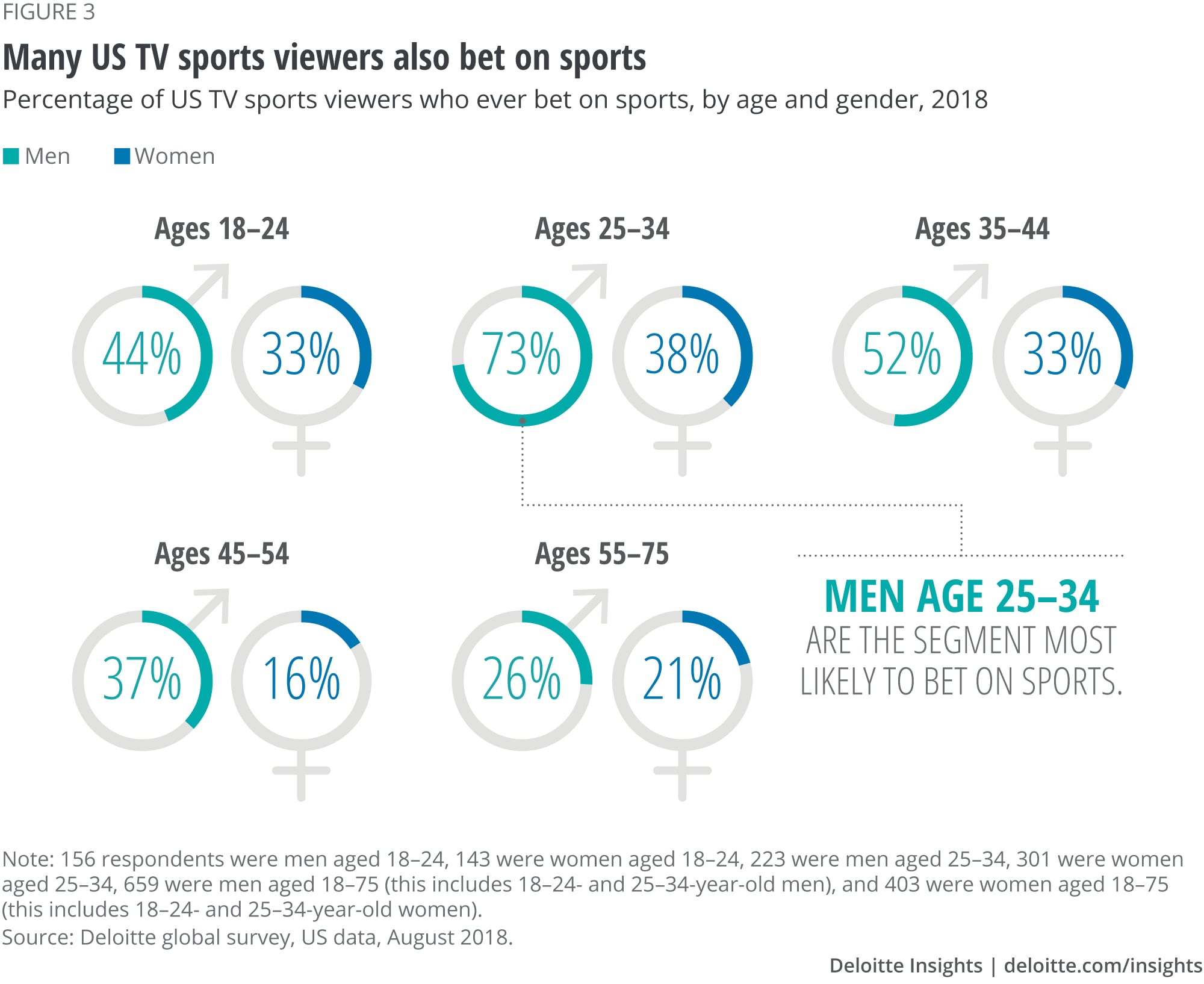

- Deloitte Global predicts that 40 percent of US adult sports TV watchers will bet on sports at least occasionally in 2019, with men of all ages more likely than women to bet. Further, Deloitte Global predicts that this gender disparity will be greater in the demographic of those age 25–34: Less than 40 percent of female US TV sports viewers that age will bet on sports in 2019, but nearly three in four male US TV sports viewers that age will do so.

- Deloitte Global predicts that more than 40 percent of US men age 18–34 who watch TV sports will bet on sports weekly or more often in 2019. In contrast, less than 15 percent of women that age will bet that often. Also, of all TV sports watchers who are 55–75 years old, less than 5 percent will bet weekly. In fact, half of all weekly sports bettors in the United States will be men age 25–34 who watch TV sports.

The relationship between sports betting and TV sports watching

- Deloitte Global predicts that, in 2019, more than half of all US and Canadian male sports viewers who bet on sports will be much more likely to watch games they have bet on. This tendency will be even more pronounced among men aged 18–34 in both countries; more than two-thirds of these will be much more likely to watch a game they have bet on. Conversely, this effect will be less strong among US women, with less than half of women who both bet and watch sports being much more likely to watch games they have bet on.

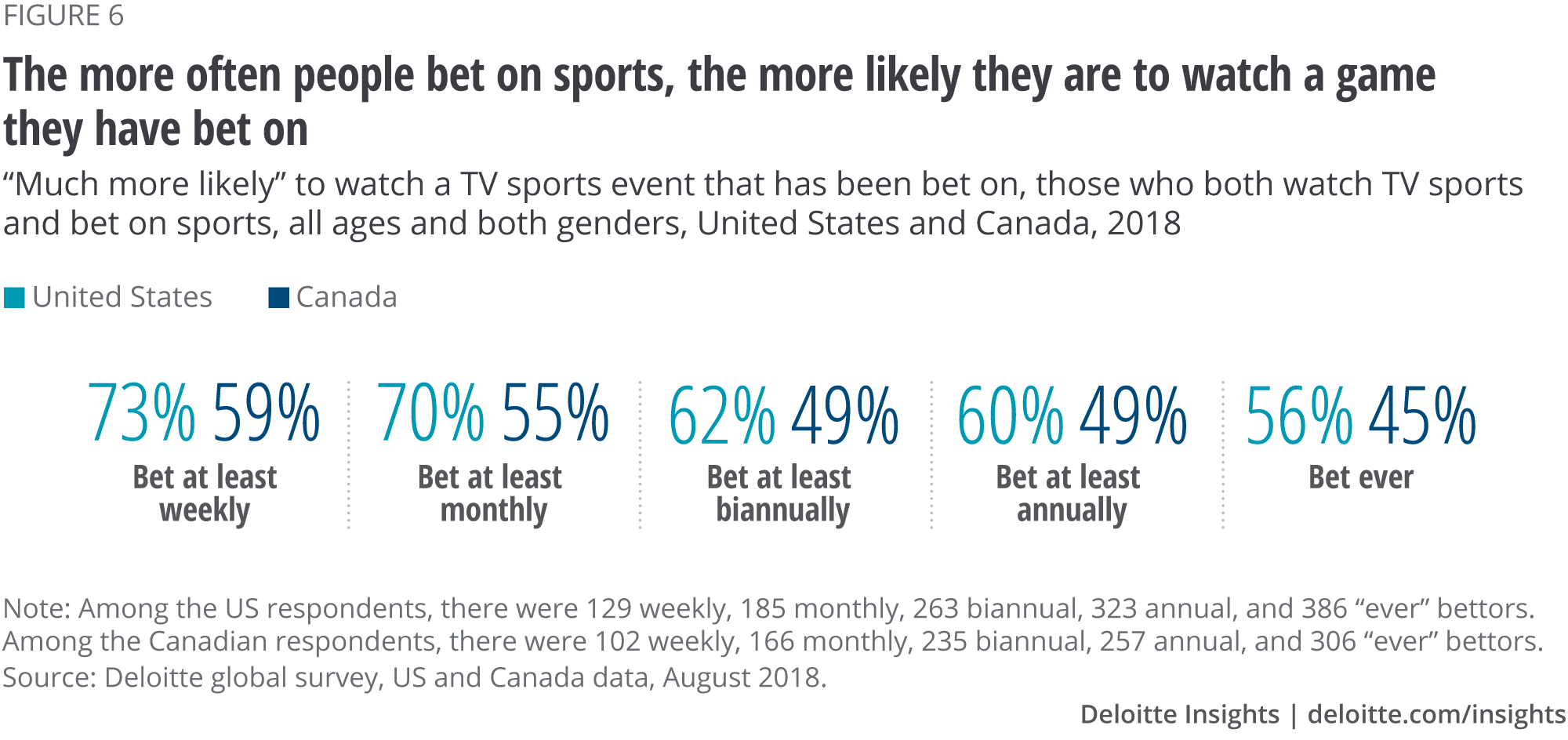

- Deloitte Global predicts that, in 2019, those who bet on sports most frequently will be the most likely to watch the games they have bet on, with three-quarters of individuals in the United States who bet on sports at least once per week watching the games they have bet on.

- Deloitte Global predicts that US sports watchers who bet weekly or more in 2019 will watch the most sports per week on TV (around 20 hours), and that they will watch sports twice as much as those who do not bet on sports.

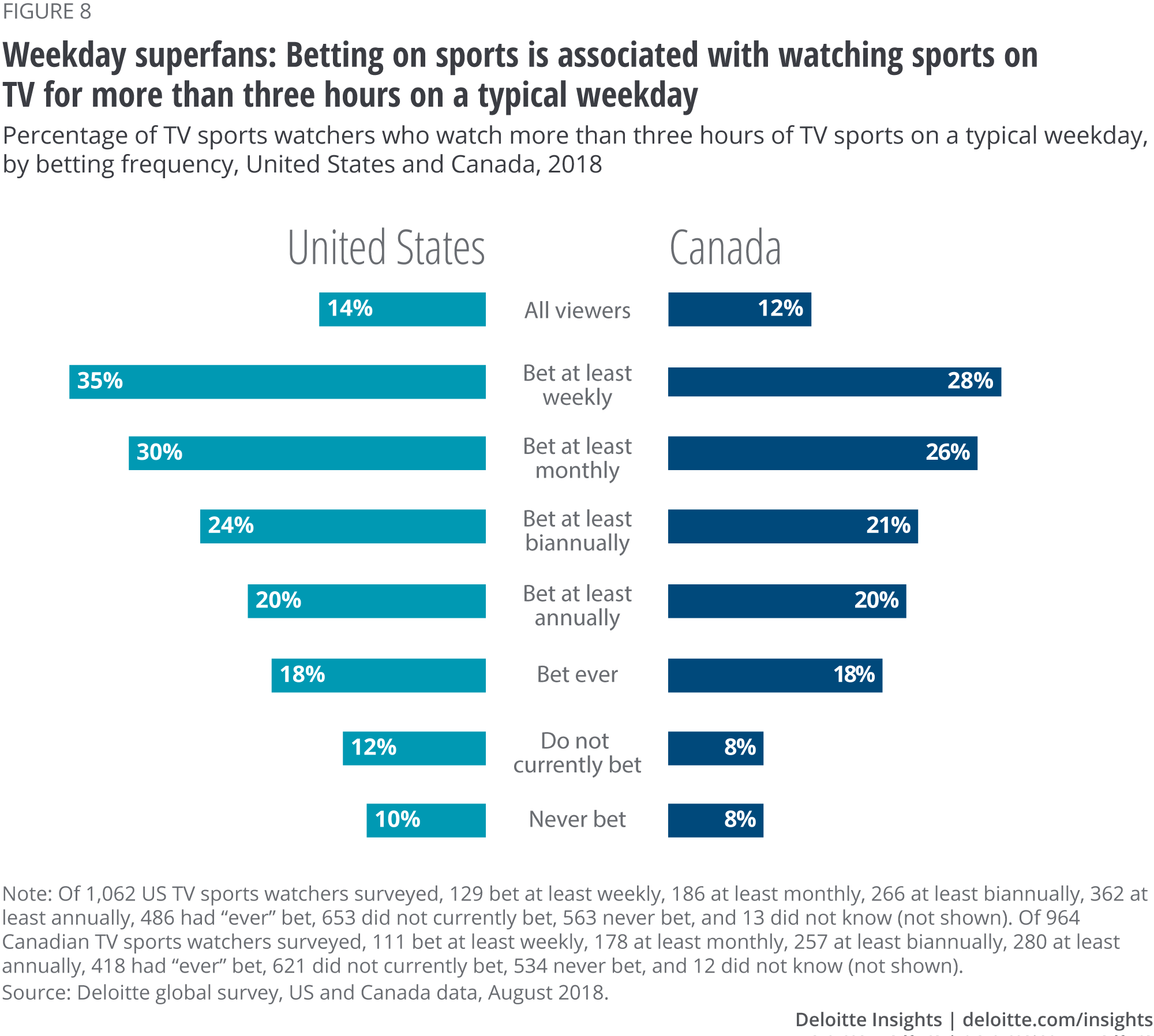

- Deloitte Global predicts that betting and being a superfan or super-superfan will be closely linked. More than a third of those who bet on sports at least weekly in the United States will be superfans, compared to only 10 percent of those who never bet; about a quarter of those who bet weekly will be super-superfans, watching TV sports more than five hours per day, compared to only 2 percent of those who don’t bet.

- Putting it all together, Deloitte Global predicts that 40 percent of all TV watching by US men aged 25–34 in 2019 will be of TV sports, and their watching behavior will be heavily influenced by betting activity.

The stereotype is that men watch more TV sports than women, and our research confirmed that perception to be true. Forty-nine percent of 18–24-year-old men who watch TV in the United States watched at least one sports broadcast (including live sports, sports talk shows, and highlights shows) in 2018, compared to 26 percent of US women of the same age. Similarly, 64 percent of 25–34-year-old US men watched TV sports, while only 37 percent of US women the same age did (figure 1).

If we focus on male US TV sports-watchers between the ages of 18 and 34, we see that not only do they watch some TV sports, they watch a lot of TV sports. In the typical week, the median 18–24-year-old US man said he watched 1.66 hours of sports on the average weekday, 1.67 hours on the average Saturday, and 1.87 hours on the average Sunday (likely showing the impact of National Football League (NFL) football), a total of 11.8 hours per week. The median 25–34-year-old US male spent even more time watching TV sports: 2.33 hours on weekdays, 2.52 hours on Saturdays, and 2.66 hours on Sundays, for a total of 16.8 hours per week.

Learn more

Listen to the related podcast

Explore the related charticle, view the infographic or watch the video for this prediction

View TMT Predictions 2019, download the full report, or create a custom PDF

In a hurry? Read a brief version from Deloitte Review, issue 25

Create a custom PDF or download Deloitte Review, issue 25

Download the Deloitte Insights and Dow Jones app

In fact, TV sports represents 64 percent and 74 percent of all TV watched by US men in the 18–24- and 25–35-year-old age groups, respectively. This is a straightforward calculation based on our finding that 18–24-year-old TV-watching US men spent a median of 18.5 hours a week watching TV (of any genre), and that 25–35-year-old US men spent a median of 22.7 hours a week watching TV.

Not surprisingly, there is also a hard core of fans who watch much more TV sports than average (figure 2). Twenty-two percent of the US men aged 18–24 who watch sports on TV, and 27 percent of the US men aged 25–34 who watch sports on TV, watch more than three hours of TV sports on a typical weekday; 20 percent and 30 percent, respectively, said they watched more than three hours of TV sports on Saturdays, and 23 percent of the younger group and 36 percent of the older group said they watched TV sports for more than three hours on Sundays. This suggests that about 22 percent of 18–24-year-old US male TV sports watchers, and about 31 percent of 25–34-year-old US male TV sports watchers, are consuming more than 21 hours of TV sports every week. We call this group “superfans”—individuals who watch more than three hours of TV sports on a typical day.

Nor is this the upper limit. Eighteen percent of male US TV sports watchers aged 25–34 qualify as “super-superfans”: They typically watch more than five hours of sports TV every day, whether weekday, Saturday, or Sunday. Roughly one in five men in this age group watches more than 35 hours of TV sports per week. That translates to about 10 percent of the total 25–34-year-old US male population watching that much.

Some might be incredulous that anyone actually watches five hours of TV sports every day, and go on to wonder if such people are even attractive to TV advertisers. Interestingly, however, while about 6 percent of employed Americans who watched TV sports watched it for more than five hours on weekdays, only 3 percent of those without jobs did likewise. Affordability is a likely factor for this: It is easy to watch more than five hours of nonsports TV per day for free or a minimal cable bill … but watching five hours of TV sports often requires a premium cable package and more money.

Now, let’s talk about gambling

Globally, gambling is a roughly half-trillion-dollar (USD) industry. Betting on sports tends to make up about 40 percent of the total market, or around US$200 billion per year. One report estimates that sports betting will grow at nearly 9 percent per year between 2018 and 2022.3 In the United Kingdom in 2017, sports betting had £14 billion in turnover.4 In the four Nordic countries, legal gambling of all kinds was an approximate €6 billion industry in 2015.5 It is estimated (since measuring unregulated/illegal gambling precisely is difficult) that the “handle” (total amount wagered) for unregulated sports betting in the United States was US$169 billion in 2018.6 Of that amount, one estimate posits that Americans bet US$93 billion per year (mostly illegally) on professional and college football.7 For purposes of comparison, the US NFL made about US$14 billion in revenue from all sources in 20178 … which suggests that the wagering market for American football is possibly four to five times larger than all gate admissions and TV rights combined.

So, gambling on sports is a big deal. But what does this have to do with TV watching?

As can be inferred from the size of the US betting industry, gambling on sports is a widespread behavior. More than 25 percent of American men who watch sports on TV, regardless of their age, bet on sports at least once a year, and between 17 percent and 33 percent of American women do the same. About 40 percent of all Americans aged 25–34 (whether sports fans or not) bet on sports; among US men of that age who watch TV sports, that proportion rises to three-quarters.9 But although many American TV sports viewers are betting, they do not all do so with the same frequency (figure 3).

As figure 4 shows, there is a remarkable pattern around TV sports watching and betting on sports. Although most Americans of all ages and both genders watch TV sports, and many of these bet on sports at least occasionally, regular betting on sports (once a week or more) is highly concentrated among men age 25–34. In fact, of all those who reported betting on sports at least weekly, 44 percent were men aged 25–34. Even more noteworthy, not only do 43 percent of men in this age group bet on sports at least weekly, but 21 percent of those in that group who watch TV sports bet daily. In our sample, of all the people who say they bet on sports daily, more than half were men age 25–34, and 85 percent were men of any age. Only 15 percent of these heaviest bettors were women.

One might suppose that someone who has bet on a game would be more likely to watch that game than if he or she had not bet on it, and we find this to be the case (figure 5). As can be seen in Figure 5, more than half of all TV sports watchers in the US who bet on sports say that they are much more likely to watch a game they have bet on, and another 18 percent say they are a little more likely to watch a game they have bet on. When we drill down to 18–34-year-old men, more than two-thirds are much more likely to watch games they have bet on, and 85 to 90 percent are at least somewhat more likely to watch such games. Here again, there is a gender divide, with a smaller percentage of female than male sports viewers saying they are more likely to watch a game because they have bet on it.

Although one might think that the likelihood of watching a game that one has bet on would have nothing to do with how often one bets on games, that does not seem to be true. Instead, there is a fairly linear relationship between the likelihood of watching a game one has bet on and the frequency of betting on games overall (figure 6): As the frequency of betting increases, so too does the probability or propensity that the bettor will watch the game on TV. To be clear, more than half of all sports bettors, regardless of how often they bet, say they are much more likely to watch the games they have wagered on—but that proportion rises to nearly three in four for the most frequent bettors as opposed to “only” 56 percent for infrequent wagerers. This phenomenon holds for all ages and both genders. As can be seen in the same figure, the same relationship is evident in Canada, although it is a little more muted than in the United States.

The propensity to watch the games one has bet on based on frequency of betting seems to translate directly into more hours per week of watching sports on TV (figure 7). Considering all of the sports viewers in the United States (including bettors and nonbettors) as a single group, we know that they watch about 12 hours of sports per week—but those who never bet on sports average just over 10 hours while those who bet weekly or more average more than 20 hours, or almost exactly twice as much as those who don’t bet at all. Again, the relationship seems highly linear: As gambling frequency goes up, so does weekly viewing time. Also notable is that the “gambling effect” is much more noticeable for weekday TV sports watching. On weekends, the most-frequent bettors watch about 6.4 hours of TV sports over the two days, or 60 percent more than the approximately four hours spent watching sports TV by nongamblers. But on weekdays, nongamblers watch TV sports for an average of only 1.25 hours daily, while the heaviest gamblers watch 2.8 hours, or 160 percent more. To put it simply, it appears that weekend TV sports has broader appeal, while weekday TV sports appeals more to the hard-core watchers—and gambling or not gambling on the games makes a bigger difference.

Not only does the average time spent watching TV sports rise as betting frequency rises, but we also see a direct and linear relationship between betting frequency and being what we call a TV sports superfan (figure 8). Only 10 percent of those who never bet on sports are weekday superfans, watching more than three hours of TV sports on weekdays. Among those who bet most frequently, that proportion rises to 35 percent—3.5 times more than those who don’t bet at all. (We are focusing on weekday watching behavior in this paragraph, on the assumption that many Americans and Canadians—bettors and nonbettors—watch TV sports on the weekends when they have more free time, but that those who watch three or more hours of TV sports on weekdays are particularly interesting to broadcasters and sports leagues.) Again, the results from Canada parallel the US results almost perfectly, adjusting for the slightly lower tendency to watch TV sports in Canada.

The betting effect is even stronger when it comes to weekday super-superfans (figure 9). Those who watch more than five hours of TV sports per weekday are split sharply along the gambling line: Only 5 percent of all US sports TV watchers watch it for five-plus hours on the typical weekday; only 2 percent of nonbettors do so, but a whopping 23 percent of those who bet on sports weekly or more often—10 times more than the non-gamblers—qualify as weekday super-superfans.

Bottom line

It will be little surprise to most that young men watch a lot of sports on TV, that they watch more sports than women do, or that they gamble. What is new is how important TV sports watching is for men age 18–34, how frequently some of them gamble, and how close the relationship is between gambling frequency and watching more TV sports. Broadcasters, distributors, and advertisers could do well to undertake further research to examine this relatively unexplored correlation.

It seems probable that this driver of TV watching may make TV watching more resilient than some critics expect. Live TV sports watching motivated by gambling may boost overall TV-watching statistics among younger demographics, either slowing the decline somewhat, or perhaps even providing a floor.

That said, the “gambling effect” on TV sports watching may show significant variation by country. Even between the United States and Canada, two markets that tend to be very similar, the relationship between TV sports watching and gambling showed small but important differences. Based on focus group studies done by Deloitte France and Deloitte Nordics, we would expect the relationship between gambling and TV sports watching among men age 18–34 to be much higher in North America than in France,10 but possibly similar to that in North America in the Nordic countries—especially in Norway and Finland, where more than 60 percent of the young men in our focus groups engaged in gambling. Interestingly, in the Nordics, women aged 18–34 were much less likely to gamble (on anything, not just sports) than women of that age in North America. In countries with less of a gambling culture, it seems likely that TV sports, and TV watching itself, may be less resilient.

Indeed, it is interesting to speculate in which countries the “gambling effect” on TV sports watching might be stronger than in others. Examining gambling behavior in different countries may hold a clue. A 2016 study looked at per-capita gambling losses, which correlate well with total gambling activity, in selected countries.11 The study showed that, while the United States and Canada reported per-capita gambling losses of US$400–500, Australia, Singapore, Ireland, Finland, and New Zealand’s per-capita gambling losses were at or above US or Canadian levels, nearing US$1,000 per capita in Australia. Based on these findings, it would seem reasonable to infer that sports betting could be a large factor in driving TV sports watching in these countries.

Although all markets matter, the US TV market, at around US$250 billion per year (for TV broadcasters and distributors),12 is the largest, and TV sports is a big part of that market. Even though most of the sports gambling that occurs is illegal and unregulated in the United States, it still has a large impact on TV-watching behavior. Also, the US Congress is currently reviewing gambling laws,13 and any measures that allow Americans to gamble more easily or more often could have an effect—likely a positive effect—on TV sports watching. Consider that a 2015 study by the American Gaming Association concluded that millions more US football fans would bet on NFL games if gambling were legalized—and that, if sports betting were legal, sports bettors would represent 56 percent of all minutes watched of regular-season NFL games.14

It’s hard to escape the conclusion that companies that make and distribute TV sports should talk more to, partner with, or even acquire those companies that are involved with sports betting. Or vice versa. It is clear from our research that the two industries, at least as far as American men 18–34 years old are concerned, are not sitting in splendid isolation.

For those worried about problem gambling, it is worth noting that we do not believe that the size of the bet matters much. Although our survey asked about betting frequency rather than wager size, in the focus groups where we developed the survey, we heard from participants that the amount they bet on a game was more or less irrelevant to their increased propensity to watch it. Bettors were equally more likely to watch a game that they had bet (say) US$10 on as a game they had bet US$50 on. This means that, although the gambling industry makes most of its money from “whales” (those who bet heavily), sports broadcasters and distributors need only think about driving sports viewing by tapping into increased betting frequency. They don’t need to encourage large bets to do that.

Where will all this lead? As a thought experiment, one can imagine a 30-year-old American man in the year 2025 (yes, it could be a woman too, but our survey results show that it is much more likely to be a man) watching a football game on the TV set, smartphone in hand. He can bet on the match at any point, modify his wager, buy back a losing wager, bet on the outcome of individual plays or individual stats such as the number of passing yards by the quarterback—all in real time, and all tailored to him. Ads could be served that are customized for him, informed by his betting and attention, and watching would have to be 100 percent live. The broadcaster or betting site could not only charge more for ads seen by such an involved viewer, but even have a share in (or own outright) the profits from the betting/video stream … at margins much higher than the usual for TV broadcasting. To an American, this sounds like science fiction, but in the United Kingdom, these solutions (or variations of them) are available today.

Will this come to America? Will young men use it? Will it drive increased watching of live TV sports matches?

We would bet on it.

© 2021. See Terms of Use for more information.

Explore the collection

-

Artificial intelligence: From expert-only to everywhere Article6 years ago

-

Quantum computers: The next supercomputers, but not the next laptops Article6 years ago

-

Radio: Revenue, reach, and resilience Article6 years ago

-

3D printing growth accelerates again Article6 years ago

-

Does TV sports have a future? Bet on it Article6 years ago