Digital media trends survey Video gaming goes mainstream

15 minute read

10 June 2019

Kevin Westcott United States

Kevin Westcott United States Jeff Loucks United States

Jeff Loucks United States David Ciampa United States

David Ciampa United States Shashank Srivastava India

Shashank Srivastava India

As content creators increasingly adopt direct-to-consumer models, video gaming has become a legitimate competitor to TV and movies. What are the implications for strategic planning? Product and partnership development?

As the media and entertainment (M&E) industry prepares for seismic shifts in video, new behavioral trends reveal that video gaming could provide more disruption in the battle for consumers’ attention and should be factored into most M&E companies’ strategic planning. These shifts are increasing the legitimacy of gaming, which could also prompt video game makers and publishers to develop direct-to-consumer offerings and foster deeper ties with media and entertainment companies.

A look at the changing nature of media consumption

Learn more

View more from the Digital media trends survey, 13th edition

Expore the Technology, media & entertainment collection

Over the past few years, the growth in gaming across generations has been dramatic and swift. Overall, 30 percent of US consumers pay for a gaming subscription service, and 41 percent play video games at least weekly, according to Deloitte’s Digital media trends survey, 13th edition. Indeed, there are more millennials, now, who have a gaming subscription than those with a traditional Pay TV subscription—and close to one-half of millennials and Gen Z pay for both a gaming and video streaming service.1 Increasingly, gaming has become integral to how many consumers are piecing together their own entertainment experience.

Recently, many entertainment executives also acknowledged how video games, such as Fortnite, which alone has attracted 250 million players in less than two years,2 have become legitimate competitors in vying for consumers’ free time. At the same time, the explosion in direct-to-consumer (DTC) subscription services ahead of high-profile DTC launches from technology companies and Hollywood studios has resulted in many media companies having to navigate a competitive environment that is in flux.

Key shifts in subscriptions economy

As consumers increasingly curate their own entertainment experiences, gaming is coming to the forefront. The compelling shifts among millennial consumers (which now includes people up to age 35 years old) reached an inflection point, with video gaming subscriptions edging ahead of Pay TV subscriptions—53 percent versus 51 percent according to Deloitte’s Digital media trends survey, 13th edition. Just one year ago, video gaming subscriptions among millennials were at 44 percent and Pay TV subscriptions were 52 percent, indicating a significant shift in momentum.

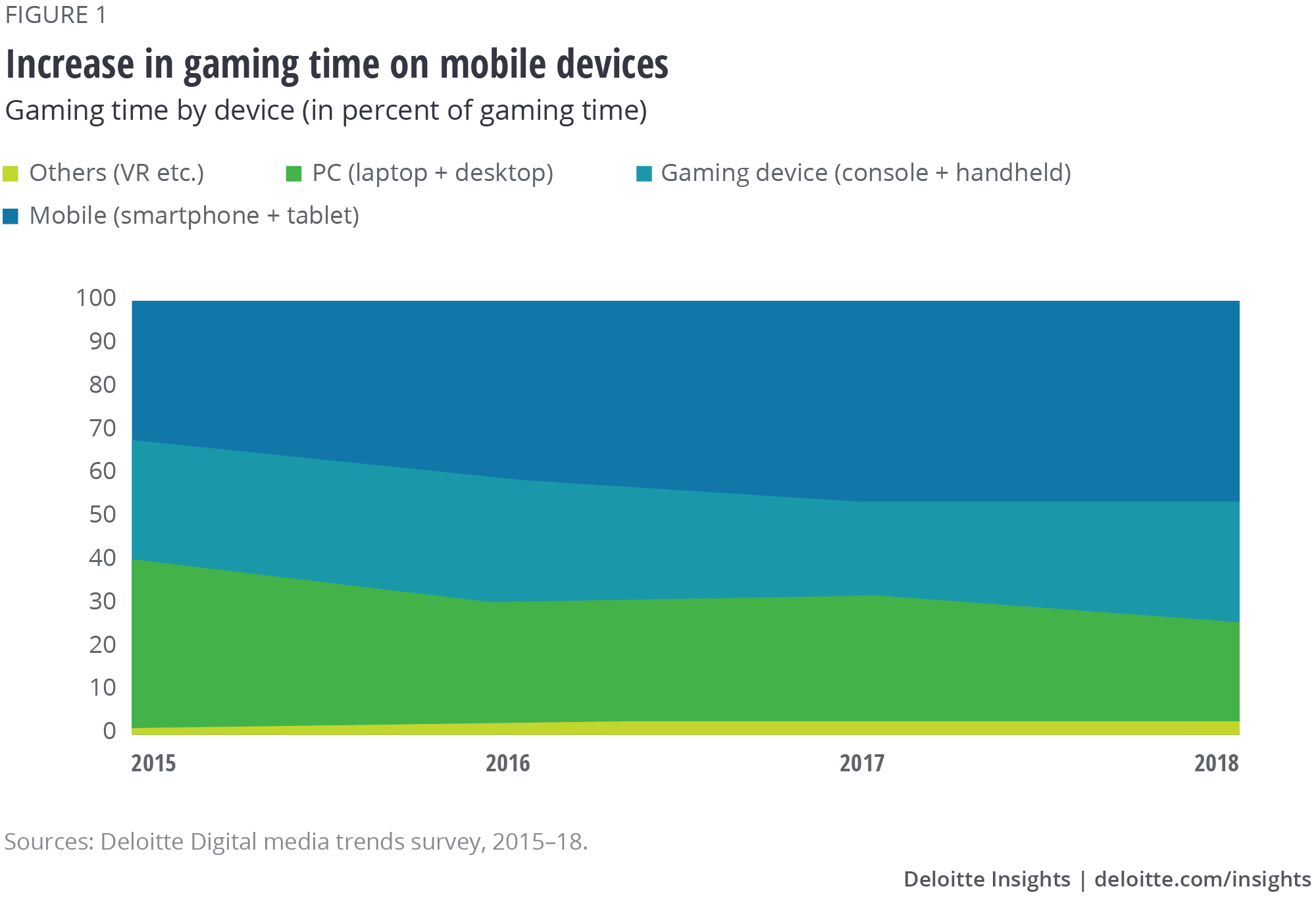

Within gaming, other shifts are happening, too. Consumers are moving away from traditional video gaming platforms, such as personal computers (PCs), to mobile and app-based gaming platforms. In 2015, 77 percent of gamers played on PCs (laptop and desktop computers). That number has now declined to 48 percent, while the proportion of gamers who play on mobile devices (smartphones and tablets) grew from 70 percent in 2015 to around 80 percent in 2018. In terms of share of total gaming time, PC gaming has dropped by almost one-half, from 39 percent in 2015 to 22 percent in 2018, despite professional esports having a strong PC footprint. In contrast, gaming time on mobile devices grew from 32 percent in 2015 to 47 percent in 2018.3

Mobile versus console gamers

While the proportion of US consumers who play video games has remained steady at 70 percent in recent years, the preferred platform has shifted. Traditionally, consumers have played on consoles or PCs, but now, the percentage of time spent gaming on mobile devices has eclipsed these more traditional gaming platforms according to our survey.

Overall, the shifts in video gaming by platform indicate that more time is being spent gaming. The shift to mobile as a video gaming platform hints at increased usage by nontraditional gamers. And although PC gaming has decreased by percentage of total gaming time, a large portion of professional and competitive sports gaming still happens on PCs.

We analyzed US video gamers based on game play platform dominance (see figure 2), with a platform deemed dominant if it accounted for more than 50 percent of total gaming time (for example, PC gamers who use their computers for more than 50 percent of total gaming time).4

How people game, by platform

- PC-dominant (15 percent of the gaming population): Use laptops or desktops more than 50 percent of the time

- Mobile-dominant (39 percent of the gaming population): Use smartphones or tablets more than 50 percent of the time

- Console-dominant (23 percent of the gaming population): Use a console or handheld device more than 50 percent of the time

- Multiplatform players (23 percent of the gaming population): Toggle between platforms and use multiple devices, including VR headsets

We will focus on the two biggest video gaming platforms by proportion of overall video gaming time: mobile and console.

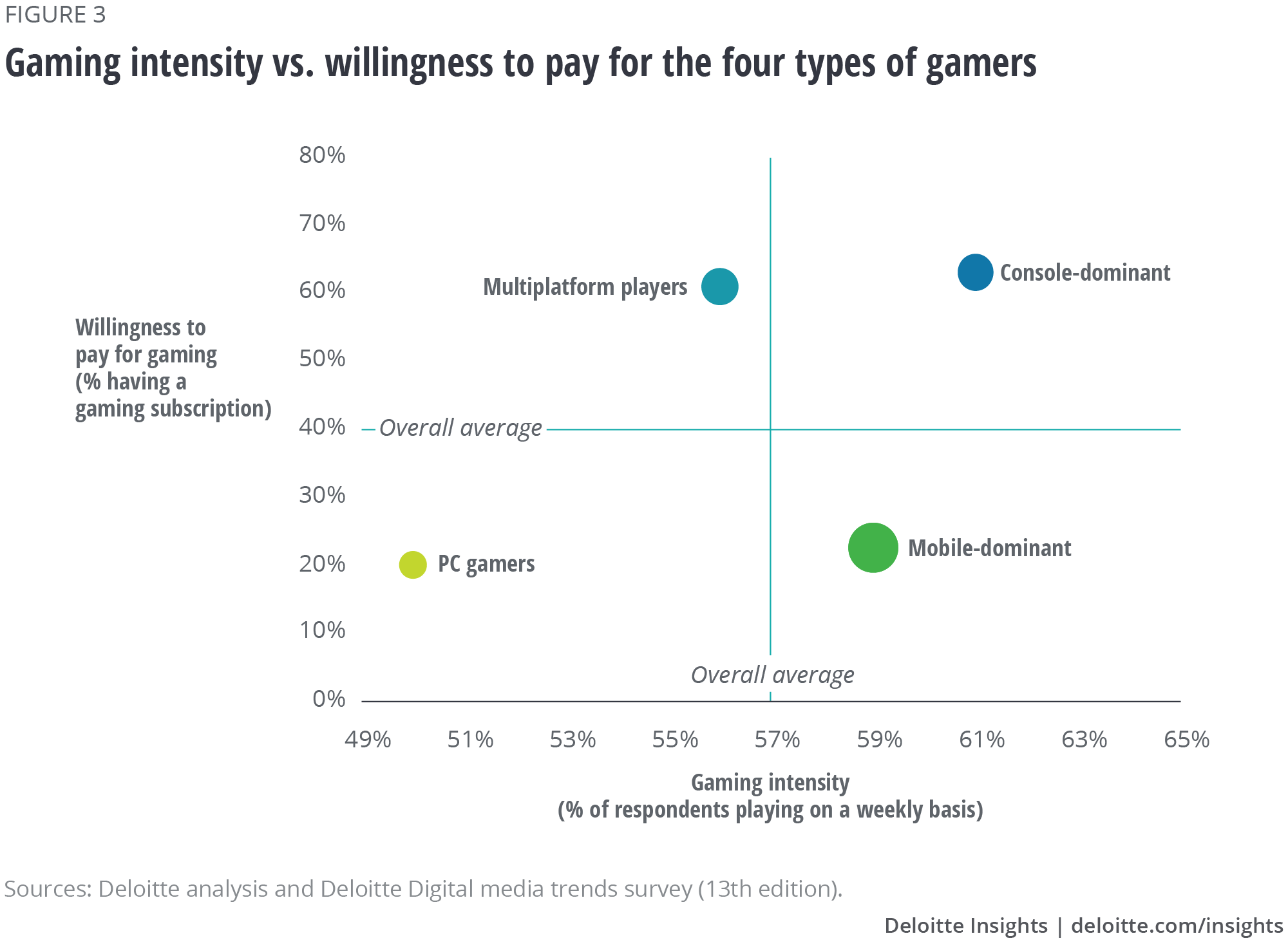

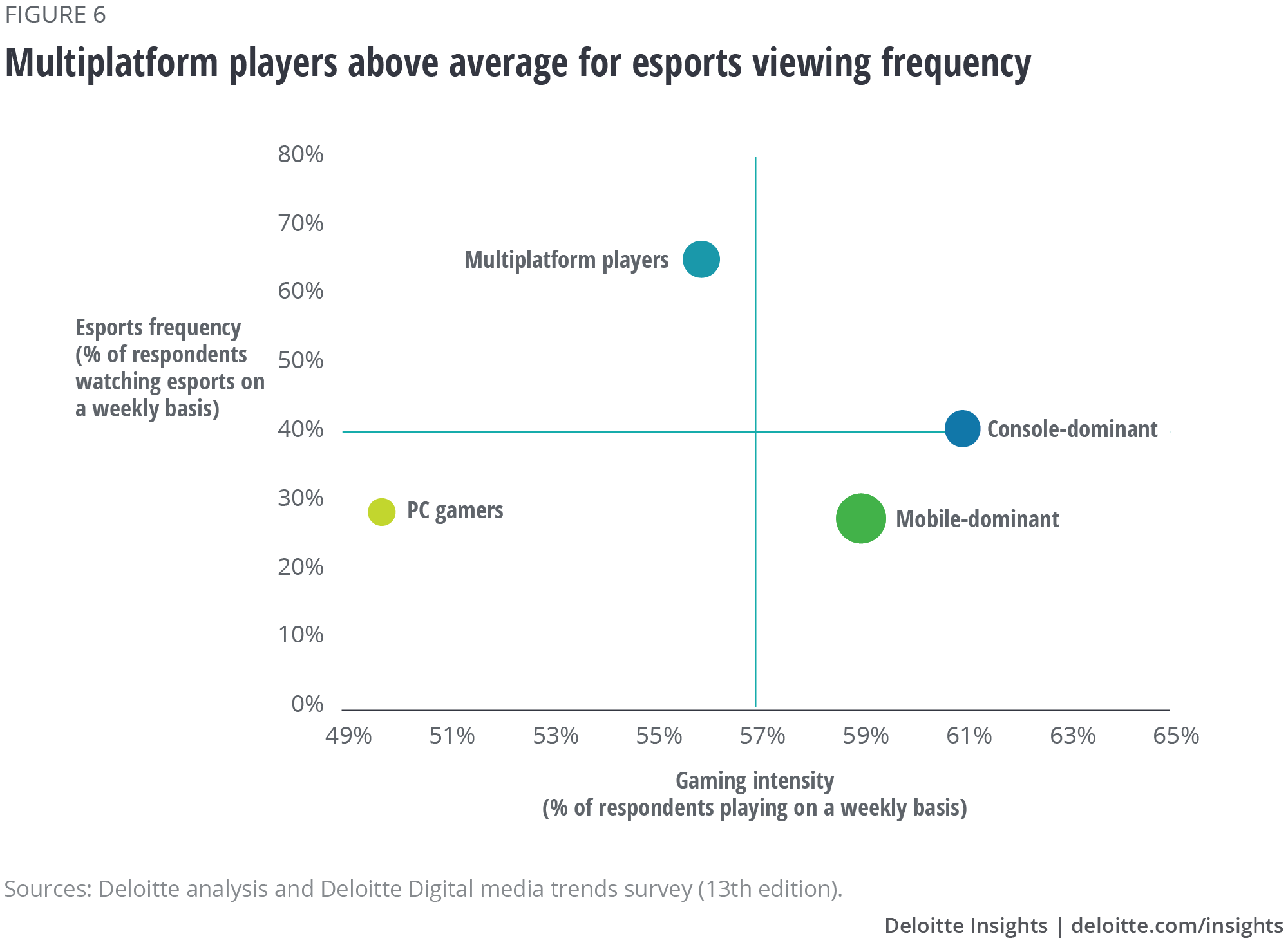

Mobile-dominant gamers. Hardcore gamers can be dismissive of mobile gaming; they often don’t regard it as “pure” gaming. But given that mobile is the most popular gaming platform across all consumers, it cannot be ignored. Mobile platforms also attract a bigger, new gaming audience than other platforms. And mobile most seamlessly integrates with social media, enabling new forms of interactive and social media gaming, such as chat fiction.5 Further, mobile-dominant gamers exhibit the second-highest gaming intensity (figure 3) with 59 percent playing at least weekly—above the 57 percent average across all gamers, but below the 61 percent of gamers who prefer consoles.6

Advertisers and brands may be interested to learn there are distinct differences between mobile-dominant gamers and traditional gamers. Sixty-five percent of mobile-dominant players are female, compared to 35 percent of console-dominant and 44 percent of PC-dominant players. Further, 33 percent of mobile-dominant players are from Gen X and 29 percent are baby boomers, compared to 28 percent and 9 percent, respectively, among console-dominant gamers.7

In terms of how these consumers interact with advertising, they may be most influenced by television commercials and product placement in TV shows. This makes sense considering that 48 percent of mobile-dominant gamers watch more than five hours per week of TV shows, compared to 42 percent for video game players overall.8 Mobile-dominant game players watch 21 hours of live broadcast TV per week, compared to 18 hours for all gamers, and 20 hours for all consumers.9 In relation to other forms of media and entertainment, 54 percent of these gamers stream video at least once a week, while more than one-half view live broadcast TV.10

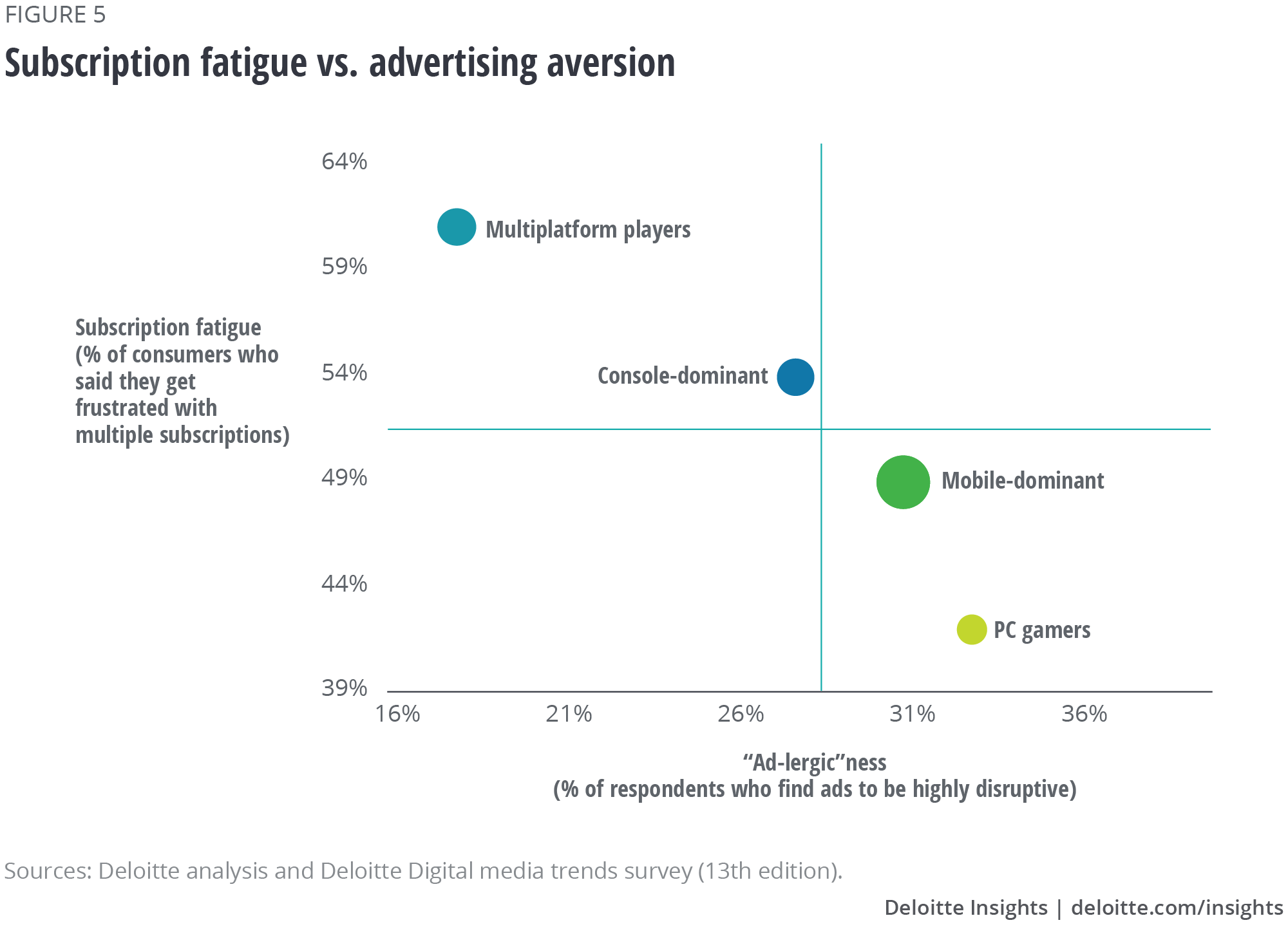

As more media and entertainment services become available through direct-to-consumer platforms that can be instantaneously activated or canceled, it will likely become increasingly important for companies to find ways to reduce the friction consumers are feeling. Among mobile-dominant game players, the ratio of consumers who say they are inundated by too much advertising (“ad-lergic”) to those who say they are frustrated by having to manage multiple subscriptions (“subscription fatigue”) is higher than it is for console-dominant gamers (see figure 5).

To address these sources of friction, Pay TV operators could offer products that combine traditional TV, video streaming, and gaming subscriptions. The usage trends on mobile show that some traditional gaming publishers that expanded franchise titles into mobile have experienced success. In 2018, Epic Games launched Fortnite on mobile; in less than a year, it was ranked second only to Candy Crush Saga in daily transactions value,11 revealing an appetite for bigger franchise adaptations among mobile gamers.

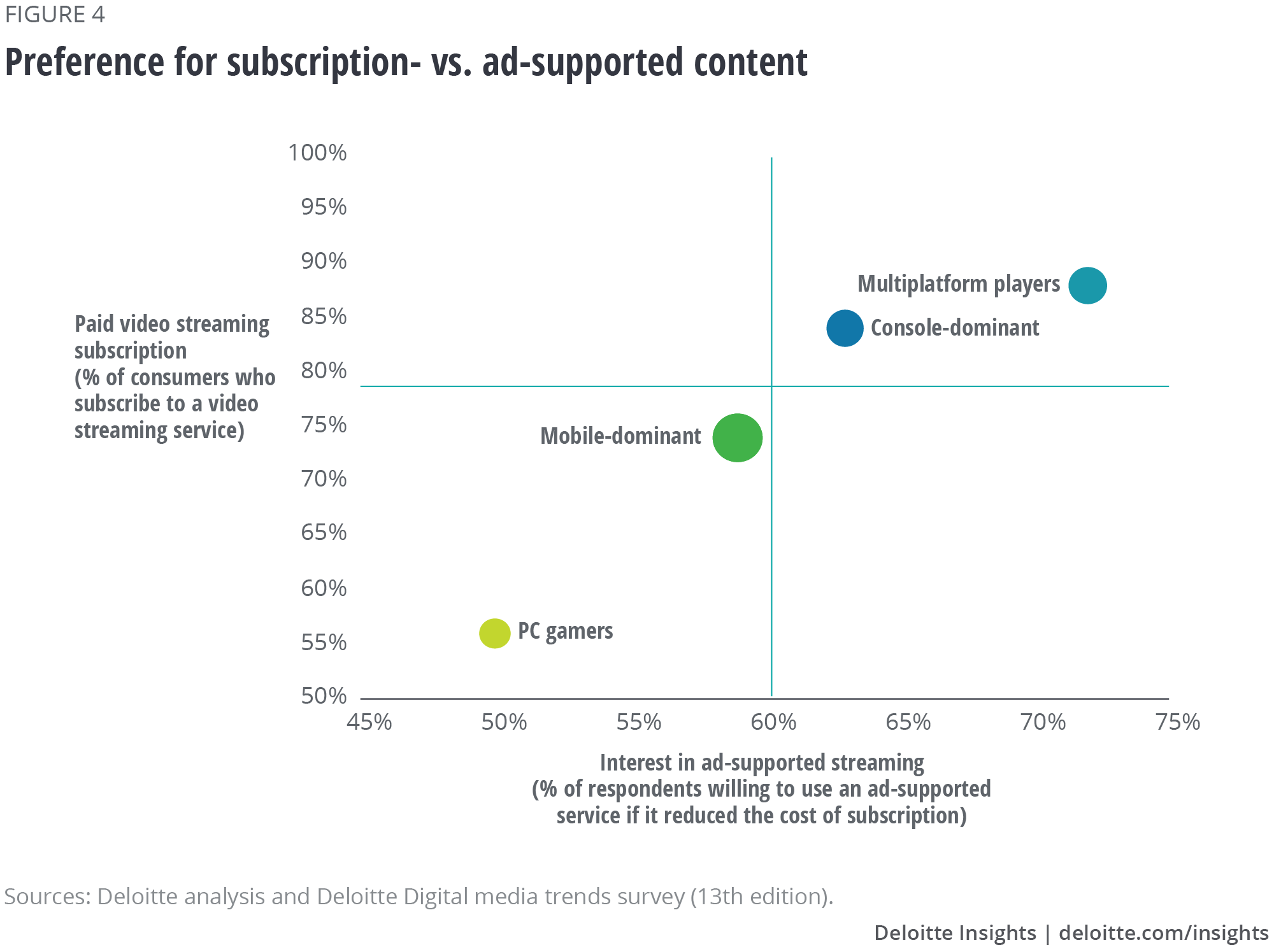

Console-dominant gamers. Gamers who prefer to use consoles are most likely to have a gaming subscription (63 percent) and they have the highest gaming utilization, with 61 percent playing at least once a week.12 More broadly, console gamers tend to value video streaming more than traditional Pay TV. Although they watch the least amount of live broadcast TV, when they do, they watch the most live sports: 31 percent watch more than four hours per week compared with an average of 24 percent across all gamers.13 Console-dominant gamers gravitate toward paid and ad-supported video streaming services; they stream 17 hours of video per week and 84 percent pay for a video streaming subscription service.14 Compared to mobile-dominant players, console gamers may be more frustrated by having to manage multiple streaming services than they are by advertising disruptions. In terms of reaching and influencing these gamers, video-game advertising, unsurprisingly, likely has the greatest impact.

Our survey showed that console-dominant gamers place a high value on gaming subscriptions and original content. In addition, given the percentage of console-dominant consumers who watch esports events at least once a week, they have above-average esports viewing frequency. To respond to these trends, connectivity and entertainment providers could target these gamers by offering fast broadband and console-related video services, such as live sports, monetizing this audience more optimally through over-the-top (OTT) ad-supported services. Video gaming companies, meanwhile, could offer higher-priced gaming subscription services that could include access to exclusive original content and esports events.

Rise of esports

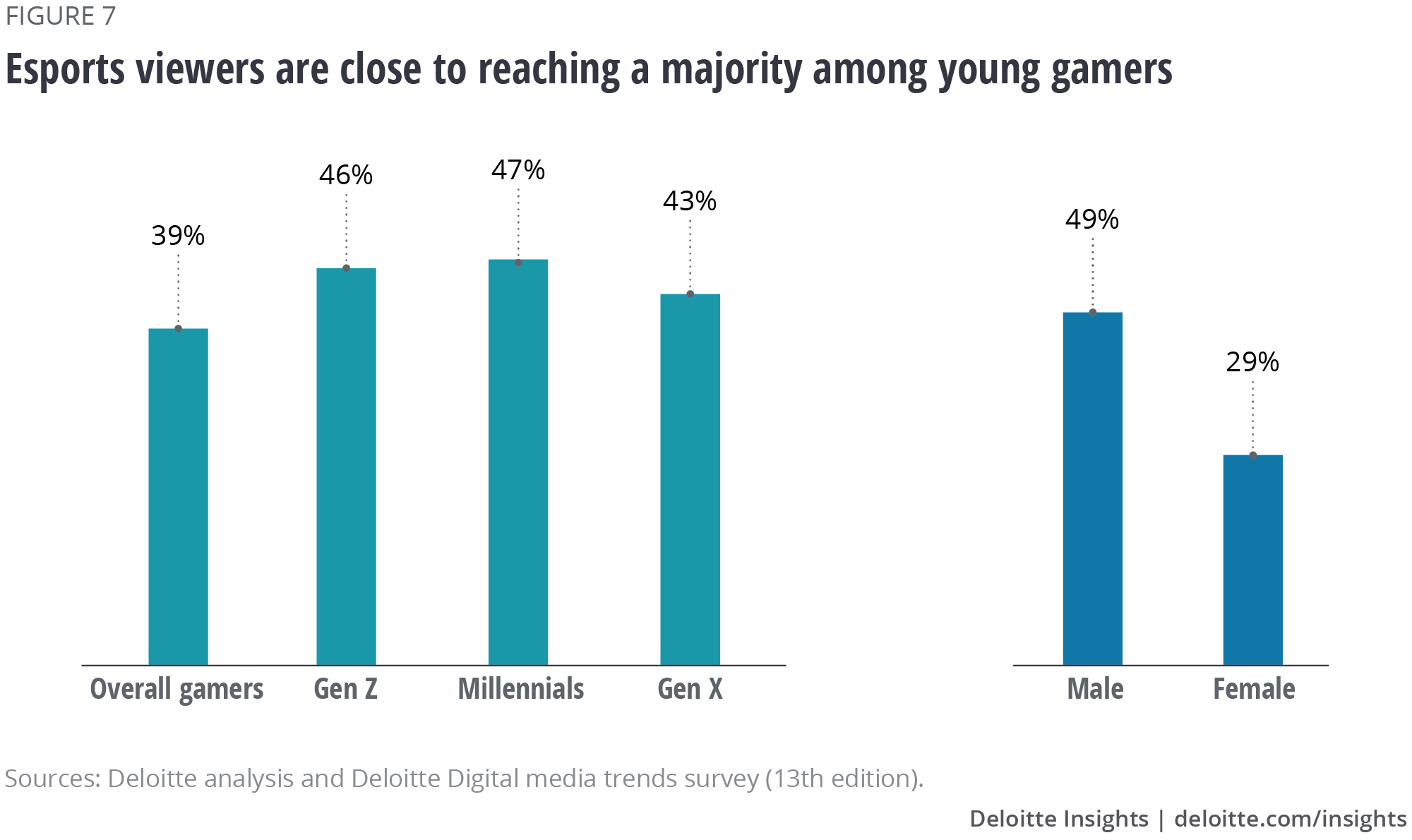

While esports currently represents less than 5 percent of the overall US video gaming market, our study shows that professional gaming events are gaining traction. Among gamers, 40 percent watch esports events at least once a week. And 25 percent of gamers who watch esports events tune in for more than four hours per week.

The figure for total video game-related viewing is most likely higher.15 Esports events, usually organized contests between professional players, make up only 30 percent of overall gaming viewing. Gamers use major platforms such as Amazon’s Twitch and Alphabet’s YouTube to watch these events.16 Whether it’s professional events or watching individual player streams, many consumers don’t just like playing video games; they like to watch the best play against one another.

Gaming platforms attract millions of daily viewers, thanks to the close interaction between esports pros and their fans, both of whom often stream their own game play live.17 This phenomenon is not just limited to the stereotypical 18- to 34-year old male gamer archetype; more than 40 percent of Gen X gamers and almost 30 percent of female gamers watch esports weekly.18

Given that content production is often one of traditional media companies’ key strengths, these companies could engage with game creators and players to create video game-related content such as reality TV, docuseries, and other forms of live competition. Our survey showed that 66 percent of gamers watch reality TV or competition shows, compared to 45 percent of people who don’t play video games. Consider, too, that many TV companies are facing rising cost pressures and declining revenue. Unscripted TV, such as reality TV, is significantly cheaper than scripted TV and can provide a more affordable way to generate content and revenue as more and more scripted TV and film content moves online. A 30-minute reality TV show episode can cost between US$100,000 and US$500,000 compared to US$3 million for a network TV sitcom episode.19 Due to challenging operating conditions across traditional TV markets, companies may be looking to add lower-cost content compared to scripted content, which could include game-related content.

Overall, consumers can access esports and daily streaming through multiple venues, platforms, and devices—in far more ways than they can get to traditional video content. Given the age and broad demographic of gaming consumers, traditional media companies that enter the esports and gaming market may have a rare opportunity to access and monetize these consumers in many ways: from directly owning gaming franchises to digital advertising.

Future of gaming and esports: A conversation with Chris Hopper, head of esports, North America, Riot Games

Given the broad increase in gaming, how do you address the growing nontraditional gaming audience? Would a direct-to-consumer strategy align with Riot’s plan for growth?

Every day, the generation who grew up with gaming as a ubiquitous form of entertainment rises, and that means the addressable market for video games across publishing and esports will grow similarly. On the esports side, we know what delights our core audience, but we are still nascent in our understanding of what content reaches an audience beyond that core. There’s a tremendous number of gamers who vary wildly in their genre choices, platform choices, and in their other hobbies, but the same can be said for fans of football or soccer. There’s no single stereotype of a traditional sports fan, and that’s because sports leagues have found ways to reach out to different groups by offering different value propositions. We’ve already seen the cross-section of gaming with music with K/DA, the Ninja/Drake streaming sessions, as well as gaming and sports with JuJu Smith-Schuster and FaZe Clan. And it’s only a matter of time before we see games and esports partnering with other cultural tenets to create more compelling products for the fans.

What do you think about adapting franchises for mobile to leverage growth in mobile gaming? And, more broadly, expanding to cross-platform?

Expanding video game franchises across platforms is certainly a great way to introduce a new audience to the game and build (or rebuild) momentum around a title that may have plateaued on certain platforms. I don’t think it has the clearest application for esports, however, as most games have one platform of choice for high-level play. Expanding beyond that doesn’t do much to bring in new pros, given the switching cost they would have to undergo to adopt the default competitive platform. Games that launch across multiple platforms definitely see impact in terms of building a critical mass of players and capturing the gamer zeitgeist, but I think that’s more about the impact of mobile gaming in the wider ecosystem.

Given the expanding influence of gaming across entertainment and culture, how does Riot view gaming’s growing presence? Is League of Legends (LoL) bigger than PC gaming? How does Riot view its business in terms of entertainment and world building?

Riot has always viewed the IP being created around Summoner’s Rift and our champions as something worth protecting and developing. Late last year, we announced a partnership with Marvel to create comics around one of our most popular champions. Our expansions into merchandise, music, and even board games are supplements to the game itself—they extend the ability our players and fans have to immerse themselves in our universe, and we believe that doing so will bring them back to the core game itself. Similarly, we see esports as a means of growing the ecosystem through a product of stand-alone value; the millions of fans who tune in weekly for our competitions are a testament to the value we’ve created with LoL esports.

How does Riot weigh the tradeoffs of creating potential partnerships (such as broadcasting or original content deals) with traditional media companies who might want to gain leverage to gaming growth and consumers?

League of Legends is a PC-only game that requires an internet connection. As such, Twitch and YouTube were, [for us], obvious choices: dense concentrations of gamers who already wanted to watch high-level play on that platform. Expanding to channels like ESPN+ has been more of an experiment—we want to understand whether different platforms will have drastically different demographics for the same content, and whether we can build content that specifically drives toward one of those unique demos. We are still quite early when it comes to designing content for individual channels, but we certainly see the value of creating partnerships to bring not only our existing content, but potentially new content to a wider audience.

How can Riot use professional players to grow its business, beyond sponsorship and event opportunities?

Pro players are the core of our esports business. Our leagues tend to be star-driven—you can see the cohorts of fans that shift team allegiances when star players like Doublelift or Aphromoo transfer organizations. As such, they are critical to our success, both in fan engagement and in putting on the competitive product. It’s no coincidence that we’ve started to center more competitive storylines around the players themselves. Fans resonated deeply with this story; they have been cheering for these players for years, and seeing a moment of such magnitude being highlighted so specifically allowed for easy engagement and excitement. We will continue to use players across all channels of the business, but we always want to make sure we are not overextending them, given their rigorous practice schedule.

What is the future of Multiplayer Online Battle Arena (MOBA) versus Battle Royale? In general, how does Riot view esports evolving in the next three to five years?

I look at MOBA versus Battle Royale like baseball versus football—they are two independent sports. It’s not unusual for kids to play several sports growing up, but they will eventually specialize if they hope to “go pro.” Esports and gaming are no different; we don’t expect League players to not play top titles like Fortnite or the new Call of Duty, but we do hope we’ve built a game that they will come back to time after time. Similarly, we don’t expect our LoL esports pros to be tempted to switch over to Apex Legends or AutoChess simply because the mastery they’ve developed in the League is valuable. Switching their significant focus to another game runs the risk of being left behind in LoL, and that is simply an economic decision most pros won’t make.

Esports has evolved at a pace unmatched in any other sport. What took decades in football or baseball takes only years. ([Riot] went from a startup to a franchised, revenue-sharing league in only five years), and so we look at the challenges to be faced in the next three to five years as critically as most sports likely think about the next 20 to 30 years. I think the future of esports involves tackling a few key areas: compelling content beyond game play, geo-affiliation strategy, growing revenue streams beyond current figures, and finding the best platforms to reach the optimal esports audience.

Amid the exciting usage and penetration trends in esports, how does Riot think about growing the North American League of Legends league?

It’s our job to not only continue to deliver the value that keeps our core excited and energized, but to find ways to deliver value to new cohorts of fans to grow the audience and generate increased revenue for teams and players alike. We’ve also recently deepened our relationship with our game publishing team in North America to celebrate and highlight key moments in the publishing cycle—new champions, new game modes, and more. We believe these actions will further tighten the mutually beneficial relationship between the game and esports. Building the LCS in North America was one of the largest steps in the evolution of esports over the last decade, and we will be continuing to innovate as we grow the league for years to come.

Note: Mr. Hopper’s participation in this article is for educational purposes only based on his knowledge of the subject, and the views expressed by him are solely his own.

What does it mean for companies?

The growth of mobile gaming is expanding the gamer user base and could provide opportunities for Telecom, Media & Entertainment (TM&E) companies, by opening cheaper and easier access to gaming markets. There could be more potential to enter the video gaming market. TM&E companies could offer existing customers extra entertainment services, in the form of video gaming-related products and services, and also help their partner brands find new advertising markets. A key behavioral trend across media and entertainment consumption is that consumers are more actively building their own collection of services and tailoring their own entertainment experience, which increasingly includes options outside traditional forms of entertainment. TM&E companies could build strategies that acknowledge the expanding presence and relevance of video gaming, especially among younger generations. The gaming penetration level among millennials is higher than Pay TV penetration, an indication that younger adults are less likely to be satisfied with traditional entertainment choices.

Explore the Technology, media & entertainment collection

-

5G: The new network arrives Article6 years ago

-

Artificial intelligence: From expert-only to everywhere Article6 years ago

-

Smart speakers: Growth at a discount Article6 years ago

-

3D printing growth accelerates again Article6 years ago

-

How to begin regulating a digital reality world Article6 years ago

-

Tuning in: Smart speakers and the resilience of radio Podcast6 years ago