3D opportunity for supply chain readiness Taking the pulse of industry

20 minute read

17 January 2019

Discussions at a recent event throw light on where things stand in the world of additive manufacturing, with a particular emphasis on emerging supply chain applications.

Since 2013, Deloitte Insights has published a richly complex array of thought leadership on the topic of additive manufacturing (AM) that parallels the technology’s ascension into mainstream manufacturing environments. In so doing, we have placed some emphasis on how AM may transform the manufacturing supply chain as part of a broader transformational framework. (See the sidebar, “The additive manufacturing framework.”) Such is especially important given the increasing digitalization that the supply chain has experienced and the role that AM may play in that evolution.

Indeed, current discussion on AM supply chain applications generally focuses much more on what is actually unfolding on the ground than on the kinds of theoretical discussions about what is “possible” that were relatively common just five years ago. Particularly useful insights in this regard can be found in the first-hand, real-world experiences and thinking of leading AM practitioners in their respective organizations.

A recent event in Austin was designed to provide those kinds of real-world perspectives in one setting. Sponsored by America Makes, “Technical Review & Exchange (TRX): Supply Chain Readiness” served as a colloquium on AM within a supply chain context. By way of personal interviews and presentations, this two-day event offered first-hand insights on the state of the AM supply chain, including general assessments, emerging AM supply chain applications, and the digital thread for additive manufacturing. Participants came from sectors as diverse as pharmaceuticals, defense, shipping, academia, among others.

In the pages that follow, we offer some of the themes that emerged from that event.

THE ADDITIVE MANUFACTURING FRAMEWORK

AM’s roots go back nearly three decades. Its importance is derived from its ability to break existing performance trade-offs in two fundamental ways. First, AM can reduce the capital required to achieve economies of scale. Second, it increases flexibility and reduces the capital required to achieve scope.

Capital versus scale: Considerations of minimum efficient scale can shape supply chains. AM has the potential to reduce the capital required to reach minimum efficient scale for production, thus lowering the manufacturing barriers to entry for a given location.

Capital versus scope: Economies of scope influence how and what products can be made. The flexibility of AM facilitates an increase in the variety of products a unit of capital can produce, which can reduce the costs associated with production changeovers and customization and, thus, the overall amount of required capital.

Changing the capital versus scale relationship has the potential to impact how supply chains are configured, and changing the capital versus scope relationship has the potential to impact product designs. These impacts present companies with choices on how to deploy AM across their businesses.

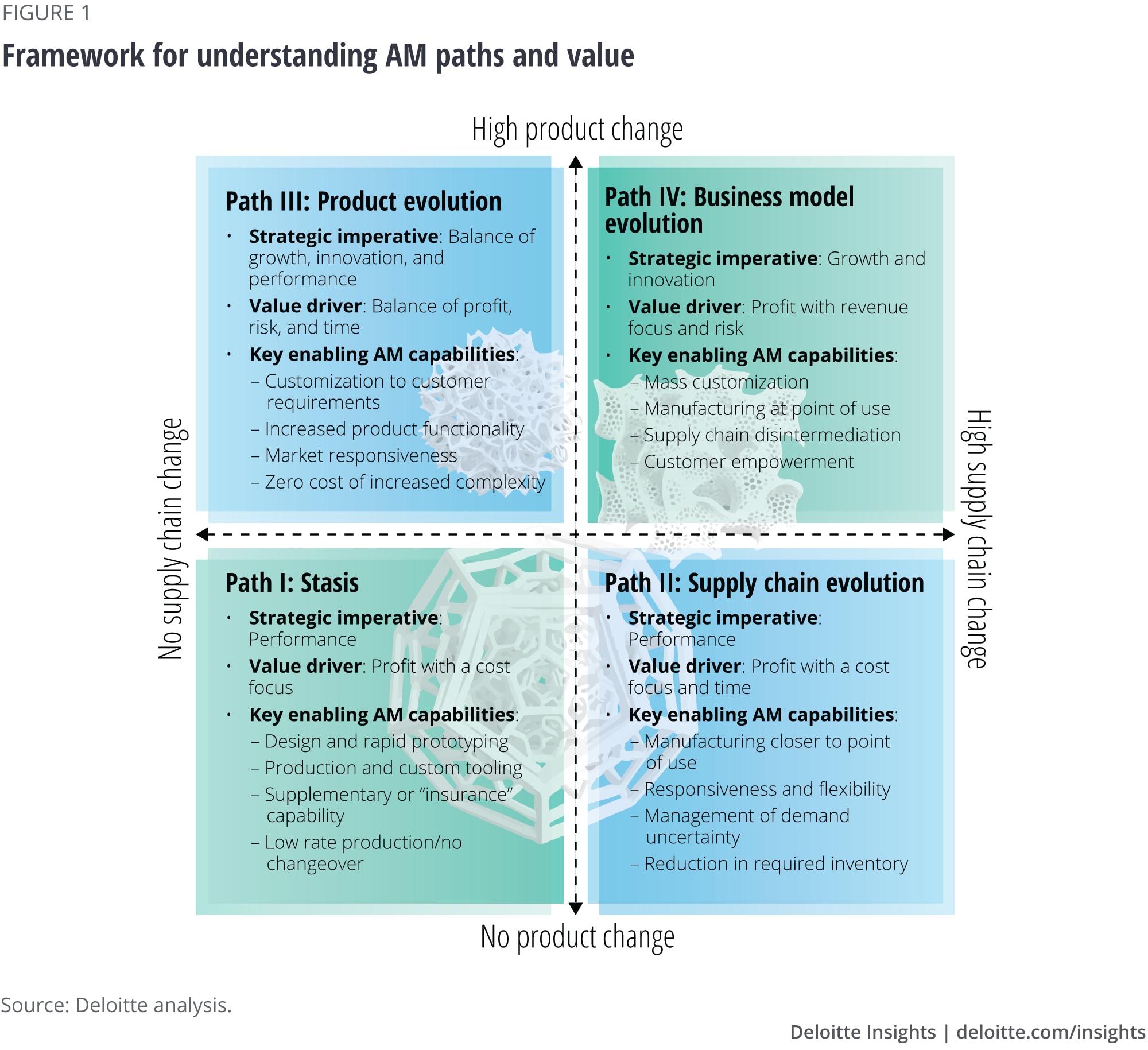

Companies pursuing AM capabilities choose between divergent paths (figure 1):

Path I: Companies do not seek radical alterations in either supply chains or products, but they may explore AM technologies to improve value delivery for current products within existing supply chains.

Path II: Companies take advantage of scale economics offered by AM as a potential enabler of supply chain transformation for the products they offer.

Path III: Companies take advantage of the scope economics offered by AM technologies to achieve new levels of performance or innovation in the products they offer.

Path IV: Companies alter both supply chains and products in pursuit of new business models.

First, some context

Even just a few years ago, the notion that AM could have found applications beyond basic prototyping and simple spare-part production may have seemed far-fetched. The idea that AM would have helped upend basic assumptions about the limitations and possibilities of capital, scale, and scope in manufacturing has traveled far beyond most expectations. Yet, just in the recent past, what AM has achieved typically goes well beyond even the most optimistic assessments.

But what exactly has driven this remarkable growth? To be sure, there is likely no single answer to this question. Certainly, AM systems have become more versatile in the materials they use, and more sophisticated in the technologies and processes they exploit. Printers have also become more cost-effective in being able to do more for the same or even less financial investment—more “bang for the buck.” But just as importantly, there seems to be an unmistakable sense that AM has “arrived.” Many players within well-established “old-line” industries appear to have begun to view AM with greater acceptance as a viable—and potentially even advantageous—manufacturing solution.

Take Aerospace & Defense (A&D), for example, perhaps one of the most “traditional” manufacturing industries. A&D was an early adopter of AM technology. This may seem a bit counterintuitive given the especially “high-stakes” nature of the A&D manufacturing process and the typically conservative mindset of A&D organizations.

But, much of A&D’s early adoption of AM rested largely in prototyping and tooling applications, with very limited production of end-use parts. And whatever AM production that did take place tended to reside within “lower risk” products like storage bins in commercial aircraft, among other examples. As Deloitte Insights published several years ago in 3D opportunity for Aerospace & Defense: Additive manufacturing takes flight, A&D executives showed reluctance to adopt AM on a broad scale for a variety of reasons that ranged from the unproven nature of the AM process in complex manufacturing environments to its perceived limited variety of usable materials. That the A&D industry traditionally has been characterized by an ethos of caution also did not likely help drive widespread AM adoption.

The tide appears to be turning.

Today, A&D players are leveraging AM in ways far beyond prototyping and tooling: from mission-critical turbine fuel nozzles, to titanium alloyed parts that go to the very heart of a plane’s structural integrity, to the development of a blockchain-based solution to certify the authenticity of an AM part.1 The list goes on.

And the same kind of story can be told in other sectors too—beyond A&D and manufacturing. But the larger point is that many organizations no longer view AM as a solution exclusively, or perhaps even primarily, for prototyping or tooling. Quite to the contrary, many increasingly rely on it as a practical solution for a wide range of sensitive applications—throughout all four phases of the AM framework of figure 1—and appear to be making substantial bets on AM’s long-term viability in terms of time, treasure, and the very future of the organization, as a result.

What are AM supply chain leaders thinking about?

Still, just as many manufacturing organizations increasingly rely on AM in increasingly sensitive applications, they tend to place commensurately more focus on the enabling factors that go well beyond the make and design of the printer itself. Perhaps nowhere is this more true than within the supply chain setting—considered by some to be the lifeblood of the manufacturing organization, and the place within the manufacturing organization that AM has enabled perhaps the most transformation.

While any full list of such AM-enabling factors is informed by the particular challenges that each organization faces, the conversations in Austin appeared to focus on a set of strategic considerations including:

Quality assurance

“A big challenge is quality, you know, we’re obviously pushing towards performance, that’s great. But are the quality assurance mechanisms trailing as quickly as … the technology itself that’s moving? I’m going to say probably not. That’s a big push that we really want to move forward.”—Process innovation leader, Major defense contractor

Perhaps unsurprisingly, quality assurance (QA) still looms large as a significant hurdle to even wider adoption of AM, and this sentiment seemed to be shared by a number of practitioners. QA—the “long pole in the tent” as one practitioner referred to it—brings to the fore any number of challenges that go to the heart of AM manufacturing scale and scope. Key in this regard is expected to be the industrywide adoption of standards that speak to repeatability of process regardless of constraints, interoperability, material variability, and consistency of the printed part’s structural integrity, among other QA-related concerns. Practitioners seem heartened that organized efforts are underway to articulate AM standards by industry stakeholders.2 But until such time that AM standards are widely adopted, QA—and all that relates to it—will likely remain square center in the minds of practitioners.3

Digital thread

“From tracking your capacity to tracking jobs and your suppliers, the digital thread is absolutely essential.”—Terry Wohlers, Wohlers Associates

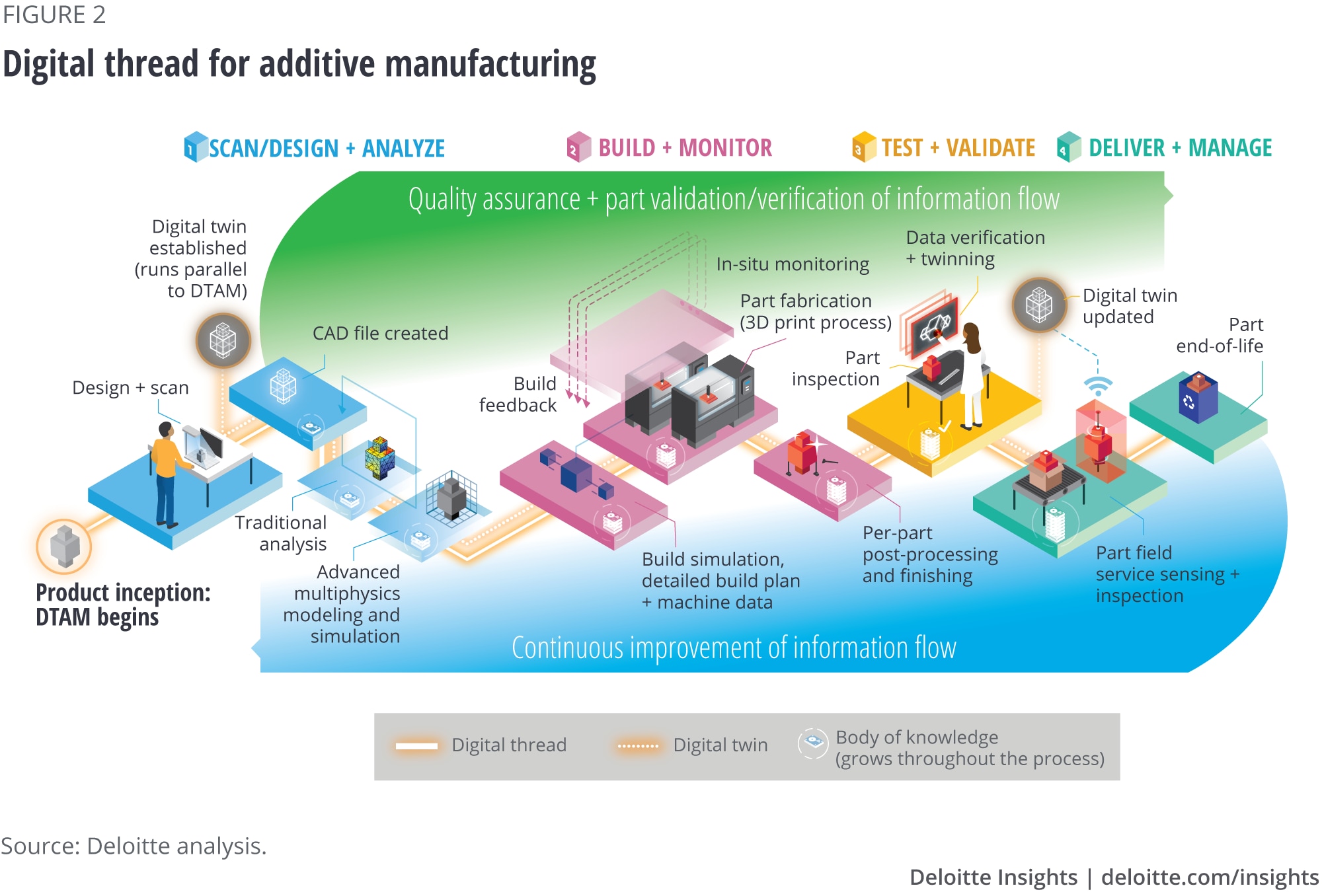

Few things seem more certain than the role that a fully functional digital thread will play if AM is ever going to achieve critical mass at the industrial level. But why do practitioners—those who attended the Austin event and others—often place such emphasis on the digital thread? Because AM is fundamentally about a digital process from start to finish, and the digital thread represents that “seamless strand of data” that links the entire AM value chain—from concept to delivery.4 The digital thread is, in effect, that information “backbone” that enables the AM manufacturing process to scale.5 For all of its importance though, the digital thread can still confront notable challenges that concern the interoperability of its constituent phases, among others. Until such gaps in interphase connectivity are fully reconciled, critical information will likely remain siloed and not fully transparent to all stakeholders across the thread.

Data integrity and protection

“[AM] gives hackers novel ways to wreak havoc.”—Dr. Eleftherios Iakovou, Texas A&M

It is axiomatic: Without data, nothing gets printed. Yet because AM is fundamentally data-driven, risks that touch upon data integrity and protection abound. For wide-scale adoption of AM to become a reality at the enterprise level, people will need an abiding faith in the integrity of the data—that it is secure from threats and not improperly altered in any way. Still, practitioners recognize that we live in a world where the risk of unauthorized access to data is quite real—whether the intent is to steal or maliciously alter that data. Cybersecurity is, of course, an industrywide concern as the digital thread builds out and the number of relevant stakeholders proliferates.6 It could also require solutions quite distinct from the underlying AM technology itself. Toward that end, one idea that is gaining currency within AM is the use of blockchain, a distributed ledger technology that may provide stakeholders across the digital thread an enhanced sense of trust in the authenticity of data.7

Talent

“So absolutely, there's tremendous opportunity, but [finding] skilled workers [is] the challenge that we're facing right now.”—Petra Mitchell, Catalyst Corporation

In any skill-based industry, talent is always an issue. Such is especially the case in a skill-based industry that is still relatively new, like AM. That the search for skilled workers is exacerbated in a strong economy is self-evident. But the larger strategic challenge for AM—and emerging sectors like it—seems the relative lack of organized training infrastructure that other, more established skill-based industries enjoy. As AM becomes increasingly a part of the manufacturing mainstream, training pipelines will likely become better organized.8

A few thoughts about the future for AM

“[T]he future is a range and not a discrete point and so getting there takes a series of small steps, but it does also require action in the near term.”—Greg Hayes, EOS North America

However important they may be, these issues are merely representative of what is front of mind among many industry practitioners. Conference participants spoke of other issues as well, ranging from AM tax policy to the AM business case, and beyond.9 Still, that these kinds of practical real-world issues are so much the source of current thinking and concern should hearten AM leaders as they speak to an industry that is vibrant and in ascension.

But what did practitioners think lies ahead for AM? To be sure, any discussion of the future for AM is framed in far less theoretical terms than it once was. But at any given time, there is always a future and what it may bring is a matter of great interest to all stakeholders. But now, AM leaders characterize the future in grounded, plausible terms, continuing the kinds of real-world advancements in AM that have enabled the industry to get to this point—material properties and variety, printer speeds and sizes, IP protection, supply chain reconfiguration, skills gap, industrywide standards, cybersecurity, return on investment, serial production, and more.

Such expression of the future points to an AM sector that remains vibrant and still evolving. But it also points to an AM sector that may be entering a new phase of maturation as the technology bears fruit in increasingly variable and cost-effective ways within an increasing variety of manufacturing supply chain environments.

More from the 3D Opportunity collection

-

3D opportunity for business capabilities Article7 years ago

-

3D opportunity for innovation Infographic6 years ago

-

3D opportunity for intellectual property risk Article8 years ago

-

3D opportunity for electronics Article7 years ago