Article

Earnings stripping rules and the potential impact on asset deals in Japan

Japan Tax & Legal Inbound Newsletter September 2021, No. 70

In Brief

In the context of certain leveraged acquisitions, companies should consider the deductibility of interest under the earnings stripping rules and the potential impact on asset deals in Japan. In particular, when an acquired entity recognizes significant amounts of goodwill in the course of a pre-closing carve-out process, the amortization of the goodwill may reduce the adjusted taxable income of the entity.

This newsletter provides an overview of the Japanese earnings stripping rules and the potential impact on asset deals in Japan.

1. Overview of Japanese earnings stripping rules

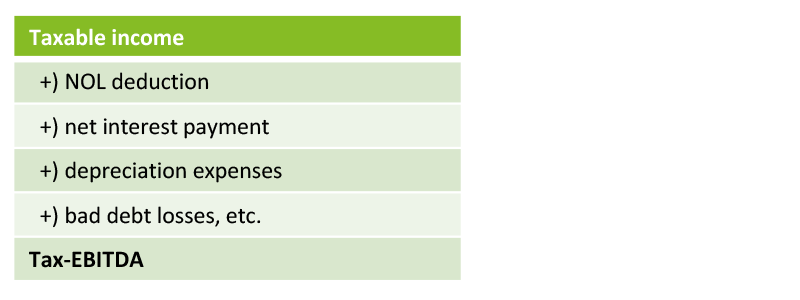

The following is an overview of the earnings stripping rules:

- Prior to the 2019 tax reform, the earnings stripping rules restricted deductions for net interest expenses that exceeded 50% of a Japanese company’s adjusted taxable income (“Tax-EBITDA”). Pursuant to the 2019 tax reform, the 50% threshold was lowered to 20%.

- “Net interest expenses” are defined as the sum of the interest on loans (excluding interest that is fully subject to Japanese corporate income tax) less the sum of certain interest income.

- Tax-EBITDA is calculated using the following formula:

- If both thin capitalization and earnings stripping rules apply, the rules that result in the largest amount of nondeductible interest will apply.

- Disallowed interest expenses may be carried forward and deducted from taxable income in the succeeding seven fiscal years.

- There are certain exceptions to the earnings stripping rules. A de minimis rule applies in the event that (1) net interest expenses are JPY 20 million or less or (2) the sum of interest expenses of a domestic group exceeds the sum of 20% of the Tax-EBITDA of such group.

2. Potential impact on commonly seen asset deals in Japan

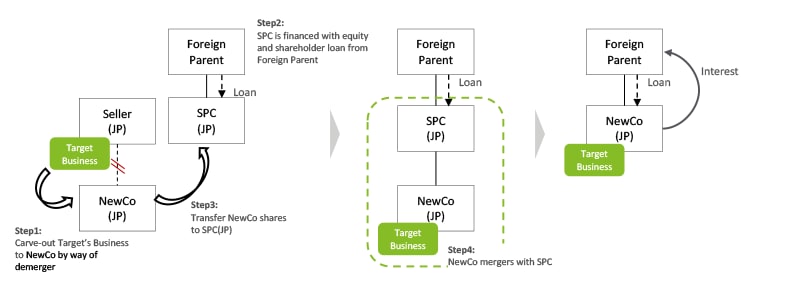

In cases where a foreign company (“Foreign Parent”) acquires the business (“Target Business”) of a Japanese company (“Seller”), the following transaction steps are commonly seen in practice:

The demerger at Step 1 generally should be treated as a taxable demerger as there is no existing business at NewCo at the time of the demerger. In the event that the demerger is treated as a taxable demerger, if the fair market value (FMV) of Target Business is greater than the FMV of identifiable assets and liabilities to be succeeded by way of the demerger, such difference may be treated as goodwill and amortized over 60 months at NewCo.

For Japanese tax purposes, a merger in a 100% controlling relationship generally should qualify as a nontaxable merger as long as boot is not delivered to the shareholders of the merging company. Therefore, the merger between NewCo and SPC at Step 4 generally should qualify as a nontaxable demerger for Japanese tax purposes and all assets and liabilities (including goodwill) of the merging company may be transferred to the succeeding company on a carryover basis.

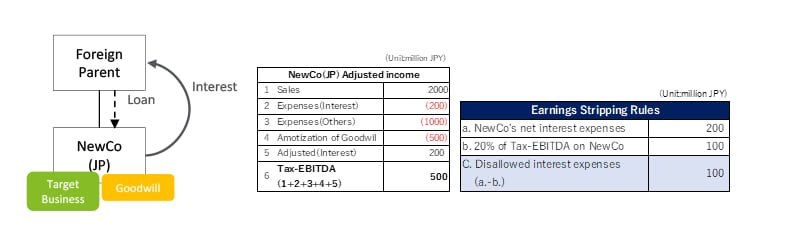

It should be noted that the amount of goodwill amortization is not added back in the Tax-EBITDA calculation and, accordingly, net interest expenses may easily exceed 20% of Tax-EBITDA if a significant amount of goodwill amortization is recognized as illustrated in the example below:

Assumptions

- Demerger is performed at the beginning of the year.

- Upon the demerger, goodwill is recognized in the amount of JPY 2,500 million.

- No limitation on interest deductibility under thin capitalization rules, transfer pricing rules, etc.

As a result, JPY 100 million of the net interest expenses are not deductible under the earnings stripping rules, and such disallowed interest expenses may be carried forward and deducted from taxable income in the succeeding seven fiscal years (up to 20% of Tax-EBITDA), which may increase after 60 months as the goodwill would have been fully amortized.

Deloitte’s View

In cases where a foreign company finances the acquisition of a Japanese business in an asset deal using a shareholder loan, the interest on the shareholder loan could be disallowed under the earnings stripping rules pursuant to the 2019 tax reform.

In addition to the earnings stripping rules, interest on shareholder loans at Newco may be disallowed under thin capitalization rules, transfer pricing rules, etc. Accordingly, due consideration should be given to the debt-to-equity ratio, various loan terms (e.g., interest rate, currencies, maturities, etc.), future income projections, acquisition value of the business, post-merger integration strategies (e.g., upstream versus downstream merger) to ensure there are no unexpected consequences related to the interest on acquisition indebtedness.

* This Article is based on the relevant Japanese or specific country’s tax law and other authorities in effect on the date of this Article. This Article would not be guaranteed updating if there are any changes in Japanese tax law, any other law, or interpretations by the courts or tax authorities thereof after the date of this Article.