US consumer payments in a post-COVID-19 world How to bolster payments institutions' growth in challenging times

13 minute read

28 July 2020

COVID-19 has challenged the payments industry’s growth momentum, making recovery a priority. But at the same time, reimagining the post-COVID-19 world in payments could create new opportunities for payments institutions.

Key messages

The payments industry has remained resilient during these difficult times

The COVID-19 pandemic has disrupted the payments industry’s growth momentum, with varying impacts on issuers, acquirers, payment network providers, and financial technology companies (fintechs) in the United States. Lower customer spending has hit their revenues, some more than others. While digital and contactless payments have surged,1 there’s been a marked decline in the point-of-sale (PoS) transaction volume.2

Learn more

Learn more about connecting for a resilient world

Explore the Financial services collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

Despite lower business activity, the US payments industry has shown resilience in supporting consumers during these challenging times. Many credit card issuers have been quick to offer forbearance options for consumers to skip their minimum interest payments.3 This help is timely, considering that US household credit card debt was at US$893 billion in the first quarter of 2020 (representing 6.2% of the total household debt). 4 Interestingly, this figure is just a bit higher than the peak of US$866 billion during the midst of the 2008–09 financial crisis.5

Importantly, the US payments infrastructure has also supported the government’s disbursement of unemployment benefits to millions of consumers. However, there’s scope for higher efficiencies from digital payment methods to offset the current challenges from the use of paper checks and legacy infrastructure.6

To that point, the issuance of contactless cards, promotion of digital wallets, and installation of PoS devices with contactless functionalities have moved the needle in meeting consumer demand for no-touch payments. But more can and should be done, as the current times mark an accelerated shift in the world of consumer payments. For instance, US-based payments institutions can take inspiration from the near-invisible, yet profound, role that the consumer payments industry plays in developing countries such as China and India. Not only are most digital payments in those regions contactless (with rampant usage of QR codes in mobile payments), but they are seamless, real-time, and ubiquitous.7

Arguably, key institutions in the US payments ecosystem have their own COVID-19 challenges to recover from. But at the same time, reimagining the post-COVID world in payments could offer new opportunities to reignite performance.

COVID-19 has challenged the momentum in the US payments industry

The US payments industry experienced a year of healthy growth in transaction volumes and value in 2019. According to The Nilson Report, payment cards generated US$6.7 trillion in consumer and commercial purchase volume in 2019, up 8.5% from 2018. 8 However, recent changes in consumer behavior due to the pandemic-induced economic lockdown and stay-at-home orders have created several challenges for payments institutions.

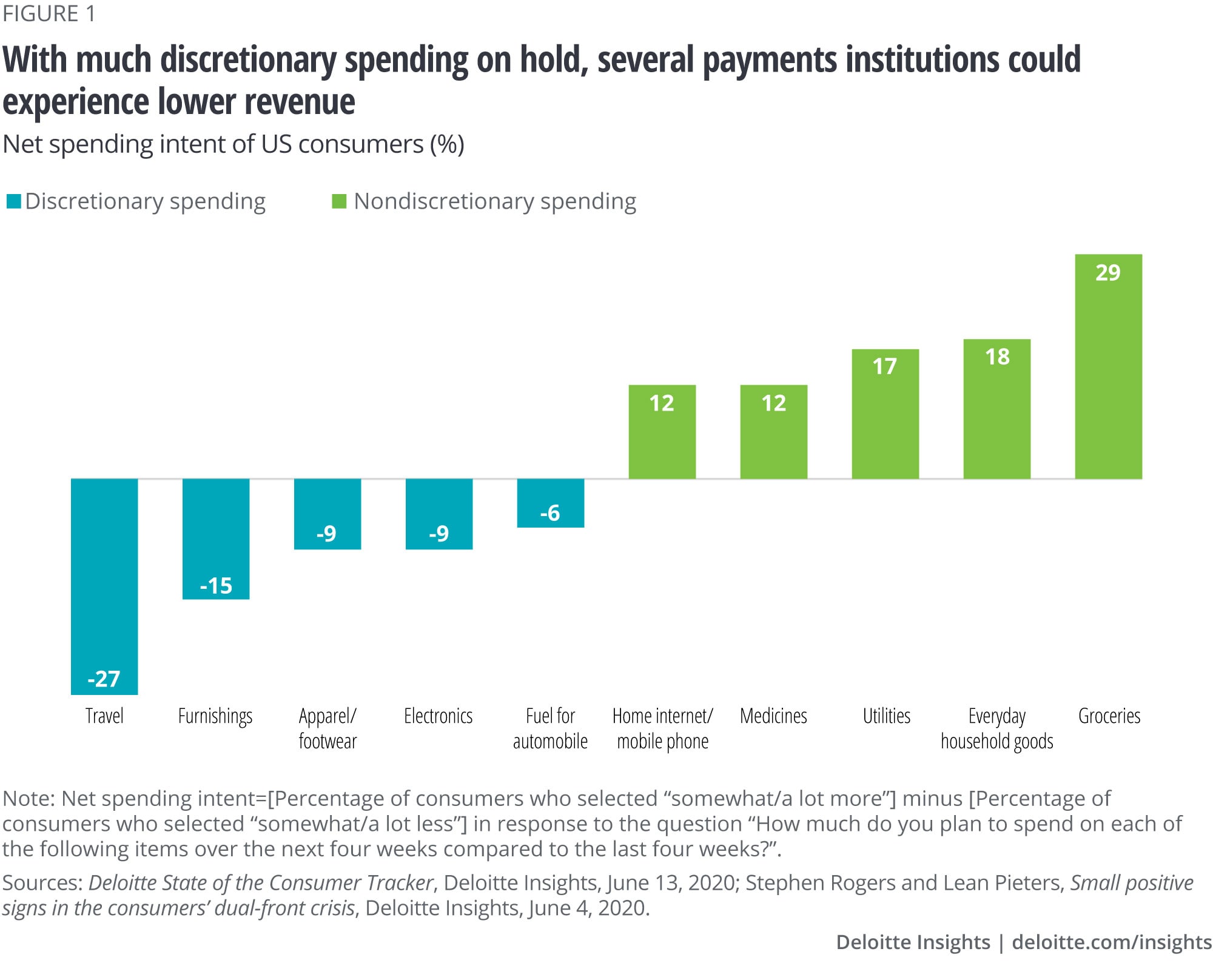

Consumers have cut down on their discretionary spending via PoS and cross-border payments, impacting volumes across many payments institutions (figure 1).9 A JPMorgan Chase Institute study of Chase cardholders’ transactions suggests that consumer spending across income demographics declined 40% between March and April this year.10 Of course, this decline has also impacted merchant acquirers servicing the affected industries, including travel and entertainment, hospitality, and restaurants.

Arguably, a rise in nondiscretionary spending (figure 1) and higher digital and contactless payments are some bright spots, especially for digital payments–based business models, some of which were developed by large fintechs.11 However, the increase in contactless and digital payments seems to underscore the importance for both acquirers to invest in contactless terminals as well as for challenged PoS finance providers to deepen partnerships with online merchants or brick-and-mortar merchants with strong digital channels.

Meanwhile, consumers appear to be aggregating purchases at large merchants that have a digital presence; offer home delivery or drive-through pickup options; and invest in their supply chains, staffing, and safety measures. This behavioral change has strengthened large merchants’ power to bargain with payment networks for lower processing fees, challenging the latter’s margins.

In addition, consumers have been canceling their transactions, such as travel, sporting, and other entertainment tickets, raising chargeback volumes.12 The increase in chargebacks could create a liquidity challenge among some cash-strapped acquirers and independent sales organizations (ISOs) or member service providers (MSPs). At the same time, the escalating risk of businesses going bankrupt could add to the worries of acquirers, ISOs, and MSPs.

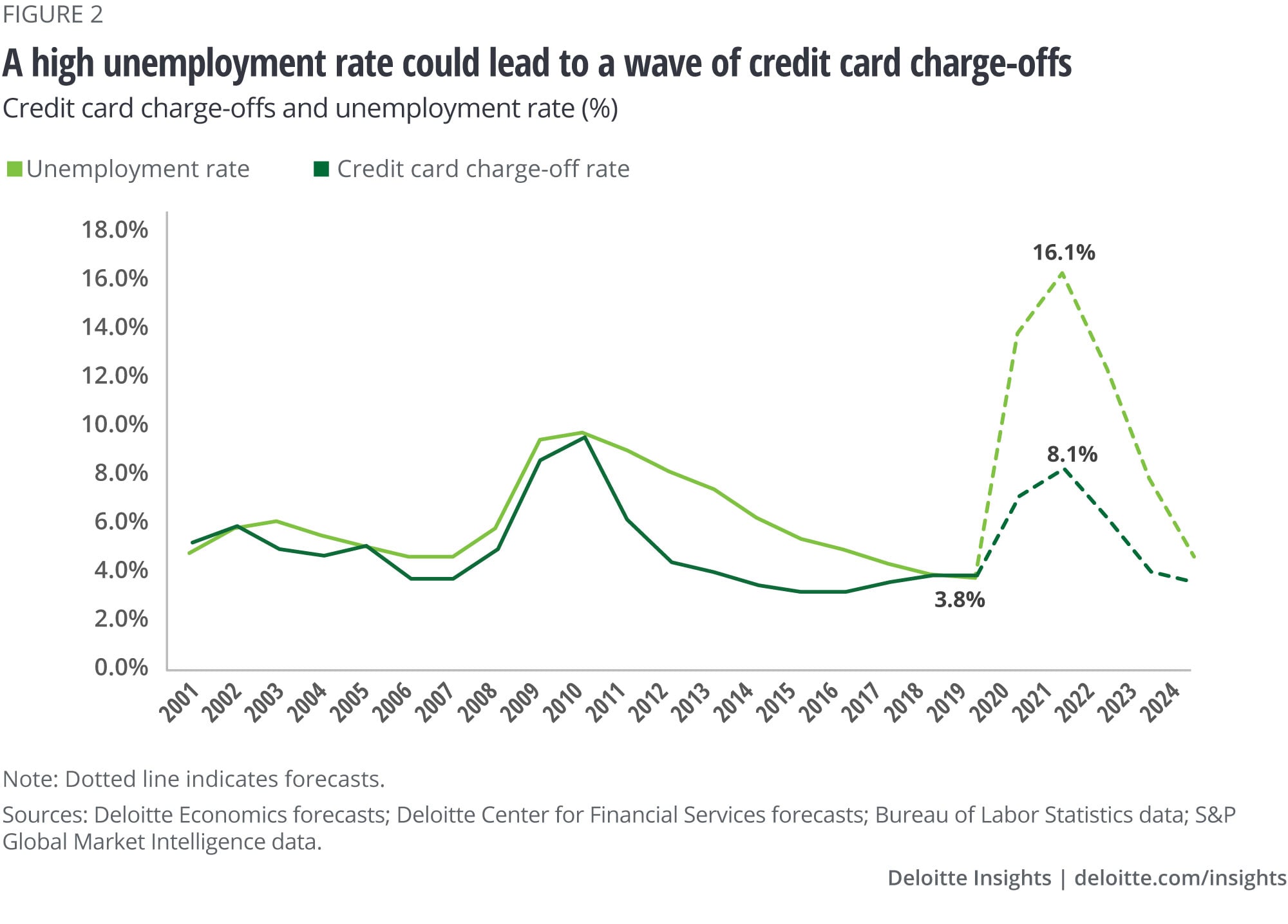

The impact of the lockdown on several small-business categories has, in turn, adversely impacted many cardholders’ employment and thus their ability to pay off their credit card bills.13 Historically, credit card charge-off rates have had a high correlation with the national unemployment rate (figure 2); however, the relationship may soften in the near term, due to government intervention, a financially stronger consumer, issuers’ forbearance programs, and the nuanced differences in the nature of unemployment.14 Credit card charge-offs could increase to 8.1% in 2021, compared with 3.8% in 2019 (figure 2; also see sidebar, “Forecasting methodology” for more details).

To mitigate credit risks, many issuers have paused solicitating new customers and started tightening their underwriting standards. Acquirers and fintechs providing financing and payment services to brick-and-mortar small- and medium-sized businesses (SMBs) have also paused some of their lending to limit credit exposure and are perhaps holding higher cash in merchants’ reserve accounts.15

However, tight standards are restricting access to credit, especially for those who may need it the most. For instance, while consumers still have over US$3 trillion in available balance on their current credit cards (as of Q1 2020), a New York Fed analysis indicates that the balance is unevenly distributed by income, with little credit available for low-income individuals.16

New opportunities for consumer payments in a post-COVID-19 world

Addressing these near-term profitability challenges could be a good start, but payments institutions should also plan for some structural changes over the next 12–18 months. Our global payments article, Global payments remade by Covid-19: Scenarios for resilient leaders, highlights potential business scenarios that the payments industry could plan for to recover and ultimately thrive.

While the length and severity of the pandemic remain uncertain, the industry is unlikely to return to its pre-COVID-19 state. We expect to see an acceleration of some recent trends in the way consumers “live, work, play, and pay” and integrate real and digital more, which will likely stick in a post-COVID world.

When the economy reopens, many consumers are likely to continue to shop online or on smartphones for home delivery,17 freeing up time for people and activities more important to them, such as family and friends, work, physical well-being, and leisure and entertainment. This consumer behavior presents interesting prospects to reimagine how payments can be made. For instance, a platform or an app that can bundle several home delivery services, such as picking up their groceries, buying medicines, and delivering household supplies, into a single payment has the potential to elevate consumers’ digital shopping experience. Payments institutions can consider creating a close-ended network on such platforms that join consumers and different merchants, aggregating consumer transactions and settling payments between parties for a fee, similar to their possible role in future mobility ecosystems.18

Moreover, digital will potentially become more integrated in physical interactions, deepening consumers’ omnichannel experiences. For instance, the digital ordering technology at some quick-service restaurants could become the new normal for dine-in experiences.19 Some consumer platforms have begun offering a contactless dining experience in partnering restaurants by digitizing the entire ordering and payment processes.20

But will a rise in digital payments make the United States a cashless society? Perhaps not: While consumers increasingly prefer no-touch payments, many are also hoarding cash as a store of value for unforeseen times.21 Whether consumers’ preference for using cash returns when the US economy comes out of the lockdown will be a dynamic to watch out for in the coming months.

Meanwhile, consumers could have higher expectations from their payments institutions around speed, security, and trust. Real-time push payments in consumer-to-business payments may gain more traction, as consumers begin to expect the same speed of money transfer when paying bills, receiving a salary, and making purchases that they get in person-to-person (P2P) payments. Moreover, they may expect faster decision-making when applying for financing, with quicker approval rates and near-real-time access to a new credit line to pay for their needs.

Security will likely be just as important as convenience and speed, or perhaps even more. A TransUnion study reveals that, within a week since the onset of the pandemic, 22% of American consumers surveyed have been targeted by digital fraud.22 As threat actors increasingly look to exploit individuals’ vulnerabilities, bolstering security could be a lynchpin to maintaining trust among consumers along emotional, financial, and digital dimensions. Consumers should be able to trust that their payments institution will tell them the truth and do what’s right for them, and that their transactions, personal data, and financial information will be kept secure and private.23

Personalized advice focused on consumers’ financial well-being—such as proactively guiding customers on managing their budgets and making sound financial decisions—would also help bolster trust and integrate payments institutions more in consumers’ lives. Citibank has taken a step in this direction: The Citi Double Cash card offers an additional 1% cashback if the credit card balance (at least the minimum due) is paid on time.24

Charting out strategies for the way forward

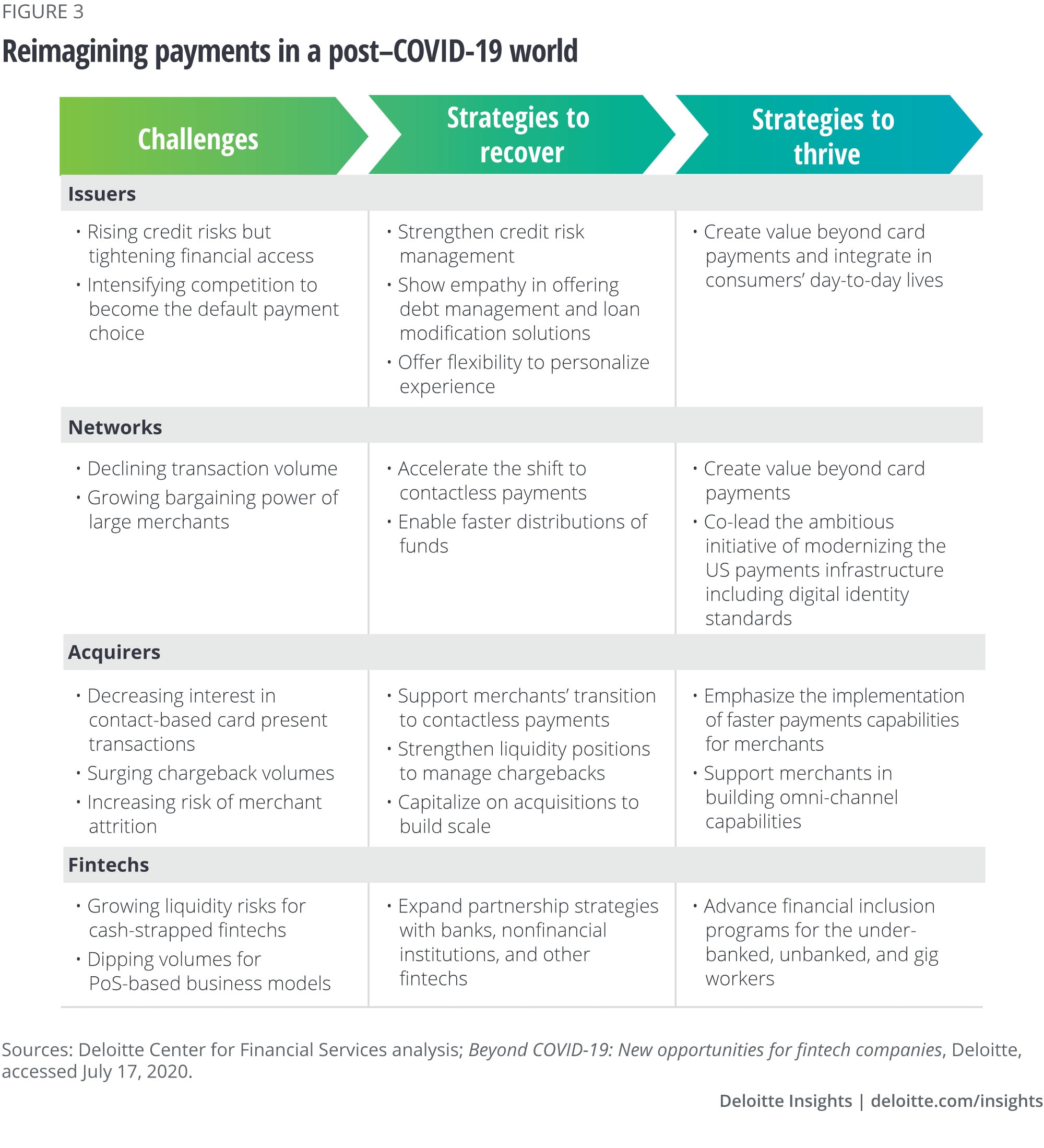

Going forward, it could be imperative for payments institutions to strike a balance between overcoming the near-term challenges to support business recovery and seizing opportunities to reignite performance. They should prioritize resources and make bold investments to address the issues that matter most to their business’s success. Though strategies may vary by institutions (figure 3), the symbiotic nature of the payments business may result in some common priorities.

Strategies to consider for recovering in the near term

Payments institutions across the value chain are targeting cost rationalization by cutting down on discretionary spending, such as marketing, travel, and entertainment expenses.25 But a focus on cost reduction alone may not suffice for a resounding recovery when consumer behavior is evolving at such a rapid pace. Payments institutions should also focus on the following strategic actions in the near term:

Accelerate the shift to contactless payments: According to a Mastercard Contactless Consumer Poll, 51% of American consumers surveyed are using some form of contactless payment, which includes tap-and-go credit cards and mobile wallets, since the pandemic began.26 To adapt to consumers’ new ways of making payments, networks should work with issuers to accelerate the issuance of contactless cards, and with acquirers to set up contactless PoS terminals (to accept tap-and-go card, digital wallet, and QR code transactions) at brick-and-mortar merchants.

Offer flexibility to personalize the consumer experience: The competition to become the default payment choice, i.e., the stored payment instrument on websites, apps, or digital wallets that consumers use most for their transactions, has intensified among card issuers with the rapid surge in digital payments. It seems an opportune time for issuers to strategize ideas—from simple to bold—to reimagine their value proposition.

Consumers are looking for flexibility in choosing their product features: Sixty-nine percent of respondents in our 2019 US payments survey said they would find a credit card that offered personalized features appealing. They may also find value in rewards that are perhaps more relevant, flexible, and personalized. For instance, Capital One is temporarily allowing select cardholders to redeem thousands of points accumulated in airline miles in spend categories most relevant to them in today’s stay-at-home environment, such as food delivery, streaming services, and mobile phone purchases.27

Help SMBs digitize payments and sales operations: Consumers’ shift to digital will likely necessitate that merchants, especially SMBs, up their digital game—but they won’t be able to do it alone. Payment networks are stepping in to assist SMBs with digital payment system setup.28 For instance, Mastercard recently announced a program to help 28 million small businesses that are eligible to participate in the Paycheck Protection Program with free identity theft protection and cybersecurity vulnerability assessments.29

Moreover, acquirers can tap into the opportunity to support their merchant clients in building omnichannel sales capabilities and strengthening customer loyalty. For instance, Square Online Store enables offline merchants to build their e-commerce website and integrate it with tools such as in-store pickups and home delivery.30 And JPMorgan Chase offers application programming interface integrations to help businesses access and make sense of customer data to tailor their customer targeting efforts.31

Balance stronger risk management with empathy: In response to the rising credit risk, default management is likely to top issuers’ agendas. Recovering from the current crisis could require issuers to reconsider their risk appetite and review the way credit is managed from origination to loss recovery in the customer life cycle.32 In this regard, they will likely continue to leverage artificial intelligence solutions to make smarter credit decisions.33

Further, they should incorporate the impact of forbearances and the resulting loan modification options on credit risk models.34 They should also continuously monitor credit portfolios to identify at-risk consumers early on and provide them with loan modification options.

Educating consumers on better debt management and being empathetic in debt collection efforts could go a long way in strengthening issuers’ relationships and trust with their cardholders. Perhaps card issuers can anchor their collection approach around longer-term recovery and credit consultation such that consumers are able to access credit again when the economy improves.35 The good news is that credit card debt holders were in better shape (higher average FICO score) before the pandemic than a comparable period before the 2008–09 financial crisis. According to American Express, 88% of consumers and SMBs that have opted for its forbearance program are prime or super-prime borrowers.36 And JPMorgan Chase noted that of the 1.5% of its cardholders who had requested for forbearance, 80% made a payment and did not defer.37

Bolster transaction security: The use of tokenization to secure cardholders’ confidential information will potentially accelerate, as the recent growth in digital commerce has made card-not-present transactions much more lucrative for threat actors. For instance, Visa’s tokens, used by 13,000 merchants globally, recently crossed one billion transaction mark.38 But securing the payments system across different rails and transaction types will call for a much stronger collaboration across ecosystem partners, including regulators.

Capitalize on acquisitions and partnerships: Acquirers, ISOs, and MSPs challenged in the highly competitive and commoditized industry may hunt for consolidation opportunities. Large acquirers may consider acquiring smaller ISOs/MSPs to grow their market share. As an example, Fiserv announced the acquisition of the ISO MerchantPro Express in March to expand operations.39

Fintechs may also continue to look for partnership opportunities with other banks, fintechs, big technology companies, and nonfinancial services firms. For instance, Walmart partnered with Affirm to offer a PoS financing option to its customers for both in-store and online transactions.40

Positioning to thrive and perform over the next 12–18 months

The acceleration of some of the current trends in consumer behavior could present exciting opportunities for payments institutions to reimagine their roles in a post-COVID world.

Drive social impact: Actions to create social impact, such as helping individuals, businesses, and communities recover from the crisis and get back on their feet, bolstering financial inclusion, and empowering gig workers, will potentially gain traction among payments institutions over the next one to two years. Providing financial advice to the underbanked and gig workers on easier ways to spend and save in this economy could prove valuable. Moreover, both fintechs and banks should consider redesigning traditional payments products and services to increase these consumer segments’ participation in the financial system. Strategic partnerships across financial institutions, retailers, and the government sector are expected to play a part in distributing benefits to consumers belonging to these impacted segments.

Modernize the payments system: Distribution of stimulus payments under the CARES Act and the Paycheck Protection Program has been a massive undertaking in the United States. That said, the last few months have highlighted the importance of modernizing the US payments system by accelerating the shift to (1) digital identity (to streamline know your customer requirements for authentication); (2) digital money (to make digital payments ubiquitous); and (3) real-time payments (to make it faster for consumers to access funds). Achieving such an ambitious vision will demand high agility, innovation, and collaboration among industry participants and central bankers alike.

Create value beyond card payments: Taking cues from platforms in developing countries, such as China, credit card issuers should aim to integrate more with consumers’ daily lives. They could consider aggregating consumers’ shopping experiences in a financial superstore app that enables customers to make purchases, pay bills, manage personal finances, access financial products, and request and receive financial advice. In our 2019 payments survey among US consumers, more than half of respondents said they would be interested in using this kind of a financial superstore app.41 Another dimension could be exploring a role in the future of mobility, where payments institutions aggregate consumers’ varied transactions in a single payment when they’re in a commute. American Express has taken a step in this regard: Its venture capital arm, American Express Ventures, joined a series B funding round to invest in Splyt, which integrates mobility services such as ride-hailing into other travel platforms or digital apps.42

On the other hand, payment networks are planning to strengthen their business models beyond consumer card payments. Many are actively pursuing mergers and acquisitions to expand into alternative rails, such as account-to-account payments, cross-border payment flows, real-time payment rails, and business-to-business payments.43

Reorganize around customers, not products: Leveraging data insights could be instrumental for card issuers to personalize experiences or integrate with consumers’ lives. But customer data is often fragmented in different silos across the organization, not allowing a single view of customers. Therefore, institutions might have to bring fundamental changes in how data across the customer journey is collected, analyzed, and integrated across the organization and with ecosystem partners.

But this may be easier said than done. Currently, many institutions are product-focused, resulting in unwieldy and duplicate functions, such as risk and compliance. They will likely need to challenge and reorganize the current operating model by putting customers at the core of operations. Institutions, therefore, should ask the right questions and make some tough decisions to reorganize their strategy, leadership, talent, and organization model around customers to thrive in the future44—and they should start now. They should use this time to retrain the retained workforce, as many of them are avoiding headcount reduction while rationalizing costs on other fronts.45

There’s (more) light at the end of the tunnel

The payments industry has not been immune to COVID-19’s impact and challenges. In many ways, COVID-19 has acted as a catalyst to deepen consumers’ digital shopping and payments behavior, requiring merchants to up their digital quotient. At the same time, the pandemic has accelerated the importance of modernizing infrastructure to make payments seamless, ubiquitous, secure, and faster.

Many payments institutions have taken the challenges head on and are focusing on their recovery plans. Now is also an opportune time to invest in new capabilities and reimagine their roles in a post-COVID world. While different institutions may take different paths, reorganizing around customer behaviors and empathetically supporting consumers to improve their financial well-being might be a good path forward to thriving in the future.

Forecasting methodology

To forecast the impact of the COVID-19 pandemic on the credit card charge-off rate from 2020 to 2024, the research team at the Deloitte Center for Financial Services studied the relationship between the national unemployment rate and banks’ credit card charge-off rate over the past 20 years.

Charge-off rates showed a one-to-one relationship with the unemployment rate during the 2008–09 financial crisis; however, the correlation somewhat weakened following the peak, with a deceleration in charge-off rates. Charge-off rates are expected to show a lower correlation with unemployment in 2020–24. As a result, the increase in charge-offs will likely be lower in magnitude compared with the rise in unemployment, due to government intervention with unemployment benefits, a financially stronger consumer, issuers’ proactive approach to help distressed borrowers, and nuanced differences in the nature of unemployment compared to the 2008–09 crisis.

© 2021. See Terms of Use for more information.

Explore the Financial services collection

-

COVID-19 return-to-the-workplace strategies Article4 years ago

-

Confronting the crisis Article4 years ago

-

2025 banking and capital markets outlook Article5 months ago

-

Women in the financial services industry Collection5 years ago

-

Emerging stronger Article4 years ago

-

Overcoming challenges to cyber insurance growth Article5 years ago