Innovation in chemicals Choosing to create long-term value

23

20 July 2020

Chemical companies that seek to survive the challenges ahead should rethink their traditional approaches to innovation. It could entail capitalizing on innovation by leveraging the advances in digital and materials science technology, collaborating with ecosystem partners, and focusing on business model acuity.

Executive summary

One of the primary drivers of sustainable growth in the chemical industry continues to be innovation. But chemical companies’ age-old approach to innovation and the status quo might no longer be an option. This is because a staggering amount of change has occurred in the industry, and there could be more to come.

Learn more

View our infographic to examine how innovation can unlock value for chemicals

Explore the Oil, gas & chemicals collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

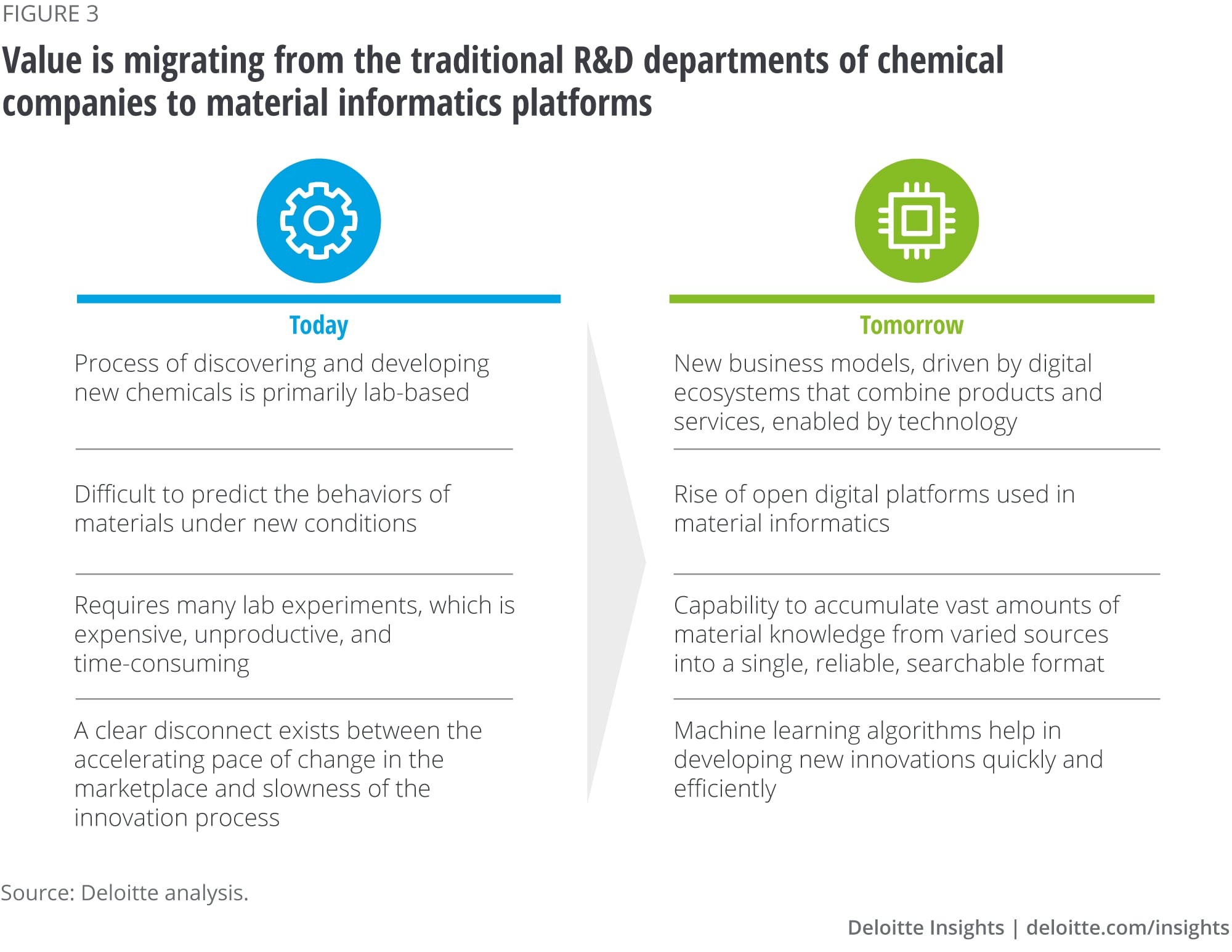

So, what has changed? The answer lies in the rise of digital technologies and open digital platforms used in material informatics. Value is migrating from the traditional R&D departments of chemical companies to material informatics platforms. Until now, the process of discovering and developing new chemicals has remained largely unchanged and primarily lab-based. This made it difficult to predict the behaviors of materials under new conditions and required many lab experiments, which were frequently expensive, unproductive, and time-consuming. There was often a disconnect between the accelerating pace of change in the marketplace and slowness of the innovation process.

To address this challenge, new startups that lie at the intersection of material science and computer science, called material informatics, are envisioning open digital platforms. These platforms have the capability to accumulate vast amounts of material knowledge from varied sources into a single, reliable, searchable format, and leverage machine learning algorithms to develop new innovations quickly and efficiently.

And more broadly, digital technologies are changing the basis of competition by unlocking potential value and making markets more accessible (figure 1). The applicability of advanced digital technologies assumes even greater importance in situations like the one the world is facing now. In responding to the COVID-19 pandemic, digital technologies can help rapidly reengineer products to reduce costs in light of changing supply chains. For instance, startups using artificial intelligence (AI) to empower materials innovation are uncovering low-cost formulations in less than three months by evaluating, optimizing, and assimilating ingredient recipes and domain knowledge.1

Extended simulations and experiments can now be run on computers that digitally model the product or process outcome and help companies decide on the best combination of design, product, and process attributes that can make a solution highly functional. A few large chemical companies are heavily invested in such digital capabilities, allowing them to perform simulations costing a fraction of what actual experiments entail. Such simulations tend to help companies reduce failures during the product development phase and make physical laboratory tests more robust.2

Therefore, to create sustainable long-term value, traditional chemical companies could consider leveraging advanced digital technologies and open platforms as well as collaboration and partnerships to reshape innovation. This may help in bringing and scaling new products and processes to market quickly and in improving the return on innovation efforts. Industry leaders could begin by asking some key questions:

- Will the existing innovation strategies remain relevant, considering industry shifts?

- What strategic investments could be made now?

- Are there new business adjacencies, alternative revenue streams, or other new opportunities to consider?

Chemical companies that work to change many of the established innovation practices and norms to navigate the innovation challenge most adeptly could be well-positioned to take full advantage of the opportunities to come.

Introduction

Over the years, the chemical industry has come up with innovative, unparalleled creations such as polystyrene and light-emitting diodes (LEDs) that surround us every day. However, in recent years, only a few chemical companies have been at the forefront of groundbreaking innovation, while many others have had mixed results. During 1950-60, which was the most prolific decade in terms of discovery of novel materials and chemicals, there were nine major chemical discoveries, compared to 13 significant discoveries from 2000 to 2019, i.e., in two decades. The pace of innovation slowed down for novel molecules and materials as well. Except for innovative crop protection chemicals, the chemical industry has not developed any blockbuster products in the past decade.3

However, this appears to be changing fast. Advances in digital technologies such as 3D printing are creating new opportunities and are driving materials companies to introduce innovative products—for example, new classes of polymers that have the structural stability to replace metal plates and prosthetics used in complicated bone surgeries. Further, technologies such as advanced data analytics and biochemical analysis have paved the way for numerous smaller players to enter the chemical industry (107 new companies that had annual revenues of less than US$3 billion entered the industry in the last decade4), aided by newer application development and reduced time-to-market.

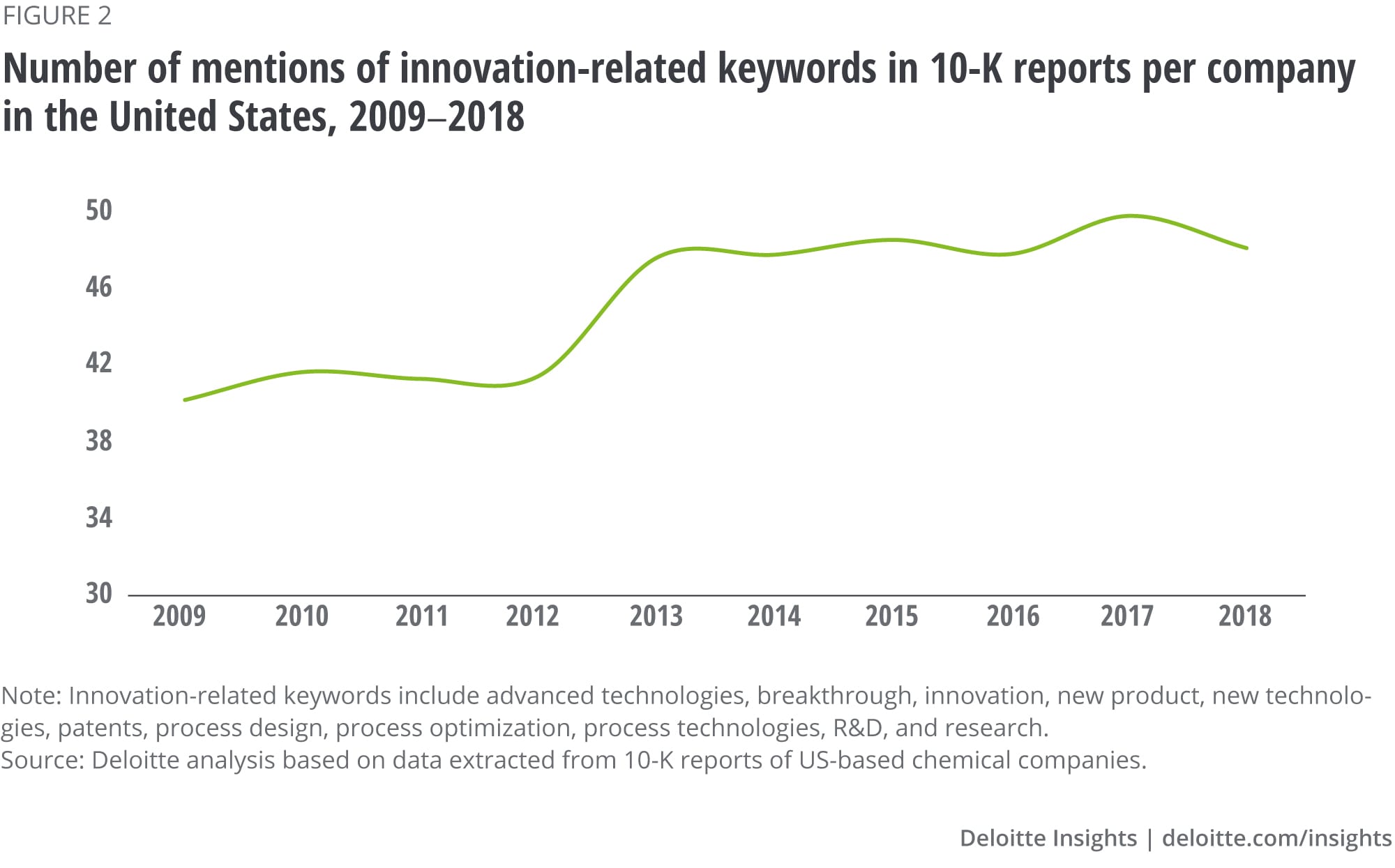

Our analysis also revealed that while R&D spending in the industry has remained relatively flat in recent years, companies report the value of their patented products and technologies has more than doubled in the past 15 years.5 Moreover, the number of mentions of innovation-related keywords in chemical companies’ 10-K reports has broadly risen over the past decade (figure 2). And while innovation at the molecule level has been less intense, companies are still creating significant value in application development, where existing molecules and processes are being modified to achieve better performance. Clearly, the efficiency and productivity of R&D has improved over the years.

Still, chemical companies could consider changing their approach to innovation to successfully respond to the current, unique disruptions (figure 3). Even beyond the economic downturn exacerbated by the COVID-19 outbreak, there are long-term disruptions faced by chemical companies. For example, companies from outside the industry are entering the fray and competing with established industry leaders; end-market demand is shifting due to consumer preferences and policy/regulatory changes6; and the industry is being affected by decarbonization and other aspects of energy transition, which is changing feedstock pricing as well as materials demand7 (see sidebar, “Energy transition and innovation: Impact on chemical segments”). In this environment, chemical companies planning for their future should focus on realigning their innovation strategy and efforts.

To better understand how chemical companies can capitalize on the innovation opportunity amid these rapidly evolving disruptions, Deloitte conducted a series of executive interviews with subject matter specialists and developed a proprietary innovation benchmarking framework. Based on the findings derived from these two approaches, we offer several insights that chemical companies can consider to generate higher value from their innovation efforts.

Long-term disruptive forces have a strong influence on chemicals innovation

Our 2010 paper titled The decade ahead: Preparing for an unpredictable future in the global chemical industry laid out a couple of scenarios along which the global chemical industry might evolve in view of a few megatrends. “Energy efficiency” and “government mandates” featured strongly as megatrends then. However, what was not foreseen was the emergence of the United States as a low-cost feedstock producer, and its rivalry with China. These changes have redefined the nature and intensity of these megatrends in recent years.

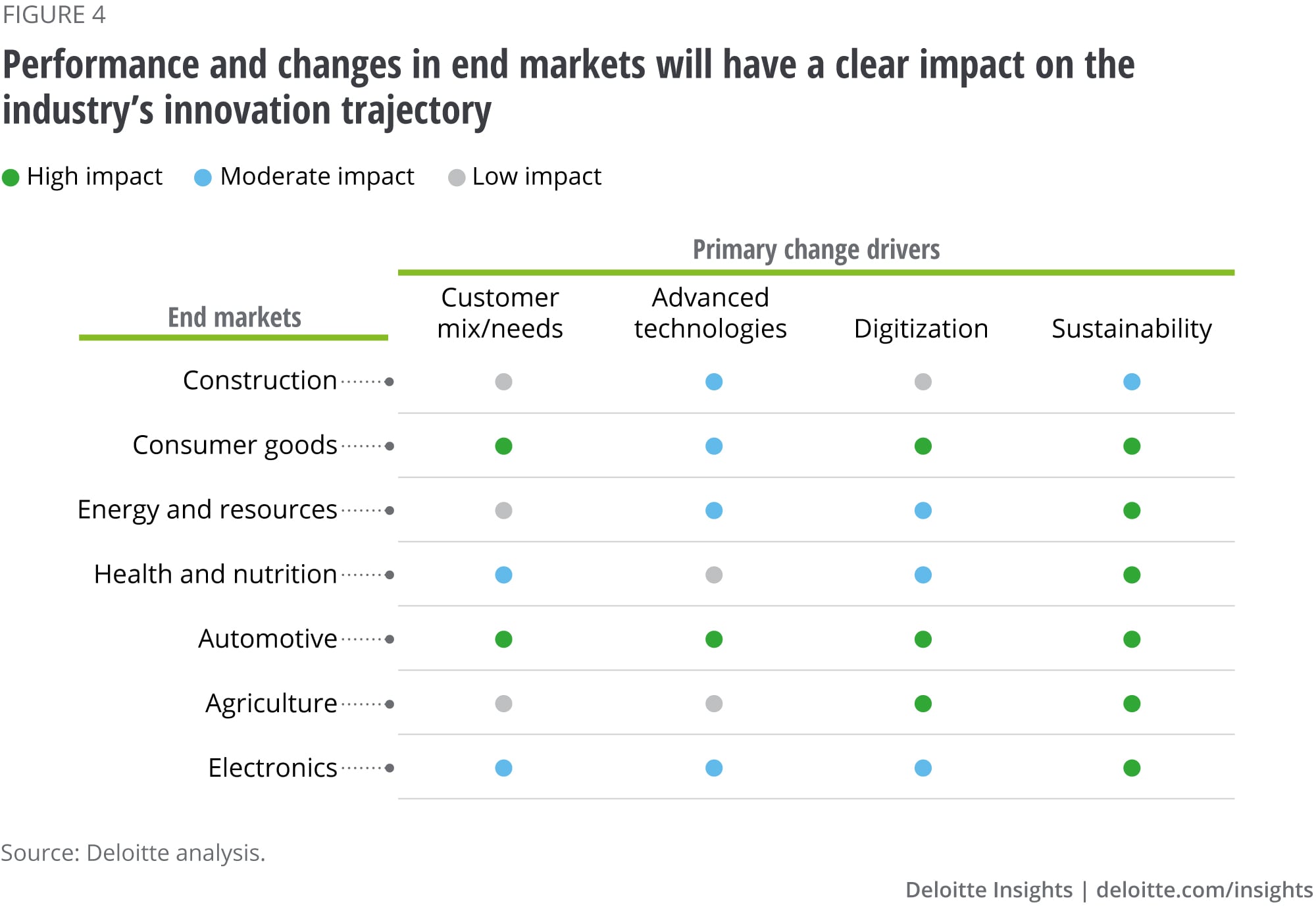

In 2020, as in 2010, the fate of the global chemical industry remains inevitably tied to end- markets demand (figure 4), price volatility of key feedstocks, trade and regulatory barriers, and sustainability. Sustainability will likely lead to higher incorporation of recycled materials in existing products and the use of renewable feedstocks (see sidebar, “Riding the sustainability wave: The growing role of novel solutions”). Similarly, electric vehicles are expected to compete for a sizable share in the automotive market, with declining automotive demand. Even as energy transition scenarios still predict an oil-dominated world, the use of renewables and natural gas is expected to grow meaningfully. Then there is changing demographics, which is exacerbating the skills gap in the industry. With much of the top R&D talent retiring over the next decade and continued immigration constraints, how the chemical industry recruits, develops, and retains its skilled talent remains a burning question.8

Riding the sustainability wave: The growing role of novel solutions

Given the single-use plastics and landfill bans as well as other regulatory burdens, plastics producers and converters seem to be concerned about the future demand of virgin plastic materials.9 Sustainability remains central to this issue even as its scope remains not just restricted to reducing environmental pollution, but instead expands to include resource efficiency, water use, and energy efficiency. In this context, the role of new products, technologies, and business models introduced by chemical companies can help to a large extent.

For instance, much interest is being generated about chemical recycling technologies. Tech startups trying to commercialize various chemical recycling technologies such as solvolysis, depolymerization, pyrolysis, and gasification have attracted increased attention from VC funds and large chemical companies. While chemical recycling technologies are just one part of the solution to tackle plastics waste, challenges remain of high capital and operational costs, scaling-up production, and feedstock sourcing, which is why a consortium approach to solving the plastics waste challenge is increasingly being adopted.10 These tech startups are striking strategic alliances with interested partners, including with large chemical companies, consumer product companies, and municipal corporations, to achieve “circularity” either by manufacturing recycled polymers, deriving energy ready for use in their existing production environment and supply chain, or through monomer production.11

All these developments indicate that it may not be enough to commercialize an advanced technology or product, but to also have a supporting business model and stakeholder (such as government agencies and industry associations) involvement to have a win-win situation for both companies and their consumers. And while interest in chemical recycling might take a backseat given the anticipated economic downturn due to the COVID-19 pandemic, the fundamentals driving the longer-term evolution of these technologies remain intact.

These uncertainties require us to segment the chemical industry differently, to distill relevant insights for innovation. We have defined these distinct segments of chemical companies that will likely drive industry development, including innovation, as follows:

- Natural Owners: Companies that have access to or ownership of a strong advantaged feedstock position and a laser-sharp focus on achieving lower operational costs

- Differentiated Commodities: Companies that are involved with a diverse group of assets, products, and markets, ranging from little differentiation to significant differentiation

- Solution Providers: Companies that primarily focus on selling solutions involving systems-level design and engineering

Energy transition and innovation: Impact on chemical segments

The segments of Natural Owners, Differentiated Commodities, and Solution Providers are defined by distinct business models and so will likely need different configurations from an innovation standpoint. Each could be affected by disruptive forces to a different extent. For instance, energy transition may disproportionately affect Natural Owners. As the chemical demand is expected to grow at a faster pace than that of fuels, many major oil and gas players have announced large integrated refinery-petrochemical complexes. Additionally, a few are also commercializing crude-oil-to-chemicals (COTC) technologies that can produce chemicals at the refinery scale. All these developments could not only transform the downstream industry but also intensify competition in commodity chemicals from oil and gas majors. This may require a change in the way pure-play chemical Natural Owners think about innovation and how they transform themselves. Given the period of low oil prices in early 2020, this exact change could take more time than usual to manifest. However, in the longer term, these structural factors continue to be an issue to watch out for. For example, pure-play chemical Natural Owners may weather the increasing competition through new process innovations enabling rapid scale-up capabilities and strengthening their low-cost leadership position. This might also attract more strategic alliances and joint ventures between unlikely partners in a bid to consolidate market power.

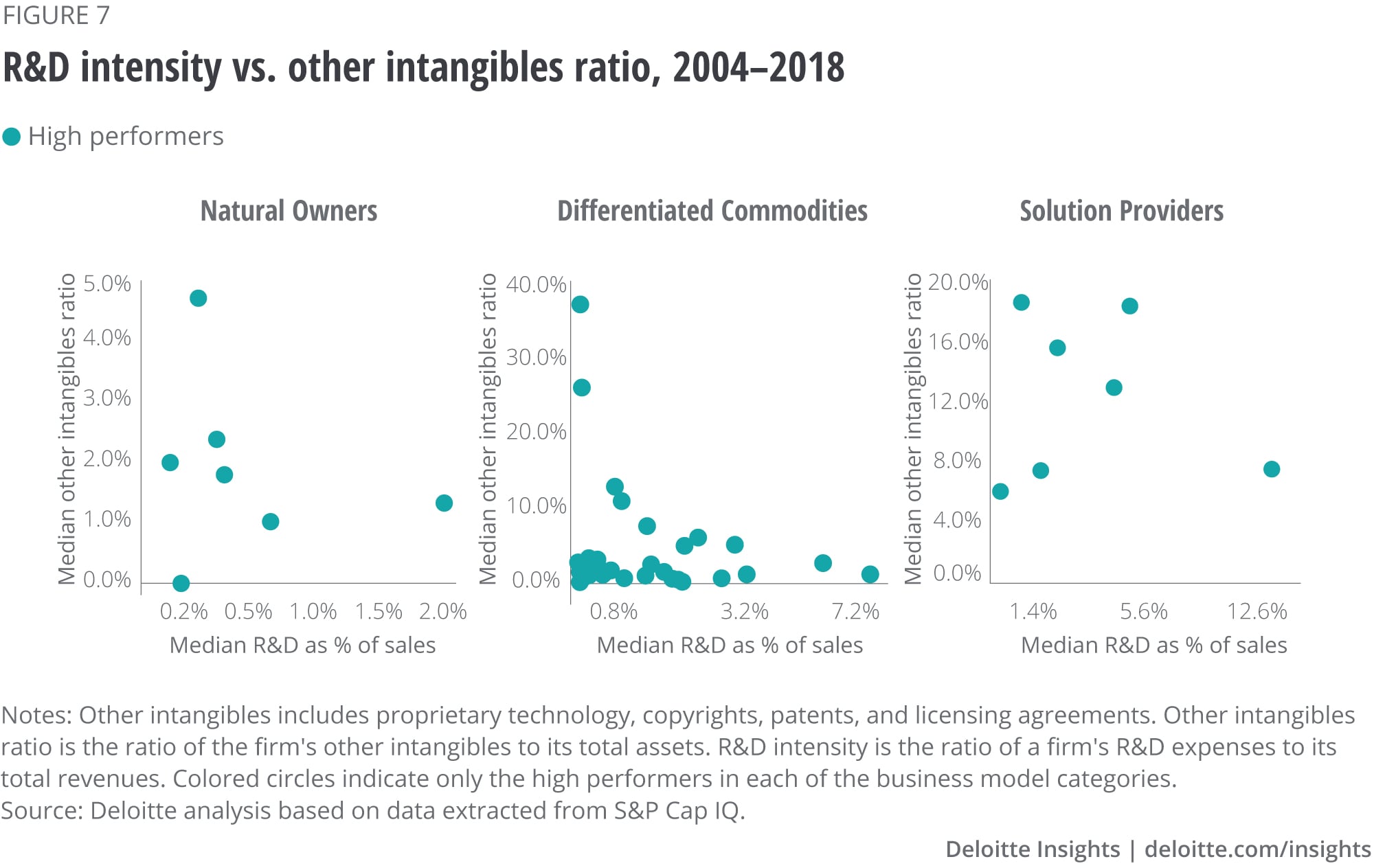

These three segments differ significantly in how their R&D intensity and value of their patented products and technologies have evolved over the years (figure 5). For instance, Solution Providers have not decreased their R&D spend relative to their revenues, displaying a consistent focus on innovation and value generated by their patented products and technologies.

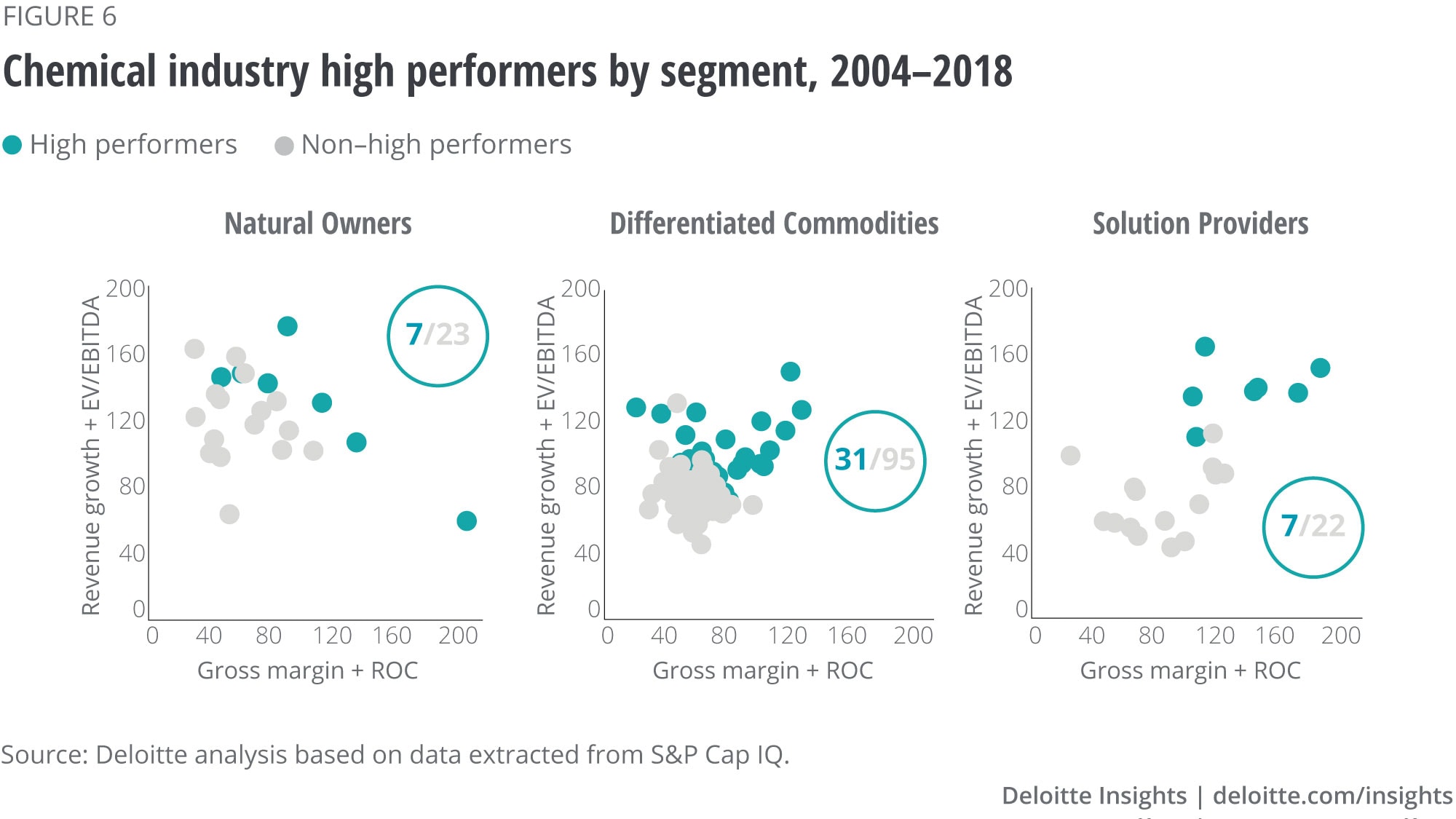

In this report, we examine high performers (see sidebar, “Methodology to determine high performance”) that generate the most value out of innovation in each of these three segments (figure 6). Our analysis highlights that only a few high-performing companies have generated disproportionately higher value from their patented products and technologies, that too on a lower R&D base (figure 7).

Methodology to determine high performance

About 140 global chemical companies were chosen to assess the high performers among them, based on two criteria: >US$1 billion in 2018 revenues, and availability of R&D data going back to 2004. For each chemical company out of this sample set, a composite score was calculated, which was composed of median revenue growth, return on capital, gross margin, and EV/EBITDA ratio over the 2004–2018 period. The highest weightage was given to revenue growth (40%), followed by gross margin (30%), ROC (15%), and EV/EBITDA (15%). The top 33 percentile companies were then chosen as high performers in each of the business segments.

While traditional innovation metrics such as R&D intensity can provide insights about companies' innovation performance, mainly the existing business models, for business models of the future, the industry should reconsider how they measure their innovation performance (figure 8). There is no one-size-fits-all approach to measure innovation effectively and so, in the future, chemical companies could assess multiple factors to measure innovation, both quantitative and qualitative.

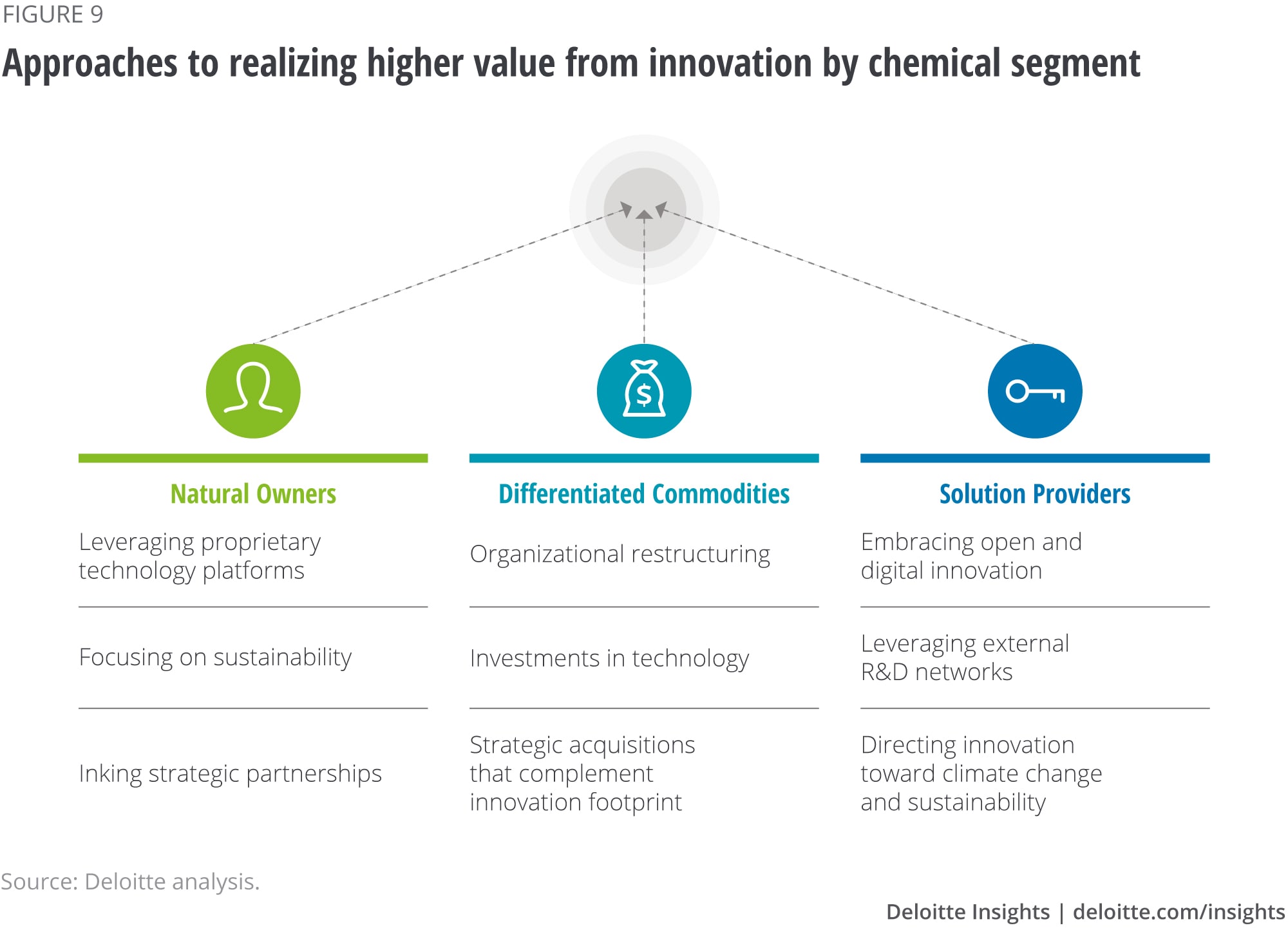

Deloitte’s evaluation of the segment-level innovation strategies revealed that high-performing chemical companies belonging to different business segments tend to take different routes (figure 9) to realize higher value from innovation.

Natural Owners: High performers such as LyondellBasell are leading value creation by leveraging proprietary technology platforms, focusing on sustainability, and undertaking strategic acquisitions that complement innovation capabilities. For instance, the company has ventured via strategic tie-ups into advanced chemical recycling technologies for multilayered and hybrid plastics packaging waste that is difficult to recycle. The A. Schulman acquisition also highlights its value-focused approach, with M&A complementing its innovation capabilities, thus finding new high-margin and high-growth markets.12

Differentiated Commodities: High performers such as Ferro and Sika are leading value creation through organizational restructuring, technology, and strategic acquisitions that complement their innovation footprint. For example, Ferro has restructured itself over the years to focus on coatings, colors, and color solutions. This has allowed the company to innovate for new solutions such as the forehearth color technology that is a cost-effective and sustainable way to manufacture colored glasses in small quantities, taking less time, improving productivity, and lowering waste.13 Sika, on the other hand, has focused on commercializing technologies such as the new process technology for recycling high-quality concrete that reduces the environmental footprint of buildings by saving natural resources (sand, gravel).14 The company has also relied on not only doing bolt-on new product acquisitions in a highly fragmented space but also extended its design, service, and sales capabilities to these acquired products that translated into higher financial gains.15

Solution Providers: High performers such as Ecolab and Innospec are leading value creation by embracing open and digital innovation, leveraging external R&D networks (see sidebar, “Collaboration and partnerships: A key to unlocking innovation”), and directing innovation toward climate change and sustainability. Companies that remain at the forefront of value creation from innovative customer solutions tend to be closest to the end users. For instance, Ecolab has indirectly invested in startups through an incubator’s accelerator portfolio to tap into innovations that it may have overlooked, in addition to capitalizing on digital innovation through which it intends to achieve annual cost savings of US$325 million by 2021.16 Innospec is developing new proprietary technologies that are becoming a benchmark for fuel performance by equipping R&D centers with advanced synthesis equipment, supporting scientists and technicians with analytical tools and technologies for testing fuel additives and oilfield chemicals, and collaborating with a number of leading universities around the world.17

Collaboration and partnerships: A key to unlocking innovation

The pathway to successful innovation typically involves collaborating externally in the broader ecosystem. With the changing landscape, no single industry can likely manage success without collaboration. And internally, chemical companies can enable cross-collaboration and dissemination of best product technologies and practices across the organization. Industry players aiming for new product innovations targeting adjacent markets could involve external partners such as universities or research institutes to shorten not only the commercialization cycle length but also integrate capabilities and talent that may not be found within their companies. New open innovation partnership announcements are happening with increasing frequency and scientists in universities and investors around the world are looking at the potential of systems-level thinking and multidisciplinary approaches as catalysts for technology breakthroughs.

Companies that are relatively successful in innovation effectively leverage strategic alliances to secure a steady supply of feedstock or jointly develop new chemicals and materials. They have strategic partnerships with pharma/biotech and consumer products/retail companies, which gives them exposure to high-growth, consumer-facing end markets, and with research organizations to develop new products. For instance, PPG collaborated closely with consumer electronics manufacturers to bring innovative coatings solutions quickly for the growing display market, including PPG easy-to-clean (EC) sprayable coating that offers better smudge control and durability, and PPG anti-glare (AG) coating that provides glare reduction and improved abrasion resistance.18

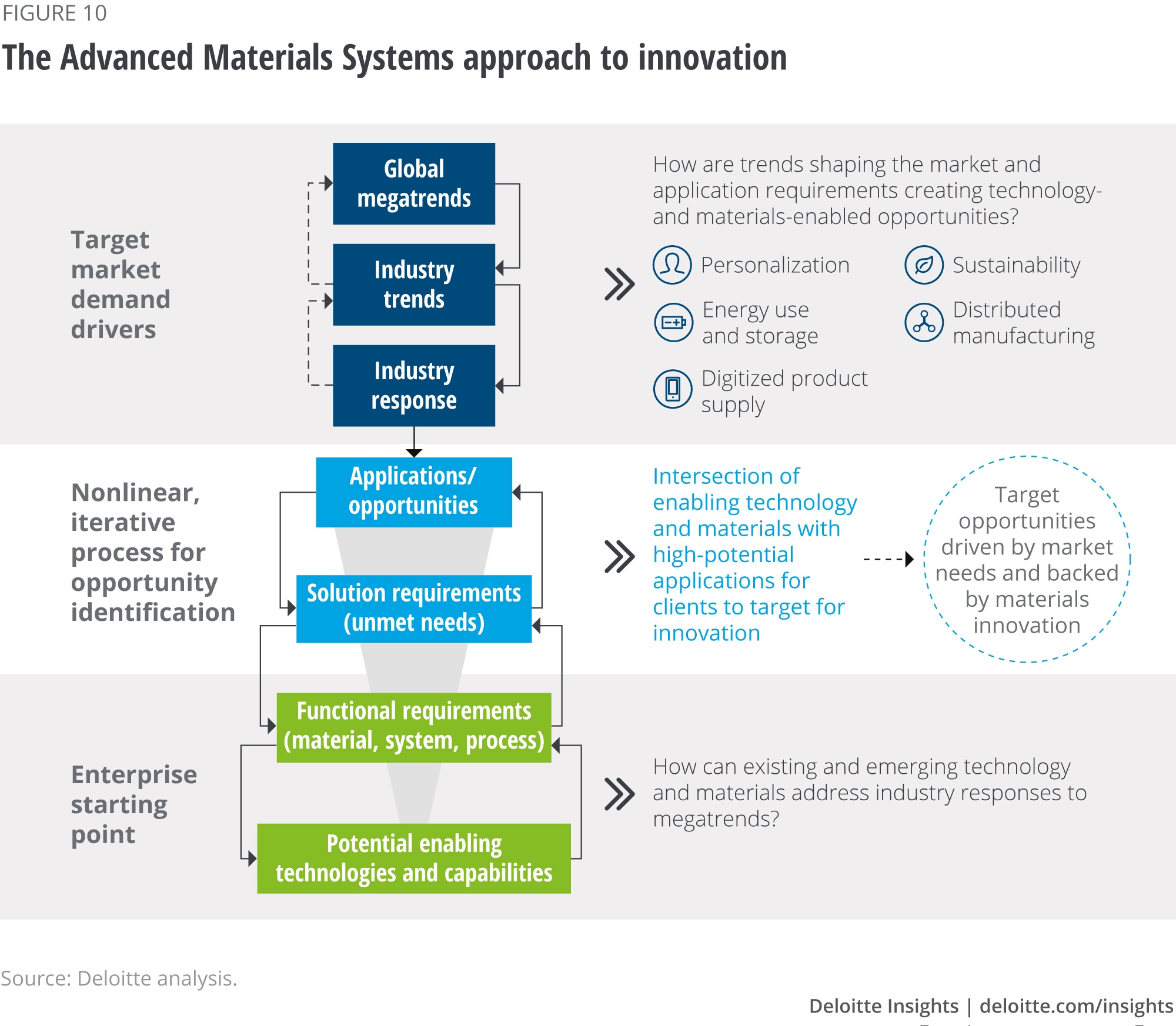

Using an Advanced Material Systems (AMS) approach for creating and capturing value in the digital age

Innovation in the chemical industry historically has been focused on molecule discovery or application development, all with a focus on selling a solid or liquid. Chemical companies looking to break the mold and move toward solutions should consider rethinking traditional innovation approaches focused on molecules (see sidebar, “A day in the life of an innovator”). Deloitte's Advanced Material Systems (AMS) framework can help to change the paradigm from molecule/applications-focused innovation to targeting end-market challenges and leading the solution development holistically with effective collaboration across an ecosystem of capabilities. Key steps to creating a viable advanced material system that can drive solutions business include:

- Clearly articulating the functional requirements needed to solve for market needs and break down the functional requirements into targeted engineering-/business-model-related problems

- Understanding and defining an ecosystem of capabilities as all the required capabilities do not likely reside within the four walls of a single enterprise

- Creating an effective collaborative model to solve for each of the individual problems across the ecosystem

- Owning the overall solution architecture and managing individual piece solutions to integrate into the whole

A day in the life of an innovator

Today, a typical day for a researcher in a chemical R&D lab entails sifting through data and reports to develop a formulation for a customer’s new application. He/she is constrained by the limitations of what can be tested in a physical laboratory. However, with the increased proliferation of digital tools and techniques in the innovation process, a typical day for future chemical R&D scientists and research professionals will likely be significantly different. A digital assistant would quickly find and organize R&D data and insights using automated queries and AI-driven databases. Machine learning algorithms could mine existing data sets to suggest formulations, allowing the R&D professional to propose novel and non-obvious ideas. He/she can test the initial hypotheses efficiently in-silico using a variety of digital simulation tools. On a customer query arising out of product-quality-related issues, a digital assistant will likely find all related inquiries and quality issues and suggest a preliminary solution, which the R&D professional can first vet and then offer to the customer.

In principle, this sounds practical and easy to do; however, given the long culture of innovation in the chemical industry, managing change to utilize a series of capabilities from across the ecosystem is difficult. Not all companies will choose the solutions path and for those that do, shortening the product innovation life cycle can be critical to the success of a solutions business.

Materials and process technologies can be innovation enablers, but alone do not create most of the value. The integration of materials into a functional solution directed toward solving a specific set of unmet customer needs in the market is often essential. As chemical companies look for a new approach to innovation and profitable growth, those that deliver systems integrating advanced digital technologies with materials will likely lead in value creation versus those that just focus on materials.

The AMS approach can help identify opportunities as driven by market needs and fulfilled by materials innovation. It generally starts with first looking at megatrends influencing the market at the broader level, which is then distilled down to identifying new applications that can potentially fulfill the unmet needs of customers. This then can give rise to functional requirements that are needed to enable the innovative solution—integrating materials, systems, and processes. If the company can launch an innovative solution that incorporates enabling technologies and materials while fulfilling the unmet market needs driven by megatrends, it could be able to derive higher value out of that solution (figure 10).

Digital technologies can not only greatly help in identifying market opportunities but also functional requirements that integrate the best of materials, systems, and processes. For example, digital technologies can enable automated trend sensing and social media scanning (using text analytics) to identify broader market trends and customer requirements. This can help improve the scope and scale of R&D efforts.19 In fact, vast amounts of data, both internal and external, are now being collated using a data-centric, platform-based approach. Moreover, materials development data is sparse and costly. AI can make chemical companies’ existing knowledge more productive and cost-effective (see sidebar “A machine learning approach to solve the materials challenge”) by integrating their domain knowledge with graphical models that can capture known correlations and analytical formulas.

A machine learning approach to solve the materials challenge

The use of AI, particularly machine learning (ML), is not new to the chemical industry. However, the frequency of ML applications has increased over the years. In 2009, there were only a few hundred studies published in journals describing the use of ML in chemistry. In 2019, this rose to 8,000—a significant increase of 35% per year in just a decade.20 These recent ML approaches (figure 11) to boost chemical understanding and computational chemistry include:

- Comprehending chemical structures and their related physical properties

- Optimizing structure-property relationships in each application

- Producing stable molecules from a pre-decided set of target properties

- Screening new chemical compounds and materials

- Improvising catalyst technologies

ML algorithms are increasingly being used to find new formulations, reduce the time-to-market of products, and improve catalyst design. For instance, a fungal active ingredient, which meets both functional and regulatory requirements, was formulated using advanced molecular modeling technologies at BASF.21 The statistical methods and computer models identified potential interactions and allowed prioritization among the likely candidates. At Pennsylvania State University and Carnegie Mellon University, researchers are applying advanced ML algorithms to optimize the design of intermetallic catalysts using “a large amount of computational data on intermetallic metal arrangements and their interaction with reactant molecules.”22 This is an “inverse design” approach—starting with the desired functionality and finding the ideal molecular fit—as opposed to the direct, trial-and-error approach, which involved working with an available set of materials and then optimizing their attributes.

Integrating capabilities that go beyond new products and processes can be key to driving long-term value

Traditional definitions of innovation often revolve around new products or technologies. However, innovation in the chemical industry goes beyond just product or process innovation since the basis of competition for all segments has moved beyond the molecule alone. Capabilities pertaining to the Ten Types of Innovation remain extremely pertinent to the chemical industry (figure 12). High-performing chemical companies that derive the most value out of innovation do this typically by creating a better customer experience through new services, brands, or channels, while integrating new products and technologies. Thus, the definition and scope of innovation expand to leverage internal capabilities that can enhance value from innovation. This is because today’s chemical companies are focused on services that are wrapped around new products or technologies as well as the overall customer experience—both physical interactions as well as digital.

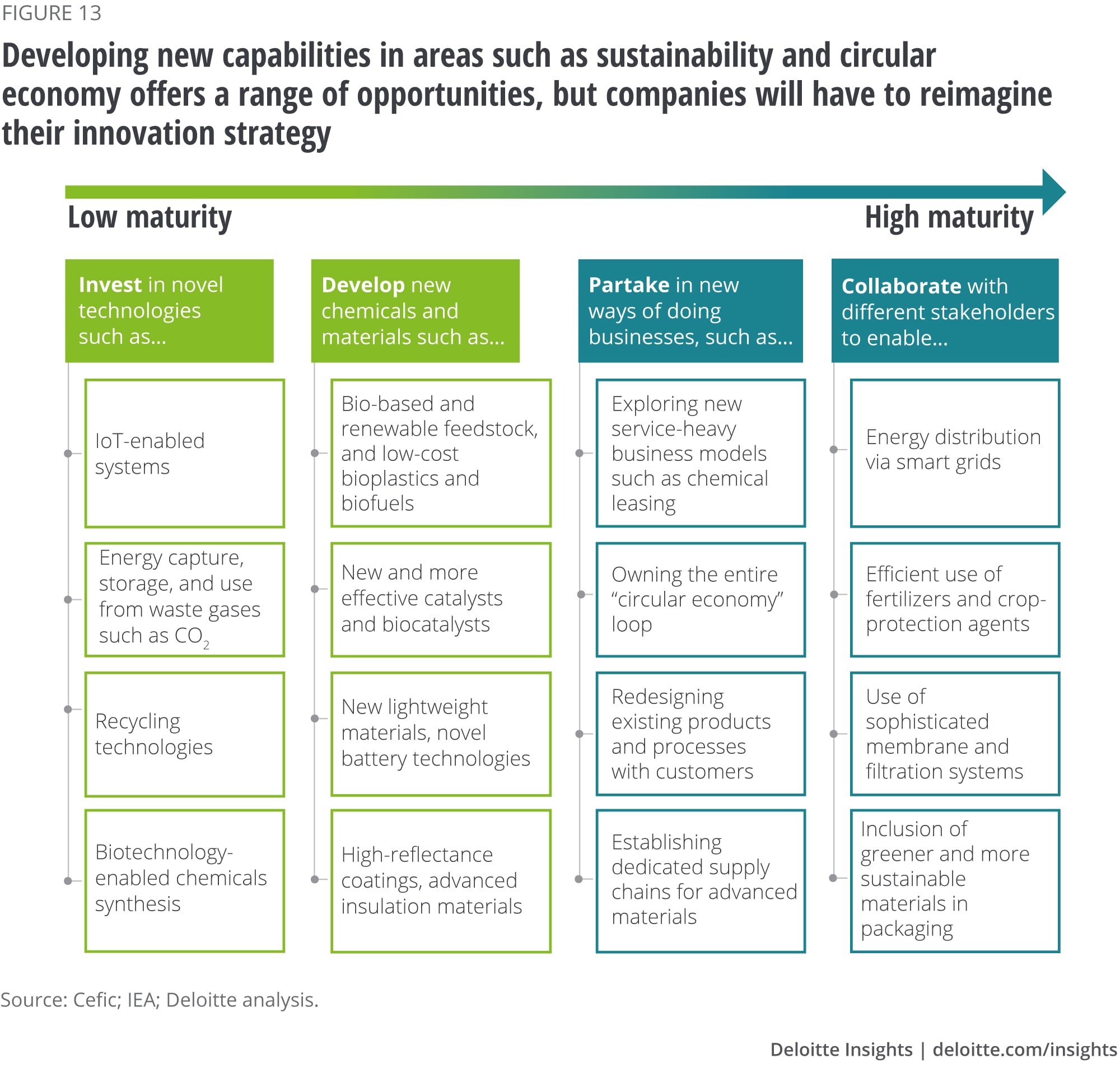

Much of the high performers’ success comes from a deliberate strategy of acquiring or developing capabilities belonging to the “experience” dimension, which cannot be easily replicated by competition. They understand that it's not enough to have new products and technologies; having new capabilities that help create a differentiated customer experience is often critical to achieving innovation success (figure 13). And creating this differentiated customer experience through innovative solutions can happen in any of the business model categories of Natural Owners, Differentiated Commodities, or Solution Providers. For instance, Ecolab—a Solutions Provider—is combining digital technologies and data analytics to provide customers visibility into operations and actionable insights that can positively affect the quality and performance of its products. The company is applying a comprehensive approach to new product development by focusing not only on designing effective chemistries (production of new formulations and product forms such as concentrated liquids and solids) and advanced manufacturing but also helping customers monitor these chemistries.23 In fact, Ecolab’s innovation strategy is inextricably linked to its overall business strategy through which it aims to ensure customer stickiness (through differentiated solutions). Due to this, it charges a higher premium for its products, services, and solutions, bestowing a competitive advantage they feel is difficult to replicate.

Many chemical companies are also leveraging venture capital (VC) to foster and bring new ideas to market (see sidebar, “Venture capital in chemicals and materials: Are we at an inflection point?”). Moreover, integrating capabilities such as digital can give rise to new ways of doing business too, and in rare cases, asset-light and service-oriented business models. Take, for example, the case of Carbon, the 3D-printing startup. Apart from commercializing its proprietary CLIP technology (a photochemical process that cures liquid plastic resin into solid parts using ultraviolet light), which enables printing of 3D parts at exceptional speeds and scale, the company has also introduced a unique subscription model for its customers. This enables its customers—belonging to sectors ranging from automotive to consumer goods—to produce 3D parts on a large scale at competitive prices, without investing in 3D printing equipment.24 In addition, Carbon has developed automated design tools and digital factory workflow elements that enable it to further improve its digital platform and support its customers in large-scale manufacturing environments.25

Venture capital in chemicals and materials: Are we at an inflection point?

Venture capital (VC) investments in chemicals and materials startups have increased over the years (figure 14). In recent times, many independent VC funds, along with corporate venture capital (CVC) funds and national research labs, have invested in startups focused on solving sustainability-related issues. These startups include Cyclopure (water purification technology using β-cyclodextrin molecules), Polystyvert (recycling solution for polystyrene), and Mosaic Materials (carbon dioxide-capturing metal-organic frameworks).26

Apart from the focus on sustainability, CVC funds have been very active over the last few years in investing in futuristic products and technologies related to strategic areas that are, in general, not developed internally. The CVC arm of Evonik, for example, has invested in startups, which are developing products in the fields of biotechnology, thermoplastic composites, and flame retardants.27 These CVC funds cater to fulfill both strategic and financial objectives, which is not the case with independent VC funds. CVCs not only bring their own expertise (including R&D and scaling-up capabilities) to these startups but also benefit from exposure to new technologies or business models. This enables the chemical companies that have a VC arm to tap early into a product or technology that may revolutionize existing markets or open new high-growth, high-margin markets.

However, CVC funds generally enter late into the funding stage and tend to exit early owing to the nature of business cycles that the industry is subjected to from time to time. Also, these CVCs generally invest in cooperation with independent VCs—an arrangement that is known as syndication in industry parlance.

Conclusion: Creating long-term value

Innovation can be critically important to a chemical company’s success and for building a sustainable competitive advantage, especially during tough times. As the chemical industry prepares itself for a potential downturn, intensified by the COVID-19 pandemic, many companies will likely focus on survival rather than commercializing new products or technologies to tap into growth markets. Innovating during tough times can be a tricky proposition as most company resources are allocated to other business areas that need immediate attention. But even while firefighting, chemical companies can plan for creating long-term value by looking at the bigger picture. Innovation need not be about the amount of R&D dollars spent but rather how it gets spent effectively and efficiently. With a host of cost-effective digital R&D tools at their disposal, chemical companies can acquire, amalgamate, and nurture the best combination of systems, products, and processes, even during tough times. And for this to happen, companies could consider adopting the innovative approaches that suit their business models and organizational cultures. Chemical companies that reimagine innovation by accelerating investments in digital capabilities, focusing on collaboration, and partnering with ecosystem stakeholders could be successful in reducing overall costs and creating new products that customers need quickly and that ultimately create long-term value.

© 2021. See Terms of Use for more information.

-

Down but not out Article5 years ago

-

Navigating the energy transition from disruption to growth Article4 years ago

-

Global renewable energy trends Article6 years ago

-

Deciphering the performance puzzle in shales Article5 years ago

-

Oilfield services: Caught in the cycle Article6 years ago

-

The new frontier Article6 years ago