M&A premiums surge as pool of targets subsides With rising demand for proprietary content, media businesses are rethinking their approach to M&A

4 minute read

15 January 2020

A wave of takeover activity in recent years has consolidated the telecommunications and media & entertainment sector, shrinking the supply of viable targets and enlarging asset premiums.

The flurry of new streaming options introduced by major telecommunications and media & entertainment (TME) companies in the last year1 has ignited a run on iconic proprietary content—including acquisitions of entire companies and media businesses—to populate these stand-alone offerings.

Learn more

Explore the Thinking Fast series library

Subscribe and never miss a charticle

Explore the Technology collection

Go straight to smart. Download the Deloitte Insights and Dow Jones app

And with a limited number of established companies available, M&A deal premiums have risen—bringing into question how companies should approach M&A going forward. The skyrocketing cost of M&A deals is especially critical due to the flurry of new direct-to-consumer streaming options and companies’ need to fill those services with often-expensive proprietary content.

According to Deloitte’s latest Digital media trends survey, consumers can now choose from more than 300 streaming options,2 with more on the way in 2020.3 No surprise that many consumers are feeling “subscription fatigue,” potentially limiting the number of streaming providers likely to survive and win in this space. These highly competitive dynamics, fueled by new entrants such as technology leaders Amazon and Apple, are intensifying the race to build the biggest and best streaming options to compete with Netflix’s first-mover advantage.

Since 2014, US companies in the TME sector have executed more than US$500 billion4 of M&A deals,5 highlighted by landmark transactions such as Walt Disney’s acquisition of 21st Century Fox’s entertainment assets, and by AT&T’s acquisition of Time Warner, including HBO and Turner assets. While this consolidation wave has been seen across the industry, these two transactions alone accounted for almost a third of the sector’s total deal value over the past five years.

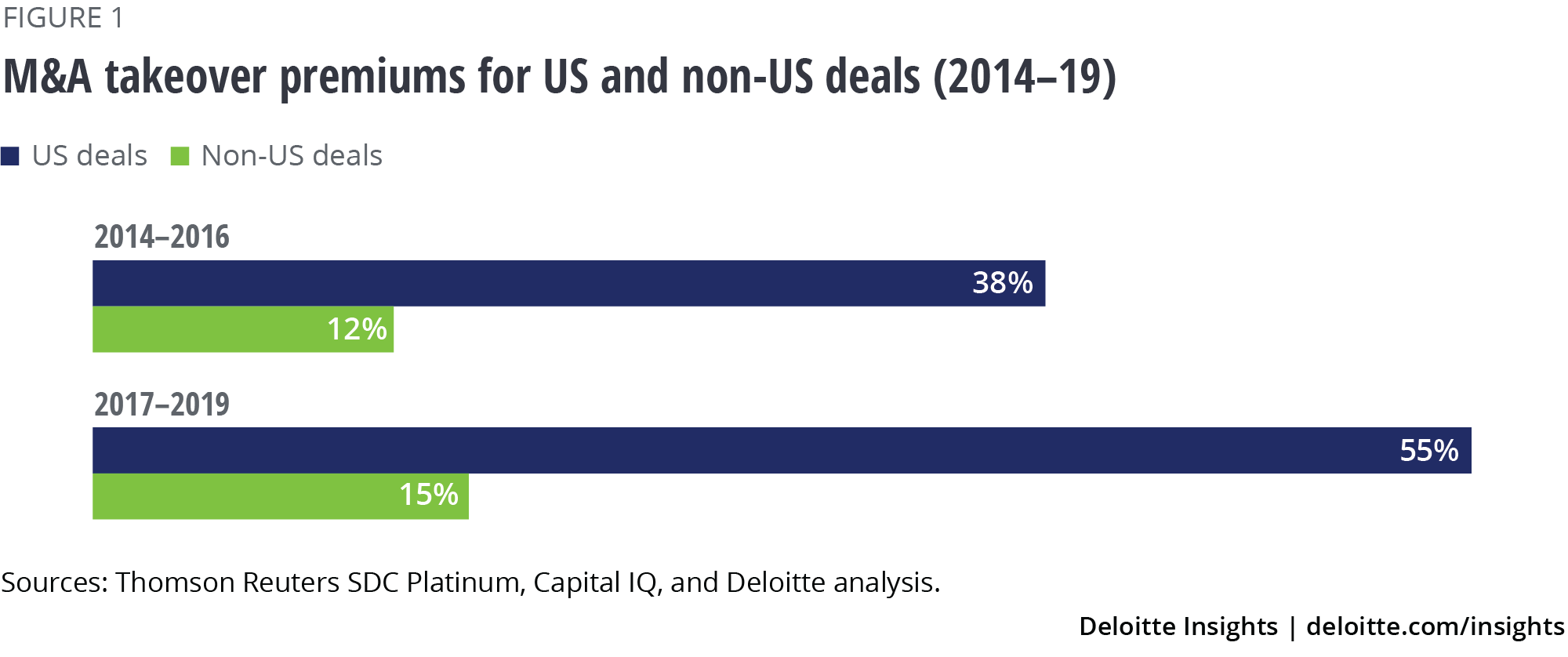

This surging takeover activity has contributed to control premiums (the amount the acquirer must pay above the pre-bid value of the acquisition target to take control) from an annual level of 27 percent in 2014 to as high as 57 percent in 2017 (see figure 1).6

M&A premium trends in the US TME sector, according to Deloitte analysis:

- 2014 to 2016 average takeover premium: 38 percent

- 2017 to 2019 average takeover premium: 55 percent

This trend has materialized outside the United States as well, albeit less dramatically. Since 2014, around US$250 billion7 of M&A deals (including a US$500 million-plus transaction value) have been executed in the non-US TME sector. However, the takeover premiums have generally been lower elsewhere in the world.

M&A premium trends in the non-US TME sector:

- 2014 to 2016 average takeover premium: 12 percent

- 2017 to 2019 average takeover premium: 15 percent

What does this mean for buyers and sellers?

Clearly, the surge in consolidation across the TME industry can drive higher valuations, and this naturally favors sellers. In addition, after some major mergers, fewer target assets are available, further boosting valuations. And the lower frequency of deals in recent years signals that there could be less-viable targets remaining. Further, some targets may have convoluted ownership structures that could discourage potential suitors.

But there could be some good news for buyers: Some diversified TME players may be weighing opportunistic divestitures to meet the supply shortfall. Buyers, though, should act cautiously. Iain Bamford, Deloitte’s TME sector lead, sums up: “Buyers should be focused on understanding their unique market positioning to develop short- and long-term content strategy prior to jumping into costly M&A activity.”

Given the steady rise of M&A deal premiums, TME companies need to be focused on finding the right targets that will bolster their existing content strategies to gain the most value from M&A activity.

© 2021. See Terms of Use for more information.

More from the Technology industry collection

-

A pragmatic pathway for redefining work Article5 years ago

-

Rediscovering your identity Article5 years ago

-

Tech Trends 2025 Article4 months ago

-

Bringing AI to the device: Edge AI chips come into their own Article5 years ago

-

Private 5G networks: Enterprise untethered Article5 years ago

-

Robots on the move: Professional service robots set for double-digit growth Article5 years ago