Standing out from the crowd How media and entertainment companies can use M&A to secure the content, customers and capabilities they need to differentiate

13 minute read

26 August 2020

Amid industry disruption and transformation, media and entertainment companies are looking to M&A to fill content libraries and bolster technology.

Introduction

Every couple of decades, major market transitions reshape how people consume content, from talkies in the late 1920s to broadcast TV in the ’50s, from cable TV in the late 1970s to onscreen video in the ’90s. But the disruption caused by technology companies entering the media and entertainment space in the last few decades is triggering transformations like never before.

Learn More

Explore the Telecom, media & entertainment collection

Visit the Technology collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Iconic media companies have long proven resilient amid disruption. But with content consumption and distribution trends shifting ever more rapidly, there’s no guarantee of survival—one major reason why storied media brands are teaming up and looking to combine assets to strengthen their position and prepare for a new era, whatever it might look like.

Traditional media was already in the late stages of this transformation, with leaders beginning to comprehend the new landscape, when COVID-19 arrived to radically disrupt everyday life. Recovery from the pandemic disruption will likely dominate operational strategy in the near term, even as companies consider how to address the broader and longer-term transformations in media and entertainment.

Dealing with disruption

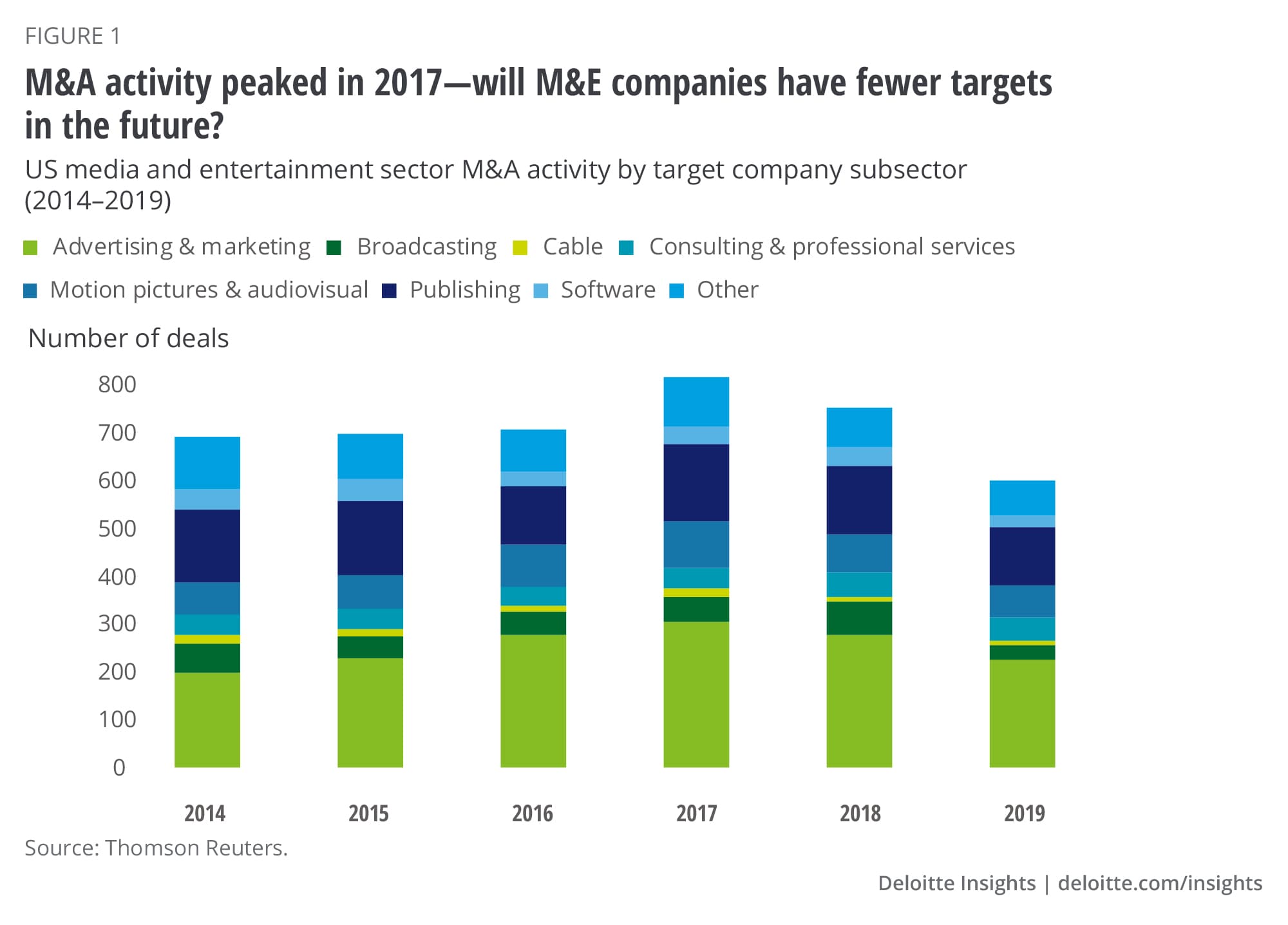

To adapt to these changes, media companies have consistently used M&A to remain competitive and future-proof businesses. Since 2014, companies have executed more than US$700 billion in strategic M&A deals across media and entertainment sectors,1 highlighted by transactions such as the Walt Disney Co.’s acquisition of 21st Century Fox’s entertainment assets and AT&T Inc.’s acquisition of Time Warner Inc., including its HBO and Turner assets. Just as unprecedented change has forced companies to consider transactions—such as merging with a fierce rival—that would have been unthinkable years before, it may cause companies look to invest in areas previously ignored or out of their comfort zone.

Globally, the broader telecom, media, and entertainment sector M&A volume fell by 17% in the first half of 2020 compared to a year earlier, while value is 47% down. In the United States, the sector has been far more resilient, with volume down only 4%. But the 45% decline in deal value suggests that companies are looking at small and midsized deals following the megamergers, albeit with continued pandemic-related uncertainty also hampering valuations. Although the economic outlook will loom large, M&A deal pricing is likely to be influenced by demand for and supply of independent targets.

The content boom

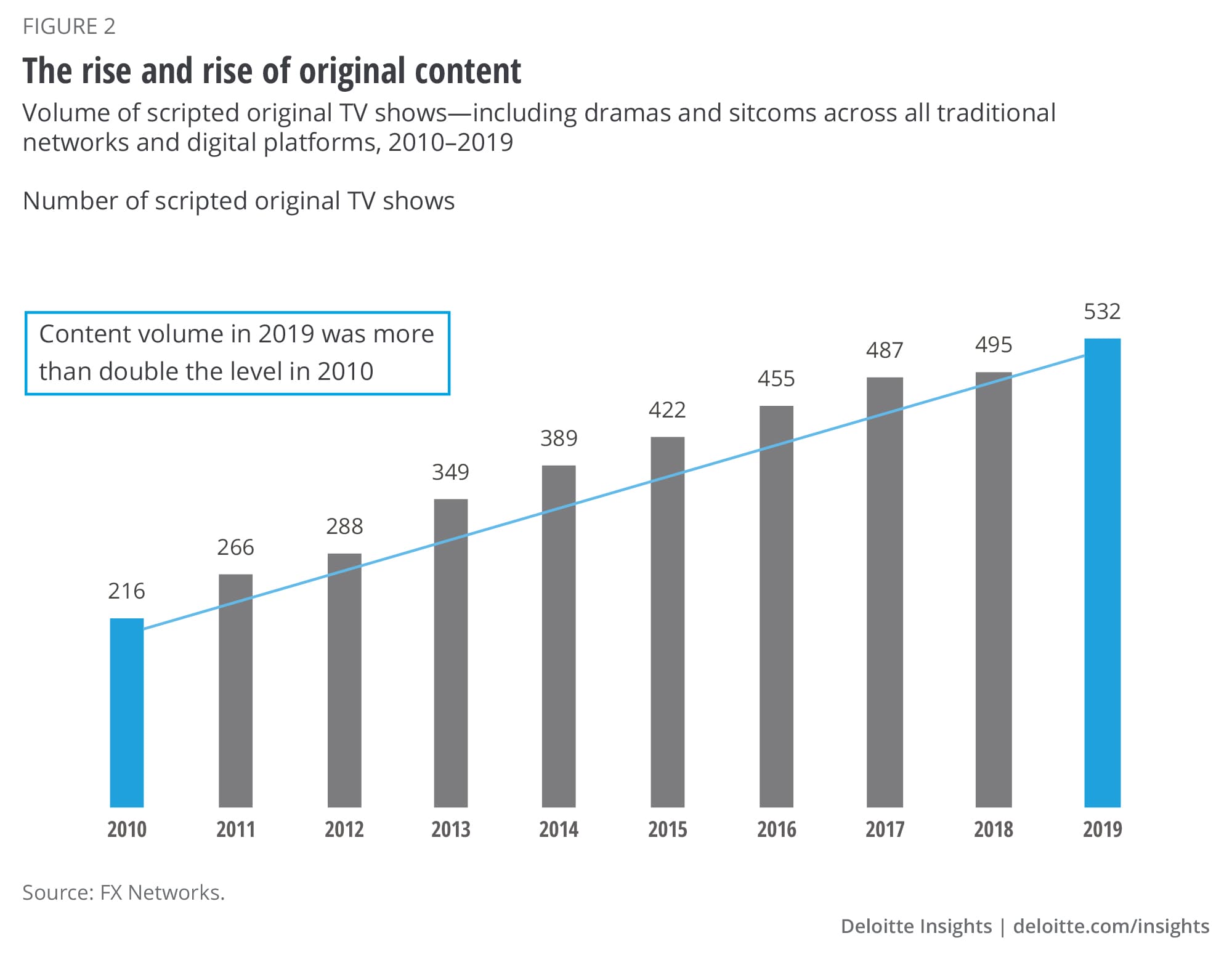

Central to the megamergers that have occurred across media and entertainment has been content—generally, iconic, popular, and marketable content—as the key driver. The battle to secure quality material commenced in earnest in 2013, when tech company-backed streaming services made their first major forays into original content, investing as much per hourlong episode as a typical top-tier network TV drama.2 Competition with premium networks such as HBO soon raised budgets, vastly increased the demand for original content, and helped draw high-profile actors and directors to TV for the first time. And over the last few years, this battle has become a full-fledged arms race, leading to soaring price tags on premium content and deals with in-demand content makers.

And in the years since, the arrival of more streaming services, and the heightened competition for talent and content, have driven a content boom and led to skyrocketing costs. Since 2010, the number of scripted TV shows on US networks has more than doubled (figure 2).3 And streaming services are now paying up to US$20 million per hourlong episode—several times the cost of just a few years ago.4

Industry experts expected the annual number to keep rising toward 600 scripted shows, considering the launches of Quibi, AT&T’s HBO Max, Comcast’s Peacock, and other streaming services. But the COVID-19 pandemic idled filming in Hollywood and around the world, delaying the production and release of any number of shows.

A hypercompetitive streaming environment5 is bifurcating media companies’ approach: Some are offering highly targeted content, narrowcasting to specialized audiences; others are focusing on elevated content with broader appeal. All of them need hours of programming, whether original or purchased, and they need it even with most studios still shut down.

The next wave of consolidation

In addition to this content boom, the industry is experiencing a technological disruption due to the explosion of streaming. Reflecting the move to digital viewing, 80% of consumers use at least one streaming video service, up from 49% three years ago.6

Like most digital businesses, streamed entertainment relies on expanding consumer activity and data generation to drive growth. It’s no surprise, then, that media companies are trying to differentiate themselves to brands and advertisers by investing more mature analytics and data technologies to offer more targeted ads and provide insight on viewers.7 The fact that platforms with the most popular content will attract a higher proportion of advertising revenue will likely drive additional consolidation of the few remaining media and entertainment targets available.

Indeed, M&A activity will likely push convergence and consolidation among companies to new levels, as merged entities bring together content libraries, capabilities, distribution, and value. The effects of the content concentration have been sharpened somewhat in the near term, given that production halts are putting a premium on established and existing content libraries. Continued consolidation will likely ultimately leave the surviving companies with not only great power in advertising but control over content and distribution.8

Strength through differentiation

In today’s rapidly changing content ecosystem—with rising consumer power, competition, and the importance of technology and data—media and entertainment companies face increasingly complex challenges far beyond broadcasting or publishing content. Companies are not only competing for talent and content—they are directly competing for access to consumers and technological resources.

Leading companies today are more likely to be those actively involved in content distribution and the value chain, suggesting that those not there yet need to work to attain the capabilities needed to be an influential link in the value chain.

We believe that companies should focus on excelling in one or more of the following differentiators to remain ahead of the competition:

- Providing differentiated content and programming, either at scale or through dominating a niche

- Controlling direct access to consumers through owned distribution channels, including direct-to-consumer(DTC)/over-the-top (OTT) alternatives, either at scale or through owning access to a valuable consumer segment

- Owning the capabilities required to capitalize on increased data and using it to boost profitability, optimizing proprietary data to develop better insights

There are a range of potential M&A strategies that could help companies address these three differentiators. The rising competition for content, consumers, and technology assets means that successful M&A will likely be transactions that achieve a distinct and differentiated market position or advantage.

Leading companies today are more likely to be those actively involved in content distribution and the value chain, suggesting that those not there yet need to work to attain the capabilities needed to be an influential link in the value chain.

How M&A can help media and entertainment companies to attain differentiated positions

Providing differentiated content

The wave of competitive and technological disruption to occur in the current era may have changed how consumers interact with content and the platforms they use. But one thing has not changed: Content is still king. If anything, the heightened competition in streaming means the imperative for must-have content has never been higher.

Unquestionably, the need to secure premium content and, more specifically, differentiated content has fueled a large portion of the M&A deals that continue to alter the media landscape. Content providers understand that services offering the most elevated, unique, and comprehensive content libraries likely have the best chance of success—after all, one of the primary reasons consumers choose a particular streaming video service is to watch shows and movies they can’t get anywhere else.9 In Deloitte’s 2019 Digital media trends survey, 40% of paid streaming video users said they subscribed primarily to access original content. And this was up to as high as 57% for Millennial consumers.10

As much as there is competition at the premium end of content, competition for library—second-run films and TV shows—is also strong.11 Recognizing its value, media companies that hold rights to and/or create popular programming have pulled back their licensed content from third parties, preferring to include established programming in their own DTC offering, potentially weakening the value proposition of streaming services that rely on licensed content.

Though some media companies have achieved success through scale, few companies can realistically strive to be all things to all consumers. Companies can also be successful by offering strong content focused on a niche or subgenre. The Acorn streaming platform has amassed more than 1 million subscribers (paying US$6 per month) while maintaining high customer retention rates based on offering mainly British TV murder mysteries, even as more diverse and more capitalized platforms struggle to achieve half of that subscriber count. AMC Networks acquired Acorn’s parent company for a total valuation of US$100 million in 2018.12

Unsurprisingly, then, M&A activity in this space typically consists of both consolidations to expand inventories and cross-industry deals in which distributors look to acquire unique, premium content.

Consolidation deals are typically driven to increase scale, resulting in expanded content libraries, greater negotiating power with distribution partners, and increased operational efficiencies. The Walt Disney Co.’s streaming-driven acquisition of 21st Century Fox—including the rights to the X-Men, Avatar, The Simpsons, FX Networks, and National Geographic—exemplifies this approach.13 The deal was a key step to accumulating premium content and properties to achieve Disney’s broader execution strategy of expanding its digital presence through three major streaming products: Disney+, ESPN+, and Hulu.

The other type of M&A deals involves companies outside of the traditional media and entertainment business looking to acquire producers of premium content.When it acquired Time Warner Inc., AT&T was best known for its wireless, broadband, and video customer relationships. Buying a diversified content company instantly made AT&T an entertainment company, transforming its content breadth through the addition of HBO, Turner, and Warner Bros. assets. AT&T launched HBO Max in May 2020, expanding HBO’s existing library with iconic and highly sought-after programming such as Friends and South Park.14

These conglomerates’ acquisitions are outliers in terms of scale and, in fairness, not easily replicable. But the strategic implications are relevant for media companies of all sizes. Not only are smaller media companies increasingly becoming acquisition targets of larger companies looking to fill out their content offerings—small-to-medium-size companies are considering mergers to remain competitive with the conglomerates and maintain sufficient scale to remain relevant to consumers and advertisers. Remaining independent leaves these companies vulnerable to diminishing commercial leverage.

Further, a paucity of conventional targets may force companies to think more laterally about how to attain differentiated content. The recent rise in appetite for original content has driven news media businesses to view their back catalog of news and magazine articles as monetizable source material for video content including TV series, documentaries, and even feature films. Similarly, companies have developed podcast programs into premium video content.15 These nontraditional sources of original content could provide targets for M&A in the coming months and years.

A paucity of conventional M&A targets may force companies to think more laterally about how to attain differentiated content.

Controlling access to consumers

Key to the early success of streaming services was providing a more user-friendly interface and consumer-centric viewing experience than the one the traditional TV ecosystem provided. Early movers’ ability to attract significant subscriber volume well before they created any original content illustrates one of the industry’s biggest distribution model shifts: from the service provider-partner model of traditional media to the disintermediated DTC model. And this highlights the second differentiator that companies can attain: controlling access to consumers. Put more simply, a media company can succeed by owning the distribution channel that feeds directly to consumers.

Traditionally, service providers—think of phone or pay TV—have distributed media content; streaming over the internet changed this, enabling the shift to DTC. Through providing a DTC solution, or owning the last mile, media companies are able to more actively participate in how their content is sold and experienced. Further, this more direct relationship enables some companies to expand beyond their traditional customer base by offering products based on new and flexible business models.

Almost a decade after tech companies found success with a DTC streaming model, every major US TV network and studio has a stand-alone DTC streaming service by mid-2020, enhancing these companies’ ability to control access to consumers and create more valuable opportunities for advertisers.

Companies considering attaining this differentiator will need to either acquire targets that already have a DTC platform or build their own offering, an expensive and time-consuming prospect. Disney chose the former strategy when it entered the streaming wars, through its acquisition of BamTech, an offshoot of Major League Baseball’s Advanced Media unit, to fuel its Disney+ and ESPN+ offerings. There are still some—though not many—independent companies in this space with significant users that could be acquisition targets; again, while consumers can choose from upward of 300 OTT services, the degree to which this represents the pool of targets may be diminishing. Early in 2020, Fox Corp. and Comcast executed deals for ad-supported DTC streaming services Tubi and Xumo, respectively.

As streaming becomes more competitive, it’s likely that additional new services will enter the market with differentiated products to stand out from the crowd.

Owning the capabilities to better monetize data

The third differentiator revolves around the capture, analysis, and monetization of data—and how companies can leverage this data to drive business optimization. In an increasingly connected world where all digital activity generates quantifiable outputs, successful companies will be those that can harness digital data to improve customer experience (for example, providing more relevant recommendations) and monetization (for example, targeted advertising or products).

This differentiator is built on targeted advertising, content customization and recommendation engines, advanced data storage and analytics, and machine learning—plus the skill sets to support them. Many advertisers are leveraging data-driven capabilities to differentiate themselves through technology, aiming to optimize efficiency with improved measurement, attribution, and analytics capabilities. These can enable advertisers to acquire audiences most likely to match and engage with certain products and strategies. Regardless of the targeting form, marketing partners’ overall objective is to achieve increased efficiency and effectiveness in moving consumers from awareness (advertising impression) to conversion (sales revenue) driving greater ROI from campaigns.16 This focus drove Comcast’s acquisition of advertising platform Freewheel.

Media companies are using multiple paths to capitalize on data and to create new offerings for advertisers. For example, traditional broadcasters have made ATSC 3.0 a strategic focus area, making it possible for broadcasting to function more like an OTT service.17 Broadcasters will be able to unlock new capabilities and potential revenue streams using ATSC 3.0’s increased ability to identify viewer information for ad targeting purposes, and also deliver IP-based data to a wide variety of connected devices.

Media companies need to continue to invest in data ownership to provide additional offerings to be attractive to advertisers in an increasingly competitive market as advertising load per unit of content—for example, minutes per hour of content—shrinks and priorities shift to more digital delivery. By developing more data-driven, relevant, and interactive consumer opportunities, media companies should be able to increase overall advertising revenue.

Although differentiation in these three areas may be required for success, the third—attaining capabilities to capitalize and monetize data—is both the hardest to execute and the likeliest to be an afterthought for many media companies. For companies traditionally focused on producing and distributing content, attaining depth in areas such as advanced analytics and advertising technology is furthest from their comfort zone—and more aggressive strategies such as directly acquiring these capabilities might be the most efficient solution. When a company demonstrates a leading position in this data differentiator, it can leverage the first two—differentiated content and access to consumers—and derive additional benefits by using data and analytics to improve those underlying assets. It is a virtuous cycle: By harnessing the data, advertisers can create more personalized content and improve distribution capabilities.

For companies traditionally focused on producing and distributing content, attaining depth in areas such as advanced analytics and advertising technology is furthest from their comfort zone.

Implications for media and entertainment industry players

In a landscape undergoing permanent and irreversible upheaval, media companies are redefining their business models and investing in areas previously ignored. M&A can be a tremendous tool in fueling these changes, building these differentiating capabilities, and positioning companies for the future.

As we’ve outlined, companies could leverage M&A to help enhance the following critical differentiators:

Providing differentiated content. The rising competition in streaming video has placed a premium on content and heightened the importance of securing content rights and the focus on M&A targets and deals that could achieve this. With some industry behemoths out of the running due to recent deals, M&A activity could be driven primarily by mergers of relative equals, or by acquisitions featuring larger, nontraditional players.

Controlling access to consumers. Many media companies have attractive content libraries, but ensuring their underlying products and platforms are robust enough to deliver content in a competitive OTT environment is another discussion entirely. Rather than trying to build capabilities internally, media companies should consider targeted acquisitions of companies or startups with digital-native technologies upon which they can build.

Capitalizing on the ability to monetize and target consumers. As the volume of data generated by digital activity grows, so too do opportunities for M&A deals that could improve a media company’s ability to store, access, manage, and monetize data. Transactions in this space will probably be on the smaller side, as most large data analytics providers and sizable advertising technology companies have already been acquired.

Each company’s path may be different, but opportunities exist for media companies to transform their businesses in response to this massive market upheaval. Consumers are relying on streaming more than ever, establishing closer connections with service providers; companies are looking at making deals or strategic partnerships, driven by fewer options and economic realities. Despite these changes and the resulting opportunities, one thing remains steadfast in this industry—the show must go on. What role will you play?

More from the Technology collection

-

The changing face of North America’s tech ecosystem Article5 years ago

-

Cloud gaming and the future of social interactive media Article5 years ago

-

Rebuilding a stronger digital society Article4 years ago

-

TMT Predictions 2025 Article5 months ago

-

The most valued technology gadgets of the last decade Article5 years ago