Financing a sustainable transition CFOs in Europe open up on sustainable finance

10 minute read

19 August 2020

The results of the latest European CFO survey reveal that when it comes to ESG, many companies are missing opportunities to engage with investors effectively. Finance departments have a role to play, but may need to build new capabilities.

Environmental, social and governance (ESG) issues, once considered extra-financial, are now being seen as material risks and opportunities for a company’s bottom line. Recognising this, financial markets are changing – with important consequences for how companies finance themselves and shape their investor relations. The results of the latest European CFO Survey reveal that when it comes to ESG, many companies are missing opportunities to engage with investors effectively. Finance departments have a role to play. In order to do so, they might need to build new capabilities.

Key takeaways

- Investors and lenders now expect companies not only to deliver strong financial performance but also to have a positive social and environmental impact.

- CFOs can promote the social and ecological transition of their companies by using new financing tools and by supporting sustainability impact projects.

- Finance executives can help rethink the performance model of their company, using new accounting frameworks (such as the Triple Depreciation Line framework) and new measures for triple performance (i.e., economic, social and environmental).

- Finance functions have a key role to play in ensuring the relevance, compliance and accuracy of sustainability information provided to external stakeholders – from risk analysis to governance, internal control, prevention and mitigation measures, and third-party assurance.

- CFOs need to steer financial and non-financial performance using new tools and solutions, internal dashboards, individual and collective performance criteria, and group and entities roadmaps.

Why sustainability is increasingly relevant to the finance function

Companies and their finance functions have been dealing with the question of sustainability for a long time. However, while the costs and regulatory burdens associated with addressing sustainability were quite evident, the benefits of doing so have until recently been less visible and quantifiable. That has changed significantly in the past few years as public awareness of the world’s environmental and social challenges has grown and with it the demand for businesses and policymakers to take action. A growing body of evidence shows that a focus on environmental, social and governance issues (ESG) makes companies’ financial and operational performance better.1

Learn More

Explore the CFO collection

Explore the Strategy collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

Investors are taking note. Asset managers are holding corporate leaders increasingly accountable for the ESG performance of their companies. By the end of 2019, more than 2,500 investors representing over US$80 trillion in funds had signed up to the UN Principles for Responsible Investment (PRI), thereby committing themselves to including sustainability factors in the investment process.

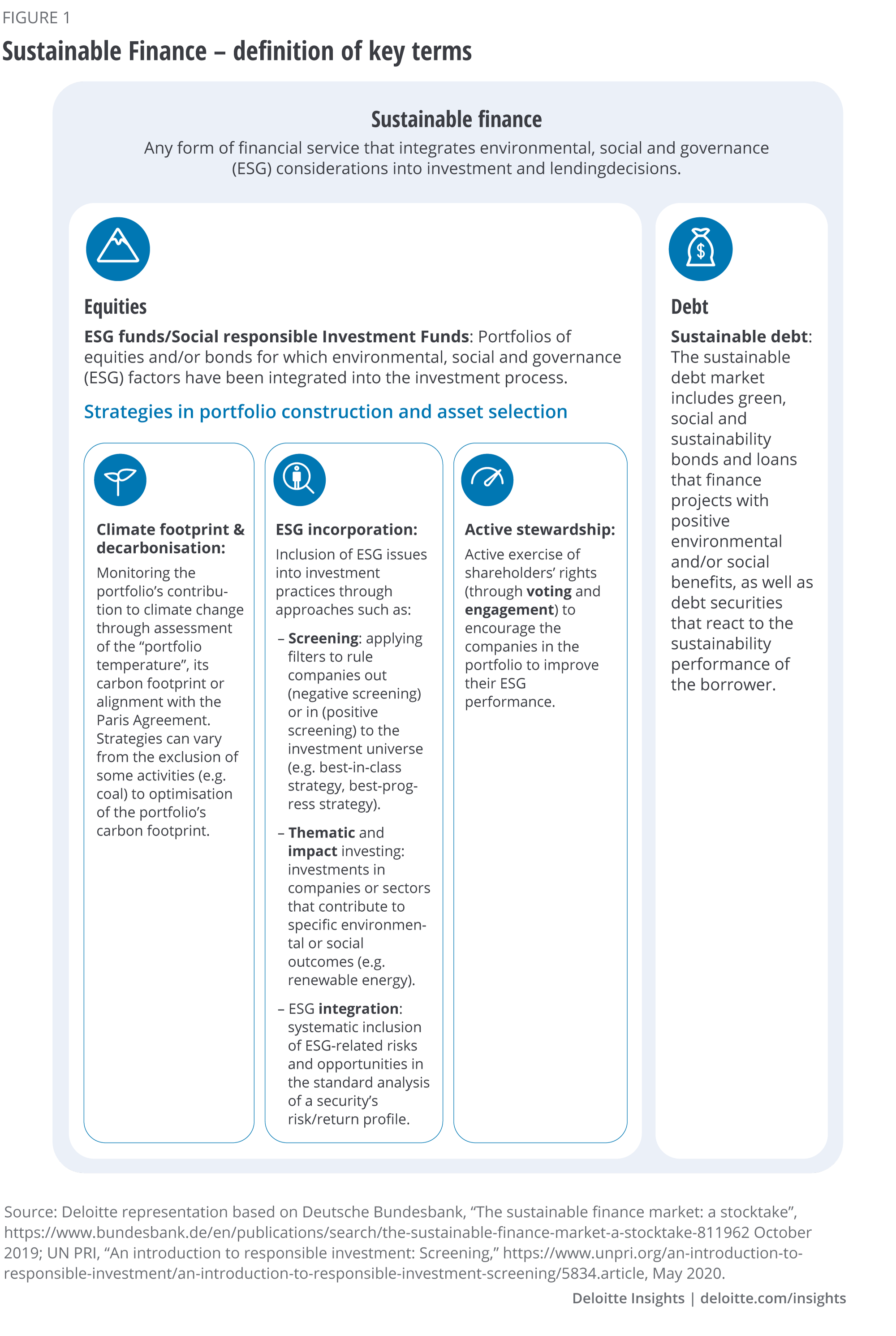

New, dedicated debt instruments have emerged over the past decade to support the move towards a more sustainable business model. More than US$450 billion in sustainable debt has been issued in 2019 – the highest volume in any one year and almost 80 per cent more than in 2018, taking the cumulative volume of issuance well over the US$1 trillion barrier.2

The onset of the COVID-19 pandemic has accelerated the rise of sustainable finance, both in equity and debt. In the equity market, investors seem willing to stick to their ESG investments and ride out uncertain economic times. Across the globe, more than US$45 billion flowed into ESG funds during the first quarter of 2020 – while the overall fund universe experienced outflows of more than US$380 billion.3 Furthermore, ESG funds are outperforming their non-ESG equivalents so far,4 suggesting that companies which address sustainability are more resilient during periods of market turmoil. In the debt market, the pandemic seems to have brought the “social” component of the ESG basket of factors into the limelight. From January to May of this year, issuance of social bonds – whose proceeds are intended for socially beneficial activities – soared to a record US$32 billion, almost twice as much as in the whole of 2019.5 In addition, many governments are making sustainability central to their COVID-19 economic recovery packages.6

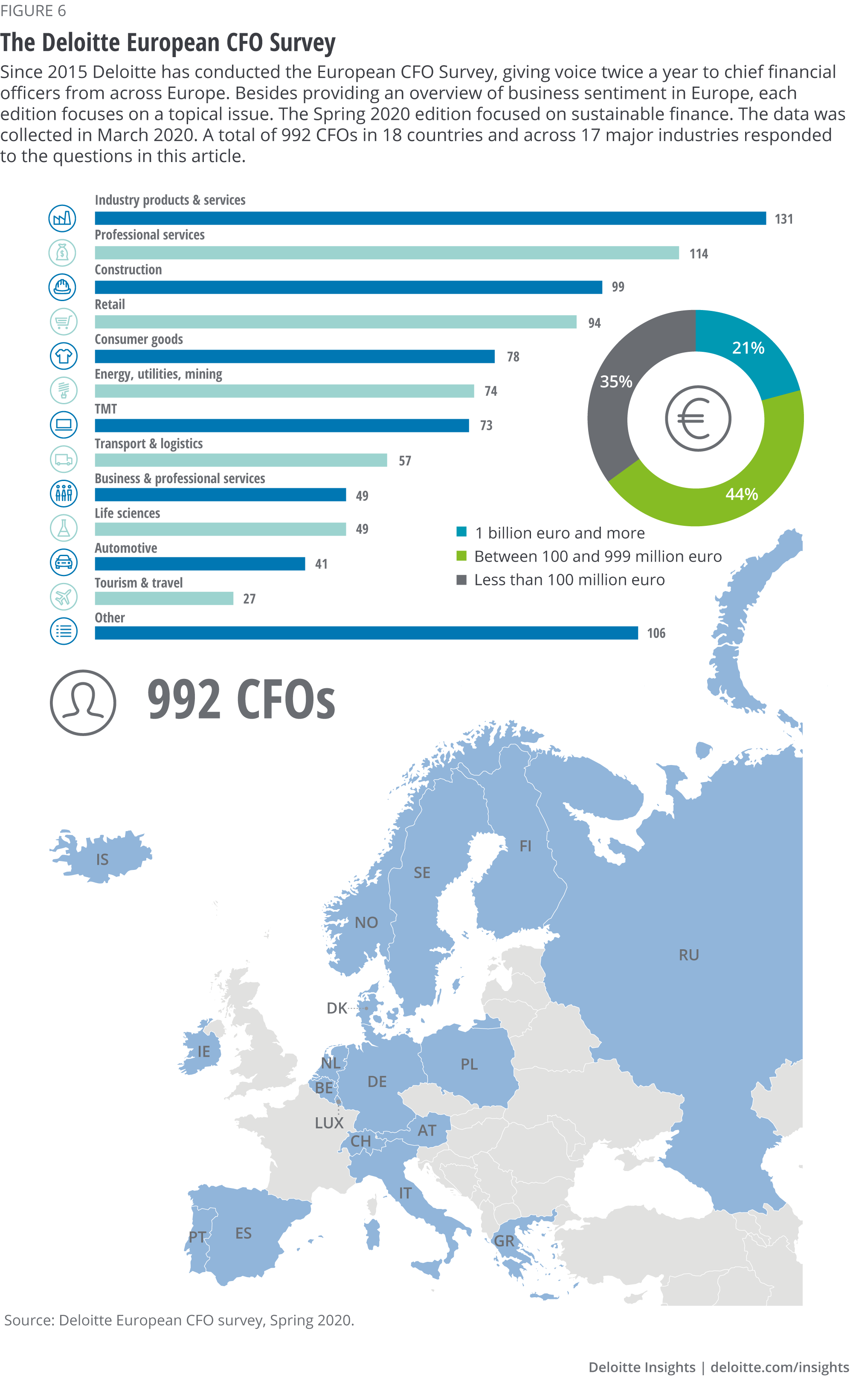

To get a sense of how companies perceive the role of sustainability in their financing decisions and in their investor relations, the latest edition of the European CFO Survey interviewed about 1,000 CFOs across Europe (figure 6).

ESG and the cost of capital

ESG matters for the cost of capital but is not yet crucial – at least for private companies

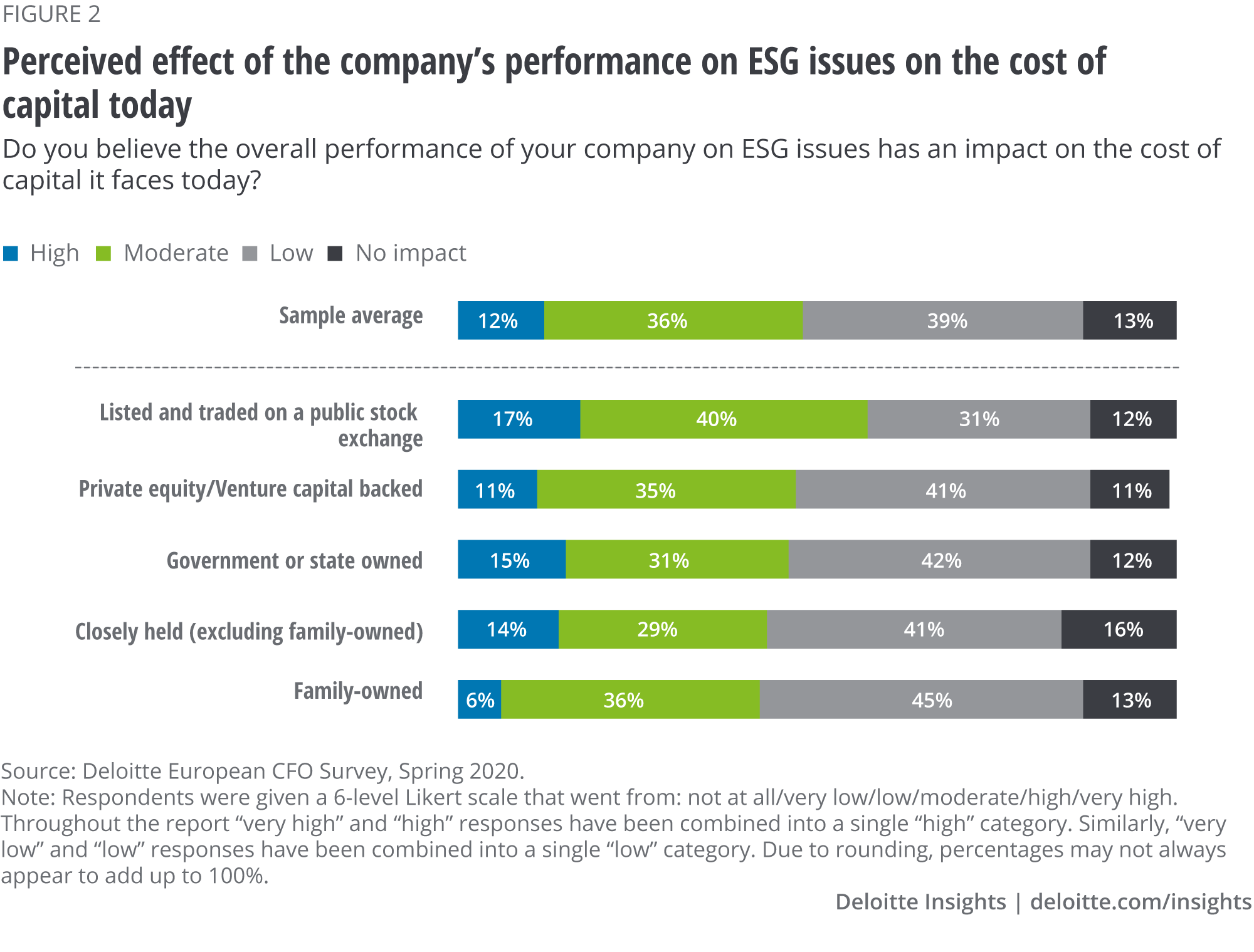

ESG performance seems to affect companies’ cost of capital. A vast majority of CFOs (87 per cent) believe that the overall performance of their company on ESG issues has at least some impact on its cost of capital today (figure 2). However, less than 50 per cent believe the impact to be moderate or high, although there is a significant difference between publicly listed companies and family-owned or closely held ones. Almost 60 per cent of CFOs of listed companies report that ESG performance has a high or moderate impact on the cost of capital, but only 42 per cent of family-owned businesses. This gap is evident even when businesses of similar size (in terms of annual revenues) are compared. For now, then, ESG performance seems to be less relevant to the cost of capital of private companies as they may be less dependent on financial markets for their financing.

European Innovation Fund case study – financial opportunities following the EU Green Deal for the energy sector

In 2019, the European Union established a €10 billion Innovation Fund to assist its efforts to make Europe the first climate-neutral continent by 2050. The fund is part of a wider landscape of both national and EU funding instruments that provide financial incentives to support companies pursuing innovative and sustainable projects.

The Innovation Fund focuses on highly innovative technologies that can bring about significant reductions in carbon emissions. To meet the criteria, the projects need to be sufficiently mature in terms of planning, business model and financial and legal structure. The fund finances up to 60 per cent of the additional capital and operational costs linked to innovation, mainly in the form of grants that are disbursed flexibly, based on project needs and milestones achieved over the project’s lifetime. Up to 40 per cent of the grants can be disbursed based on pre-defined milestones before the whole project is fully up and running.

CFOs should consider the implications of all incentives available, such as the Innovation Fund, when considering a carbon-reducing project. The finance departments of those companies which apply successfully will need professionals with sufficient knowledge of sustainability and related laws and legislation, in order to comply with ESG reporting requirements.

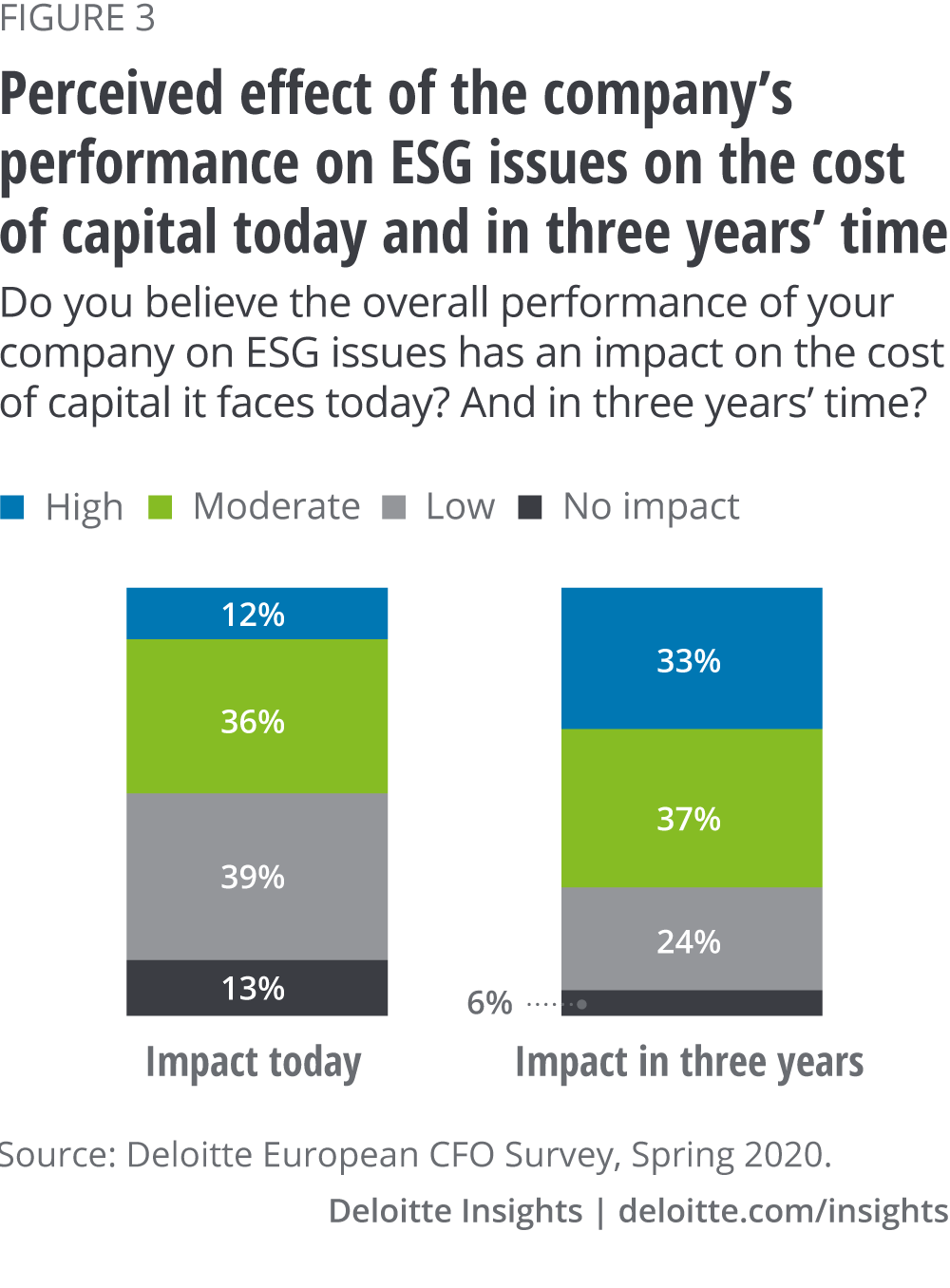

ESG’s impact on the cost of capital is likely to increase

The picture changes, however, when CFOs look three years ahead. Across the whole sample, 70 per cent of CFOs expect their ESG performance to have a moderate or high impact on the cost of capital in three years’ time. One in three CFOs expect the impact of ESG to be high in the near future – three times as many as those who already see a high impact today (figure 2). This shift in perception is not confined to those who already believe ESG affects the cost of capital. Twenty per cent of the CFOs who see no impact at all today expect ESG criteria to have a moderate or high impact on their company’s cost of capital in three years’ time. CFOs across Europe seem therefore to agree that sustainability issues are likely to affect their companies soon.

Similarly, asked about the role that third-party ESG ratings will have on investors’ and lenders’ decision-making, about two-thirds of CFOs (63 per cent) expect a significant increase in their relevance. There is no standardisation in the criteria used to produce ESG ratings, and ratings firms regularly update these criteria to incorporate new trends. For example, the recommendations of the Taskforce on Climate-Related Financial Disclosures (TCFD) are now generally incorporated into ESG ratings. Agencies also increasingly use alternative data to identify material risks and opportunities.7 Finance functions therefore need to build new skills and capabilities to stay ahead of the game and retain their ratings.

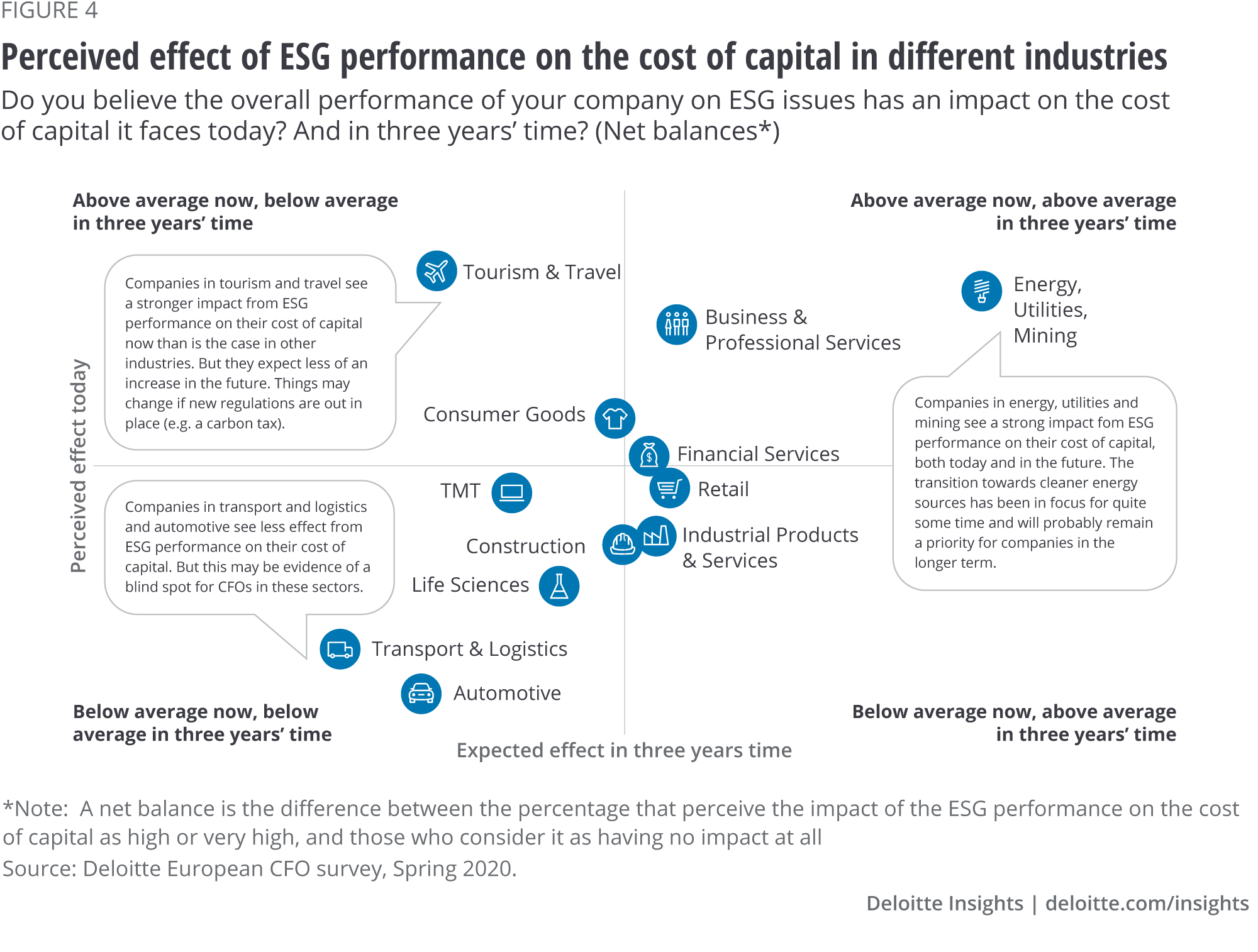

When we look at the survey sample from an industry perspective, key differences emerge. CFOs in energy and utilities, for example, are much more likely to report that ESG factors have a significant impact on the cost of capital now, as well as in three years’ time (figure 3). Investors and shareholders began to turn their attention to this sector earlier, scrutinising in particular the actions taken in response to climate change.8 There has been a strong focus for some time on the transition to cleaner energy sources. ESG issues and sustainability in general will probably remain a high priority for companies in this sector in the long term.9

Sustainability issues in the power and utilities sector

Structural changes in the market – many of them directly related to sustainability – have long challenged the business model of companies in the power and utilities sector.

Investors have therefore focused on understanding their exposure to risks and opportunities related to sustainability. They seem willing to reward companies that are pivoting in a credible way towards a more sustainable business model.

In 2019, a major utility issued two bonds with a coupon that is linked to the achievement of specific targets for generation of renewable energy and the reduction of greenhouse gases. Although the bonds provoked considerable controversy in the market, they were heavily oversubscribed, signalling investors’ demand for financial instruments that allow them to hold a company accountable for its sustainability performance.

The strong demand for the bonds gave the issuer an immediate economic advantage. In the longer run, the ability to stick to the agreed targets will allow the company to give quantifiable clues on the evolution of its business model, improving the way it is seen in the market.

How ESG considerations shape investor relations

Defining ESG in the company’s strategy is mainstream….

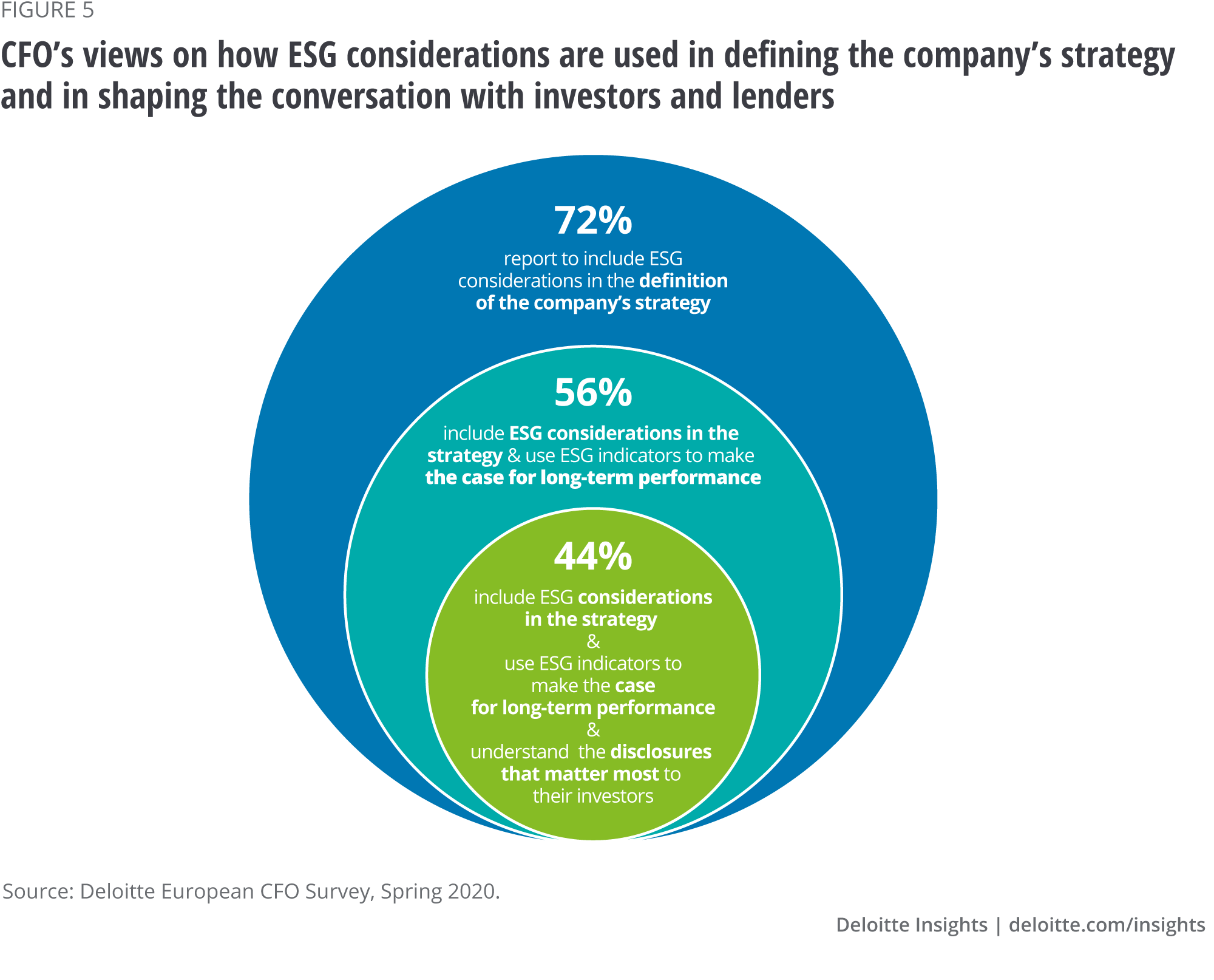

Sustainability is now a strategic issue for a large majority of companies in Europe. On average, 72 per cent of CFOs report that ESG considerations are a defined part of their company’s strategy, and that share is substantially higher (87 per cent) among CFOs who see that ESG performance is already affecting their cost of capital.

…but using sustainability to engage with investors is not

The picture differs, however, when it comes to taking sustainability to the next level and engaging with investors and lenders. Only a little more than half of the respondents (56 per cent) go beyond integrating ESG considerations into company strategy by communicating the case for the long-term performance of the business through ESG indicators.

The third level of awareness of the importance of sustainability for the business involves disclosures. The share of CFOs reporting that they also have a good understanding of the disclosures that matter most to their investors is smaller still, at 44 per cent of respondents (figure 3).

Companies that fail to embed sustainability in their corporate communications to create a strategic, investor-relevant narrative are missing an opportunity. Investors are increasingly focused on the ESG issues that have (or may have in the future) a financial impact on the company. Thus, developing a good understanding of what these issues are, quantifying their material relevance for the long-term performance of the business and setting up ambitious and yet achievable key performance indicators (KPIs) is essential to engage effectively with the capital markets. The survey results indicate that a majority of companies need to do more to integrate their commitment to sustainability in their relationship with investors.

Seek and you will find: engaging with investors on ESG leads to better data

According to the survey, a majority of financial executives do not see the availability of ESG data as a major obstacle to communication with investors. On average, less than one in three CFOs agree that there is a gap between the ESG data they can provide and the data expected by the capital market. That share is higher, however, at 42 per cent, among CFOs in companies that are at a more “advanced” stage in their use of sustainability issues in their investor relations.10 The reality is that most CFOs in companies that do not leverage sustainability in their corporate communications are unable to judge whether there is a data gap or not.

Similarly, only a minority of CFOs perceive a lack of standardised and commonly agreed ESG indicators as a constraint to productive engagement with investors and lenders. And again it is the case that CFOs who are already engaging with investors on sustainability issues are more likely to see a lack of standardised indicators as a constraint. CFOs in companies that do not use sustainability within their investor relations do not have a stance on this issue. In other words, the more that companies use ESG indicators in their investor relations, the more they recognise the limitations of their data.

In ESG the Social and Governance are vital, too

There is widespread agreement among CFOs participating in our survey that improved disclosures on environmental issues represent an opportunity for their company to gain better access to capital markets. This seems logical given the attention climate change has received, particularly since the signing of the Paris Agreement in 2015 and the setting out of tangible ambitions in the EU Green Deal. Environmental concerns tend to dominate the sustainability discussion, making the former synonym used for the latter.

However, a recent analysis from the Moody’s ratings agency reports that governance issues were the most widely mentioned material consideration affecting rating actions for private-sector issuers. And social considerations led to negative rating actions more often than environmental issues.11 This underlines the importance of periodically evaluating the materiality of sustainability issues when considering where to put time and effort into improving disclosures.

What this means for companies and the role of financial executives

Sustainability is increasingly affecting how companies interact with the financial market. The COVID-19 pandemic has accelerated the trend, showing the relevance of ESG considerations for the financial performance of businesses.

Finance departments have a key role to play in supporting the transition to sustainability in their companies. Financial executives could benefit from considering the following points:

- Connect with all relevant stakeholders. Setting sustainability targets alone is not enough to move toward a more sustainable business model. These ambitions need to permeate the organisation. It is therefore key for the finance function to involve all stakeholders and departments, in order to ensure there is both the will and a budget to implement the required practices and plans. By connecting in a structured way, the finance function can promote innovation and the creation of sustainable products and services in the organisation.

- Assess and transform data capabilities. The demand for more reliable sustainability information is increasing. Finance functions have a key role to play in ensuring the relevance, compliance and accuracy of non-financial information provided to external stakeholders. Also, the quality of management’s internal reporting needs to be on a par with the external reporting, in order to steer the business strategy and execute it. This requires new flows of reliable data. Finance functions will need professionals with sufficient knowledge of sustainability and related laws and legislation, as well as data modelling capabilities to address different scenarios.

- Digital non-financial information: Financial information is likely to become available in real time without manual interference.12 This is also likely to be the case for non-financial information. Digitisation and automation may prove an effective means to be in control of information gathering and delivery while keeping finance costs at an acceptable level.

© 2021. See Terms of Use for more information.

Explore more on CFO & Strategy

-

Building business resilience to the next economic slowdown Article5 years ago

-

The essence of resilient leadership: Business recovery from COVID-19 Article5 years ago

-

New architectures of resilience Article4 years ago

-

2020 Chief Strategy Officer Survey Article5 years ago

-

The heart of resilient leadership: Responding to COVID-19 Article5 years ago

-

Sustainability: Why CFOs are driving savings and strategy Article12 years ago