Perspectives

The Deloitte Research Monthly Report

Issue XIII

18 April 2016

Economics

Stability has returned but certain challenges remain

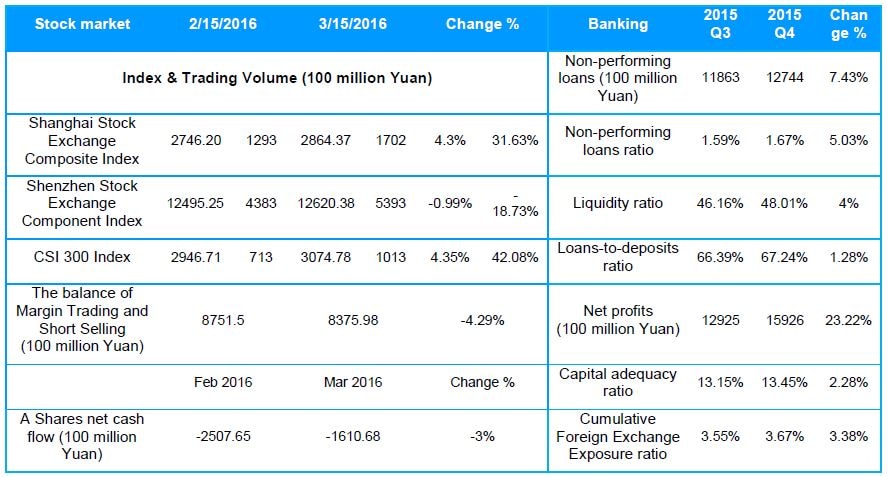

March has turned out to be a very good month for China in terms of restoring confidence. The volatile A share market has risen above 3100 (up over 10% since last January) largely because of renewed appetite on the part of retail investor’s as well as a mild appreciation of the RMB whose gains are underpinned by the dollar’s pullback and PBOC’s persistent intervention. This return of optimism only reinforces some of our long-held views.

First of all, there is no shortage of savings in China but how to allocate such vast savings efficiently remains the critical question and this is where economic reform could affect China’s long-term growth. Second, although consumers have plenty of scope for contributing to China’s transition to a more balanced growth model, de-leveraging of firms and local governments is a must. Third, the A share market must ultimately be transformed into a stock exchange where firms’ listings can be done by a proper registration system, thus making the market less prone to frequent government intervention.

While the points above are about meaningful financial liberalization in the medium and long term, in the short term, what China really needs is to buy time for implementing structural reform. But in the long term, a successful financial liberalization will elevate China’s long-term growth trajectory in the sense that a well-functioning capital market (not just stocks) will allow good companies to have access to funding, offsetting the fall in savings that is the inevitable result of increased consumption.

Recently the government’s debt-equity swap program has come under scrutiny. The rationale of debt equity swaps (RMB1trn so far) is about having banks bail out the firms who are supposedly “suffering from temporary difficulties but have viable future prospects”. But obviously there is no free lunch. And in this case it is the Chinese consumer who is paying the price eventually because the fact that all banks are effectively state-owned. For China is using its vast domestic savings and a closed capital account to lower firms’ leverage at the expense of consumers. The challenge is whether China can avoid the so-called `moral hazard’ particularly when some firms are being tempted to default. Therefore, debt-equity swaps are no substitute for corporate restructuring and SOE reform.

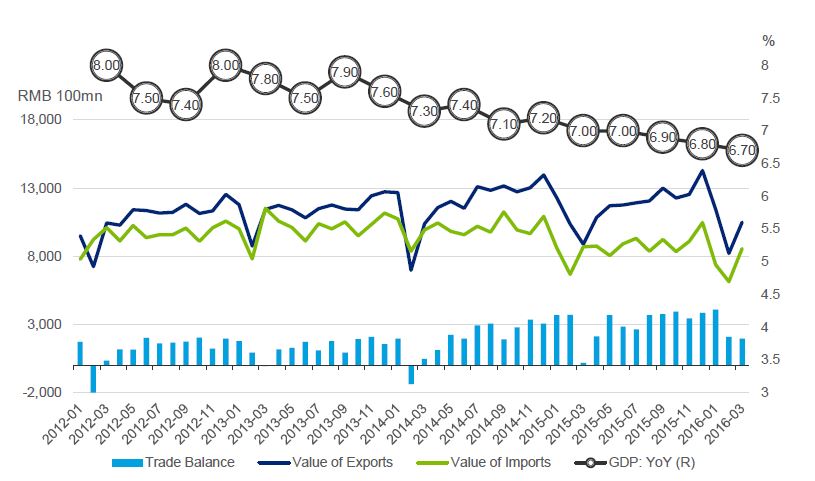

Structural reform would have been more challenging in an environment of a strong dollar and rising US interest rates. Encouragingly, China’s foreign reserves have seen increases (over $10bn) in March, for the first time in 5 months. The trade sector has experienced a turnaround (exports of March up 18.7% yoy while imports have contracted 1.7% in RMB) and the closely-watched Q1 GDP is 6.7%.

Positive surprises on growth front

However, despite restored confidence, certain serious challenges still exist in the short run. First of all, the dollar’s weakness which coincides with the Yen’s absurd strength in the wake of Bank of Japan’s announcement of negative interest rate policy in January suggests that the market is still quite doubtful about the central banks’ monetary policy. Second, China’s trade surplus (RMB810.2bn in Q1 of 2016) indicates that the Chinese investment pattern will remain a drag on economic growth. Such large trade surpluses in today’s global economic environment are a sign of a weak industrial sector not booming external demand. Third, due to the dollar’s fall in value, expectations of another RMB devaluation have not quite disappeared. Which leads us to the following big question: in these conditions, should credit growth (13%) be maintained at a relatively high target level compared to GDP growth (6.5-7%)? If the answer is yes, then exchange rate stability will be tested by the market again. Though we have been advocating the merit of a more flexible exchange rate for China, we are also aware that the combination of a large trade surplus and a weaker RMB could generate a severe backlash.

Click to enlarge images on this page

Energy

Cuts in oil production, overseas acquisitions pick up

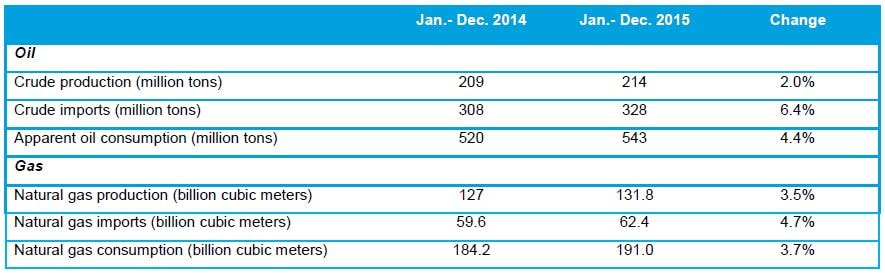

- China is aiming to cut crude oil production by 7% and boost natural gas output by 13% in 2016, according to a working guideline released by the National Energy Administration on April 1. The lower production targets don't come as a surprise given the current levels of global oil prices and the production cuts of China's Big Three oil companies announced at the beginning of this year.

- Oil production cuts are not taking place in China alone. As the price of crude hovers around some of the lowest price levels we have seen in close to a decade, a number of oil companies in the West have come under financial stress and have resorted to production cuts and asset sales in order to protect their credit worthiness. This may lead Chinese oil companies back to the overseas acquisition market considering China's heavy reliance on imported oil. In fact, this may have already begun: PetroChina is currently holding talks with an international peer on swapping its unconventional oil and gas assets in Canada with some of the said company’s assets. However, deal sizes may not return to 2012 levels anytime soon given changes in the global economic situation and also because dealmakers appear to have become more cautious.

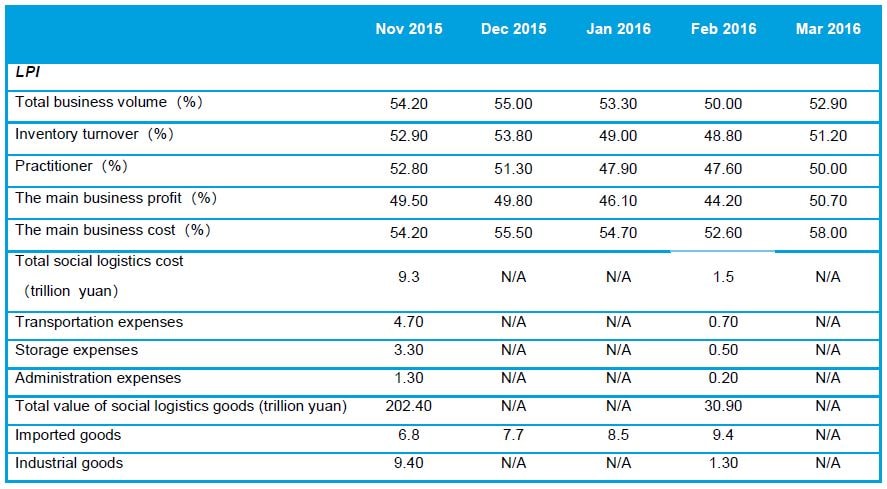

Logistics

E-commerce logistics upgraded to 'national strategy' status

- On March 17 the Commerce ministry and 5 other ministries jointly released "The National E-commerce Logistics Development Plan (2016 ~ 2020)". This plan aims to accelerate growth in e-commerce logistics, enhance e-commerce and reduce logistics costs while improving circulation efficiency. In terms of rural e-commerce logistics development, the plan specifically incentivizes the advancement of e-commerce logistics channels, and offers to support e-commerce logistics enterprises in the expansion of their networks towards small- and medium-sized cities and rural areas. Meanwhile, the plan greatly encourages competitive e-commerce logistics enterprises to speed up their global strategic roadmap and to extend their service network and linkups with key cities in developed countries, while also opening up specialized express delivery businesses with major developing countries. Cooperation and integration among leading e-commerce logistics enterprises will also be encouraged.

- In March 2016, YTO Express through a backdoor listing process completed its IPO with the price of RMB17.5 billion by way of asset sales. In addition, SF Express has initiated its own IPO process while ZTO Express also confirmed its intent to IPO in the HK or US market. All this led to some very intense strategic IPO actions and the development of new financing options in the express delivery industry and as such, signifies that competition is shifting from price and operation fields to capital markets. Along with the rapid growth and maturing of the express industry, the level of concentration in the field was substantially enhanced. Now there are only 3 or 4 dominant players which will probably give rise to the emergence of an oligopoly market for the first time in the industry’s history. Squeezed between price pressures from e-commerce and rising labor costs, the express delivery industry opened up a new battlefield, a rapid market share war, in order to achieve economies of scale, this time, by capitalizing on the financial market.

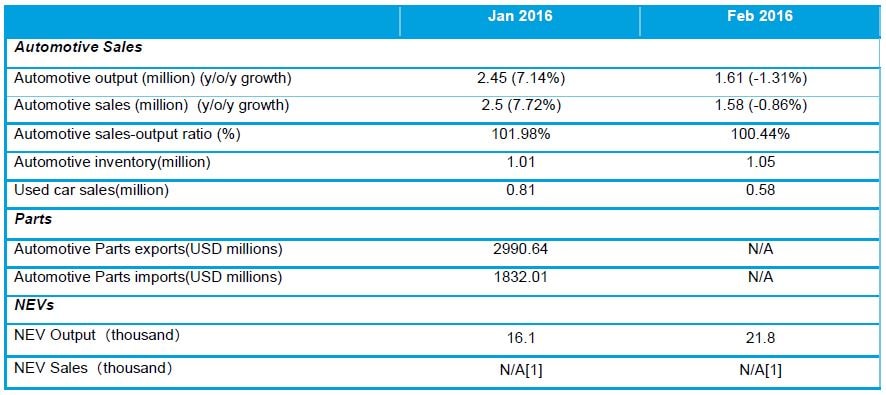

Automotive

Auto market starts the year with flat growth, used car market’s prospects brighten

- Vehicle production and sales reached 4.07 million and 4.09 million units in the first two months of 2016, up 3.74% and 4.37% respectively from the previous year. With disappointing sedan sales, slowing MPV growth, passenger vehicle sales still managed to achieve a 5.1% year-on-year growth, largely due to the surge in SUV sales, especially in small engine SUV sales. Also, commercial vehicle sales are no longer decreasing quite so fast and truck sales have finally rebounded after a 17-month decline. While major foreign carmakers are still suffering large losses, Chinese brands have shown remarkable growth, their market share increasing to 46%. Although March sales figures are not yet available, a moderate growth in vehicle sales is expected. Spring is a key moment in automotive sales. It is crucial to have a strong spring-selling season as it will help set a positive tone for the remainder of the year.

- On March 25, the State Council issued a guideline to facilitate the distribution of used cars between provinces in China, urging governments at all levels, except for Beijing, Shanghai, Guangzhou, Shenzhen and 11 other cites, to stop placing any restrictions on the transfer of used cars. Since 2011, several Chinese cities have adopted higher emissions standards in an effort to limit the influx of used cars with low emission standards and thus to improve air quality in their cities. This means that vehicles registered at China 3/III or lower cannot be sold to cities where higher vehicle emission standards exist. An inefficient transfer system has led to a significant drop in the price of used cars, and the falling prices have deterred some consumers from trading in their old cars to franchised dealers (who rely heavily on trade-ins in cities where new car purchases are restricted). The guideline also requires local governments to simplify transaction registration and taxation systems, as well as to lower down payment requirements for used cars, aiming to establish a fair and transparent market for this country's untapped used-car industry. Independent dealers are being strongly encouraged to adopt a franchise system and embrace online-to-offline strategies in order to revolutionize their business models.