Press releases

Global Powers of Luxury Goods 2023

Luxury goods sales continued their recovery from the pandemic, with double-digit sales growth in all product sectors in FY2022

Publish date: 26 January 2024

- US$347 billion in aggregate net luxury goods sales of Top 100 companies

- GenAI and Luxury companies; a flourishing collaboration

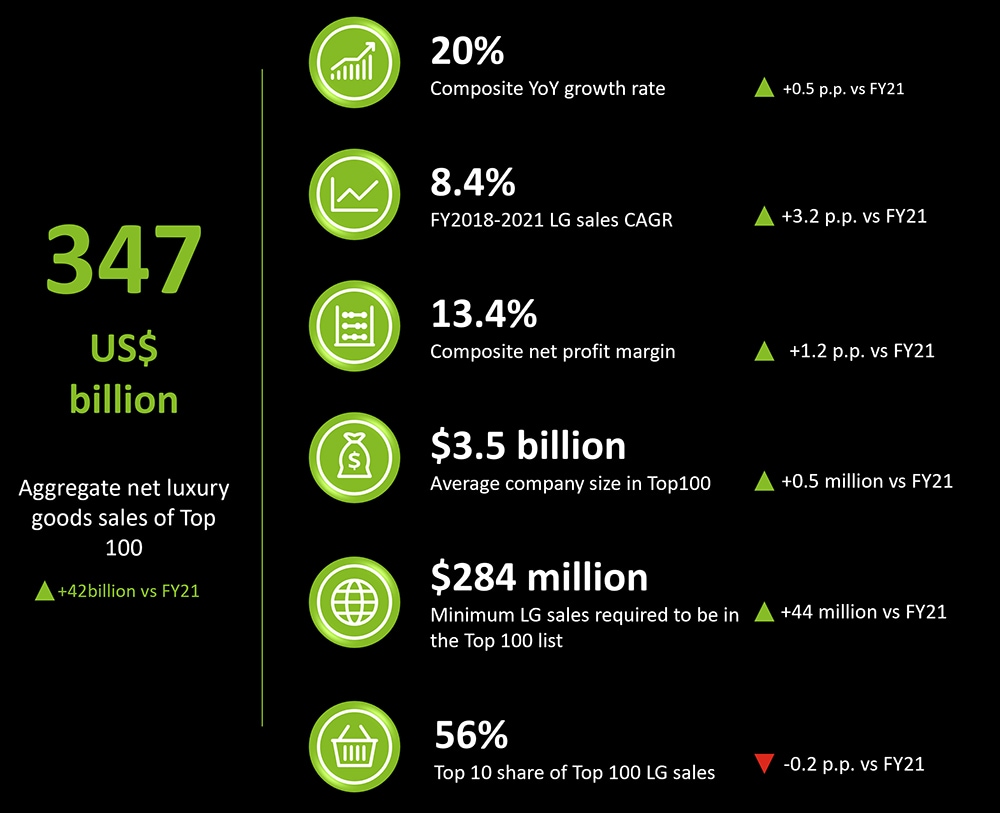

The 2023 Global Powers of Luxury Goods reported that the Top 100 luxury goods companies generated composite sales of US$347 billion in FY2022, up from US$305 billion in FY2021. This sharp increase in luxury goods sales signals a flourishing state of the luxury industry following the COVID-19 pandemic.

Luxury goods companies are playing an important role in steering the broader fashion industry towards more environmentally responsible practices and circularity as a whole. Emerging technologies can help companies accelerate their green transition and also help build trust and improve the relationship between brand and customer.

There is a growing connection between technology and sustainability in the luxury industry. Recent developments in digital technology, including artificial intelligence (AI), Generative AI , machine learning , and the Internet of Things , have the potential to bring long-lasting change to the luxury market. AI may help power the adoption of sustainability-oriented practices in the luxury industry by enabling more efficient and responsible practices.

"With the help and advancements of technology, in FY2022, the world’s Top 100 luxury goods companies are bigger and more profitable than ever” says Karla Martin, Fashion & Luxury industry global co-leader, Deloitte US. “It’s a good news story as companies registered double-digit sales growth in all product sectors—in particular, the fashion sector returned to growth with the strongest recovery in FY2022."

Tianbing Zhang, Deloitte APAC Consumer Product and Retail Sector leader, adds, “Eleven Chinese companies made the Top 100 in 2023, including 10 jewelry and watch brands and a fashion apparel and footwear company, accounting for 10.1% of the Top 100’s luxury goods sales. Additionally, three of the 20 fastest-growing luxury brands this year are from China and all of them are in the jewelry and watch segment. China’s luxury market has maintained a high degree of resilience over the past few years, while Chinese consumers remain a significant force in global luxury. With the resumption of business travel, we expect China to further contribute to the luxury market worldwide, opening new growth opportunities for Chinese luxury brands.”

As growth within the luxury sector continues to climb, companies are continuing to move toward a more circular economic model. They are tracking their sustainability commitments, such as net-zero targets and supply chain traceability. In addition to driving demand for greener products, mounting consumer awareness of Environmental, Social, Governance (ESG) matters is influencing luxury companies’ product offerings. This is not the only factor driving change, however—companies are now being held accountable for their production systems due to increasing government regulations and reporting requirements.

Global Powers of Luxury Goods Top 100

Top 100 quick statistics

The world’s Top 100 luxury goods companies generated personal luxury goods revenues higher than the previous year as consumer demand recovered, particularly in the beauty sector. The impact of the largest luxury goods companies is clear: the 17 companies with luxury goods sales of more than US$5 billion contributed nearly 70% of the total Top 100 luxury goods sales. The 43 companies with sales of US$1 billion or less contributed only 6.4%. The minimum revenue threshold to enter the Top 100 was US$284 million.

In FY2022, 91 of the Top 100 companies reported growth in luxury goods sales, compared to 72 in FY2021 and only 23 in FY2020.

The Top 10 companies contributed nearly 63% of the year-on-year growth in sales value and 76.4% of the combined net profit of the Top 100 luxury goods companies. The Top 10 are up 23%; Richemont regains third place; PVH Corp returns to the Top 10; LVMH consolidates its position as leader contributing 31% of the Top 10 sales in FY2022.

"The luxury goods industry has shown remarkable recovery and growth, reaching its highest figures in history after overcoming challenges from previous years. With most stores open worldwide, revived travel and tourism, and a resurgence in consumer demand, the Top 100 companies achieved record-high consolidated net profits in FY2022." says Giovanni Faccioli, Fashion and Luxury industry global co-leader, Deloitte Italy. “This success suggests an imminent transition from rapid growth to a phase of market consolidation, foreseeing a shift towards single-digit growth by 2024."

Appendix

Top 10 luxury goods companies

About Global Powers of Luxury Goods

Companies are included among the Top 100 according to their consolidated sales of luxury goods in financial year 2022, which Deloitte defines as financial years ending within the 12 months from 1 January to 31 December 2022.