Payments and the future of mobility How can payment providers create value and seize opportunities in the evolving mobility ecosystem?

13 minute read

01 April 2019

Ulrike Guigui United States

Ulrike Guigui United States Chris Allen United States

Chris Allen United States Sebastian Gores United States

Sebastian Gores United States Alex Kostecki United States

Alex Kostecki United States

Consumers are used to seamless payments for most daily transactions—and they will expect integrated and secure ways to pay for any trip and service. For payment providers, that means both challenges and opportunities.

Introduction: Who’s paying—and how?

Leading retailers and technology companies have set a high bar for the financial services industry to create better experiences and simple, seamless integrations that can make traditional banking, payment, and other related activities easier to accomplish. The advancement of omnichannel commerce and the presence of leading technology companies have specifically driven the industry to become more open and enable improved payments experiences. And payments are already becoming easier: Most commercial websites, browsers, and smartphones can store credit-card information1 and allow instant payments and transfers to merchants or contacts, and the first stores and restaurants are going cashless.2

There’s no reason why consumers wouldn’t expect the same or better level of ease and convenience when engaging with the evolving mobility ecosystem that moves them and their goods about. Someone who uses an app to navigate a trip through a bike rental, a taxi ride, a package pickup, and a food delivery3 would expect an integrated, private, and secure way to pay for any trip and service.

With today’s shopping and bill-paying, there’s a great deal going on behind the scenes. A smartphone user might rely on a couple of one-touch payment apps,4 but underneath that clean interface lies a shifting, complex infrastructure of companies that are building a new ecosystem by partnering in new ways.

And the future of mobility is arriving with a whole new set of players and services that are expected to expand that ecosystem further (see sidebar, “The future mobility ecosystem”). Most expect transactions in the new mobility ecosystem to be a bundle of services covering one or multiple modes of transportation as well as some ancillary services. Facilitating the flow of payments for such a mobility-as-a-service platform will likely be an important component,5 which means that, in order to be successful, payment providers would have to find their role in shaping the new mobility ecosystem or could risk losing importance for their current customers.

In this article, we look at how the evolution of mobility is likely to affect payment providers, and what opportunities they have to be successful in this rapidly changing ecosystem. The goal is clear: Payments in the future mobility ecosystem should be transparent, seamless, integrated, and highly convenient.

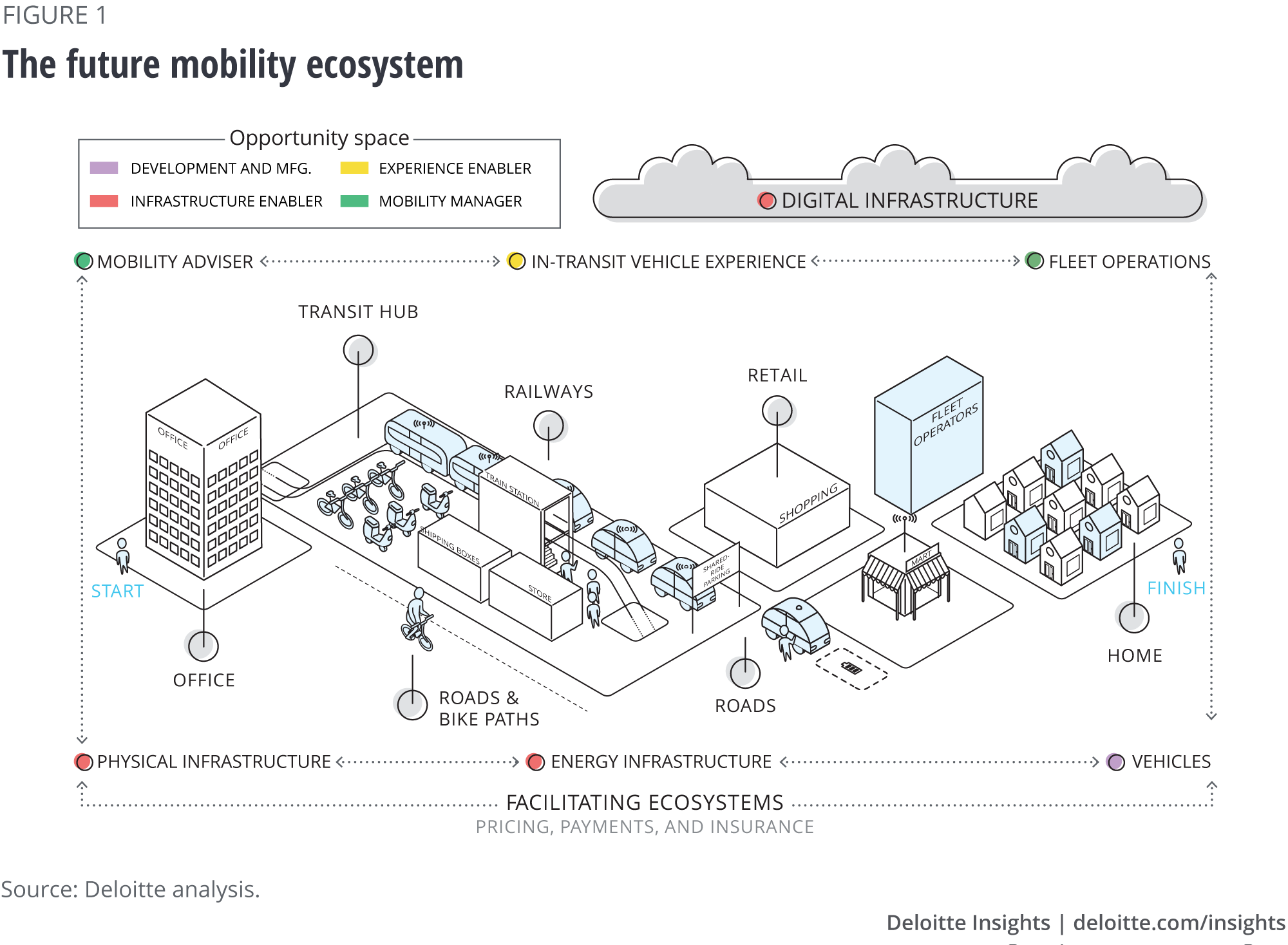

The future mobility ecosystem

The way people and goods move from point A to point B is changing dramatically, driven by a series of converging technological and social forces.6 While much about the speed and trajectory of this transition remains uncertain, it’s been estimated that by 2040 shared autonomous vehicles could travel more than half of US road miles.7 In the future, in urban areas in particular, travelers might be able to continue journeys in shared autonomous vehicles by using other modes of transit, much as they do today with traditional transportation. But in the new mobility ecosystem, trips could offer intermodal travel on demand (figure 1) while offering products and services in transit. And passengers will likely expect to be able to pay for these products and services speedily, reliably, and seamlessly, in the background, without having to take action at each step, as is the case today. Indeed, many of the pieces of this ecosystem are already in place, from shared mobility providers to new types of connected infrastructure. (For a more complete discussion of how the future of mobility could unfold and affect a host of industries, visit the full collection of research on Deloitte Insights.)

Promise and challenges in the new ecosystem

The payments industry is facing considerable change largely because of factors such as digitalization, the increasing prevalence of omnichannel customer experiences, and the ongoing shift from owning assets to the sharing economy. Fifteen years ago, the average consumer typically used two touchpoints when buying an item. Today the average is nearly six.8 About half a trillion dollars of the associated purchases were done through the use of mobile payments, a medium growing at about 80 percent a year.9

In some ways, the future of mobility represents an extension of these changes, and the shifts unfolding in transportation could have similarly dramatic impacts on the market for payments there. Mobility itself already represents an enormous set of transactions, both overall and its component sub-markets. Analysts value US public transportation at nearly US$75 billion annually,10 car rentals bring in US$42 billion,11 and taxis and limousines generate almost US$25 billion a year.12 Ridesharing generates US$2 billion and is forecast to grow 20 percent annually over the next five years. Niche mobility-specific payment solutions—including fuel cards and fleet cards, which ease corporate drivers’ on-the-job gas payments—gathered an estimated US$620 million in transaction fees and other revenues in 2017.13 Together, these markets represent a large chunk of spend, with transportation being the second-most important expense category for the American household, at 14 percent of annual expenditures.14

Changes in the mobility ecosystem could increase revenue opportunities for mobility players facilitating the transactions, as new options and modes of transportation become viable. But those changes will likely rearrange payment flows and unlock new experiences, meaning rapidly shifting markets and a host of fresh challenges for payment providers.

While complex, from a payments perspective, the key roles in the integrated, multimodal journeys of the future are likely to be:

Mobility consumers, who may not initiate every transaction in the new mobility ecosystem, but who would be at least indirectly end users of all services, including those consumers attempting to complete mobility-related transactions while in transit.

Mobility merchants—for instance, a ridesharing provider, in-transit entertainment and content supplier, or bicycle rental company—that are businesses offering services to the end consumer indirectly via a mobility platform.

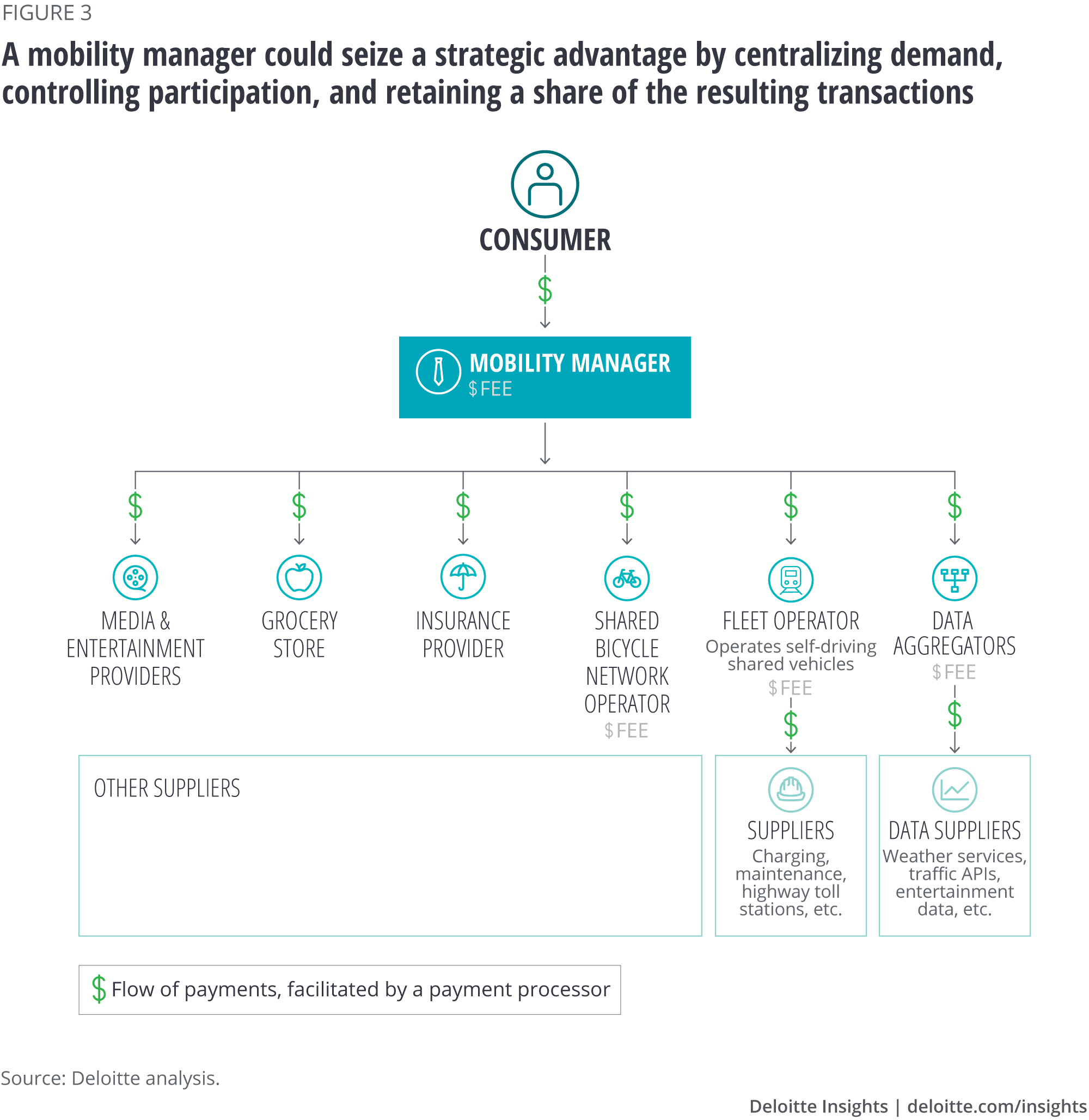

Mobility managers that could aim to provide end consumers with tailored, integrated travel options and an array of ancillary services, such as entertainment and shopping. They could look to link the demand for transportation to multiple merchants.

For the payments market, conflicting forces would be at play to determine the total volume subject to fees. On the one hand, a rise of players and transactions would mean more money all around. However, there is a real possibility of a new player creating a “closed-ended” network by sitting between customers and their suppliers, aggregating the ecosystem of transactions and then settling respective balances between parties.

Payments companies should evaluate their mobility business plans and identify who is most likely to become a mobility manager so they can potentially target their most promising customers—or quickly determine how to build a platform-based business model by identifying partners needed to circumvent competing intermediaries. Already vying for positions in this space: ride-hailing providers, a variety of technology companies, some payment networks, mobility-as-a-service (MaaS) entrants, and, increasingly, automakers.

Enabling the mobility business plan

Understandably, the more colorful elements of the emerging transportation ecosystem—from self-driving cars to airborne passenger drones15—have drawn the most attention. But something more fundamental will likely underpin the future of mobility: building and servicing integrated, multimodal networks. Payment providers have an important role to play in setting up the infrastructure that enables these new business plans, determining how the sources of network effects and ecosystem revenue pools—data and their flow—can be shared.

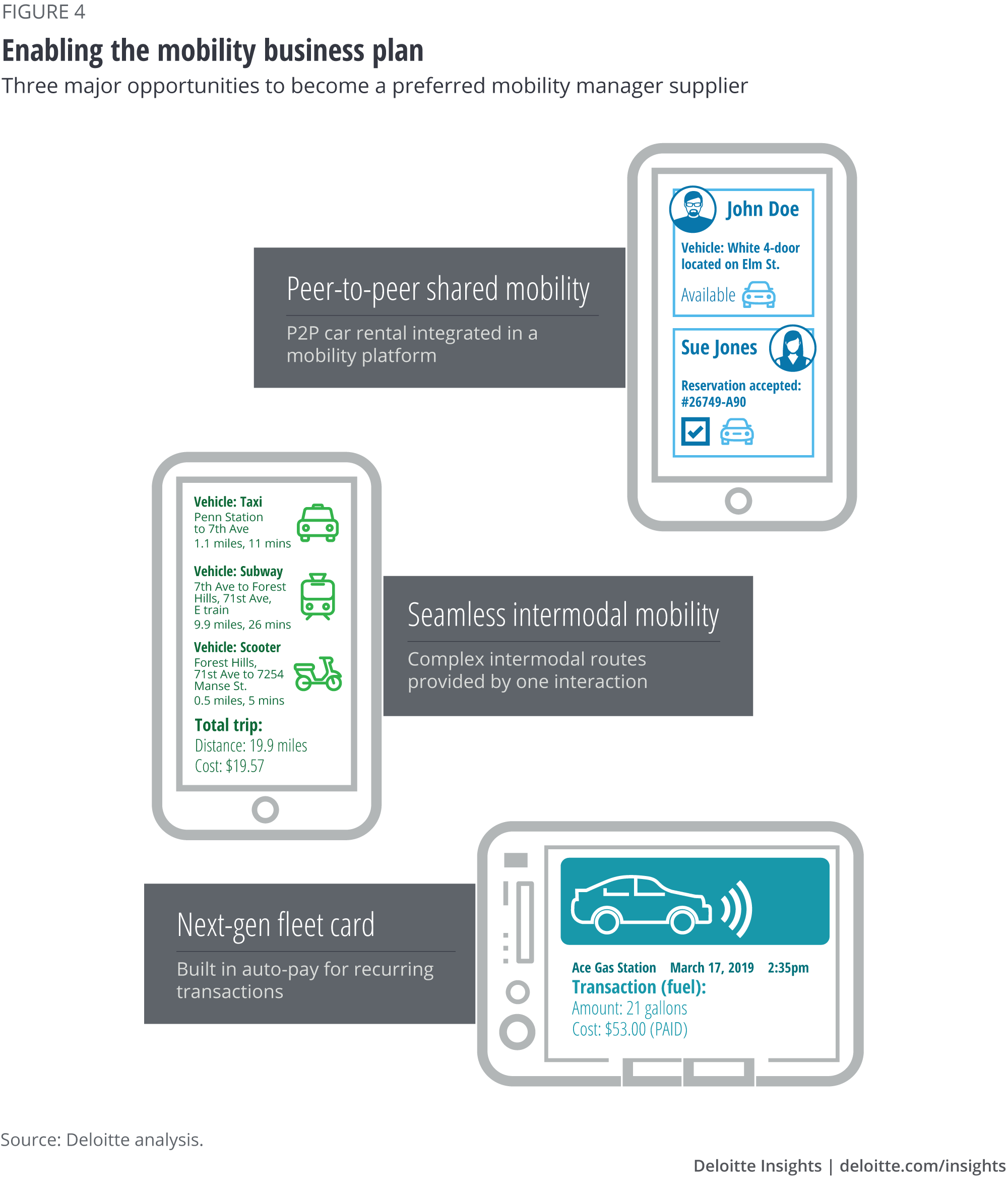

In order to enable this future state, payment providers should create stronger bonds with the mobility companies creating change: to become a preferred mobility manager supplier, to entwine providers’ technology with these growing companies, and, ideally, to develop a unique insight into what changes lie around the corner. We have outlined three major opportunities below. Ultimately, the winners will likely be those able to bring together multiple players who today might be reluctant to share data.

Enabling seamless intermodal mobility

The opportunity. Enabling users to make one transaction to set off a sequence of multiple transactions across different services—for instance, across several modes of transport with added ancillary services, on demand (individually scheduled by the user, proposed by artificial intelligence, or through saved historic preferences). This sequence could be managed via one defined interaction.

At this point, the MaaS market consists of a wide variety of players, many of which lack the capability to handle complex, secure transactions themselves. Some smaller companies may find the technical requirements daunting to set up a mobility adviser platform. Developing this capacity and integrating it into an app or user interface, while surmounting regulatory and anti-fraud barriers, could be a high barrier to entry. On the other hand, users already have a wide variety of payment options (Venmo, PayPal, real-time payments, etc.) that developers could potentially streamline into one customer-experience offering and offer as a plug-and-play service for applications. By developing a tailored offering, a payment provider has the near-term opportunity of surveilling a business’s value chain end-to-end as it services payments to its suppliers as well as consumers. This would allow the user to smoothly and quickly plan trips across all modes of transport, customized based on individual preferences. Mobility managers should enable people’s ability to pay only once (front-end processing) and then have that payment distributed across multiple mobility providers (back-end processing, transactions to public transit, ride-hail, bikeshare, etc.).

The product. A payment provider can aim to offer a MaaS-specific platform that follows the value chain. When handling supplier transactions (fleet operators, fueling, bicycle rental, ancillary services), the platform could handle cost allocations across all of a given travel segment’s service providers—for instance, how much should the bicycle rental platform earn, given that a certain trip was loss-making? On the customer side, a portal could integrate all payment options that a customer might need to purchase her fare, potentially including PayPal, a credit card, or a real-time payment. Data-sharing could occur by taking advantage of technologies such as blockchain to create conditional contracts or by using token-like information versus sharing actual data across infrastructure points.

This platform would need to integrate seamlessly with a mobility adviser’s enterprise resource planning (ERP) and invoicing systems. A payment provider could package the offering with implementation and consulting services, ultimately locking itself in as the preferred supplier of the MaaS company.

Getting there. Payment providers might consider risking establishing working relationships with promising players with relatively little cash flow, piloting a product with a few companies before having developed a scalable and adaptable platform with one of them. This four-step approach may require little that a payment provider does not currently do:

- Pilot a mobility-specific payment provider capability for a promising MaaS provider; Moovel, MaaS Global’s Whim, Moovit, and others are actively developing such services.

- Refine the pilot with the provider, developing a full ERP integration to manage revenue tracking and allocations of the margins to the respective suppliers; on the front end, integrate an existing mobile-wallet solution to reduce friction between customers and the partner.

- Approach other MaaS providers as well as companies able to take on this role in the near future (such as ride-hailing providers or autonomous vehicle developers) and offer a mobile-wallet product in exchange for transaction processing exclusivity.

- Repeat until the winner in the market is a loyal—and digitally entangled—customer that can carry its partners into growth.

The next-gen “fleet” card: Payments facilitated by connected vehicles

The opportunity. As more vehicles become connected, there is an immediate opportunity to leverage the car as a platform to ease the payments process. The technology to do this is readily available, and developers are already testing pilots in vehicles. Applications could include tolling and congestion pricing, fueling and charging vehicles, vehicle maintenance, parking, basic consumer products, entertainment, and more, and some network players are leading the way: Visa and SiriusXM Connected Vehicles Services recently announced a partnership to work on a new in-vehicle payment system.16

By championing the potential increases in sales of redirected customer traffic, payment providers could look to convince gas stations and consumer stores to install receptors or other required infrastructure to process the payments at their retail locations, thereby improving the consumer experience. Carmakers might view this as an opportunity to add vehicle features and attract market attention.

The product. Payment providers already play the role of the intermediary between, for instance, gas retailers and logistics companies. By owning this relationship, a payment provider can develop the customer-facing tools and data analytics that could give the company a strong advantage in their segment. This industry segment offers an opportunity for significant growth: As vehicles transition to autonomous and shared, having an effective automatic and vehicle-specific payment system for fleet operators could prove extremely practical for recurring, vehicle-specific transactions such as fueling and maintenance—and could potentially become standardized across networks.

Payment providers could look to bootstrap themselves by creating an alliance between two existing service providers, using this four-step approach:

- Begin with large networks involving regular transactions for auto drivers—filling stations or toll collectors—and, with utmost urgency, identify players willing to become partners on your platform.

- Bring an original equipment manufacturer (OEM) into the conversation, using the first relationship as a pilot program for a new tool.

- To broaden the network and its value, bring in networks selling impulse-buy products appealing to road warriors, such as drive-through donut and coffee shops.

- Expand the capability to smaller-scale retailers and other OEMs.

Peer-to-peer shared mobility

The opportunity. Much of the sharing economy is predicated on repurposing underutilized assets, and the same model extends to peer-to-peer carsharing, where individual car owners rent out their vehicle for others to use. One such company, Turo, has signed up 10 million users and facilitates their transactions on its marketplace.17 And privately owned carsharing may well expand in coming years as autonomous vehicles become available to the general public, since self-driving cars could ease handoffs between renters and owners by traveling to pickup and drop-off points. Indeed, Tesla and other automakers have explicitly discussed this model as a way to drive growth.18 This opportunity seems particularly promising in suburban and rural areas where density is insufficient to support rail transit or fleets of shared autonomous vehicles. For payment providers, it may offer an opportunity to pilot complex transactions that could become the norm with larger providers.

The product. No one has yet put into place payment solutions for a universal rental system. The problem to be solved, at its core, is of carrying value from the account of a person driving a vehicle to the account of the vehicle owner, without losing too much on the way. Take pricing: A vehicle owner could guarantee a profit on her rental given vehicle demand as well as her costs—vehicle maintenance, energy, parking, etc. A front- to back-end payment processor could offer the visibility required to do this and, perhaps, suggest an ideal rental price, thereby becoming a source of value.

Getting there. A payment provider could look to capture this opportunity by creating a simple plug-and-play solution to enable this growing market. The five-step approach could be comparatively simple:

- Create a low-involvement retail customer experience (payment tool, mobile-integrated vehicles, seamless customer experience) by starting a pilot with a mobility operator.

- Ensure processing that’s effective and reliable, with processing quality adequate for this market.

- Bank on a high-quality, highly customizable business/customer experience.

- Deploy across the industry using mobility-specialized implementation and consulting services.

- Pilot the capability to service a P2P network, and leverage these findings across products.

Planning for change: Significant payments opportunities in the evolving mobility ecosystem

As we outlined in our 2019 banking and capital markets outlook,19 payments continues to be one of the most disruptive and dynamic banking businesses. Innovations being developed by incumbents and fintechs alike are reshaping the payments landscape, boosting customer expectations, and intensifying competition globally. Incumbents are looking to differentiate in areas where customer experience is fraught with friction and where disparate data has the opportunity to be brought together. This holds ever truer in the evolving mobility ecosystem. To seize these opportunities, incumbents should consider restructuring their organizations around customer solutions rather than products. As the contours of the future mobility ecosystem begin to take shape in this innovative space, payment providers appear to face two strategic choices:

Engaging with emerging mobility managers. The crux of the challenge could be the way in which players negotiate the arrival of a new entrant: the mobility manager. This new actor sits between consumers and suppliers, planning, booking, and ticketing all transactions related to mobility requested by its users, and becoming the market’s main consumer-facing entity, consolidating all those payment processes—for bike rentals, taxi rides, refueling, and more—into one. And some of the processes would require serious rethinking for operators. For instance, the costs associated with fueling, maintaining, and insuring vehicles, as well as costs linked with infrastructure (think tolls), would likely become broader B2B transactions as street traffic transitions to autonomous cars managed as fleets. This would require different business models and behavioral shifts in how data flows through the system and is shared.

Go big or focus. To go big, aim to become a platform provider or even take on the role of the mobility manager. For those payment providers considering a move into the mobility management role, however, such a shift could face stiff competition from a host of players potentially better suited to that business, ranging from ride-hailing services to mobility-as-a-service operators and automakers. Alternatively, payment providers can focus by identifying and serving new niche markets—such as servicing peer-to-peer car rentals or helping implement vehicle wallets—in the mobility ecosystem and designing better user experiences or creating white-label offerings that can be used by other players.

Next-gen capabilities required in the future mobility ecosystem

Competing successfully could require a variety of new capabilities: fleet optimization, dynamic route planning, integrated electronic ticketing, and close collaborations with city governments and mobility operators.

In the mobility payments space, network effects could benefit players in such an ecosystem if they find a way to legally, safely, and instantly share the needed data with each other across infrastructures that are currently distinct. Depending on how actors will build the network, mobility merchants can displace such intermediaries if they are able to quickly build valuable platforms. But for any of these technologies to have maximal impact, data is key.

The strength of data. Payment providers may need to bring together disparate data across multiple functions and systems. Players can create new services, as well as use big data and analytics to help improve the customer experience across the mobility landscape. Although data is plentiful, it is often not easily accessible, sufficiently clean, or integrated—and especially not shared. Sorting this out now could result in a first-mover advantage through creating and owning standards such as authentication, risk modeling, fraud prevention or tokenization, and analytics to glean insights from the data.

Data infrastructure required. The future of mobility won’t likely emerge without operators and passengers being able to deal with payments smoothly and efficiently, and that offers payment providers an important role to play in setting up the underlying digital infrastructure. Proactivity is likely a key to success, even if it means considering more risky investments. The data challenge becomes more daunting as data integrity increases in importance. Regulatory expectations can further elevate the role of effective data management. Regulatory requirements must be complied with and security concerns overcome, as well as new business models devised that value the sharing of data over hiding it behind individual company walls. Key industry players that process large chunks of payments hold the key to most of the data and insights and are building analytics capabilities to harness them.20 Already, payments analytics architectures are increasingly evolving toward integration between mission-critical payments systems and analytical applications, enabling a new mobility payments ecosystem that crosses company borders.

Payment providers should be able to navigate the dramatic changes arriving soon, by leveraging their current technology and expertise to partner with mobility companies and become preferred suppliers. As tomorrow’s passengers drop off rental bicycles and climb into self-driving taxis, they’ll need clean, intuitive interfaces to move seamlessly within the ecosystem. Taking baby steps to prototype businesses for problems that already exist in mobility today is how payment providers could get there.

© 2021. See Terms of Use for more information.

Explore the Future of Mobility

-

How digital technologies can elevate car buying Article6 years ago

-

Tempering the utopian vision of the mobility revolution Article6 years ago

-

Forces of change: The future of mobility Article7 years ago

-

Sourcing innovation in the auto industry with new collaborative models Article6 years ago

-

Auto executive/adviser Larry Burns sees the future of mobility Article6 years ago