Services

Support for Application of DX Tax Incentives

New tax incentives have been established for companies that engage in corporate transformation using digital technology (“DX”)

As part of its 2021 tax reform package, the Japanese government introduced new tax incentives related to investments in digital transformation (“DX”) that came into effect as of April 1, 2021. In order to promote the integrated implementation of management and digital strategies which result in digital transformation (“DX”) in the post COVID-19 era, tax credits or special depreciation are provided for digital-related investments that utilize cloud technology necessary to realize DX. Deloitte Tohmatsu Group provides one-stop support for a series of processes from confirmation of various prerequisites to submission of the application for DX tax incentives.

Explore Content

- Overview of DX Tax Incentives

- Support services offered by Deloitte Tohmatsu Group for the application of DX Tax Incentives

Overview of DX Tax Incentives

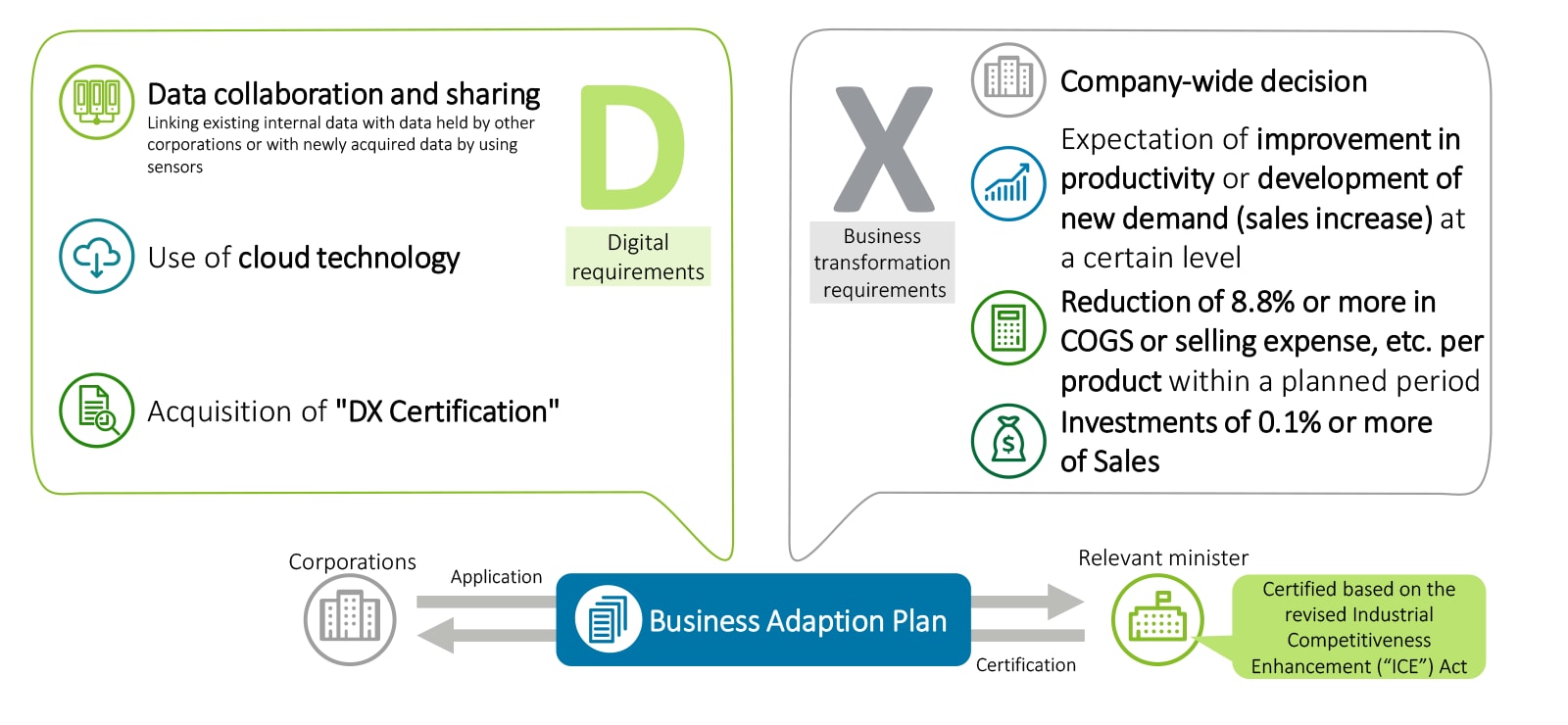

■Certification requirements

In order to be qualified for the DX tax incentives, companies need to obtain certification of a business adaptation plan which satisfies the digital (“D”) and the corporate transformation (“X”) requirements. Within the digital requirements, it is a prerequisite to obtain “DX Certification”, which is granted to companies certified by the government who comply with basic conditions of the digital governance code.

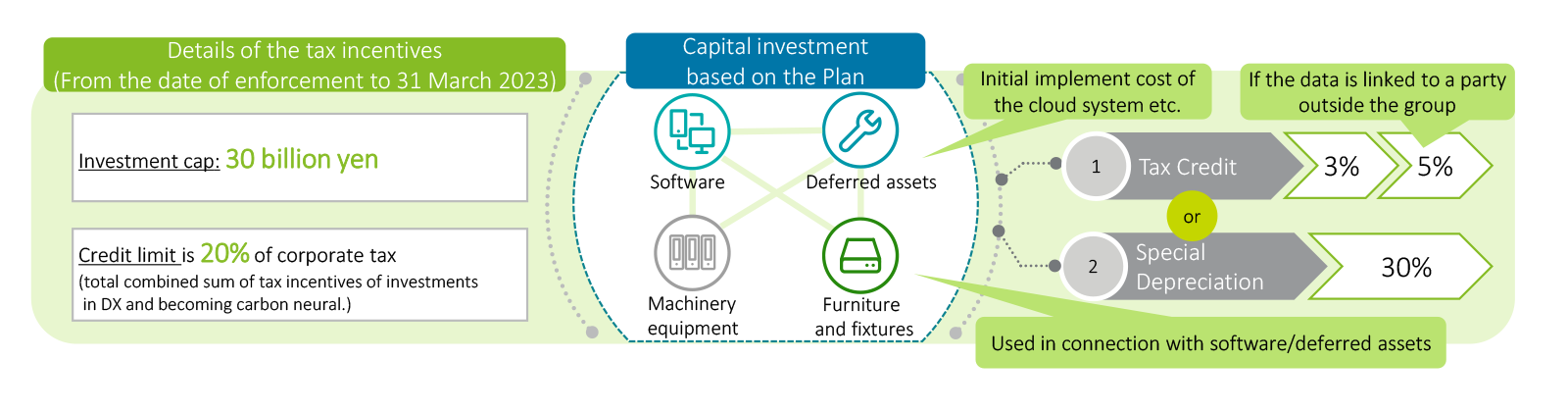

■Details of the incentives

Applicable companies that qualify for the incentives and purchase certain specified assets may choose to take either special depreciation of 30% or a tax credit of 3% (5% if data is linked to an external third party) of the cost of the applicable assets acquired, up to JPY 30 billion. Eligible assets include, certain new software, machinery and equipment, or deferred assets used for business in Japan.

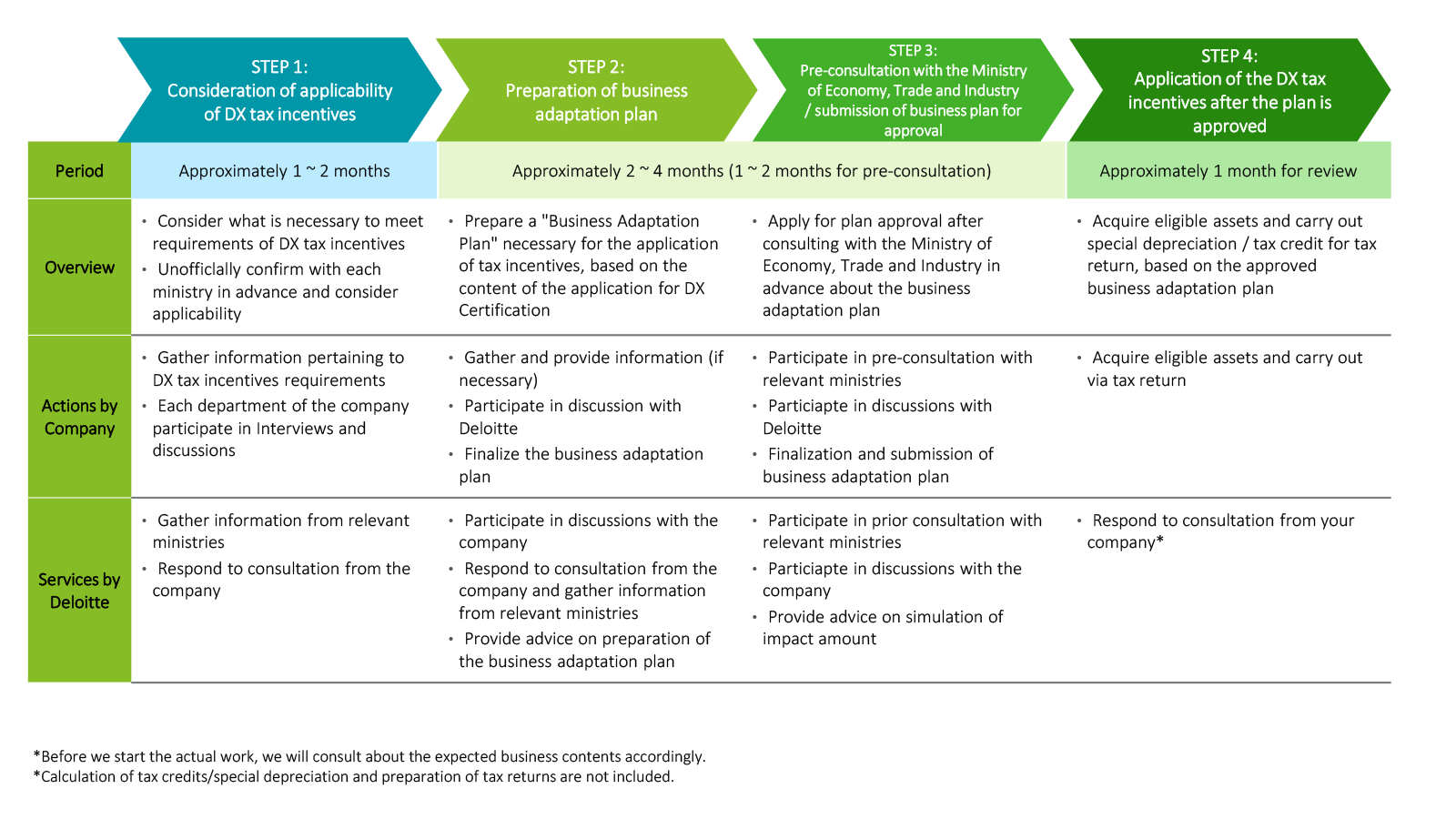

■DX tax incentives application process

The DX tax incentives will apply to investments made in eligible assets under a certified business plan between the date of enforcement of the Industrial Competitiveness Enhancement (“ICE”) act (i.e., 2 August 2021) and 31 March 2023. Companies that do not possess “DX certification” may need more than six months for preparation to qualify for the DX tax incentives. In addition, in order to meet the requirements, the involvement of multiple departments may be required. Therefore, it is recommended to start the preparation process early and proceed with the process efficiently.

Support services offered by Deloitte Tohmatsu Group for the application of DX Tax Incentives

Deloitte Tohmatsu Group offers one-stop support for the process from confirmation of various prerequisites to submission of the application for the DX tax incentives, which enables companies to apply the tax incentives in the most efficient and effective manner.

■ Support to obtain “DX Certification”

- Support for establishment of Digital Governance System

Deloitte Tohmatsu Group supports companies to meet the requirements of the Digital Governance Code and realize “DX Ready” status in order to obtain “DX certification”, which is a prerequisite for the DX tax incentives.

- Support for responding to cyber security requirements

With regard to cyber security requirements which require the establishment of a security management system at the management level and the promotion of appropriate measures, Deloitte Tohmatsu Group professionals will support companies effectively and efficiently by cooperating with the teams supporting the establishment of a digital governance system.

■ Support for the application of the DX tax incentives

Professionals of Deloitte Tohmatsu Group will support companies for effective application of the tax incentives.

Recommendations

Global Investment and Innovation Incentives (Gi3)

Identifying credits and incentives available globally to help secure resources to improve cash flow and reinvestment