Services

Japanese Consumption Tax: Qualified Invoice System

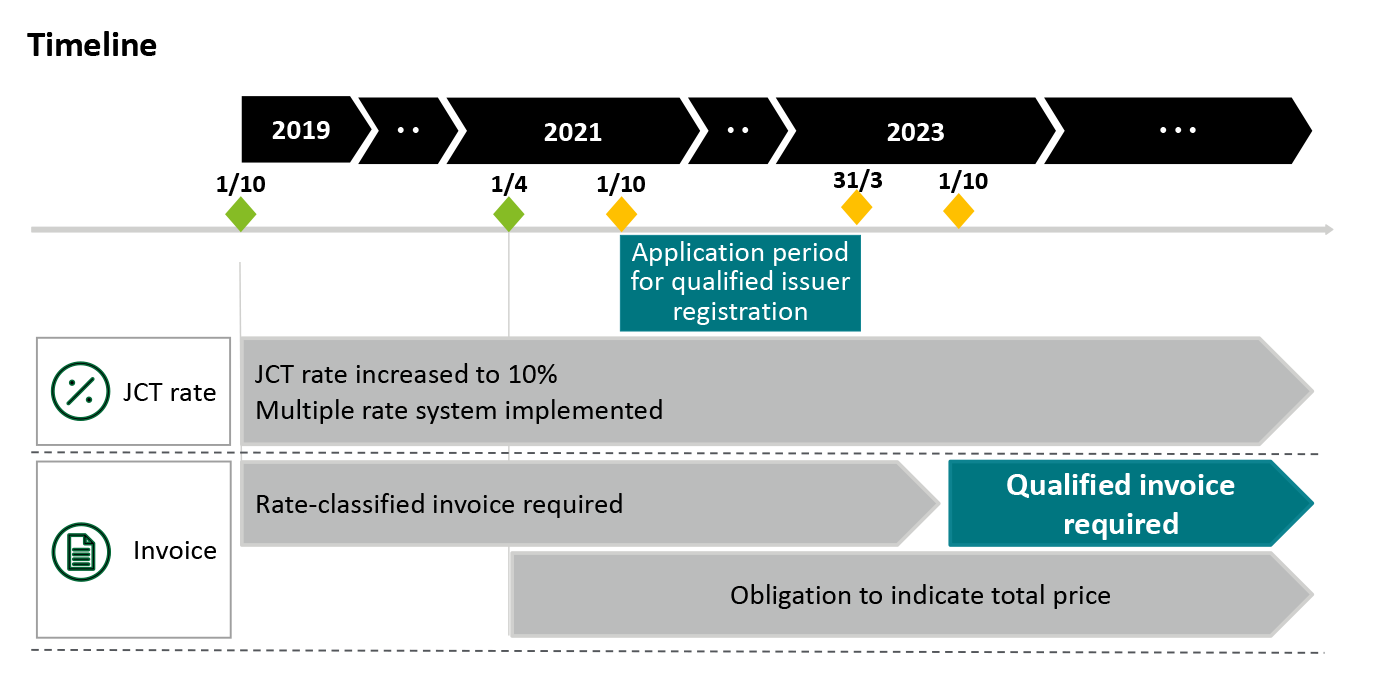

A new invoice system will start on 1 October 2023.

Japan will implement a new invoice system for Japanese consumption tax (JCT) on 1 October 2023. The new system will require business customers to retain qualified invoices which fulfil certain conditions in order for them to claim input JCT credits while requiring sellers to issue such qualified invoices.

Explore Content

- New JCT invoice system starts on 1 October 2023

- Key issues businesses operating in Japan need to consider

- Preparation and action plan

- What Deloitte Tohmatsu can do

New JCT invoice system starts on 1 October 2023

The new JCT invoice system will require business customers to retain qualified invoices which fulfil certain conditions in order for them to claim input JCT credits while requiring sellers to issue such qualified invoices. Sellers need to submit applications from 1 October 2021 to 31 March 2023 to be registered to issue qualified invoices (“registered issuers”). Sellers as well as business customers, however, have many other things to consider before implementation.

Key issues businesses operating in Japan need to consider

Companies need to be able to, among others, issue qualified invoices with obligatory items and be compliant with price negotiation rules under the JCT special measures law as per below.

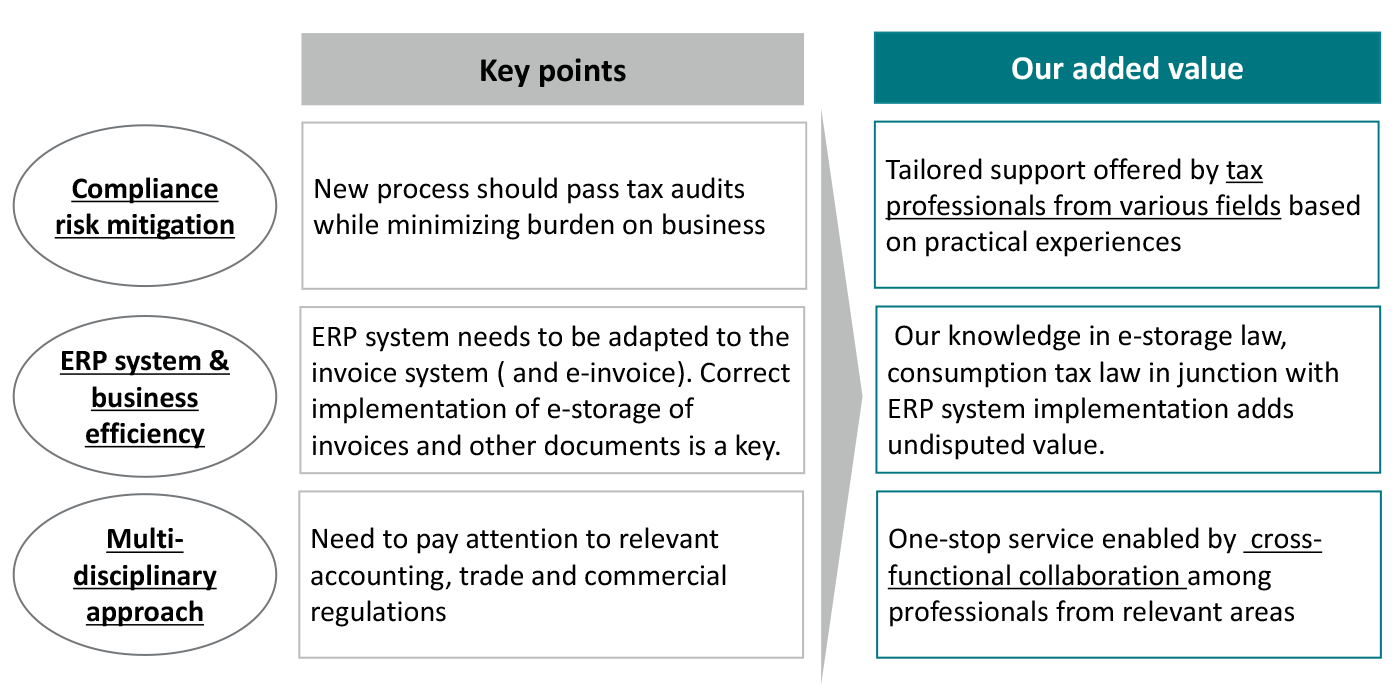

The implications of the new invoice system, however, encompasses accounting, tax and legal as well as ERP system matters, including but not limited to the following:

No. |

Expected key considerations |

|---|---|

1 |

Retention of invoices that pass tax audits |

2 |

Additionally required information for qualified invoices |

3 |

Management of registered and non-registered suppliers |

4 |

Review of end to end operational process from transaction to journal entry (to fulfil book retention requirements) |

5 |

Journal entry process and JCT classification codes |

6 |

Impacts on management accounting |

7 |

Calculation of input/output JCT (during and after transition period by 2029) |

8 |

E-storage of invoices and related commercial documents such as accounting records, contracts |

9 |

Price setting and treatment of input JCT on purchases from non-registered suppliers |

10 |

Implications of the JCT special measures law and the subcontract law |

11 |

Contract wording to be compliant with the JCT special measures law and the subcontract law |

12 |

Planning/training on communication with customers and suppliers |

* JCT special measures law aims at preventing large companies from rejecting the addition of the increased JCT to the price of goods purchased from small and medium-sized sellers.

Preparation and action plan

You may think that you still have time to go before the start of the qualified invoice system, but considering the time necessary to change your systems and negotiate with customers and suppliers, the identification of key issues should start now to secure a sufficient time to resolve any issues and make any necessary preparations.

What Deloitte Tohmatsu can do

Invoicing processes vary between companies, so key issues may differ. Deloitte Tohmatsu’s wide range of experiences and skills allow to provide tailored support for your smooth transition to the new invoice system.