2021 commercial real estate outlook has been saved

2021 commercial real estate outlook Rebuilding to enhance resilience

21 minute read

03 December 2020

In our 2021 CRE Outlook, 200 industry leaders weighed in on how their companies are recovering from the COVID-19 pandemic. Learn how companies can overcome formidable challenges to gain momentum in the coming year.

As new regulatory trends make an impact in the financial services marketplace, how can your organization remain resilient? Our 2021 regulatory outlooks explore key issues that could have a significant impact on the market and your business in 2021.

Subscribe now to receive your digital copy of the reports as soon as they are live.

Key messages

View sections

Breaking inertia, gaining momentum

The impact of COVID-19 on the global economy and the CRE industry has made 2020 the most memorable year in recent history. CRE companies have needed to digitize operations, close physical facilities due to extensive lockdowns, and prepare for reopening, while ensuring the health and safety of employees and occupiers and considering the financial health of tenants and end users.

Learn more

2021 Financial services industry outlooks

Explore the 2021 regulatory outlooks

Visit the Within reach? Women in the financial services industry collection

Explore the Financial services collection

Learn about Deloitte's services

Go straight to smart. Get the Deloitte Insights app

With economic recovery heavily dependent on a vaccine, the length of this downturn remains uncertain. As we write this outlook, economic activity is contracting due to a fresh resurgence of the virus in Europe.1 Large Asia-Pacific (APAC) economies such as Japan and Australia haven’t yet turned the corner to growth, India is facing a severe downturn, and strained relationships between the United States and China are creating significant geopolitical tensions.2 According to Deloitte’s economic forecast, in the United States, it is expected that “a vaccine and/or treatment will allow normal economic activity to begin to resume in mid-2021.”3 As it will take time to deploy the vaccine, our economists expect growth to remain somewhat constrained for a period of time.4 (Click here to read Deloitte’s latest US Economic Forecast.)

The CRE macro environment is being impacted similarly. But there is a dichotomy in operating fundamentals among property types—industrial real estate, health care, data centers, and cell towers have been positively disrupted, while offices, hotels, and retail have felt the negative effects. Global CRE deal volume declined 36% year over year (YoY) to US$306B in 2Q20 due to economic stagnation and an uncertain pricing environment.5 Prices are showing early signs of stress across the more negatively impacted property types. 6 For instance, US retail and office price indices declined 4.1% and 0.5% YoY in August. In contrast, industrial property index rose 7.4% YoY.7 Unlike the Global Financial Crisis (GFC), CRE companies had generally strong financials at the start of the pandemic and debt markets remain sufficiently liquid. Yet, troubled loans are rising; banks, fearing higher delinquencies, are tightening lending standards.8 In several sectors, rent collections have remained healthy, but largely because of higher tenant incentives and leasing concessions. Along with the evolving financial landscape, the pandemic has resulted in tectonic shifts in the way people live, work, and play, which has put unique pressures on certain property sectors.

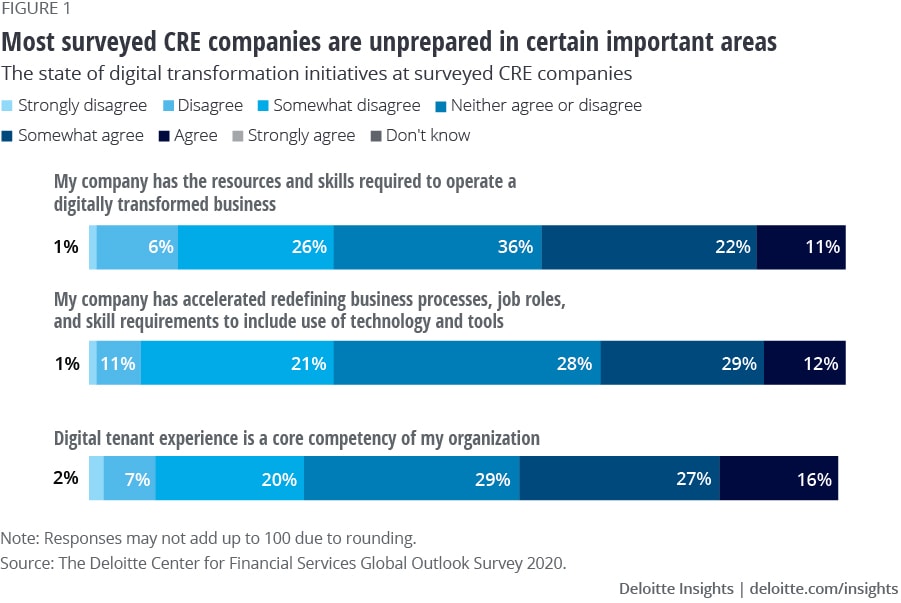

With this as the backdrop, we wanted to understand how well-equipped CRE leaders were to weather the current economic situation, how they are planning to recover over the next 12 months, and how they are preparing to remain competitive and thrive in the long term. To do this, we surveyed 200 CRE senior executives—owners/operators, developers, brokers, and investors—in 10 countries during the summer of 2020. (See sidebar, “Methodology,” for more details about the survey.) Overall, most survey respondents felt their companies were unprepared in certain important areas and that the industry continues to struggle to adapt their long-term strategies (figure 1). Some key challenges:

- Only one-third of respondents agree or strongly agree that they have the resources and skills required to operate a digitally transformed business.

- Less than 50% of respondents consider digital tenant experience a core competency of their organization.

- Only 41% of respondents said their company has stepped up efforts to redefine business processes, job roles, and skill requirements to include the use of technology and tools.

CRE company leaders have their work cut out. To position their companies to thrive long term, they need to break inertia to move into rapid recovery. As monumental as 2020 has been, 2021 could be even more so; the critical decisions and investments leaders make now could come to fruition over the next 12 months. They should strive to be digital—optimizing business, operating, and customer models for a digital environment. Rapid digital transformation will likely be needed to build operational resilience, maintain a strong financial position, develop and retain talent, and create an enabling culture.

In this year’s 0utlook, we look at the impact of COVID-19 on four functions: technology, operations, finance, and talent—and highlight how overcoming these formidable challenges could open up a new world of opportunities beyond the horizon.

Sections

Technology: Digital transformation and tenant experience are a business imperative

COVID-19 accelerated the use of technology in the CRE industry. In a matter of weeks, most of the CRE workforce moved to remote work, property tours turned virtual, most tenant communication converted to online channels, and more technology was required to manage day-to-day operations.9 Some CRE companies also increased their use of cloud-based collaboration and productivity tools to lower in-house technology costs and increase flexibility.10

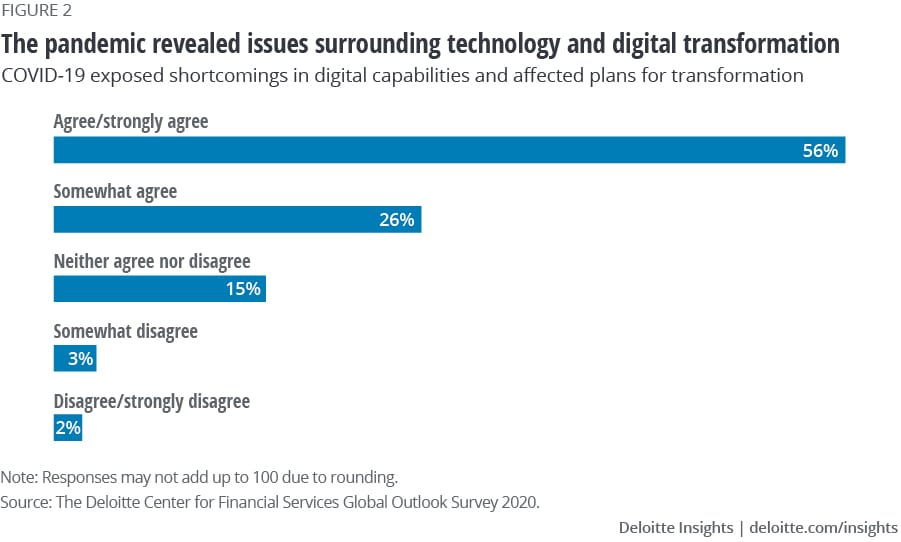

While these measures may help improve tenant convenience and ensure business continuity, CRE companies still struggle with defining digital workflows and digitizing key business processes.11 Most respondents (56%) believe the pandemic has uncovered shortcomings in their company’s digital capabilities and affected their plans to transform (figure 2). Additionally, there are growing cybersecurity and data privacy concerns among those surveyed, due to the increase in virtualization, data capture, and data-sharing using cloud and digital tools.

Balancing tactical and strategic actions

The pandemic has made enhancing agility and nimbleness a top priority for CRE organizations. These goals require companies to focus on digitization of key CRE business processes and the tenant experience. And while many CRE companies have taken a reactive approach to digital transformation, developing a more structured plan, including the implementation of various technologies and data analytics, would likely yield more meaningful results. Along with this, to enhance resilience, companies should double down on their cybersecurity and data privacy investments.

Developing the digital strategy and road map

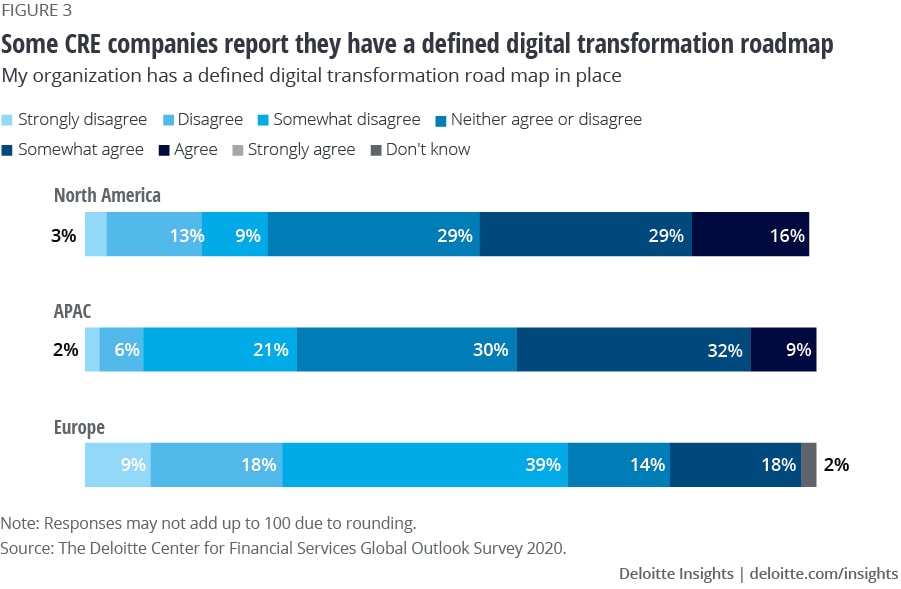

According to our survey, many companies plan to accelerate digital transformation, yet only 40% of respondents said their company has a defined digital transformation road map. North American respondents report their companies are farther ahead than their European and APAC counterparts (figure 3): Fifty-three percent of respondents that have a defined digital transformation roadmap consider digital tenant experience a core competency. Further, 47% of European respondents and 44% of APAC respondents, compared to 32% of North American respondents, have started redefining business processes, job roles, and skill requirements to embed the use of technology and tools.

CRE companies should assess their digital maturity by reviewing existing capabilities. This could include evaluating the maturity level of technology usage for managing operations, elevating tenant experience, and developing tech talent. Based on this assessment and considering the business vision, CRE leaders should develop a digital strategy that focuses on technologies and initiatives that deliver strategic value. Thereafter, companies should frame the execution plan to work on key initiatives for digital transformation and ensure the transformation team has the right talent and governance structure to implement the digital solutions. Governance structure should focus on effectively managing transformation programs and encouraging innovation.

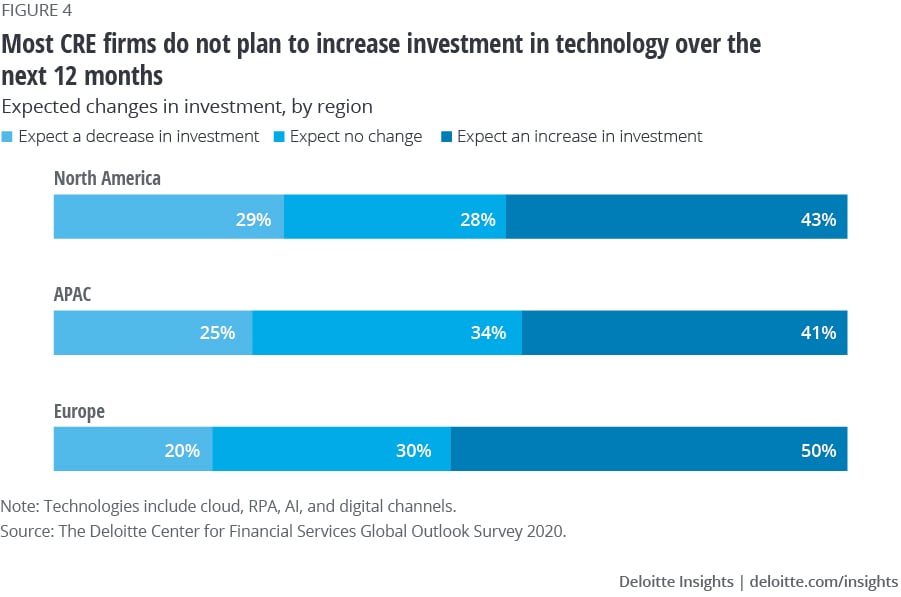

Companies should increase investment in technologies that can serve as building blocks of their digital transformation efforts. However, on average, only 45% of respondents plan to increase their investments in cloud, robotic process automation (RPA), artificial intelligence (AI), and digital channels over the next 12 months (figure 4).

Companies can significantly increase tenant engagement by optimizing real-time updates about facilities and developing a sense of community using mobile apps. About one-half (48%) of respondents who said their company is using digital technologies, such as interactive mobile apps, to increase communication with tenants or end users, plan to increase investment on digital channels over the next year. Cloud technology could be the backbone for many new capabilities as it offers scalability, data storage, and ubiquitous access. For instance, companies can leverage cloud-based tools for digital marketing and to connect virtually with tenants to build a digital tenant experience.

To expedite implementation of a digital transformation road map, CRE companies should look for strategic partnerships with technology providers or proptechs. REIT respondents seem to acknowledge this and are being more open to collaborating with proptechs. On an average, 58% of REIT respondents have increased their intent to partner, compared to 45% of respondents who are developers.

Leverage tenant data and analytics

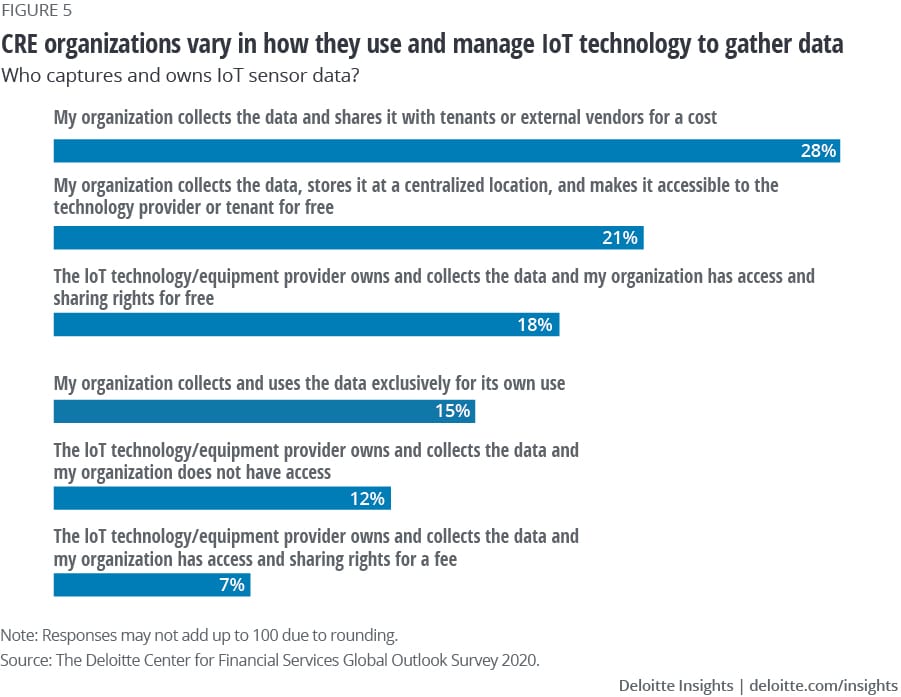

More than three-fifths of companies acknowledge that they are capturing Internet of Things (IoT) sensor data. With more organizations and end users making data-backed decisions, sharing relevant property-related data could help companies build trust and increase tenant/end-user engagement. This might be a great opportunity for organizations: Currently, 49% of respondents share data with tenants (figure 5).

Next, companies could use different analytical tools to generate insights and facilitate decision-making. Now more than ever, CRE companies need to capture and analyze high-frequency data to create a meaningful tenant experience. This could include data around how tenants use different amenities, and/or engagement and performance levels. Companies can analyze tenant engagement levels and behavior to understand preferences and provide a more customized experience. For instance, owners/operators can combine and analyze the occupancy, movement, and temperature sensor data and assist tenants in creating COVID-19–safe seating and space utilization decisions. They can also use tenant data to predict lease renewals and devise appropriate strategies for tenant retention.12 APAC companies seem to have a higher focus on data analytics: Fifty-eight percent of APAC respondents expect their companies to increase investment on data analytics in the next year, compared to only 32% of European respondents and 34% of North American respondents.

Better data analytics can also build the confidence of investors who are increasingly looking at leveraging alternative data for insight generation and decision-making. Fifty-seven percent of private equity/hedge fund/mutual fund respondents said they are likely or very likely to identify new alternative data sets for insight generation and facilitating investment decisions.

Bolster cybersecurity and data privacy

Cyberthreats are increasing in sophistication and widening the vulnerabilities of CRE companies, potentially exposing them to enterprise or tenant data breach and ransomware attacks. Ransomware attacks continue to increase and are rated as a key cyberthreat for REITs.13 Companies should first assess whether current efforts are sufficient; if they aren’t, they should upgrade their cybersecurity programs to have greater control over both internal and external information flows.14 In particular, they should assess potential cyberthreats from using new cloud-based communication and collaboration tools. Companies should adopt a “security-by-design” approach in which customized controls are built into new solutions. This could include role-based identity and access management, network admission controls, and integration with existing enterprise security architecture.15 To avoid data privacy issues, companies should make sure that any information is captured by consent and stored securely. For instance, while implementing facial recognition technology at its properties, Vornado provided an opt-out option and invested in secured data storage.16

Sections

Operations: The key to enhancing business resilience

The pandemic has made cost management and redefining the value proposition of CRE properties top priorities for the operations function.

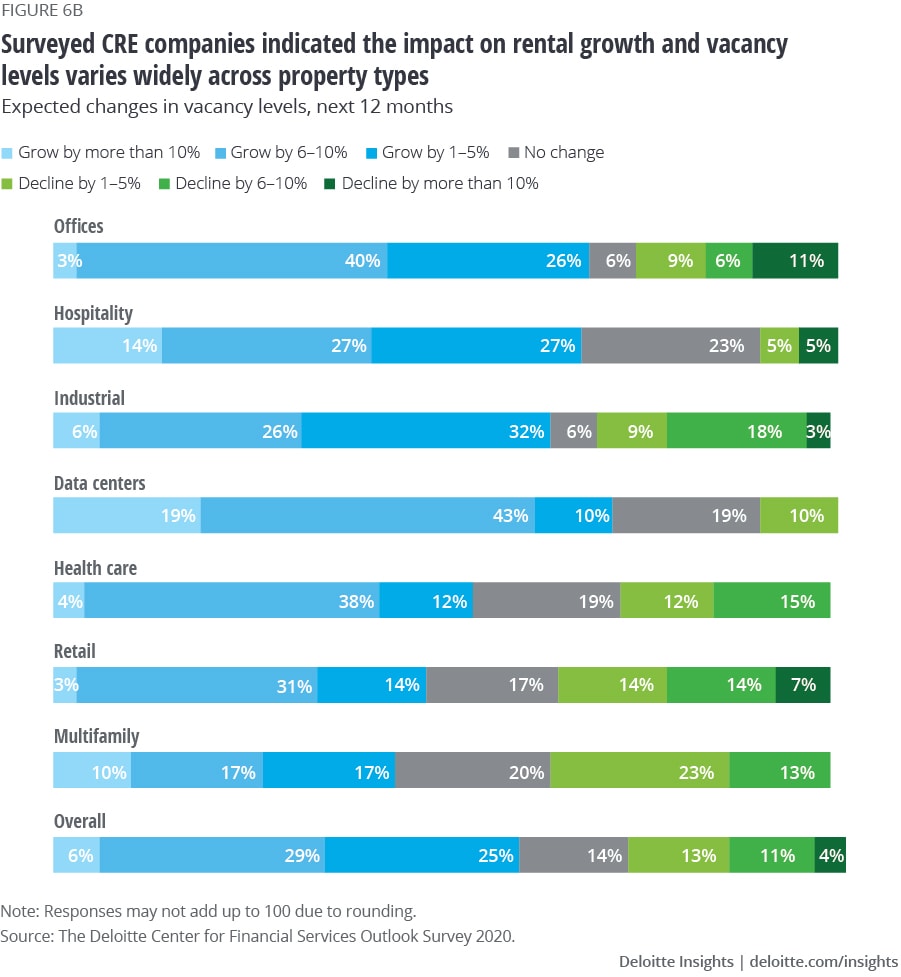

With much lower demand for leased space, CRE companies face rising pressure to contain costs. Globally, 40% of respondents expect a decline in rental growth and 59% anticipate an increase in vacancy rates over the next 12 months. Interestingly, only 37% of the APAC respondents expect a decline in rents, but 74% anticipate a significant increase in vacancy levels. In contrast, North American respondents’ expectations are balanced: Forty-seven percent expect a rental decline and 49% anticipate an increase in vacancy levels (figure 6). Companies are also incurring higher operating costs because of the additional health and safety measures they are implementing in office spaces. Our estimates show operating costs could increase by at least US$19.4 per square foot, which equals 5.8% of the average annual office rents at the beginning of 2020.17

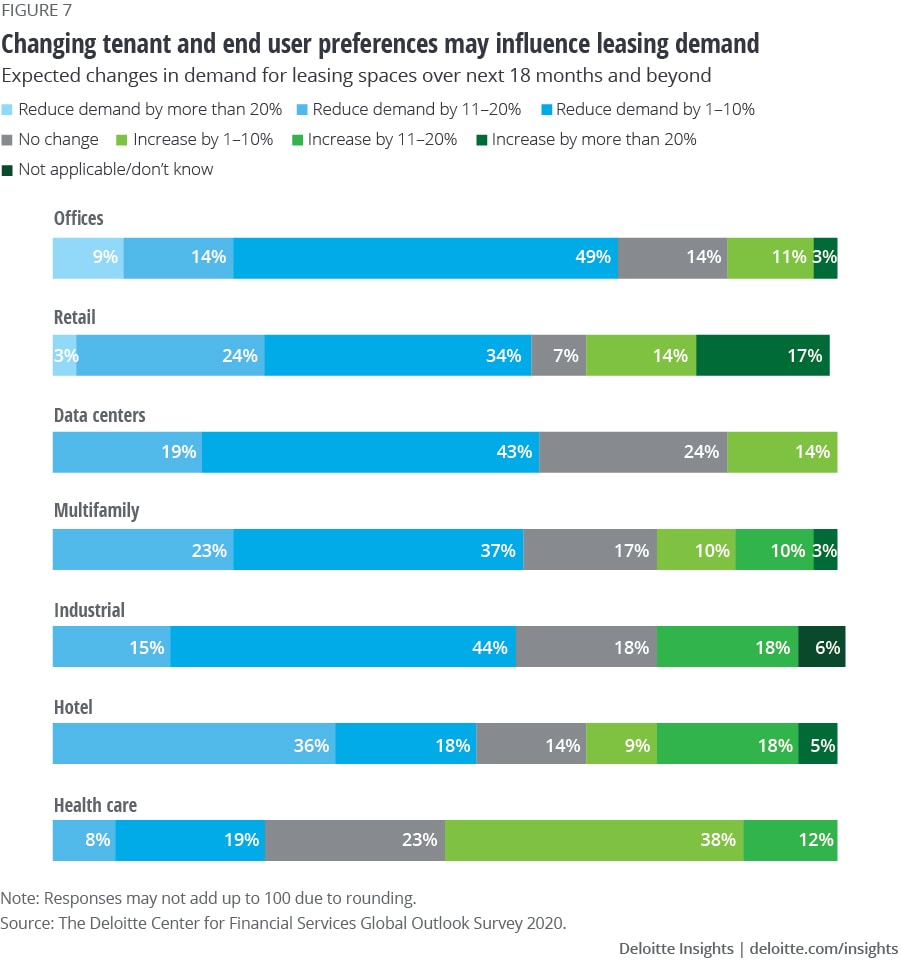

The pandemic is also creating longer-term, evolving shifts in tenant and end-user preferences, which will likely influence leasing demand. Because of this, CRE companies will need to reassess the value proposition of properties. About one-third of our banking, insurance, and investment management respondents say their companies plan to rationalize their CRE footprint over the next six to 12 months. More and more companies are rethinking how and when they use office spaces: Increasingly, offices will be reserved for face-to-face interactions and team-based activities, and enhancing collaboration and innovation, while employees would continue to work remotely for more individualized tasks and assignments. In a 9,100-respondent pulse survey published in The Deloitte Global Millennial Survey 2020, more than 60% of respondents say they want the option to work remotely more frequently, even after the pandemic fades.18 Nearly as many say they would prefer to use videoconferencing instead of traveling for work.19 Our survey suggests that demand for hotel, retail, and office spaces could see a double-digit decline in leasing activity over the next 18 months (figure 7). There is also a shift in market dynamics; people are starting to avoid overcrowded cities such as San Francisco, New York, Toronto, Tokyo, and Paris.20 This shift has led to tremendous short-term uncertainty surrounding property valuations and the premium associated with Class A properties globally.

Balancing tactical and strategic actions

To recover and prepare to thrive over the next 12 months, the CRE industry should focus on managing costs to improve operational efficiency and repositioning the value of existing CRE spaces. Only 48% of the surveyed executives agree or strongly agree that their organization has a clear vision and action plan for maintaining operational and financial resilience. Regionally, 38% of North American respondents reported their companies had such plans versus 53% of their European and APAC counterparts. Overall, respondents seem committed to digitizing operations: Most plan to make the highest technology investment in property operations and management among different CRE functions.

Optimizing operations

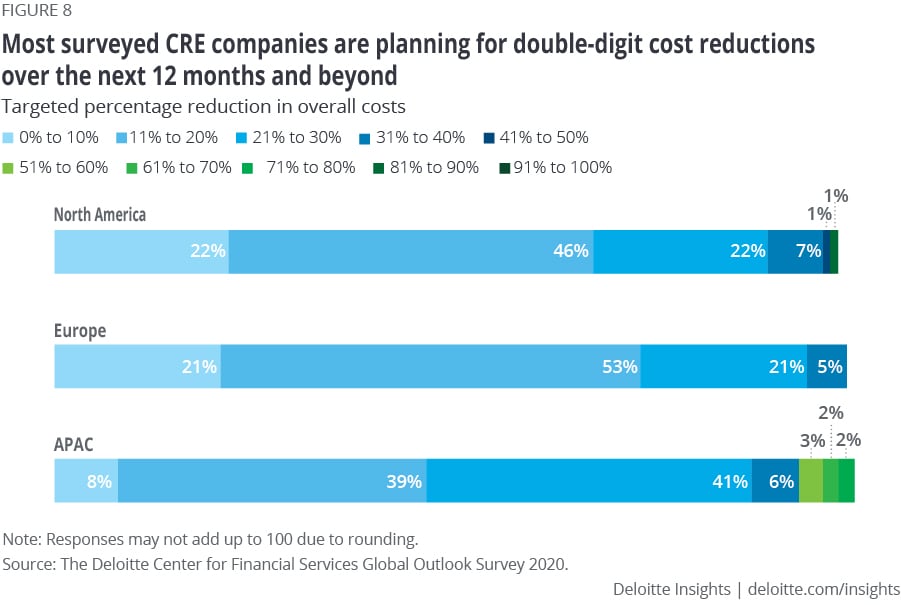

Our survey data reveals CRE companies aim to reduce costs by 20% on average over the next year or more, because most owners/operators have had to absorb the cost of making spaces ready for reoccupancy. While 46% of North American and 53% of European respondents anticipate lowering costs by 11–20%, 41% of APAC respondents expect a steeper rationalization of 21–30% (figure 8). As expected, many companies plan to reduce discretionary spending to manage costs over the next 12 months. More than 50% of respondents have reduced compensation, frozen promotions, reduced or offered flexible work hours, and enacted furloughs and layoffs to lower workforce-related expenses since the outbreak.

To position themselves for longer-term success, companies should consider streamlining and restructuring their operations to allow work to get done faster, cheaper, and more efficiently. This could involve an in-depth analysis of business processes, identifying opportunities to restructure and reduce redundancies. Companies can use automation or outsourcing of noncore operations, or a combination of both, to gain operational efficiency. They could also modernize asset management systems and enable data-driven decision-making related to demand-supply of physical space, location, collaboration with tenants and vendors, and managing and surveilling facilities. Finally, they could leverage a combination of cloud, RPA, and AI to automate and digitize the leasing process end-to-end.21

Using technology to reposition CRE space and facilities management

With tenants and end users likely to leverage different CRE properties to make emotional in-person connections, spaces are likely to be valued based on the experiential value rather than just traditional metrics such as cost/square foot or sales/square foot. Our survey responses also suggest that unlike the prior emphasis on location, health and safety-related smart building features, and occupation density may play a more important role in leasing decisions going forward. CRE owners/operators should shift their mindsets to align with how tenants place strategic bets on their CRE investments. To do this, leaders should use technology and data at every step of decision-making and execution. They would also need to frequently collaborate, communicate, and coordinate with tenants to be in lockstep. Only 38% of respondents say their organization has increased collaboration with tenants to understand end-user preferences.

Organizations should use sensing tools, alternative data sets, and analytics to evaluate and predict the impact of changing investor and tenant/end-user preferences on CRE usage and demand. In some instances, companies may have to be creative and adapt spaces for complementary or new purposes. Even before the pandemic, many retail properties were losing their value and purpose due to online sales; this trend has only accelerated since COVID-19 hit. But now, some landlords are converting empty retail spaces into mixed-use developments, apartments, or warehouses. For example, an AUD500 million redevelopment of Melbourne’s Westfield Doncaster shopping mall is being transformed into a mixed-use property comprising retail, office, and health and well-being spaces.22

In most other instances, companies could increase the value of their properties by deploying smart building design and maintenance capabilities and offering more relevant services to tenants and end users. These services include using sensor technologies and predictive analytics to monitor facilities remotely and offer preemptive or usage-driven maintenance activities; or using smart building technologies and 3D visualizations to help landlords assess operational readiness of physical spaces in real time, implement more rigorous cleaning systems, and monitor HVAC systems.23 Faced with rising demand for warehouse space, some warehouses are accelerating the adoption of technologies such as autonomous forklift trucks and drones to keep facilities operational with reduced workforces.24

Sections

Finance: Treading cautiously

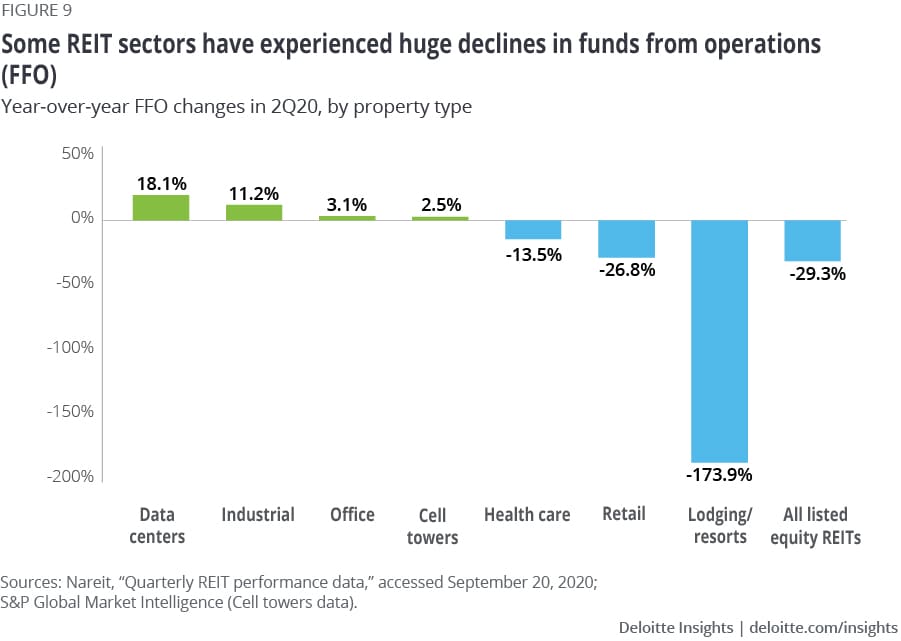

CRE companies have maintained financial strength, but many have started to feel the impact of the turbulent business environment. Average rent collections have been above 90% for industrial, office, apartments, and health care REITs during the April–July 2020 period.25 Rent collections for US shopping center REITs dropped to 50% in April, but continue to recover, rising to 80% in August.26 The healthy rent collection is being offset by higher tenant improvement and leasing commission costs (TI & LC), which are impacting operating margins in some sectors. In 2Q20, office owners increasingly offered a rent-free period, TI, and LCs, resulting in a decline in net effective office rents of 6.6% YoY in top US markets.27 On average, funds from operations (FFO) declined 29.3% YoY and net operating income lowered 15.6% YoY for the public REITs in 2Q20 (figure 9).28 But industrial spaces and data centers experienced FFO growth of 11.2% YoY and 18.1% YoY, respectively, in 2Q20.29

Unlike during the GFC, as of October 2020, CRE debt markets have remained liquid since the outbreak, with capital available at low rates. Consequently, even after an addition of US$30B of newly troubled CRE loans in 2Q20, distressed asset sales were only 1.4% of the deal volume, a level comparable to the past two years.30 There is a growing concern among banks around lending, however, with delinquencies on the rise. The commercial mortgage-backed securities delinquency rate remained above 9% in August, after reaching an all-time high of 10.3% in June, largely driven by hotels at 23% and retail at 15%.31 In July, 78% of US domestic banks tightened lending standards for CRE loans.32

Balancing tactical and strategic actions

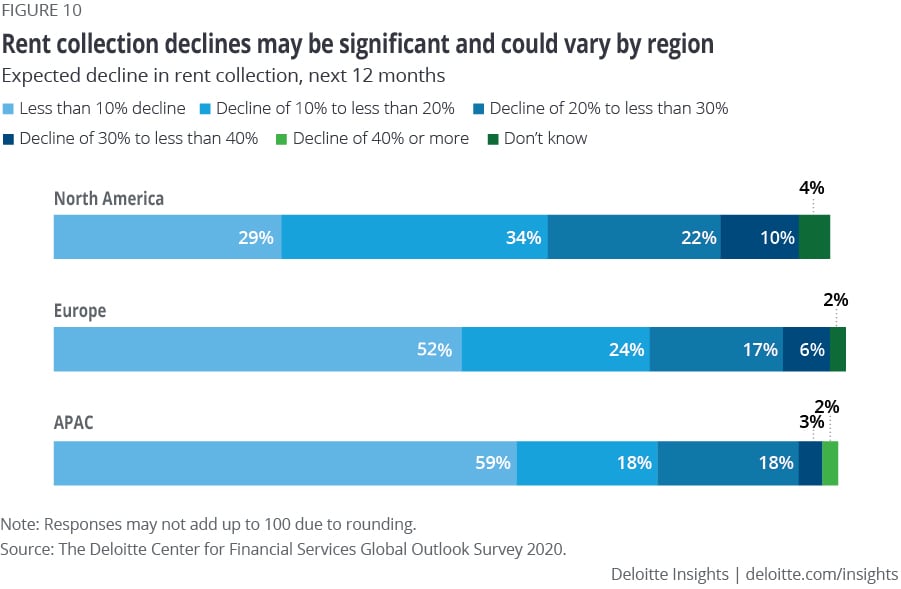

Given that the CRE industry generally lags the rest of the economy, respondents were cautious about industry financials for the next 12 months. For example, a larger proportion of respondents from North America, compared to respondents from Europe and APAC, expect rental collection declines of more than 20% in the next one year (figure 10). Further, the factors cited above could put pressure on liquidity and lead to more distressed asset sales and price declines. Forty-six percent of North American respondents and 45% of European respondents versus only 26% of APAC respondents expect capital availability to decline in the next 12 months. Companies should strengthen their asset portfolios, especially as the financing environment may tighten, if the current economic environment continues for a long time. They should also implement a data-driven finance function so they can be more responsive and efficient, and able to adapt to varied economic scenarios in the future.

Strengthening asset portfolios

While portfolio restructuring is commonplace, it’s taken on a new meaning due to the pandemic’s effect on space usage. As tenants and end users reengage with physical spaces, CRE companies should reconsider how they assess and value properties and their locations. Overall, 41% of survey respondents say they may rationalize their CRE footprint to support financial and operational stability over the next six to 12 months. At 48%, a larger proportion of European respondents are looking at CRE footprint reduction as a cost management lever. Based on a detailed assessment of asset performance, companies could forecast the future performance of their existing portfolios and identify and sell the underperforming or noncore assets. Respondents who plan to pursue M&A to support their financial stability also said they plan to sell underperforming or noncore assets.

Implementing a data-driven finance function

Companies seem to recognize the need to digitize the finance function. According to our survey, property operations and management and finance ranked first and second among anticipated investment in CRE functions. Companies should use technologies such as RPA and AI to automate tasks. For instance, they could use cloud-based software tools and RPA to digitize invoices, automate ledger entries, and handle reconciliation, reporting, and compliance checks. AI and data analytics can identify irregular entries and perform more robust forecasts of property income and expenses, which could allow for better planning and budgeting.33

Sections

Talent: A key competitive differentiator

The shift to remote working was difficult for the industry: Many jobs, such as facility manager, valuation appraiser, agent, or broker traditionally required employees to show up, in-person. Companies had to provide the infrastructure that would make it possible for employees to work effectively from home, while prioritizing health and safety. Given the challenges and stresses brought on by the pandemic, many companies also invested in health and wellness programs for their people. JLL, for example, offered employees a variety of health and wellness options, allowing them to select programs to suit their needs. Activities included free virtual cooking classes, games, educational programs, fitness classes, and access to meditation apps.34

But as weeks have turned into months of remote work or a limited return to in-person work, many CRE leaders find it challenging to maintain employee productivity, culture, engagement and cohesiveness, and appropriate communication levels. Research shows that distractions, isolation, blurred work/life balance, and adjusting to new ways of working are negatively impacting productivity in virtual work environments. In a Deloitte study of 11,000 workers, 80% of employees said they were able to meet the expectations of their role in a virtual setting. However, when asked how frequently they exhibit certain behaviors linked to virtual productivity, they did so less than 50% of the time.35

Overall, the pandemic appears to have accelerated many organizations’ need to revamp job roles, recruiting strategy, talent systems and processes, and culture to attract and retain a multigenerational workforce. Additionally, companies should focus on creating a more enabling culture for virtual work and prioritizing diversity and inclusion efforts.

Balancing tactical and strategic actions

Right now, companies need to make holistic choices about in-office and virtual work to ensure employees feel safe and remain productive. More than 50% of respondents acknowledged that their ability to succeed in the postpandemic world would be hampered by employee concerns about returning to work. Over the next 12 months, companies will need to make choices that continue to enable work to happen in different ways and places than it did before the pandemic. This may involve redefining their cultures to be more accepting about having more work done remotely versus in-person.

Longer term, companies would need to pull several levers to prepare for the future of work. Ultimately, a CRE company’s competitiveness in the post–COVID-19 world could hinge significantly on the extent to which their people can succeed in a digital work environment. Our recent article offers in-depth insights related to talent transformation, which will likely be a multiyear effort for many organizations.

Creating an enabling culture

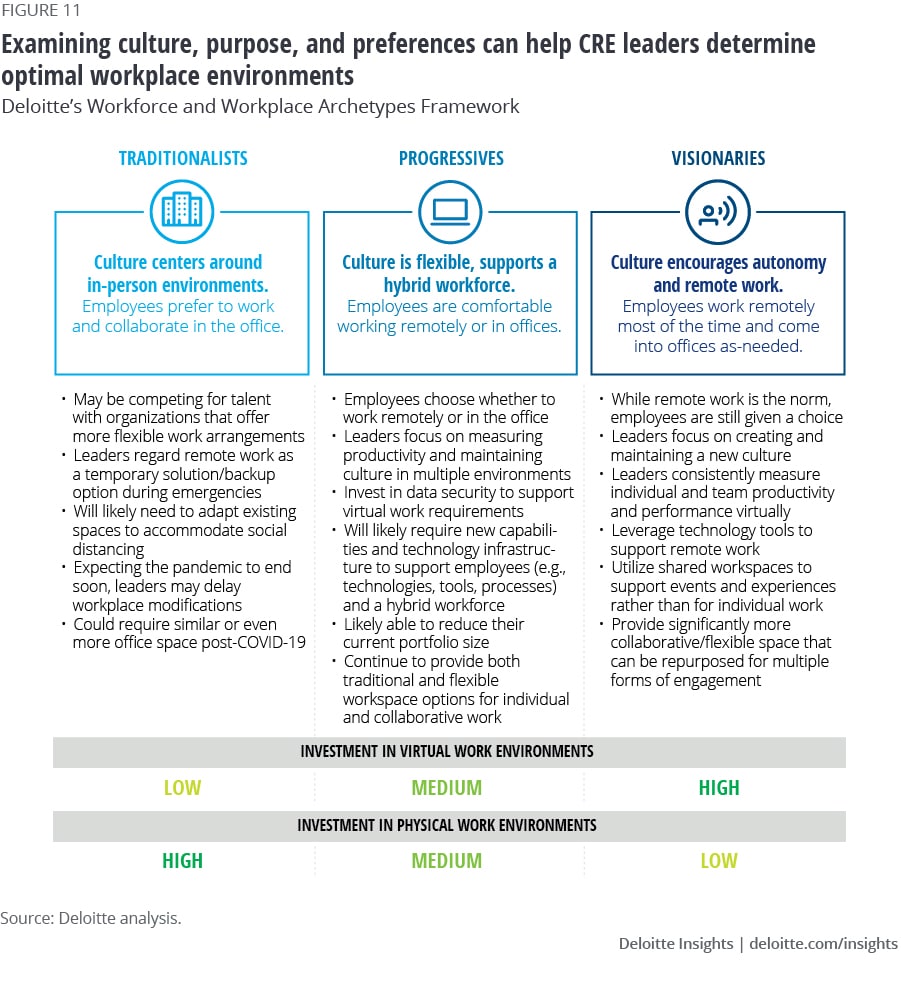

CRE companies could consider three approaches to the way work is done in the future (figure 11). As a starting point, companies should evaluate not only employee preferences, but also the job role and the degree to which it can be done remotely and autonomously. Each profile has different implications on organizational culture and office space demand and design. For instance, companies that fall into either the progressives and visionaries profiles may have to make higher investments in technologies, tools, and processes to install the appropriate infrastructure for long-term hybrid work. These investments may include productivity and performance measurement tools, training leaders to manage virtual teams, and redesigning spaces to facilitate collaboration and make employees feel safe. Conversely, companies that are traditionalists may have to incur higher costs to make spaces safe to support an in-person workforce.

Regardless of profile, companies should consider using contact-tracing tools, and other preventive processes and protocols, until the pandemic is over to help alleviate employee safety concerns.

Workplace design is expected to play an increasingly critical role in creating an enabling culture. Companies that adopt a hybrid work approach will likely use offices to develop more emotional connections, facilitate collaboration, and create human experiences. Visionaries may have to repurpose a lot of their spaces for multiple uses, while traditionalists could maintain existing spaces with guidelines around seat usage and sharing. Talent leaders would have to work closely with operations leaders to influence space design decisions.

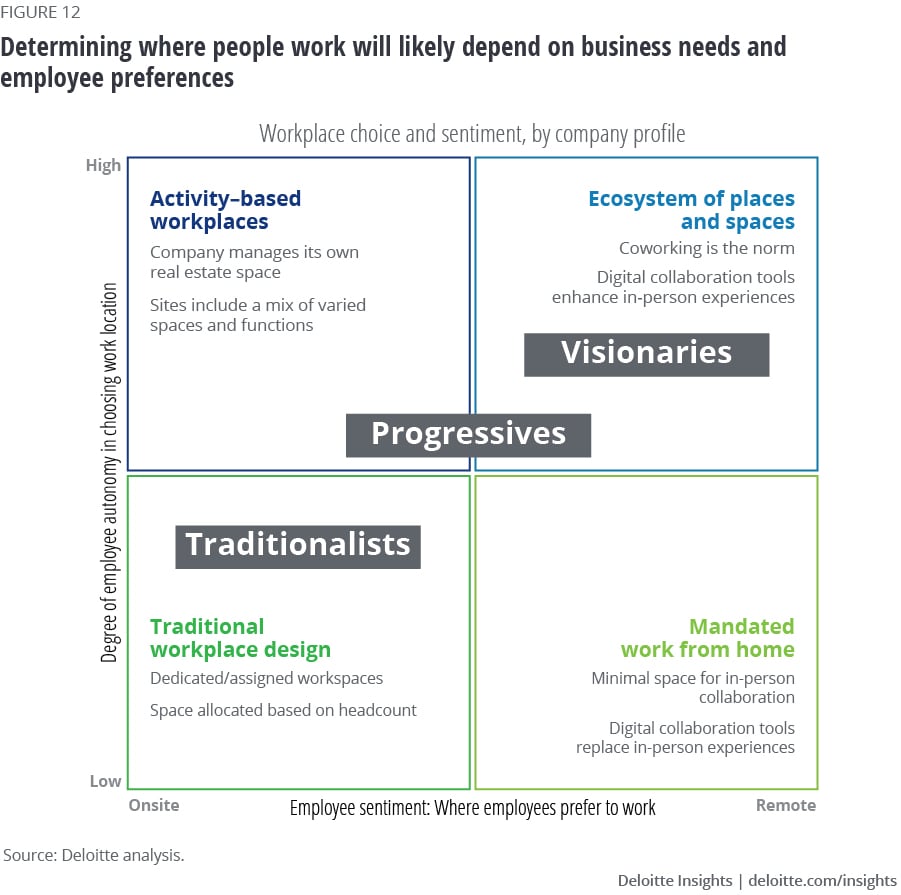

Companies can use a decision matrix (figure 12) to design or redesign office space based on employees’ preferred work location and their ability to choose where they work. After the pandemic subsides, we expect some organizations may continue to function as traditionalists. But they will likely leverage learnings gleaned from remote working to incorporate more progressive and visionary approaches.

Strengthening diversity and inclusion (D&I) efforts

Research suggests that a diverse and inclusive workforce leads to higher productivity, creativity, profitability, employee morale, and a stronger brand.36 However, only 46% of respondents report being focused on increasing the level of diversity in hiring, development, and leadership. As companies reinvent their talent function, leaders should make diversity and inclusion a foundational value by strategically infusing it into all talent actions.

Sections

Mastering the tightrope

For many CRE industry leaders, the pandemic has been an eye-opener. It has tested the resilience of every single leader across the globe, and likely will for many months to come.

COVID-19 has forced companies to focus on cost containment and for many, heightened the need for—and pace of—digital transformation. Yet, the importance of empathy and human connection is also coming to the fore. People are increasingly missing human interaction, which was vastly reduced or eliminated due to shelter-in-place orders for a long period of time, and in some regions continues. And people remain anxious about their health and well-being and the health and well-being of their families and friends, which is compounded by growing concerns about climate change and political unrest in many parts of the world.37

Leaders should therefore master the art of walking on a tightrope—balancing business recovery, seizing new opportunities, and tenant and employee engagement. This will likely require a combination of elements: breaking down functional silos, enhancing leadership and organizational agility, increasing levels of collaboration and communication, and engaging in transparent and ethical decision-making. Traversing the tightrope effectively in these ways could differentiate organizations from their less successful competitors in the not-too-distant future.

Survey methodology

In July–August 2020, the Deloitte US Center for Financial Services fielded a global survey that elicited responses from 800 senior financial services executives across industry sectors. Of these, 200 were senior CRE executives, which included roughly even representation from the finance, operations, talent, and technology functions. Respondents were equally distributed among three regions: North America (the United States and Canada), Europe (the United Kingdom, France, Germany, and Switzerland), and Asia-Pacific (Australia, China, Hong Kong SAR, and Japan).

The survey included CRE companies with assets under management (AUM) of at least US$100 million in 2019. Forty percent had more than US$100 million but less than US$5 billion in AUM, 29% had between US$5 billion and US$10 billion, 31% had more than US$10 billion.

The survey focused on how CRE companies are adapting to the pandemic’s impact on the market, society, and the economy, as well as their own workforce, operations, and culture. We also asked about their plans for investment priorities and likely structural changes in the year ahead as they continue to adjust and pivot from recovery to future success.

© 2021. See Terms of Use for more information.

More from the Financial services collection

-

The path ahead Article4 years ago

-

US consumer payments in a post-COVID-19 world Article4 years ago

-

Preparing for the future of commercial real estate Article4 years ago

-

COVID-19 return-to-the-workplace strategies Article4 years ago

-

Confronting the crisis Article4 years ago