2021 investment management outlook Transforming to thrive

19 minute read

03 December 2020

In our 2021 investment management outlook, 200 industry leaders weighed in on their companies’ COVID-19 recovery efforts. How can the emerging lessons serve as a catalyst for business transformation?

As new regulatory trends make an impact in the financial services marketplace, how can your organization remain resilient? Our 2021 regulatory outlooks explore key issues that could have a significant impact on the market and your business in 2021.

Subscribe now to receive your digital copy of the reports as soon as they are live.

Key messages

View sections

Transforming to thrive

The COVID-19 pandemic was the global story for 2020, but how firms recover from the pandemic and thrive in a post–COVID-19 world is expected to be the story for the investment management industry for 2021. Industry impact from COVID-19 varied widely, with investment management as a whole sustaining less damage than some other sectors of the economy. Revenues for investment management firms remained largely intact, but the people, the operations, and the technology used by investment managers were impacted. At the same time, market volatility and price movement dramatically accelerated at the industry sector and asset class levels.

Learn more

2021 Financial services industry outlooks

Read the 2021 investment management regulatory outlook

Explore all of the 2021 regulatory outlooks

Visit the Within Reach? Women in the financial services industry collection

Explore the Financial services collection

Learn about Deloitte’s services

Download the Deloitte Insights and Dow Jones app

Before the world turned upside down, the investment management industry was experiencing two important forces: the longest running bull market in history and shrinking margins at all but the most successful investment management firms.1 The market correction from February to March ended the bull market run, while operations were simultaneously thrown into turmoil by stay-at-home orders in the face of growing case counts of COVID-19. The market correction was short lived, but the subsequent recovery activities undertaken continue today at many firms.

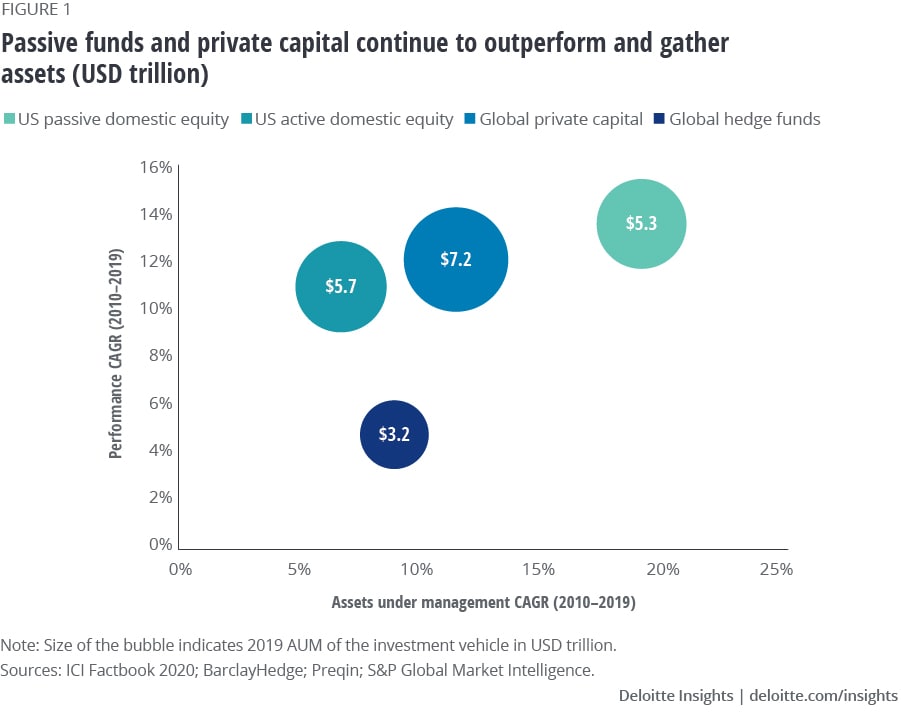

As we look at the assets under management (AUM) in the investment management industry and their long-term growth rates, the year-end 2019 figures are still instructive even though at the firm level there were dramatic changes. Figure 1 shows that global private capital still has shown very favorable performance and AUM growth over the past 10 years. The chart also shows that US passive investments have strong returns and AUM growth through 2019. Passive funds continue to take share of the overall investment management AUM in the United States. Globally, the performance of active equity managers over the past 10 years has been mixed. Portfolio managers in Japan have found success outperforming their benchmark by 1.2% over this period.2 However, active equity managers in Europe and Australia have faced challenges similar to their US counterparts as the average performance trailed the benchmark by 1.5% and 0.8%, respectively, on an annual basis over the past 10 years.3

Sections

The outlook

Investor preferences through the pandemic may have shifted, and any possible shift is not yet fully understood, nor has it fully played out. A key question is whether or not active managers provide value to investors through the volatility in ways that will drive investor behavior. Deloitte forecasts weakness for the economy going forward, predicted with a 55% probability, until deployment of a COVID-19 vaccine.4 Will a lumpy economic recovery favor some investment managers over others? Perhaps it is all just about relative performance or some form of risk-adjusted return.

In this outlook, we will explore the current status of investment management firms and their plans for achieving success in 2021 and beyond. This outlook is based on a proprietary survey of investment management firms across the globe and by examples of bold action taken by investment management firms (see sidebar, "Survey methodology").

Talent, financial management, and operations are three organizing areas that investment management firms appear to be prioritizing to emerge into the post-COVID-19 environment stronger than they were at the start of 2020.

Sections

Three perspectives on the investment management outlook

The biggest resource for the investment management industry is its talent pool. So, industry prospects will likely revolve around how the industry makes fundamental financial and operational decisions to balance organizational growth and stability with employee safety and productivity. Furthermore, another important factor is how efficiently organizations invest in technologies and train their workforces to utilize them. In a nutshell, over the next 18 months, the future of investment management firms could depend on how they execute on their plans related to the return to the workplace, managing finances, and controlling operational change.

Managing the return to the workplace, preserving the culture, and creating a diverse workforce

Investment management firms continued, without pause, to manage assets throughout 2020. While the revenue stream for investment managers was uninterrupted, customers also expected heightened diligence through the volatility, as opposed to excuses. Investment firms faced real difficulties keeping their people equipped to meet these expectations as they were simultaneously protecting their well-being in the face of the pandemic. Employee safety is the primary concern of investment management firms as they work to meet or exceed customer expectations. And, for long-term success it has to be done while preserving or strengthening the corporate culture.

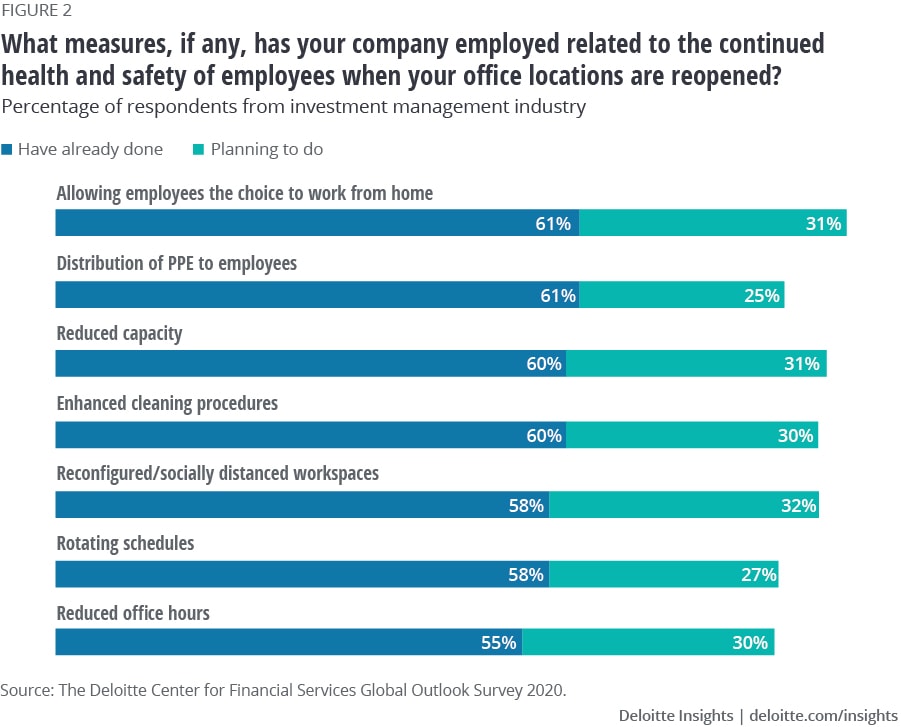

The first step to bring employees safely back to the workplace should be having a vision and a plan. Interestingly, in our survey fielded in August of 2020, 48% of respondents from the investment management industry agreed or strongly agreed that their firm had a vision and a clear action plan to maintain operational and financial resilience through the COVID-19 pandemic. This level appears low, given the importance of a clear action plan, and the high percentage (~90%) of respondents who indicated that their firm has already taken steps or has a plan for elements of a safe return to the workplace (figure 2). The low reporting of a vision and a clear action plan may be due to the uncertain nature of the pandemic itself, further complicated by government action that also continues to be unpredictable at times. Planning has to be agile enough to meet changes on a daily basis in this environment, and a clear vision and action plan for operational and financial resilience is important, just as is a safe return to the workplace.

The standard policies and preparations appear either implemented or planned consistently at investment management firms across North America, Europe, and Asia-Pacific regions. The results are also consistent by type of firm—active mutual fund managers, passive managers, alternative investment managers, and separate account managers. These results are also consistent by firm size. However, the degree of flexibility and the effectiveness of management’s communication plan impacts how employees feel about returning to the workplace.

Nearly half of the respondents, 46%, agree or strongly agree that fear of returning to the workplace could hamper their firm’s ability to succeed. Well-known firms have brought groups back into the workplace, and within days they had to send employees home after some of them tested positive for the novel coronavirus. They have since modified their back-to-the-workplace regimen.5 These findings indicate that investment management firms have more to do in both the development and communication of agile plans for recovery, and in creation of back-to-the-workplace plans to safeguard and comfort employees.

In addition to all the internal practices that firms are developing, some large firms such as Vanguard are using pandemic spread data to inform the return-to-the-workplace approach across their global footprint.6 They are using case rates and spread statistics to determine when specific geographies have reached threshold virus incidence levels. The back-to-the-workplace plan also considers state and local laws as inputs to inform the plan development. Using external data and a geographic approach adds a layer of objectivity and control to back-to-the-workplace plans, which are elements that can increase confidence in the return-to-work process.

Objective development and execution of the return-to-the-workplace plan can also help prevent fracturing of firms’ culture across organizational lines based on different treatments. Some firms are seeing employees that come back to the office develop closer working relationships within specific organizational groups. This can strengthen intra-unit cohesion. However, just as working together through stressful periods can bring a team together, teams that bear an overweighted portion of the risk or hardship may grow resentful of those teams that have it easier—especially if the rationale behind the allocations is subjective.

However, not everyone can or should come back to the workplace at the same time. Leadership communication of the overall staggered approach to back-to-the-workplace can squelch the division that can potentially arise from differentiated timing of the workforce’s return. Leadership can also emphasize that away from the workplace is not the same as away from work. Data-driven return-to-the-workplace approaches are expected to be a leading practice in 2021. Firms that follow a data-driven approach and communicate that approach well throughout their organizations are more likely to enhance enterprisewide unity and emerge from the pandemic culturally stronger.

The diversity makeup of organizations is also likely to rise in importance in 2021, as more data becomes available to external stakeholders. Institutional investment data collected by eVestment will soon include diversity data not only about the composition of an investment management firm’s leadership, but also at the portfolio manager team level.7 The questionnaire is expected to also look for deeper insights into the steps firms are undertaking to raise the diversity profile. This additional perspective is important because it allows investment management firms the opportunity to demonstrate their commitment to diversity, equity, and inclusion, which in turn may better enable the organization to attract and retain top talent.8 Diversity is expected to be a major topic for discussion as firms develop their talent objectives for 2021.

With these plans in place, the number of investment management firms that externally share high-level road maps for increasing diversity is likely to grow. However, firms may be able to differentiate by providing additional transparency about that road map. The L.E.A.D. (Listen, Engage, Acknowledge, Do) framework is one such road map that can help investment management leaders take meaningful action today to build an inclusive workplace for all current and prospective employees.9 The L.E.A.D. framework can be used globally to address racism, and firms can apply many of its considerations to create an inclusive and supportive workplace environment within their local communities.

Managing finances through 2021

Many investment management firms are adjusting their budgets and financial strategies based on their experiences from 2020. Firms found that their planning for long-tail events proved valuable, even though they simultaneously proved to be insufficient for the rapid disruption created by the virus. The value came from knowing how to tackle a major problem and make decisions in the face of adversity and uncertainty. The planning exercise helped in this regard, even when the planning steps themselves did not neatly fit the problems presented by COVID-19.

Leadership at most investment managers stabilized financing as an early action step in the highly uncertain times at the onset of the pandemic, as one of a broad spectrum of activities. Private equity firms seemed to manage risk by offering guidance, network access, or capital to their portfolio companies, while managers of public securities often reviewed counterparty and asset class–specific risks. Valuation of assets for reporting and investment decision support both proved challenging during the early stages of the pandemic. Investment managers of all kinds reassured investors that their portfolios were being managed continuously in the face of adversity.

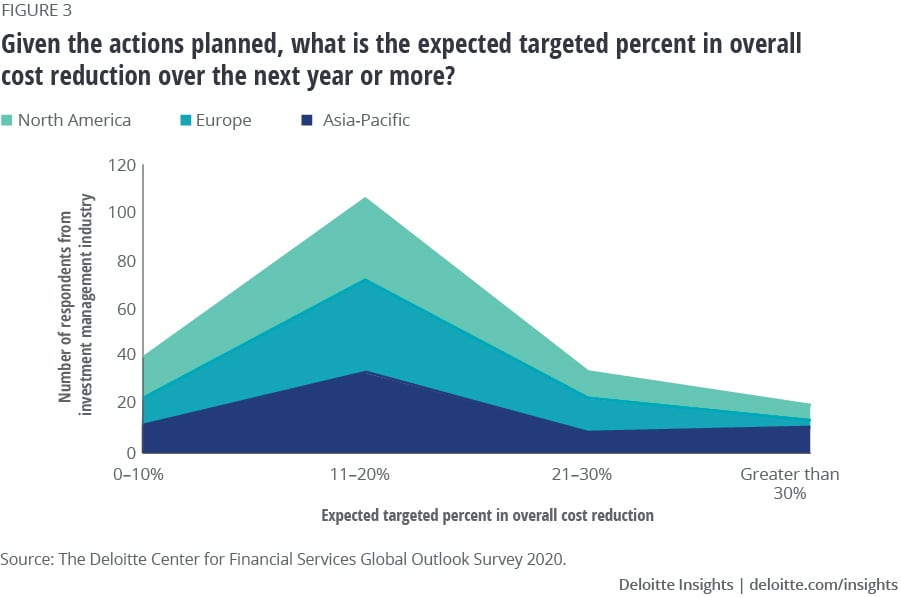

Half of our survey respondents indicate that their firms plan to reduce total costs by 11% to 20%. These cost-reduction targets look ambitious considering that the workplace-related cost per employee is estimated to increase by as much as 50%, straining cost-reduction plans.10 At the same time, many firms plan to change their spending profile in technology by adjusting strategic approaches to building capability and shifting the priorities of technologies being developed. Let’s explore the cost-reduction changes for these two large expense categories—workforce and technology.

Workforce

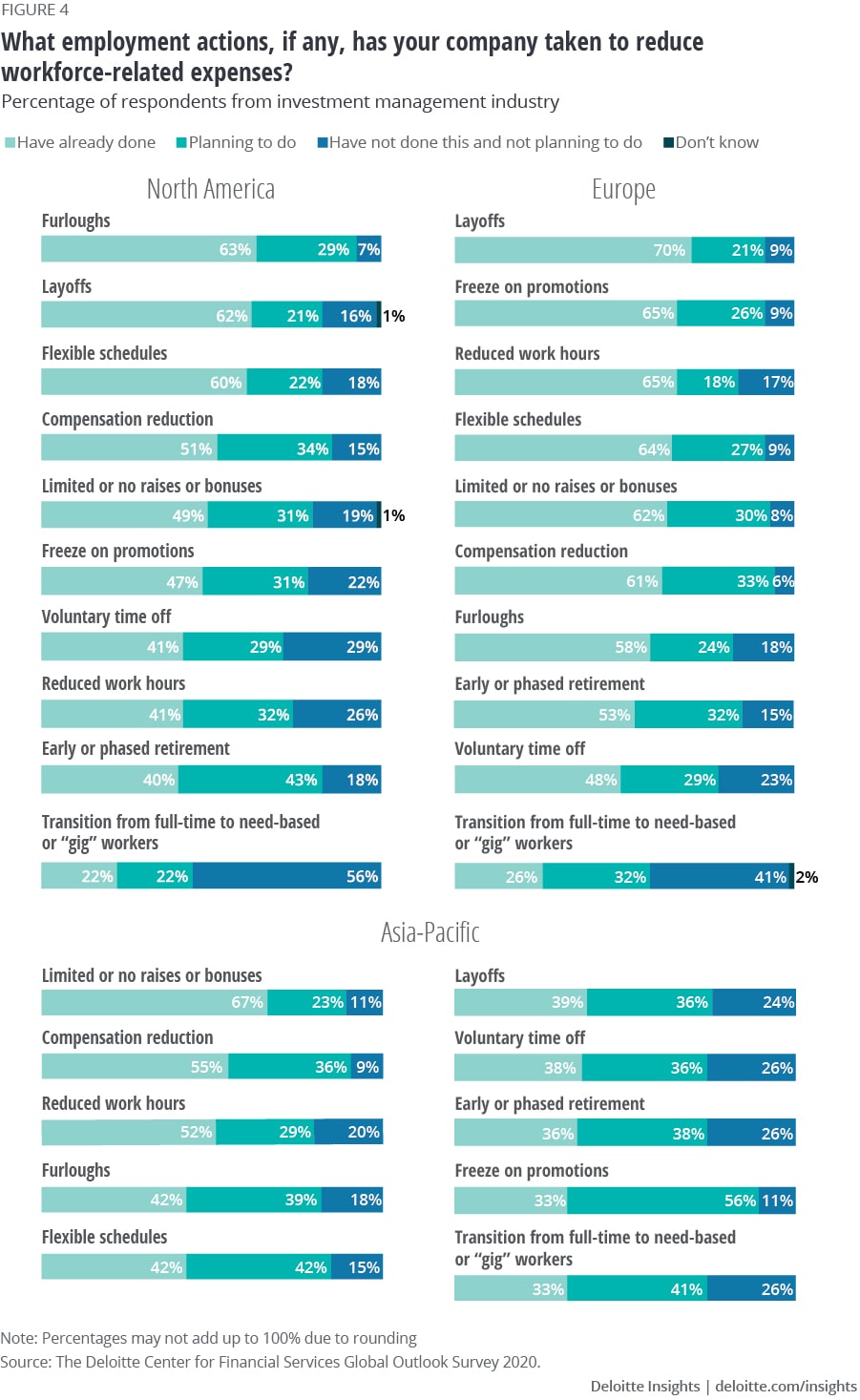

Leadership has many options available to manage the cost of the workforce, and many firms are breaking traditional patterns as they address this pandemic. Our survey results indicate that, globally, firms are taking multiple approaches to managing the workforce costs, and that most actions were taken by the summer of 2020 even though there were some significant regional differences. At the time of the survey, executed workforce actions outnumbered “planned but unexecuted” actions by a factor of about two to one.

While each of these workforce cost management actions have planned and completed utilization rates of approximately 80% (with the exception being transition to a gig working model), it is important to note that this is a binary indicator, which does not speak to the depth of cost management of any of the alternative actions. For example, deep layoffs at investment management firms have not been widely reported in the news, and according to the US Bureau of Labor Statistics employment in the group containing investment management increased in 2020.11 Only two months in 2020, April and June, saw employment decline in the group containing investment management.12

A similar occurrence is found in the European Union. The number of persons employed in the economic activity classification including fund management dropped by 0.1% between Q1 and Q2 after increasing during the first quarter of 2020.13

In the Asia-Pacific region, some investment management firms preferred to use strategic reductions in bonuses and salaries rather than implementing job eliminations.14 This course of action is also evident in the survey as the top two actions already taken by firms in Asia-Pacific are both related to compensation (figure 4).

Furloughs, which are unpaid leaves of absence, make up a part of unemployment figures. Furloughs were much more widely used across industries in response to the pandemic than they had been used historically.15 This factor likely contributed to the initial V-shaped employment recovery in the US economy.16 Our survey respondents indicate that furloughs have been used by firms at practically the same rate as layoffs (figure 4). This indicates both optimism for a recovery on the part of leadership and creativity to deploy less-utilized approaches to manage the workforce through COVID-19. These results point to industry leadership preserving their workforce capabilities—setting themselves up to thrive as the world recovers from COVID-19.

Digital transformation and underlying technologies

Technology and digital transformation represent another important area for expense management. Overall, investment management firms are changing approaches to digital transformation to support cost savings. The spending allocations by technology are also changing in ways that appear to support the security and efficiency of digital interaction.

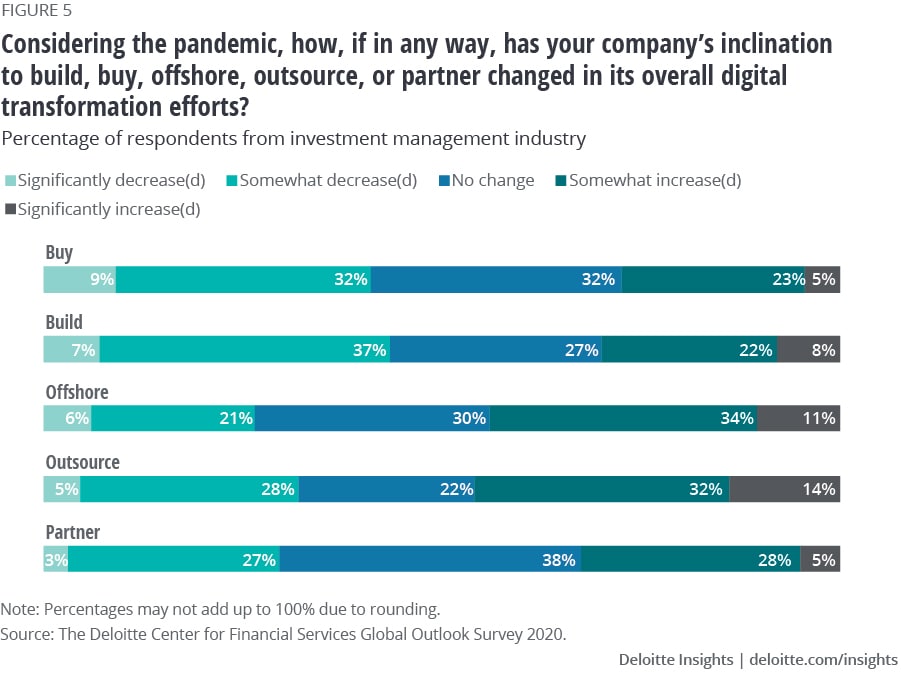

Overall, investment management firms are more likely to increase than decrease both outsource and offshore approaches to digital transformation. In contrast, they are decreasing emphasis on vendor solutions and in-house build projects, while partnering is more balanced. But Europe and Asia-Pacific each show some interesting deviations from the overall trend. In Asia-Pacific, both build and buy projects are much less likely to be de-emphasized. In Europe, partnering and outsourcing projects are much more likely to be de-emphasized.

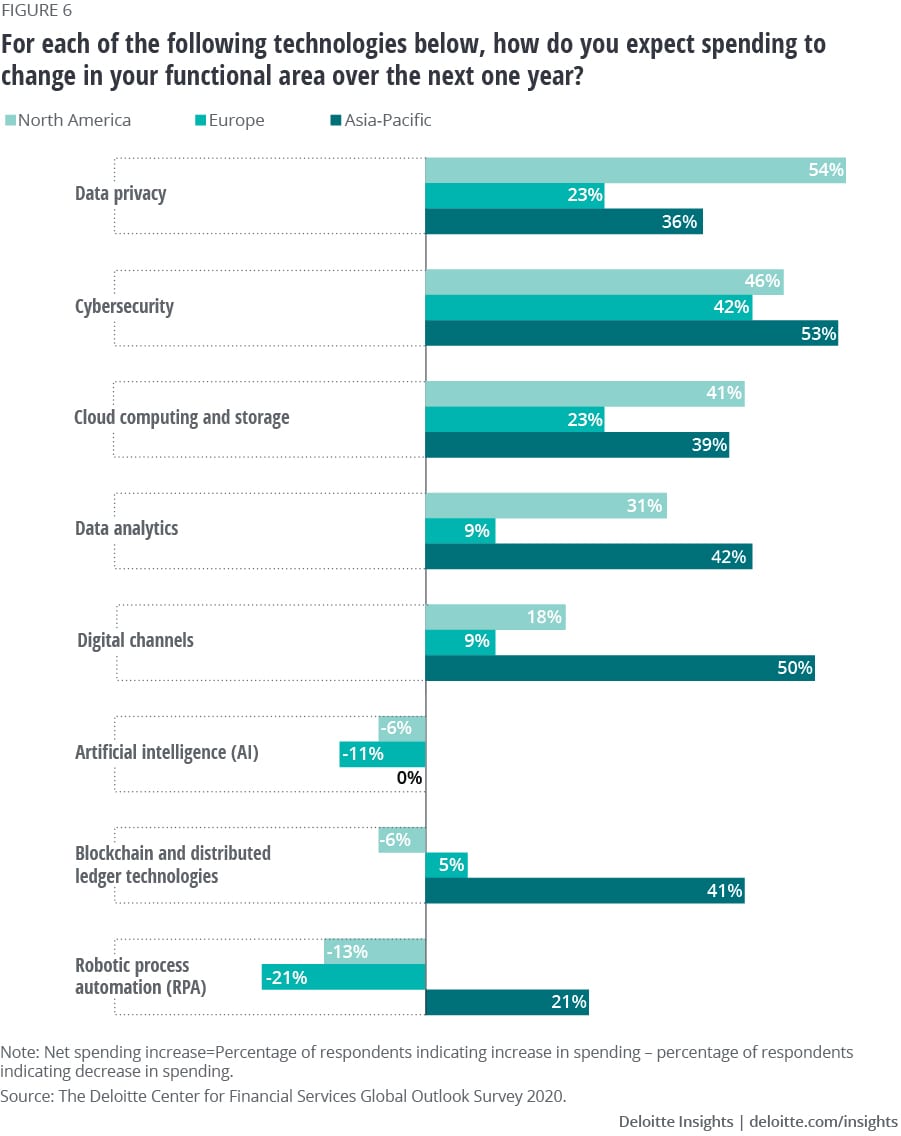

When we look at the technologies with spending expected to increase over the next year, an interesting pattern emerges. Respondents report that, in their firms, the top technologies seeing an expected net increase in spending are cybersecurity and data privacy. Not surprisingly, this indicates that investment management firms are spending in part to support remote and distributed working arrangements brought about by the pandemic.

According to our survey, some firms seem to be cutting AI projects, perhaps because, “The impact of AI may not be linear, but may build up at an accelerating pace over time.”17 The surprise in these survey results is the reduction in spending on RPA for firms with US$1–25B in revenue. These projects often lead to direct cost savings—the results indicate that the largest and smallest firms are continuing these projects. Many notable investment management firms pledged to forgo layoffs through the course of COVID-19.18 Perhaps firms are delaying these RPA projects to a time that is more favorable to reassigning employees, rather than laying them off. It is also interesting to note that in Asia-Pacific the respondents did not indicate a net decrease in spending in any of the technologies, including AI and RPA.

According to 92% of survey respondents, firms are implementing or are planning to implement technologies that enable their people to work from anywhere. This accelerated effort is being achieved with an increased emphasis on outsourcing and offshoring, rather than building or buying new technologies. In addition to the broad modernization benefits that cloud computing offers, it enables firms to perform their tasks in a remote, low-contact work model while meeting the heightened data security requirements.

Controlling operational change and meeting customer demands digitally

What investment management firms do to satisfy investors has not fundamentally changed in the last decade. Investment managers set expectations for how their portfolios may perform on multiple parameters, such as return, risk, diversification, and correlation to indices. They also divulge the principles of the strategy that seeks to provide these results to investors and prospects. These elements are constant, but how investment management firms achieve the results operationally is changing relatively swiftly, and how clients are managed across the life cycle is also experiencing rapid change.

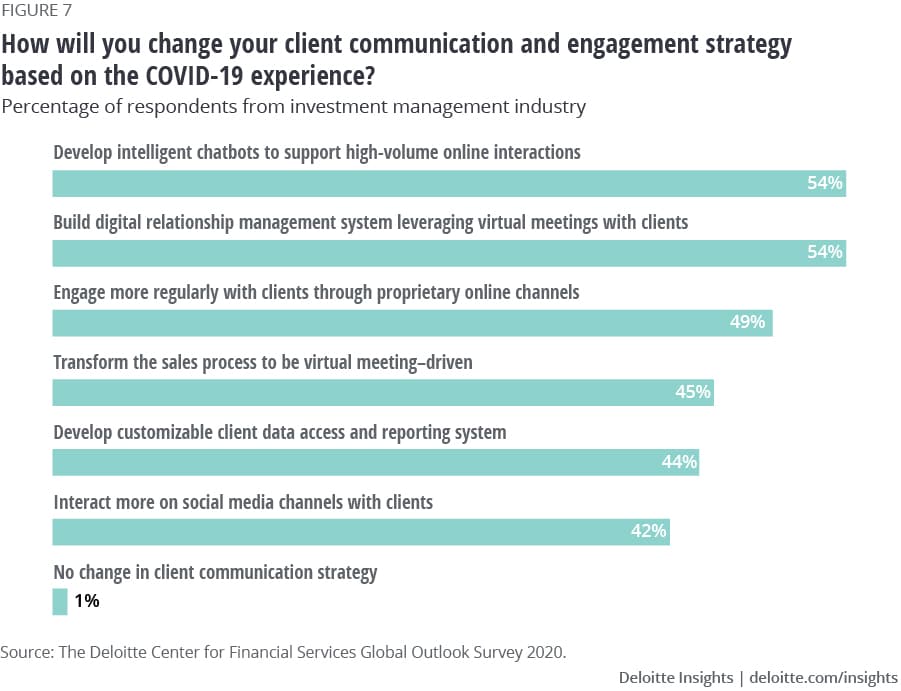

Digital transformation enables adaptation of existing processes in addition to development of new offerings such as targeted environmental, social, and governance (ESG) portfolios (see sidebar, “ESG in 2021”). Digital transformation is accelerating, and 2021 has the potential to be the year that laggards face strategic risk, not from what they offer investors but from how the offerings are supplemented by digital capabilities. Digital transformation will likely also become an element in many investment management firms’ brands. Like it or not, investors may judge investment management firms on the sophistication and elegance of their customer interactions. Many will likely assume that technological prowess in customer interactions translates to prowess in the investment management process.19 In line with this thinking, investment management firms on average are instituting three of the six digital client communication and engagement strategies listed in figure 7, which is fairly high given the retail focus of some of the actions. This point is also highlighted by the 1% of respondents that report no change in the client communication strategy.

While customer experience will likely be an important face of digital transformation, the heart of an active investment management firm is its investment decision process. Digital transformation has the potential to update how strategies are implemented and portfolios are managed.

The disruption brought about by COVID-19 pointed out that many firms were not operating at the speed of the markets. Markets were moving in March of 2020 faster than many proprietary valuation models were able to refresh. Even the central banks were updating their economic models to incorporate data sources that reflected near real-time data to achieve what has been called “nowcasting.”20 These events served as the impetus to initiate activities and develop new operational plans. This nowcasting capability now resides in production at 53% of hedge funds, the first group of investment managers to embrace the technology.21 Long-only managers and private capital managers are following suit. Now that the alternative data technology is more mature, the application to long-term investing has blossomed.22 Furthermore, the risks associated with implementation are now offset by the risk of being left behind.

ESG in 2021

Advancements in ESG funds demonstrate how digital transformation drives product evolution. ESG investing is currently the biggest fundamental change in the industry and has been in the works since at least the 1970s.23 Over the years, ESG investing has progressed from being a niche offering to becoming a mainstream product. Today, ESG considerations are increasingly in demand by investors, and investment management firms are responding with growing numbers of product launches.24 Vanguard, BlackRock, Transamerica, Goldman Sachs, and Franklin Templeton have all launched ESG products in 2020.25 Throughout 2021, ESG is likely to gain momentum as data and analytics are tuned to quantify the myriad approaches and flavors of ESG. More than 50% of investment management respondents in North America, Europe, and Asia-Pacific indicate that their company is reprioritizing ESG policies, programs, and products as a result of COVID-19.

Similar to the early development of the automobile, which was initially offered in any desired color as long as it was black, ESG is in the process of unpacking into dozens of targeted environmental, social, or governance goals, which can more closely match the specific ESG goals of investors. Creation of these funds would be backed by corporate disclosures and alternative data sources, and the progress toward the goal of the portfolio may be reported to investors on a regular basis.

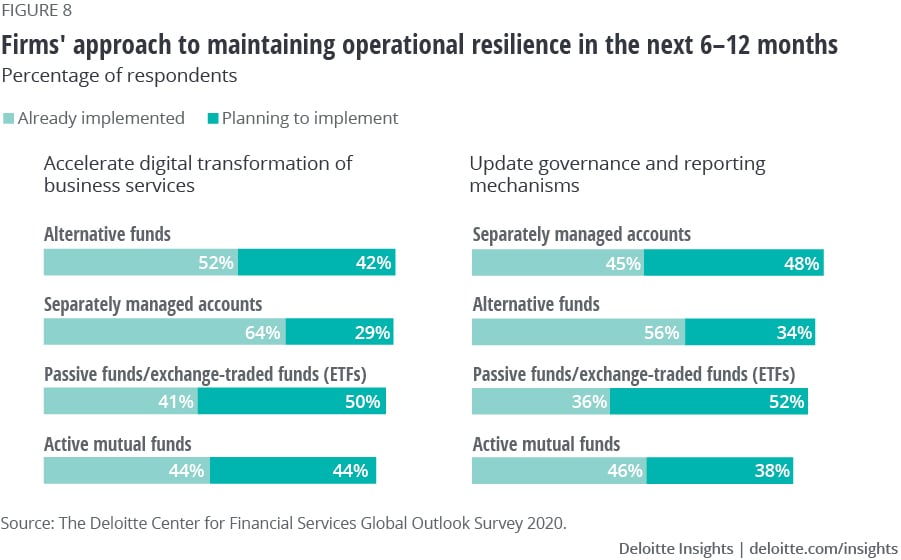

But moving ahead with new capabilities calls for corresponding updates to governance and reporting practices. Our top line survey results for these activities are very similar (figure 8) but these similarities in the top line belie an important detail. Less than half of the firms that are already executing accelerated digital transformation of their business services have also started implementing updated governance and reporting mechanisms. This result indicates that these endeavors are not tightly linked and that there is operational risk creeping into the equation as digital transformation is implemented. This potential operational risk is evenly spread across active mutual fund managers, passive managers, alternative investment managers, and separate account managers.

As 2021 unfolds, look for governance and reporting projects to increase at firms as they roll out new or enhanced services enabled by digital transformation. This order of development, capability first then reporting and controls, seems to follow the old adage, “It is better to ask forgiveness than permission.” In this case, firms seem to be making sure they get the desired upgrades before building all the rules to manage them. This may be risky, but it does enable operational progress.

Sections

Pressure catalyzes prudent transformation

2020 challenged the investment management industry, and the industry responded. The volatility, personal hardship, and the industry’s commitment to both customers and employees will likely lead to a stronger, more digitally capable investment management industry at the end of 2021. Investment management firms changed priorities based on the experiences and necessities brought about by the COVID-19 pandemic. The actions and numbers bear evidence that the commitment to employee health and well-being was palpable across the industry. There was also a commitment to transformation on behalf of the customers, supported by a persevering and competitive spirit.

The industry is trading some long-term differentiation for a swift transformation to digitally enabled processes that support operations and customer interactions. Collaboration and relationship building on digital platforms will likely emerge as necessary elements of an effective process. By the end of 2021, the impact of the human element is likely to grow and act as an accelerant to digital processes that served adequately while it was squelched. The employee retention levels in the investment management industry suggest that employees were valued by their firms through the pandemic. Employees have the opportunity to return the investment in them back to their firms with renewed energy and commitment. 2021 is setting up to be a remarkable year for the investment management industry, which is likely to emerge stronger.

Figure 1 methodology

- US passive domestic equity funds comprise AUMs for 1940 Act domestic equity index ETFs and domestic equity index mutual funds sourced from ICI Factbook 2020. Returns correspond to 10-year returns for S&P Composite 1500 from SPIVA US year-end 2019 scorecard. Domestic equity index ETF AUM was estimated based on the proportion of domestic equity AUM in the total ETF AUM by investment objective.

- US active domestic equity funds comprise AUMs for 1940 Act actively managed ETFs and actively managed domestic equity mutual funds sourced from ICI Factbook 2020. Returns correspond to 10-year returns for all domestic equity funds from SPIVA US year-end 2019 scorecard. Domestic equity active ETF AUM was estimated based on the proportion of domestic equity AUM in the total ETF AUM by investment objective.

- Global private capital: AUM and performance data has been sourced from Preqin. AUM is the sum of unrealized value and dry powder. Performance corresponds to Preqin Private Capital Index returns.

- Global hedge funds: AUM and performance data has been sourced from BarclayHedge. AUM figures exclude fund of funds assets. Hedge fund performance represents Barclay Hedge Fund Index return, which is a simple arithmetic average of the net returns of all the reporting hedge funds (except fund of funds) in the Barclay database.

Survey methodology

In July-August 2020, the Deloitte US Center for Financial Services fielded a global survey, eliciting responses from 200 senior investment management executives, including fairly even representation from finance, operations, talent, and technology. Respondents were equally distributed among three regions—North America (United States and Canada), Europe (United Kingdom, France, Germany, and Switzerland), and Asia-Pacific (Australia, China, Hong Kong SAR, and Japan).

The survey included investment management companies with revenue of at least US$500 million in 2019. About one-tenth (11.5%) of companies had more than US$500 million but less than US$1 billion in revenue, 28.5% had between US$1 billion and US$5 billion, while 60.0% had more than US$5 billion.

The survey focused on how investment management companies are adapting to the pandemic’s impact on the market, society, and the economy, as well as their own workforce, operations, and culture. We also asked about their plans for investment priorities and likely structural changes in the year ahead as they continue to adjust and start pivoting from recovery to the future.

More from the financial services collection

-

The path ahead Article4 years ago

-

Diversifying the path to CEO in financial services Article4 years ago

-

US consumer payments in a post-COVID-19 world Article4 years ago

-

Preparing for the future of commercial real estate Article4 years ago

-

COVID-19 return-to-the-workplace strategies Article4 years ago

-

Confronting the crisis Article4 years ago