Financial disclosure trends identified in the 2023 reporting season | Deloitte US has been saved

By Doug Rand, Audit & Assurance Managing Director, Deloitte & Touche LLP

Talking points

- Our analysis of 2023 annual financial reports from the Fortune 500 revealed that disclosures for three topics—cybersecurity, artificial intelligence (AI), and Pillar Two implementation—increased significantly.

- Inflation, interest rates, and climate change, which were key topics from the previous year, also continued to figure prominently in 2023 annual report disclosures.

- Deloitte can advise you on these and other SEC disclosure trends and requirements.

Looking for a quiet moment in your day? You’ll be hard-pressed to find it in today’s unpredictable business environment. From interest rate changes to geopolitical tensions, conditions have certainly been challenging.1 But how are these challenges affecting companies, and what are management teams doing to address them? Analyzing company financial reporting disclosures is often a great way to find out, because disclosures can play a crucial role in conveying to investors how companies navigate and are affected by broader global events.

Recently, Deloitte examined 2023 annual reports from Fortune 500 companies to see how they approached topics in their disclosures and found three key themes—as well as a few recurring disclosure trends on macroeconomic conditions and other topics.

New cybersecurity disclosures

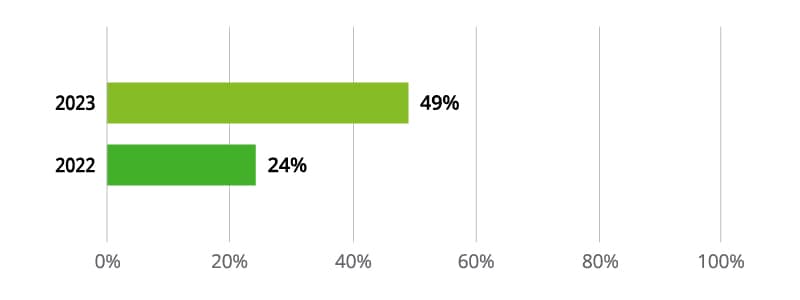

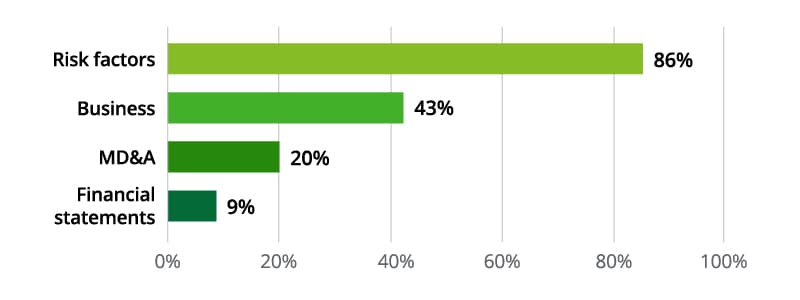

Figure 1. Percentage of companies disclosing2

The SEC’s final rule3 mandates public companies disclose material information regarding their cybersecurity risk management, strategy, and governance. It allows registrants flexibility to disclose sufficient information for investors to draw their own conclusions on a company’s cyber programs.

Most companies included:

- National Institute of Standards and Technology (NIST) or International Organization for Standardization (ISO) framework usage.

- Formal incident response plans.

- Employee cybersecurity trainings.

- Penetration or vulnerability testing.

A significant increase in AI disclosures

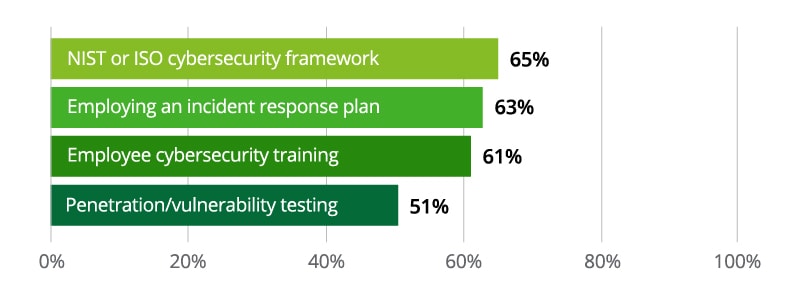

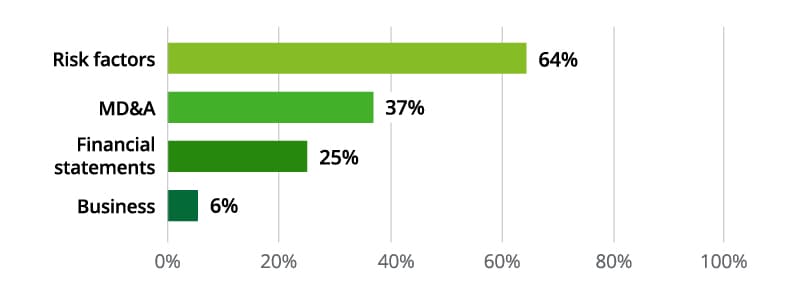

Figure 2. Percentage of companies disclosing4

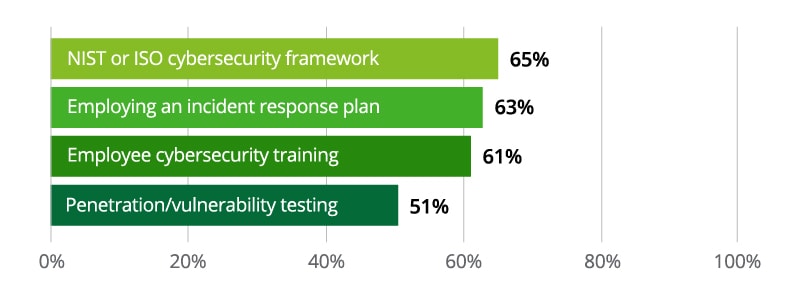

Figure 3. Percentage of disclosures by section5

Many companies are also disclosing more information about their use of AI. Risks addressed include legal and compliance requirements, regulatory penalties, and AI-aided cyberattacks.

Many companies are also disclosing more information about their use of AI. Risks addressed include legal and compliance requirements, regulatory penalties, and AI-aided cyberattacks.

We also expect more and more companies to start adding greater clarity to what they mean by AI, such as machine learning or generative intelligence—a disclosure recently emphasized by SEC Chair Gary Gensler.6

Pillar Two income taxes on the horizon

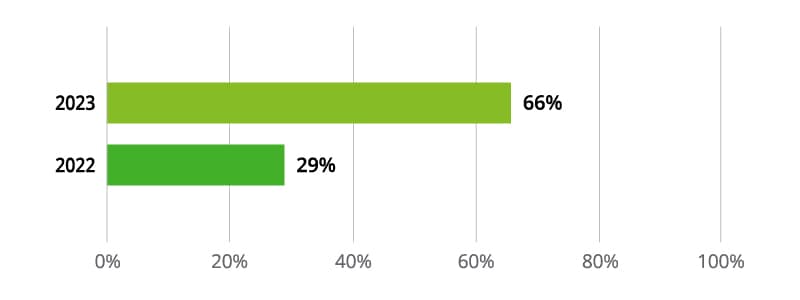

Figure 4. Percentage of companies disclosing

Figure 5. Percentage of disclosures by section

Many registrants updated their disclosures to include risks posed by changes to tax laws, including the global minimum tax under Pillar Two.7 Some addressed various government plans to enact new tax laws,8 while others disclosed that Pillar Two had no material impact on their reporting as of the fiscal year end. With most registrants indicating they’re continuing to evaluate the impact of the global minimum tax, it’s likely there will be more to come on Pillar Two in the near term.

Macroeconomic trends to watch for

While cybersecurity, AI, and Pillar Two were the three new disclosure themes that emerged this year, we also identified three recurring disclosure topics that virtually all companies reported on in 2023. These include:

Inflation. The SEC staff continues to issue comment letters that request greater detail about the factors responsible for material changes in results, including inflation.9 Accordingly, registrants continued to underscore the actual and potential impacts of inflation, such as decreased demand for their products or services as a result of higher prices and costs.

Interest rates. Disclosures in notes to financial statements and MD&A generally focused on the impact of changes in interest rates on a registrant’s financial statements. Risk factors tended to address the potential impact of increases in interest rates on the registrant’s business, financial condition, and operations.

Climate change. Business disclosures primarily addressed a registrant’s sustainability activities, whereas in MD&A, registrants discussed how climate change might affect the company’s financial condition, operations, and growth prospects. Climate disclosures will likely evolve further in the wake of the SEC’s final rule on this topic.10

Keeping stakeholders informed

The SEC encourages registrants to clearly disclose material risks, trends, and uncertainties related to the current environment, and often issues comments asking for expanded disclosure about how current business trends are impacting a company. That makes it a good idea to regularly assess your disclosures and consider whether they continue to reflect your current circumstances in preparation for your next SEC filing.

You can find our full report on 2023 disclosure trends here and insights on improving your company’s financial statement disclosures here. Questions or comments? Please reach out—I’d love to hear them.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional adviser. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.

But how are these challenges affecting companies, and what are management teams doing to address them? Analyzing company financial reporting disclosures is often a great way to find out, because disclosures can play a crucial role in conveying to investors how companies navigate and are affected by broader global events.

Endnotes

1 See Deloitte’s September 15, 2023, Financial Reporting Alert for further discussion of accounting and reporting considerations related to macroeconomic and geopolitical challenges.

2 These percentages reflect a population of the Form 10-K filings of Fortune 500 companies subject to the SEC’s final rule on cybersecurity from the date on which the rule became effective (December 15, 2023) through February 29, 2024.

3 SEC Final Rule Release No. 33-11216, Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure. See Deloitte’s July 30, 2023 (updated December 19, 2023), Heads Up for a discussion of the final rule.

4 Hereafter, “percentage of companies disclosing” refers to our comparison of (1) the current-year Form 10-K filings (i.e., from July 1, 2023, to February 29, 2024) of a population of Fortune 500 companies with (2) those of the prior year (i.e., from July 1, 2022, to March 1, 2023).

5 “Percentage of disclosures by section” in the tables throughout this publication refers to our comparison of (1) the number of registrants in a population of Fortune 500 companies that discussed a given topic in a specific section of their current-year annual reports with (2) the total number of registrants that addressed that topic in their Form 10-K filings. We based the comparison on a search of keywords related to the topic being discussed in each section. If registrants discussed a topic in multiple annual report sections, the total percentages for that topic may exceed 100%.

6 Gary Gensler, “‘AI, Finance, Movies, and the Law’ Prepared Remarks before the Yale Law School,” US Securities and Exchange Commission (SEC), February 13, 2024.

7 For more information and answers to frequently asked questions about Pillar Two, see Deloitte’s March 5, 2024, Financial Reporting Alert.

8 The Organisation for Economic Co-operation and Development (OECD) provides jurisdictional legislation updates on its website.

9 See Deloitte’s Roadmap “SEC comment letter considerations, including industry insights” for further information.

10 SEC Final Rule Release No. 33-11275, The Enhancement and Standardization of Climate-Related Disclosures for Investors. See Deloitte’s March 6, 2024, and March 15, 2024, Heads Up newsletters for an executive summary and comprehensive analysis, respectively, of the SEC’s climate rule.

Get in touch

Doug Rand

Doug is a Managing Director in Deloitte’s National Office – Accounting and Reporting Services focusing on ESG reporting, SEC reporting and IPOs. He consults on technical SEC reporting matters, reviews SEC filings, advises clients on transactions and interpretations of SEC and ESG reporting literature, and develops Deloitte's SEC and ESG publications. He has experience serving clients in a variety of industries. He has experience with a wide range of technical accounting (US GAAP and IFRS) and auditing (PCAOB and AICPA) matters.