Federal Reserve monetary policy in the time of COVID-19 Issues by the Numbers, November 2020

14 minute read

19 November 2020

The Federal Reserve’s monetary policy has stabilized the US financial system, but its power to help the economy recover more swiftly is more limited than many people may be willing to accept.

“We lent by every means possible and in modes we had never adopted before.”—Jeremiah Harman, director of the Bank of England, statement before the Bank Charter Committee on the bank’s policy during the Panic of 1825.1

In the past 12 years, the US Federal Reserve (the “Fed”) has faced two major financial crises. One started within financial markets (the housing finance collapse of 2007–2009) and one involved an outside shock (the COVID-19 pandemic). The Fed responded in each case with an alphabet soup of new programs, and despite the differences between the two crises, these actions had a similar effect: stabilizing the financial system. But in both cases, the Fed’s impact on employment and economic growth has seemed sluggish at best.

Learn more

Explore the Issues by the Numbers collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

If the Fed can shore up a tottering financial system through monetary policy, why hasn’t it been able to help the economy recover more swiftly? The candid answer is that the Fed’s power is more limited than many people may be willing to accept. In both the 2007–2009 and the 2020 crises, the Fed pulled many levers in its effort to avert total financial system collapse, but these levers focused on keeping the financial system operating. That’s a necessary—but not sufficient—requirement for a healthy economy. If businesses continue to see excess capacity, and if consumers are worried about the future and unwilling to spend, the economy will suffer—and there is little the Fed can do. Especially today, when interest rates are already at near-zero levels, the Fed just doesn’t have the tools to put the economy back on track. To speed the recovery, the onus should be on Congress and the president—not the Fed—to consider how best to get the economy moving again.

Why does the Fed exist?

To understand why the Fed’s leaders took the actions that they did in 2020—and why those actions are having an important, but limited, impact—it helps to know something about the Fed’s purpose.

The financial system appears at first glance to be very technical. But it’s not really that complicated. The financial system—banks, stock markets, financial planners, traders, hedge funds—exists to match savers (mostly households) with people and organizations (investors)2 who wish to turn those savings into capital assets—buildings, machines, even ideas—that produce goods and services. The players in the system—“financial intermediaries” in the jargon of finance—offer a wide variety of “products” designed to balance the needs and desires of the savers with those of these savings’ users (the aforementioned investors). These investors are mainly businesses that wish to increase their capacity to produce goods and services by purchasing capital goods such as buildings and machines. Financial products that help to connect savers and investors range from savings accounts at banks to exotic derivatives.

Many financial products are traded in markets, which allows savers to buy and sell ownership of those assets as they see fit. If there is regular trading in a market, financial experts say that it is “liquid.” Savers like assets that are traded in liquid markets because they can sell them any time they wish. Investors like liquid markets because they can plan on being able to borrow when they need cash for operations or even just to make payrolls. But what happens when trading stops in a liquid market?

That’s not an academic question. It is precisely what happened on a regular basis starting in the early 19th century as the number of financial products multiplied. These financial “panics” occurred when people suddenly decided that they didn’t want to hold a particular asset, and trading in that asset suddenly stopped. Suddenly, financial intermediaries could no longer match savers and investors. The result: The economy’s ability to support investment—houses, commercial buildings, industrial machinery, computers—plunged because those wishing to acquire capital goods found it impossible to find financing. When this happens, the economy goes into a tailspin. The same pattern has held from before the British Railway Mania of the 1840s through the global financial crisis of 2008–2009.

One of the Fed’s key responsibilities is to prevent such panics, or at least to prevent them from having a large impact on the real economy of production and employment. The simplest way to do this is to provide money—liquid assets—so that savers and financial intermediaries can meet their obligations. But in addition, the Fed and other central banks can step in to keep markets functioning. That’s what the Bank of England did in the early 19th century—and that’s what the Fed has been doing in 2020. The quote at the beginning of this article comes from a parliamentary investigation of the Panic of 1825, and describes the Fed’s actions this year remarkably well.3

The pandemic panic

US financial markets started to react to the spread of COVID-19 in early March. The pandemic created a huge amount of uncertainty, impelling traders to become unwilling to trade anything that might be at risk from the pandemic. This led to a sell-off in markets that were perceived as being risky and a strong desire to hold the safest assets possible—US Treasuries. Without asset buyers, some markets looked like they might shut down completely.

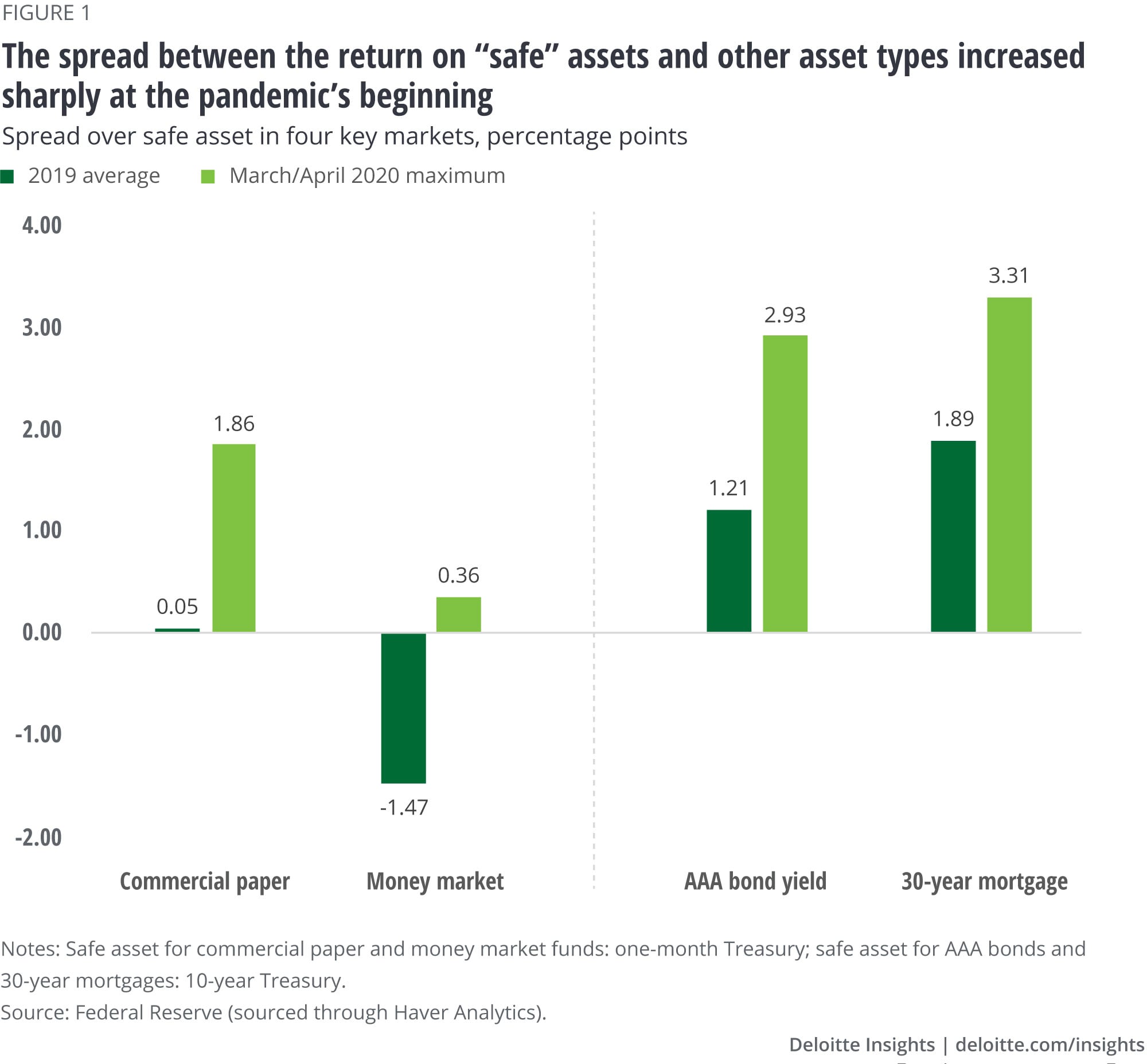

This was evident in the returns being offered to savers to entice them to purchase those assets. Figure 1 shows the spread, or percentage point difference, between the return paid in four key financial markets compared to the return on a “safe” asset (a Treasury security of similar duration). The average spreads in 2019 are a good measure of “normal” spreads that account for the (sometimes slight) differences in the overall riskiness of these assets. For example, commercial paper is a close substitute for Treasury bills, and almost as safe. Under normal conditions, the spread between them is very small. But in March 2020, the interest rate for commercial paper suddenly soared above the rate for Treasury bills, for a spread of almost 2%. This reflected a sudden preference for Treasury bills by savers seeking safe short-term places to park their money. For businesses that depended on commercial paper markets to obtain cash, the higher interest rate was a sudden and unexpected cost. Worse, there was the possibility that savers, thinking that private debt would be too risky, would simply shun the commercial paper market at any interest rate. If that were to happen, it would leave businesses that planned to raise money via the commercial paper market short of cash, and perhaps unable to pay bills or salaries that depended on that cash.

Something similar happened in other markets. For instance, short-term money markets suddenly became suspect relative to the safety and liquidity of short-term Treasuries. Corporate AAA bonds also suddenly looked risky, and the markets forced up the yield relative to equivalent long-term Treasuries. And many savers did not want to take on the additional risk of holding mortgages in an economy with high unemployment, so the mortgage rate spiked relative to Treasuries. Because of these developments, corporations using the bond market to fund investments and homebuyers wanting to purchase a house might have found the market dried up and their plans interrupted.

That’s why the Fed stepped in. First, it did something very traditional: It supplied a lot of liquidity in the form of cash so banks could intervene if necessary. But that wasn’t really enough. So the Fed then became a direct buyer in a variety of financial markets to be sure that those markets could continue to operate. This prevented businesses and households that had planned to use those markets from having their access to cash interrupted.

Each market required a separate program, so Fed watchers were inundated with alphabet soup: the MMLF (money market liquidity facility), CPFF (commercial paper liquidity facility), MSLP (main street lending program, to buy loans extended to smaller businesses), MLF (municipal liquidity facility, to buy short-term state and local debt). Each program has distinct requirements and limits tailored to the market the Fed wishes to support.4 Some require more Fed action than others. But all share the goal of keeping open a particular channel for connecting savers and investors.

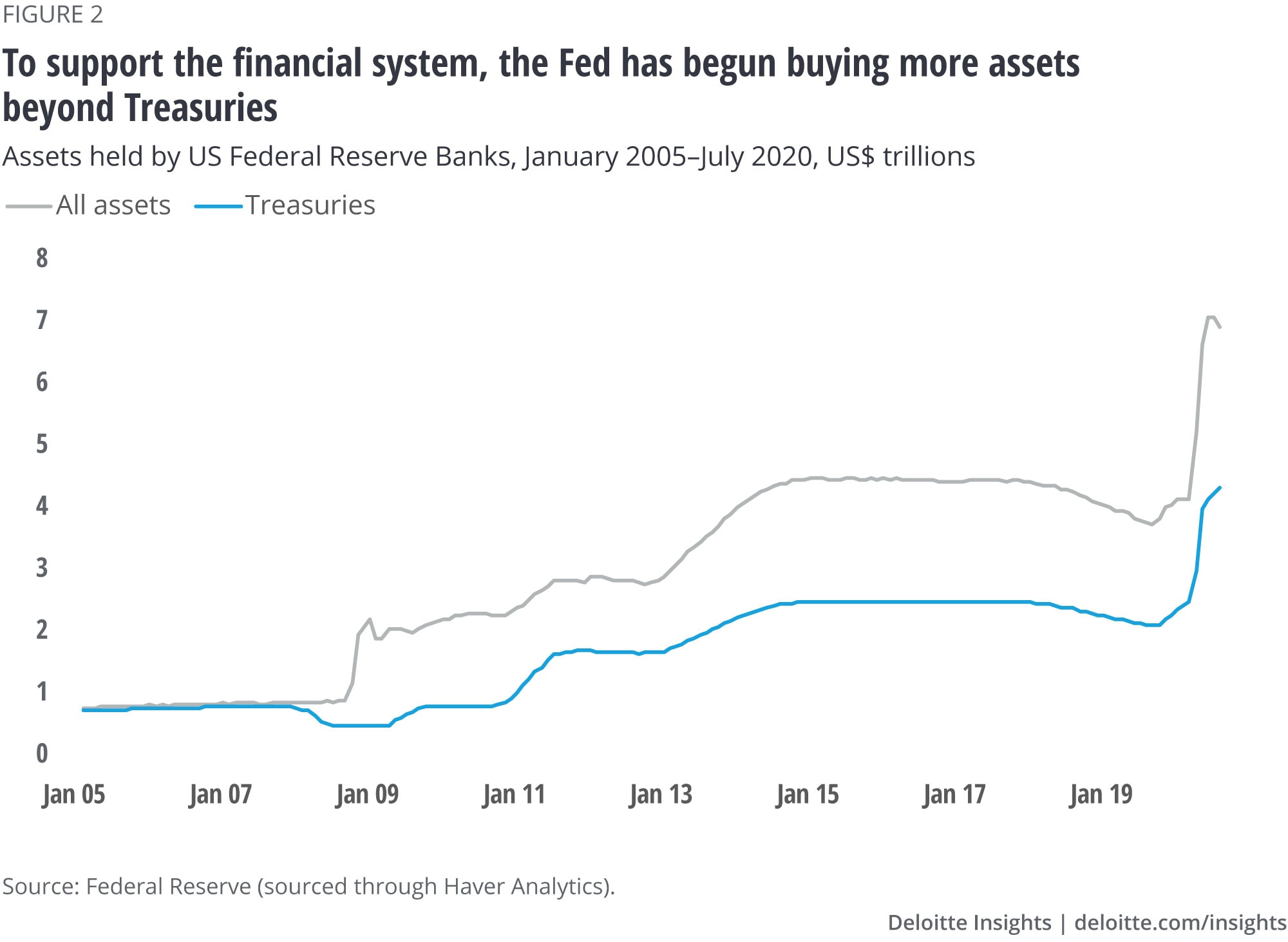

Supplying liquidity, and then buying all those assets, have ballooned the Fed’s balance sheet. Figure 2 shows the total assets held by the Fed from 2005 to 2019.

Until the 2007–09 global financial crisis, the Fed held only Treasuries.5 A key part of the Fed’s response to the global financial crisis after 2009 involved purchasing longer-term Treasuries and mortgage-backed securities (MBS). That move was the famous “quantitative easing,” which generated a lot of debate in the mid-2010s. You can see the rise in assets owned by the Fed around that time.

In 2018, the Fed started to take steps to reduce its holdings of MBS and longer-term Treasuries, first by not replacing maturing MBS, and then by actively selling the remaining holdings at a slow, steady pace. That was interrupted by the pandemic, however, and the Fed is now buying (and sometimes selling) a surprising variety of assets. At the end of July 2020, the Fed held US$2.6 trillion in non-Treasury assets, about 37% of its balance sheet. And financial markets continued to operate normally. The Fed’s actions successfully prevented the pandemic from causing a financial crisis—no small feat.

What? No inflation?

As any accountant knows, a balance sheet balances—which means that the Fed’s liabilities grew with its assets. The liabilities of a central bank are mostly currency and commercial banks’ reserve deposits. Banks are required to hold reserves, with the amount depending on the size of the bank deposits (such as checking accounts) they have outstanding. Because bank deposits are the main form of money in a modern economy, the Fed’s creations of reserves should—under normal circumstances—determine the size and growth of the money stock.

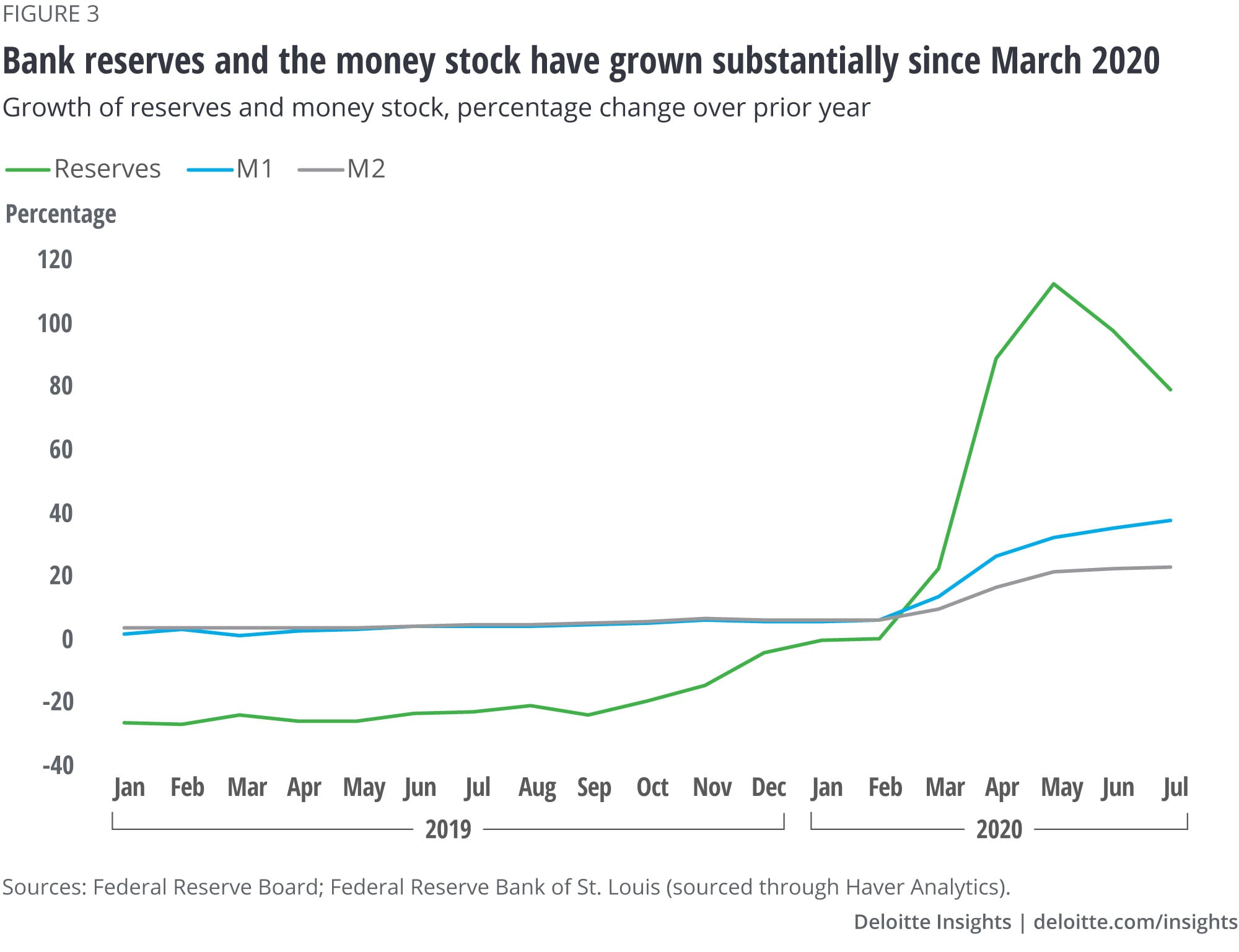

Sure enough, as figure 3 shows, March 2020 saw a sudden acceleration in bank reserves in the two most common measures of the money stock: M1 (currency and checking accounts) and M2 (M1 plus some savings and time deposits). With M2, the broadest measure of money, growing at over 20% in the past year, can inflation be far behind?

That conclusion is a severe oversimplification of basic monetary theory. According to the theory, inflation is described by an equation that many readers will remember having learned in an economics class:

MV = PT

M is the supply of money, V the velocity at which money circulates (i.e., the number of times in a given period money is used, on average), and PT the value (price times number) of total transactions in a given time. If the velocity and the number of transactions don’t change much, a large increase in M, the supply of money, should create a large increase in P, the price level. And if the money supply grows quickly, the price level will follow—meaning the economy will experience inflation.

As is often the case in economics, however, it’s the assumptions that matter. The velocity of money is not constant: It depends on how much money people want to hold at any given time. And financial crises create conditions that make people want to hold a lot more money in their portfolios. This means that velocity, V in the above equation, has fallen considerably during the pandemic. The velocity of M1, for example, fell from 5.5 in February to 3.9 in March6—reflecting savers’ rush to safer assets and the consequent huge demand for liquidity that threatened to freeze many financial markets.

Because the velocity of money decreased so sharply (and remains low), the Fed’s asset purchases are very unlikely to create inflation even though the money supply has swelled. In fact, the Fed did the same thing in 2008, and predictions of future hyperinflation at the time proved to be unfounded.7 The median forecast for inflation in 2021 is around 2.0%, which means that inflation is rightly very low on the Fed’s list of concerns. (See “Appendix: Who’s afraid of the big, bad money supply?,” for an explanation of the historical context of the argument that money creation will lead to inflation.)

The Fed’s new clothes: A change in its stance on inflation

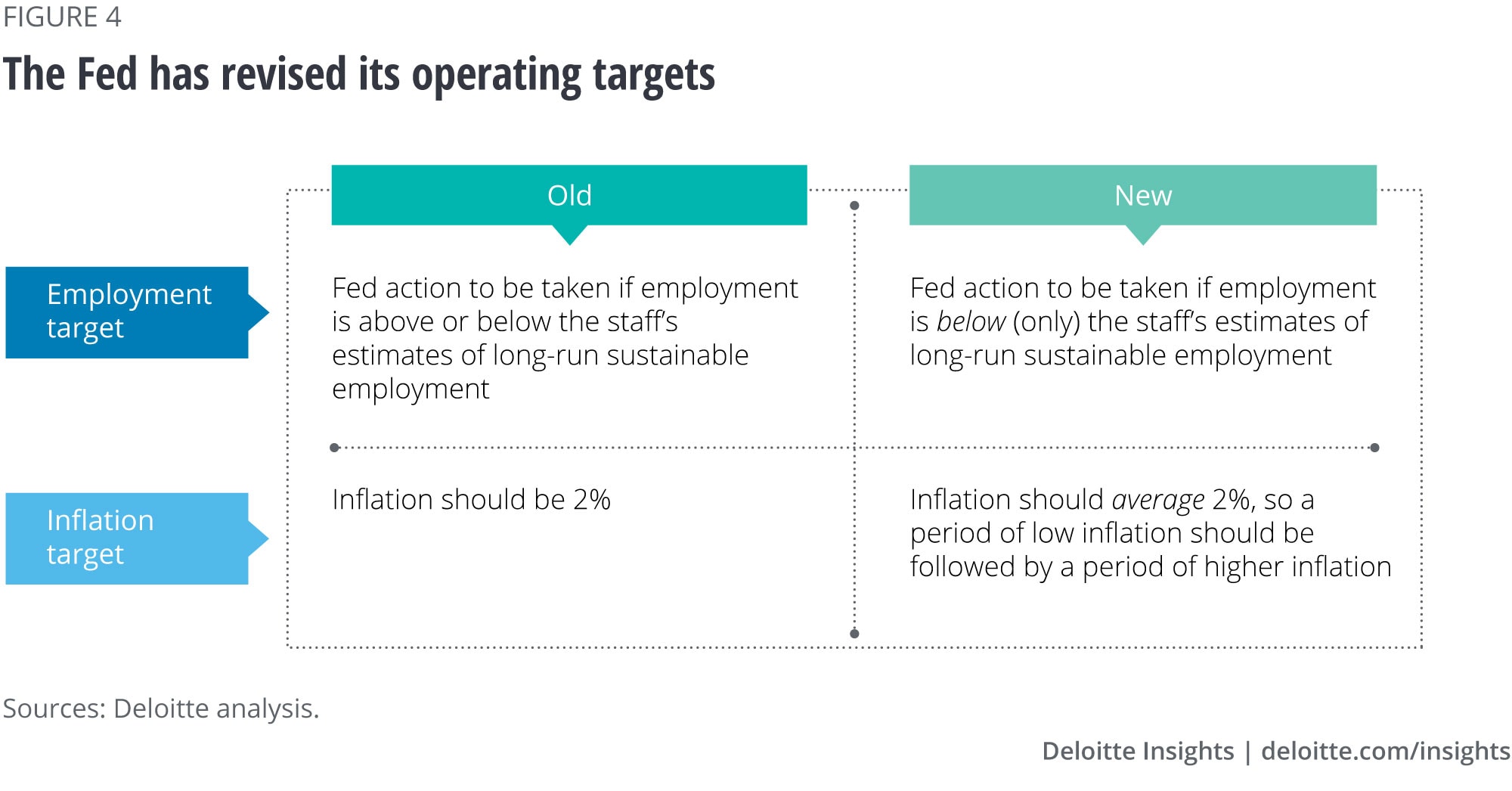

In August 2020, the Fed’s board of governors announced several changes in how it conducts monetary policy. Two key related changes have to do with how the Fed defines its inflation target (figure 4). Together, these changes amount to a significant dovish swing in monetary policy.

The change in the employment target amounts to a very significant tweak to the “Phillips curve” concept that economists have used for decades to explain inflation. The Phillips curve connected accelerating inflation to tight labor markets, so monetary policymakers concerned about inflation looked to keep labor markets from being too tight. Now, in adjusting the employment target, the Fed has declared that it won’t be worried about tight labor markets. It might even welcome them, since it will now try to push inflation higher after a period of inflation below 2%. This move reflects the experience of the last two recoveries when supposedly tight labor markets never led to higher inflation, it took very low unemployment rates to induce employers to offer higher wages, and the profit share of national income reached near-record levels.

The change in the inflation target shows how much the (monetary) world has changed since the Great Inflation of the 1970s. That episode left economists wondering how to prevent inflation from accelerating. After trying, and rejecting, a variety of monetary policy targets, central banks hit on inflation targeting as a method of convincing the public that inflation would remain under control.

What the Fed can’t do

As if keeping financial markets operating isn’t enough, the Fed is legally required to promote price stability and full employment—the Fed’s “dual mandate.”8 Promoting price stability has not been a problem recently: If anything, Fed officials have been concerned about inflation being too low. But the Fed’s ability to do anything about the current high unemployment rate is very limited, for two reasons.

First, the economy is being suppressed by a pandemic, and economic activity—and employment—is expected to remain low as long as people are concerned that economic activity might make them sick. Fed chair Jerome Powell has pointedly said that “the path forward for the economy is extraordinarily uncertain and will depend in large part on our success in keeping the virus in check.”9 The Fed is a powerful government agency, but success in defeating the virus depends on other agencies such as the Centers for Disease Control and Prevention and the National Institutes of Health, as well on pharmaceutical companies and the medical profession.

Second, much of the Fed’s ability to stimulate the economy depends on its ability to manage the supply of credit by manipulating interest rates. Short-term interest rates are already at or close to zero, and long-term rates are at record lows. The cost of capital was remarkably cheap even before the pandemic, but interest-sensitive sectors of the economy weren’t responding very much. There’s not much more that the Fed can do to make the cost of capital cheaper, and cheaper capital isn’t likely to induce much more spending anyway.10

With the Fed’s main tool for stimulating the economy—interest rates—virtually useless right now, the problem becomes one of how to help the economy recover without it. But there is a solution. Under current conditions, fiscal policy—government deficit spending—is likely to be a very powerful tool for stimulating the economy. After all, with interest rates likely to stay at record lows, more federal borrowing is not going to affect investment spending by raising the cost of capital. That means that government spending financed by borrowing is likely to be particularly effective, since it won’t be offset by lower investment spending.

The bottom line: To help cushion the crisis’s impact, the Fed has done its job and done it well. Now it’s up to the rest of the government to act to support the US economy.

Appendix

Who’s afraid of the big, bad, money supply?

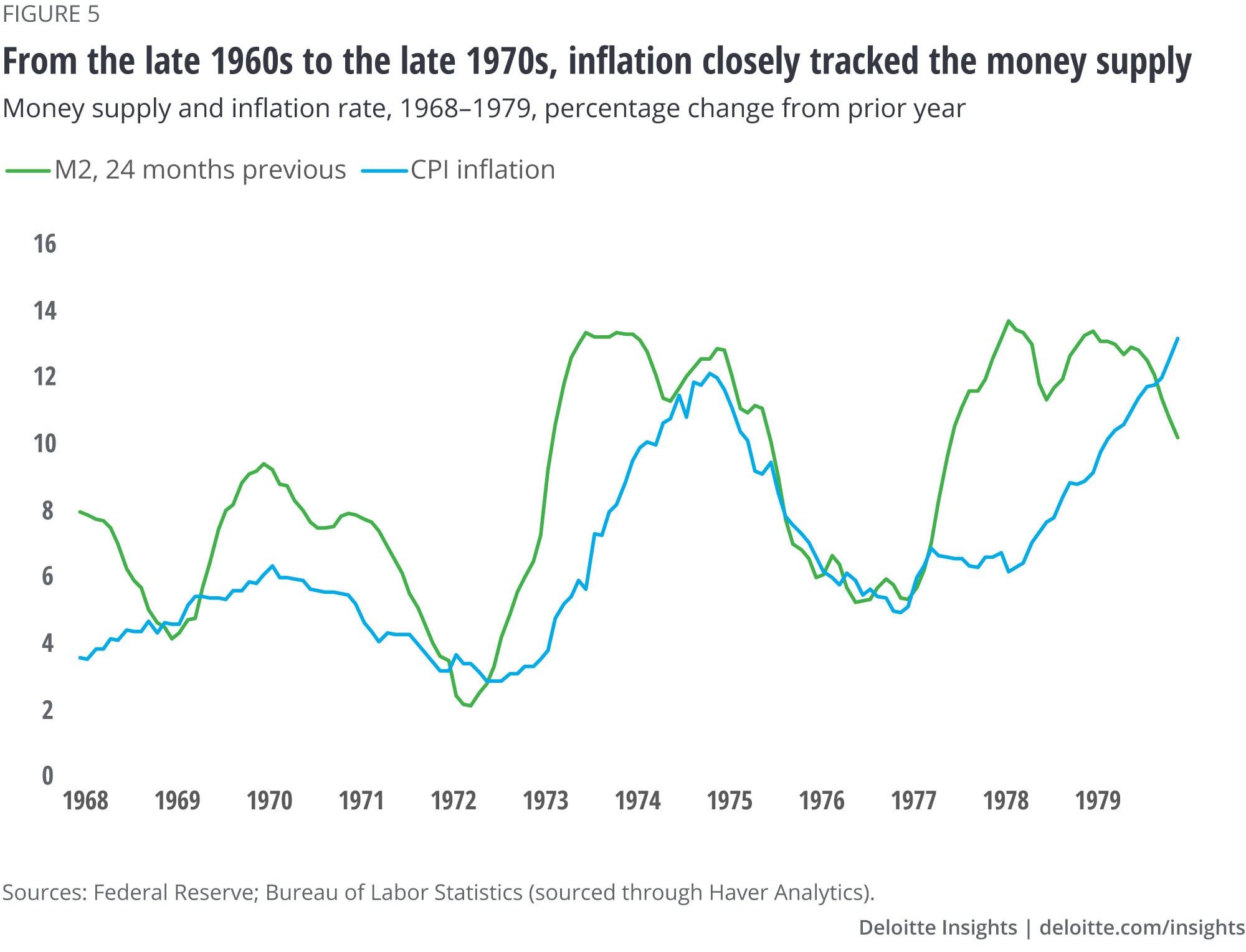

Anybody who learned economics in the 1970s or 1980s—or who read the Wall Street Journal’s editorial page during that period—will have seen a version of figure 5. That figure showed the rate of inflation compared to the growth of the money supply (M2 in this case) from two years prior. The figure’s message was pretty impressive. The best explanation for inflation was past growth in the money supply—not, as the then-popular view would have it, oil shocks, labor unions, or excessive federal spending. The famous economist Milton Friedman, in whose columns the figure regularly appeared, said that “inflation is always and everywhere a monetary phenomenon”11—fighting words when many economists were focused on other things.

According to Friedman’s view, the United States will experience very significant inflation in 2022. The narrow money supply (M1) is up 34% over the past year, and the broad money supply (M2) is up 23%. Friedman’s chart suggests that inflation will rise to double-digit levels within two years. Yet few if any economists today are concerned about inflation. Why? And what does that mean for the consequences of the Fed’s recent actions? The answer to both questions is rooted in the observation that, since the early 1980s, inflation has not tracked the money supply.

Right until it was wrong

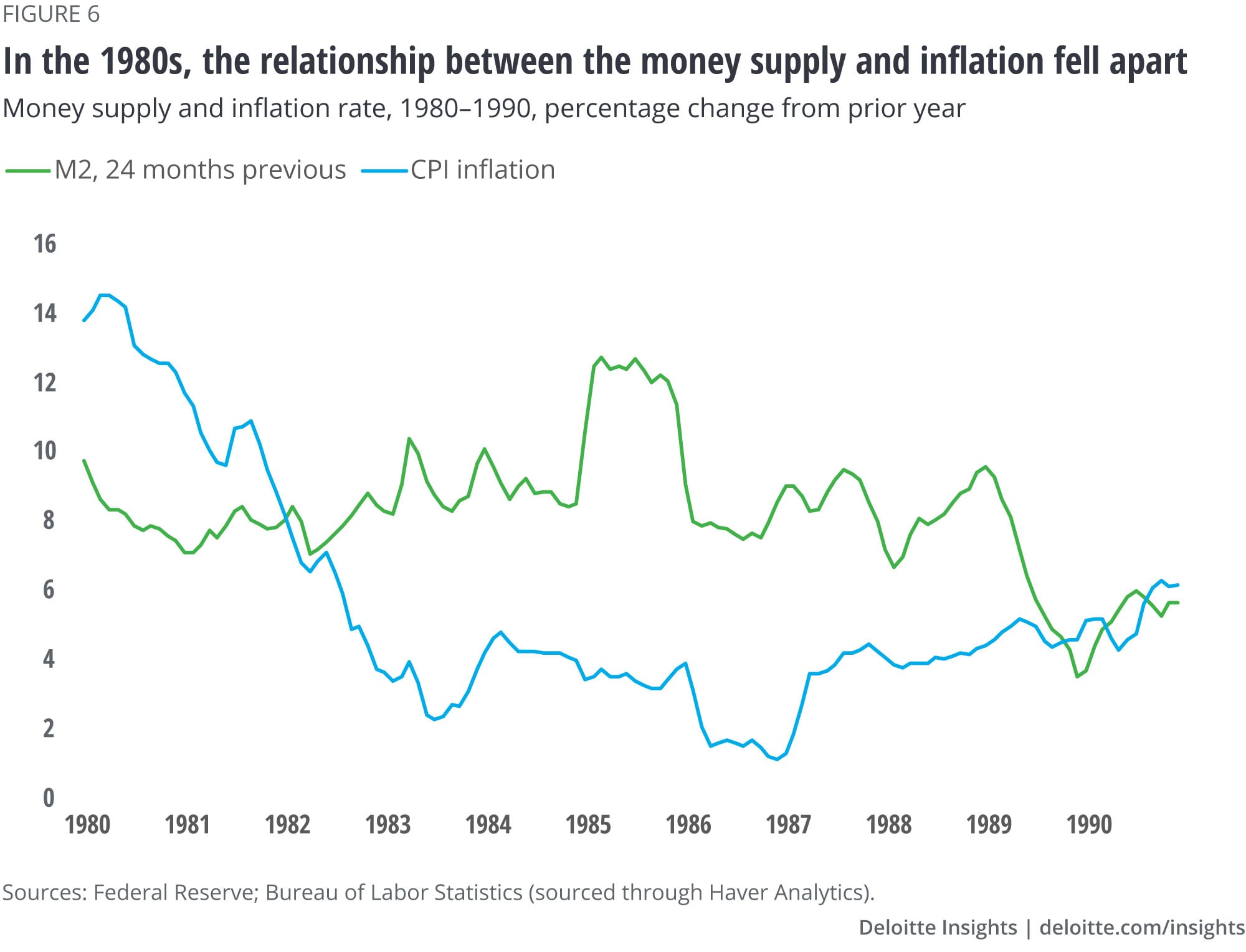

By the 1980s, Friedman’s dictum had become more accepted in the economics profession. In fact, the Fed experimented with targeting the money supply to control inflation in the early 1980s. It seemed like a great way to get a consistently low and stable inflation rate: Just make sure to keep the money supply’s rate of growth low and stable! Unfortunately for this approach, a couple of years into the decade, the relationship between the money supply and inflation fell apart. Figure 6 shows the same metrics as figure 5, but for the 1980s.

Despite a steady growth of the money supply in the late 1970s and early 1980s, the inflation rate fell. And a spike in the money supply in 1983 had no impact on inflation in 1985. Instead, inflation fell because of low oil prices.

What is money?

The reason for the collapse of the relationship between money and inflation was quite obvious, even at the time. Money as a concept must be measured by existing assets in a specific institutional and legal framework. The 1980s saw a period of innovation in assets and a changing legal framework as financial deregulation unfolded. The concept of “money”—assets that can easily be exchanged for goods and services—encompassed a larger and different variety of actual assets, and the connection between money, as measured by the M1, M2, and M3 concepts on the one hand and inflation on the other hand, was broken.

The Fed rapidly abandoned its money targeting efforts, but Friedmanites continued to argue into the 1990s that with just the right measure, or just by waiting, the magic of figure 5 would reassert itself, and that monetary policy would once again benefit from targeting the quantity of money. Over time, however, those arguments faded, and the Fed’s basic operating procedure of targeting price (the easily observed federal funds rate) rather than the quantity of money (whatever it might be) became broadly accepted. The Fed’s recent adoption of new goals (see sidebar, “The Fed’s new clothes: A change in its stance on inflation”) takes it even farther from the “monetarist” view that Friedman popularized in the 1970s.

Explore more on economics

-

Issues by the Numbers Collection

-

Global Weekly Economic Update Article4 days ago

-

US policy response to COVID-19 aims to set the stage for recovery Article4 years ago

-

The path ahead Article4 years ago

-

United States Economic Forecast Q3 2024 Article2 months ago