The mixed signals of today’s M&A market

Global mergers and acquisitions (M&A) markets reached a nadir in 2023, with challenging conditions suppressing total deal value below $3 trillion for the first time in a decade. There are, however, a few strong positives.

Deal volumes remained well above the decade average in spite of a 3% slippage. In a clear sign of returning corporate confidence, the megadeal segment (over $10 billion) largely kept pace, with 28 such agreements announced. Perhaps most notably, the year ended with a bang when nearly $750 billion worth of deals were announced in rapid succession during the last three months, with buoyancy spilling over into 2024.

Deal volumes remained well above the decade average in spite of a 3% slippage. In a clear sign of returning corporate confidence, the megadeal segment (over $10 billion) largely kept pace, with 28 such agreements announced. Perhaps most notably, the year ended with a bang when nearly $750 billion worth of deals were announced in rapid succession during the last three months, with buoyancy spilling over into 2024.

How we got here

In 2021–22, following the uneven sector effects from the COVID-19 pandemic, a record $8 trillion worth of deals were announced. The businesses doing deals took advantage of their strong cash positions and the favorable debt markets, particularly in 2021 before the Ukraine crisis, to make M&A central to recovery.

The recovery of recent years was short-lived, however. In 2023, deal values slumped to a decade low of $2.6 trillion, following a period of macroeconomic uncertainty, inflation, and the raised interest rates that had an impact on businesses’ cost of debt.

Nevertheless, the near $750 billion worth of deals announced in the last quarter of 2023, and the 28 megadeals throughout the year, may indicate returning confidence. The largest corporate M&A activity by value was in energy, resources, and industrials, the only category to grow as oil and gas companies defensively pursued scale.

Overall, deal volumes remained steady in 2023, with more than 54,600 agreements. Amid the value decline, there was an emphasis on mid/smaller-sized deals. Agreements worth less than $100 million were the only category to grow, as companies sought targeted market growth, new capabilities, and cutting-edge partnerships.

The recovery of recent years was short-lived, however. In 2023, deal values slumped to a decade low of $2.6 trillion, following a period of macroeconomic uncertainty, inflation, and the raised interest rates that had an impact on businesses’ cost of debt.

Nevertheless, the near $750 billion worth of deals announced in the last quarter of 2023, and the 28 megadeals throughout the year, may indicate returning confidence. The largest corporate M&A activity by value was in energy, resources, and industrials, the only category to grow as oil and gas companies defensively pursued scale.

Overall, deal volumes remained steady in 2023, with more than 54,600 agreements. Amid the value decline, there was an emphasis on mid/smaller-sized deals. Agreements worth less than $100 million were the only category to grow, as companies sought targeted market growth, new capabilities, and cutting-edge partnerships.

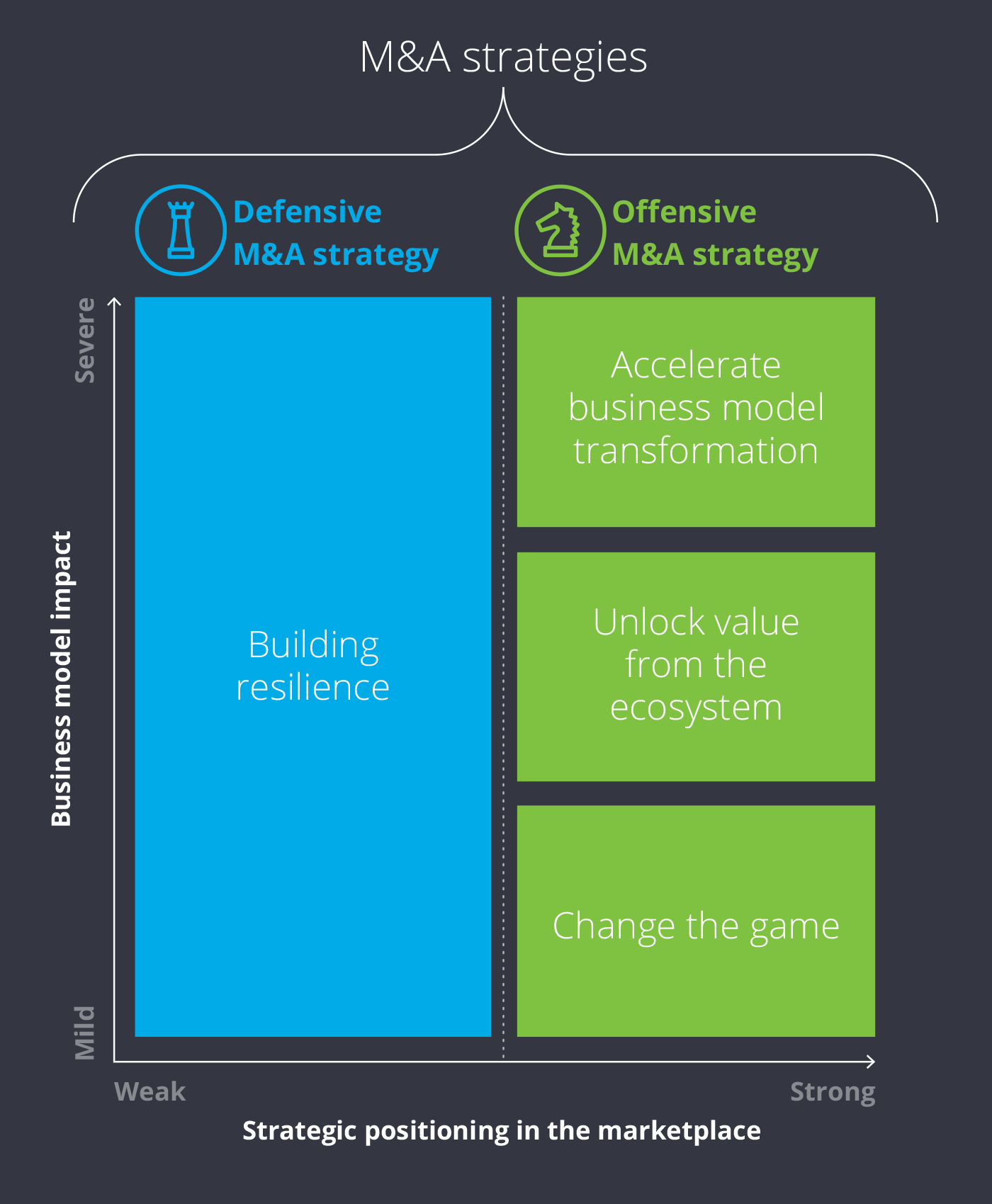

Defensive M&A: Building resilience

One of the lessons from the pandemic is that all companies, large or small, will need to firmly establish resilience at the heart of their business model and organizational culture. We anticipate these defensive plays will materialize in a few different ways.

Accelerate synergy realization and deliver value: In 2022 and 2023, shareholders approved more than $5.8 trillion worth of deals, and now the dealmakers involved can expect significant investor pressure to accelerate synergy realization and deliver value.

Optimize the portfolio: Many companies are facing pressure from activist hedge funds for portfolio restructuring, from regulators pressing for asset carve-outs as a condition for merger approval—and from their own boards, which are keen to ensure companies remain on track with sustainability and net-zero commitments.

Explore opportunistic deals to safeguard supply chains and competitive positioning: Global supply chain disruptions are affecting every sector, either directly or indirectly. In addition, changing stakeholder expectations toward environmental, social, and governance (ESG) are putting pressure on businesses to fundamentally redesign their supply chain systems to improve transparency and reduce their carbon footprint. M&A activities can play a key role in shaping the response.

Accelerate synergy realization and deliver value: In 2022 and 2023, shareholders approved more than $5.8 trillion worth of deals, and now the dealmakers involved can expect significant investor pressure to accelerate synergy realization and deliver value.

Optimize the portfolio: Many companies are facing pressure from activist hedge funds for portfolio restructuring, from regulators pressing for asset carve-outs as a condition for merger approval—and from their own boards, which are keen to ensure companies remain on track with sustainability and net-zero commitments.

Explore opportunistic deals to safeguard supply chains and competitive positioning: Global supply chain disruptions are affecting every sector, either directly or indirectly. In addition, changing stakeholder expectations toward environmental, social, and governance (ESG) are putting pressure on businesses to fundamentally redesign their supply chain systems to improve transparency and reduce their carbon footprint. M&A activities can play a key role in shaping the response.

Offensive M&A: Charging the growth engine

Bold moves involving transformative acquisitions, ecosystem alliances, and disruptive investments will be required to charge the growth engine and lay the groundwork to capture market leadership. Companies clearly need to play offense to gain momentum, and we anticipate those efforts to materialize in several different ways.

Capture the digital future: The pandemic conditions ruthlessly exposed companies that lagged in digital investment, omnichannel capabilities, and agile operating models. At the same time, they enabled new market opportunities for companies that were digitally prepared.

Identify portfolio gaps and expand the value chain: Corporations need to regularly reevaluate their sources of competitive advantage, identify portfolio gaps, and consider opportunities for expansion. Establishing a pipeline of deals can expand a company’s value chain and make it easier to capitalize on adjacent market spaces.

ESG—delivering returns with purpose: Businesses are increasingly expected to demonstrate they can deliver returns with purpose and create value not only for their shareholders, but also for their stakeholders including employees, customers, suppliers, and the societies where they operate.

Collaboration as a competitive advantage: One of the enduring legacies of the pandemic is how corporates embraced collaboration, forming the bedrock of global recovery. Current conditions will continue to bring significant challenges such as supply chain disruptions, skills shortages, climate change complexities, cross-sector convergence, and many others that cannot be solved unilaterally.

Capitalize on cross-sector convergence: The rapid adoption of exponential technologies, digitization of businesses, and shifts in consumer attitudes are blurring traditional sector boundaries, leading to convergence of business models across disparate sectors. It is resulting in the further evolution of ecosystems and creating opportunities for innovators and nontraditional players to disrupt established companies by redefining the basis of competition.

Capture the digital future: The pandemic conditions ruthlessly exposed companies that lagged in digital investment, omnichannel capabilities, and agile operating models. At the same time, they enabled new market opportunities for companies that were digitally prepared.

Identify portfolio gaps and expand the value chain: Corporations need to regularly reevaluate their sources of competitive advantage, identify portfolio gaps, and consider opportunities for expansion. Establishing a pipeline of deals can expand a company’s value chain and make it easier to capitalize on adjacent market spaces.

ESG—delivering returns with purpose: Businesses are increasingly expected to demonstrate they can deliver returns with purpose and create value not only for their shareholders, but also for their stakeholders including employees, customers, suppliers, and the societies where they operate.

Collaboration as a competitive advantage: One of the enduring legacies of the pandemic is how corporates embraced collaboration, forming the bedrock of global recovery. Current conditions will continue to bring significant challenges such as supply chain disruptions, skills shortages, climate change complexities, cross-sector convergence, and many others that cannot be solved unilaterally.

Capitalize on cross-sector convergence: The rapid adoption of exponential technologies, digitization of businesses, and shifts in consumer attitudes are blurring traditional sector boundaries, leading to convergence of business models across disparate sectors. It is resulting in the further evolution of ecosystems and creating opportunities for innovators and nontraditional players to disrupt established companies by redefining the basis of competition.

M&A and the path to thrive

M&A strategies are now firmly cemented as a fundamental part of the corporate arsenal, both in defense to preserve value and in offense to drive transformative growth. This framework can help companies articulate a new combination of M&A strategies to fortify their gains, accelerate business model transformation, and make horizon investments to capture lasting market leadership.