CFO Signals™ 3Q 2023 has been saved

Perspectives

CFO Signals™ 3Q 2023

Our third-quarter 2023 North American CFO Signals survey reveals a fair degree of positive momentum—in CFOs’ assessments of North America’s economy, their level of optimism for their own companies’ financial prospects, and their interest in the potential uses and benefits of Generative Artificial Intelligence (GenAI).

For many CFOs, the economy has resembled a labyrinth in recent years. But they don’t have the luxury of letting the twists and turns of economic indicators—a relatively strong labor market, moderating inflation, and uncertainty about the future trajectory of interest rates—block them from seeing, and acting on, the environment in which their companies operate.

Surveyed CFOs’ rising expectations for the North American economy and increasing optimism regarding their own-company prospects—as well as their improved outlook since last quarter for earnings and revenues—don’t simply reflect a need to focus on the bright side. Rather, many CFOs may be that much more aware of the need to find new pathways in a tangled economy. Lower growth expectations for capital investment and domestic wages/salaries may be linked to interest-rate hikes and a potential uptick in the unemployment rate. In any case, cost and cash management (as well as avoiding big risks) could be prudent amid uncertainty, as exemplified by, for example, the number of surveyed CFOs who view equity markets as overvalued.

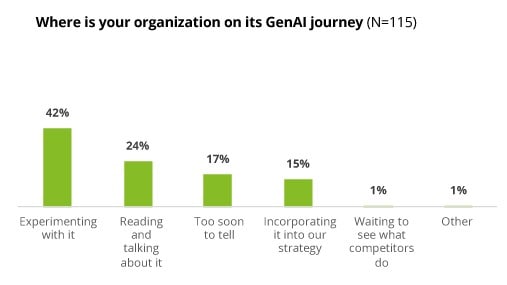

Resources tend to shift with priorities. Perhaps changing priorities underlie why 42% of surveyed CFOs say their organizations are experimenting with GenAI. It could be that CFOs and their organizations see the potential of GenAI to reduce costs, improve customer/client experience, and increase productivity, all benefits they expect to derive from GenAI. But what scale of investment will they need to make? Do they have the necessary data, technology, and talent to implement GenAI? The survey results suggest no―not yet anyway. But for now, CFOs appear to be curious about the upsides and downsides of GenAI, and what opportunities, as well as challenges, the technology might bring.

For a more detailed look at this quarter’s results, download the report.

CFOs’ views of regional economies and capital markets

This quarter CFOs boosted their assessments of the economies of North America, Europe, and South America, compared to 2Q23, considering both current conditions and the year ahead. Meanwhile, they dimmed their views of current economic conditions in China and its 12-month outlook. Their assessment of current economic conditions in Asia, excluding China, decreased slightly while their views of its 12-month outlook stayed flat with 2Q23.

More than half of surveyed CFOs (56%) consider U.S. equity markets overvalued this quarter, a notable increase from the 39% of CFOs who shared that view in 2Q23. The proportion of CFOs who regard U.S. equity markets as undervalued dropped to 9% from 21% in the prior quarter. As a result, the gap between CFOs viewing U.S. equity markets as overvalued and undervalued widened this quarter, compared to 2Q23. Still, the gap is not nearly as large as it was during some periods in 2020 and 2021.

Growth expectations and risk appetite

CFOs have higher year-over-year (YOY) growth expectations for revenue, earnings, and domestic hiring this quarter, compared to 2Q23, but lower expectations for YOY growth in capital investment, dividends, and domestic wages/salaries. Their expectations for year-over-year growth in earnings reflect the greatest increase, jumping to 8.3% this quarter, from 4.4% in 2Q23.

With regard to risk appetite, 41% of CFOs say now is a good time to be taking greater risks. While this result is a bump from the prior quarter’s 33% and slightly exceeds the two-year average of 40%, it is outweighed by the 59% of CFOs who say now is not a good time to take greater risks. Based on what CFOs mentioned as their most worrisome internal and external risks, geopolitics, macroeconomic developments, and talent issues are likely dampening their appetite for greater risk-taking.

Chief risk concerns

Talent availability and retention land at the top of CFOs’ most worrisome internal risks this quarter, followed by execution and prioritization of business strategies. Innovation and growth, along with data and technology, are the next most frequently mentioned internal risks.

Employee engagement, employees’ morale, and cost management also appear among CFOs’ most worrisome internal risks. Such concerns might reflect the difficulties some organizations are experiencing in the transition from the hybrid work model to on-site work arrangements, and the challenges of containing costs amid high inflation.

Ranking among CFOs’ most worrisome external risks in 3Q23 are geopolitics along with policies and regulations. Macroeconomics, including concerns over interest rates and inflation, are also among the top external risk concerns.

Generative AI

With Generative AI in the headlines almost daily, our 3Q23 CFO Signals special topic focused on CFOs’ views on the technology, and our survey found that a sizeable proportion of CFOs’ organizations (42%) are experimenting with it, while 15% are incorporating it into their business strategy.

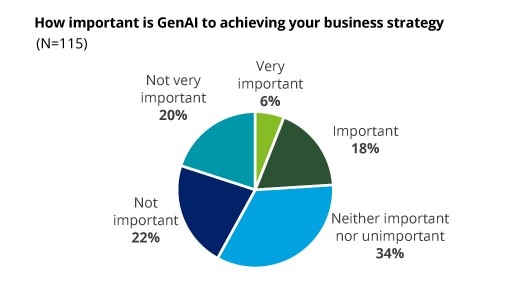

For nearly one-quarter of CFOs, GenAI is important to achieving their business strategy, compared to 42% who say the technology is not important overall. That leaves more than one-third of CFOs not yet weighing in on whether GenAI is important or not to achieving their organizations’ business strategy. For 17% of CFOs, it’s too soon to tell where their organizations stand on its GenAI journey, but nearly one-quarter of CFOs indicate their organizations are reading and talking about it.

When asked about their top three concerns regarding GenAI, more than half of surveyed CFOs cite impact to risk and internal controls, data infrastructure and technology needs, and investment needs. Governance requirements, ethical issues, and potential legal impact are also among CFOs’ chief concerns over GenAI, but to a lesser extent. Other responses included concerns over the accuracy and quality of GenAI outputs and data protection when using GenAI.

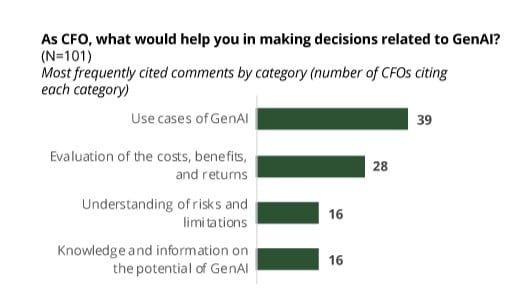

In this quarter’s survey, CFOs tell us they want use cases, as well as evaluations of the costs, benefits, and returns of adopting and deploying GenAI to help them in making decisions related to the technology. They also say that greater understanding of the risks and limitations of GenAI and more knowledge and information on its potential would be helpful in their decision-making. To a lesser extent, CFOs cite a better understanding of needed data quality and controls, organizational readiness, and clear guidelines and regulations as helpful in making decisions related to GenAI.

Cost reductions; better customer/client experiences; and greater margins, efficiencies and/or productivity are the top three benefits surveyed CFOs say their organizations hope to achieve by adopting GenAI.

Other sought-after benefits include the ability to develop new capabilities, services, or products, create scale and/or capacity, and improve accuracy of forecasting, modeling, and scenario planning, each cited by more than 30% of CFOs. A smaller proportion of CFOs (6%) hope to use GenAI to disrupt competitors.

When asked for the most promising uses of GenAI for the finance function, surveyed CFOs most frequently mention improvements in planning, forecasting, and analysis activities, as well as automation of routine and transactional processes. While some CFOs note that it is too early to tell what the most promising uses of GenAI for finance will be, there is a desire for improved decision-making, higher-value insights, increased efficiencies, and reduced costs.

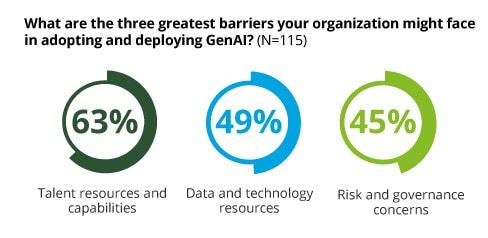

What’s keeping organizations from adopting and deploying GenAI? For 63% of surveyed CFOs, obtaining the necessary talent resources and capabilities is the greatest barrier to adopting and deploying GenAI in their organizations, followed by the data and technology resources GenAI might require, and risk and governance concerns.