Cognitive Accelerator for Signature Cards Validation has been saved

Solutions

Cognitive Accelerator for Signature Cards Validation

FDIC Part 370 compliance

Deloitte's automated cognitive intelligence solutions efficiently and effectively reviews signature cards using natural language processing (NLP) technology. It detects those with missing signatures for one or more account holders as well as identify accounts missing signature cards.

Explore content

- Watch the video

- Download the PDF

- Tangible benefits to covered institutions

- Contact us

- Join the conversation

Deloitte's automated cognitive intelligence solution

Deloitte has been focused on developing innovative solutions to help impacted banks comply with the Federal Deposit Insurance Corporation (FDIC) Part 370 signature card requirement.

We have developed a solution leveraging advanced data extraction, handwriting recognition, and cognitive technologies to automate the solution providing cost savings of up to 50 percent or more and time savings between 50-70 percent over a manual process.

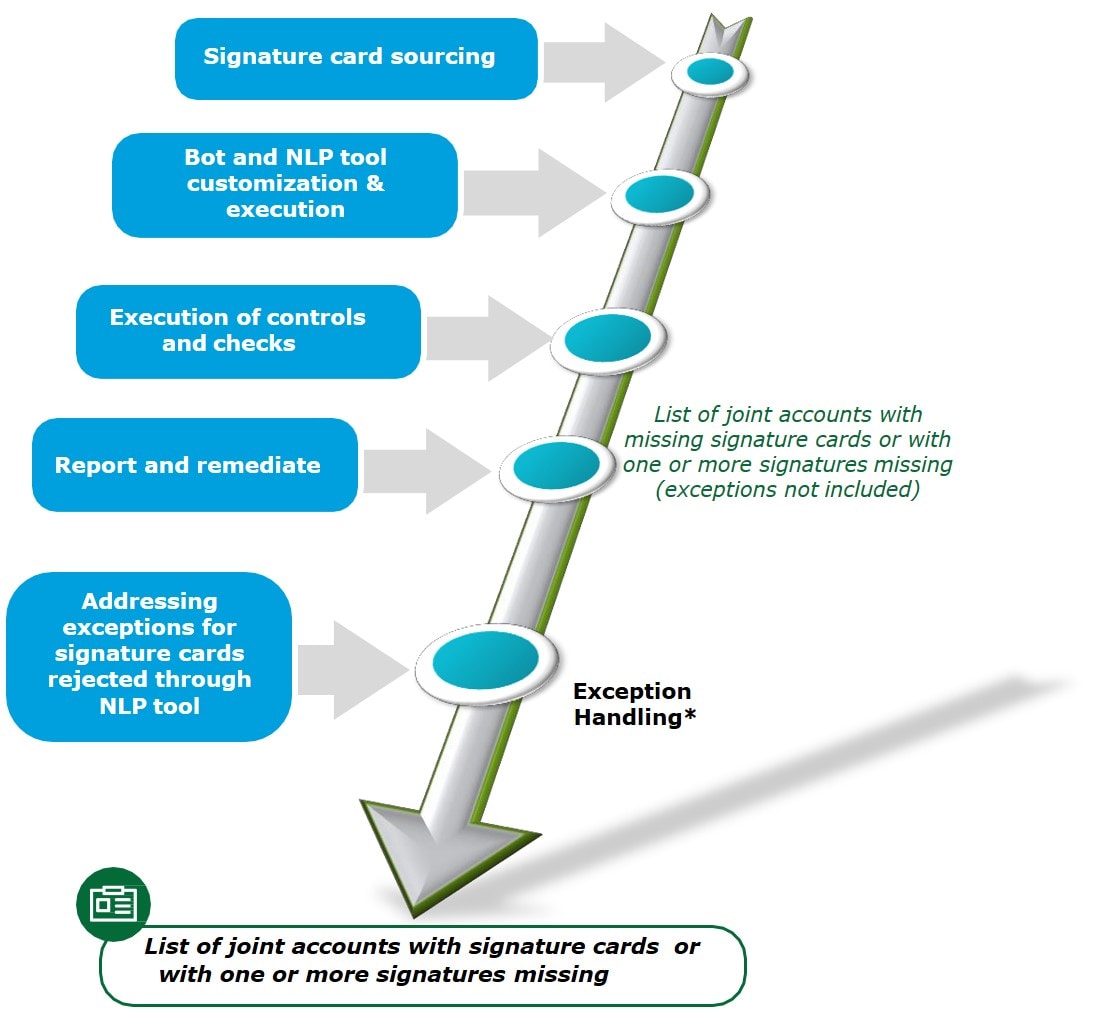

The key activities involved in implementing Deloitte’s automated cognitive solution for signature card validation are:

- Source signature cards by scanning both digital and handwritten cards using optical character recognition (OCR) technology and unique signature card templates

- Analyze cards and detect signatures utilizing an iterative process that ‘trains the tool’ progressively, leading it to a state where extracted data is highly accurate and reliable

- Execute control checks and quality review of extracted signature card information to ensure accuracy of model and reconcile with customer account database

- Report outcome metrics on dashboards and remediate exceptions through customer outreach and process optimization

Want regulatory news?

Visit Deloitte's Reg Pulse blog for insights on related topics such as FDIC Part 370 and 330 compliance and more.

Visit Reg Pulse blogTangible benefits to covered institutions (CI)

- Cost savings and operational efficiencies–CIs stand to achieve substantial cost savings and significant process efficiencies with the help of this automation solution. A comparison of the estimated costs involved in solving for the signature card requirement through manual processing versus using the automation solution indicates the potential for cost savings of 50 percent or higher, while also providing time efficiencies in the range of 60-70 percent.

*The numbers used in this example are for illustrative purposes only and may change based on a variety of factors

- Auditable processes – The use of signature card extraction models and processing templates allows Deloitte’s automation solution to be auditable through snapshots.

- Scalable solution with high-quality outputs – Deloitte’s automation solution is extendable to millions of documents and supports the processing of both digital and handwritten signature cards with a high degree of accuracy.

- Targeted customer outreach – Deloitte’s automation solution enables systematic identification of deficient accounts and targeted notification as part of a CI’s streamlined remediation effort.

Contact us

Please contact the below Deloitte professionals discuss the signature card solution:

| Michael Quilatan Managing Director Deloitte & Touche LLP |

John Corston Independent Senior Advisor Deloitte & Touche LLP |

| Olga Kasparova Managing Director Deloitte & Touche LLP |

Pranav Shanghvi Senior Manager Deloitte & Touche LLP |