Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue 92

Published date: 12 August 2024

Economy

Reform & reflation: what to expect from the second half of 2024

Will China’s 2024 growth target remain on track after the mixed data release for Q2? What will the policy response be to mitigate against weak consumption caused by the continued consolidation of the once mighty property sector? Cyclical weaknesses aside, what will be the roadmap for achieving Chinese-style modernization? Should a reflationary policy be adopted in order to cushion against the adjustment pains felt during the economic transition? Will global financial market jitters triggered by the Bank of Japan’s rate hike and expected slowing US economy make such countercyclical policy more imperative?

Let’s begin with a stocktake of Q2 economic data. GDP growth has come down from the torrid pace of Q1 (5.3%) and 1H growth stands exactly at the full year target of 5%. But if the property sector’s decline persists into the next few months, then additional stimulus, which has to be more potent than what we’ve seen so far, would be needed in order to achieve the stated GDP growth target of “around 5%” for 2024.

The overall slowdown in economic growth in Q2 is hardly surprising given the property sector’s outsized influence on the economy (real estate-related activities account for nearly 30% of GDP) and the greater-than-expected declines in new developments (dropping by 10.1% YoY in H1) and transactions (sales area of commercial residential buildings shrinking by 19% YoY in H1). The property sector’s weakness has been felt by general consumption, with retail sales decelerating visibly in Q2 (only growing by 2.6%). The good news is that deflationary pressure has eased, with the spread of CPI/PPI narrowing in Q2 compared to that of Q1 (from 2.7% to 1.8% YoY). Data on incomes (per capita disposable income rose by 5.3% YoY in H1) have indicated that the perceived shock hitting the labor market is more concentrated among fresh graduates.

But as expected, China’s exports remain the biggest growth driver (exports grew by 8.6% YoY in June), just as they did in Q1. The ASEAN market has emerged as China’s largest export market after surpassing the EU in 2022, and economic integration on the back of both the Regional Comprehensive Economic Partnership (RCEP) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is likely to bring about more efficiency gains in Asia. The ASEAN region so far has benefited from China’s investment which has been underpinned by cost arbitrage, regional trade pacts, and China’s trade tensions with the US. If the US further increases tariffs after the presidential election in November, then the business community would see such trade tensions between the two largest economies in the world as a permanent feature, in turn, driving more Chinese investment into Thailand, Indonesia, Malaysia, and Vietnam.

Unlike in developed countries, the ASEAN region is generally promoting investment from China and is trying to attract more Chinese tourism, Thailand especially. That said, most ASEAN countries are also keen to industrialize, and therefore China’s investment could be seen as an important source of capital as well as a shock to their domestic industries. In Indonesia, for example, policymakers have been strong-arming China’s investment into downstream industries, and China’s e-commerce players are perceived as a threat to mom-and-pop shops (see the Thai Times, August 3, Temu's Entry Disrupts Thai E-commerce Market - Thai Times). A combination of populism and industrial policy in some of these economies will cement job creation and industrial upgrading as preconditions for further Chinese investment into the region. In the short run, the global south will be seen as an alternative export market for China because tariffs and geopolitical considerations simply present a significant risk in major developed economies. In the long run, China’s economic rebalancing from an over-reliance on investment and exports must give way to a larger role for consumption, but external demand has to shoulder GDP growth before the property sector can stabilize.

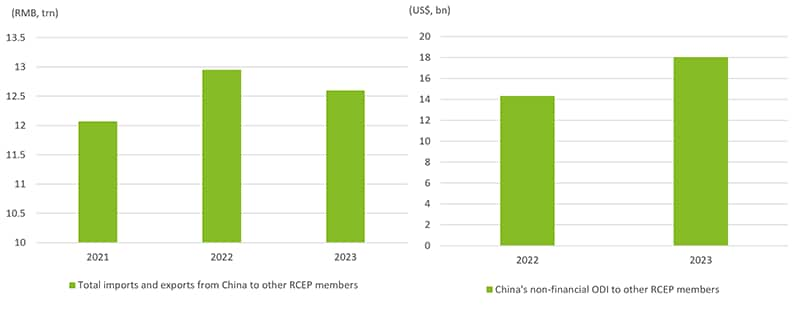

Chart: Intra-regional trade in Asia spurred by trade pacts

Source: MOFCOM

Source: MOFCOM

At the widely watched Third Plenum in July, policymakers reiterated the 2024 growth target of around 5% and pledged policy support (read, targeted monetary easing and further fiscal expansion). Indeed, the People’s Bank of China (PBOC) cut short-term interest rates by 10 basis points from 3.45% to 3.35% on July 22. We would advocate further reductions in short-term interest rates because inflationary risk is minimal in light of property sector woes and slacks in the labor market. However, there is little room for the central bank to pursue meaningful monetary easing unless the RMB exchange rate is allowed to fluctuate within a wider band. Interestingly, USD/CNY dipped (from 7.28 to 7.13) on the heels of the PBOC’s latest rate cut. We think the RMB’s rebound was more due to a recovering Yen (from 161 to 142), which has been trading at a multiple-decade low. However, such sudden reversal in USD/JPY has severely spooked global financial markets because the Yen has been the chief funding currency in sustaining a ferocious rally in assets markets this year. Nevertheless, China does have the luxury of pushing the monetary lever hard thanks to a closed capital account. Again, a more flexible RMB exchange rate will give the PBOC more room to manoeuvre in reducing real interest rates.

In our view, the gist of the Plenum’s document is a comprehensive summary of previous policy pronouncements, namely: 1) to establish a uniform domestic market – meaning to do away protectionism among provinces; 2) to pursue high-quality growth – meaning not relying on excessive debt financing; and 3) to promote new productive forces – meaning that new growth drivers will be led by technological breakthroughs and innovation. The Plenum has also reinforced the notion of the “two unshakables”, meaning to support both state-owned enterprises and the private sector, with the latter specifically underscored for its critical role in selective areas deemed to be of national interest. We see this as an additional assurance to private enterprises. Overall, the Plenum document highlighted policy continuity and set a deadline of 2029, the year of the People’s Republic of China’s 80th anniversary, for achieving the pledged reform agenda.

In terms of concrete initiatives, extending the retirement age to 65 for those born after 1990 is a step in the right direction for improving labor mobility. According to Han Wenxiu, executive deputy director of the Office of the Central Committee for Financial and Economic Affairs, those working in major cities will be provided with comparable public services to residents. This is a significant move towards relaxing the household registration system. According to Mr. Han, China will also undertake unilateral trade liberalization with less developed economies. This initiative seems to imply that policymakers have taken a rather sober view on trade tensions with developed countries, where political winds continue to blow unfavourably. Looking ahead, the outcome of the US election will surely present a significant risk to global trade, not just for China. There seems to be a growing acceptance of tariffs in the US on the basis that it is worthwhile for consumers to pay a bit more if more manufacturing jobs could be created or protected locally.

The question is, what should China do if the US increases tariffs? This would be particularly pertinent if they go beyond just tariffs levied against EVs and solar panels (we regard that move by President Biden in June as campaign-driven) because tariffs levied at a rate of 100% only account for 2% of China’s exports to the US. Donald Trump has vowed to impose tariffs of 60% on Chinese imports across board, as well as tariffs of 10% on imports from rest of the world. Again, such threats might well be campaign rhetoric but with the US economy slowing, political incentives for the US to unwind trade tariffs may well be negligible. For China, the best policy response is to avoid escalation. The way in which China has reacted to the EU’s tariffs against Chinese EVs is a case in point. Given the vast price differentials in EVs and the EU’s strong commitment to defending its strategic industries (e.g., the automotive sector), China’s mild retaliations by launching anti-dumping investigations into EU pork exports so far have averted unnecessary further escalation. However, going forward, contentious issues such as over-capacities and subsidies are unlikely to go away regardless of the outcome of the US election. That is why China’s commitment to creating a truly uniform market, which will unleash sustainable demand by bringing down internal trade barriers and changing the incentives of local governments, is so critical.

Back to the state of the economy, mixed data from Q2 have clearly enhanced the argument for bolder fiscal and monetary policy. If major central banks led by the Federal Reserve (a pre-emptive rate cut ahead of the September FOMC meeting seems likely) are prepared to unwind their aggressive tightening in the post-COVID era, it would make sense for the PBOC to join the easing chorus. On July 30, at the Politburo meeting chaired by President Xi, the explicit emphasis was on increasing aggregate demand by boosting consumption, especially those in low-income thresholds. In addition to accelerating existing schemes of Cash for Clunkers (mainly appliances), additional subsides will be expected to help consumers. The fact that the Politburo meeting reiterated the 2024 growth target and stressed the economic challenges arising chiefly from an economic transition suggests that more reflationary policy is on the cards for the second half of the year.

TMT

China's AI applications in going global rush

According to World Intellectual Property Organization (WIPO), during the 2014-2023 period, China filed more than 38,000 generative artificial intelligence patent applications, ranking it the first in the world and six times that of the US. It is also highlighted in Stanford University's Artificial Intelligence Index Report that 15 of the well-known artificial intelligence models in 2023 are from China. As of March 2024, the number of large language models in China with over one billion parameters has exceeded 100, which greatly empowers AI applications in areas such as electronics, medical, and transportation, showcasing China's significant contributions to the global AI development.

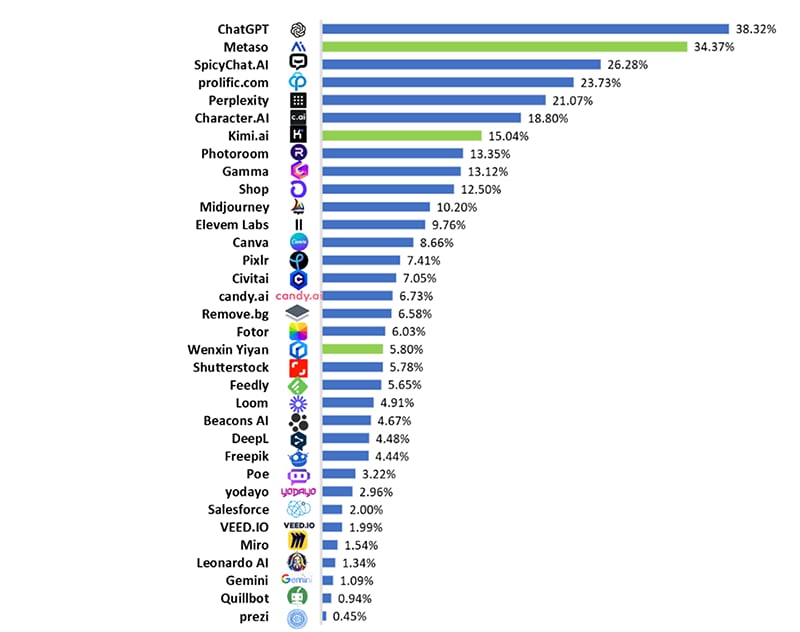

Amidst the new wave of technology spurred by AI large language models, the trend of domestic AI applications going global is increasingly strong. From an application perspective, among the top 50 AI products in the world, three are made in China (Metaso, Kimi, Wenxin Yiyan). The popular applications mainly focus on image editing and generation, video production, and chatbots.

Month-on-month growth of traffic volume of global top-50 AI products

*Include AI products with positive month-on-month growth only

Source: Similarweb

While in the areas of 2B industrial-level applications, Chinese manufacturing enterprises are making breakthroughs in various aspects such as design development, process management, product quality inspection, and customer service. China already has mature AI solutions in the fields of healthcare, finance, retail, and automotive, and is evolving into a more mature and comprehensive intelligent model. AI enterprises such as SenseTime, Megvii, iFlytek, and Yitu Technology are expanding their global footprint, providing 2B industrial-level AI solutions in regions such as Southeast Asia and Saudi Arabia.

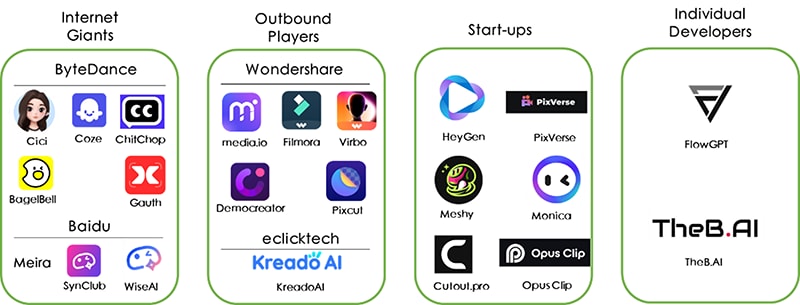

Currently, the AI products are undergoing rapid iteration in the application layer, and Southeast Asia and Africa are becoming the main overseas markets for Chinese players. Participants in China's AI application going global include internet giants (ByteDance, Baidu, etc.), seasoned outbound players (Wondershare, eclicktech), young start-ups and independent developers (Meshy, PixVerse). Some start-ups have even set up shops directly in the overseas markets (Heygen).

Overview of Major Outbound AI Products

The drivers for the globalization of domestic AI products mainly surround four reasons: First, the global market is much larger than the domestic market alone, and companies need a broader market reach to enhance their valuations. Second, overseas users, both B2B and B2C, have stronger willingness and capability to pay for services. Third, the engineering development capability of applications is an advantage for Chinese companies going global, and such an advantage is even more prominent in the era of generative AI. Fourth, overseas regulations are relatively lax. For example, developing social AI chat products overseas faces less regulatory risks.

Despite the positive trends, Chinese AI applications going global are still facing two major challenges: technology embargoes and monetization of business models. At the technical level, the US-based OpenAI has said that it will ban Chinese developers from accessing its tools and software from 9 July, which will be a blow to companies that are creating startups by wrapping OpenAI's large language models, as they always face the risk of being banned from accessing OpenAI's official API in China. Moreover, monetization of the AI products is not clear yet. In 2023, the global in-app purchase revenue for non-gaming mobile applications was $53.1 billion, while AI in-app purchase revenue was only $1.7 billion, indicating that AI applications still have a low penetration rate in the app markets.

Therefore, finding the right business model is crucial, especially for companies with complex cost structure and long management paths. It is essential to proceed with caution when embracing generative AI. Chinese AI enterprises need to formulate systematic and comprehensive strategies to ensure that their technology and products can successfully enter the international market while addressing various potential challenges:

- Technological Innovation and R&D: Chinese AI companies should increase their investment in R&D to enhance their innovation capabilities. By continuously innovating and developing technologies, they can create core technologies with independent intellectual property rights and build technical barriers to maintain a leading position.

- Ensuring ROI with Generative AI: After investing in AI technology, how to measure the return on investment becomes a core issue. Since the effects and benefits of AI technology are not immediately visible, companies may face uncertainty in decision-making when ROI is not clearly verified. For example, an AI application may have reached a million daily active users and grossed significant revenue, but profitability may still be low comparing to costs, including computing costs and marketing expenses to attract users. In advanced countries, the cost per user is generally believed to be three times the actual consumption of each user.

- Piloting Business Scenarios from Mature Cases: In terms of AI technology, the application scenarios in the industry still need further development. AI's B2B applications are concentrated in material generation, intelligent customer service, and business opportunity follow-ups, achieving cost reduction and efficiency increase in specific aspects, no systematic mechanism has yet been formed. Enterprises can start with mature cases and then start the deployment on a large scale.

- Data Privacy and Security Compliance: AI companies going global should understand and comply with data protection laws and regulations of the target markets, such as the European Union's General Data Protection Regulation (GDPR), ensuring legal and compliant data processing activities. Additionally, they can manage data locally by setting up local data centers in each target market, following local data storage and processing requirements.

- Brand Building and Marketing: AI companies going global can deeply understand local market needs and user habits through market research and user feedback, providing strong support for product customization and optimization. Moreover, enterprises need to establish a unified global brand image, enhance brand awareness and reputation through international marketing and promotion activities, and cooperate with well-known local enterprises and brands to leverage their influence and resources to increase market penetration.

Looking to the future, generative AI is expected to be a key force in reshaping Chinese and global industries. However, in this process, companies can only fully unleash the tremendous economic value contained in the new generation of artificial intelligence opportunities by formulating AI strategies deeply integrated with business, accelerating talent transformation, and improving talent cultivation mechanisms. This will allow them to have more opportunities in the broader global AI market.

Consumer

Cultural and tourism consumption: new market increments under the rapid change of consumption structure

Recently, the National Bureau of Statistics announced the domestic consumption data for the first half of the year. Overall, the current consumption still shows a weak recovery trend. In the first half, total retail sales of social consumer goods nationwide increased by 3.7% year-on-year, with catering revenue growing by 7.9% and the growth rate of goods retail at 3.2%. In terms of physical consumption, essential consumer goods maintained rapid growth overall, with tobacco and alcohol pencilling in double-digit growth. The growth rate of discretionary consumer goods categories has shown significant divergence. Clothing, shoes and hats, cosmetics, and gold and silver jewellery have further slowed down, with anaemic growth rates of 1.3%, 1%, and 0.2% respectively in the first half of the year while sports and entertainment products and communication equipment grew by 11.2% and 11.3%, respectively.

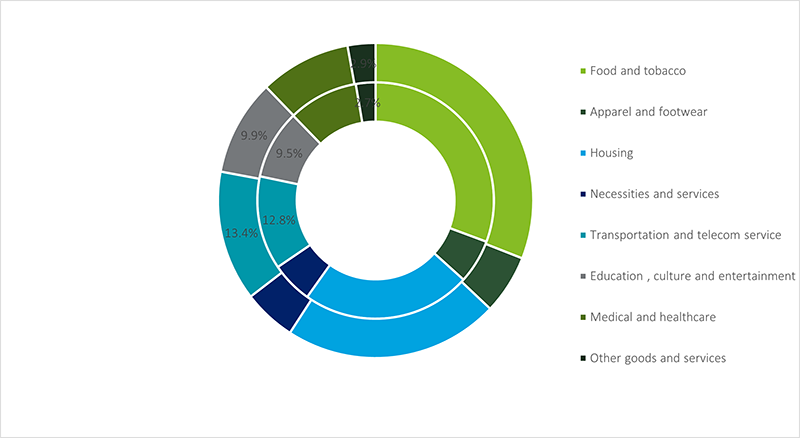

Although consumption in the first half of the year showed a weak recovery, there were still some emerging growth highlights under the influence of changes in the consumption structure of residents. The demand for resident services consumption continued to rise, with the growth rate of service retail sales in the first half of the year reaching 7.5%, 4.3 percentage points higher than the growth rate of goods retail sales during the same period. Amid the current trending consumption preferences of consumers who are continuously rational, experiential and in favour of domestic destinations, there is a surge in demand for culture, entertainment, and travel. Looking at the per capita consumption expenditure in the first half of the year, the proportion of transportation and communication, education, culture, and entertainment, and other goods and services related to cultural and tourism consumption continued to expand, with year-on-year growth rates of 11.6%, 11.2%, and 12.8%, respectively.

Chart: Proportion of Per Capita Consumption Expenditure by Category for the First Half of 2023 and the First Half of 2024

Source: National Bureau of Statistics

Driven by the holiday economy and the leisure economy, cultural and tourism consumption has become one of the hottest consumption trends at present. By the first half of 2024, the domestic tourism revenue reached RMB2.73 trillion, with a year-on-year growth rate of 19.0%. On one hand, county-level regions have become popular among consumers due to their cost-effectiveness and lower tourist density. According to Meituan statistics, in the past two weeks (from the end of June to the beginning of July), the scale of cultural and tourism consumption in third-tier and below cities and county regions has seen rapid growth, with popular destinations such as Shengsi, Anji, Tonglu, and Yanji experiencing a month-on-month increase of over 60%.

At the same time, the overseas inbound tourism boom has also been a boon to the recovery of domestic consumption. Boosted by favourable factors such as visa-free policies and easier payment facilitation, overseas social media platforms have sparked a trend of traveling to China, attracting a large number of foreign tourists to visit China for sightseeing. According to Ctrip data, inbound tourism orders for this summer have doubled compared to the same period last year, with overall growth in inbound tourism orders shooting up 1.5 times from countries such as France, Italy, Germany, Malaysia, and Thailand, whose citizens can enter China visa-free.

The market currently has strong confidence in the market potential of cultural and tourism consumption. According to incomplete statistics from the Mai Dian Research Institute, by the first quarter of 2024, the number of investment and signed projects in domestic cultural and tourism groups reached 62, nearly three times the number of the same period last year. The investment amount reached RMB45.7 billion, a 65% increase in the same period. Many local governments have set more active cultural and tourism consumption targets for tourism revenue.

Figure: 2024 tourism revenue targets for some provinces

Source: Wind, official websites of local governments

Source: Wind, official websites of local governments

Although the current consumer market sees an weak recovery due to the cyclical slowdown of the macroeconomy, there are still many structural growth opportunities in the market such as rapid growing culture and tourism demand. Enterprises should actively embrace digitalization, utilizing new technologies and tools such as AI and big data to enhance their insights into consumer and market trends, and respond in a timely manner to market changes.

Automotive

Outlook for the automotive price war: shifting from quantity to quality

Since the beginning of 2023, price war in the Chinese automotive industry has been ongoing for a year and a half. At the beginning of this year, leading new energy vehicles (NEV) companies proposed the slogan "electricity is cheaper than oil" and successively launched low-priced models, further escalating the price war. Not only does it involve a wider reach of enterprises, but the depth of discounts has also significantly increased compared to last year.

The price war epitomizes the current imbalance between supply and demand in the automotive market. It is also a typical feature in a phase where the industry transitions from old technology to the new and reshapes the competitive landscape, in this case, from internal combustion engines (ICE) to the one led by NEVs. Looking ahead to the second half of the year, price war is expected to continue, but the rate of price reduction is likely to narrow. Car companies will adjust their sales expectations and production plans in the Chinese market, returning to the competition that revolves around value.

The intensification of price war is compounded by insufficient demand for cars and uneven development between ICE and NEV market.

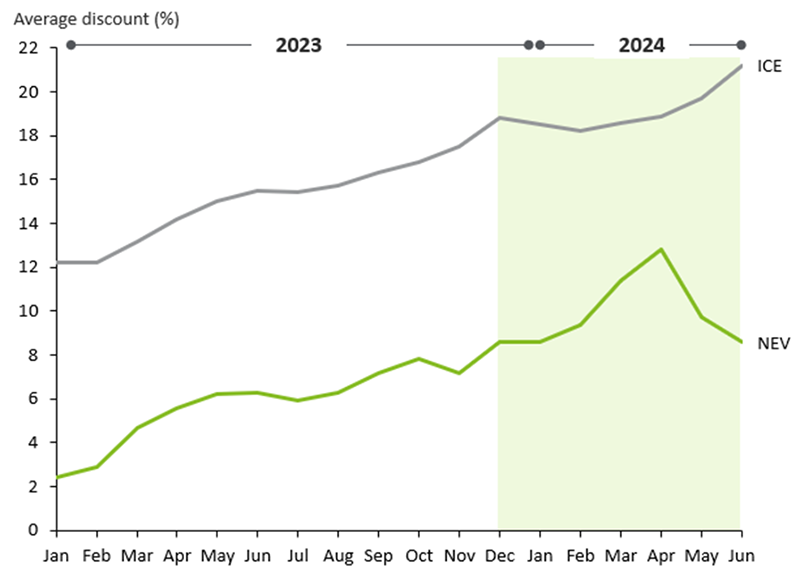

The scope and discount levels this year have significantly expanded compared to last year, mainly due to the overall economic downturn, slower growth in consumer income, lack of consumer confidence, and uneven industry policy (the extension of the vehicle purchase tax redemption policy has given plug-in-hybrid vehicles a significant price advantage over traditional fuel vehicles). Since the beginning of the year, promotion efforts for fuel vehicles have continuously intensified, with discount rates reaching new height of 21% by June. In contrast, discount rates for NEVs have been gradually decreasing on a monthly basis since reaching a peak in April.

Chart: Average discounts on passenger cars by different power type, Jan-June 2024

The marginal effect of price reductions on boosting sales is diminishing as industry profits are facing mounting challenges.

The marginal effect of price reductions is diminishing, as consumers become more cautious and adopt a wait-and-see approach in response to deeper discounts offered by companies. For example, after a brief recovery in the first quarter stimulated by the price war, the growth rate of gasoline cars sales has once again teetered into negative territory, with the decline continuing to widen. In the first half of the year, cumulative sales of ICEs dropped by 11% compared to the same period last year. Car manufacturers with a high proportion of ICEs, such as Japanese and German brands, have experienced varying degrees of sales decline.

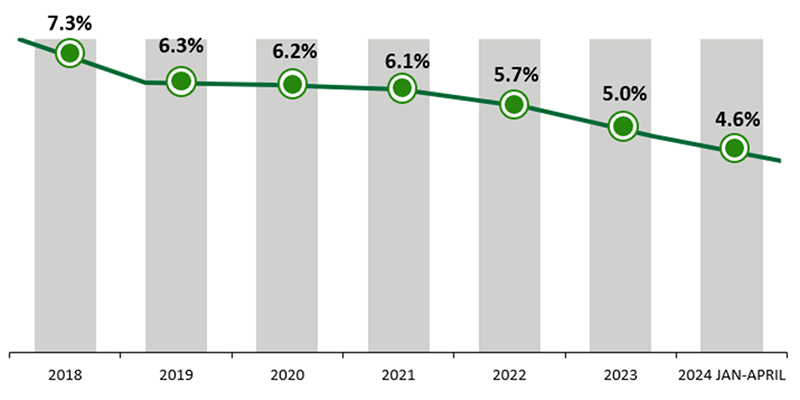

Chart: 2018-2024 Automotive Manufacturing Sales Margins

At the same time, price reductions have a negative impact on profit health and brand image. For example, in the first four months of this year, the sales profit margin of the automotive manufacturing industry was 4.6%, lower than the year-end level of last year (5%), and significantly lower than 2018 (7.3%). At the company level, only leading NEV companies have maintained high revenue and profit growth rates, while most traditional car companies have experienced a decline in gross profit margin and net profit margin. The price war has also dragged down the financial performance of dealership groups.

In addition, the price war tarnished brand image. According to the "June 2024 China Vehicle Residual Value Report" released by the China Automobile Dealers Association, the residual value of all brands has significantly declined, with luxury brands experiencing a bigger decline.

Looking ahead, the price war is showing signs of cooling as car companies shift their focus towards profitability and service over sales and market share.

Prices are primarily influenced by various factors such as industry supply and demand, competitive environment, preferential policies, and others.

- From a demand perspective, the overall car sales volume is approaching saturation. Considering macroeconomic factors, consumer income and confidence, and per capita car ownership, the growth of passenger car sales in China is expected to stabilize around 23 million units, with an average annual growth rate of around 1% over the next three years.

- On the supply side, price wars have accelerated industry consolidation. The number of available brands will continue to shrink, but due to an imperfect exit mechanism, this process will take some time. Dealerships will undergo consolidation, with car manufacturers focusing more on serving existing fuel vehicle customers and increasing after-sales value in the backdrop of lowered production and sales targets and reduced rebates from OEMs.

- From a competitive landscape perspective, NEVs will continue to compete neck and neck with traditional fuel vehicles. During the period when new energy vehicles are exempt from purchase taxes until the end of 2027, fuel vehicles will continue to face pressure, especially from PHEV. The penetration rate of new energy vehicles is expected to reach around 44%-45% this year and potentially reach 50% by 2025. With the background of divergent regulations for conventional and electric vehicles, the pressure for fuel vehicle price reductions will persist, making it more difficult for fuel vehicle prices to return to the 2022/23 levels.

In general, due to weak consumer demand and the shift from traditional to emerging industries, it is expected that price wars will persist, but the extent of discounts may decrease. Fuel vehicle manufacturers may contemplate reducing their production and sales targets in China over the next few years, focusing on quality over quantity, and scaling back on promotional activities. As for NEVs, with favourable purchase tax policies in place till the end of 2027 and an increasingly concentrated competitive landscape, prices are expected to remain more stable.