Perspectives

The Deloitte Research Monthly Outlook and Perspectives Issue 93: Rate cut a right move

Published date: 27 September 2024

Economy

Rate cut a right move

The Chinese economy, whose headline growth remains on track to achieve the 2024 growth target of "around 5%" (just barely), is facing greater deflationary risks. The market is increasingly longing for a potent stimulus that will not only boost sentiment for consumers and investors but also avoid negative side effects. As the US election campaign heats up, contentious issues such as subsidies, over-capacities and industrial policy will inevitably become political. Therefore, even calibrated policy responses by China must take into account reactions from abroad. But first and foremost, should China unveil a "shock and awe" or a bazooka-style stimulus? What should be the intended targets? And what tools does China have at its disposal? On Sept 24, 2024, People's Bank of China has cut reserve requirement rate from 8.5% to 8% and short-term repo rate from 1.7% to 1.5%. In addition, initial downpayment of mortgage of 2nd home has been cut to 15% (previously roughly 25%). By no means, this is a bazooka, but stock market and RMB have rallied significantly, nevertheless. Would fiscal expansion be next step?

Chart: Sagging equity market surged on PBOC's easing

Source: Wind

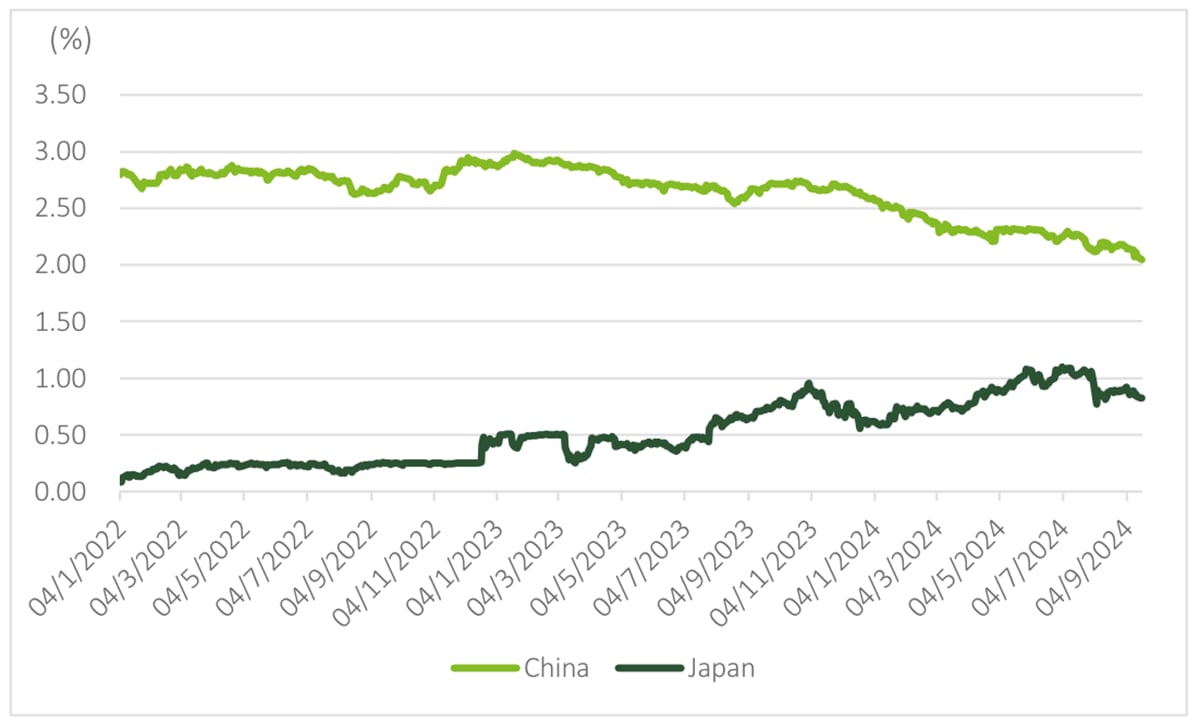

China's post-Covid recovery has been delicate and patchy, mainly because of a protracted adjustment in the property sector and the erosion of consumer balance sheets. This was not entirely unexpected. Most Chinese cities experienced an unprecedented housing boom from the late '90s until 2021, fuelled by a secular trend of urbanization, an undervalued currency and rapid economic growth. The overheated housing market received an additional boost during Covid when RMB interest rates were substantially higher than international rates, as most major central banks slashed rates to almost zero. In a way, housing has long been perceived as a growth stock. In the past two years, however, most cyclical factors such as the outlook for short-term growth have stacked up against the housing market despite a significant adjustment in prices. First-tier cities have seen a price drop of over 20% over the past two years, while second- and third-tier cities have come down more depending on the region. The underperformance of the stock market and a drastic decline in FDI past two years caused by supply chain adjustments have also put downward pressure on the RMB despite China's large current account surplus. China's ultra-competitiveness (sometimes being dubbed as 2nd wave of China shock by Western pundits) and a comfortable balance of payments do not warrant RMB devaluation. However, any meaningful monetary easing, given already low short-term interest rates, must go hand in hand with a more flexible exchange rate. Otherwise, real interest rates will remain high, deterring corporate investment. Investors, at least in the short-run, no longer anticipate the RMB to appreciate, as the Fed's aggressive tightening post-Covid has reversed interest rate differentials between China and the US in favor of the latter. Geopolitical risks have bolstered the greenback's international standing, to say the least. If housing is not seen by consumers as an appreciating asset, then rental yields could be a determining factor in driving the valuation of the property market. In most cities, rental yields are low at around 1-2%, so it is sensible to assume that additional price correction is needed to make yields more attractive. This could likely be a multi-year process. Meanwhile, the equity market continues to struggle with investors' persistent concerns around an economic slowdown, corporate profit squeezes brought about by over-capacities, and piecemeal stimulus. Government bond yields have consistently broken new lows because of investors' risk aversion and the risk of deflation.

Chart: Convergence of long-term government yields between China and Japan

Source: Refinitiv

Source: Refinitiv

The debate raging over the size of stimulus is hardly new, but the risk of deflation, flagged by Yi Gang, former governor of the People's Bank of China at the Bund Forum on September 6, has put the urgency of a "shock and awe" to the fore. According to Dr Yi, China's main economic challenge is inadequate domestic demand, both in terms of consumption and investment. Unlike developed countries, China must battle deflation by helping SMEs, who are mainly responsible for job creation. By implication, both fiscal policy and monetary policy ought to be more expansionary. August data indeed aligns with what Dr Yi has depicted. Retail sales, a broad gauge of urban consumption, have decreased to 2.1% from 2.7% in July. Property-related data remains weak across the board, with property investment falling by 10.2% YoY in the first eight months of 2024. If the current trend continues, 2024 may well see a greater decline in housing investment than that of 2023 (-9.6%). M1 has contracted by 7.3% compared to 6.6% in July, highlighting consumers' caution. Fixed asset investment has posted a moderate increase of 3.4% on the back of policy support. As expected, exports have gone from strength to strength with a whopping 8.7% growth in USD terms. Of course, domestic weaknesses have given firms greater incentive to export their way out of the malaise. Is this sustainable? In the short-run, yes. Looking further ahead though, the backlash against China's exports is likely to intensify.

As the housing sector undergoes a painful consolidation, it is hardly surprising that local governments' fiscal revenues have shrunk. The central government, of course, has significant capacity in assuming local government debt – this one of the preferred means of fiscal outlay advocated by this column. The reluctance by the central government is owing to the potential misuse of funds which may end up being put towards civil servants' salaries instead of ensuring developers' funding for finishing their projects. The central government has repeatedly called for government agencies to engage in belt-tightening. This fiscal prudence is sensible given the fiscal shortfalls caused by Covid and collapsed land auction revenues. However, there are policy trade-offs. In our view, stabilizing the housing market clearly is a higher priority than enforcing fiscal discipline on regional governments. It is also sensible for the government to nudge banks to go easy on those who have financial difficulties in meeting their mortgage payments.

In the region, China is not the only economy trying to get consumers to loosen their wallets. The Thai government announced a program of providing $4.2 billion in cash to economically vulnerable groups on September 25 (Thailand's GDP is forecasted to grow between 3.0% to 3.5% in 2024). China could provide tax relief to SMEs, especially in the food & beverage sector, which has been adversely affected by weak consumer sentiment. We have been of the view that a "shock and awe" in the form of fiscal stimulus to large investment projects may well worsen overcapacity in the manufacturing sector. On this basis, there are compelling arguments for the central bank to aggressively slash interest rates. As Dr Yi has pointed out, China's economic cycle is not in sync with that of major economies where interest rates are set to fall from elevated levels. The highly volatile Yen has regained its footing of late. The impact on the RMB exchange rate is unlikely to be significant, even if interest rate differentials may result in firms hoarding dollars. The reality is that if deflation becomes entrenched, both firms and consumers could become even more cautious, as Japan has experienced for almost three decades. One lesson from Japan's lost decades is policymakers' refusal to open up domestic services sectors to foreign competition. On September 8, China’s Ministry of Commerce announced measures allowing foreign operators to run hospitals in several cities. This is a step in the right direction, but more concrete measures are needed to reignite investor sentiment. We would also like to reiterate our view that China could have undertaken more drastic reflationary measures such as a bigger rate cut and bigger fiscal transfers to local governments, but the fact that China's central bank has finally chosen to join major central banks' easing campaign is definitely a right move.

Financial Services

Supportive monetary policy to intensify regulation

The Resolution (The Resolution) adopted at the Third Plenary session of the 20th CPC Central Committee proposed “deepening the reform of the financial system” and a series of reform tasks. After the meeting, the central bank has continuously regulated the policy rate through open market operations, reflecting that the monetary policy framework has formally shifted from quantity-based regulation to price-based regulation. Smoothing out the monetary transmission mechanism is a key element of the financial system reform, as well as an important measure for the central bank to regulate long-term bond yields and require financial institutions to control the interest rate risk.

On September 24th, at the press conference held by the State Council Information Office along with the People’s Bank of China (PBOC), National Financial Regulatory Commission (NFRA) and China Securities Regulatory Commission (CSRC), the PBOC announced cuts to both the reserve requirement ratio and its interest rates. This served to inject more liquidity into the market, which also further pushed market interest rates lower. The move helped the address the need for incremental policy measures to further reduce corporate financing and residential credit costs, as demonstrated by the financial data that came out in August. This was broadly in line with market expectations.

Currency price-based regulation: OMO-7D as short-term policy interest rate

Governor of the People's Bank of China, Pan Gongsheng, said that there are varieties of central bank policy interest rates and the rate relationship between different monetary policy tools is more complicated. So the PBOC moves to fix a certain short-term policy interest rate to send a clearer signal to the market. Now, the 7-day interest rate of open market reverse repo operations (OMO-7D) has assumed the function of the main policy interest rate.

To enhance the authority of this policy rate, the PBOC on July 22 announced that OMO-7D would be changed from price tender to fixed rate, volume tender and reduced the rate by 10bp to 1.70%.

Interest rate transmission: from short-end OMO-7D to long-end LPR

The medium-term policy rate (MLF) is gradually fading out, i.e. the loan prime rate (LPR) shifted from following the change of MLF to OMO-7D, forming a transmission framework from the short-end policy rate OMO-7D to the long-end market rate LPR. For example, no adjustment was made for the MLF rate on July 15, but the OMO dropped 10bp on July 22, and the LPR quoted on the same day reacted quickly and followed the OMO adjustment. It indicates that the LPR quotes have shifted to refer more to OMO-7D, and that the interest-rate transmission from the short-end to the long-end is being gradually straightened out.

Table: Table: Central bank cut interest rates and LPR downward

# |

Interest rate downward |

Interest rate transmission |

OMO-7D |

Adjusted to fixed rate, volume tender (previously price tender). The rate was cut by 10bp from 1.80% to 1.70% |

Short-end rate down |

LPR |

The 1 - and 5-year LPR was cut by 10bp to 3.35%/3.85% |

Long-end rate down |

Source: PBOC, Deloitte research

To further narrow interest rate corridors to control the range of interest rate fluctuations.

When regulating short-end interest rates, the PBOC will also use interest rate corridors. At present, the upper corridor is the standing lending facility (SLF) interest rate and the lower corridor is the ratio of excessive reserve. Overall, the width of the corridor is relatively large.

The PBOC would further enhance the authority of policy interest rates and "moderately narrow the width of the interest rate corridor" to send a clearer signal of interest rate control targets to the market.

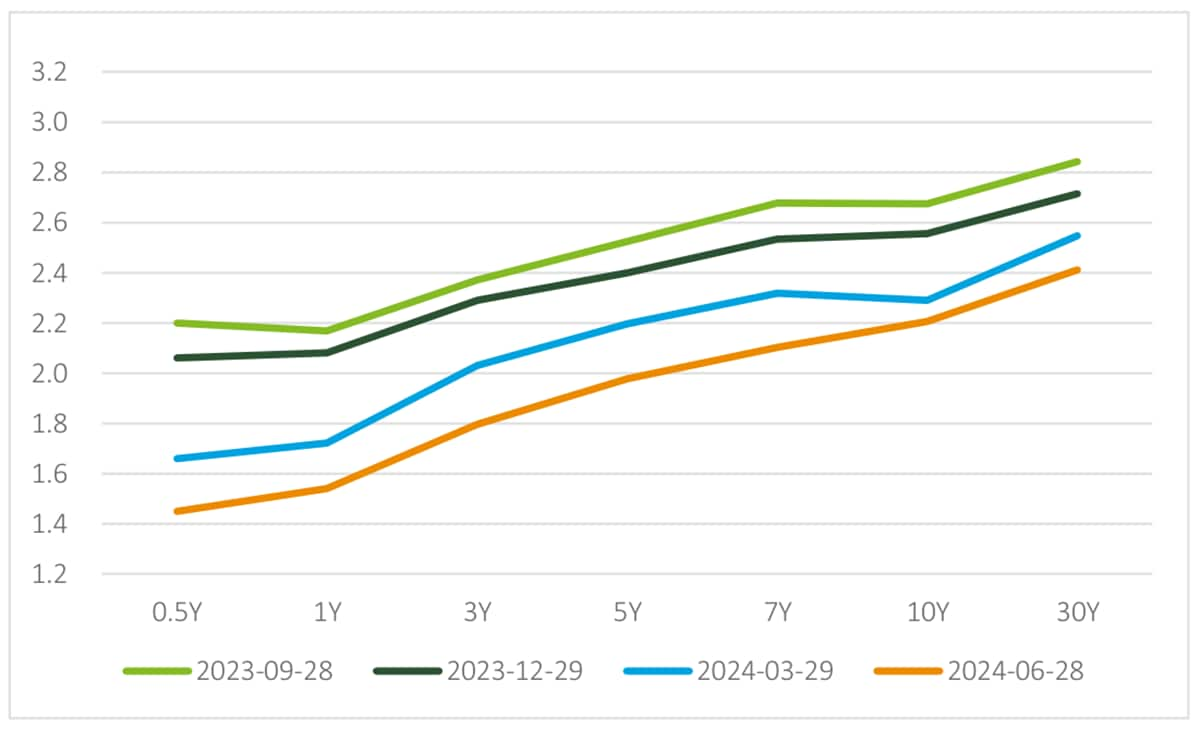

PBOC to buy/sell national bonds, enriching the open market operation and controlling bond market risk

The Central Financial Work Conference proposed to expand the monetary policy toolbox and gradually increase the buying and selling of national bonds. Since the beginning of this year, yield of national bonds has continued to decline rapidly. In late July, the yield of 10-year treasury bonds hit a 20-year low to approach 2.15%, significantly deviating from the reasonable central level and accumulating financial risks. On July 1, the PBOC announced its decision to buy and sell treasury bonds to balance the supply and demand of the bond market and to prevent the accumulation of risks.

In developed countries, sales of government bonds is a tool of QE. That is, injecting liquidity without issuing money. The most immediate goal of the PBOC's buying and selling of government bonds is to regulate bond yields, and to regulate liquidity as well, which is similar to QE. According to the Resolution and the logic of opening the bond market and the outlook in the medium and long term, the "price-oriented" monetary policy framework is ever more clear: using OMO-7D rate cut operation to regulate the short-term policy rate, framing the short-end interest rate fluctuation range by interest rate corridors. And the liquidity adjustment method is supplemented by the trading of national bond. On September 24th, the PBOC further enriched its toolkit by announcing the creation of new monetary policy instruments to support the stock market, including a swap facility for securities, funds, and insurance companies, as well as a special re-lending facility for repurchasing shares and increasing shareholdings. These policy tools are expected to enhance the fundraising capabilities of institutions and listed companies, as well as their ability to increase stock holdings.

Figure: China's interbank market treasury yield curve

Source: ChinaBond, PBOC

Source: ChinaBond, PBOC

Financial institutions need to prevent interest rate risk and dig deeper into effective credit demand

Against the background of a red hot bond market, some asset management products of long bond allocation have increased. The central bank clearly warns of the risks: the annualized yield of some asset management products, especially bond financial products, is significantly higher than that of the underlying assets, which is mainly realized by adding leverage. When the market interest rate rises in the future, the net withdrawal of related asset management products will also be very large.

Data show that bond income of some small- and medium-sized financial institutions accounts for more than 30% of operating income, and even exceeded 50% for some other institutions. Aggressive investment strategies may exceed their risk management ability. It is necessary for financial institutions to conduct stress tests on interest rate risk. Silicon Valley Bank is a lesson from the past.

According to the regulatory requirements of "digging deeper into effective credit demand while preventing funds settling and idling", commercial banks need to pay closer attention to the construction of their own operating capacity, address the issue of idle capital and focus on key areas to dig deeper into credit demand, especially under the framework of new supportive policies for the stock market.

Logistics

Reshape Logistics through the in-depth application of AI

The logistics and express delivery industry has witnessed strong growth. According to the State Post Bureau, the volume and revenue of express delivery services increased by 23.1% and 15.1% year-on-year in the first half of 2024, respectively. The industry's parcel volume growth rate for the whole year of 2024 is expected to be around 15% -20%. The sustained growth of the logistics and express delivery industry is determined by a multitude of factors including the volume increase of e-commerce parcels, the development of overseas business by enterprises, and the expansion of service scenarios. Among these, the new productive force of the logistics industry, Intelligent Logistics, is crucial for improving quality, reducing costs, and increasing efficiency of warehousing and transportation. It is one of the core driving forces for the sustained profitability of the logistics enterprises, as well as a key factor in the transformation and upgrading of the logistics industry.

The Intelligent Logistics Market is Flourishing with AI as the Next Breakthrough.

Deloitte estimates that the size of China's Intelligent Logistics market has reached around RMB 800 billion by 2023. The innovation and improvement of new technologies, including Autonomous Mobile Robots (AMR), unmanned logistics vehicles, and logistics drones, have provided a strong impetus for the rapid growth of Intelligent Logistics. In 2023, the sales scale of AMRs alone reached RMB21.2 billion, with over 50 new products launched. In 2024, pilot autonomous driving and the first flight of unmanned logistics drone routes have been conducted in multiple cities, promoting the expansion of the application of unmanned transportation technology. These Artificial Intelligence (AI) applications have breakthrough significance for revolutionizing the logistics operation system and reshaping the logistics industry ecosystem.

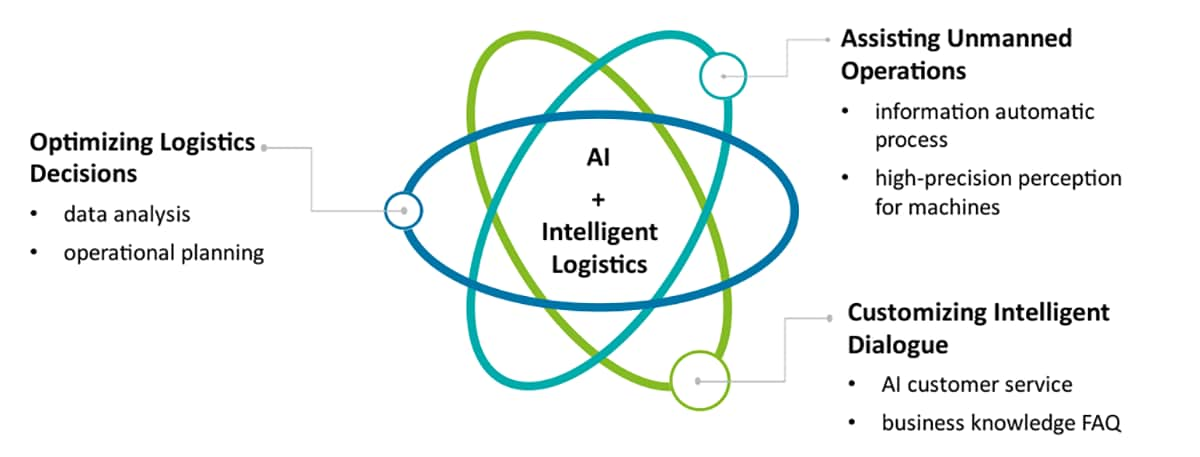

In March 2024, the first alliance in the logistics industry dedicated to the research and practice of Large Model (LM) applications, the "Logistics Intelligence Alliance", was established, marking the accelerated landing of LM in the logistics industry. The cutting-edge application of AI in optimizing logistics decisions, assisting unmanned operations, customizing intelligent dialogue and other scenarios will provide better services and solutions for the logistics industry, enhance multiple aspects of the logistics supply chain, and make logistics more intelligent and efficient.

Graphic: AI Empowering Intelligent Logistics

Source:Deloitte research

Source:Deloitte research

Cutting-Edge Application: AI Optimizing Logistics Decisions

Traditionally, data analysts are responsible for market analysis, demand forecasting and supply chain inspection and consulting. With the application of AI, the above-mentioned responsibilities can be replaced by a logistics domain LM. At the same time, AI enjoys machine learning-based operational planning capabilities, which can be developed to rapidly solve routine and typical logistics problems such as route optimization, packaging optimization, and vehicle scheduling, therefore improving operational efficiency.

Certain leading enterprises have been tentatively releasing LM products for the logistics supply chain since 2023. In June 2023, Cainiao Supply Chain released its LM-based intelligent supply chain product "Tianji π", achieving quality and efficiency improvement in sales forecasting, replenishment planning, inventory health and other areas. In August 2024, SF Technology released the SF Logistics Decision Large Model, which applies AI to intelligent analysis, sales forecasting, route optimization, packaging optimization and other logistics supply chain decision-making fields.

Cutting-Edge Application: AI Assisting Unmanned Operations

AI can be applied to the intelligent recognition and automatic processing of freight documents and receipts, as well as quickly and uniformly connecting orders in different formats. At the same time, some enterprises are launching innovative models of AI + mobile robots (AGV/AMR) and AI + unmanned logistics vehicles, which use AI's autonomous navigation and high-precision perception to help robots and unmanned driving systems better understand logistics scenarios, improve the flexibility, effectiveness, and safety of unmanned operations.

At present, the attempts of AI in unmanned logistics operations are mainly led by AI technology companies. In 2023, Megvii Technology innovatively improved the "four-way vehicle + AMR + Hetu" solution, using AI Internet of Things to connect downstream robots and devices as well as upstream business systems. UQI has relied on AI robot technology to launch industrial mobile robots, stacking robots, and unmanned logistics vehicles in the past three years, providing integrated unmanned warehouses and unmanned delivery solutions.

Cutting-Edge Application: AI Customizing Intelligent Dialogue

For the customer side, conversational AI customer service has been pervasive in online consultation, intelligent outbound calls, and intelligent voice responses, playing a crucial role in such scenarios as shipping, operations, and queries.

For the business side, employees in marketing, collection and delivery, customer service, international customs and other fields can quickly obtain information from the enterprise's knowledge platform through AI dialogue, improving efficiency. In 2024, JD Logistics first applied its logistics LM during the 618 sales promotion period to ensure fast and accurate performance. By the end of June, the Model had been called over 30 million times, helping hundreds of thousands of employees handle over 400 million addresses and improving logistics efficiency.

Challenges Remain in the AI + Intelligent Logistics Market Regardless of Promising Prospects.

The application of AI and AI large models in Logistics industry still faces a series of problems. On the one hand, the cost of LM is too high, as its acquisition and operation require a large amount of funds and resources. On the other hand, the construction of a standard system for Intelligent Logistics on AI specialization needs to be strengthened. Although the National Development and Reform Commission issued policy guidance such as "Specification for management of intelligent warehousing" and "General requirements for functions of logistics big data sharing system" in 2023, the rapid development of AI has necessitated higher requirements for the formulation of Intelligent Logistics standards in this field.

In summary, the competition among logistics enterprises in the future will be the ultimate showdown between speed and efficiency, especially in the express delivery market with an average of 440 million parcels per day, where the intelligence and digitalization level of logistics and express delivery networks need to be further improved. Accelerating the application of new technologies such as big data and AI will promote the reshaping of logistics processes, significantly improve service efficiency and market supply and demand matching efficiency, and therefore effectively reduce circulation costs.

Life Science & Healthcare

Accelerated national medical payment landscape

Medical innovation and payment reform were prominent topics of discussion this year at both the Two Sessions and the Third Plenary Session, capturing significant attention. As 2024 marks the final year of the three-year action plan for DRG/DIP payment reform, the effectiveness and outcomes of these reforms come under closer scrutiny. In July, the National Healthcare Security Administration (NHSA) issued the Notice on the Grouping Scheme for DRG/DIP Payment 2.0 and Further Promotion of Relevant Work (referred to as "DRG/DIP Payment 2.0"). This development has accelerated the nationwide implementation of healthcare payment reform, offering important guidance for the innovative growth of enterprises and healthcare institutions.

The necessity of healthcare payment reform and practices

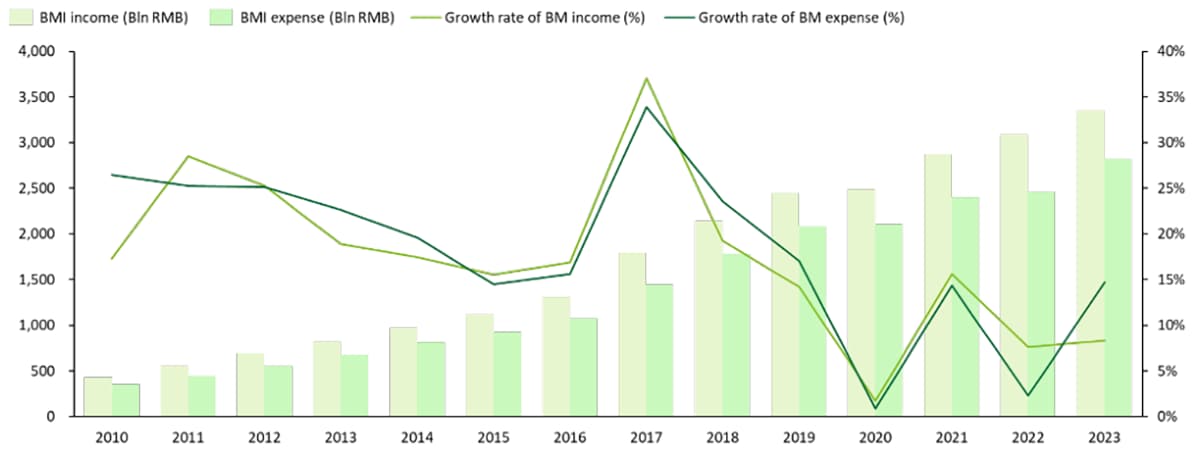

China’s basic medical insurance (BMI) fund is facing increasing pressure due to an aging population and declining birth rates, leading to a slowdown in growth in both income and spending. Although the NHSA, established in 2018, has introduced a series of BMI fund reforms and cost-control measures, achieving a compound annual growth rate (CAGR) of 9.4% in healthcare fund income from 2018 to 2023, this rate is still outpaced by the fund's expenditure growth (CAGR) of 9.6%. This indicates substantial long-term pressure on BMI fund payments and underscores the critical need for ongoing cost-control reforms.

Figure: Growing payment pressure from changes in the BMI fund income and expense of the national basic medical insurance (BMI) fund

Source: NHSA, MOHRSS, Deloitte Research

Source: NHSA, MOHRSS, Deloitte Research

Currently, BMI cost control is primarily approached from two perspectives: the supply side and the payment side. On the supply side, the focus is on controlling the prices of pharmaceuticals and medical devices through dynamic adjustments to the Nation Drug Reimbursement List and volume-based procurement. On the payment side, efforts are centered on reforming medical payment models, particularly by controlling and adjusting the costs of treatments and diagnostics at medical institutions.

Since its establishment, the NHSA has been actively promoting DRG/DIP payment reform. It has issued multiple policy guidelines, launched comprehensive DRG/DIP payment pilot programs. NHSA initiated structural reforms at the national level through the issuance of Three-Year Action Plan for DRG/DIP Payment Reform, which mandates the nationwide implementation of DRG/DIP payment reform by the end of 2024, with full coverage of medical institutions by the end of 2025.

As of first half of 2024, 282 regions, representing 71% of all regions, have implemented DRG/DIP payment reform, achieving the goal of phasing in the action plan. The reform has effectively curbed the rapid growth of local medical expenses and inpatient costs, with many regions reporting a surplus in BMI fund balances. The ongoing payment reform has resulted in new opportunities for the BMI payment landscape, initiating a transformation of the medical payment value chain.

Challenges and Issues in DRG/DIP Reform

With the deepening of the DRG/DIP reform, many deep-seated problems and challenges have emerged, including the slower-than-expected improvement in the operational capabilities of BMI agencies, the limited guidance provided by healthcare authorities, and the inadequate coordination with local medical institutions. Additionally, there are ongoing issues with the technical capabilities of BMI settlement systems, the quality and standardization of medical data, and the development and integration of information systems across different levels of medical institutions.

Table 1: Key Differences and Challenges of DRG and DIP

|

DRG |

DIP |

Payment design focus |

Based on case groupings, with uniform treatment for similar cases |

Based on disease groupings, with differentiated payment management aligned with the functional roles of medical institutions |

Grouping principle |

Emphasizes clinical experience, grouping multiple diseases or procedures together, resulting in significant variability between groups |

Emphasizes statistical analysis of clinical real-world evidence (RWE), grouping based on shared characteristics, typically with one disease per procedure per group |

Rate and point value |

DRG payment standard = Annual DRG rate * Adjusted weight per DRG |

DIP payment standard = DIP disease score * Settlement point value |

Regulatory challenges |

High dependency on grouping tools and expert assessments; varying diagnostic and treatment practices across institutions complicate standardized grouping |

Reliance on historical medical big data; challenges in eliminating existing treatment biases; high degree of difficulty in ensuring accuracy and fairness of medical assessments |

Source: Public info, Deloitte Research

Refinements and advancements in DRG/DIP Payment 2.0 is accelerating the deployment.

The release of DRG/DIP Payment 2.0 in July 2024 has been highly anticipated by the industry. The new version is expected to enhance support for the development of innovative pharmaceuticals and medical devices, while providing clearer guidelines and operational support for payment reforms at medical institutions. Key innovations in the latest grouping scheme include: 1) Special Case: Ensuring that complex and severe cases receive adequate treatment with the rational use of innovative drugs and devices and increasing the flexibility of DRG/DIP payments to reduce the treatment burden; 2) Exempt Payments: Granting exemptions for leading innovative drugs and devices, ensuring that DRG/DIP payment reform does not hinder innovation. These products will be included in the grouping scheme only after sufficient real-world data has been collected; 3) Prepayment System: Establishing a prepayment system to provide effective financial support to medical institutions during the reform process to alleviate financial pressure and to ensure smooth operations.

As the "three-year action plan" approaches its final stage, China’s DRG/DIP payment reform is shifting from a focus on "low-cost, high-efficiency, and high-quality" framework to a new paradigm of "value-based healthcare." This reform and its implementation have far-reaching implications for various industrial stakeholders. Overall, the comprehensive rollout of medical payment reform needs to be further accelerated to ensure BMI fund solvency, alongside ongoing refinement of the grouping scheme to enhance healthcare equity. Medical institutions need to enhance the capability of refined analysis and control of profit and loss, with real-time adjustments to performance indicators based on the latest grouping schemes. Healthcare professionals need to stay abreast of the latest policies and provide standardized treatment in line with updated clinical guidelines. Pharmaceutical and medical device companies must actively engage in the development of clinical grouping schemes, paying close attention to the usage and dosage requirements within different schemes to effectively adjust their marketing strategies.