Perspectives

The Deloitte Research Monthly Outlook and Perspectives Issue 94

Published date: 12 November 2024

Economy

China to Embrace US Election

We still believe that the 2024 growth target of "around 5%" will be achieved with a slight margin for error. The key issues in the short term are to prepare for a meaningful policy offset should the US raise tariffs against China or trade surplus economies (the EU and some Asian economies) and to provide further clarity on shoring up fiscal support to local governments. On details of long-awaited debt swap details which were released at NPC session on Nov 8, a total of RMB10trn will be rolled out next five years -RMB6trnas additional debt in additional to RMB800bn a year from 2025 to 2030. This is actually slightly higher than we previously anticipated. But the US election result and Fed's most recent rate cut of 25bps have increased the sense of urgency on fiscal expansion.

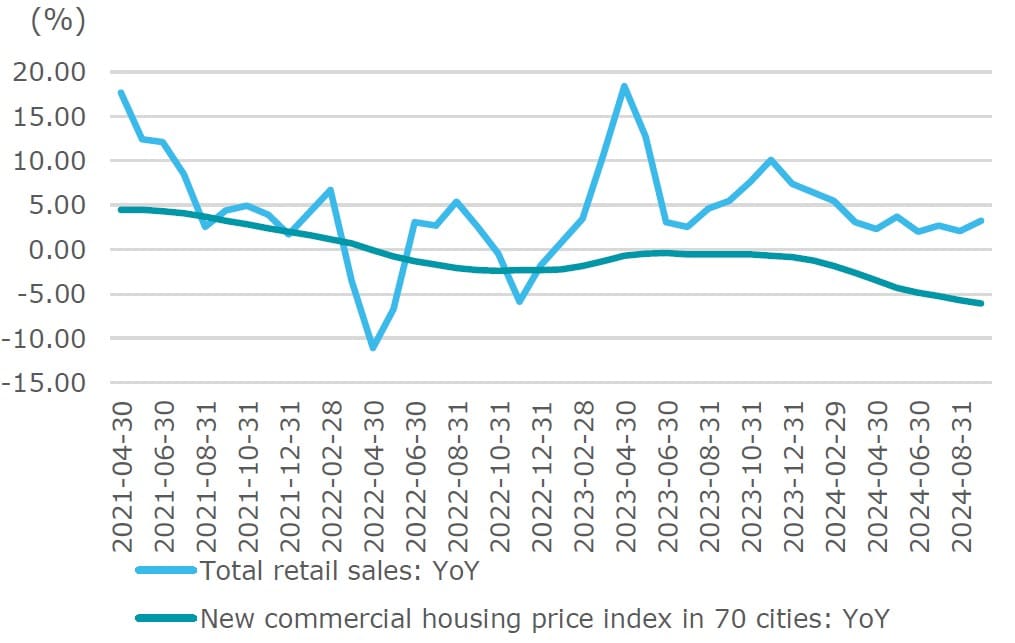

The tariffs that were raised during the 1st Trump Administration have remained unchanged during the Biden Administration, although tariffs of over 100% against China's EV exports were largely campaign-motivated. However, China's trade surplus with the US has not decreased since the trade war broke out due to various reasons — mainly China's export juggernaut and weakening domestic demand stemming from a severe property sector consolidation.

Chart: China's trade surplus with the US stays high amid high tariffs

Chart: A severe property sector consolidation weighs on domestic demand

Source: Wind

Hypothetically speaking, what should be the likely policy responses if tariffs rise further under Trump 2.0? The lesson from the phase one trade deal with the 1st Trump trade deal was that a trade deal based on quantity (even without the adverse impact of Covid) would have been unlikely to work in the medium term because trade diversion and substitution could distort global trade. If higher tariffs were levied against trade-surplus countries, such a policy could invite retaliation, resulting in inflation or even stagflation. If higher tariffs were aimed at China, there is a strong likelihood for the USMCA to be reviewed because Mexico has replaced China's the largest trading partner of the US and Mexico has been running a widening trade deficit with China.

Regarding inflation, there are few signs that the US economy is showing signs of a slowdown. Currently, the Fed is poised to cut rates one more time for the rest of 2024 and could ease twice in 2025. However, the widely-watched 10-year treasury yield continues to rise, reaching above 4.4% as Trump 2.0 became the reality. Surging treasury yields indicate that investors are increasingly doubting a soft-landing scenario for the US economy. Moreover, the consistent sell-off since September 2024 has also suggested that fiscal discipline in the US may be compromised due to rising trade tariffs or a slew of industrial policies, or both, regardless of the state of the economy moving forward. If the Fed has to scale back its originally planned easing campaign, it will have significant implications for both asset markets and the global economy. Higher risk premiums could lead to financial market volatility. Such high premiums may renew carry trades in the forex market, as we have seen through the weakness of the Yen, despite the Bank of Japan's normalization of its monetary policy in 2024. For China, considering that the risk of inflation is likely to remain low, a calibrated monetary easing by the PBOC should remain the dominant theme. The complication lies in whether China would introduce more exchange rate flexibility to enhance the effectiveness of its monetary policy. So far this year, China has maintained a steady RMB exchange rate amidst the overwhelming strength of the greenback. The question in 2025 is whether such a policy would remain viable, especially with a potential external shock on tariffs looming large.

Chart: Long-term interest rates between the US and China sets to widen

Source: Wind

Meanwhile, the immediate priority is for Chinese central government to engineer a debt rollover of local government liabilities. Given that long-term interest rates are low, Beijing does have ample capacity to bail out those local governments facing revenue shortfalls. Fiscal relief is also expected to boost consumer demand, mainly in the form of cash for clunkers (from autos to electric appliances).

Overall, the uncertainty of the US election has indeed prompted China's policymakers to adopt an incremental approach in rolling out fiscal stimulus. This is a sensible approach. From the policymakers' standpoint, fiscal support is mainly about limiting downside. This policy goal has largely been achieved since the PBOC's initial easing and coordinated policy moves with the Ministry of Finance, as judged by the domestic A share market. Looking ahead, the test is whether the debt rollover with local governments will be seen as credible by the market. Elsewhere in the region, export growth has significantly decelerated in recent months. For China, this is significant. If the share of the US market continues to fall, especially if tariffs were to become permanent, then the ASEAN region, which has emerged as China's biggest market in recent years, would have to absorb more Chinese exports. In general, China and most ASEAN countries have favorable relations, but close economic ties through trade and investment (China being the third-largest FDI provider) are also strained by China's export competitiveness. For example, Thailand has levied tariffs against China's steel exports since Aug 2024. Several ASEAN countries, such as Indonesia and Malaysia, have undertaken restrictive measures against China's e-commerce giants. Against this backdrop, China's export machine will be unlikely to play an equally potent role in shouldering growth in 2025 as it did in 2024.

Energy

The solar industry at a turning point: what is behind the SOE withdrawals and increased corporate investments

Recently, we have witnessed that State-owned energy enterprises (SOEs) have been withdrawing from some new energy projects, while at the same time, PV module manufacturers are increasing investments in new technologies and production lines. On the surface, the SOE withdrawals seem to signal a contraction of solar power station projects. But the fact that PV companies keep expanding against the headwinds provides food for thoughts about the future of the industry. Amid concerns over overcapacity, does SOE withdrawal indicate a downturn for the PV industry? In fact, the industry is undergoing a new wave of technological transformation and market expansion, presenting both challenges and opportunities.

Why are SOEs withdrawing from new energy projects?

Since the start of 2024, SOEs have gradually withdrawn from certain new energy projects for two main reasons. First, as renewable energy becomes increasingly integrated into the electricity market, the power output and pricing of PV plants are no longer fixed. This creates uncertainties in power absorption, generation volume, and returns, contrasting with the past when these factors were more stable and predictable. For example, in the "Distributed Photovoltaic Power Generation Development and Construction Management Measures (Draft for Comments)" released on October 9 of this year, restrictions were imposed on the grid connection for distributed solar projects with a capacity greater than 6MW. Second, SOEs have strict IRR requirements for projects. With renewable energy capacity targets largely achieved, their focus has shifted to maximizing returns. Projects with lower level of profitability face the risk of being shut down. SOE withdrawals do not signal a decline in the industry but rather reflect a higher threshold for returns in the face of market uncertainties.

In this context of fluctuating power prices and variable outputs, PV plants are under increasing pressure to reduce costs and improve profitability. According to estimates from the China Photovoltaic Association, PV plant costs are primarily composed of three parts: PV modules (47.2%), other technologies (39.2%), and non-technical costs (13.6%). Consequently, upstream PV manufacturers are accelerating their transformation, focusing on technological innovations to reduce costs and increase efficiency.

Technological innovation: the driver of the PV industry

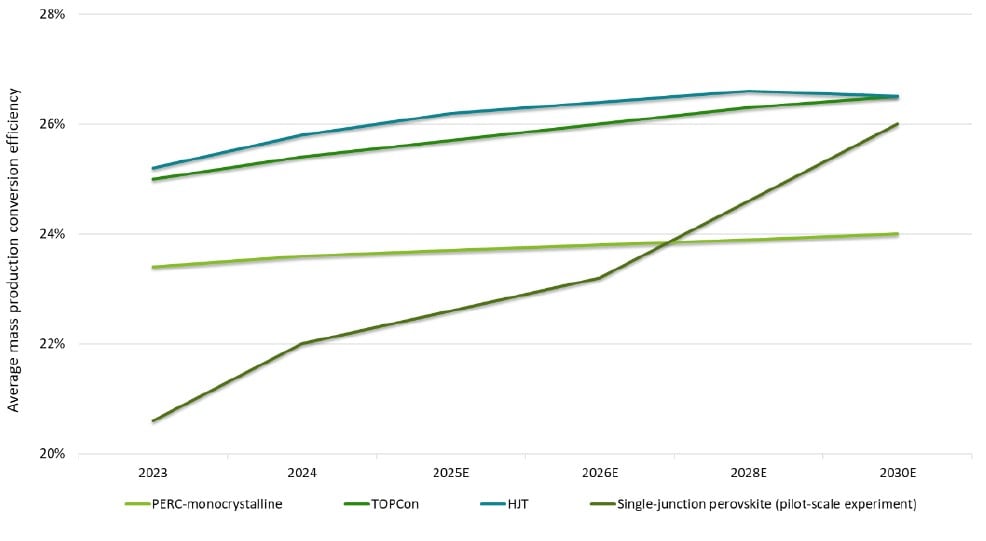

In contrast to the SOE withdrawals, PV manufacturers are increasing their investments in new technologies. This is driven by the rapid pace of technological advances in the PV industry, particularly in the breakthroughs that improve photoelectric conversion efficiency, which offer opportunities to optimize costs. Higher conversion efficiency means lower generation costs for PV plants. Industry estimates suggest that for every 1% increase in PV cell conversion efficiency, downstream plant costs can be reduced by approximately 5%. This allows PV companies to enhance their competitiveness and capture larger market shares, even in a volatile pricing environment.

Currently, as P-type PERC cell technology is approaching its efficiency limits, the market is focusing on and N-type cell technology, which offers higher photoelectric conversion efficiency. N-type technology includes TOPCon (Tunnel Oxide Passivated Contact solar cell), HJT (Heterojunction Technology), and BC (Back Contact solar cells). Several technologies coexist in the market, with LONGi Green Energy focusing on BC cells, which it regards as the future mainstream technology, while companies like JinkoSolar and Trina Solar continue to focus on TOPCon technology.

Figure: Photoelectric conversion efficiency of major technologies

Source: CPIA, Deloitte Research

Overseas expansion: opportunities in the Middle East

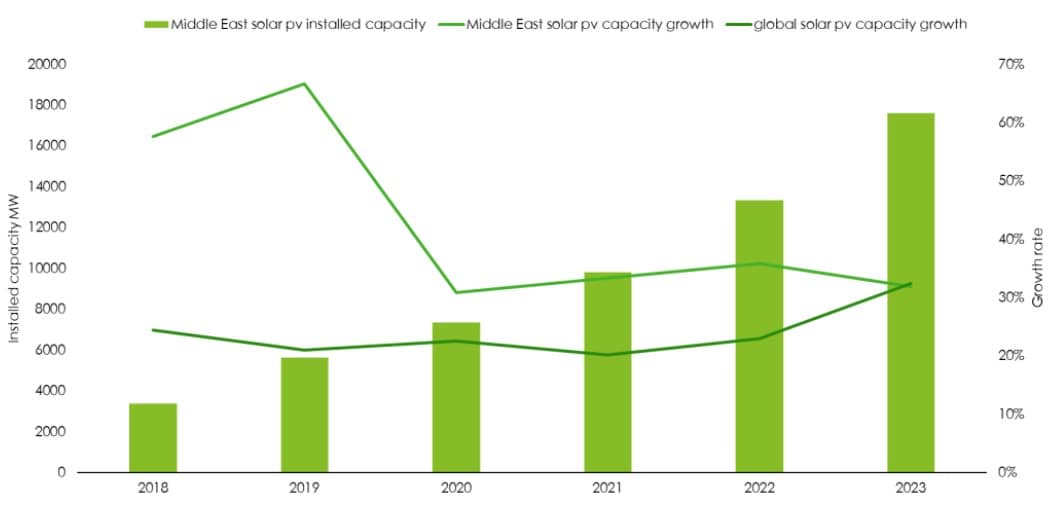

With Trump's election, the U.S. may adjust its energy policy, leading to a slowdown in the development of new energy. Additionally, the "America First" international trade policy will undoubtedly further increase the difficulty for Chinese photovoltaic companies in exporting to the U.S., setting up factories there, and obtaining subsidies. As a result, we will see more companies accelerating their diversification of market strategies and actively expanding into emerging markets.

Middle East is emerging as a new growth point. State Power Investment Corporation (SPIC) and Saudi ACWA Power jointly hold shares in the AlRass solar PV project, which has launched a 700 MW solar project in Qassim Province. Chinese PV companies are also accelerating their presence in the Middle East. For example, JinkoSolar is partnering with Saudi Arabia to establish a 10 GW high-efficiency battery and module project, and Q-Sun is collaborating with Omani energy firm Bakarat to build an 8 GW advanced PV module and 2 GW PV cell production base in Oman’s Sohar Free Trade Zone. These expansion projects cover diverse technology routes, including TOPCon, HJT, XBC, and perovskite technologies.

The appeal of the Middle East lies in its abundant sunlight and relatively stable long-term power purchase agreements (PPA). All this offer high return potential for PV plants. For Chinese PV companies, the booming Middle Eastern market provides an opportunity to offset domestic market fluctuations.

Figure: Middle Eastern countries are stepping up solar PV capacity

Source: Irena, Deloitte Research

Emerging application markets: Building-Integrated Photovoltaics (BIPV)

Beyond traditional ground-mounted PV power stations, PV companies are developing new application markets, as building-integrated photovoltaics (BIPV) keep on gaining attention. BIPV not only provides renewable energy but also enhances the aesthetic value of buildings. According to Grand View Research, the global BIPV market is expected to reach approximately $70 billion by 2030, with a compound annual growth rate (CAGR) exceeding 20%.

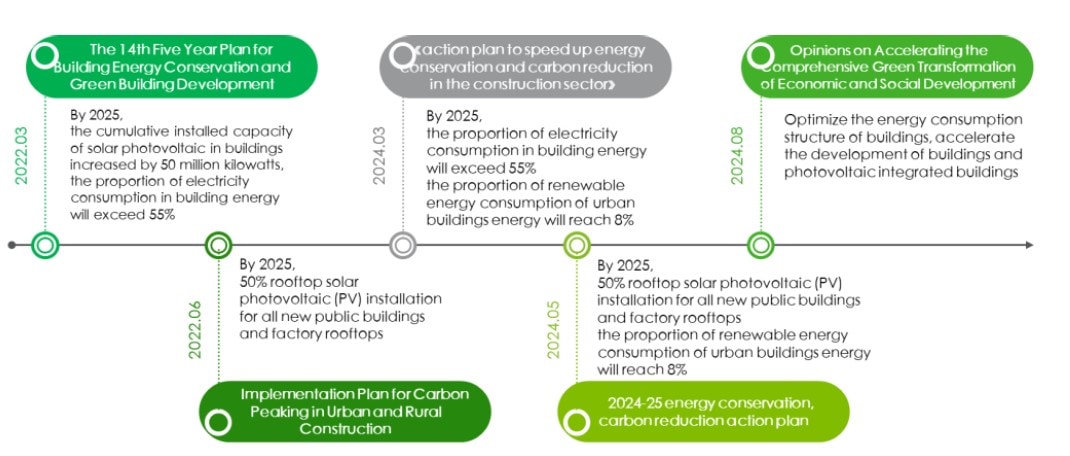

In China, BIPV is also gaining momentum, driven by national policies such as the “14th Five-Year Plan” for building energy efficiency and green building development, as well as the "Countywide PV" initiative. Several provinces and cities have introduced BIPV subsidy policies, creating new opportunities for PV companies in the domestic market. Companies like Hanergy Mobile Energy and LONGi Green Energy are at the forefront of innovation in BIPV, developing products such as thin-film solar tiles, PV curtain walls, and transparent solar glass.

Figure: China’s policies accelerate the develop of BIPV

Future industry trends

The PV industry is shifting its research focus from "watts" to "kilowatt-hours," meaning that the industry is now focused not only on power output and efficiency but also on optimizing applications across various use cases. Future PV products are expected to evolve along four major trends: high efficiency, high-end applications, high adaptability, and high integration.

- High efficiency refers to technological innovations that boost conversion rates, such as N-type TOPCon, HJT, and perovskite technologies.

- High-end applications include the expansion of new markets like PV hydrogen production and solar-powered vehicles.

- High adaptability allude to the ability of PV products to perform reliably in diverse and extreme environments, addressing the specific climatic conditions of regions such as deserts, high plateaus, and cold regions.

- High integration involves the seamless combination of PV with other technologies, such as energy storages, electric vehicles, and hydrogen production, creating a more holistic energy ecosystem.

The PV industry is standing at a new turning point of technological innovation and market expansion. While SOE withdrawals from new energy projects may raise concerns, PV companies are seizing new growth opportunities through technological advances, overseas expansion, and the development of emerging markets. In the future, the industry will continue to move toward higher efficiency, intelligence, and diversification, contributing significantly to the global energy transition endeavour.

Technology, Media &Telecommunications

Incremental policies designed to revitalize the Tech sector

Following Trump's recent return to office, expectations are that his administration will adopt a more aggressive technological stance towards China, particularly in strategic sectors such as semiconductors, artificial intelligence, and quantum technology. This could lead to further restrictions on China's access to cutting-edge technologies, with expanded export controls and tighter investment limitations. In response, China has significantly ramped up support for key technology industries. A notable move came during the 20th Central Committee’s Third Plenary Session, which outlined ambitious goals for the nation’s technology industry. Key to this strategy are the concepts of "New Quality Productive Forces" and a "Comprehensive Innovation System," which emphasizes the integration of educational, scientific, and technological talent. This framework has prompted China to introduce a series of incremental policies designed to secure investment in technology, foster industrial innovation, and expand foreign investment opportunities.

Driving digital transformation and future industry growth

At the heart of China's industrial policy is a commitment to supply-side structural reform. The government is set to optimize mechanisms that facilitate the fusion of digital and real economies. This entails transforming traditional manufacturing into smart and service-oriented sectors, enhancing value across industries.

Moreover, to cultivate future growth areas, China plans to establish special funds and offer R&D subsidies while streamlining market access requirements. Key sectors targeted for development include energy conservation, environmental protection, biotechnology, new materials, new energy, artificial intelligence, and quantum technology.

Financial prudence for technological sovereignty

To bolster scientific advancement, the Chinese government is implementing strict controls on general expenditure. This includes the issuance of ultra-long-term treasury bonds to enhance national strategic and security capabilities, coupled with localized special-purpose bonds to strengthen key industries. A significant focus will be placed on independent and controllable technology, particularly in critical "chokepoint" areas, as well as fostering collaboration across the industrial chain.

Cultivating high-quality talent

Recognizing the need for skilled personnel, China is set to enhance its talent cultivation system, aligning resources to boost investment in skills training for emerging sectors. This initiative aims to utilize public training bases and promote industry-education integration. To retain high-quality talent, the country will implement a comprehensive incentive mechanism designed to foster and encourage creativity and provide opportunities for personal development. Efforts will also be intensified to attract talents from both domestic and international institutions through collaborative programs.

Sectoral opportunities ahead

As these policies unfold, both traditional and emerging industries are poised for growth.

Traditional industries:

- In the traditional sectors, digital transformation is accelerating, with investments directed toward enhancing digital infrastructure and services. This transition is expected to boost production efficiency and elevate industrial standards.

Emerging industries:

- Artificial Intelligence are on the cusp of significant expansion. With supportive policies and technological advancements, AI is projected to see increased global engagement, particularly in intelligent terminals and large-scale models, with applications spanning various fields including enterprise management and education.

- The low-altitude economy is also gaining traction, driven by technological advancements and an expanding application base. With an estimated value exceeding RMB500 billion in 2023, projections suggest this sector could reach RMB2 trillion by 2030.

- Meanwhile, the integrated circuits industry is shifting towards a self-sufficient supply chain, backed by intensified policy support and talent cultivation programs aimed at enhancing independent R&D capabilities.

- In terms of data and network security, the government is strengthening regulatory frameworks across departments, promoting a coordinated approach to ensure safe and compliant data usage — a crucial factor in fostering innovation.

Future industries:

- Looking ahead, the satellite internet industry represents a burgeoning frontier. As a novel communication technology, it is set to undergo significant R&D and practical application, especially in aerospace. Market estimates indicate that the satellite internet sector in China could reach RMB40.4 billion in 2024, climbing to RMB44.7 billion by 2025, with a compound annual growth rate of 11% over the next decade.

- Finally, quantum technology is emerging as a pivotal area for economic growth. With ongoing technological advances and a maturing industrial ecosystem, it holds the promise of creating new industrial sectors and driving substantial economic opportunities.

As China navigates these ambitious reforms, the technology landscape stands poised for transformation, potentially reshaping its industrial future.

Government & Public Services

Special-purpose bonds: promoting growth while reducing risks

In recent years, the scale of additional special-purpose bonds issued by local governments has steadily approached RMB4 trillion per annum. Special-purpose bonds were aimed at providing local governments with the necessary financial resources and policy space to focus on driving development and safeguarding people's livelihoods. At the press conference held by the State Council Information Office on October 12, the Ministry of Finance revealed that the 2024 annual quota for additional local government special-purpose bonds is set at RMB3.9 trillion, the largest amount ever. By the end of September, local governments had issued RMB3.6 trillion of special-purpose bonds, accounting for 92.5% of the annual quota. Next, the Ministry of Finance will do research on expanding the scope of use for special-purpose bonds to maintain government's investment efforts and pace, while reasonably lowering costs of financing.

Slow issuance of local government bonds has caused slow government investment in the first half of the year

Since Q4 2023 when the comprehensive debt risk resolution policies were implemented, part of the additional special-purpose bonds have been employed in existing government investment projects refinancing and existing debt resolution, showing that local governments are striving to achieve a balance between debt risk resolution and growth promotion. Local governments have been engaged in debt risks resolution efforts through the issuance of special refinancing bonds, participation by financial institutions in debt swaps and the revitalization of state-owned assets. Such efforts have inevitably led to a "passive contraction" in local fiscal expenditure. The growth rate of infrastructure investment from January to August 2024 was 4.4%, 2.0 percentage points lower than the same period last year. Twelve provinces with heavy debt burdens have even suspended their spending on infrastructure construction. The GDP and fixed asset investment growth rates of those provinces in the first half of the year were lower than those of other provinces, reflecting the negative impact of risk resolution pressure on local investment.

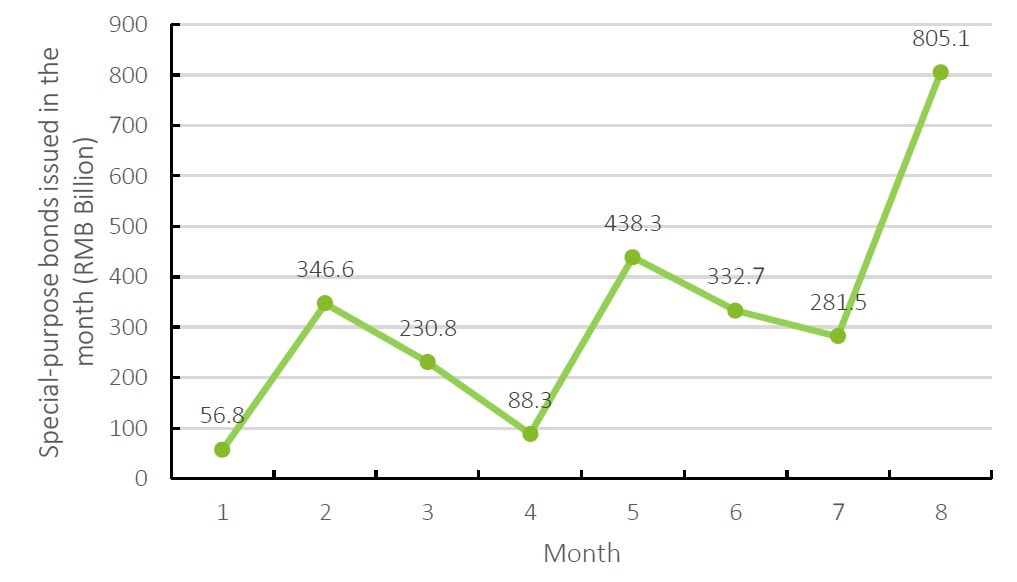

Figure: Special-purpose bonds issuance in 2024 (RMB Billion)

Source: Official website of the Ministry of Finance

Local government bonds issuance accelerated after the Third Plenary Session

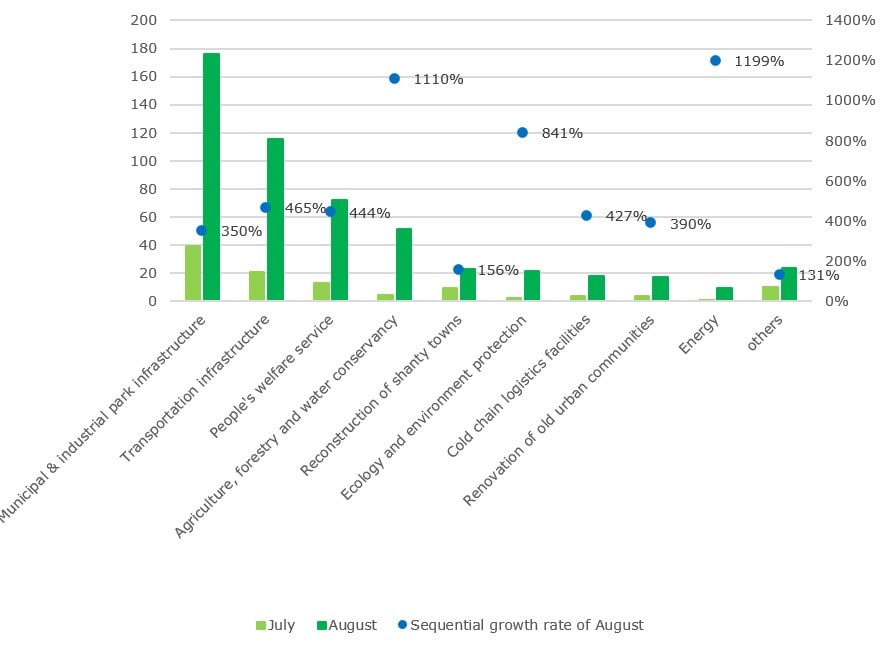

The Third Plenary Session of the 20th CPC Central Committee pointed out that it is necessary to reasonably expand the scope of support for local government special-purpose bonds, and appropriately expand the areas, scale and proportion of special-purpose bonds used as capital fund. In August, the plenary meeting of the State Council further clarified that it is necessary to foster stable economic growth by expanding investment, give full play to the leading role of government investment, and leverage broader social investment. In the same month, RMB805.1 billion of special-purpose bonds were issued, recording the highest monthly issuance since the second half of 2022. The sequential growth rate of investment in energy was significant, so was the growth rate of agriculture, forestry and water conservancy. While the investment in municipal & industrial park infrastructure, as well as transportation infrastructure has increased remarkably.

Figure: Usage of funds raised by special-purpose bonds in July and August 2024 (RMB Billion)

Source: Wind, Golden Credit Rating

Source: Wind, Golden Credit Rating

It is worth noting that policy makers are thinking about supporting local governments utilizing special-purpose bonds to reclaim idle lands that meet certain criteria. The Ministry of Natural Resources has already issued a document, clarifying that special-purpose bonds can be used for the reclaiming of land for affordable housing. At the end of September, the central bank also said that it would consider the financial support policy for qualified firms to purchase undeveloped land held by real estate enterprises in a market-based approach and provide re-lending support if necessary. This will help accelerate the pace of acquisition of idle land in the fourth quarter and next year, promote the "destocking" of the land market, and promote the balance between supply and demand in the real estate market.

Establish a long-term debt mechanism, make economic growth stable and mitigate risks

In recent years, the scale of special-purpose bonds has expand rapidly, but with the low efficiency of economic operation and the gradual saturation of traditional infrastructure fields, the issue of insufficient reserve of high-quality projects for special-purpose bonds has emerged, and the illegal use of bonds has led to heavy debt burdens for local governments. The fiscal policy makers must figure out how to keep debt risks under control while keeping special-purpose bonds in support of stable economic growth and counter-cyclical adjustment.

The country is exploring a series of new measures to optimize the management and use of special-purpose bonds. The National Development and Reform Commission (NDRC) said it will introduce a series of measures to make full use of local government special-purpose bonds, including expanding the scope of use for special-purpose bonds reasonably and improving the speed of approval. At the same time, it is also necessary to strengthen the supervision of the use of funds, improve the quality of special-purpose bonds projects, and avoid debt repayment risks in the future.

On Nov. 8th, Chinese lawmakers have approved a State Council bill on raising the ceiling on local government debt by 6 trillion yuan (about $840 billion) to replace existing hidden debts, which is “the most substantial debt resolution support policy introduced in recent years”. By issuing government bonds with lower interest rates and longer periods to replace debts with high financial costs and shorter periods, the local governments can reduce their interest expenses, and there will regain their ability for expenditure more quickly to help expand investment, promote consumption, and ensure people's welfare.

Sun Xiaoxia, former director of the Department of Finance of the Ministry of Finance, pointed out that debt risk resolution is not to eliminate debt, but to make it sustainable, and it is necessary to appropriately deal with the relationship between debt risk resolution and promoting growth. As local debt risks continue to be mitigated, local governments need to think about ways to build a long-term debt mechanism, seek sustainable debt development, and maximize the role of fiscal policy in promoting local economic growth.