This article is a content of “Japan Incentive Insights”, a search service for preferential tax systems and subsidies in Japan. The information in this article is based on the data as of November 20, 2024, and may differ from the most recent information.

Japan Incentive Insights : Strategic Domestic Production Promotion Tax Incentive

1. Overview

(Note: This article was created in August 2024, and the necessary ordinances and notifications for the operation of the incentive have not yet been published. Information will be updated as soon as the relevant regulations are released.)

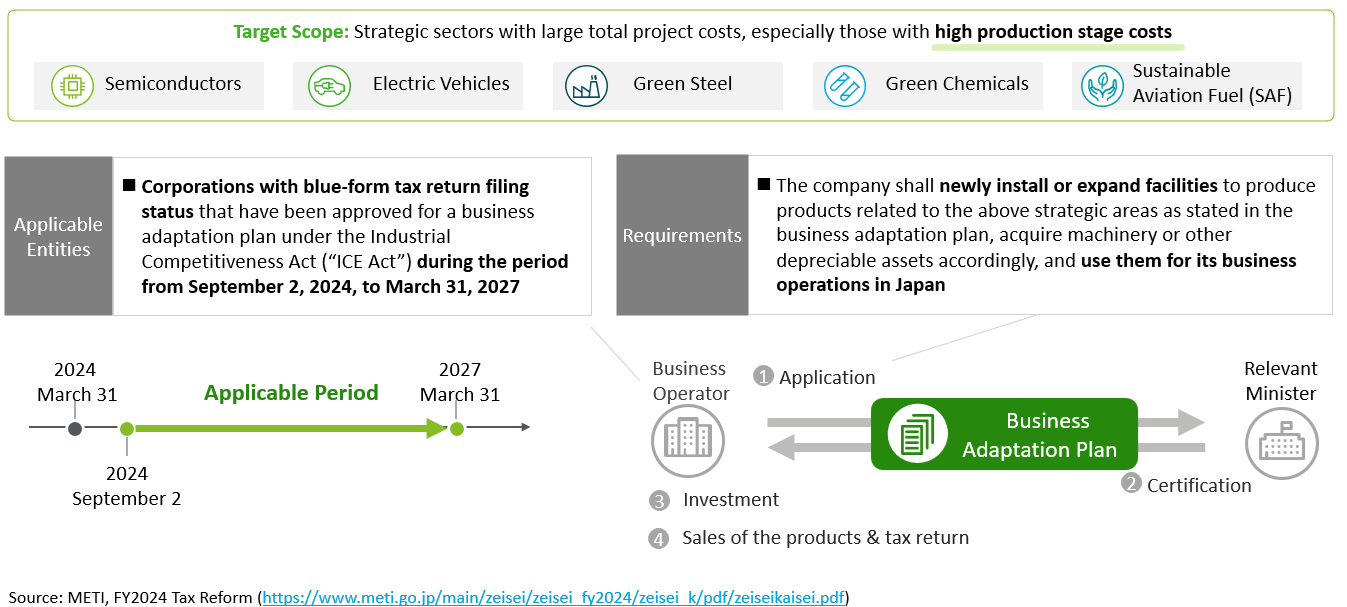

In regions including Europe and America, industrial policies aimed at robustly promoting domestic investments in strategic areas such as Green Transformation (GX), Digital Transformation (DX), and economic security are becoming increasingly active. The Strategic Domestic Production Promotion Tax Incentive targets sectors where, due to high production costs and other factors, business profitability is not easily foreseeable for private companies, making investment decisions challenging. This incentive introduces tax deductions based on production and sales volumes to stimulate new domestic investments by companies.

2. Eligible Sectors

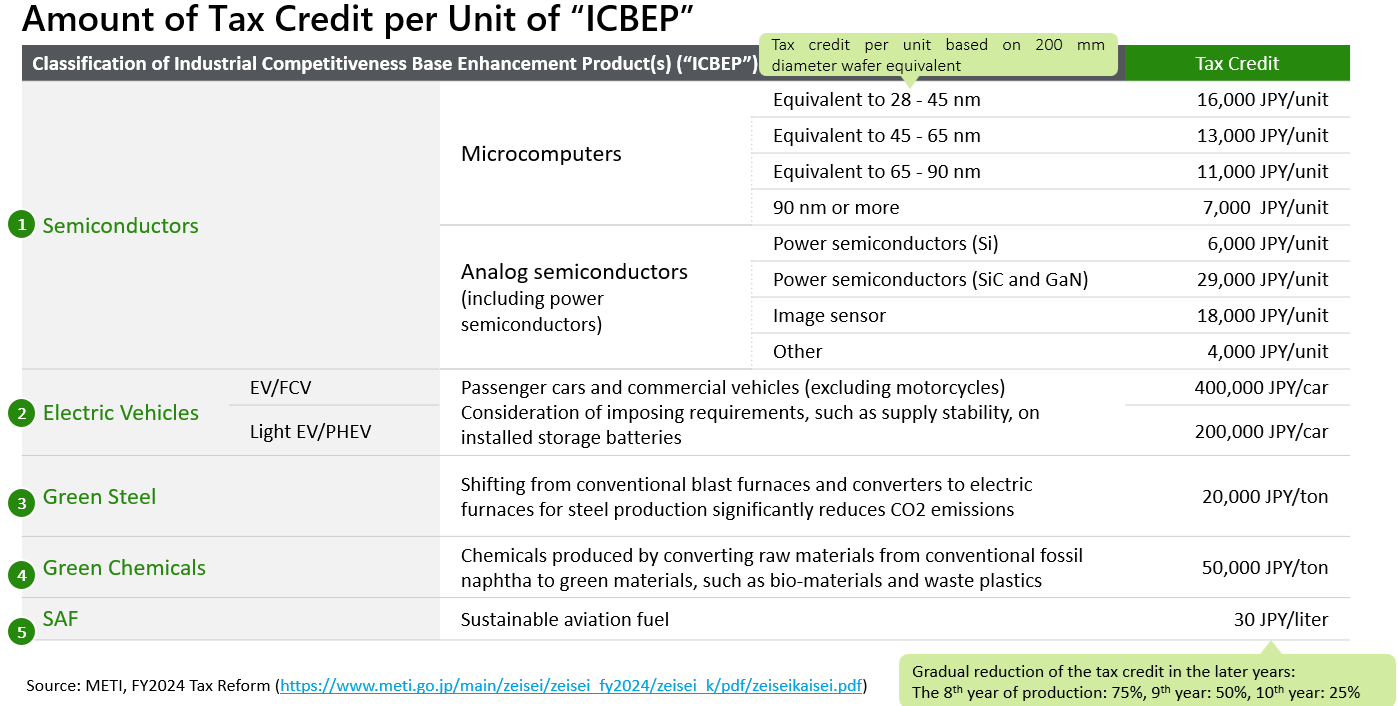

Companies manufacturing the following final products are eligible for tax deductions based on the sales volume of their products:

(1)Semiconductors (microcontrollers and analog devices)

(2)Electric vehicles (EVs)

(3)Steel (green steel)

(4)Basic chemicals (green chemicals)

(5)Aviation fuel (SAF)

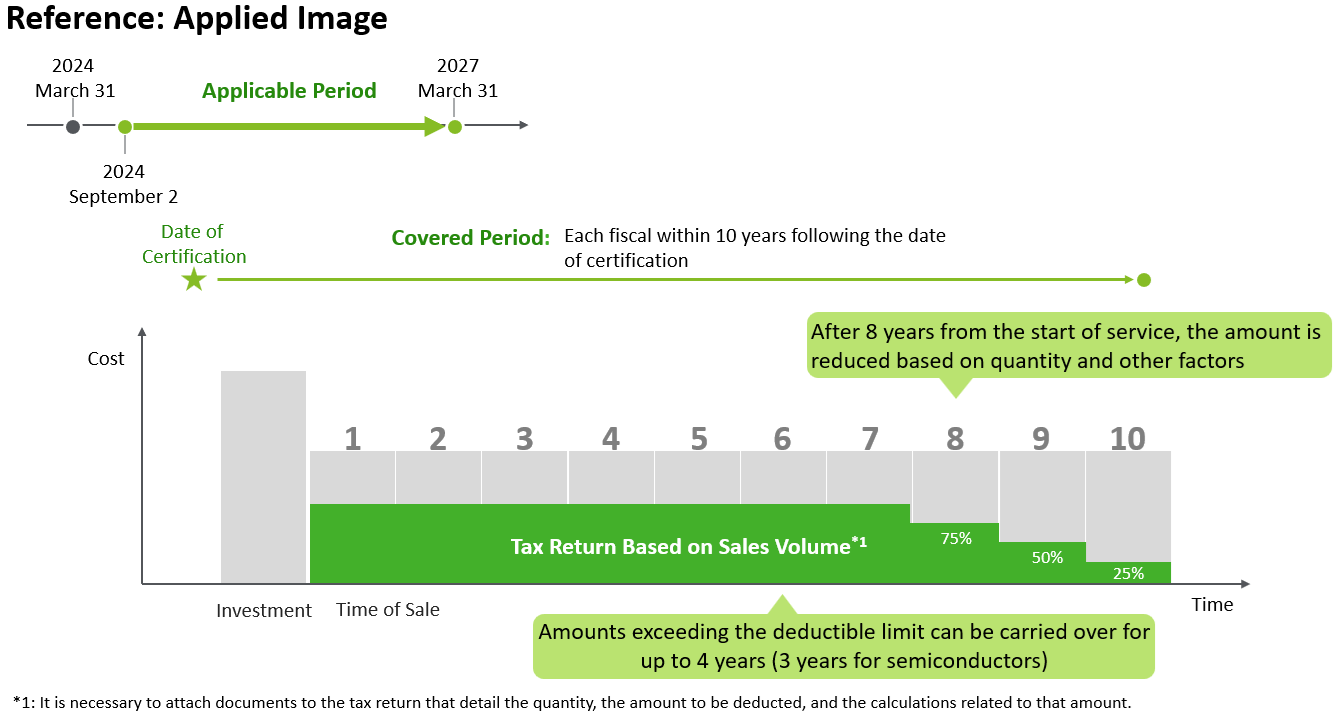

The measure includes a notably long-term provision of ten years from the date of plan certification, with a carryover period for tax deductions spanning four years (three years for semiconductors).

3. Preparation for Application

As previously mentioned, this tax incentive is currently in a state where the necessary ordinances and notifications for its operation have not been published (expected to be legislated by fall 2024). Information will be updated sequentially following the publication of the relevant regulations.

If you are considering applying for this tax incentive, please consult with Deloitte Touche Tohmatsu for guidance.

Related Links

- Japan Tax & Legal Inbound podcast/webcast Series

- Dbriefs Podcasts

- Apple Podcast - Deloitte Dbriefs Asia Pacific

- tax@hand

Dbriefs Asia Pacific SNS & Video

Facebook | Twitter / X | LinkedIn | YouTube