Perspectives

The Deloitte Research Monthly Report

Issue XXIII

21 February 2017

Economy

The perils of protectionism and deflating bubbles

January’s trade data was a pleasant surprise. Not only does the trade surplus remain high ($51.4bn in Jan 2017, albeit a reduction of almost 10% yoy) but also both exports and imports have rebounded strongly (values of exports and imports have gained 7.9% and 16.7% yoy respectively) -- proof of the continuing resilience of the Chinese economy (we have highlighted the significance of a sharply rising PPI on enterprise profits in previous issues of the Monthly). This strong performance on the trade front validates our hypothesis (which seemed counter-intuitive at the time) that regional trade could provide some positive surprises in 2017. Our upbeat view on regional trade has rested on two arguments – 1) regional governments in Asia are supporting trade liberalization and integration; 2) certain trade related leading indicators (e.g. activities of containers and ports in emerging Asian economies and China) have shown signs of recovery since last summer. China’s trade surplus is also bolstered by the RMB exchange rate adjustment of 6.3% depreciation against the dollar which took place in 2016.

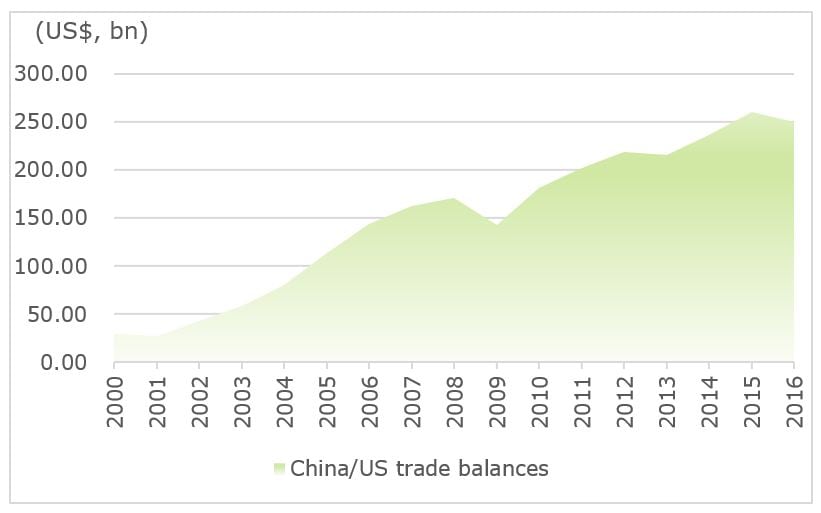

Such a large trade surplus, however, has had some unfortunate political consequences, making trade imbalances between China and the US a sticking point ($250bn in 2016, accounting for more than half of the total trade deficit of the US that year) in the China-USA relationship. We are not of the view that there will be a full-blown trade war between the two largest economies in the world but we do recognize the risk of a certain significant trade “friction” that is bound to arise as top leaders in both countries become more assertive. Already several leading domestic think-tanks in China have highlighted “external risks” (a euphemistic reference to the evolving and complicated Sino-US relation) as the top challenge this year.

Chart: trade imbalances between China and the US

So far, a number of countries (Mexico, Japan, Germany and China) have been singled out by the US on trade imbalances. Mexico has taken the brunt of the US criticism so far resulting in the peso plunging by 15.8% since last November. But China is no Mexico -- for several reasons. First of all, it is easier for the US to put pressure on countries that are smaller than them and who tend to benefit more from freer trade. Second, it is a well-known fact that China’s large trade surplus with the US also reflects a complicated global supply chain which benefits many US companies (Apple is a primary example) far more than China itself in terms of value creation. Third, it is almost certain that China would resort to tit-for-tat type retaliation should the US actually start a trade war, i.e. make a sweeping increase in tariffs against Chinese imports. In addition, it is inconceivable for the US to accuse China of currency manipulation because China has been trying extremely hard to push the RMB exchange rate higher for over a year, even at the cost of halting the RMB’s internationalization and hurting domestic trading companies who rely on trade finance facilities. Indeed, certain measures taken by the State Administration of Foreign Exchange (SAFE) which are aimed at preventing firms from hoarding dollars have gone far beyond capital account restrictions. For example, the Chinese Government has rolled out measures for the authentication of external trade and stepped up window guidance on dividend repatriations by multinational corporations. These administrative measures even involve restrictions on current accounts which were supposedly fully liberalized as early as 1996. If the chief objective of the Trump administration is to “bring back jobs to America” and substantially narrow the bilateral trade deficit with China, the mechanism cannot be a simplistic repeat of the 1985 Plaza Accord which resulted in a rapidly appreciating Japanese Yen. A much stronger RMB would have a devastating effect on the Chinese economy which though quite resilient is still far from being a balanced one.

In our view, the Chinese economy is unlikely to suffer a hard landing, or a drastic slowdown in 2017, but a few challenges such as de-leveraging and maintaining financial sector stability loom large. Structural reform would not have proceeded smoothly without a concomitant monetary easing. Favorable liquidity is like anesthesia given to a patient who is undergoing surgery. In other words, certain non-performing assets could only be turned around through reflation or inflation and economic growth. But as China is stabilizing the RMB exchange rate by allowing its reserves ($2.99trn by January 2017, down 7.2% from a year ago) to run down and tightening capital controls, liquidity conditions are worsening. Meanwhile, as policymakers are carefully deflating bubbles (please refer to the article on finance in this issue of the monthly), a stable exchange rate is being seen as a precondition of confidence. The latest development in the continuing saga of deflating bubbles is that the Government has announced a series of policies cutting off trust products from real estate financing in 16 cities (Beijing, Shanghai, Guangzhou, Xiamen, Nanjing and Fuzhou, etc.) where property markets are seen to be overheating. The rationale is that the bulk of such trust products originated from bank loans but have been subsequently repackaged. Regulators clearly view such “regulatory arbitrages” as reckless risk taking behavior which will undermine China’s financial stability. The policy responses from the PBOC are basically of the ‘credit tightening without resorting to outright interest rate hikes’ type. In theory, the current economic conditions in China call for a more accommodative monetary policy (meaning lower interest and a cheaper RMB), but in practice this is less feasible due to domestic and international constraints. That said, China’s efforts of stabilizing the RMB which are consistent with President Xi’s articulation that “globalization has powered global growth and capital, advances in science, technology, and civilization, and interactions among people”, have put China on the high moral ground internationally. But this is a dangerous position for China to hold. The bottom line is that it would be fundamentally against China’s economic interests for the RMB exchange rate to be set at an artificially over-valued level and therefore China must not succumb to pressure from the US.

On the other hand, there are several measures that China could initiate to achieve a substantial reduction in the trade imbalance between China and the US. This could be achieved by greater US exports to China or less Chinese exports to the US or both. From China’s perspective, the US has long blocked exports of its high-tech products to China. From the US’s perspective, China has not opened up its domestic market adequately to American companies (e.g., healthcare, financial services and entertainment) and has not lived up to its pre-WTO promises. Under the Trump Administration, we are unlikely to see an increase in exports of US high-tech to China if the latter does not significantly improve market access. Moreover, the US could argue that China should at least be reciprocal in terms of giving US Internet companies more access to the domestic market.

So what are China’s bargaining chips? The trump Administration’s swift withdrawal from the TPP indicates its lack of interest in multi-lateral trade pacts. The RCEP which is being championed by China, though it may gain acceptance some by some emerging Asian economies, will have little appeal to the US. Can China help the US with President Trump’s much-trumpeted infrastructure spending program? The answer is resounding yes. According to Patricia Buckley, our US economist, there will be a federal infrastructure spending program but no specific details of the spending program have yet been announced. Though such a spending program would spur economic growth (she sees US trend growth rate of slightly above 2%), the money for this ambitious program is still to be found. It would make economic sense for the US to have China fund a part of such an infrastructure program. It also makes economic and geopolitical sense for China to engage US companies in some of its belt-and-road related infrastructure projects as a trust-building effort. At present these projects are being undertaken in the typical Chinese way of “learning by doing and doing by learning”. Sharing resources, technology and know-how for building infrastructure might well prove to be a ‘win-win’ situation for both parties. However, collaborations between China and the US on infrastructure spending (in both the US and emerging economies) cannot be expected to yield dividends in the short run. So for the Trump Administration which is looking for quick wins, China’s market access is indeed the most important bargaining chip.

In conclusion, China will be better off if she gives up certain economic goals such as a GDP growth rate of 6.5% or a certain threshold of foreign exchange reserves when the labor market is relatively tight. (Please refer to our January 2017 issue entitled ‘Time to remove certain policy objectives’ where we argue that China could live with a GDP growth rate lower than “around 6.5%” and does not have to stick to a certain threshold of foreign reserves ($3trn of reserves are enough for paying off 18 months of imports). The reality is that the external constraint (mainly from the US) has inevitably put China in the category of “trade surplus countries”, meaning that trade frictions will not vanish, and these will in turn exacerbate capital outflows. The best policy response for China to mitigate such “imbalances” is a meaningful market access which could also reignite reform momentum within the country.

Financial Services

Would PBOC’s targeted tightening prick property “bubble”?

In Q1 2017, PBOC will officially include off-balance sheet Wealth Management Products (WMPs) in the Broad Credit Loans category under the MPA (Macro Prudential Assessment) system of risk assessment. In other words, the growth of Broad Credit Loans is not allowed to exceed the M2 growth rate by more than a certain number of percentage points. As banks need to consider the allocation of each part in the Broad Credit Loans category which includes loans, bond investment, equity investment, reverse repurchase agreements and off-balance sheet WPMs, PBOC’s move signals the end of an era for the small- and medium-sized banks which have been relying on WPMs for business expansion. This will slow down the growth of off-balance sheet financing and outsourcing by banks which entrust WPMs to external professional managers for growth. Additionally, the bond market into which WPMs have been mostly invested, also faces adjustment. Along with arbitrage channels tightened and PBOC's raising interest rates, capital chains in Real Estate (RE) industry would face ordeals.

Inclusion of off-balance sheet financing in Broad Credit Loans category under MPA leads to slower growth of WMPs and strict capital chains in RE industry.

Since off-balance sheet financing (non-breakeven) is not reflected on the balance sheet or not subject to the withdrawal of risk capital and/or provision thereof, banks can make money by issuing WMPs, which are then entrusted to external management parties to invest in bonds and other non-standard assets for arbitrage profits by means of leverage and term mismatch.

In recent years, WMPs have shown very rapid growth. Funding for WMPs in 2014, 2015 and 2016Q2 skyrocketed 47%, 56% and 42% respectively compared to the corresponding period of the previous years. Now, their growth shows signs of a slowdown. As of the end of October 2016 when controls were officially implemented on off-balance sheet financing, there was a deluge of fund redemptions as the bond market came under tremendous pressure. And along with "on behalf of holders" issues, market confidence bombed and liquidity dried up. This made bond markets plunge. Only when PBOC injected liquidity did the bond market stabilise.

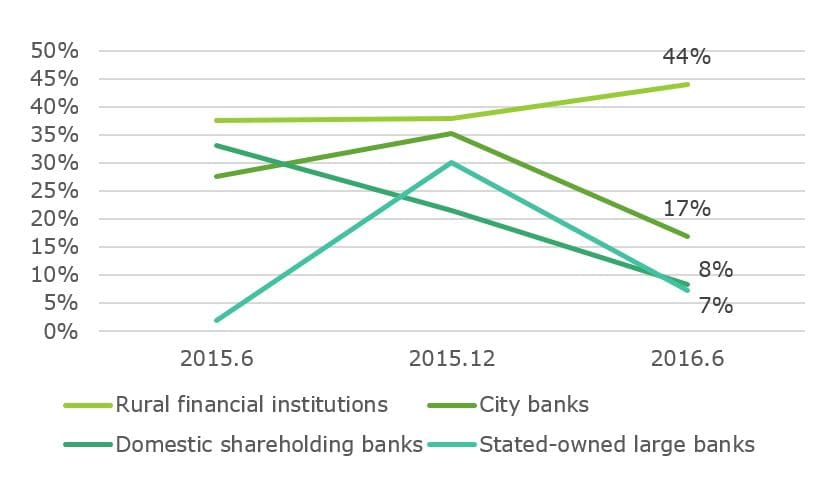

Chart: growth of funds for WMPs

- Growth of WMPs will decelerate in the long run, with small and medium-sized banks bearing the brunt of the impact. Capital chains in RE industry would face ordeals due to financing channels' tightened up. Currently, the growth of WMP at large banks has slowed down but not at small and medium-sized banks, which continue to ramp up at a fast pace. But, the time for such banks to expand their scale by offering WMPs to their clients is coming to an end. At present and in the future it will be increasingly difficult to resort to off balance sheet financial channels for arbitrage opportunities. Also, the capital chains of RE companies which have financed by WMPs for properties development would face ordeals. This may "Force" RE companies to adjust prices and marketing strategies, and commercial banks should actively de-leverage to let off-balance sheet financing return to the essence of entrusted asset management. Hence, we suggest commercial banks enhance competitiveness, identify their own business models and market strategies, differente operations based on local market conditions and requirements as well as customer needs, innovate products, and improve processes and services to attract and retain customers.

Chart: growth rate of bank funding for WMPs from 2015 to 2016H1

- In the long run, arbitrage will give way to the start of multi-faceted investments, with particular focus on active management or investment scope expansion. Within the limited increase in the Broad Credit Loans category, banks should prioritize allocation to credit and non-standard assets which generate relatively sizable returns. As growth of WMPs and outsourcing business will fall sharply, coupled with the adjustment pressure faced by the bond market, it is going to be much tougher to generate considerable returns from investments, putting the capabilities of investment managers to test.

PBOC adjusted Interest Rate Corridor, by increasing funding costs, will keep rapid credit growth and financial leverage under control to prevent banks taking financial risks.

Medium-term Lending Facility (MLF) and Standing Lending Facility (SLF) are two kinds of interest charged by PBOC when lending money to commercial banks. Right before and after the Chinese New Year, PBOC increased the rates for MLF (10bps for 6-month and 1-year durations), Reverse Repo (10bps for 7-day, 14-day, and 28-day durations, respectively) and SLF (35bp for overnight rate, 10bps for 7-day and 1-month durations, respectively). This move was generally viewed as a signal that the PBOC is bent on slowing down credit growth, cracking down on regulatory arbitrage opportunities and keeping financial leverage under control.

- RE loan volume will fall on a year-on-year basis and funds will be redirected to industry and large infrastructure projects (PPPs).

The raising of interest rates by PBOC on capital markets signals the risk of a marked increase in real estate interest. If rates continue to rise, coupled with regulatory rules implemented by local governments in some municipalities since October 2016, the easy credit environment will fast disappear. As a result, RE companies are faced with a new bout of credit tightening. On an annual comparison basis, it is estimated that RE loans will fall in 2017. A CICC research report said “investment requirement will be driven by industry profit improvement and there will be much follow-up funding needs for infrastructure projects.” - Credit loans in RMB decreased RMB475.1 billion in January 2017 and PBOC begins to use "window guidance" to adjust credit lending.

All in all, finance investment was vigorous in 2016 with the total increment reaching a historic high of RMB17.8 trillion. Traditionally, January marks the peak for credit launching and PBOC has just published that the increment amount in January 2017 was RMB2.03 trillion, less than the record figure of RMB2.54 trillion in January 2016. Thus, recently, PBOC has made a requirement that some banks launch full-court press to reduce newly-added credit and report loan requests (both private and corporate) one month in advance. Only consumption loans can be issued on time. This may have a negative impact on banks' profit. In view of the stringent approval requirement for mortgage loans, we believe consumption loans and P2P lending may ramp up on a sustained basis. - Neutral to negative impact on banks. Raising policy interest rates will raise funding cost for banks, along with credit lending controlled, which means interest margin narrowing with negative impact on both net interest margin and profit. However, by financial deleveraging, rising interest rate is helpful in lowering overall macro financial risk, creating a stable financial environment which will force banks to lend prudently.

Energy

Would coal price’s rebound be sustainable?

Coal prices rallied substantially last year and it came as a huge surprise. Since China introduced rules to curb coal production, the price of coal shot up from 300 yuan per ton at the beginning of 2016 to 700 yuan per ton in the fourth quarter. Price of coking coal soared from 580 yuan per ton in January to 1,800 yuan per ton in December. In the meantime, China's total coal output dropped 9.4% to 3.3 billion tons in 2016 while imports have increased 25% to 255 million tons.

In November 2016, to allow the struggling mines to take advantage of the rising prices and taking into consideration the higher demand for coal in winter China relaxed the curb on coal mine operating hours. However, we believe it will switch back to a tight production control to stabilize the price once winter ends. There are a few important reasons for this.

First, the gains that came from the increased demand have slowly faded as domestic mines ramped up production, putting pressure on prices both inside and outside the country. Thermal coal prices at Qinhuangdao port retreated to 590 yuan per ton in January. Similarly, Australian coking coal prices dropped to USD168 per tonne in January 2017 from a peak of USD273 per tonne in December 2016. China has to resort to a strict production cut to prevent these prices from falling further.

Chart: China and Australia Coal Prices Rally

Note: China coal price is China Qinhuangdao Port Thermal Coal 5500kcal/kg & Australia coal price refers to F.O.B. piers, Newcastle/Port Kembla prices.

Secondly, overcapacity of China's coal industry is estimated at about 1.7 billion tons, so capacity reduction continues to be a key issue for China's coal sector. The Chinese government is aiming to reduce coal production capacity by 300 million tons per year by 2020. A sudden collapse of the coal industry will not just threaten the mining companies but also banks which are the biggest creditors of China’s coal mines.

Additionally, as a sign that China will stick to strict production cuts to stabilize coal prices, Yancoal Australia, a subsidiary of China's state-owned Yanzhou Coal Minning, agreed to acquire Rio Tinto's Australian unit Coal & Allied Industries for up to USD2.45 billion. After completion of the deal, Yancoal Australia will be Australia's largest pure-play coal producer. The acquired coal mines have an annual output of 35 million tonnes, which is mainly exported to Japan and South Korea.

Under the expectation of tightening policy, many institutions and coal companies predicted that the average price of thermal coal price this year will be about 550 yuan per ton. We expect that the coal price will remain relative high in the first half of 2017 and gradually decline in the second half of the year. However, as the control policy is in place, the price will not fall sharply. In summer and winter when coal demand peaks, coal prices may rebound but will not once again staged a "roller coaster".

Automotive

China’s efforts to jump-start crippled used-car market

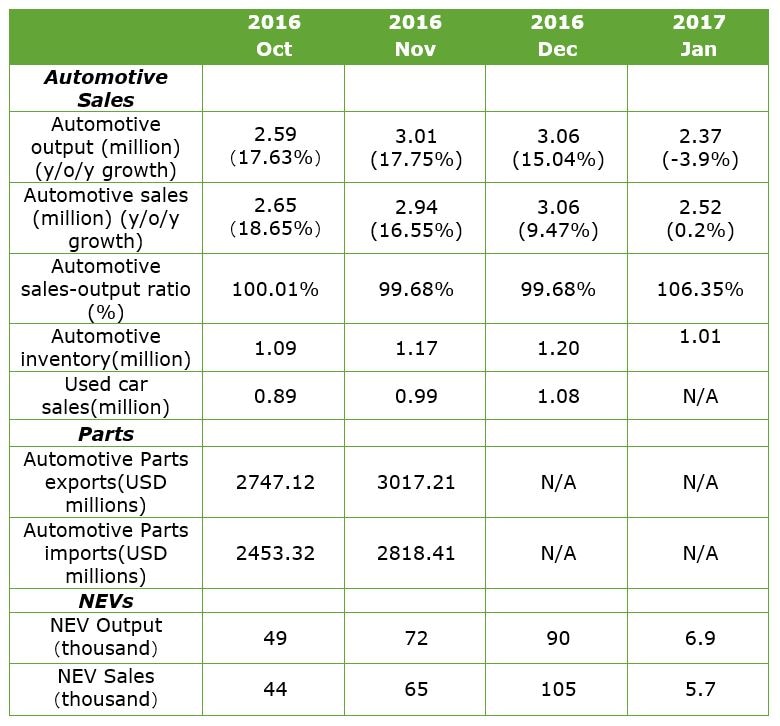

- China auto sales edged up 0.2% in January

China’s auto market started 2017 with a downward note as data from CAAM showed that a total of 2.52 million cars were sold in January, merely up 0.2% y/oy. Vehicle output dropped 3.9% y/o/y to 2.37 million. The reduced tax cut along with the new year holiday have weighed heavily on passenger vehicle market which declined 1.1% y/o/y in January. SUV sales growth hit a record low, with an unexpected 10% y/oy. MPV sales plunged more than 20%. In sharp contrast to the slowdown in PV market, sales of commercial vehicle jumped 11.3%.

With demand cooled, inventories piled up with the Vehicle Inventory Alert Index hitting 61.5% in January, 18.6 ppt higher than last month. CADA blamed the new 7.5% purchase tax rate as well as the advance purchases during the last few months of 2016 for this build-up in inventories. But it also warned that the stockpile would get worse not better in the short run as there were fewer working days in February.

- China lifts red-tape to boost its crippled used car market

On January 23, Ministry of Commerce and Ministry of Environmental Protection issued a joint policy guideline reiterating the urgent need for scrapping any restrictions that have been imposed by local municipal governments on the influx of used cars. This wasn't the first time Central regulatory bodies attempted to tackle the cumbersome used-car trading system in China. The State Council in March 2016 introduced a similar guideline which was implemented poorly at the municipal level. Beijing was the first city to impose restrictions on the influx of used-vehicles registered at National III or below emission standards — citing these polluting vehicles as one of the main culprits in the capital city’s air pollution problems. Numerous municipal cities (more than 300 cities up to now) followed suit, leaving used vehicles with lower emission standards with fewer and fewer places to go.

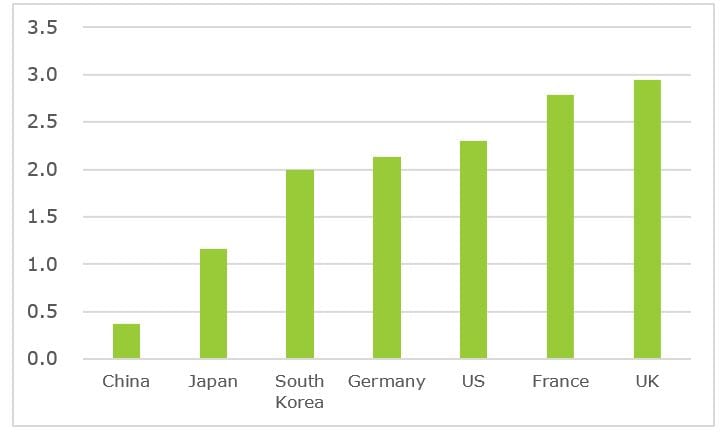

Chart: Used to new car sales ratio in China and several developed countries

China’s used car sales hit 10.39 million in 2016, an increase of 10.3% y/o/y. The ratio of used to new car sales in developed countries stands at an average of 2.0 whereas it is merely 0.37 in China. We expect used-car volume will reach 12.5 million in 2017 with the lift of restrictions nationwide. An efficient and steady used-car market not only will spur new car sales (trade-ins were the prevailing way to buy a new car in Beijing, Shanghai and other purchase restrictive cities), but can also encourage after-sales services including repair, parts, insurance and finance.

Education

Booming private education gets bolstered by asset-backed securities

On January 19, 2017, the State Council issued “The 13th Five-Year Plan for National Education Development” which focuses on three major themes - improving quality, optimizing structure and promoting fairness. Since late 2016, a series of national laws and policies have been introduced, which aim to promote the development of China's private education industry. In November 2016, the “China Private Education Promotion Law Amendment" was passed and it paved the way for private education, clarifying such thorny issues as the legal status of private schools vis-a-vis property ownership, thus opening up opportunities for the development of private schools.

A pattern of Asset-backed Securities (ABS) in the education industry is gradually emerging. On February 6 2017, the special plan of tuition trust beneficiary assets of Twenty-first Century International School was passed by the Shanghai Stock Exchange. This is the first ABS project of private education since the implementation of “China Private Education Promotion Law Amendment". The ABS project can help entities in private education expand their businesses with lower cost funding even if they have no plans to pursue a public offering or undergo corporate restructuring. As a result, many a private school’s asset liquidity has undergone substantive change. As far as Deloitte is concerned, such ABS projects should bring in more opportunities for company audit business.

There are more integration opportunities for private education companies and the capital market. On January 18, Yitong education announced that they had raised a total of 160 million yuan during the past three and a half years, and have now entered the stage of IPO counselling at the beginning of 2017. At the same time, Jiada Early Education, China Education Star, Huatu Education and some others submitted IPO applications in the past two years. With the gradual liberalization of education policy, potential IPO opportunities for current education companies on the New Third Board will undoubtedly continue to increase.

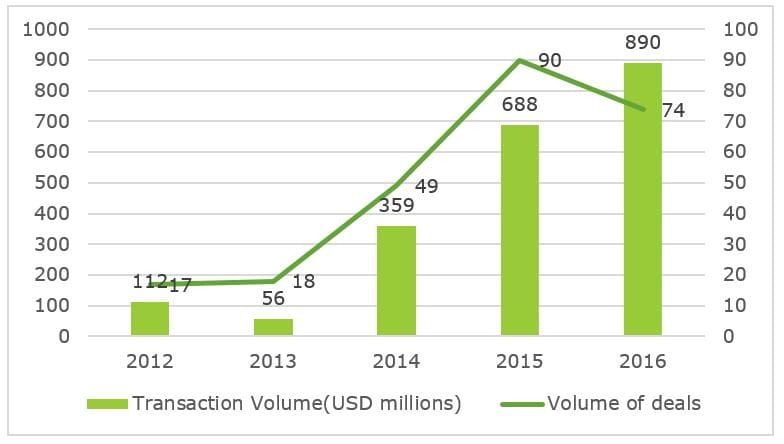

Educational services was still viewed as the most attractive industry for investment by private equities (PE) and venture capitals (VC). According to ChinaVenture’s statistics, 74 investment cases succeeded in the education industry in 2016 with total transactions valued at around US$890 million, a leap of 29% over the US$688 million recorded last year. In addition, the average value of the transaction skyrocketed by 57%. Nowadays, the education industry in China which still need adequate capital investment is undergoing profound change. Especially in the innovative integration of science and technology and education, there is a long way to go.

Chart: 2012-2016 VC/PE Investment Trend In China education market