Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue XXXIII

19 December 2017

Economy

How should China react to tax war?

US tax reform, which has been the most important factor in driving global financial markets over the past few months, is in its final sprint across the finishing line. The main feature of this is to lower the corporate tax rate from the existing 35% to 21%, so that from 2018 onwards many US MNCs will have added incentive to repatriate overseas funds.

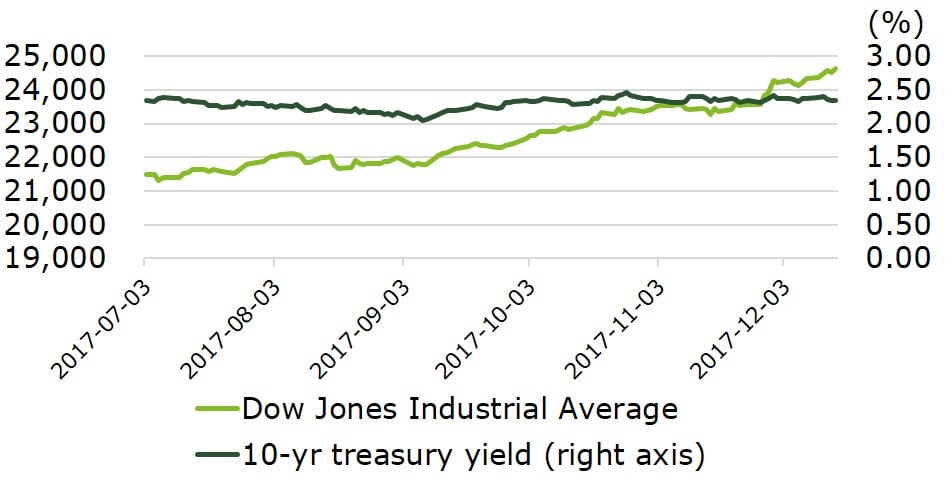

Reactions from the US stock market have been overwhelmingly positive although one might wonder if too much good news has been discounted (the market seems to downplay the adverse effect of a possible inflationary shock). Most investors have taken the view that meaningful reductions of corporate income tax will justify more elevated P/E multiples of large companies and spur economic growth. However, the credit market, or the treasury market, the most liquid market in the world, has been remarkably calm of late with a flattening yield curve, suggesting that investors also believe that the stimulus effect of tax cuts on the economy will be short-lived. In the medium term, a more plausible scenario is that either equity market or fixed income will sell off. But in the short run, the market is being determined by a highly bullish sentiment. Be that as it may, what is certain is that such tax cuts will nevertheless make the Fed's stance more hawkish ceteris paribus (the most recent FOMC meeting, which took place on Dec 12-13th, voted to lift the federal fund rate by 25bps to between 1.25% and 1.50%). Previously, we saw three interest rate hikes by the Fed in 2018. It is likely to be four times should President Trump sign the tax reform bill by the end of this month.

Chart: Equity market cheers tax cuts while credit market sees a recession risk

So what does this mean for China? Should China unveil its own tax cuts to undo some of the ill-effects of likely fund repatriations by the US multinational subsidiaries in China? The short answer is yes because in theory there are many areas in which taxes could be reduced and a benign inflationary outlook would warrant reduced fiscal revenues. But in practice, the situation in China is much more complicated. Many policymakers still hold the view that China's long-standing policy of a strong government (and by default, relatively high taxes) has made possible the kinds of mega projects (e.g., high-speed rails) which are unthinkable in most other countries. But, the unorthodox approach taken by President Trump "to get the job done" has managed to create shockwaves in China's policy circles. What if MNC subsidiaries massively repatriate funds to the US and worsen the business environment in China, in turn deterring future FDI? What if President Trump makes China a primary target of trade deficit reduction if higher investment in the US causes a widening trade deficit? Would closures of MNC factories result in social problems in China? Would the pressure from the US on bilateral trade deficit reduction remove China's policy leeway on the exchange rate? The list of questions goes on.

Chart:Tax rates may not be high but overall tax burden stands out in China

Based on several informal discussions with policymakers, it is clear that the upcoming tax overhaul in the US has indeed created a sense of urgency amongst policymakers in China. Thus the discussions on property tax and estate tax have quietly died out here. (Before the U.S. Congress passed the new tax bill, the Chinese Ministry of Finance demonstrated a semi-passive attitude toward estate tax. But now, against a backdrop of global competition to cut taxes, the idea no longer holds water.) Indeed, if China can't match the US on tax reductions, it can at least avoid any tax increases. According to some senior tax officials, there are a handful of low hanging fruits (taxes) that could easily be disposed of in China. For example, China could easily shorten the asset depreciation period. It could also correct certain distortions on tax rebates, such as incrementally phasing out the current system in which overpaid VAT is retained to offset future tax payables. Moreover, China could use its policy leverage to curb soaring labor costs by, for instance, lowering firms' social security contributions, and reducing the tax burden for companies investing abroad by streamlining foreign tax credit.

In terms of tax rate cuts, the likelihood seems slim because we simply do not see much impetus on this front. That said, we would like to highlight the fact that tax wars have most often been waged amongst developed countries. Indeed, Trump's tax cuts are likely to be replicated to an extent by rich countries and regions in any case. For example, Japan has indicated that it would lower corporate taxes (According to Nikkei, the Japanese government is considering rewarding businesses that increase wages and invest in productivity growth by offering tax breaks that could lower their effective tax rates to as low as 20% or so). The HKSAR Government has explicitly stated its intention of cutting taxes on the back of soaring asset markets. In general, developing countries do not have to resort to tax cuts in the name of supply-side reforms. Taking emerging Asia as an example, tax rates have not been an impediment to FDI. However, China's total tax rate of 67.3% as measured by World Bank's Doing Business 2017 report does suggest that there is immense room for China to reduce fees (e.g., social security contributions).

The issue is more about liberalizing certain sectors. In China, liberalization is playing an even more important role (e.g., financial and energy sectors) than in most emerging markets because key factor prices in China such as land, energy and capital are distorted due to the legacy of central planning. In addition, measures to improve the overall business environment such as reducing the burden of business operation (in particular, non-tax burdens or "institutional" costs including administrative inconsistencies which have long been a drain on private businesses) are expected to gain traction among entrepreneurs. From this perspective, China could do many things to improve the overall business environment without cutting taxes significantly (the latter is clearly more politically challenging). The most sensible policy move for China, with the aim of mitigating the adverse effects of US tax reform, is to provide some tax relief to those beset by higher environmental and labor costs. This is particularly true in sectors where environmental costs have risen sharply in recent years.

The impact of tax reform in the US will surely increase the likelihood of a more hawkish Fed. The credit market has priced 3 more rate hikes in 2018, but in our view, the Fed could strike 4 times for a very simple reason – synchronized recovery in OECD countries may well broaden to emerging markets. China, due to its policy priority of containing financial risk, clearly does not want to follow the Fed and there are more than enough signs suggesting that existing capital account restrictions might have outlived their usefulness as reserves have risen for 10 consecutive months now. In conclusion, China needs to have a comprehensive game plan in terms of policy responses to the tax reform in the US. If not, it could find itself in a difficult position as other countries are likely to follow suit with their own tax cuts or supply-side reforms.

Financial Services

Can foreign financial players create a "catfish effect"?

China’s status as the world’s second largest economy has meant that investors have been angling for a foothold in the Chinese financial market for a very long time, but restrictions on foreign ownership and the issuing of business licenses have made progress in this area extremely difficult. However, on November 10, in an historical announcement, the Chinese Government promised that they would ease restrictions on foreign ownership in the financial sector (banks, securities and fund, and insurance). This move came on the heels of a series of meetings in Beijing between the Chinese and US heads of state and opening up the financial sectors of both countries was just the consensus reached by two heads of state. Financial institutions, both inside and outside China, have been paying close attention to the opening-up of the Chinese financial sector and market sentiment is upbeat and investment plans are being drawn up.

What will be the effect of greater foreign participation?

Foreign participation in the financial sector will increase the pace of liberalization at the national level and further the internationalization of the RMB. At the industry level this will encourage foreign investors to deepen their long term value investment in the financial sectors. In other words, like catfish swimming into a tank of sardines, their arrival will create disruption and this disruption will galvanize local players into improving performance and providing better services. Thus the sector will become revitalized with the entrance of foreign institutional players.

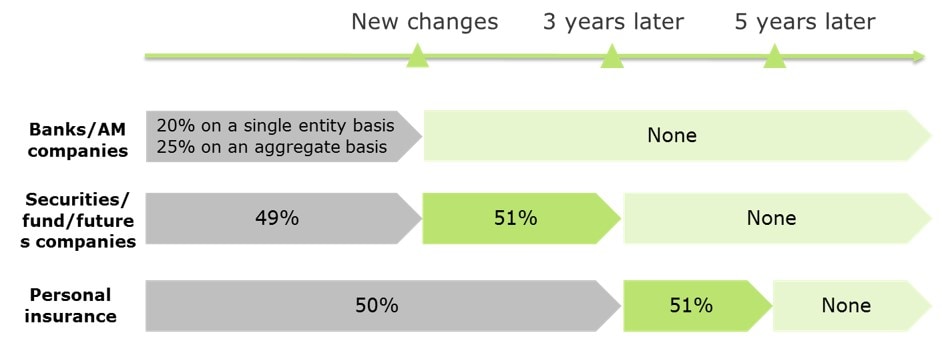

Chart: China will eliminate all foreign ownership limits after 5 years

US institutions could make up the majority of foreign players who are accelerating their strategic investment

From our perspective, the most immediate effect is that the new-round opening-up policy has stimulated the enthusiasm of foreign financial institutions in investing in the Chinese financial sector. Second, the timing of the announcement, right after the so-called “state visit-plus" of the US President Donald Trump, was viewed by many as a move that is actually and especially geared towards attracting US financial institutions.

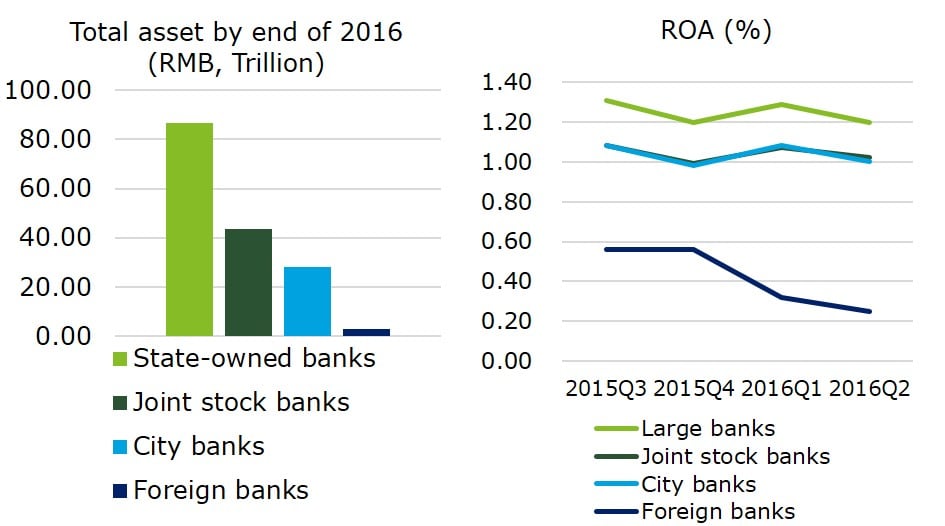

Currently foreign investors participate in the Chinese market mainly as financial investors due to ownership restrictions. While they may be profitable, they do not have the right to speak, or getting involved in decision-making or corporate governance processes. Therefore, most of them have not taken well to the Chinese market. In the three major areas within the financial sector – banking, securities and insurance - foreign entities are currently dwarfed by their domestic Chinese counterparts. Data disclosed recently by regulators reveals that the total asset ratio is around 1.3%-6.1% (foreign banks – 1.3% by end of 2016, joint venture securities – 4.5% by March 2017, and foreign insurance – 6.1% by July 2017).

Chart: Much lower level of total assets and returns of foreign banks

Due to constrains of asset scale, business licenses, small number of institutions and other factors, foreign players' have been unable to develop their businesses efficiently, and have low profit margins. With this new policy, well-known US institutions are likely to be the first groups to expand their investment in China's financial sector and become major players, taking on new roles of controlling shareholders or solely-owned institutions.

Thanks to the relatively lower barrier of entry, insurance could become the most promising industry for them as compared to banking, securities and fund industries. According to the Chinese regulator's data, China's insurance premium income in 2016 increased 27.5% on a YoY base to reach RMB3.1 trillion, taking it to second position in the world. Given the size of the Chinese population, there is great potential for development for foreign players in the life, health and pension insurance market in China.

Domestic financial institutions (smaller ones) will be the main beneficiaries

In fact, most foreign investors have not yet reached the ownership ceiling since they are not allowed to become controlling shareholders under the current policy environment and their investees tend mainly to be small and medium-sized companies in China.

In the banking sector, 8 of 25 A share listed banks have foreign institutional shareholders and 5 (of the 8) banks are city commercial banks. The highest foreign ownership remains at 20%, an investment made by Singapore’s OCBC (Overseas-Chinese Banking Corporation) in Ningbo Bank and HSBC holds 18.7% shares in BoCom (Bank of Communications).

In the securities sector, only Morgan Stanley’s ownership of its JV has reached the ceiling of 49% while UBS is working to raise its ownership holding from its current 25%. In the insurance sector, only AIA (American Insurance Assurance) has a wholly-owned subsidiary, thanks in large part to historical reasons. Most foreign ownership levels stand at between 25 and 50%.

Looking ahead, foreign institutions will likely break through the 50 percent ceiling to become controlling shareholders of many small- and medium-sized Chinese financial companies for the following reasons.

- Capital requirement. The amount of investment required in smaller companies is less than what is needed for large institutions.

- Smaller companies operate in a much more flexible manner and they are always in urgent need of capital.

- Foreign strategic investors can bring in advanced technology and management skills in addition to a considerable amount of capital. Hence they are well-positioned to help enhance capital adequacy level, drive financial innovation (such as Fintech applications) and improve risk management.

These are precisely what the Chinese regulatory authorities are anticipating from foreign investors, that is, to promote prosperity through competition, to reduce internal relevancy (due to the shareholdings of domestic Chinese investors) within the financial system through the deployment of diversified external capital, and to keep financial risk under control and prevent asset bubbles.

Will “catfish effect” be significant?

Mr. Zhou Xiaochuan, the governor of China’s central bank, has pointed out that "financial protection leads to laziness while financial restriction hurts competitiveness". To what degree can foreign capital exert the “catfish effect”? Can foreign players overcome the roadblocks in uncharted territories to compete and play with China's domestic institutions by receiving equal national treatment? Could the financial ecological environment be truly optimized in China?

On December 7, the IMF and the World Bank co-released the 2017 China Financial Sector Stability Assessment Report, which warned that China's NPL (non-performing loan) ratio is possibly underestimated, and there has been a rash of "moral hazard and excessive risk-taking" by the Government. This situation contradicts the spirit of financial liberalization and opening-up. The PBOC in its response, asserted that the underestimated possibility is less and that the Chinese financial system is still in fact quite resilient. But their assertion was belied by data which came out at the end of Q3 2017. It showed that Chinese domestic banks' NPL ratio stood at 1.51-1.76% with a provision coverage ratio at 173.43-216.20% while the NPL ratio of foreign banks in China was just 0.76% with their provision coverage ratio at up to 288.65%. Although foreign banks' lower NPL is correlated to the low level of total assets (see above Chart), the characteristic of "high NPL with low provision coverage" of Chinese banks, however, is clearly quite apparent and should be watched closely. Furthermore, it is quite possible that the NPL level is still being underestimated.

In short, along with opening up market access, equal treatment is widely expected, and many foreign financial institutions and private equity firms have already begun to prepare for deployment in China in order to get a bigger slice of the financial market pie. Governor Zhou Xiaochuan would like to "promote optimization and prosperity by competition to bring Chinese financial regulations in line with international standards". Besides encouraging foreign enthusiasm for the Chinese financial market, opening up the domestic market will also enable further market penetration of Chinese financial institutions overseas. A case in point is CICC (China International Capital Corporation), China’s first joint venture investment bank, which is currently applying for business licences in the US. Nevertheless, the actual opening-up process is expected to be slow, gradual and methodical in nature. We should expect further guidelines with practical rules coming from the Chinese Government in the coming year. In the short term, the change to foreign players' performance in China will be small and it is not likely that we will see a sudden surge of foreign ownership in the Chinese market.

Energy

China's gas shortage is the beginning

In November, China's wholesale LNG price rose by a whopping 72.4% from the previous month’s price, hitting a record high of RMB 9,400 per ton on December 1. This forced Chinese companies to turn to the spot market, pushing up world LNG prices in turn. On December 4th, the Asia spot LNG price index Japan-Korea marker rose to $10.04 per million British thermal unit (BTU), the highest level since December 2014, thus making China's domestic gas shortage a world problem.

Pollution combat has triggered gas shortage

Earlier this year, in response to mounting pressure from the population to take action on pollution, China introduced the '2+26' policy limiting the use of coal for both residential heating and industrial operations in Northern China. This pro-environment legislation pushed the demand for gas to new heights. China's natural gas demand is estimated to reach 230 billion cubic meters (bcm) by the end of 2017, an increase of 33 bcm compared to last year, with the “2+26” coal limiting policy alone creating 23 bcm of additional demand this winter.

The increase in demand for natural gas will be met partly through an increase in domestic gas production and partly through an increase in imports. But will it be enough? According to Wood Mackenzie, China’s domestic gas production is estimated to increase to around 7 bcm this winter. China's pipeline imports from Central Asia are also expected to grow 4 bcm this winter thanks to new/amended supply contracts. As storage capacity also increased by 2 bcm, LNG imports are expected to grow 8 bcm versus last winter. This raises supply by 21 bcm which almost meets the 23 bcm incremental demand in Northern China. On paper the figures looked good, only under the condition that all supply sources and infrastructure facilities are running at optimum capacity. This could very well be the reason that the government did not anticipate such a severe gas shortage. In reality, however, gas supply has failed to keep pace with demand due to a lack of storage and transport infrastructure facilities.

Hebei Province has announced an orange alert for gas supplies, which signals there exists a 10%-20% gap between supply and demand. The province-wide gas shortage has left industrial, commercial and even residential users quite literally in the cold, sparking a public outrage. Unfortunately, Hebei is not the only province with this problem.

The root cause lies in the system

On December 1, the government relaxed the restrictions on the use of coal for heating in the 2+26 cities to offset the gas shortage and stabilize prices. The Ministry of Environmental Protection told authorities in the 28 cities to relax the coal use ban at places where the conversion process had not been completed.

Will China break out of the gas bottleneck anytime soon? We believe China's gas shortage is far from over as the problems can’t be fixed overnight:

- Domestic exploration and production: monopolized by national oil companies (NOCs);

- Domestic pipeline gas transmission: uncertainty in Shaanxi-Beijing IV pipeline construction, over-charged mandatory transmission tariff at provincial level;

- Pipeline gas import: delay in Sino-Russia pipeline project (west line), no third party access to pipeline;

- LNG receiving terminal: not enough LNG receiving terminals, no third party access to LNG terminals, no private capital investment guidelines;

- Storage capacity: China has 20 gas storage facilities with stored gas at 3 percent of consumption, far below the world average of 16 percent.

The root cause of China's gas shortage lies in the fact that at both national and provincial levels there exist monopolies which are less reactive to changes in demand. Although natural gas deregulation is under way, shortages are expected for every winter in the next several years.

Automotive

Why foreign OEMs are betting on China’s car sharing again?

Car sharing business seemed to have made a comeback in China in spite of two car-sharing start-ups in a row closing shop. In early December, BMW launched its car-sharing service in Chengdu in partnership with EVCard, one of its local rivals. On the same day, the car-sharing start-up PonyCar announced that it had secured a C-round funding of RMB250 million.

BMW’s move only highlights the fact that all the three leading luxury car companies in the world have transplanted their car-sharing services to the Chinese market from Europe and the US where. There are strong incentives for foreign OEMs to move into the car sharing business. First, they are under huge pressure to meet the stringent “dual credit” requirement that sets NEV sales goals for every car manufacturer in China. Car sharing divisions are a good way of ensuring these targets are met. Second, ride-hailing platforms have developed into formidable mobility service providers and are likely to become the largest procurers of new vehicles. OEMS desperately need to be at the forefront of the automotive market, thus the rush to become a mobility service operator.

Car sharing made its debut in China as early as 2010 when there was no ride-hailing or carpooling service available. But this fledgling business hardly took off as its expansion depended largely upon the size of fleets and operators’ access to parking lots. Unlike the ride-hailing service which has been dominated by Didi, there has been no single winner in the car sharing market with around 10 companies operating over 10,000 vehicles. Companies backed by large OEMS hold larger slices of the market (75%), followed by fledgling start-ups and companies belonging or related to large car rental groups. Recently, fuelled by the capital market and the success of ride hailing services, car sharing has made it onto the fast track with an aggregated investment amount of RMB2.545 billion in the last two years, making up 2% of total value in the mobility industry. At the same time, the government issued a regulatory guideline in August green-lighting electric vehicle sharing.

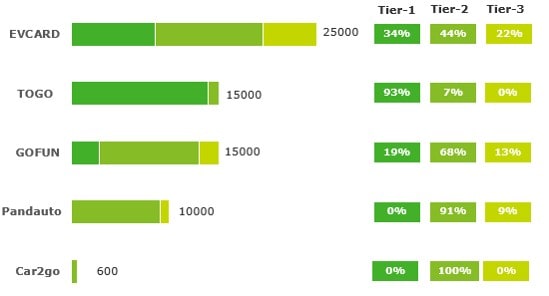

Chart: Fleet size and city penetration of car-sharing companies

Yet, after 7 years of development, car sharing is still in its infancy compared with other forms of mobility services in China. This is because many roadblocks remain and therefore, new comers in the market will face the same hurdles as those already in the business.

Obtaining license plates, parking lots and charging infrastructure are the main problems that new players will need to overcome and for this without government policy support there can be no meaningful expansion of the car sharing business in China. Service operators have to ensure that they can obtain government support in either license plate quotas or exclusive parking zones in central business districts before they enter a new city. Due to the limited number of EV license plates, companies’ ability to scale up has been capped. Both the Beijing and Shanghai governments have set an annual quota on license plates for electric vehicle sharing services. Hence, in Beijing for example, a dozen or so market players had to compete for a total of 2,000 licenses last year.

In major cities, customers are mostly unhappy with car sharing services because the car stations are few and far apart and consumers, most of the time, have to walk quite a distance to get to one. In addition, car sharing companies haven’t been able to provide a wide array of vehicles available for rent. At times, the operators fail to keep the vehicles clean and safe to operate.

This is why most car sharing companies find it hard to become profitable. If we break down their cost structure, vehicle depreciation makes up the largest component of operation cost, followed by parking space rentals, operation and maintenance costs and insurance fees. As against this, the only source of revenue is the usage fee which is calculated by travel time or distance. For the industry to grow, it is essential, therefore, that car sharing operators increase the utilization rate of their fleets, cut down operation costs and develop new revenue sources.

Life Science & Healthcare

Pharma MNCs are opting for a new R&D strategy

In Q3 2017, GSK and Eli Lily both closed their R&D centers in Zhangjiang outside Shanghai and this seems to have become a trend amongst Pharma MNCs. During the period 2015-2016, AbbVie suspended its Zhangjiang R&D center project while Roche and Novartis both dismissed several Chinese research teams. Although it may appear that Pharmaceutical MNCs are reducing R&D investments in China, these closures may, in fact, signal a transition to a different R&D strategy. As Pharmaceutical MNCs no longer do all the works themselves, they will instead, start to develop more R&D approaches by building multiple partnerships.

The purposes of Pharma MNCs' Chinese R&D centers have always been unclear

It has been 20 years since Novo Nordisk built China's first Pharma MNC R&D center in 1997. More than 40 Pharma MNCs subsequently invested in research facilities in China. In the beginning, most Pharma MNCs established China R&D centers as a part of their global R&D strategies. By leveraging local talent resources, China R&D centers were tasked to execute certain parts of the global new drug R&D projects. Due to low communication efficiency and potential IP risks, China R&D centers were not involved in the core parts of the research projects. Some Pharma MNCs then explored other options, starting to change the function of China R&D center from an "In China for Global" to an "In China for China" model, with which China R&D centers focus only on the clinical development, registration and new indication development of existing products in China. Thus, China R&D centers have been swinging precariously between two functions and this has resulted in low productivity. The latter was what led many Pharma MNCs to close their China research facilities.

Marketing Authorization Holder policy pushes Pharma MNCs to explore virtual research

In June 2016, China initiated the Marketing Authorization Holder (MAH) pilot project which allows domestic drug R&D institutions and individuals to apply for and hold drug product licenses. This allows them to commercialize their drug assets without becoming drug manufacturers themselves. Also, such a holder may apply to transfer the marketing authorization to another eligible holder. With implementation of the MAH policy, Pharma MNCs will be able to engage in virtual research by investing and acquiring biotech companies with promising drug pipelines, or establishing joint venture partnerships with domestic Chinese pharma companies and investment firms. For example, AstraZeneca partnered with Chinese Future Industry Investment Fund (FIIF) to form an equally-owned, stand-alone joint venture company in China to focus on drug innovation and commercialization.

Rapidly growing CRO market helps Pharma MNCs lighten up R&D assets

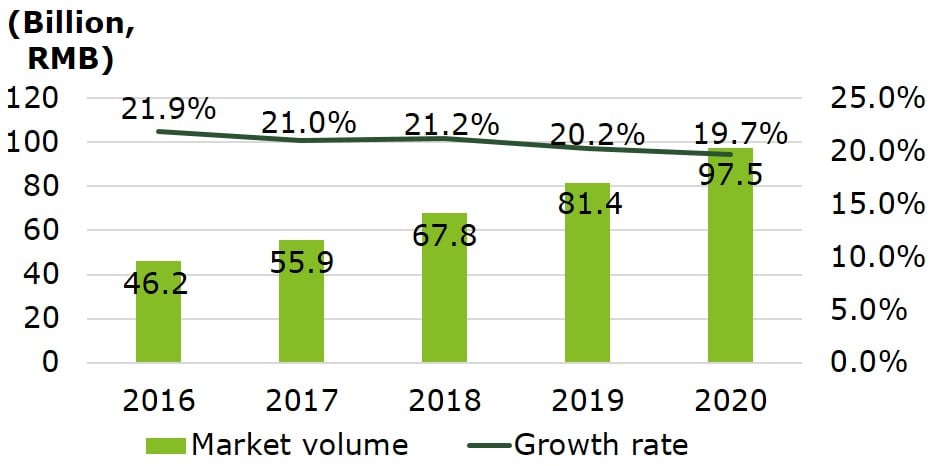

The rapidly growing Contract Research Organization (CRO) market is another catalyst that is driving the transition of Pharma MNCs' R&D strategies. China Food and Drug Administration (CFDA) data shows that the Chinese CRO market is expected to reach RMB 97.5 billion by 2020. The increasing volume and research productivity of the Chinese CRO sector is providing more and more high quality outsourcing resources for Pharma MNCs to break down and outsource their R&D projects. As CRO companies provide customized laboratories and implement all the fieldwork, Pharma MNCs need only to keep the core team for project management. In addition, the job cuts by the MNC R&D centers will create a flow of research talent from Pharma MNCs to CRO companies, which will eventually create a win-win situation for them both.

Chart: Chinese CRO market forecasts

After all, given the increase in both the cost of development of new drugs and the research productivity of the Chinese life science industry, an "asset-light" R&D strategy is finally emerging as a viable option for Pharmaceutical MNCs. The trend will not only benefit the MNCs but also pave the way for innovation in domestic CRO and biotech companies. Many drug innovation startups might well emerge and attract potential investors as well.