Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue IL

9 July 2019

Economy

After Osaka – where to go from truce?

The stakes were enormously high at the G20 meeting in Osaka last week, both in terms of economics and geopolitics. On the economic front, the IMF had already issued a warning: the economic impact of the escalating trade tensions between the US and China, or more precisely, the worsening trade war, was likely to shave off 0.5% of global GDP growth this year. Such a result could only be circumvented should Beijing and Washington renew trade talks soon.

Fortunately, the highly anticipated meeting on June 29 lived up to market expectations. The decision to impose higher tariffs on over $300bn worth of Chinese exports was postponed indefinitely. In addition, President Trump also promised to remove restrictions on US suppliers who sell their products to Huawei. This is a significant step because the slew of actions against Huawei since May 2019 greatly increased the level of distrust towards the US, fanning suspicions that the trade war was also driven by hawks in the US administration whose chief objective was to slow down China's technological development. If actions against Huawei by the Trump Administration had only been perceived as being about gaining leverage in trade talks, they would not have provoked such a reaction.

At the close of the Osaka meeting, China and the US announced that they would be resuming trade talks immediately. China also stated that it would start purchasing more US agricultural and energy products. In our view, future trade talks are likely to get easier but it would be wise for investors not to be too optimistic yet. At the last Xi-Trump meeting at the G20 summit in December 2018, China and the US agreed to map out a trade deal but the talks collapsed, prompting President Trump to hike tariffs from 10% to 25% on over $200 billion dollars worth of Chinese goods. Subsequently, both sides expressed willingness to go back to the negotiation table. President Xi made an important speech at the St Petersburgh Economic Forum on June 8, 2019, stating that the economic decoupling of China and the US was impossible given the entrenched codependency of the two economies. As China’s economy is far more dependent on trade and is undergoing a shift in gear towards a more sustainable consumption-driven growth (actually slower growth and a shrinking current account surplus), it cannot afford a trade war as the result would be a far greater economic slowdown and higher inflation. For the US, if the goal is to bring manufacturers back to America and create jobs, a trade war will only do the opposite and consumers will bear the brunt of the conflict as they will have to pay more and live with fewer choices. But, in the short run, the adverse impact of higher tariffs falls more heavily on China and is less evident in the US because the US economy is not as dependent on trade as China is, and therefore the momentum of its growth is not affected. Hence, President Trump does not have much incentive to soften his stance on "unfair trade". That said, the US economy is clearly in the last stages of economic recovery and the effects of tax cuts are wearing off. As President Trump's re-election hinges on a positive outlook for the US economy, if he can appear to be winning concessions from China (e.g., greater purchases of US products), then he will be more likely to close a trade deal following the truce/temporary timeout in the wake of Osaka G20 meeting.

It is in recognition of this that President Xi announced a spate of new initiatives on China's further opening-up on the eve of the Xi-Trump meeting on June 29. The gist of his message was the following: First, a shorter negative list for foreign investment (with effect from July 30). Second, another lowering of tariffs (current simple mean is at 8.5%) and greater efforts to increase imports. Third, China will make a greater effort to improve the business environment for foreign companies. Fourth, China will create mechanisms by which foreign companies may better express their point of view on IPR related issues. And finally, China will speed up negotiations on the EU-China bilateral investment treaty and China-Japan-South Korea Free Trade Agreement. In a way, the trade war has pushed China to take bolder steps in liberalizing the economy and fostering trade links with its neighbors.

What is interesting is that such bold steps were not only necessary to reduce trade tensions but also in line with China's own domestic reform agenda. The key issue is whether concrete actions will follow. So where do we go after the Xi-Trump meeting in Osaka? There remain a few sticking points in future trade talks. How should China cope with the demand from the US on reducing subsidies to SOEs? It will be difficult to find a workable solution. How to quantify China's progress in protecting intellectual property rights (IPR)? Will China be able to work out a "verifiable mechanism" with the US? The reality is that the Chinese government has, for many years, been playing an important and unique role in social and economic goals, with liberalizing and transforming the economy gradually. It would be unthinkable for China not to subsidize SOEs as the latter perform many social functions. But one could also argue that it is in China's best interest to improve the efficiency of SOEs by quantifying and enumerating their social responsibilities. In our views, solutions to these thorny issues cannot be seen through the narrow perspective of trade alone. It would be good if China and the US were to rekindle their annual strategic dialogue. For the time being, meaningful liberalization of the economy (e.g., more licenses to foreign insurance companies and asset managers) will reduce mistrust between the two countries.

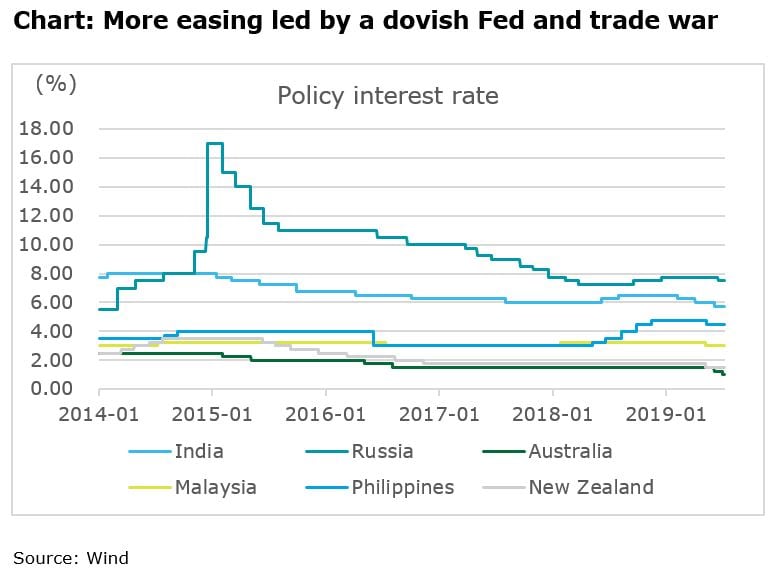

Meanwhile, the Osaka truce will certainly boost investor sentiment and keep the RMB exchange rate stable. Barring a further escalation of trade tensions, the PBOC is likely to cap the USD/CNY exchange rate at somewhere below 7.0 this year. Given that a dovish Fed is likely to slash the Federal Fund Rate twice this year, a stable RMB and more easing by major central banks will give the PBOC room to stimulate the economy. All things considered, we think that the PBOC is likely to bring down reserve requirement rates but keep short-term interest rates steady. Since this will further reduce interest rate differentials between China and the US, the PBOC is likely to opt for relaxing the capital controls that have been in place for the past two years in order to stimulate investment, rather than join many major central banks in embarking on another round of monetary easing.

Financial Services

Supply-side reform in the financial sector

Supply-side structural reform in China’s financial sector is this year's policy priority (formally proposed in February). While the steel and real estate sector have focused their reform efforts on capacity and inventory reduction respectively, financial sector reform requires 1) reducing financial risks and removing hurdles to access to capital, and 2) improving liquidity and optimizing the financial system. In order to achieve these two goals, efforts are being made to restructure high-risk institutions in a market-oriented manner and dispose of non-performing assets, as well as making finance accessible to private enterprises and small and micro enterprises through multiple channels, and to attract foreign capital.

The recent takeover of the Inner Mongolia-based Baoshang Bank (BSB) by banking regulators caused an uproar despite the People’s Bank of China’s repeated efforts to calm the market and improve liquidity. This is the first time in the history of China's banking industry that regulators have actually seized control of a financial institution and is a taste of just how seriously the central government takes the implementation of supply-side structural reform. It will have a far-reaching impact on the sector.

Mergers and reorganizations likely for high-risk rural and urban banks

The takeover of the BSB has exposed the high level of risk incurred by small- and medium-sized banks in the past few years in their efforts to grow. Such institutions are mainly regional rural and urban commercial banks focusing on small and micro loans. Over the past few years, they expanded their assets through inter-bank business and leverage, and even issued loans under the umbrella of "credit-like investment" to evade regulatory restrictions, accumulating a large number of non-performing assets as a result. In 2017, the non-performing loan (NPL) ratio of BSB was 1.72%, a reasonable rate on the surface. But the real risky investments were hidden within another portfolio entitled "accounts receivable investment" (in other words, lending). `Receivable investment’ to the tune of RMB 178.7 billion accounted for about 80% of the credit loan balance while the ratio of "more than 90 days overdue loan balance/non-performing loan balance" was as high as 196%. These numbers reveal a serious cover-up of NPLs and a high degree of deviation from the norm. Hence, the real credit risk is difficult to estimate.

During this year’s annual Two Sessions, Guo Shuqing, chairman of China Banking and Insurance Regulatory Commission (CBRIC), said that this year studies will be conducted on how to restructure and reform high-risk institutions, some of which may either exit the market or be merged and reorganized to advance supply-side reform in the financial industry. Banks need to return to the business of servicing the real economy of the regions they operate in rather than creating funds which simply circulate amongst banking institutions and have little impact on the local economy.

The recently released 2018 Bankers' Survey of the China Banking Association reveals similar concerns: 70% of the bankers surveyed believe that in the next three years, some banking institutions, primarily private banks (53.7%) and rural financial institutions (43.6%), will exit the market. But many practical issues - excessive intervention by the administration, lack of a market-oriented exit mechanism, lack of relevant legislation on, amongst other things, the rights and responsibilities of local governments, as well as proper regulation and supervision - need to be addressed in the implementation phase of supply side reforms.

Financial institutions of all sizes need to be better positioned by focusing on respective fields

Regulating the flow of finance to small and micro enterprises is currently the priority in supply side reform. The five major State-owned banks have been tasked to increase the scale of small and micro loans by 30% and reduce the interest rate by 1%. This will affect small- and medium-sized banks as the downward pressure on the interest rate, shrinking profit margins and possible loss of customers comes into play. In the future, a network of "large comprehensive banks + small- and medium-sized banks focusing on specific areas" will gradually be built. The large banks will focus on comprehensive businesses such as mortgage credit, investment banking and asset management while rural and urban commercial banks will focus on specific areas such as credit and guaranteed loans (without mortgages).

In addition to increased bank credit, the government hopes to supply additional finance to small and micro enterprises through direct equity financing in a multi-tier capital market. It is also keen to open the financial services sector to more foreign and domestic financial institutions. This is expected to bring in advanced management mechanisms which will further reorganize and optimize the sector. For example, the opening of the STAR Market (Science and Technology innovation board) on the Shanghai Stock Exchange will support innovative enterprises in the science and technology sector. The government is also gradually opening the capital market to foreign investors through measures such as the recent Shanghai London Stock Connect).

In short, following the deleveraging effort, supply-side reform in the financial sector has been moved into the fast lane. Financial risks are being identified and cleaned up, so that the relevant measures can be implemented. As a multi-level, differentiated banking system is built in China, the financial industry will be further optimized.

Automotive

China’s domestic carmakers at a critical juncture

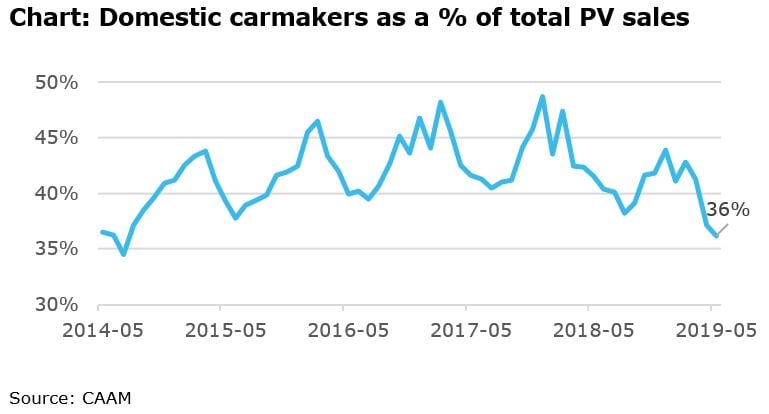

Overall, the sale of passenger vehicles has continued to fall, registering a 17.4% drop when compared to the same time last year. Domestic carmakers, however, fared much worse than their joint venture counterparts, with aggregate sales plummeting 28%. What is more worrying is that not even a single car maker managed to buck the downward spiral. The steep fall in sales has put domestic car companies in an extremely precarious position as their combined market share plunged to 36.2%, the lowest it has been in the last five years.

There are about 145 domestic carmakers in China, no more than 10 of whom have an annual production capacity of 500,000 or above. The market is fairly fragmented as well, with the top 5 best-selling companies controlling close to 60% of the market share. Back in the days when SUVs overwhelmingly dominated China’s car sales, domestic carmakers did very well for themselves by offering low-priced compact SUVs. But, the lack of long product lines and fewer options and accessories went against them when competition intensified. The last straw that has sealed their demise is the broad-based sagging of consumer demand referred to earlier which has forced the entire industry to resort to a full-blown price war in 2019. Many domestic carmakers have either reduced the number of shifts or halted production altogether while some are on the verge of closing their plants. We estimate only 6 domestic car companies are currently operating at over 70% of their capacities.

Early signs of market consolidation have already emerged since last year. First, we have seen large state-owned auto groups spin off unprofitable assets or shut down less promising segments. Their subsidiary enterprises live on by resorting to sales of production licenses to NEV start-ups.

The medium-sized carmakers are attempting to absorb their underutilized capacity by collaborating with newly minted carmakers and by becoming the suppliers of white-label cars to electric vehicle start-ups. In spite of their sales woes, these carmakers have established sound production management systems and reliable supply chains and created a rather skilled workforce, all of which enable them to fill in the missing core competency of newly built EV companies. The government also welcomes this kind of collaboration as it can avoid massive layoffs and heavy losses of tax revenues.

The rest of the domestic car companies are less fortunate and they will have to suffer the consequences of their overzealous expansion. We expect to see a wave of carmakers filing for bankruptcy.

Over the years the industry has got used to the perception that government agencies will always step in and stimulate the demand when auto sales slump. But this time the government has shied away from any direct intervention. As a result, we expect the industry will undergo a significant restructuring. For a start, the state-owned auto companies will merge into a new giant, combining business, sharing production capacity and R&D costs. Small-sized local enterprises will bring in private shareholders or outside partners in an attempt to revive growth.

On the other hand, with the value chain of auto industry shifting from products to services, we expect that a few home-grown carmakers will go beyond the role of white-label manufacturer and start to invest in technologies that will enhance smart manufacturing. They will also restructure the supply chain to enhance their core competency for mass customization and agile production.

Energy

Transition to subsidy-free solar and wind energy

China has released a range of policies and guidelines on solar and wind power pricing for existing and new projects in recent months. These demonstrate its determination to achieve parity between conventional and renewable energy prices for electricity supplied to power grids. China aims to reach its goal by 2021.

Behind the grid parity policies

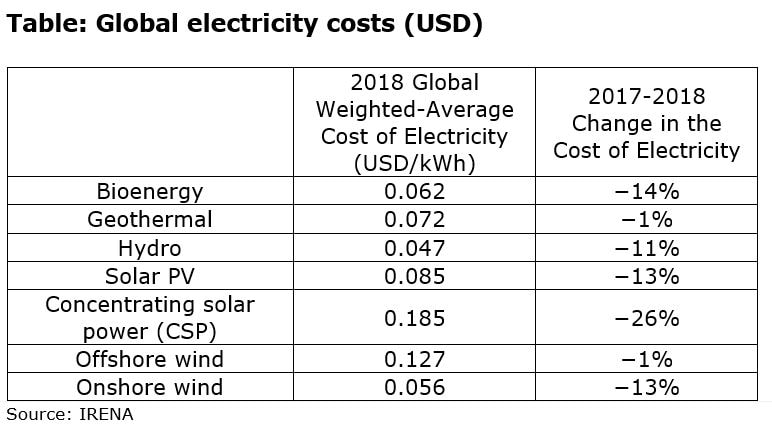

A dramatic reduction of solar and wind power generation costs is the major reason for setting this target. Solar construction costs had fallen by 45% from 2012 to 2017 while wind project costs also dropped by 20% over the same period. Early this year, China launched a series of subsidy-free wind and solar projects to take advantage of the falling construction costs.

The fall in the cost of generation could not have come at a better time because the subsidies being paid to achieve grid parity prices for solar and wind power had become a heavy burden on the government. While these subsidies have so far played an important role in China's renewable energy development, they have absorbed an increasing proportion of the Renewable Energy Development Fund managed by the central government and sharply reduced its capacity to promote further innovation in this area. By the end of 2018, the fund had already accumulated a deficit of over RMB100 billion (US$14.5 billion). China is leveraging the fall in generation costs to reduce its subsidy burden while maintaining a stable renewable market.

New rules

According to the new pricing rules released on May 24 by China's NDRC and the National Energy Administration (NEA), new onshore wind projects that are connected to the grid after January 1, 2021 will no longer receive the fixed payment (FIT, also known as a feed-in-tariff) paid out previously and a price will instead have to be negotiated with grid companies directly.

Subsidies on solar power projects are also being phased out after the NEA announced plans to promote the development of subsidy-free solar projects through policy support. For example, power purchase agreements guaranteeing a fixed price for at least 20 years will be signed with solar power companies willing to provide subsidy free power to the grid that are commissioned by 2020. In addition, the government is guaranteeing subsidy-free power plants priority over conventional and other subsidized power plants in the dispatch of their power through the grid.

In May, the government approved the construction of the first batch of 250 subsidy-free solar and wind projects with a combined capacity of 20.76GW. These include 168 solar projects which will contribute 14.78GW of generating capacity, 56 wind projects with an installed capacity of 4.51 GW, and 26 distributed energy projects with 1.65GW generating capacity. According to NDRC, power distribution companies will be required to sign long-term power purchase agreements with operators of the unsubsidized renewable power projects.

Outlook and risks

China has entered a transition period from a subsidy driven energy market to one driven by grid parity and feed-in tariff supported projects. By the beginning of 2021 these will start giving way to projects based on subsidy free market pricing. However, a policy of auctioning renewable energy projects on the basis of subsidy–free price bids will require the discussion of measures that will safeguard the internal rate of return of these projects so that they are not tempted to sacrifice quality under the intense pressure they will experience to lower costs. Another risk that will need to be minimized is that potential lenders and developers may be scared away from making investments in projects where the rate of return is at the mercy of the wholesale electricity market and is no longer guaranteed through fixed payments by the government.