Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue 89

China's economic and industry outlook for 2024

Published date: 7 April 2024

Economy

Establishing the new before destroying the old

Has China’s economy, which stalled late last year, received a fresh boost in 2024? How should investors evaluate the key economic targets laid out in the Two Sessions? What would be the chief means for achieving such targets? In answering these questions, it goes without saying that any meaningful adjustments in policy responses should take into account the external environment, given the sheer size of the Chinese economy and the externalities of domestic policies.

China’s key economic goals for 2024 can be boiled down into three items: GDP growth, inflation and projected deficit (the room for monetary easing is relatively constrained). We believe that the growth target of "around 5%" is feasible, but there are challenges nonetheless. Compared to 2023, the base effect is indeed less favorable. Setting a target of "around 5%" instead of a binding 5% reflects a policy bias of pursuing quality growth and an implicit rejection of a large fiscal stimulus as seen in late 2008. The inflation target of 3% is almost a certainty, given the continued slowdown of the property sector and industrial over-capacities. Will the projected fiscal deficit therefore need to be expanded in 2024 if the property sector's slump is more severe than expected?

Economic data in Q1 have painted a mixed-to-somewhat encouraging trend in terms of the potency of recovery. Domestic consumption has held up (retail sales rose by 5.5% YoY in Jan-Feb), while fixed income growth has been more than stable (4.2% YoY in Jan-Feb). Exports have almost defied gravity, and their stellar performance cannot be solely explained by surging trade with the global south (total exports grew by 7.1% in Jan-Feb). As expected, inflation has been subdued so far this year. However, by accounting for seasonal effects due to the Chinese New Year, it is hard to present a case of a deflationary spiral or a scenario of Japanification, a term referring to shrunken demand on the back of a burst bubble in Japan in the 1990s.

This has explained the PBOC's reluctance to cut interest rates because policymakers feel that even a protracted slowdown of the property sector could be offset by higher productivity growth in emerging sectors. The property sector's struggles are hardly surprising (sales of commercial housing dropped by nearly 30% in Jan-Feb). Chinese consumers have long viewed real estate as the most reliable form of investment. If house prices continue to fall, rental yields, which have been negligible for years thanks to rampant asset inflation, begin to matter. This could further deter buying until the gap between mortgage rates and rental yields has narrowed significantly. Meanwhile, unless the PBOC reduces short-term interest rates, commercial banks do not have much room to bring down mortgage rates. We still hold the view that a complete removal of restrictions on housing demand would unleash both pent-up demand and investment buying. At this juncture, renewed housing speculation is highly unlikely, even if more incentives are provided for purchasing homes.

If the trend of Q1 data persists, growth could rely more heavily on external demand. At the firm level, anecdotal evidence has revealed a greater willingness for many companies to explore overseas markets. Such motives are propelled by tariffs in the US, which are unlikely to fall regardless of the outcome of the Presidential election in November, supply chain reconfiguration and ferocious domestic competition in China. The incentive for firms and consumers to trade in old appliances and machinery for new ones will be helpful, but such a scheme is unlikely to alter the dynamics of overcapacities. So, the question is to what extent China's export machine would fan protectionism, which is already brewing among China's main trading partners. If Trump is re-elected, US trade policy could well return to the doctrine of pursuing balanced trade, leaving China with the prospect of even higher tariffs. This is certainly a risk that can't be shrugged off. Meanwhile, Democrats do not have much appetite for free trade either, and so tariffs that have been enacted under the Trump administration may well remain for some time, in the bet case scenario.

Protectionism in Europe is also on the rise as Chinese companies' competitiveness is deeply felt both at home and in the EU's largest export markets (the global south especially). Speculated tariffs on China's EV exports could be just the beginning. In the long run, such headwinds could push Chinese companies towards localization in Europe, but in the short run, this has raised the risk of another episode of a trade spat. In emerging markets, there have been signs of protectionism as well, even in countries that either have a large trade surplus with China or where bilateral relations are congenial. For example, in Brazil, anti-dumping cases against imports of China's steel were filed in March 2024 (Now Open: Antidumping Investigation on Brazilian Imports of Prepainted Steel Sheets from China - Trench Rossi Watanabe). In Indonesia, TikTok’s e-commerce function was banned last September on the grounds of predatory pricing of Chinese imports. Protectionism is only a part of the external uncertainties faced by China. A strong US economy has provided both a favorable backdrop of global demand, which bodes well for Asia, including China, and a challenge for the Fed, whose timetable of cutting interest rates has been pushed back. A strong dollar and high US interest rates are constraining the PBOC's potential to reduce rates, while China's competitiveness and perceived state subsidies have also led the authorities to effectively rule out the possibility of exchange rate adjustments as a monetary lever.

Figure: China's export product prices, at historic low, may trigger protectionism

Source: Wind

In conclusion, Q1 data have increased the likelihood for China to meet the growth target in 2024, but also heightened the risk of a potential backlash against Chinese exports when protectionism and geopolitical risks are reinforcing each other. As China embarks on a path towards higher quality growth, stabilizing the property market remains a short-term priority. Such a strategy fits one of the guiding principles from the Two Sessions – to establish the new before destroying the old.

Financial Services

Stable demand could have lifted by further rate cut

2023 saw economic recovery stall with CPI and PPI trending downward throughout the year. However, towards the end of the year, China’s economy began gradually climbing out of its hole. Several consecutive months of negative growth raised concerns in the market about whether the Chinese economy would experience deflation. But, there was a silver lining: when deflationary pressure increases and endogenous growth is sluggish, the effect of credit easing on stimulating demand can be direct with policy guidance. Hence, on February 20, the 5-year Loan Prime Rate (LPR) was unexpectedly cut by 25 bp, from 4.2% to 3.95%, marking the largest reduction since LPR reform started in August 2019. The 5-year LPR targets mid- and long-term loans in manufacturing and real estate sectors, among others. Combined with the "Five Priorities for Future Finance -- technology, green finance, inclusive finance, pension finance, and digital finance," this surprising and significant rate cut will help stimulate loan demand from enterprises and residents and boost market sentiment. To take advantage of this, the banking industry should optimize its credit structure, and make credit readily available in the key areas.

To stimulate effective demand with room for further rate cut

At the press conference on January 24, the Governor of the People’s Bank of China (PBoC), Pan Gongsheng, summarized the current domestic macro situation as being characterized by the following trends: insufficient effective demand, overcapacity in some industries, weak expectations, and low-price levels. Currently, the most pressing issue is weak endogenous momentum, and low willingness of enterprises and residents to increase leverage. In 2023, the CPI only increased by 0.2% YoY, while PPI decreased by 3.0% YoY; The CPI has been declining month by month since October last year; The PPI remained in a downward trajectory throughout the year. Moreover, there has been no significant improvement in the real estate sector, with a YoY decrease of 9.6% in real estate investment in 2023. Moreover, residential housing sales in terms of footage and volume, fell by 8.2% and 6.0%, respectively.

Investment and consumption are two of the three engines driving economic growth. Hence, a reluctance to invest on the part of enterprises and reduced consumer spending will lead to an economic downturn or even a recession. This delicate situation is further exacerbated by the fact that the real estate industry is in a downturn, and real estate companies are facing significant financial and debt pressures. The Chinese real estate industry remains an important part of overall economic output but for some time now the real estate market is in a period of inventory clearance and adjustment. As a result debt default events occur frequently and this has a negative impact on market confidence and economic fundamentals.

The 5-year LPR corresponding to mid- and long-term loans in manufacturing, real estate, and other sectors, will boost market sentiment and help reduce enterprise loan costs. This will enable a further reduction in rates for the newly added and existing housing loans, alleviate the pressure on residents to purchase and repay loans, and unleash investment and reasonable housing demand. From an external perspective, the market generally expects the US to enter a rate cutting cycle this year, and external constraints such as interest rate spreads and exchange rate effects will be relaxed, which will also benefit China's expansion of rate cuts.

With a smoother interest rate transmission, the bond market will enjoy a sustained boom

While the PBoC has kept the recent medium-term lending facility (MLF) rates constant, the significant reduction in LPR this time around reflects a more mature market-oriented interest rate transmission mechanism thanks to the development of self-discipline mechanisms in financial institutions in the past decade. The measures to reduce LPR in credit pricing benchmarks include two important developments: 1) from November to December 2023, major domestic banks lowered deposit interest rates; 2) on January 25, the interest rate for loans provided by the PBOC to financial institutions for re-lending and rediscounting to agricultural and small businesses was lowered by 25bp.

The largest 5-year LPR cut in history on February 20 led to a decline in yields in the bond market and a bull market. On February 29, the yield of 10-year and 30-year “ChinaBond” government bonds was 2.3375% and 2.4616%, a new low in recent years. Moreover, the yield of 30-year ChinaBonds fell below 2.5% for the first time, lower than the current MLF level. Based on this, the interest rate transmission is more comprehensive, covering three categories: policy interest rates (MLF, re-lending and re-discount rates), bank interest rates, and bond yields. The transmission path is smooth, which helps to reduce investment and financing costs effectively.

For the formation, regulation, and transmission mechanism of sound market-oriented interest rates, the PBOC also requires "effectively streamlining the credit and bond markets". At the news briefing, Governor Pan clearly stated that "there is still room for improvement in residents' purchase of government bonds", indicating the improvement of regulator’s attention on direct financing, which not only encourages the development of the bond market, but also signals the governments support of local debt resolution.

The future of the "Five Priorities" under pressure from high Net Interest Margins (NIMs)

Although the rates for deposits and loan interest is determined largely by banks themselves, weak domestic demand has dragged down the growth of bank loan scale and affected revenue growth. In 2023, net profit of commercial banks increased by 3.2% YoY, dropping 2.2 percentage points from the 2022 growth rate, while the net interest margin (NIM) dropped to 1.69%, a historic low. Thus, the February unadjusted 1-year LPR has also been influenced by significant pressure from the NIM.

In this new phase of structural transformation and upgrading, stabilizing interest margins must be combined with a judicious allocation of credit resources. Under the current downward cycle of deposit and loan interest rates, financial resources must be mainly directed towards key and weak areas of the real economy as outlined in the "Five Priorities" proposed by the Central Financial Work Conference. Compared to focusing on credit growth, Chinese government and regulators are more concerned with improving the credit structure and access to credit. The PBoC’s newly established Credit Market Department will be responsible for revitalizing existing loan resources to focus on the above-mentioned five priority areas.

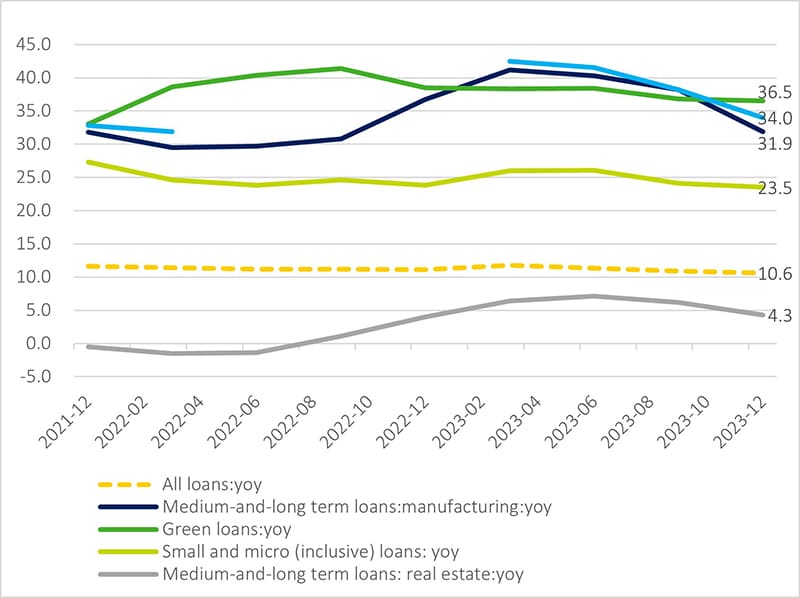

The Five Priorities have reoriented credit lending in recent years. In 2023, loan growth in the priority fields was significantly higher than the 10.6% of total loan growth: 1) the credit loans for green and inclusive areas increased by 36.5% and 23.5% YoY; 2) loan growth rates for high-tech manufacturing and technology-based small- and medium-sized enterprises have reached 34% and 21.9% respectively; 3) the loans for elderly care industry from seven banks, including CDB, ADBC, ICBC, ABC, BOC,CCB and BoCom, increased by 26.4% YoY.

Figure: credit is mainly injected to the inclusive, green and high-tech manufacturing sectors

Source: National Financial Regulatory Administration (NAFR)

Li Yunze, administrator of the National Financial Regulatory Administration (NAFR), stated at the recent 2023 annual conference of the Financial Street Forum that the Five Priorities will “inject strong momentum into high-quality development, bring significant development opportunities to China's financial industry” pointing the way for future mid- and long-term financial services. Specifically, in response to the needs of technology and digital finance, the PBOC has stated that it will further "research and develop tool plans to integrate and support technology innovation and digital finance,". It is expected to introduce new tools and implementation methods soon. With the vigorous development of the digital economy, advanced manufacturing, and strategic emerging industries, China's banking sector will complete its own structural adjustment and begin to grow steadily while supporting the high-quality development of the economy.

Energy

China leads the green hydrogen race amid global cost inflation

A mixed picture of global green hydrogen development

By end of 2023, the global total announced capacity of green hydrogen had hit 120.5 million tons annually, much of which stemmed from export-oriented countries and markets, particularly in North Africa. For instance, Egypt has announced a plan to develop a four-billion-dollar green hydrogen project and to build a capacity of 600,000 tonnes of green ammonia per year in its first phase.

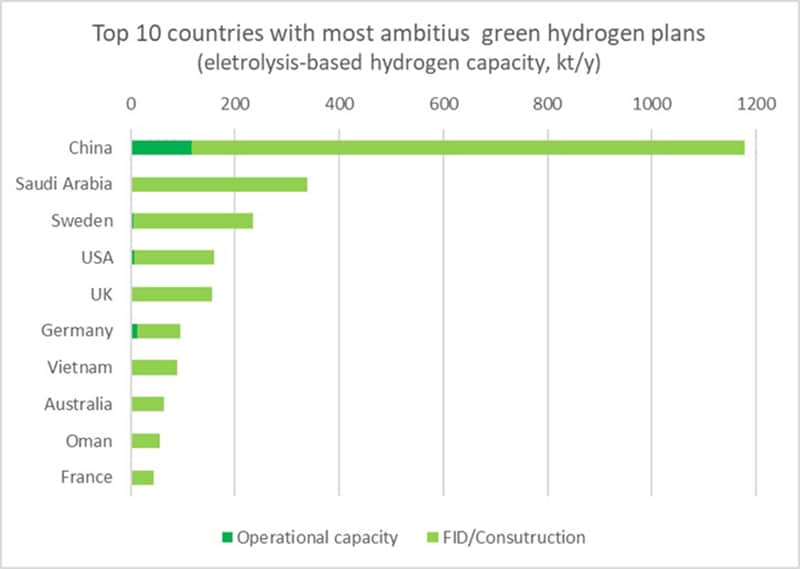

However, only 2% of the global announced capacity of green hydrogen is either operational or under construction. According to IEA’s hydrogen projects database, China, Saudi Arabia, and Europe currently have the most capacity under construction. Meanwhile, nearly 40% of the announced capacities are struggling to get into Final Investment Decision (FID) due to challenges in securing financing or a lack of clear policy support.

Figure: Top 10 countries with most ambitious green hydrogen plans

Source: IEA, Deloitte Research

One reason behind the project delay and cancellation is that the development cost for hydrogen and renewables projects increased significantly during 2023, due to increasing energy prices and geopolitical uncertainties.

In the face of global cost inflation, China accelerates its green hydrogen development

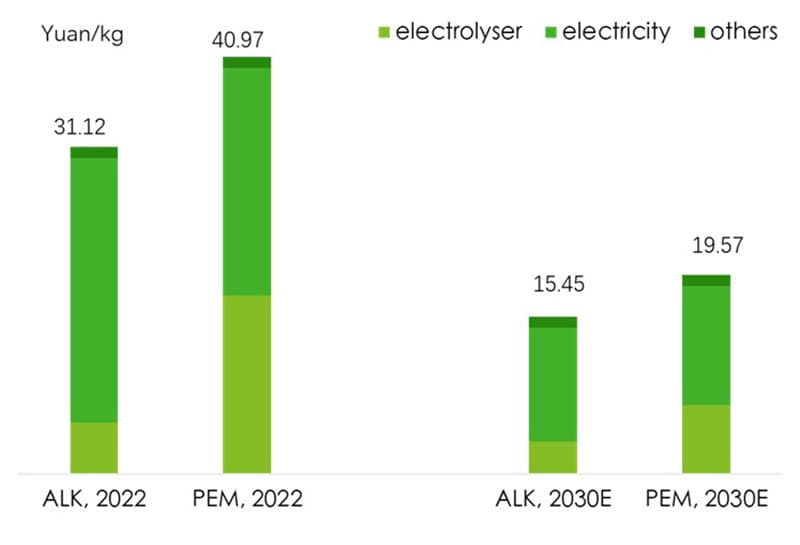

The development cost of green hydrogen mainly depends on two things: the cost of green electricity and the cost of the electrolyser.

Most of China’s green hydrogen projects are located in its northwest and northeast regions, such as Xinjiang, Inner Mongolia, and Jilin, because solar and wind electricity prices in those regions are relatively low.

Currently, in China, the cost of utilizing an electrolyser to produce hydrogen is estimated to be approximately RMB 31.12/kg for Alkaline (ALK) and RMB 40.97/kg for Proton Exchange Membrane (PEM) electrolysers. As production increases and begins to benefit from economies of scale, it is anticipated that the cost of electrolysers will gradually decline, eventually aligning with the cost of producing hydrogen from coal in ten years.

Figure: Production costs for green hydrogen via electrolysis in China

Source: China Hydrogen Energy Industry Promotion Association, Deloitte Research

Riding on the coattails of decreasing costs and strong policy support, China’s green hydrogen program is on the fast track.

According to data from China Hydrogen Energy Industry Promotion Association, from January to November 2023, China signed, approved, and announced a total of 64 green hydrogen projects, with a total planned investment exceeding RMB 410 billion. Once all the projects are operational, the additional green hydrogen production capacity will reach 2.35 million tons per year (green ammonia and green methanol projects are converted into hydrogen equivalent).

Green ammonia and green methanol fuelling the demand for green hydrogen

Ammonia accounts for 37% of hydrogen utilization globally, and thanks to its versatility in acting as a hydrogen carrier, feedstock, and fuel, green ammonia will continue to be the leading end-use sector for green hydrogen. China has launched pilot projects to explore the utilization of green ammonia under various use-case scenarios.

Figure: China’s green ammonia pilot projects

Use case |

Pilot project |

Year |

Ammonia utilization potential (tons per year) |

Ammonia as hydrogen carrier |

China’s first commercialized ammonia to hydrogen and hydrogen refill station |

2023 |

800 |

Ammonia as feedstock |

600MW coal power engine with ammonia as feedstock pilot |

2023 |

200,000 |

Ammonia as fuel |

Ammonia-powered ship order (6 ships, 1st to be delivered in 2026) |

2023 |

180,000 |

Source: EnerScen

Another promising hydrogen utilization is in the production of green methanol. Methanol is a liquid fuel that shares similarities with traditional fuels, allowing it to be integrated into existing infrastructure with only minor modifications. The decarbonization of the ocean shipping industry is driving the use of green methanol. In 2023, following the International Maritime Organization's (IMO) agreed net-zero emissions target, the European Union also introduced new regulations to include the shipping industry in the Emissions Trading Scheme starting from 2024. According to data from Clarksons’ latest Green Technology Tracker for 2023, the global orderbook for methanol-powered ships reached 200, accounting for 8.3% of the global orderbook in gross tonnage terms. If all of them are delivered and fuelled by green methanol, it is estimated that these ships will consume 3 million to 5 million tons of green methanol annually.

Who will lead green hydrogen development in China?

Project owners, including power and equipment companies, as well as energy and chemical enterprises, have taken the lead in developing domestic green hydrogen. Power companies have frequently leveraged their extensive wind and solar power facilities to undertake integrated hydrogen and ammonia projects. Meanwhile, energy and chemical companies, which have a broad range of hydrogen applications in coal, chemical, and petroleum refining sectors, often opt for low-carbon enhancements to their existing chemical operations when integrating green hydrogen. These companies typically focus on constructing projects that follow an integrated production approach for green ammonia and methanol.

This trend towards integrated green hydrogen projects is not limited to domestic initiatives. An example of this global effort is the partnership between Saudi Arabia’s Public Investment Fund and ACWA with Air Products, which obtained a Final Investment Decision (FID) on the USD 8.5 billion NEOM Helios Green Fuel Project. This large-scale project is set to produce 230,000 tons per annum of green hydrogen, intended for the production of green ammonia. Air Products will be the buyer for the ammonia produced.

As well as addressing technical challenges, for project developers aiming to maintain a leading position, it is crucial to address several key factors such as securing a low electricity price and ensuring buyers for the output. These elements are essential for the successful development and scalability of green hydrogen projects, both domestically and internationally.

Retail

Emotional and experiential satisfaction remains the main driver of consumer demand

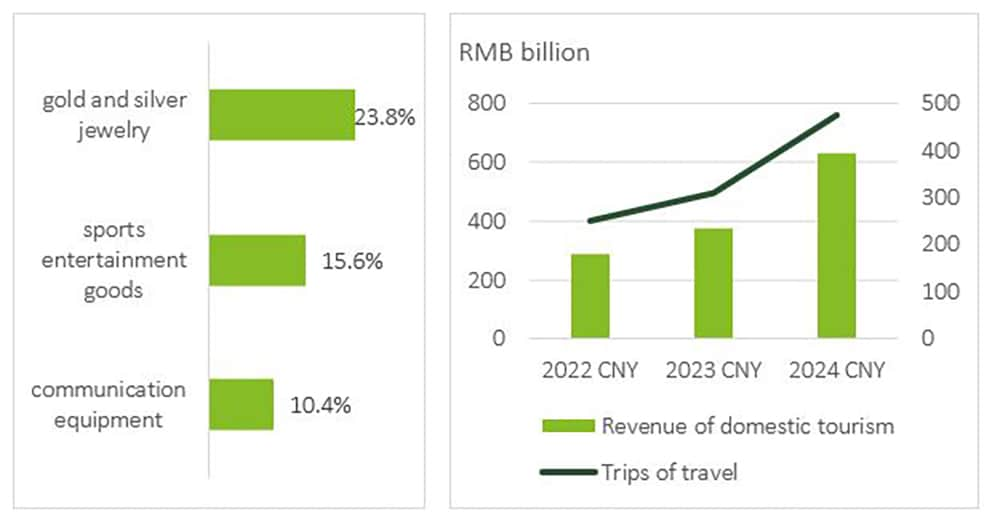

The domestic consumer market had been warming up during the recent New Year and Spring Festival holidays. On the one hand, the market for consumer services is heating up thanks to a rapid increase in demand for entertainment and leisure travel. During the 8-day Spring Festival holiday in February, there were 474 million domestic tourism trips nationwide, an increase of 19.0% compared to the same period in 2019 according to comparable standards, while total spending of domestic tourists reached RMB 632.687 billion, an increase of 7.7% compared to the same period in 2019. Also, sales of catering enterprises which were monitored closely by the Ministry of Commerce grew 17% y-o-y while box office receipts from the Spring Festival films exceeded RMB 8 billion, setting a historic record for box office revenue and number of moviegoers in the Spring Festival period. On the other hand, physical goods consumption also picked up speed thanks to an uptick in entertainment and travel demand. During the Spring Festival holiday, sales of key retail and catering enterprises nationwide increased by 8.5% year-on-year, with gold and silver jewellery, sports entertainment goods and communication equipment sales up 23.8%, 15.6% and 10.4%, respectively. The e-commerce platforms, which the Ministry of Commerce monitors most closely, saw a 32.2% year-on-year increase in instant retail sales, and some e-commerce platforms for cycling and skiing equipment increased by more than 50%. Sales at tea houses such as Heytea and Naixue increased by more than 400%.

Figure: The growth of services during the 2024 Chinese New Year drives the sales of related physical goods

Source: Ministry of Culture and Tourism, Ministry of Commerce

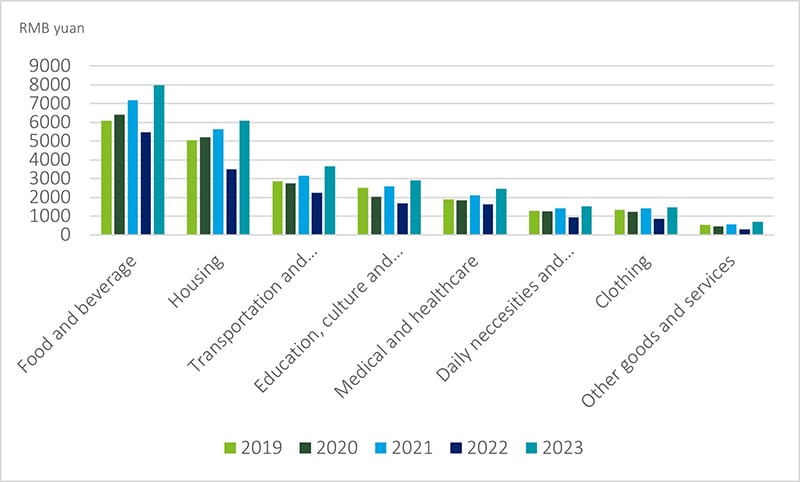

The rapid growth in tourism and leisure-related physical goods expenditure is the result of a better understanding of the change in consumer demand. This year consumers opened their wallets for goods and services that gave them experiential and emotional satisfaction. The DT Business Watch's 2023 Youth Consumption Survey showed that nearly half of young people prefer to spend on things that give them emotional satisfaction, and they are active participants in the immersive experience. This demand is not accidental, as in the past few years of public health crisis, economic downturn and natural disasters, consumers have become physically and mentally exhausted and desperately need products and services that can evoke positive emotions to relieve stress. Looking at the per capita consumption expenditure data of the past four years, we found that the growth rate and share of expenditure on services related to the upgrade of consumption further improved in 2023, with per capita education, culture and entertainment expenditure increasing by 72.5% year-on-year, and exceeded 2019 by 15.6%. This shows that in the post-pandemic period, national consumption is not a downgrading of consumption but a stratification of consumption according to different needs.

Figure: Y-O-Y growth of per capita consumption expenditure and service consumption items in 2023

Source:NBS

In the face of consumer demand for "higher emotional satisfaction," which has been dubbed "dopamine consumption" (i.e. the consumer products and services which provides people with the feeling of reward and motivation or instant gratification, such as bubble tea, gaming, travelling, live shows and the like), retailers are accelerating business expansion of such ‘pleasure-providing’ goods and services. We see the consumer businesses involved in the capital markets move frequently. For example, bubble tea chains such as Guming, MXBC, Auntea Jenny and Cha Panda all submitted their Hong Kong listing applications earlier this year. In a competitive tea-beverage arena, the IPO can provide an efficient means of financing for opening new markets and overseas ventures while also building secure supply chains to reduce costs and improve operational efficiency. It is worth mentioning that the Hong Kong Stock Exchange is becoming an important route for consumer goods retailers to seek listings as A-share market audits become more stringent.

Figure: Retail companies that have submitted Hong Kong stock prospectuses since the beginning of 2024

Source: Wind

In addition, lifestyle brands continue to dominate first- and second-tier cities, and even expanding into the lower tier cities. The spike in consumption in lower tier cities such as Dali, Kunshan, Chanshu during this year's Spring Festival holiday once again gave brands a glimpse of their potential of consumption. The Spring Festival 2024 "Eat and Enjoy" Consumer Insights released by Meituan showed that during this year's Spring Festival, the average daily consumption of lifestyle services in tier-5 cities grew at twice the rate of tier-one cities. In its "China Strategic Vision 2025" report, Starbucks said that it values China's more than 300 local markets in regional level cities and the nearly 3,000 markets across county-level cities. According to publicly available data, Starbucks calculates that more than 70% of new store openings in the last 15 months have been in third-tier, or even smaller, cities. Also, Lululemon has deepened its connection with consumers in lower-tier cities through its social media operations. According to a “The Entrepreneur” report, as of February this year, Lululemon's live streaming service had attracted many new users from second and third-tier cities such as Taizhou, Zhenjiang, Busan, Jining, and Baoding.

With the growth of various consumer groups in smaller cities, personalized and diversified segmented markets are developing rapidly, and "emotional value" consumption will continue to increase. Enterprises are facing a dispersed and diverse demand. Faced with an increasingly diversified consumer market in the future, enterprises will need to continuously follow consumer needs and preferences in multiple dimensions such as products, marketing, and services, and leverage this to drive business growth.

G&PS

A new round of reforms on land management

The complicated international situation and the relentless pressure on the domestic economy has brought the issue of land management into the limelight. This comes with a growing awareness that better land management is a crucial component of the structural transformation of local economies. In late February, the Fourth Meeting of the Central Commission for Comprehensively Deepening Reform (hereinafter referred to as the "Fourth Meeting”) reviewed and adopted the Guidelines on Reforming the Land Management System to Promote the Ability to Guarantee High-quality Development of Regions with Competitive Strengths (hereinafter referred to as the "Guidelines"). The Guidelines emphasize the need to establish a land management system that can more effectively dovetail with macroeconomic policies and regional development initiatives. It also aims to strengthen the capacity of the land to guarantee high-quality development of “regions with competitive strengths”.

How to understand "regions with competitive strengths"

The report of the 20th CPC National Congress notes that “it is necessary to develop a regional economic deployment and a territorial space system, which can complement each other’s strengths and promote high-quality development”. One of the important tasks is to allocate more lands designated for business-related construction to central city and major city clusters, so that the “regions with competitive strengths” will have more space for development. These Guidelines can be interpreted as a document that aligns with the objective of “integrated development of regions” of the 20th CPC National Congress and is a part of the implementation of this objective.

At present, the market has three interpretations of "regions with competitive strengths":(1) They are areas with population and economic growth concentration, that have showcased pilot projects and been demonstration areas of Chinese-style modernization programs. (2) They are mainly urban areas, especially large and medium-sized cities. (3) They are mostly south-eastern coastal areas with fast growth but tight or even seriously insufficient land use indexes. Currently these areas are at a stage of high-quality development where ‘talent’, i.e. qualified and highly trained people, is the most crucial and core element in innovation. The trend of "talents promote the development of new industries" will become more and more significant in the future, so to some extent, "regions with competitive strengths" can be interpreted as areas which attract highly trained ‘talent’ and population inflow. Allocating more land to regions with competitive strengths means further promoting the idea that "the flow of land is consistent with the flow of talents".

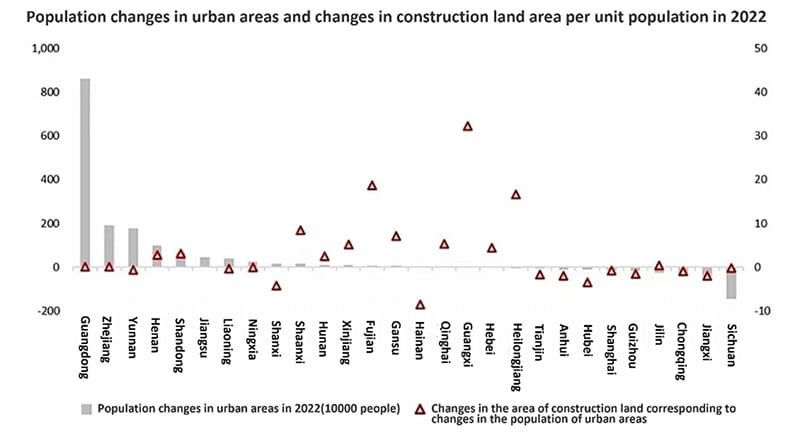

More land for construction will be allocated to “regions with competitive strengths”

In recent years, "regions with competitive strengths" with a continuous population inflow have seen a steady decline in the per capita area of constructible land while, on the other hand, in some provinces and cities with a net outflow of population, the constructible area ratio has not been reduced accordingly, resulting in a fair bit of land being left idle. According to research by Tianfeng Securities, the urban population of Jiangsu Province increased by 450,000 people in 2022, but the construction area decreased by 981 square kilometres, while the urban population of Sichuan Province decreased by 1.45 million people, but the construction area increased by 17 square kilometres. The mismatch between the increase or decrease in construction land and the flow of population will exacerbate urban land shortages, which will hamper the high-quality development of "regions with competitive strengths".

Source: Tianfeng Securities

The “Guidelines” emphasizes the increase of land supply to regions with competitive strengths, that is, more land use plan indexes may be allocated to the eastern coastal area instead of the central-west region. An expert from the Institute of Political Science of the Chinese Academy of Social Sciences believes that the Ministry will probably revise specific policies on the allocation of land use indexes, so that each year cities with higher tax revenue unit areas are likely to receive more new construction land use indexes.

Promoting pilot projects to improve urban land utilization

The Fourth Meeting also noted that, for some exploratory yet pressing reform measures, in-depth research must be conducted in a cautious manner before decisions are taken. Among these steps, revitalizing idle construction land is vital to improving urban land utilization.

In June last year, the Ministry of Natural Resources issued a policy, requiring all localities to put more efforts into discovering and reusing idle land in industrial parks and accelerating the redevelopment of idle land.

In September, the Ministry of Natural Resources launched a pilot project of redeveloping idle land in 43 cities which will last for years, in order to improve land-use efficiency. Cities with net population inflow, limited new space and prominent land conflicts for industrial development were selected as pilot cities. They are supposed to explore different ways of redevelopment, ensure adequate land for business projects, transformation and upgrading of industrial projects, and also address the weak links of public facilities. At present, Shanghai has taken the lead by issuing a new version of “Several Opinions on Comprehensively Promoting the High-Quality Utilization of Land Resources,” which puts forward the reform roadmap and methodology for the redevelopment of Shanghai's idle land. The document proposes combining the orderly implementation of idle land redevelopment with the revitalization of State-owned enterprises' stock land assets. Land planning, policy incentives, and balance of interests should be stressed in order to ensure a high standard of development. It is expected that more cities will roll out specific programs and action plans to improve land use efficiency this year.