Article

Deloitte 2023 Q3 CFO Express

Issue No. 11

Published: 7 September 2023

Explore Content

- Play this episode

- Policies to reignite the entrepreneurial spirits

- Analysis of Web 3.0 model and its innovative applications in China

- Chinese enterprises seeking high-quality global expansion

- Mainland and Hong Kong IPO market review and outlook for the 1H of 2023

- With the release of EAST no.28, data governance for the banking sector continues to be upgraded

- Rethinking the value equation: How CFOs can catalyse value creation for a broader group of stakeholders

- Deloitte Global 2023 Gen Z and Millennial Survey

- Seven shifts reshaping organizations and workplaces in a disruptive decade

After experiencing a strong rebound in the first quarter, China’s GDP growth in the second quarter of this year fell below market expectations. Property related sectors and local governments will likely face a balance-sheet recession. However, if the economic growth rate reaches 4.6% in the second half of the year, the annual growth target of "around 5%" is very likely to be achieved. The crucial issue for China’s economy recovery is how to deter consumers from precautionary savings and rekindle the market confidence of entrepreneurs. Stimulating private investment requires a series of fundamental reforms in financing, for example, IPO registration system reforms that expand capital access for private enterprises.

This issue of CFO Express handpicked a few popular market trends, including IPO market review and outlook for 2023 1H, and the release of EAST no.28 on banking data governance. We also discuss business operations and management strategies, such as analysis and applications of Web3.0, high-quality global expansion of Chinese enterprises, and sustainable value creation. Additionally, it covers topics on future talent development, which contains 2023 Gen Z and Millennial survey, and seven shifts reshaping organizations and workplaces. We hope finance executives and their colleagues find these excerpts instructive.

Chief Economist’s View |

|

Trends and Outlook |

|

Expertise and Practice |

|

Talent and development |

Chief Economist's View

Chief Economist's View

Policies to reignite the entrepreneurial spirits

Deloitte Chief Economist, Sitao Xu, shared his views on the first half of the year’s economic review and market outlook:

- The Chinese economy, after experiencing a strong rebound in the first quarter, has seen its recovery momentum gradual slowdown from the second quarter, with GDP growth falling below market expectations. However, if the economic growth rate reaches 4.6% in the second half of the year, the annual growth target of "around 5%" is very likely to be achieved.

- China's economic situation is distinctly different from Japan in the 1990s when it fell into a balance-sheet recession. The exceptionally high savings rate in China and suppressed demand for improved housing ensure that a full-scale property price collapse is unlikely. This year, the People's Bank of China has demonstrated greater tolerance towards fluctuations in the RMB exchange rate, suggesting China is less likely to follow in Japan's footsteps of drastic interest rate cuts to alleviate the pressure of currency appreciation.

- A crucial issue for China's economic recovery is how to deter consumers from precautionary savings and rekindle the market confidence of entrepreneurs. Stimulating private investment necessitates fundamental reforms in financing. We believe that reforms in the IPO registration system can play a significant role in this regard. This reform would fundamentally change the financing landscape for businesses, aiding many private firms that previously lacked capital channels to rapidly expand their operations. This liberalization might also be extended to multinational corporations looking to raise funds in China, thereby reinforcing supply chain configurations disrupted by geopolitical tensions.

More information: Policies to reignite the entrepreneurial spirit

Trends and Outlook

Trends and Outlook

Analysis of Web 3.0 model and its innovative applications in China

With concepts such as blockchain, the metaverse, and Web3.0 becoming increasingly prominent in the public's view, both domestic and overseas businesses are actively participating in defining and building the next generation of the internet. In the long run, Web3.0's technological, organizational, and economic innovations will reshape the internet industry structure, infusing the traffic peak Web2.0 with new vitality. The "bear market" since the second half of 2022 will also provide the best breeding ground and development opportunity for quality projects and business models. Deloitte has released a report titled "Web3.0 Model Analysis and Exploration of Chinese Application Innovations", aiming to uncover the core value brought about by Web3.0 model innovations through analyzing Web3.0's definition, key elements, ecosystem applications, technical systems, and related policies, as well as discussing the direction of its application development in China.

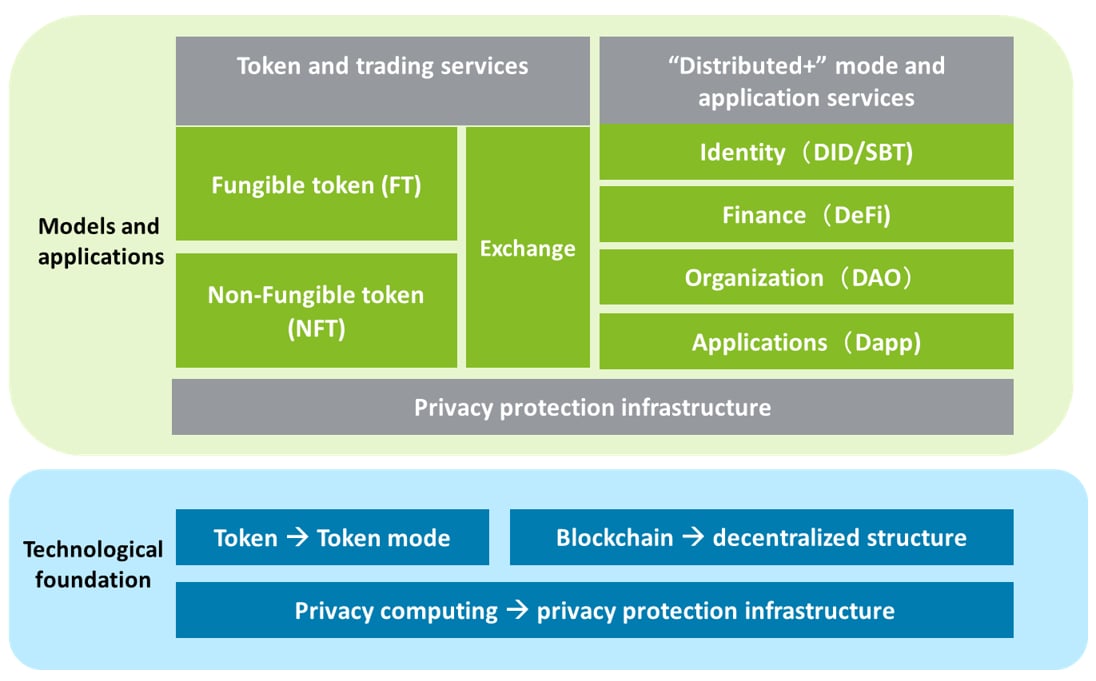

Deloitte believes that the most probable architecture for the next generation of the internet is the "blockchain-based Web3.0". As illustrated below, the three technological foundations of Web3.0 are decentralized architecture (e.g., distributed ledger technology), the Token model (e.g., cryptocurrencies), and privacy protection infrastructure (e.g., AI algorithms). Built on these three technological foundations, the Web3.0 model is divided into Token and trading services, "Distributed+" mode and application services, and privacy protection infrastructure. In terms of models and applications, Tokens can be divided into fungible and non-fungible categories, with the former representing digital currency and its applications, and the latter representing digital assets and its applications. Digital currency and assets primarily trade on exchanges. The "Distributed+" model and application services are mainly based on blockchain's distributed system technology, transforming Web2.0’s centralized identities, organizations, application management, and services into Web3.0's distributed applications and services, thereby creating a more private, secure, open and collaborative business environment and ecosystem. Privacy protection infrastructure utilizes cryptography, AI, and other technologies to offer comprehensive solutions of data storage and authorization protection.

Figure: Illustration of Web3.0 models, applications and technological foundations (full version please see report)

In general, all countries are actively embracing new technologies and exploring scenario applications, as well as gradually improving the regulatory system of Web3.0, balancing risk and innovation as long as risks of money-laundering, terrorist financing and financial stability are properly under control. In China, blockchain’s “trusted” feature is harnessing greater potential:

- Support industrial blockchain applications. Technology integration and deepening is critical to maximizing value from existing industrial applications. For example, blockchain technology and IoT could be integrated to lower barriers for trusted links in the industry; blockchain technology and privacy computing could be integrated to help protect data privacy and safety; blockchain technology could also be used in the development of digital yuan.

- Explore application ecosystem of digital collections. The design, community operations, multi-technology convergence, and combination with industry will become priorities for sustainable development in the mid-to long-term. Digital collections can be combined with immersive experiences provided by meta-universe, such as VR exhibitions of virtual cultural heritage, and AR interactions of virtual scenic spots in cultural tourism industry.

- Leverage decentralized autonomous organization (DAO) to upgrade digital marketing. The evolution to Web3.0 brings about a new type of organization model, DAO, that is efficient, low-cost and flexible. Combining with DAO and NFT could enable restructuring of membership and community system, empower a new type of marketing organization and achieve precision marketing of services and products.

- Help to build gig economy. In Web3.0 world, the new collaboration model brought by DAO and related technologies provides an efficient organizational structure, which could effectively guarantee the distribution of benefits among participants. This model not only meets future flexible employment needs, but also provides more lower cost options for running start-ups.

- Create opportunities for enterprises to strengthen ESG and sustainable development. The emergence of Web3.0 and meta-universe technologies creates opportunities for enterprises to strengthen ESG and sustainable development, including leveraging technologies such as distributed ledgers to reduce the cost of business negotiations and labour. In addition, it ensures traceability and reliability of executive outcomes, providing support for organizations’ daily ESG supervision.

More information: Analysis of Web 3.0 model and its innovative applications in China (Chinese version only)

Chinese enterprises seeking high-quality global expansion

With global economic slowdown, increasing market uncertainties and fierce domestic competition, overseas expansion is a new growth driver for Chinese enterprises seeking high-quality development. In recent years, Chinese enterprises going global has faced market uncertainties and competition as they move towards to more mature models of multinational operations and globalization, so risk management capabilities and overall competitiveness become imperative. The report titled “Chinese enterprises seeking high-quality global expansion white paper” released jointly by Deloitte and SAP uses industry analysis and model building to summarize difficulties encountered and factors to be considered during the globalization process, such as overseas risk management, global platform building, requirements for sustainable development and digital capabilities.

In a volatile environment and during rapid industrial technology development, some Chinese enterprises going overseas have climbed the industrial chain ladder from low value-added activities to high value-added activities. Enterprises with successful overseas businesses are mainly concentrated in industries where China has technological advantages, such as new energy vehicles, energy industry, high-tech industry, and equipment manufacturing. The paths and strategies that companies undertook to expand overseas vary among industries:

- The globalization of NEV (New Energy Vehicle) companies has made rapid progress, with various brands embarking on global sales and market expansion, propelling China to become the world’s second largest car exporter.

- The high-tech industry is gradually forming competitive advantages in the fields of new energy, photovoltaic, smart vehicles, etc., and is moving towards globalization, as seen in multiple processes including product development, supply chain and market operations.

- A growing number of energy and mining companies is expanding overseas to seek growth as a result of domestic reserve level and resource endowment.

- The paths for overseas development of equipment manufacturing companies are diverse and different segments within the industry choose different models of expansion, such as overseas marketing, M&A and building greenfield factories.

While companies may adopt different models for going global, they all share certain challenges during the process:

- Strategically, Chinese companies generally are not fully aware of complexities and uncertainties revolving around globalization. Nor do they have top-down planning.

- From operation perspective, Chinese companies are usually rigid in managing overseas business and are in need of forward-looking global supply chain strategies and layout.

- In terms of technical support, building digital capability has room for improvement, since fragmented data from different sectors makes it more difficult for Chinese companies to analyse and gain insights into global business operations.

In order to respond to the above challenges, companies going overseas should consider planning from the three dimensions of strategy, operation and technical support, as well as building differentiated capability models based on their different overseas business patterns.

More information: Chinese enterprises seeking high-quality global expansion White Paper (Chinese version only)

Expertise and Practice

Expertise and Practice

Mainland and Hong Kong IPO market review and outlook for the 1H of 2023

Global capital markets tumbled in 1H 2023 due to global banking turbulence, continuous US interest rate hikes, US debt ceiling deal, and the weak recovery of the Chinese economy. The analysis indicates that Shanghai Stock Exchange and Shenzhen Stock Exchange were the world’s largest and 2nd largest listing destinations by funds raised in 1H 2023. Shanghai hosted three of the world’s 10 biggest IPOs while Shenzhen recorded one during the period, with four IPOs coming from the semiconductor or energy and resources sectors. New York Stock Exchange took 3rd place with the world’s largest IPO, which was from a consumer healthcare company. And the Stock Exchange of Hong Kong ranked 6th.

Deloitte China’s Capital Market Services Group (“CMSG”) expects IPO activity in the Chinese Mainland to become more vibrant in 2H 2023 following full implementation of the registration-based regime. The market is expected to record more IPO funds raised in the whole of 2023 than it did in 2022, boosted by a continuous revival in economic and business activities, government policies and measures to stabilize growth, and the normal issuance of IPOs. The 2023 IPO fund raising estimates are as follows:

- For the full year, the A-share market will record 430 to 510 IPOs raising approximately RMB620 to RMB699 billion, versus 2022’s 424 new listings raising RMB586.8 billion.

- The SSE STAR Market is expected to have 120 to 140 listings raising RMB240 billion to RMB275 billion.

- The ChiNext with 150 to 170 new listings raising about RMB185 billion to RMB210 billion.

- The main boards in Shanghai and Shenzhen will have around 60 to 80 IPO raising RMB175 billion to RMB 190 billion.

- Beijing Stock Change with about 100 to 120 listings raising RMB20 billion to RMB24 billion.

Numerous enhancements to Stock Connect, including its addition of HK-listed overseas companies, more spin-offs from technology companies, the return of China concept stocks, and the launch of the Specialist Technology Company listing rules are to set help the Hong Kong IPO market rebound in around Q4 2023, following an expectation that US interest rate hikes might peak in Q3 2023. The CMSG forecasts that Hong Kong will record nearly 100 new listings raising around HKD 180 billion.

More information: Mainland and Hong Kong IPO markets review and outlook for the 1H of 2023

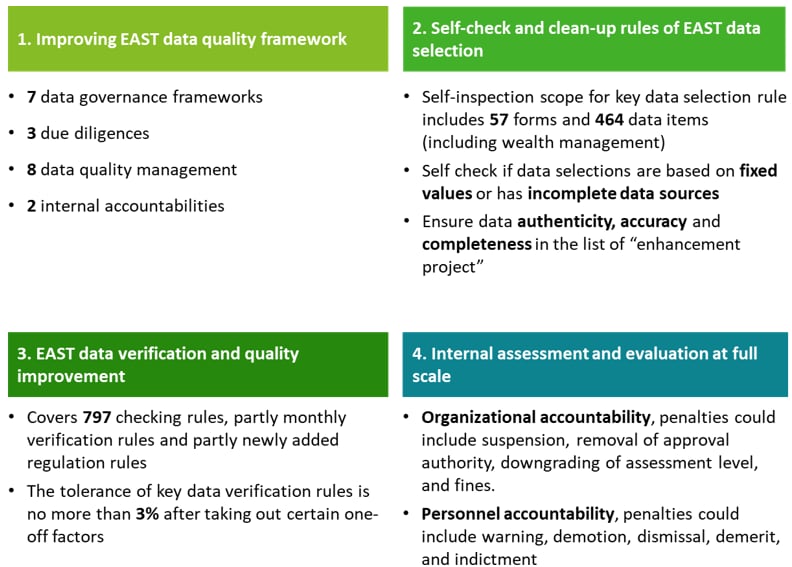

With the release of EAST no.28, data governance for the banking sector continues to be upgraded

Since 2018, regulators have issued a series of data governance requirements for the banking sector. In May 2023, the National Administration of Financial Regulation (NAFR) issued the Notice on Carrying out the EAST Data Quality “enhancement project” (Memorandum [2023] No. 28) (also as the “Notice”), which proposed that EAST should be implemented as a systematic project and detailed the working requirement of ‘applying governance requirements to fully explore data value’. EAST, known as Examination and Analysis System Technology, is used to collect banks’ full range of data including those from off-balance sheet, management, finance, organizational and employee aspects, and thereby establish models of compliance check points for regulators. The “enhancement project” lasts for a year from June 2023 to May 2024 and has an impact on a number of financial institutions, including policy bank, large state-owned banks, joint-stock banks, and foreign banks, wealth management companies and wealth management registration centres directly supervised by NAFR.

Graph: Implementation priorities for “enhancement project”

In response to the requirements of the “enhancement project”, regulators and organizations need to work together to promote high-quality supervision and development starting with high-quality data. Regulators should explore collaborations of supervision and examination, promote EAST data governance, and build solid foundation for regulatory technology. Banking and financial institutions need to enhance the EAST data governance capability and promote digital transformation. Deloitte suggests that banks shall pay great attention to the requirements, take a top-down approach and set up a dedicated team combining expertise in the areas of industry, technology and data, addressing issues of data governance basis, data quality improvement and data application value.

More information: With the release of EAST no.28, data governance requirements for the banking sector continues to be upgraded (Chinese version only)

Rethinking the value equation: How CFOs can catalyse value creation for a broader group of stakeholders

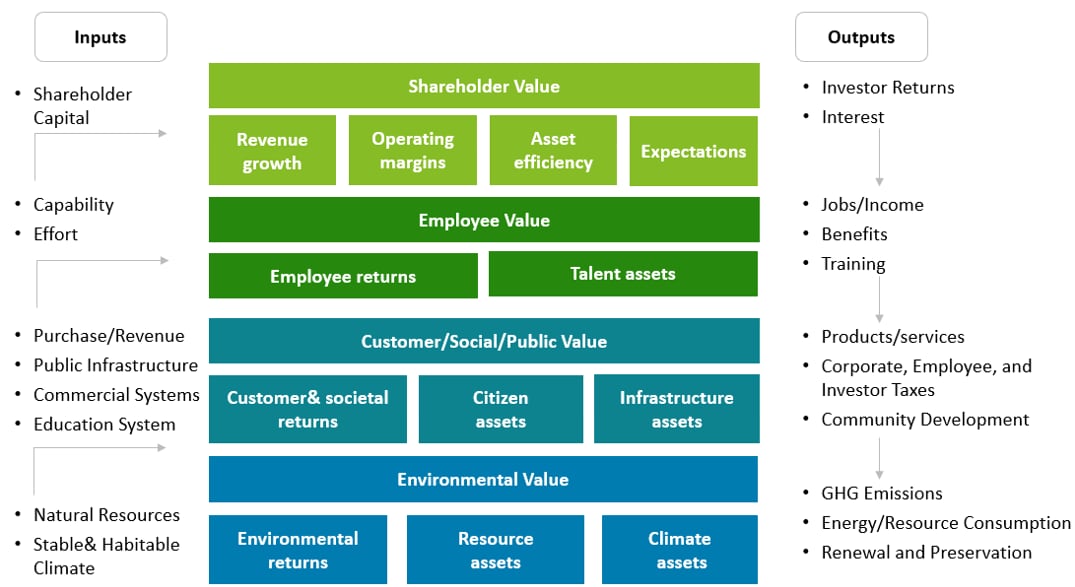

Key regulators, leading investors, and influential customer groups have begun calling for more extensive reporting on broader stakeholder considerations. In response, some executives have made commitments to focus their organization on creating value not just for shareholders, but also for a broader range of stakeholders, including employees, customers and the public, and even the environment itself. In this issue of CFO Insights, we seek to provide an updated view of value creation from multiple stakeholders’ perspectives and demonstrate how the new Sustainable Value Map™ are used to catalyse important changes through capital budgeting and performance management and assist CFOs in driving long-term decision making and sustainable value creation.

Compared to the traditional enterprises value map™, the new sustainable value map™ expands its scope to a broader range of stakeholders and transitions from a single perspective of ROI (shareholder view) to a multistakeholder view, thus helping CFOs catalyse a shift toward a more sustainable version of value-based management. Such an approach better identifies, prioritizes, and balances value-creating investments across stakeholder groups. The Sustainable Value Map™ incorporates three key features, (1) provides baseline ROI framework for each group; (2) provides examples of potential resource and impact flows across stakeholder groups; (3) orchestrate management of value creation inputs/outputs.

Graph:The Sustainable Value Map (refer to the report for a detailed map)

In terms of implementation, capital budgeting and performance measurement are two areas where CFOs and their finance teams often have a stronger influence, and hence they are the two key areas in which applying the new sustainable value map™ could promote multi-stakeholder thinking. Integrating value-based thinking into capital budgeting process, especially evaluation criteria designed for business cases, helps reshape organizations’ conceptualization of value creation. Incorporating a multi-stakeholder viewpoint into the organizations’ performance management system encourages consideration of similar value chains for non-shareholder stakeholders, strengthens the effectiveness of the balanced scorecard, and recognizes the interdependence of metrics and value creation across stakeholder groups.

Talent and development

Talent and development

Deloitte Global 2023 Gen Z and Millennial Survey

2023 Deloitte’s Gen Z and Millennial Survey gathered feedback from more than 22,000 Gen Z and millennial respondents in 44 countries. Their responses reveal that many employers have made progress in a number of areas in recent years, including work/life balance, workplace flexibility, DEI, social impact, and environmental sustainability. Approximately one-third of Gen Zs and millennials in full-or part-time work reported that they are very satisfied with their work/life balance. But the recent disruptive events such as cost-of-living crisis, geopolitical tensions and concerns about unemployment have promoted many to remain deeply concerned about their futures.

Side jobs are on the rise as a result of significant financial concerns. Cost of living is once again the top concern for Gen Zs and millennials this year, with the proportion citing high prices as a major worry up six points to 35% for Gen Zs and 42% for millennials since last year. A growing number of Gen Zs and millennials are turning to side jobs to relive financial pressures, particular among respondents with caregiving responsibilities for children, parents, and/or elderly relatives. In the survey, 46% of Gen Zs and 37% of millennials have taken on either a part-or full-time paying job in addition to their primary job, and many of these side jobs leverage on technology and social media platforms.

A growing demand for more work/life balance. Consistent with last year’s findings, work/life balance is Gen Zs’ and millennials’ top consideration when choosing an employer, followed by learning and development opportunities and pay. When asked how they’d like organizations to foster better work/life balance, Gen Zs and millennials prioritized better career advancement opportunities for part-time jobs (36% of Gen Zs and 30% of millennials), condensed four-day work weeks (33% of Gen Zs and 31% of millennials), job sharing (26% of Gen Zs and 20% of millennials) and allowing employees to work flexible hours (24% of Gen Zs and 30% of millennials).

Persistent stress and burnout continue to impact Gen Zs’ and millennials’ mental health. 46% of Gen Zs and 39% of millennials feel stressed or anxious all or most of the time, and roughly half of Gen Zs (52%) and millennials (49%) feel burned out, mostly because their finances and the welfare of friends and families, as well as workplace issues such as heavy workloads, poor work/life balance, and unhealthy team cultures. In addition, more than four in 10 Gen Zs say social media also makes them feel lonely and inadequate and feel pressured to have online presence. It’s crucial for business leaders to continue provide mental health support and policies since as a top factor when Gen Zs and millennials considering a potential employer.

Companies need to bring their employees along in the transition to a low-carbon future. Climate change is a major stressor for both generations, 60% of Gen Zs and 57% of millennials say they have felt anxious about the environment in the past month. The majority agree that their employers are working to address climate change (55% of Gen Zs and 53% of millennials), although only 20% of Gen Zs and 16% of millennials strongly agree. Many Gen Zs and millennials want their employers to keep doing more and having larger societal impact, and to help them learn and develop skills needed for the transition to a low-carbon economy.

Note: Gen Zs in the survey refer to those born between January 1995 and December 2004, and Millennials are those born between January 1983 and December 1994.

More information: Deloitte Global 2023 Gen Z and Millennial Survey

Seven shifts reshaping organizations and workplaces in a disruptive decade

From the worst global pandemic of the century to a level of political/military tension we haven’t seen for 80 years, the world has been plunged into an age of instability, profound discontinuity, and unpredictability. It is time for organizations use new thinking, a new toolkit, and new energy and commitment to gain success, and to choose a human-centered strategy to generate organizational resilience, helping thrive in a disrupted and disruptive marketplace.

We predict that the pandemic-driven Great Disruption and Great Resignation have been accelerating seven disruptive shifts that will impact on the future of workforce strategy.

As employee expectations and autonomy increasing, more fluid, human, and digital ways become essential. Organizations move away from traditional work and workplace operating models, by establishing flexible working system to meet the needs of remote working, and flexible working hours; changing the nature of work, to categorize job descriptions based on skills, experience, and interests promote inclusiveness.

Longer lives becomes a trend, organizations should value people at different stages of life. To fully realize the benefits of generational diversity, companies may need to compete for talent of all ages with better salaries and age-appropriate benefits, and redesign jobs to be more flexible, as well as help older employees overcome an embedded ageism problem.

The relationships between human and technology are shifting from a substitution framework to an augmentation framework, and from a mechanized view of how people, teams, and technology work to an organic, human-centered view. Effective worker-technology collaboration might require organizations to reimagine the workplace experience and better leverage technology innovation to assist employee works, improving productivity.

Digital and virtual technology advances and the emerging role of the metaverse are increasing interconnectedness and driving global business models and standards shift from highly targeted interactions with homogeneity populations to community-based interactions with diverse groups. This shift requires companies to make substantial investments in customer engagement capabilities and employee development tools.

Data control and privacy are gaining attention among individuals, technology giants, and governments. As regulatory agencies are paying increased attention to business’ data practices, companies should ensure responsible collection and storage of consumer/worker data and be transparent about how they use that data.

Trust is critical for company succeed with internal and external stakeholders. Businesses should demonstrate authenticity, be intentional about the values the organization espouses, and provide trustworthy consistent, and fact-based information. Similarly, increasing management of diversity, equity, and inclusion (DEI) can help strengthen employer-employee trust.

Shareholder capitalism is shifting to stakeholder capitalism. CEOs and boards are focusing on financial performance, while a broader set of environmental, social, and governance (ESG) issues, and their organization’s impact on the long-term welfare of multiple stakeholders, including employees, customers, and communities- not just their stockholders.

Contact us

If you need any further information, please feel free to reach out to your Deloitte contact person, or reach out to us via the following contact details.

Norman Sze

Vice Chair

Deloitte China

Phone: +86 10 8512 5888

Email: normansze@deloitte.com.cn

Maggie Yang

Partner

Deloitte Consulting China

Phone: +86 10 8520 7822

Email: megyang@deloitte.com.cn

Michael Jin

Partner

Deloitte Consulting China

Phone: +86 21 2316 6317

Email: mijin@deloitte.com.cn

Bo Sun

Senior Manager

Deloitte China CXO Program

Phone: +86 10 8512 4866

Email: bsun@deloitte.com.cn

Explore Content

- Play this episode

- Policies to reignite the entrepreneurial spirits

- Analysis of Web 3.0 model and its innovative applications in China

- Chinese enterprises seeking high-quality global expansion

- Mainland and Hong Kong IPO market review and outlook for the 1H of 2023

- With the release of EAST no.28, data governance for the banking sector continues to be upgraded

- Rethinking the value equation: How CFOs can catalyse value creation for a broader group of stakeholders

- Deloitte Global 2023 Gen Z and Millennial Survey

- Seven shifts reshaping organizations and workplaces in a disruptive decade