Analysis

Sizing the brain——Segmentation and growth factors of the global neuroscience market

Published: 7 June 2023

Brain disorders are the leading cause of disability worldwide and a cause of death second only to cardiovascular diseases. They create disabling misery for the sufferer and long-term distress in their relationships with loved ones, friends and colleagues. They also impose significant costs upon the wider society. However, with advancements in brain disorders lagging behind treatments in other fields, such as cancer or treatments for the heart, new energy and ideas are flowing into neuroscience. There is now hope that new treatments will arise to overcome the limitations of existing therapies and relieve the millions of patients suffering worldwide. To help new capital form investment decisions, Deloitte has studied the Global Neuroscience Market (GNM) across segments and regions.

Our report provides a comprehensive analysis of available diagnostic and treatment options (as a proxy for the neuroscience market size) to estimate the revenue-based valuation of the GNM until 2026. We have developed a holistic framework to help guide investment decisions across neuroscience segments. The intention is to identify where patient demand will drive growth and where investments will most readily lead to effective market solutions.

The following are the key findings from the report:

1. Brain disorders and their impact on patients and society

The negative impact of brain disorders is expected to worsen over the coming years as the COVID-19 pandemic served as an unprecedented global stress test. Furthermore, because we are increasingly a ‘Brain Economy’, we need to ensure people are mentally healthy, so our societies continue to be productive. Neuroscience investments are fundamental to achieving such long-term economic resilience.

- There are two main types of brain disorders including Neurological Conditions and Neuropsychiatric Conditions. Neurological Conditions are those triggering cognitive and motor dysfunction from damaged neurons and nerves. And Neuropsychiatric Conditions are those characterised by disturbed behavioural and emotional states (for example, anxiety, depression, addiction).

- Globally, brain disorders impose a high cost on societies, which are a significant global health problem. It indicates that current treatments for brain disorders leave much room for improvement. They also highlight the desperate need for more resources to be devoted to brain disorders to elevate the standards of care.

- The roadblocks and limitations of current treatments arise from three factors. First, we have a limited understanding of the biological basis of brain disorders. Second, traditional pharmacological treatments are not enough to address brain disorders. Lastly, the limited availability of early diagnostic tools generates a situation where clinically observable symptoms often only appear once the molecular signatures of the disease are at an advanced stage.

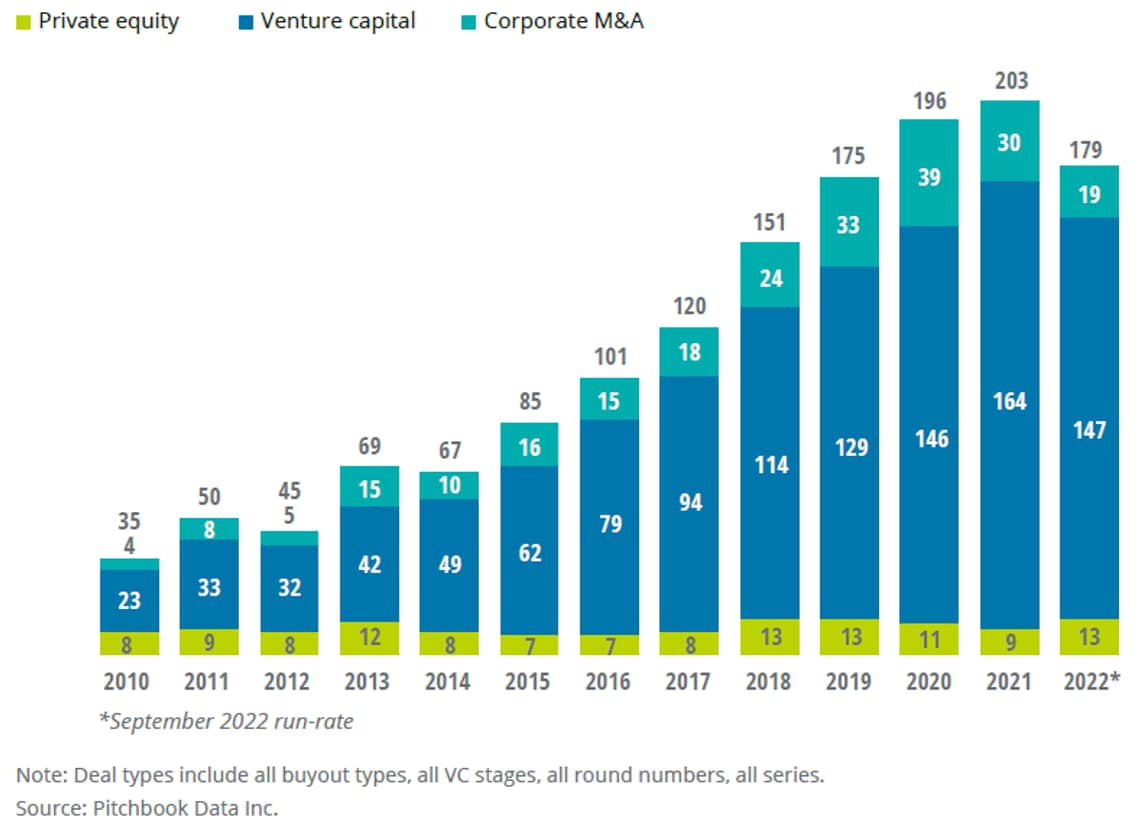

- Over the last decade, investment bodies such as private equity, venture capital and corporate M&A divisions have been increasing the amount of capital dedicated to M&A deals in neuroscience. However, further and more sizable investments are required if the Life Sciences Industry is to meet the needs of patients suffering from brain disorders worldwide.

Figure 1— Historical number of M&A deals in the neuroscience space

2. The findings

The GNM had a value of $612 billion in 2022, with an outstanding 73 percent derived from non-drug therapies. The GNM is forecast to grow at a relatively low rate in the coming years, featuring a compound annual growth rate (CAGR) of 4.2 percent until 2026 with a valuation of $721 billion.

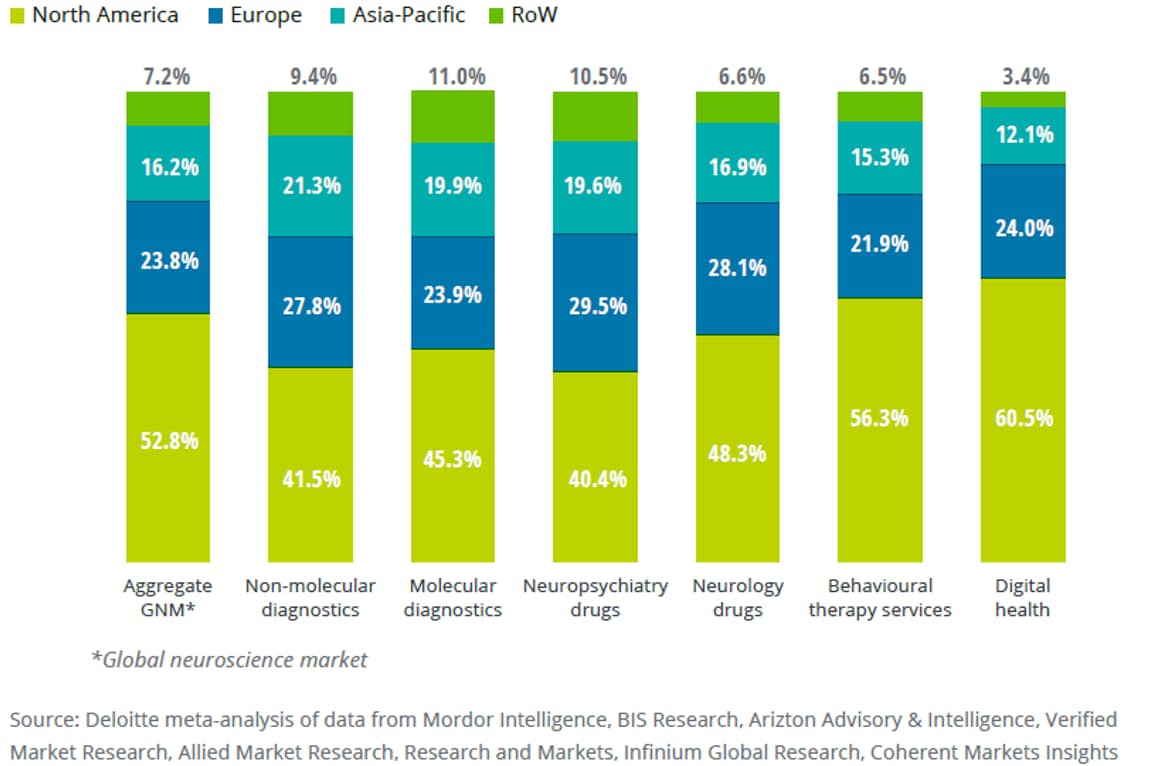

Figure 2—Overview of the global neuroscience market share across geographical regions by segment, 2022

- Over 75% of the GNM value stems from North America and Europe. If patients in low-to-middle-income regions, particularly in emerging markets such as Africa, begin accessing therapy in increasing numbers, the market has much potential to grow.

- The neuroscience diagnostic market is primarily driven by medical imaging and next-generation sequencing technologies. Effective implementation of early diagnosis is paramount for the optimal intervention and management of brain disorders. Physicians increasingly demand hybrid technologies combining various imaging techniques to improve diagnostic accuracy. Together with rising investments in AI-based imaging by health care companies and high-tech players, these trends support the growth projection.

- Pharmacological interventions dominate the neuroscience drug market against multiple sclerosis, anxiety, mood disorders and substance abuse disorders. The current allocation of drug innovation does not represent patient needs, leading to an underserved CNS drug market.

- The neuroscience non-drug market is dominated by the low-growth segment of behavioural therapy services. Digital health interventions accounted for only 0.8% of non-drug therapies revenue in 2022, but the low-value segment of digital health is expected to experience sizable growth over the coming years. Digital health companies are developing non-pharmacological approaches by combining diverse technological components, including software, hardware or artificial intelligence.

- Current revenue levels and future growth rates negatively correlate across GNM segments, which indicates high-value segments display low CAGR forecasts, while low-value segments have significant growth potential.

The analysis reflects Deloitte’s current view on potential investment opportunities in neuroscience by presenting a selection of segments, their forecasted returns, and estimated growth rates, based also on regional differentiators and local developments. The global neuroscience market offers attractive return potential. Investment bodies may infer future growth, and therefore projected return on investment based on current revenue levels across segments of the global neuroscience market. Moreover, private equity, venture capital and corporate M&A organisations may adjust their investment strategy according to the target region.