Article

Key Points on the Reorganization/Establishment of State-owned Capital Investment Companies and State-owned Capital Operating Companies

State-owned enterprises (SOEs) are playing a significant role in Chinese economy. SOEs claimed 75% (83 companies) of the 110 Chinese companies on the list of Fortune Global 500 in 2016. However, SOEs are usually large but not strong, and have been operating without a clear line between the functions of the government and enterprises. These problems have been significantly impeding SOEs' efficiency improvement. Reorganization and establishment of state-owned capital investment companies and state-owned capital operating companies are innovative and experimental initiatives towards the capital management-based approach to enhanced supervision and administration over state-owned assets and the reform of authorized operation mechanism for state-owned capital in this round of SOE reform.

The central government has issued the guidelines for the future direction of reform, yet has not provided any instructions on practices. As state-owned capital investment companies and state-owned capital operating companies are newly-emerging models, there are hardly any successful examples to serve as a perfect reference. Over 100 pilot state-owned capital investment companies and state-owned capital operating companies on the list published by the central government and local governments are taking tentative measures towards reorganization/establishment of state-owned capital investment companies and state-owned capital operating companies. SOE Transformation Initiative Whitepaper (Issue 5): Key Points on the Reorganization/Establishment of State-owned Capital Investment Companies and State-owned Capital Operating Companies has in-depth interpretations on relevant policies and includes questionnaires and face-to-face interviews targeted to the management of pilot state-owned capital investment companies and state-owned capital operating companies, with a purpose of learning about the concerns of pilot companies. Their feedbacks are set forth below:

- Respondents lack sufficient understanding of the policies related to state-owned capital investment companies and state-owned capital operating companies. 70% of respondents said that they had partly understood the respective functions of state-owned capital investment companies and state-owned capital operating companies, relevant policies and the differences between the two types of companies, while 8% of respondents said they were not clear about such information.

- About 60% of respondents are pessimistic or neutral about the reform results of state-owned capital investment companies and state-owned capital operating companies.

- Temasek was established and has been operating successfully due to special political and economic factors under particular historical background. State-owned capital investment companies and state-owned capital operating companies in China can learn from rather than indiscriminately imitating Temasek model. The pilot companies should take the initiative to develop effective operating mechanisms of their own.

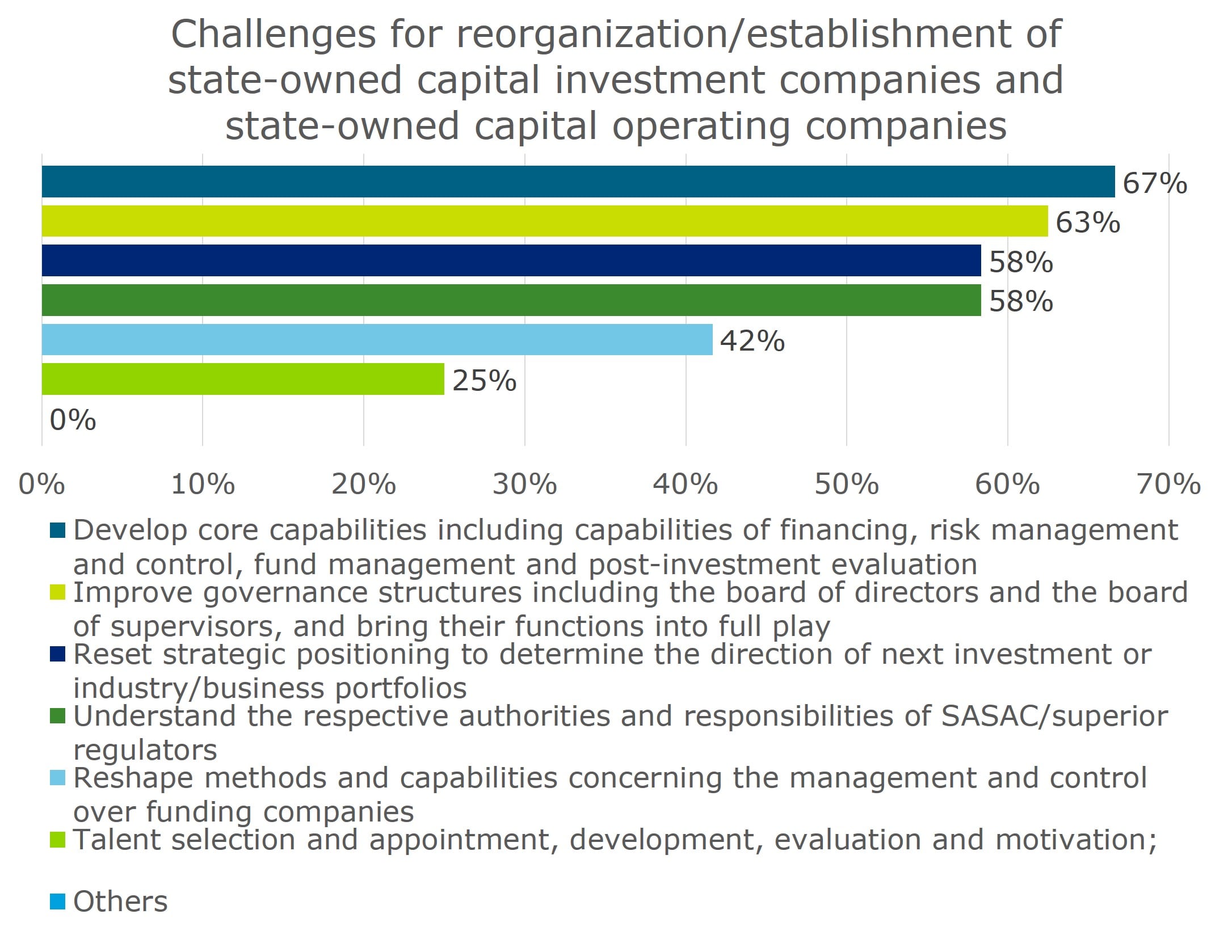

- Development of core capabilities (including capabilities of financing, risk management and control, fund management and post-investment evaluation) is considered as the toughest challenge of reform for most respondents.

- Over 90% of respondents believe that company directors should be engaged and evaluated through a market-based approach rather than following the appointment by the Party and government regulators.

- State-owned capital investment companies take strategic management and control as the priority model of management and control over funding companies, while state-owned capital operating companies take financial management and control as the priority model of management and control over funding companies. Extreme adoption of management and control models is not recommended, while combination of multiple management and control models is likely to create more effective results.

- Both the respondent state-owned capital investment companies and state-owned capital operating companies (about 90%) consider risk management and control as the capability to be enhanced most urgently.

Focusing on these challenges, this Whitepaper compares the similarities and differences between state-owned capital investment companies and state-owned capital operating companies, and analyzes the respective functions and the required core capabilities of the two types of companies. The Whitepaper also provides four cases extracted from practices, including the establishment and optimization of legal person governance structure, reshaping of the methods and capabilities concerning the management and control over funding companies, post-investment management transfer and treasurers (fund and capital management), which should be regarded as the key areas in reorganization/establishment of state-owned capital investment companies and state-owned capital operating companies. Finally, the Whitepaper summarizes the key issues of the reorganization/establishment of state-owned capital investment companies and state-owned capital operating companies and provides an outlook for the future reform.