The construction workforce: Growing again, but not changing much Economics Spotlight, February 2020

7 minute read

29 February 2020

The construction sector has seen a lot of upheaval in the past two decades, given the boom before the Great Recession and the bust following soon thereafter. How have these changes affected the construction workforce?

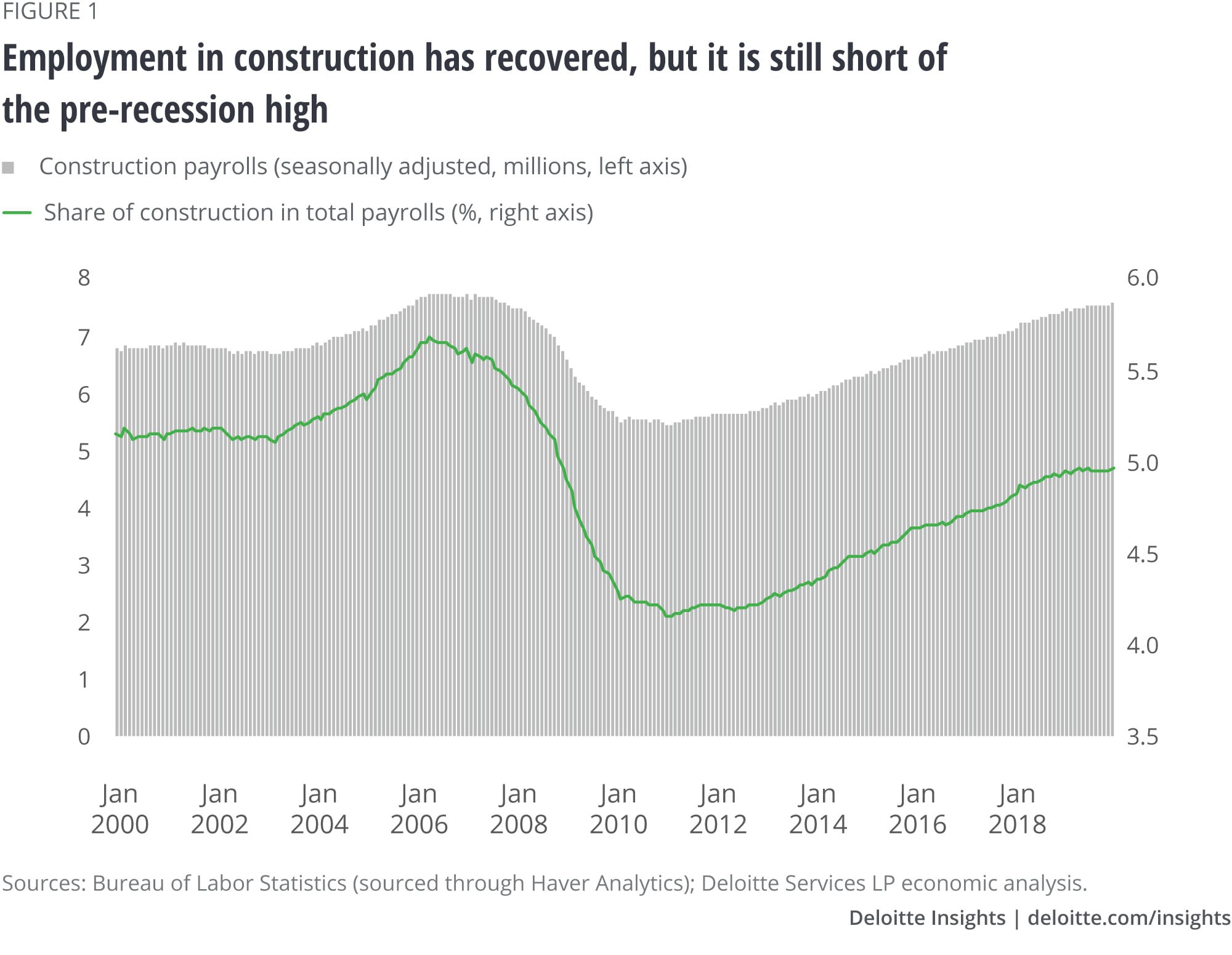

At 7.5 million, the construction workforce is sizeable, contributing about 5 percent (in 2019) to overall employment in the economy.1 Yet, the journey of this workforce hasn’t always been a smooth one, especially over the last two decades. Construction employment expanded strongly in the early 2000s during the housing boom, only for the subsequent bust to leave a deep scar. Even now, after more than nine years of steady recovery, the size of the workforce is still short of its 2006 peak of 7.7 million. These ups and downs, in turn, have clouded the emergence of any clear long-term employment trend in the sector since 2000. As an analysis of payrolls and occupations data from the Bureau of Labor Statistics (BLS) reveals, any changes that have occurred in the workforce—such as the declining role of building construction, and construction and extraction occupations—have been subtle.

BLS data tells all

Payrolls data from the establishment survey, a component of BLS’ Current Employment Statistics (CES) program,2 is useful for analyzing job creation trends in the economy and the role of different sectors in employment. Analysis of occupations in the economy is possible using BLS’ Occupational Employment Statistics (OES).3 Through OES, annual data on employment and wages by occupations is available for 22 major occupations (and key sub-occupations) from 1999 to 2018. Data prior to 1999 uses a different classification for occupations and, hence, is not comparable. For construction, comparable data is available only from 2003; we arrive at the overall data for the sector by aggregating numbers for three key components—construction of buildings, heavy and civil engineering construction, and specialty trade contractors. Also, despite BLS’ involvement in generating both datasets, employment numbers from these two surveys do not match exactly due to differences in the nature and collection of OES and CES data.

Back from the brink, yet still short of the highs

Learn more

Explore the Economics collection

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

Construction employment, as measured by CES payrolls data, has gone up by an average annual rate of 0.5 percent between 2000–2019.4 While this is lower than the corresponding growth in total employment during this period (0.7 percent), slower growth in construction employment was likely due to the crash and slow recovery in the sector between 2006–2010. At its April 2006 peak, payrolls in construction numbered 7.7 million. That was before overheating in the housing market took a toll on the wider construction sector and those employed within it. While the Great Recession ended in June 2009, it was not until February 2011 that construction employment started its recovery on a broad upward trend.

Between the period of decline from May 2006 to January 2011, payrolls in construction fell by a staggering 29.8 percent—a downturn deeper and more prolonged than the overall economy. The share of construction in total payrolls in the economy fell to 4.1 percent from 5.7 percent. The sector has recovered since then, with employment rising to 7.5 million by December 2019. But the share of construction in overall employment is still below pre-recession highs (figure 1). Figure 2 shows in more detail how the deep contraction in the construction workforce between 2006–2010 (roughly the period of the downturn) overshadowed the gains during 2000–2006 (the runup to the construction peak) and 2010–2019 (the current recovery).

Residential construction’s share in total construction employment has declined

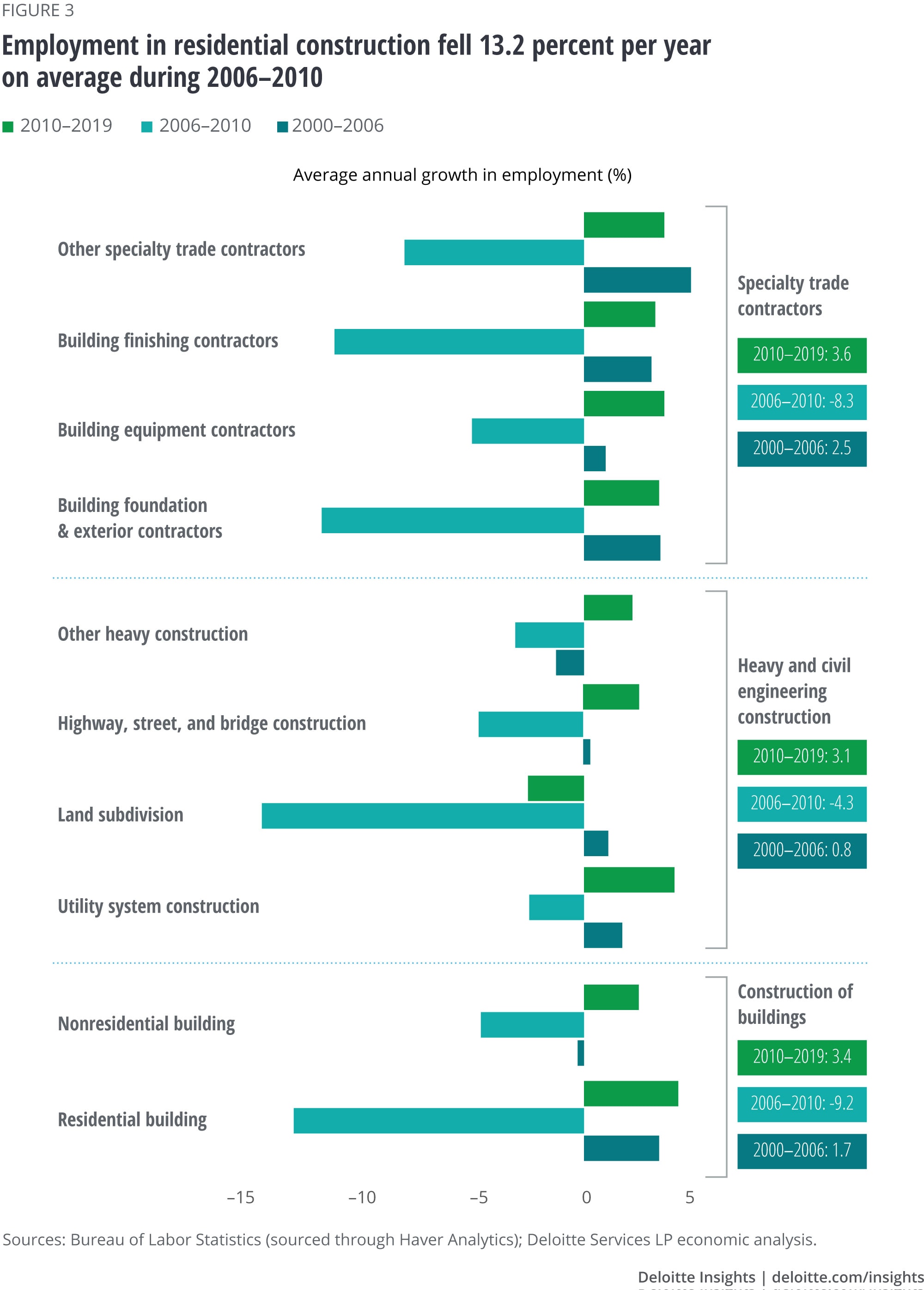

The workforce within the construction sector is distributed across three major sub-sectors. The sector is dominated by specialty trade contractors (63.5 percent in 2019), followed by those in construction of buildings (22.1 percent), and heavy and civil engineering construction (14.4 percent). During the downturn of 2006–2010, job losses were the most extreme in construction of buildings (–9.2 percent on average per year), followed by specialty trade contractors (–8.3 percent); losses were lower in heavy and civil engineering construction. Within construction of buildings, residential construction bore the brunt of the downturn, with employment falling 13.2 percent on average per year between 2006 and 2010. The decline in employment in nonresidential building construction was relatively lower (figure 3). Given these declines, building foundation and exterior contractors—a key component of specialty trade contractors—and closely related to construction of buildings, also witnessed a strong decline in jobs between 2006–2010.

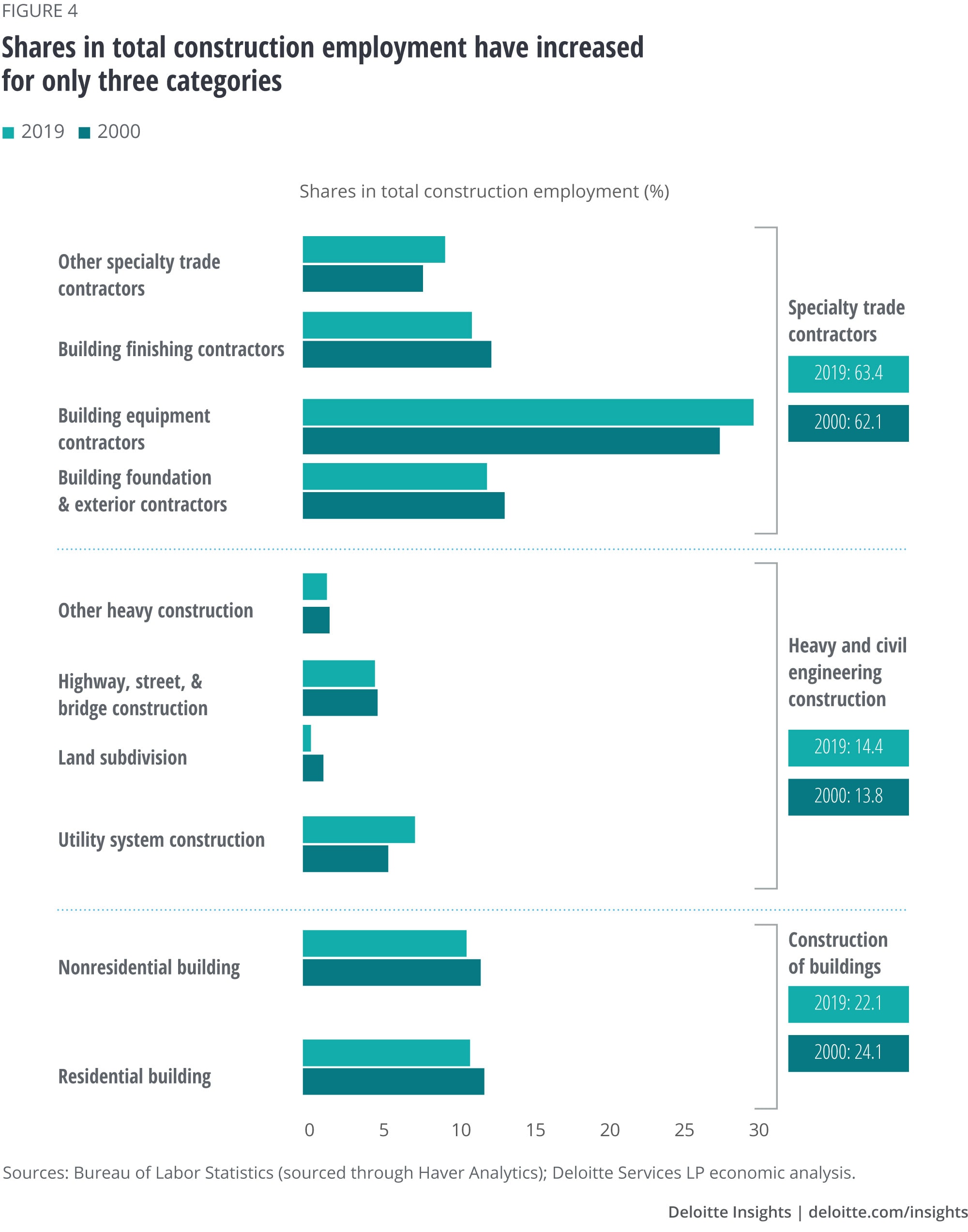

Varying employment growth in the three construction sub-sectors over 2000–2019 has meant that their shares in total construction employment have changed over time. The share of specialty trade contractors, for example, has gone up, while that of construction of buildings has fallen by nearly 2 percentage points to 22.1 percent during this period (figure 4). These changes, however, are not much. Figure 4 also shows that within the three sub-sectors of construction, there were two key gainers: utility system construction (under heavy and civil engineering construction) and building equipment contractors (within specialty trade contractors).

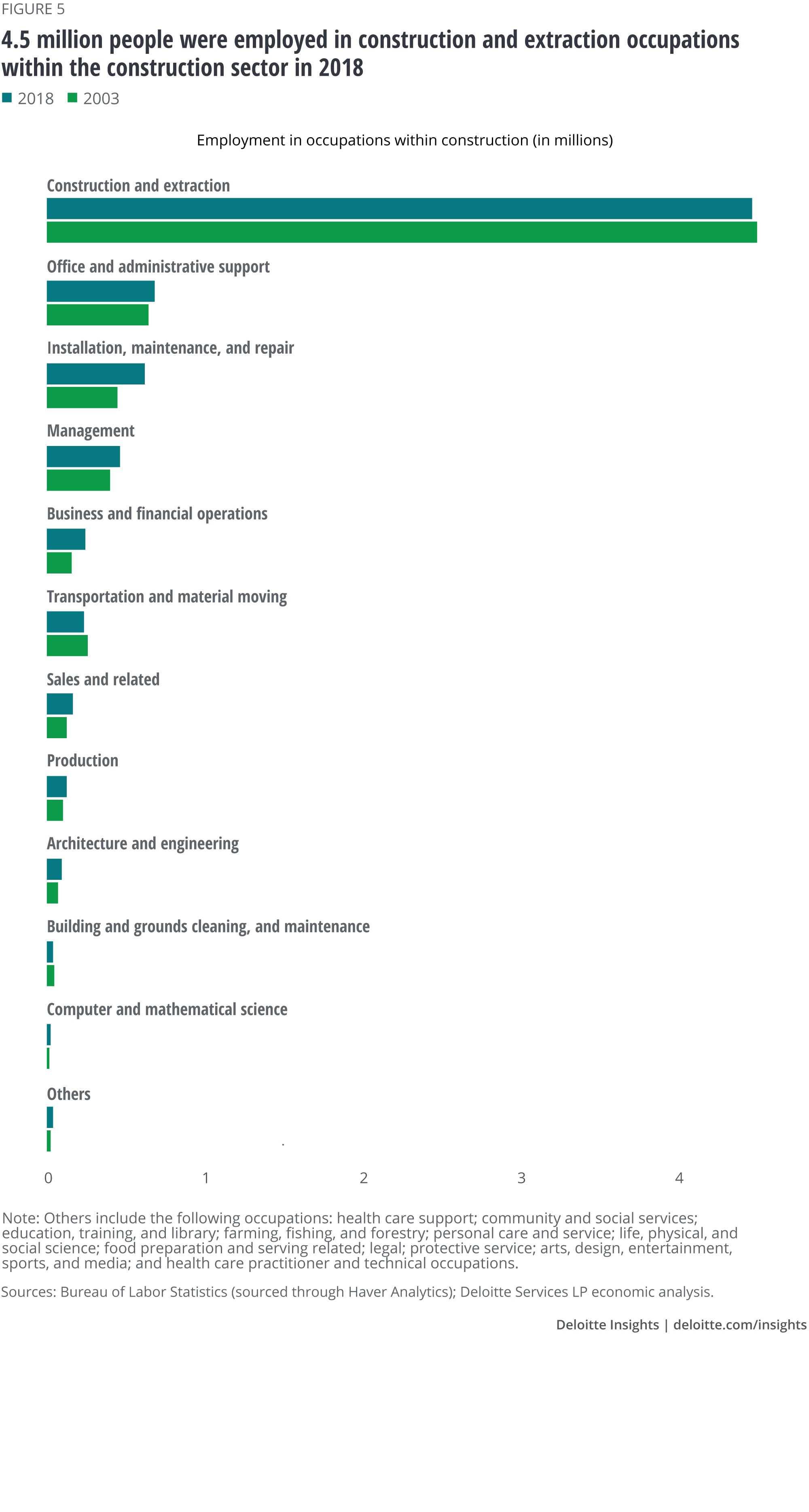

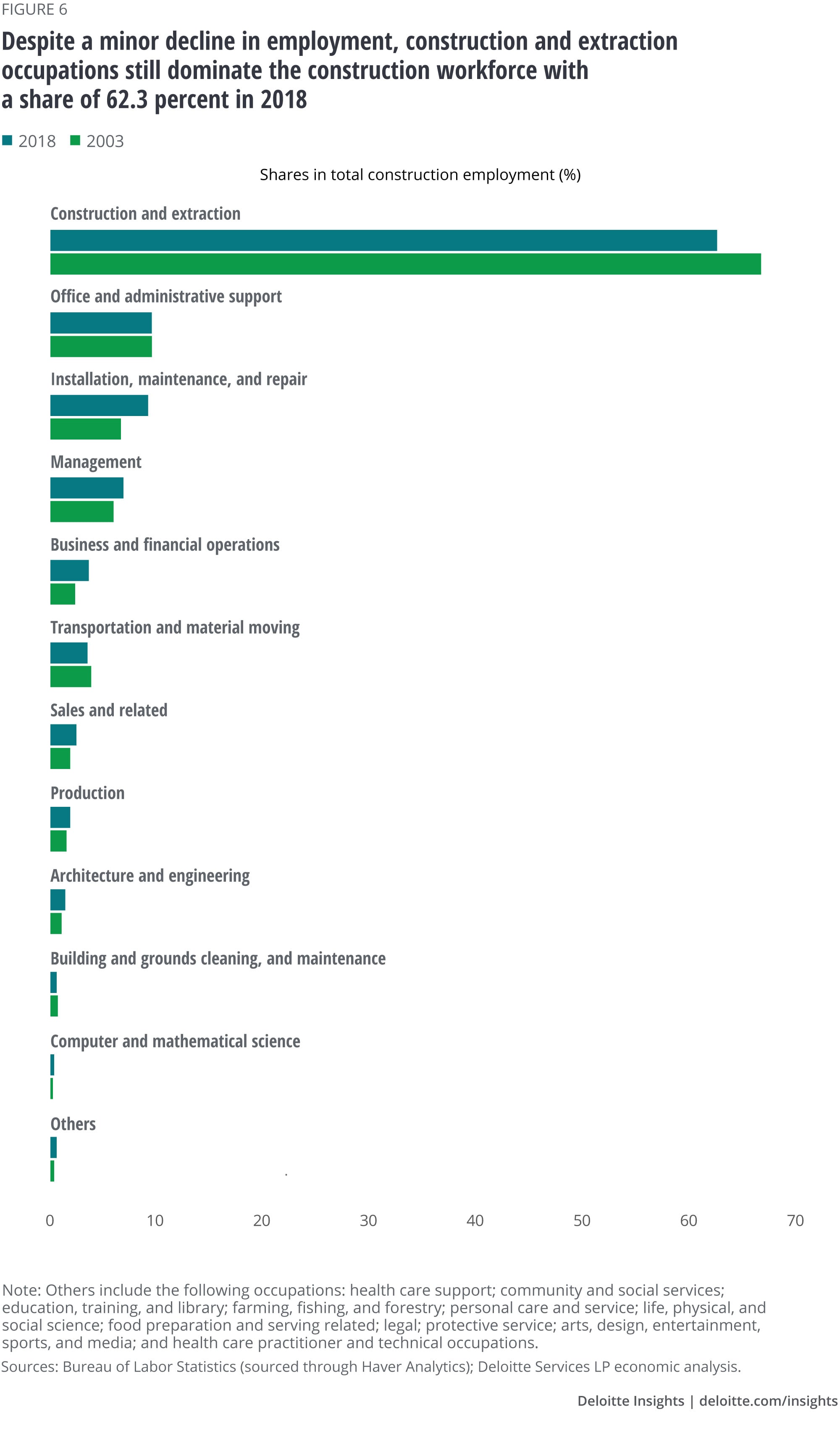

Construction and extraction occupations have the largest share in construction employment

A large bulk of the construction workforce—4.5 million in 2018, amounting to 62.3 percent of employment—is engaged in construction and extraction occupations.5 Of this group, 82.5 percent are in construction trades—brickmasons, stonemasons, carpenters, etc.—followed by supervisors (10.3 percent) and helpers in construction trades (4.8 percent). The large share of construction and extraction occupations in overall construction employment is not surprising given the nature of the sector—the occupation’s share in total employment in the economy is much smaller (4.8 percent in 2018). Other notable occupations within construction are office and administrative support; installation, maintenance, and repair; management; and transport and material moving (figures 5 and 6).

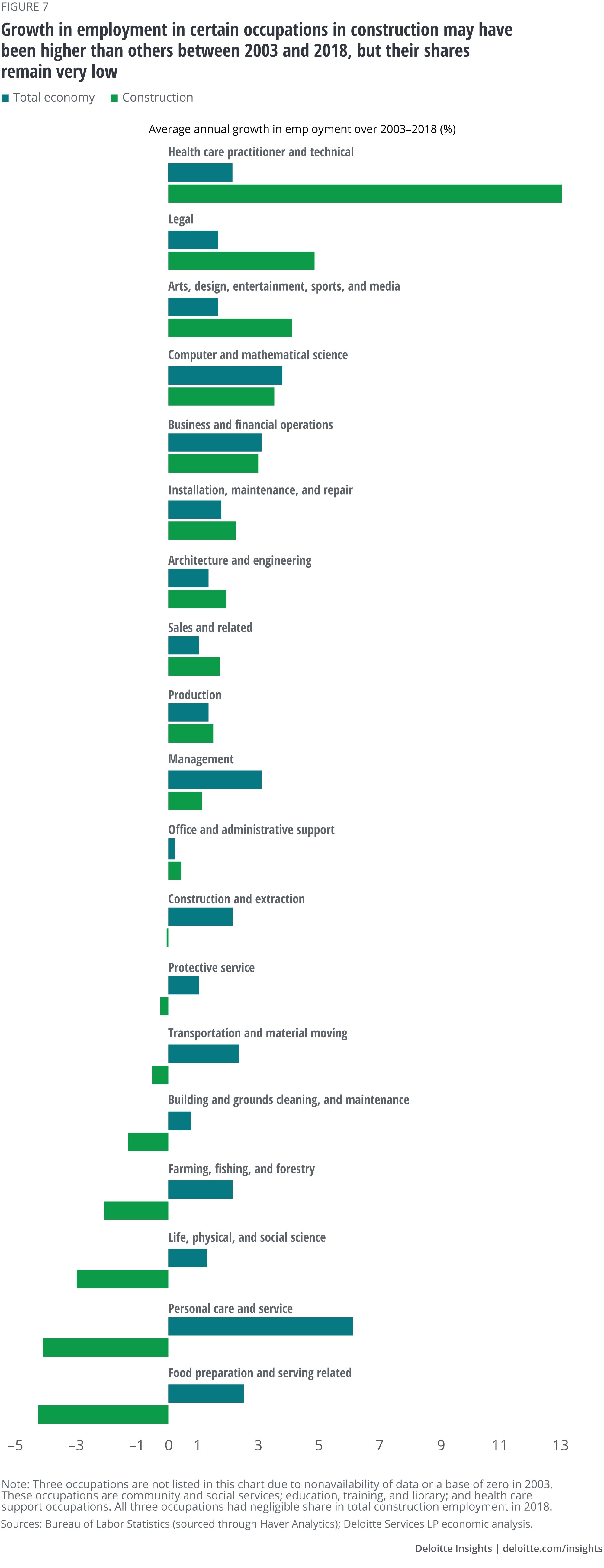

Figure 7 shows that over 2003–2018, the period for which OES data is comparable (see sidebar, “BLS data tells all”), employment in the construction industry fell marginally on average per year for construction and extraction occupations (–0.05 percent); the decline was higher for transportation and material moving occupations (–0.5 percent). In contrast, employment grew in installation, maintenance, and repair occupations (2.2 percent); management occupations (1.1 percent); and business and financial operations occupations (2.9 percent). Consequently, these three occupations have gained a bit of share in overall construction employment at the expense of construction and extraction, as well as transportation and material moving.

An interesting aspect that stands out in figure 7 is the stellar employment growth in occupations such as computer and mathematical science, health care practitioners and technical occupations, and legal operations. However, given these occupations’ negligible share in construction employment to begin with, they barely make a dent in total employment. For example, employment among health care practitioners and technical occupations within construction grew at an average annual rate of 12.7 percent between 2003 and 2018—much higher than the occupation’s 2.1 percent rise for the wider economy. But its share in total construction employment rose to just 0.2 percent in 2018.

Interestingly, in contrast to the trend of office and administrative support occupations’ declining share in total employment in the economy over 2003–2018, its share in construction employment hasn’t changed much during the same period.6 There could be two things at play here. First, technological advancements have not reduced administrative workloads by as much in the construction sector as it has for the overall economy. Second, the marginal decline in employment in construction and extraction occupations—likely aggravated by the housing downturn—has meant that the shares of other occupations in the industry have grown, even if there are reasons why demand for those occupations is broadly weak.

Not much change for now

Small changes are evident in construction employment trends over the past two decades. A dip in the share of residential construction in total construction jobs is one example; a small rise for building equipment contractors is another. Yet, these changes are not major, with the sharp downturn and subsequent recovery clouding the emergence of any overarching trend. Within occupations too, not much has changed: Construction and extraction occupations dominate others despite a decline in employment share. Also, unlike the wider economy, administrative-related occupations have retained their share in the construction workforce. So, is it that advancements in technology haven’t broadly changed the demand dynamics for occupations within construction? Maybe yes. Changes may yet be in store for the future, especially with the advent of new technologies such as 3D-printed houses. But the impact of such technologies is not yet visible in construction employment patterns.

© 2021. See Terms of Use for more information.

More from the Economics collection

-

The shifting sands of employment and occupations in American manufacturing Article5 years ago

-

United States Economic Forecast Q1 2025 Article3 days ago

-

All in a day’s work—and sleep and play: How Americans spend their 24 hours Article6 years ago

-

Personal savings: A look at how Americans are saving Article5 years ago

-

Falling interest rates: Puzzles keeping economists awake at night Article5 years ago

-

Rising corporate debt: Should we worry? Article5 years ago