Perspectives

The Deloitte Research Monthly Outlook and Perspectives

Issue XXVII

19 June 2017

Economy

An orderly de-leveraging?

De-leveraging has been a hotly debated topic in China in recent years, but roaring property prices in major cities have made financial stability of even greater concern in recent months. How has this come about?

Policy pundits have been saying repeatedly that the government needs to pay more attention to rising leverage and asset inflation. Our views on China's leverage have been that 1) China could tolerate further increases in leverage; 2) China should address this within two years, before debt/GDP ratio crosses the 300% mark; 3) the most effective means of reducing leverage for China is SOE reform (reining in reckless borrowing, disposal of non-performing assets and bringing private ownership into state-dominated sectors) and financial reform (to increase equities in the economy, preferably more from foreigners). However, in the run up to the 19th Party Congress de-leveraging has been out on the back burner a little as the focus has been primarily upon economic growth and stability. (The focus has actually been on several targets simultaneously - GDP growth, financial sector stability, and RMB exchange rate stability.) Policymakers will only start to address corporate leverage issues after the leadership transition is completed.

In an ideal scenario, money supply should be broadly in line with GDP growth rate plus inflation. Where China is concerned this would mean that credit growth should be reduced by 3-5% from the current level (May M2 growth, which came in at 9.6% yoy, is an encouraging sign). But given the dual targets of growth and stability and recent political events, there is a real likelihood of more capital coming into the market through equity and foreign inflows into China’s vast debt market (almost $9.4trn, the 3rd largest in the world, trailing only the US and Japan).

Chart: Further deceleration of money supply on the card

In the wake of Xi-Trump meeting in April 2017, China opened the market for foreign credit rating agencies. As a result, foreign institutional investors such as pension funds tapping into China’s debt market has become a very real possibility. Therefore, given the very real chance of foreign capital coming to the Chinese economy, we may well see frequent knee-jerk reactions to financial sector stress. This was greatly in evidence recently when IPOs were halted in the A-share market and restrictions were placed on majority shareholder's unwinding of their positions in order to boost investment sentiment.

Comparing the CSRC's reaction this time around to events exactly two years ago when Shanghai Composite Index has hit almost 5200 on rampant speculation and crashed spectacularly despite numerous attempts of government support we can see that this time, the China Securities Regulatory Commission was quick to act. But such restrictive measures could effectively shut the door on corporate equity issuance. As a result, it could well be that the compositions of leverage might become less optimal, consumers leverage coming down on PBOC’s restrictive policy on mortgage underwriting while corporate debt remains high.

The rationale for the Government to open up debt market first is understandable because the stock market is too volatile and liberalization of the domestic bond market could make the RMB exchange rate more flexible. If the debt market is well positioned to attract foreign capital, is a stronger RMB a pre-condition for liberalizing the bond market? Recent upticks of the RMB against the greenback has generated more speculations on whether the RMB’s depreciation has reached an inflection point. Is this a gesture of goodwill from China to the Trump Administration during the “100 day program” which was set to reduce bilateral trade imbalance between China and the US? Will China try to reverse the market expectations on RMB depreciation in order to prepare for liberalizing debt market or will the market take the view that de-leveraging could happen sooner than expected?

On the RMB exchange rate, we see a few trends in the short run which could strengthen the subtle interventions by the People’s Bank of China. First of all, there is a growing recognition among investors that USD assets are expensive, while those in emerging markets are relatively cheap. Second, downward pressures on the RMB have been mitigated by the falling USD index (an 8-month low). Third, in line with the heightened emphasis on stability, the PBOC has made exchange rate stability one of its key objectives. And finally, in an environment of ultra-low interest rates, investors have seen that they can get a relatively good yield pick-up by parking in the RMB offshore market (about 3-4% based on CNH) because the RMB is likely to stay stable before the 19th Party Congress.

The real issue is not the stability of the RMB but what will happen after the 19th Party Congress. The strengthening RMB clearly reflects investors’ renewed hopes for reform. But serious de-leveraging in 2018 will necessitate a lower GDP target and concrete progress in reforming SOEs. But de-leveraging, for any country, is a painful undertaking made more painful by creditors' insistence that crisis-hit countries enact austerity measures. Greece is a prime example of this, where creditors are imposing harsh conditions in the teeth of a sluggish economy and dim prospects for future growth. Something similar was done to many Asian economies after 1997, after receiving IMF packages, they were forced to engage in "fire sales". The price of such de-leveraging was an extreme recession, the social cost of which some of the countries are still paying today. It is true that China today is in a much stronger position than the emerging Asia of yesterday despite a high debt/GDP ratio and sporadic financial sector distress are a drag on sustainable economic growth. In our view, it is possible for China to willingly undertake de-leveraging at a measured pace but the window of opportunities may narrow significantly in a year or so.

Chart: Forced de-leveraging in Thailand

What should be the roadmap for such an orderly de-leveraging? First of all, it will be wise to lower GDP growth target in 2018 and ultimately abandon such a target by replacing it with goals of inflation and unemployment rates. Second, China should embrace the immense appetite of institutional investors and central banks who are eager to hold RMB denominated fixed income products. For most of these institutions, eased restrictions of capital movement are far more important than exchange rate appreciation. Third, the chief argument for RMB depreciation is never about competitiveness, but about the result of diversified investment by Chinese firms and consumers. Efforts to boost foreign reserves (which have actually seen four consecutive months of increases) would give the market the wrong signal that China’s reserves are not enough. In conclusion, policymakers' proactive measures of addressing financial stability is a positive step, however, an orderly de-leveraging can only be achieved if the GDP growth target is lowered. In a speech in Beijing last week, David Lipton, the IMF's First Deputy Managing Director said, "While some near-term risks have receded, the reform process needs to accelerate." Indeed, reform should begin with a lower growth rate.

Financial Services

Are Chinese insurers ready for the Belt and Road?

A full-blooded promotion of the Belt and Road (B&R) Initiative will bring huge business opportunities for insurers. The China Insurance Regulatory Commission (CIRC) has recently released four sets of guidelines and decided upon the establishment of a comprehensive insurance system especially to support the B&R by providing an all-around risk safeguard and fund support. The guidelines also address innovation of products and service, fund utilization and establishment of green accesses. However, a lot remains to be done for Chinese insurers to cater to the needs involved in the B&R, thereafter the industry should return to origins of risk safeguard, focus on industrial investment, and will usher in a new era of explosive growth.

Table: CIRC released four guidelines during April to May 2017

For Chinese insurers, B&R Initiative could net a premium income of USD23 bn

With the B&R Initiative, Chinese enterprises are not only presented with international opportunities but also face huge risk exposures, including but not limited to political, economic, legal and default risks. Chinese enterprises primarily engage in overseas projects either as investors and/or contractors. Both roles require them to buy insurance, either during the construction or the operating phase. However, the coverage level of commercial insurance in countries along the B&R route is far lower than the world average. Chinese enterprises are exposed under high risks as they implement their "outward bound" strategies.

In its October 2016 research report on the impact of the B&R on commercial insurance, the Reinsurance Company Swiss Re estimated that the creation of brand new and significant business opportunities by the B&R would bring USD34 billion of premium income to the global insurance industry by 2030, of which USD23 billion will go to Chinese insurers. There are predominantly four categories of insurance requirements: traditional insurance related to assets, projects and liabilities; coverage related to trade such as export credit insurance and overseas investment insurance; coverage on people such as accident insurance and cross border insurance.

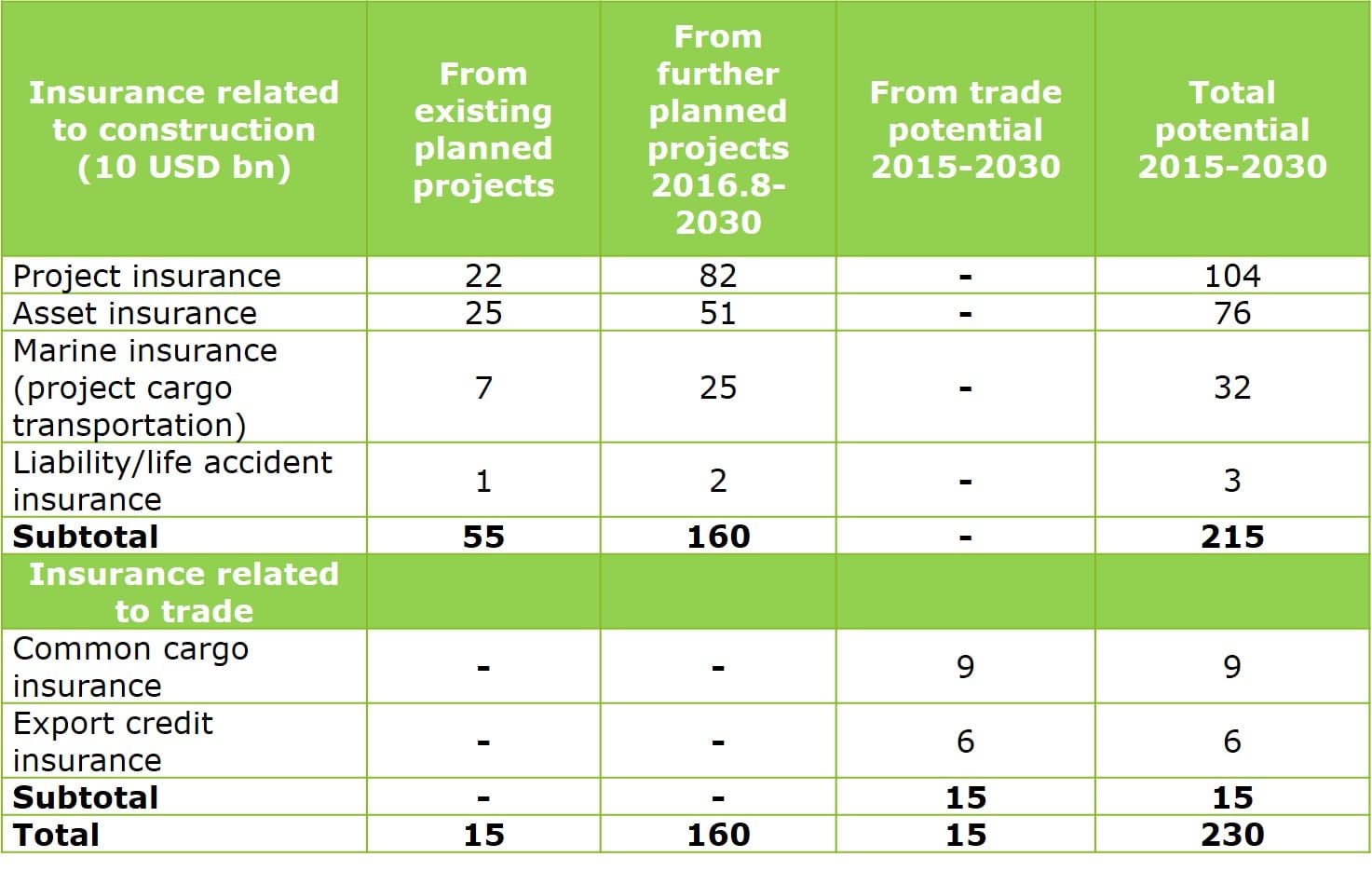

Table: Estimated premium income potential to Chinese companies

Return to origins of risk safeguard

The B&R Initiative presents opportunities but also challenges to the Chinese insurance industry. At present, Chinese insurance industry's premium income is already ranked amongst the top 3 in the world, whereas insurance penetration (premium/GDP) and insurance density (premium per capita) remain substantially lower than the world average. To provide comprehensive insurance solutions, Chinese insurers need to build their strength in the following two areas:

On the one hand, Chinese insurers need to plug internal weaknesses, develop better trade insurance and strengthen overseas network coverage. Currently the scale of insurance servicing trade is quite small and has been in deficit for quite a while. For example, the amount in the first 3 quarters in 2016 was only 2.9 billion dollars, less than 1% of the total premium with a deficit amount of 6.1 billion dollars. Additionally, related products and services are insufficient at best as only SINOSURE can provide export credit insurance and just a few institutions provide overseas investment insurance. At the end of 2016, only 12 Chinese companies have set up 38 operational branches overseas. The low number of overseas institutions and their insufficient market experience will limit business development and service capabilities.

On the other hand, Chinese insurers need to cooperate with external parties. While quite a few companies have already created the "going out" risk blanket insurance platforms, project/enterprise databases and mapped out the B&R country risks, they still need to focus on cooperation with foreign insurers in such areas as co-insurance and technical exchanges, learning from their rich experience in risk pricing and case accumulation with their large global networks. For example, the Pakistan hydroelectric project was underwritten by a China insurer with Zurich Insurance as the key reinsurer.

Return to industrial investment on infrastructure

The propensity of insurance fund for long-term and stable returns is a perfect match for B&R infrastructure projects which have a long-term construction cycle with stable benefits and large funding needs. Currently, the Chinese government has established the RMB300 billion national insurance investment fund focusing on national strategic projects including those under the B&R. By the end of 2016, the outstanding investment balance was RMB13.4 trillion out of which RMB1.65 trillion was injected into key infrastructure projects. This percentage will increase soon later and investment activities can be quite diversified to include such vehicles as debt, equity, PEs as well as investment products issued by AIIB, the Silk Road Fund and other institutions.

In today’s world, insurance is regarded as a means for market-oriented risk management and fund accommodation. As such, insurance supporting "out-going" or outward bound enterprises has become the focus of attention. Moreover, as many large foreign insurers are salivating at the huge market potential offered by the B&R, Chinese insurers should return to risk safeguard and support real economy with long-term and stable benefit.

Energy

Fuel retailing: the real battle lies elsewhere

In order to stimulate demand, Chinese fuel retailers are now engaged in a price war. However, fuel retail dynamics suggest that the real battle lies elsewhere.

Price war looms

On June 9th, the government announced another round of downward adjustment to retail fuel prices. In May, in order to stimulate sluggish demand, the oil majors had already cut the gasoline retail price as much as 1.5 yuan per litre (about 20% of the retail price). Now, independent retailers will also have to join the price war to fend off competition from state-owned and foreign oil majors, plunging the industry into an all-out price war.

The major fuel retailers' move to cut prices was not surprising, given stagnant demand and oversupply of oil products in the market. Moreover, a relatively high price gap between wholesale and retail prices had given retailers some leeway to engage in a price war without hurting profits too much.

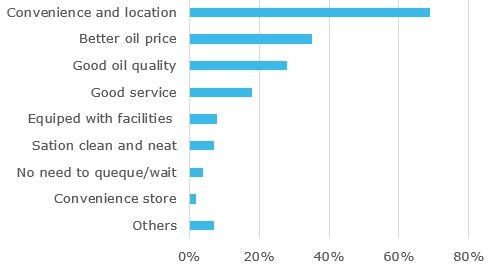

However, while Chinese customers are still quite price sensitive, it is no longer the predominant factor in the minds of many customers. In a recent survey of 36,823 private car owners, 69% of customers surveyed put location and convenience as the first priority for choosing a petrol station while a better price is in second place, followed by quality of product and quality of service.

Chart: Key Factors to Consider for Choosing Petrol Station

The real battle lies elsewhere

What the survey indicates is that the fuel retail market has already changed. Emerging trends such as changes in demand profile, introduction of vehicle sharing schemes, rising importance of non-fuel product sales, and technology applications will force the industry to rethink the way they compete.

Oil demand profile shifting to gasoline-driven. Oil is transforming from an industry commodity to a consumer product as the rebalancing of China's economy is altering the oil consumption pattern. Buoyed by a steady increase in passenger car sales, China's oil demand profile has become primarily gasoline-driven. The gasoline demand is expect to grow 5.3% yoy to reach 125 million tonnes in 2017 while diesel demand by contrast is likely to drop by 1.5% to 160 million tonnes. The changing profile of oil product demand will ultimately affect the product strategies of retailers.

Introduction of vehicle sharing schemes. The concept of vehicle-sharing and ride-sharing is widely accepted in China by a huge number of users. Didi Chuxing, the ride-sharing service company, provides 20 million rides on a daily basis; Ofo, the Chinese bike-sharing start-up claims to have 20 million registered users across the country. Looking ahead, the vehicle/ride-sharing services will likely reduce car ownership and even car use – thereby undercutting fuel demand. Furthermore, these fleet service providers will have stronger bargaining power with fuel retailers.

Rising importance of non-fuel retail business. Nowadays a huge number of people go to petrol stations not just for filling up the tanks, but also for buying breakfast or getting a car wash. Their need for convenience retail is more frequent than their car’s need for fuel. Fuel retail companies are increasingly focusing on non-fuel business, with hopes of improving margins and luring customers to shop. Sinopec for example started building its non-fuel retail business in 2008 by investing RMB20 billion in network development. Today this investment has paid off as its non-fuel retail business revenue reached RMB35 billion in 2016, a 41% yoy growth.

Enabling mobile payment and beyond. The rapid uptake of mobile payment in China forces all retailers to follow suit. The common nirvana that all fuel retailers seek is the ability to accept, seamlessly and with ease, all payment options desired by the majority of regular shoppers while being able to provide a personalized and loyalty building shopping experience. Mobile payment certainly is the most critical factor of this over-arching strategy. Multiple oil companies, including CNPC, Sinopec, Shell, BP and some independent retailers, have started building mobile payment connections into their systems. And beyond that, they are working on ways to better leverage the consumer data and enhance system security.

In the future the fuel retail business will be the crown jewel of any oil company's assets, a buffer against oil price fluctuations and more importantly a creator of opportunities.

Automotive

China‘s NEV market runs on the skids

Stringent eligibility standards coupled with the rollback of government subsidies for NEV purchases has put unprecedented pressure upon China’s NEV market and sales plummeted in the first four months of this year. In addition, investigations into subsidy fraud as well as a policy vacuum at the level of local government in the past few months has dented the confidence of NEV makers in the future. Further clouding the prospect are rumours that the government is planning to halt the issuing of NEV production. If this is true, new entrants will be barred from the Chinese market which is currently dominated by conventional car manufacturers. China’s EV craze has attracted a dozen of start-ups who secured funding and endorsement from local governments and also unveiled mass production plans as early as 2018. Huge losses will be incurred if they failed to get a permit.

Subsidies still play a huge part in the sale of NEVs and the reduction of fiscal stimulus has already been reflected in weaker sales, demonstrating that the pool of Chinese NEV consumers won’t be growing without the help of further subsidies. By introducing more fledging EV manufacturers, the Chinese government hoped to stir up competition and bolster technological innovation. But given current circumstances - the ups and downs of the NEV market to a large extent relies on fiscal funding, granting more companies easy access to the market will raise overcapacity concerns.

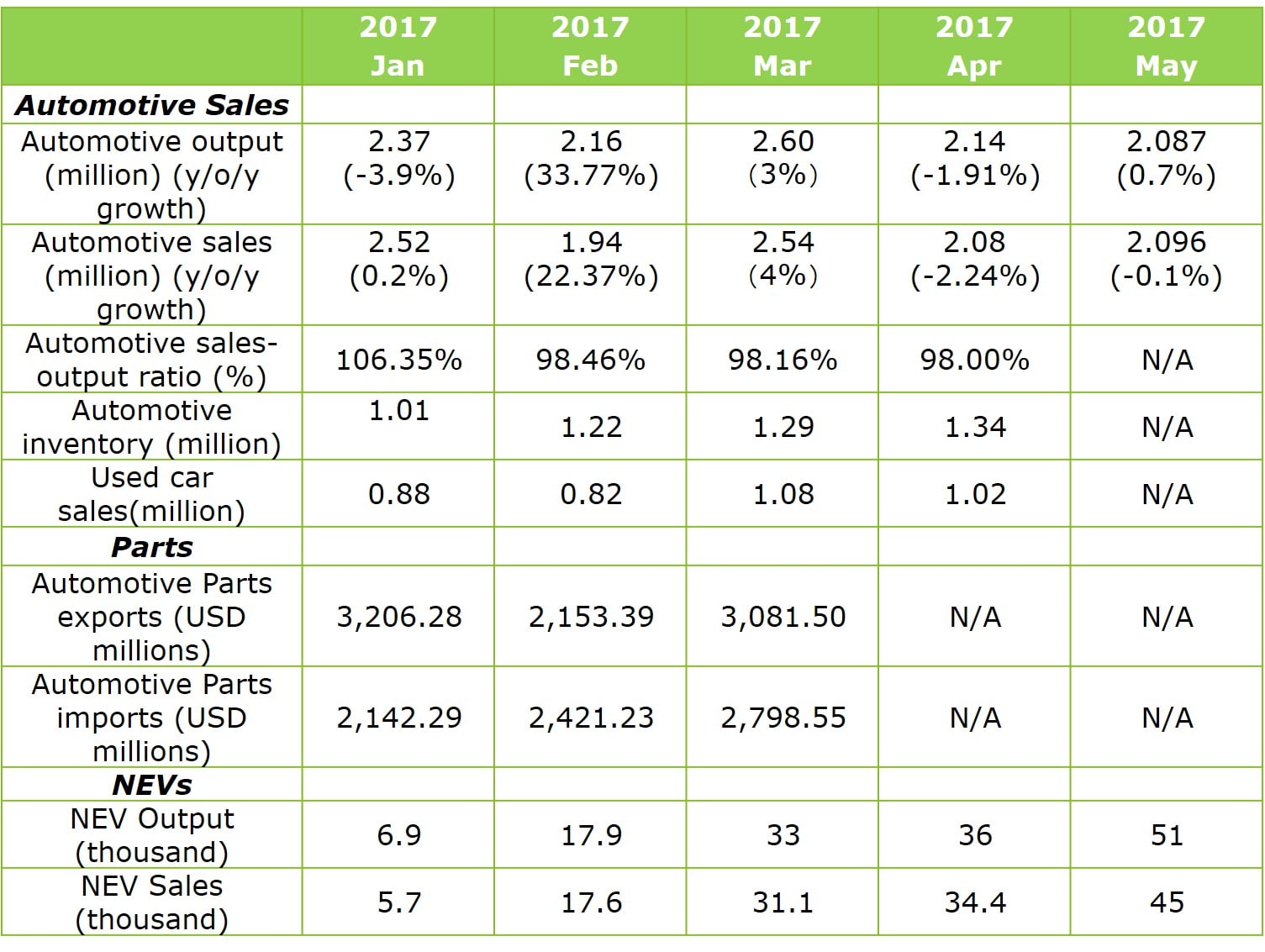

Stark departure from the “golden days”. NEV sales dropped 0.2% yoy in the first four months this year in stark contrast with a 147% surge in the same period of the previous year. Electric buses which have been hardest hit during the government’s crackdown on subsidy frauds posted a 72% yoy decline in sales. Automakers attributed the underperformance to a policy vacuum as many provincial governments postponed rolling out the latest funding schemes. The central government, as it had promised, lowered subsidies for NEV purchases but at the same time raised eligibility standards for manufacturers. (Vehicles will have to meet various technical requirements, such as battery energy density, charging speed and the like). Such a move is widely seen as being part of the central government’s plan to weed out small-sized and lower-quality EV makers.

Leading carmakers’ profits weighed down by reduced subsidies and sluggish sales. China’s largest NEV carmaker BYD, which used to account for a quarter of all NEV sales, has seen its sales tumbling this year and lost the lead to its home-grown rivals. The company reported a 29% loss in net profit in the first quarter. Likewise, Electric bus manufacturers also saw big losses due to a sales slump. Deep-pocketed carmakers have started to subsidize EV purchase out of their own war chests to avoid any price spikes brought on by the rollback of government subsidy. Those who choose not to compensate consumers will have to suffer from a declining demand. Even worse, carmakers won't be able to receive subsidies for a full year, further weighing on their cash flow.

A sudden halt to the EV production permit issuance. The Chinese government reportedly plans to put a brake on the issuing of EV manufacturing licenses. There are in total 15 licensed EV makers so far, who plan to add 1.17 million capacity annually (traditional OEM’s plans on NEV are not even included). Despite the ambitious goal of having 2 million NEVs sold in 2020, the Chinese government still frets that the investment frenzy in electric vehicles will lead to a severe overcapacity problem. If the plan is confirmed, this represents a departure from the original goal of leapfrogging western competitors in the EV race.

NEVs only account for less than 2% of total auto sales. The Chinese government wants to increase the proportion to 20% by 2025. Therefore, the key will be to stimulate consumption as the market already shows signs of excess supply. By cutting subsidies, however, the government has shifted the burden of creating demand onto the backs of manufacturers who, as a result, have seen their profitability deteriorate. We expect downward pressure on NEV sales to persist till later this year and carmakers without much financial strength will be knocked out of the market amidst growing competition.

Auto sales growth may slip to 1%. The latest data showed that auto market also faced downward pressure of late. Vehicle sales dropped for the second straight month in May, with production increased 0.7% to 2.1million and sales declined 0.1% to 2.1 million. Automakers have begun to wage price wars in late May to meet their half-year sales target, further weighing on dealership’s swelling inventory level (vehicle inventory alert index has been hovering above the warning level) . We expect China’s auto sales may continue to decelerate especially when the high-base effect kicks in. We revise down our annual sales projection to lower than 1% due to the following downside risks.

- The economic growth peaked in Q1 and continues to decelerate since then. The tightening credit condition as well as government’s firm stances on deleveraging has entailed some financial tensions and slower growth. Meanwhile, the other economic engines also seemed to lose stream as consumption growth remain tame, fiscal spending slows and trade outlook keeps uncertain;

- The cost of home purchase is expected to rise sharply as the tightened regulation takes effect, restraining household spending. The slowdown in property and infrastructure investment may also reduce the demand for commercial vehicles;

- China’s auto sales has reached its cyclical peak in 2016Q3 (cyclical bottom is in 2015Q2), fuelled by the tax incentive. We believe the auto market has been on a downward trajectory and the trend will carry on this year;

- Given the high-base effect, room for high growth of auto sales is limited;

- Automakers who used to stuff inventory at dealers’ lots in order to sugar up sales figures are expected to see loss of control over dealerships when the new sales regulation takes effect on July 1st.