In this time of dramatic economic, social, and technological transition, consumers are using their dollars to effect the change they want to see in the world. They’re choosing brands that align with their values and needs.

At the same time, consumer companies are extending their intentions beyond profit to positively impact a broader set of stakeholders, including society and the planet. Together, consumers and consumer companies are buying into better.

At Deloitte, we help our clients innovate to reach a deeper understanding of their customers and fuse profit with purpose to achieve better outcomes: Better trust. Better experience. Better value.

Let’s engineer the future of the consumer industry together

Over the next decade, six forces will impact the consumer industry—and our future—in radical new ways and will compel consumer companies to examine implications across markets, models, and mechanics as they chart their paths to buying into better.

Explore the implicationsSectors we serve

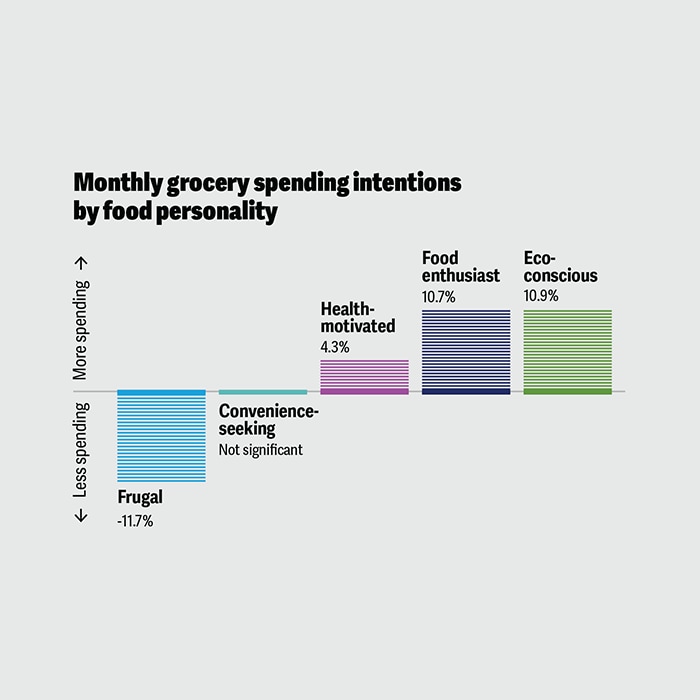

Monitoring shifts in customer preferences

What happens when you really listen to the signals consumers are sending to understand who they are, what they look like below the surface, and what they truly want? You’ll find an empowered consumer that wants a better future for themselves, their communities, and the planet. At Deloitte, we combine world-class consumer business knowledge with a full command of technology to help our clients understand the massive shifts consumers are facing so they can build and deliver products and services that align with their customers’ values and desires.

IndustryAdvantage™

Deloitte IndustryAdvantage offers deep industry insights with cutting-edge digital capabilities to position your business for the future. Explore how we can help you face your commercial, product, and operations challenges and gain a competitive advantage.

Let’s get started

Services we provide

Deloitte’s depth, breadth of services and solutions, and industry experience with many of the world’s most forward-thinking brands offers us the ability to provide deeper consumer behavior insights and a decisive strategy, no matter what your business objective. We’re passionate about looking ahead—and around corners—to help you create greater relevancy for your brand; greater trust, innovation, purpose, and value for your customers; and greater confidence in your company’s resilience, agility, and vision. This is the Deloitte advantage. It's why, while others bet on the future, we help you build it.

Client success stories

Deloitte is unrivaled in our ability and commitment to help consumer industry clients buy into better, and design what they want their future to be. Our business-first thinking, breadth and scale of capabilities, and ability to surround an issue from every angle help us engineer innovative solutions that enable businesses to thrive—and create lasting change for the customers they serve.

Discover some of Deloitte’s many stories of purpose and impact.

A new day for the night shift

Kroger uses data analytics, AI, and ML tools to modernize its employee experience.

Accelerating the drive toward a more-sustainable automotive industry

BorgWarner develops a data strategy and builds cloud-based analytics dashboards to support their Charging Forward project to shift toward electric vehicles and charging infrastructure.

When it comes to emissions, uncertainty likely doesn’t cut it

A consumer products company seeks increased clarity around its sustainability data through ESG assurance readiness and works to build trust with stakeholders.

${column4-title}

Better starts here

Our latest thinking

Gain insights to help you reimagine your business, engage differently with your customers, engineer innovative solutions, contribute to a net-zero future, drive diversity and inclusion, and lead in building the future you want to see.

Get in touch

Want to take a deeper dive into our research or discuss the role you can play in the future of the consumer industry? Get in touch with our team.