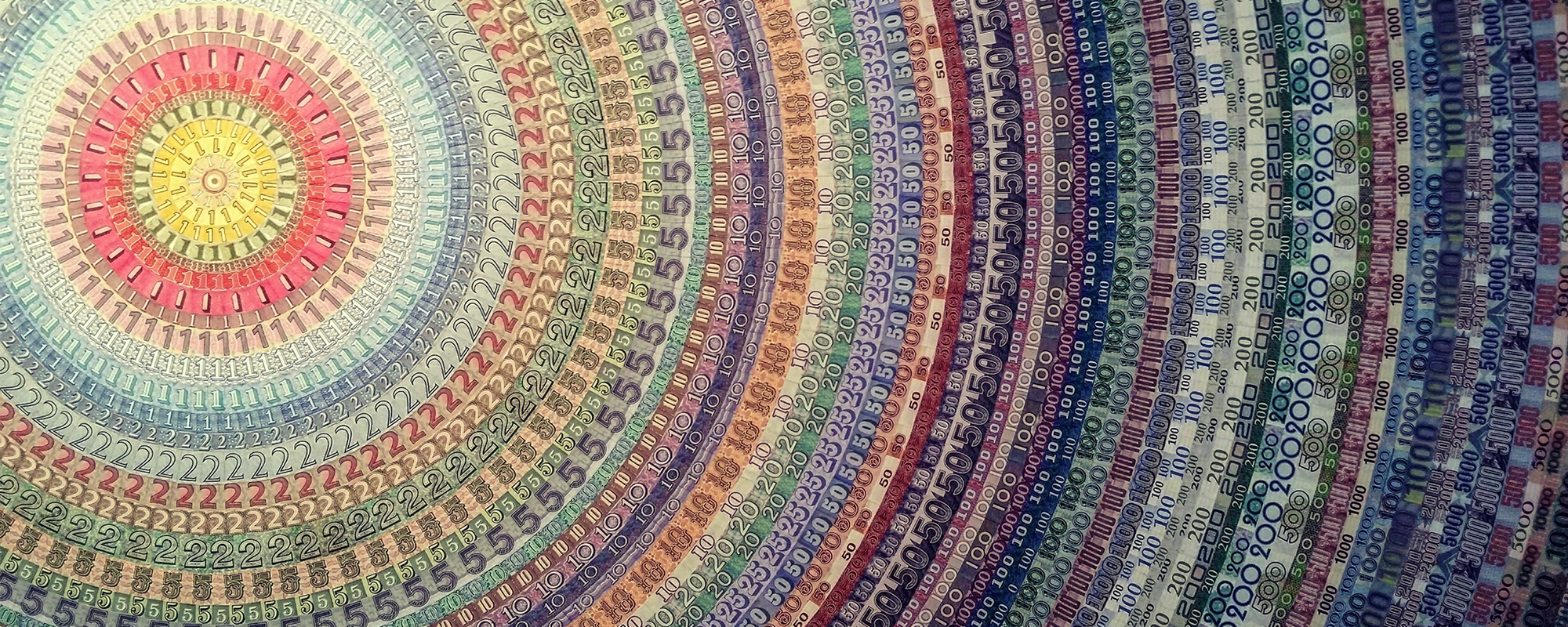

Many foreign currencies, one shared vision

An international oilfield services company pumps new energy into its FX program

CURRENCY VOLATILITY

IS EXPECTED.

EARNINGS VOLATILITY,

NOT SO MUCH.

The Situation

Investors prefer steady, predictable earnings growth. But for an oilfield services provider that operates in dozens of countries, buying equipment and services in one country to deploy in another, performing work that often takes years to complete … the perpetually unsteady balance among global currencies was causing the company’s balance sheet to teeter like a broken pumpjack.

If only it were that easy to fix. Oil exploration and extraction are complex and risky undertakings. The company seeks to be the go-to partner providing a range of oilfield services across the exploration and extraction value chain—from analysis of underground oil deposits, to planning and drilling, to site remediation. Every project takes precision, expertise, equipment … and time. But in the few weeks it takes to, say, drill a well, currency exchange rates can fluctuate significantly. The result? One contract strikes black gold—while another turns into a dry hole.

Like many big international operators, the company had a foreign currency exchange (FX) hedging program in place. What it lacked was a cohesive vision, strategy, and process for identifying and addressing FX risk exposures in ways that produced consistent, predictable results. It didn’t help that the treasury team was stretched thin and still working manually via spreadsheets.

THE SOLVE

The company’s leadership needed solutions fast. FX hedges were being managed as rolling, one-month forward contracts—meaning every month that passed would be another when those contracts weren’t optimized. Could Deloitte provide a preliminary analysis and recommendation in two weeks, with the whole project completed in four weeks?

Yes, we could—and did. A core team of three Deloitte advisers quickly met with the company’s CFO, treasurer, treasury senior manager, and other stakeholders to develop a current-state understanding of the company’s FX approach and processes. In those initial interviews, differing perspectives emerged among leadership regarding the appropriate guiding philosophy for FX risk management. Was it to minimize economic (operating) risk exposure, reduce pre-tax earnings volatility, or mitigate tax liabilities? Drilling down, the Deloitte team could see these philosophical differences were resulting in inconsistencies in how the balance sheet was protected, what was considered a risk, and other issues.

Within two weeks, Deloitte delivered a preliminary assessment of the company’s current state and a series of recommendations regarding operational improvements that were needed. Two weeks later, the final analysis and recommendations were delivered, along with a roadmap for the company’s FX transformation.

GET ON THE

SAME PAGE.

THE BALANCE (SHEET)

WILL COME.

The Impact

Every company in the oil and gas business knows the critical importance of consistent flow and control. Unanticipated well shutdowns can be costly; blowouts can turn deadly. Deloitte’s client is recognized for reducing such risks for its customers.

Now, the company has what it needs to improve its own cash flow consistency and control as well.

The CFO and treasury team now share an understanding of the most appropriate FX strategy to help drive shareholder value. They also have a step-by-step guide for putting that vision into practice through process standardization, technology improvements, and team communication and training. These initiatives can help the company control costs and optimize value from each foreign currency transaction.

The result? Risks reduced, forecasts achieved … and balance sustained.

Insert Custom HTML fragment. Do not delete! This box/component contains code

that is needed on this page. This message will not be visible when page is

activated.

+++ DO NOT USE THIS FRAGMENT WITHOUT EXPLICIT APPROVAL FROM THE CREATIVE

STUDIO DEVELOPMENT TEAM +++

- Chapters

- descriptions off, selected

- subtitles off, selected

- captions settings, opens captions settings dialog

- captions off, selected

This is a modal window.

The Video Cloud resource was not found.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

LET'S CONNECT.

Do these challenges sound familiar?

${foot-notes}

${foot-notes}

-

Erik Smolders

Managing Director

Deloitte & Touche LLP

esmolders@deloitte.com

+1 714 913 1025 -

Phil Chun

Manager

Deloitte & Touche LLP

philchun@deloitte.com

+1 213 361 9837 -

Michael Seo

Consultant

Deloitte & Touche LLP

micseo@deloitte.com

+1 212 436 4441 -

${tile-4-title}

${tile-4-info}

-

${tile-5-title}

${tile-5-info}

-

${tile-6-title}

${tile-6-info}

Insert Custom HTML fragment. Do not delete! This box/component contains code

that is needed on this page. This message will not be visible when page is

activated.

+++ DO NOT USE THIS FRAGMENT WITHOUT EXPLICIT APPROVAL FROM THE CREATIVE

STUDIO DEVELOPMENT TEAM +++

Custom Sticky Header