Transfers and servicing of financial assets has been saved

Perspectives

Transfers and servicing of financial assets

On the Radar: Determining a sale under ASC 860

Is it a sale or isn’t it? A transfer of financial assets may not qualify as a sale under ASC 860—and it may take a legal opinion to make the determination. Here’s a step-by-step guide to help you through the process.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

An analysis with legal implications

Determining whether a transfer of financial assets or servicing rights qualifies as a sale for financial reporting purposes can be time-consuming and complex. An entity must consider both the form and substance of the transfer. As part of such an analysis, the entity would evaluate relevant legal and accounting rules and interpretations and generally must consult legal experts. The outcome of this analysis could significantly affect the classification, measurement, and earnings impact of the transaction as well as the related financial statement ratios. This guidance has not significantly changed for more than a decade, and no changes are expected in the near term.

Accounting for transfers of financial assets

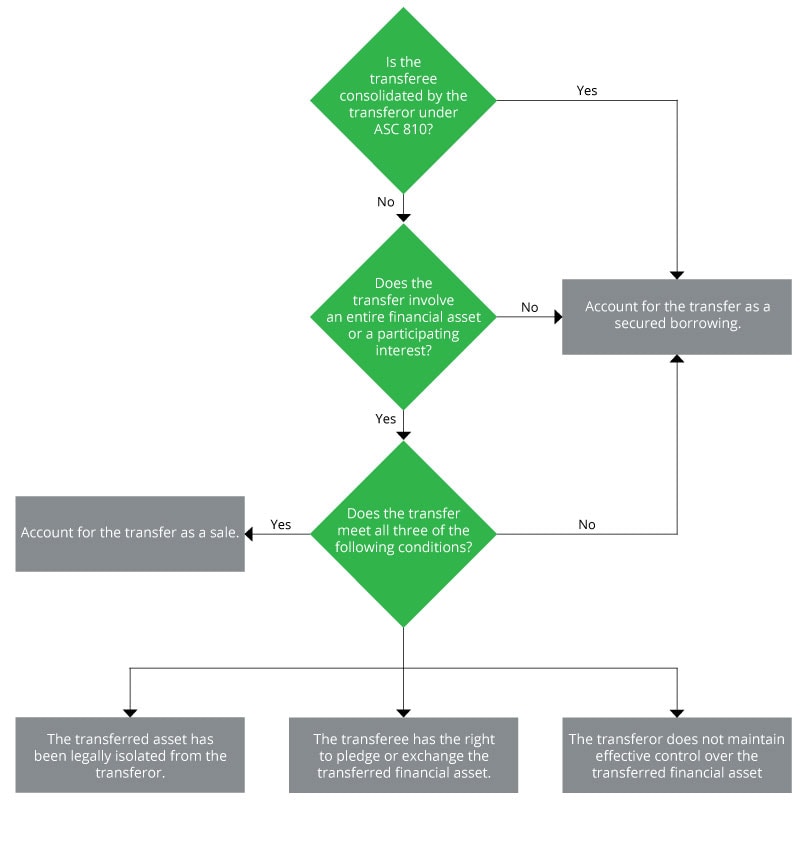

The flow chart below illustrates the steps an entity would perform in evaluating whether a transfer of financial assets (e.g., trade receivables, loan receivables, or equity securities) qualifies as a sale for financial reporting purposes.

For a transfer of financial assets to be accounted for as a sale, the three conditions in ASC 860 10 40 5 must be met. However, before evaluating those conditions, a transferor must reach the following two conclusions to avoid accounting for the transfer as a secured borrowing:

- The transferor does not consolidate the transferee – ASC 810 addresses consolidation. Sale accounting can never be achieved for a transfer of financial assets to a consolidated affiliate.

- The transfer involves an entire financial asset or a participating interest – If a transfer involves an interest in a financial asset, as opposed to the asset itself, sale accounting can only potentially be achieved if the interest meets the definition of a participating interest. ASC 860 addresses the conditions that an interest must meet to be a participating interest. The application of such guidance can be time-consuming and complex.

An entity that reaches the above two conclusions must evaluate the three conditions for sale accounting in ASC 860. In evaluating these three conditions, an entity would consider both the legal nature and the substance of the transfer. To meet the conditions for sale accounting, the transfer must be a true legal sale. This determination is made by attorneys, not accountants. Even if the transfer meets this legal isolation condition, the transferee must be able to freely pledge or exchange (i.e., sell) the financial asset received (or the beneficial interests received from a securitization entity), and the transferor cannot maintain effective control over the transferred financial asset (e.g., by being able to repurchase it). An entity may need to use significant judgment in evaluating these two conditions and often must consult its accounting advisers.

ASC 860 also addresses the initial and subsequent recognition and measurement for a transfer, as well as the related disclosures an entity must provide. The guidance an entity applies will differ depending on whether the transfer is accounted for as a sale or a borrowing.

Accounting symmetry

The accounting for a transfer as a sale or secured borrowing is symmetrical. That is, if the transferor meets the conditions to account for a transfer of financial assets as a sale and therefore derecognizes the transferred financial assets, the transferee accounts for the transfer as a purchase of financial assets. Similarly, if the transferor does not meet the conditions to account for a transfer of financial assets as a sale and reflects the transfer as a secured borrowing (i.e., it does not derecognize the financial assets), the transferee accounts for the transfer as a receivable from the transferor.

Accounting for servicing assets and servicing liabilities

ASC 860-50 separately addresses the accounting for servicing of financial assets, including transfers of servicing assets and disclosures. The derecognition model for transfers of servicing assets differs from that for transfers of financial assets. However, as with transfers of financial assets, the accounting for a transfer of servicing rights is symmetrical between the transferor and transferee.

Continue your transfers and servicing of financial assets learning

Deloitte’s Roadmap Transfers and servicing of financial assets comprehensively discusses the accounting for transfers and servicing of financial assets, including disclosures, in accordance with ASC 860. Entities may also need to refer to Deloitte’s Roadmap Consolidation – Identifying a controlling financial interest to determine whether a transferee must be consolidated by a transferor.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

A guide to consolidation accounting

On the Radar: Identifying a controlling financial interest

Accounting & financial reporting roadmap

Find comprehensive guides to help you face your most pressing accounting and reporting challenges with clarity and confidence.