Using the equity method of accounting has been saved

Perspectives

Using the equity method of accounting

On the Radar: Equity method investments and joint ventures

With equity method investments and joint ventures, investors often have questions as to when they should use the equity method of accounting. There are a number of factors to consider, including whether an investor has significant influence over an investee, as well as basis differences. As such, there are questions an investor should ask to make this determination.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

Equity method of accounting: Key questions

An investor must consider the substance of a transaction as well as the form of an investee when determining the appropriate accounting for its ownership interest in the investee. If the investor does not control the investee and is not required to consolidate it, the investor must evaluate whether to use the equity method to account for its interest. This evaluation frequently requires the use of significant judgment. The flowchart below illustrates the relevant questions to be considered in the determination of whether an investment should be accounted for under the equity method of accounting.

When considering the questions in the decision tree, an investor must take into account the specific facts and circumstances of its investment in the investee, including its legal form. The two red circles in the flowchart highlight scenarios in which the equity method of accounting would be applied. Some of the more challenging aspects of applying the equity method of accounting and accounting for joint ventures are discussed next.

Evaluating indicators of significant influence

The guidance in ASC 323 on determining whether an investor has significant influence over an investee can be difficult to apply for corporations and limited liability companies that do not have separate capital accounts. For limited partnerships and limited liability companies with separate capital accounts, the equity method of accounting must be used if an investor owns more than 5% of the investee (see ASC 323-30-S99-1) and an evaluation of the indicators of significant influence is not performed. Consequently, there are two models in ASC 323 for applying the equity method (one in ASC 323-10 and one in ASC 323-30), depending on what type of legal entity structure the investee has.

The ability to exercise significant influence is often related to an investor’s ownership interest in the investee on the basis of common stock and in-substance common stock. While there are presumptions in ASC 323 related to whether an investor has the ability to exercise significant influence over an investee, an entity must consider other factors, such as the following, in making this determination.

- Investor is represented on investee’s board of directors

- Investor participates in investee’s policymaking processes

- Material intra-entity transactions between investor and investee

- Interchange of managerial personnel between investor and investee

- Investee’s dependency on investor’s technology to operate

- Extent of ownership by investor relative to concentration of other shareholdings

- Investor tries and fails to obtain representation on investee’s board of directors

- Agreement under which investor surrenders significant rights as a shareholder

- Majority ownership of investee is concentrated among small group of shareholders that operates without regard to the investor

- Investor tries and fails to obtain financial information about whether investee qualifies for application of equity method of accounting

- Challenges by the investee to the investor’s ability to exercise significant influence (e.g., litigation, complaints to governmental regulatory authorities)

None of the circumstances listed previously are necessarily determinative with respect to whether the investor is able or unable to exercise significant influence over the investee’s operating and financial policies. Rather, the investor should evaluate all facts and circumstances related to the investment when assessing whether the investor has the ability to exercise significant influence.

Evaluating changes in an investor’s level of influence

Changes in an investor’s level of ownership or degree of influence should be evaluated to determine whether the accounting treatment should change. The table below summarizes the effects of changes in ownership or level of influence as well as the related impacts on the investor’s accounting. Also included are references to Roadmap sections that contain additional examples and guidance.

Change in the ownership or level of influence |

Example scenario |

Accounting by investor |

||||

Transaction increases investor’s ownership percentage or level of influence |

Investor obtains a controlling financial interest in investee |

If the investee is a business, the investor should remeasure its equity interest at fair value as of the acquisition date and recognize any gain or loss in earnings. |

||||

Investor obtains significant influence in investee |

The investor adds the cost of acquiring the additional interest in an investee to the current basis of the investor’s previously held interest, and the equity method is subsequently applied from the date the investor obtains significant influence. |

|||||

Investor retains significant influence (both before and after transaction) |

The investor accounts for the additional interest in a similar manner for the initial investment in the equity method investee and continues to use a cost accumulation model and account for any new basis differences if the purchase price differs from the share of the investee’s underlying net assets. The investor may not remeasure the existing equity method investment at fair value. |

|||||

Transaction decreases investor’s ownership percentage or level of influence |

Investor retains significant influence in investee (both before and after transaction) |

The investor should first consider the requirements of ASC 860 to determine whether the transfer of the equity method investment (a financial asset) should be considered a sale. If the transfer is a sale under ASC 860, the investor would partially derecognize its equity method investment and recognize a gain or loss on the basis of the difference between the selling price and carrying amount of the stock sold. |

||||

Investor loses significant influence in investee |

An investor can lose significant influence in various circumstances. In all instances, the investor may no longer apply the equity method of accounting. Examples of circumstances in which the investor may lose significant influence include:

|

Other key indicators

An investor presents an equity method investment on the balance sheet as a single amount. However, the investor must identify and account for basis differences. An equity method basis difference is the difference between the cost of an equity method investment and the investor’s proportionate share of the carrying value of the investee’s underlying assets and liabilities. The investor must account for this basis difference as if the investee were a consolidated subsidiary. To identify basis differences, the investor must perform a hypothetical purchase price allocation on the investee as of the date of the investor’s investment. Once basis differences are identified, the investor tracks them in “memo” accounts and amortizes and accretes them into equity method earnings and losses, depending on the nature of the respective basis difference.

When applying the equity method of accounting, an investor should typically record its share of an investee’s earnings or losses on the basis of the percentage of the equity interest the investor owns. However, contractual agreements often specify attributions of an investee’s profits and losses, certain costs and expenses, distributions from operations, or distributions upon liquidation that are different from an investor’s relative ownership percentages. An investor may find it particularly challenging to account for arrangements in which its earnings and losses are not attributed on the basis of the percentage of equity interest the investor owns.

If an equity method investee is considered significant to a registrant, the registrant may be required to provide the investee’s separate financial statements or summarized financial information in the financial statement footnotes (or both). The amount of information a registrant must present depends on the level of significance, which is determined on the basis of the results of various tests outlined in SEC Regulation S-X. See Deloitte’s Roadmap SEC Reporting Considerations for Equity Method Investees for more information.

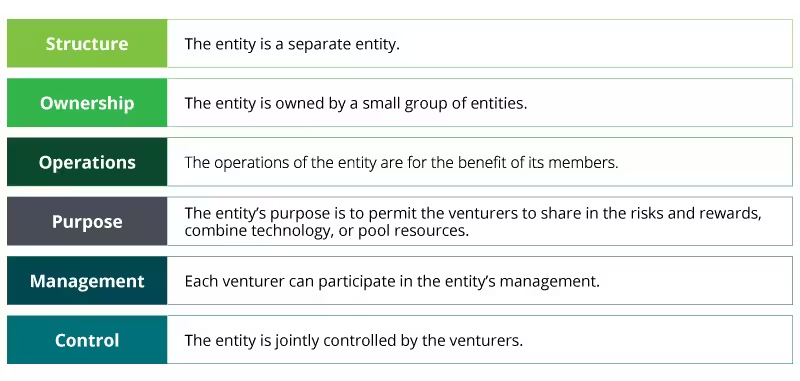

Generally, a venturer accounts for its investment in a joint venture the same way it would account for any other equity method investment. However, it is necessary to assess whether a legal entity is in fact a joint venture because this determination may affect the financial statements of the joint venture upon the venture’s initial formation and thereafter. The specific characteristics of the entity must be evaluated.

A corporation owned and operated by a small group of entities (the joint venturers) as a separate and specific business or project for the mutual benefit of the members of the group. A government may also be a member of the group. The purpose of a corporate joint venture frequently is to share risks and rewards in developing a new market, product, or technology; to combine complementary technological knowledge; or to pool resources in developing production or other facilities. A corporate joint venture also usually provides an arrangement under which each joint venturer may participate, directly or indirectly, in the overall management of the joint venture. Joint venturers thus have an interest or relationship other than as passive investors. An entity that is a subsidiary of one of the joint venturers is not a corporate joint venture. The ownership of a corporate joint venture seldom changes, and its stock is usually not traded publicly. A noncontrolling interest held by public ownership, however, does not preclude a corporation from being a corporate joint venture

Further, for an entity to be considered a corporate joint venture, it is assumed that venturers have joint control of it. All of the following criteria must be met for a venturer to conclude that an entity is a corporate joint venture under US GAAP:

Recent Updates

In March 2023, the FASB issued ASU 2023-02, which expands the use of the proportional amortization method to tax equity investments beyond low-income housing tax credit investments provided that the investments meet certain revised criteria in ASC 323-740-25-1. The ASU is intended to improve the accounting and disclosures for investments in tax credit structures. For public business entities (PBEs), the ASU’s amendments are effective for fiscal years beginning after December 15, 2023; for all other entities, the new guidance is effective for fiscal years beginning after December 15, 2024.

In August 2023, the FASB issued ASU 2023-05 to address the accounting by a joint venture for the initial contribution of nonmonetary and monetary assets to the venture. Adoption of the ASU will be required for joint ventures with a formation date on or after January 1, 2025, with early adoption permitted. The FASB issued the ASU because of the absence of guidance on the recognition and measurement of the contribution of nonmonetary and monetary assets in a joint venture’s stand-alone financial statements.

Continue your equity method investments and joint ventures learning

For a comprehensive discussion of considerations related to the application of the equity method of accounting and the accounting for joint ventures, see Deloitte’s Roadmap Equity Method Investments and Joint Ventures.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Learn more about this topic

|

Andrew Winters |

|

Morgan Miles |

Get in touch for service offerings

|

Jamie Davis |

|

Recommendations

What to consider as an equity method investee

On the Radar: Equity method investments & SEC reporting

Fair value measurements and disclosures

On the Radar: Financial reporting impacts of ASC 820