Artificial intelligence in capital markets has been saved

Perspectives

Artificial intelligence in capital markets

Leveraging AI to optimize post-trade processes

Evolving capital markets landscape presents an array of challenges in post-trade processing - rising costs and margin pressures, higher risk and compliance requirements and increased regulatory interventions. Learn how adopting cutting-edge AI capabilities with a structured approach can help capital markets firms address these challenges and gain a competitive advantage.

Artificial intelligence in post-trade processing

Post-trade processing has seen frequent changes across asset classes and the regulatory landscape. These changes, coupled with human-driven decisions across processes, introduce inefficiencies and lead to errors. Artificial intelligence can play an important role in reducing post-trade processing inefficiencies by easing decision-making through automated self-learning. AI capabilities, on effective application can significantly reduce the requirement for manual interventions, reduce reconciliation requirements, support straight-through processing, and enhance operations considerably.

Determine the right solutions with an AI application framework

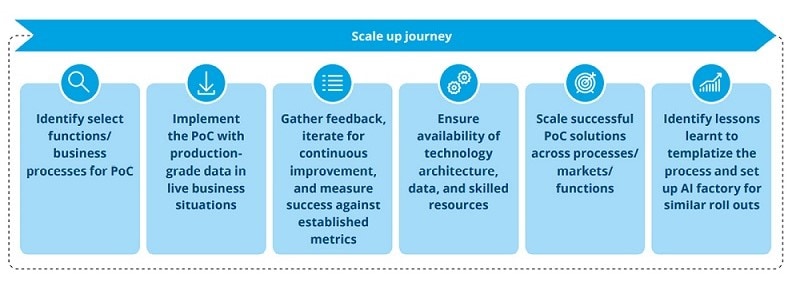

A clear answer to “how will we implement AI?” can help organizations navigate the AI journey efficiently. They need to have a structured approach towards identifying and prioritizing use cases for AI implementation. The following approach can be a starting point for organizations in their journey to implement AI within post-trade processing.

Assess AI affinity

As a first step toward implementation, organizations need to apply a filter across their post-trade processes and understand if there could be a potential AI solution to their challenges. We have identified a few factors and illustrative measures that can guide organizations in assessing their processes for AI fitment.

Rationale

• Processes with a high degree of errors increase the organization’s operational and regulatory risk.

• AI models, through supervised and unsupervised learning, can be used to predict future error occurrences via anomaly detection.

• AI algorithms can also help in automated root-cause analysis based on historical and real-time data.

Post-trade example

• Trade mismatch

• Settlement failure

• Allocation error

Rationale

• Increased human intervention for decision-making leads to an increase in operational and process inefficiencies.

• Human intervention can help in visual object recognition, speech recognition and production, basic natural language prediction, and comprehension.

• Through analysis, AI can help by identifying underlying patterns and building rule sets to undertake these fuzzy decisions.

Post-trade example

• Regulatory violations of trades

Rationale

• Process change involves changes to underlying systems or workflow. It is difficult for traditional rules-based systems to be modified based on these changes.

• AI can uncover key risk factors of change, predict which changes are about to fail, prevent change failure, and monitor for new threats.

Post-trade example

• Portfolio reconciliation with counterparties for newer asset classes in OTC trades

Rationale

• AI algorithms can help in processing unstructured and semistructured data, which cannot occur through standard statistical analysis techniques.

• AI algorithms help in establishing link between structured data and unstructured data.

Post-trade example

• End-customer issues reported via emails and social media related to margin calls, etc.

Rationale

• Anomalies (i.e., deviation from expected behavior) require analysis across time series or large volumes of data. Traditionally, analysts and risk managers have analyzed this data manually.

• AI algorithms can help analyze large volumes of data generated across a wide time duration to establish trends, recognize patterns, and highlight deviations, if any.

Post-trade example

• Proactive anomaly detection in standing orders

• Expired and/or invalid standing settlement instructions

Rationale

• Scenario planning requires analysis of multiple structured and unstructured variables, determining relationships between them and planning for future outcomes that are in the organization’s best interest.

• AI models can help analyze both structured and unstructured data, identify causation and correlation between hundreds of these variables, and generate complex outcomes that are either likely or unlikely.

Post-trade example

• Collateral optimization

• Liquidity and cash management

Analyze business impact and technology feasibility

Business impact analysis

AI can help capital market firms generate insights to drive efficiencies, automate risk management and compliance across post-trade processes, and create value. We believe that firms can analyze the business impact of the AI use case across the following domains:

Enhance insights and productivity: |

Increase compliance to regulations: |

|||

Reduce exposure to risk: |

Reduce costs and losses: |

Technology feasibility analysis

To harness the true potential of AI, financial institutions will need to make significant changes and ready themselves for the implementation of AI solutions. Some of the factors that organizations need to consider while assessing technology feasibility include:

Data pipeline: |

Frameworks and infrastructure: |

||

Infrastructure elasticity: |

Data sufficiency: |

A guide for AI implementation

The post-trade processing space is inherently complex, with varied processes across legacy systems and proliferation of data coupled with constantly changing regulatory frameworks. A structured approach to leverage AI can help organizations optimize these processes at scale with increased efficiencies.