CFO Signals™ 2Q 2023 has been saved

Perspectives

CFO Signals™ 2Q 2023

This quarter, surveyed CFOs lowered their assessment of North America’s current and future economic conditions and shared that their CEOs want them to focus on cost reduction.

In the second quarter of 2023, CFO Signals reveals a slightly smaller proportion of North America’s CFOs feeling optimistic about their own companies’ financial prospects, compared to the prior quarter, and a smaller proportion of CFOs saying now is a good time to be taking greater risk, compared to 1Q23. Still, CFOs have higher expectations for year-over-year (YOY) growth for revenue, dividends, and capital investment. On the other hand, they have lower growth expectations for earnings―which had the largest pullback, compared to last quarter―followed by domestic hiring and domestic wages and salaries.

The special topic covered in this quarter’s survey was enterprise risk and regulation. If the last few years have shown anything, it's that threats, like opportunities, can take shape rapidly. That heightened sense of dynamism may account for CFOs’ evolving risk concerns. That said, their understanding of risk has likely fueled their awareness of needing better systems to identify and react to a variety of threats. We asked CFOs about their most worrisome risks and their greatest challenges in managing enterprise risk and regulation, among other questions.

For a more detailed look at this quarter’s results, download the report.

CFOs’ views of regional economies and capital markets

Compared to the previous quarter, a higher proportion of CFOs view current economic conditions as good across four of the five regions tracked by CFO Signals. The exception: North America, with CFOs’ sentiment falling measurably. Looking a year out, CFOs have lower expectations for economic conditions to improve across all five regions.

Continued high inflation, interest rate increases, geopolitics, and the uncertainty over the debt ceiling likely influenced CFOs’ outlook.

Growth expectations and risk appetite

CFOs signaled expectations for higher year-over-year growth in revenue, dividends, and capital investment this quarter, compared to 1Q23, while dialing down their expectations for YOY growth in earnings, domestic hiring, and domestic wages and salaries.

These expectations could be influencing CFOs’ appetite for risk-taking. Nearly one-third (33%) of surveyed CFOs say now is a good time to be taking greater risks, a decline from 40% in the previous quarter and below the two-year average of 43%. The decrease in some CFOs’ risk appetite could reflect their reluctance to take on new risks amid continued high inflation, rising interest rates, uncertainty in the markets, and the geopolitical landscape.

Expectations for CFOs

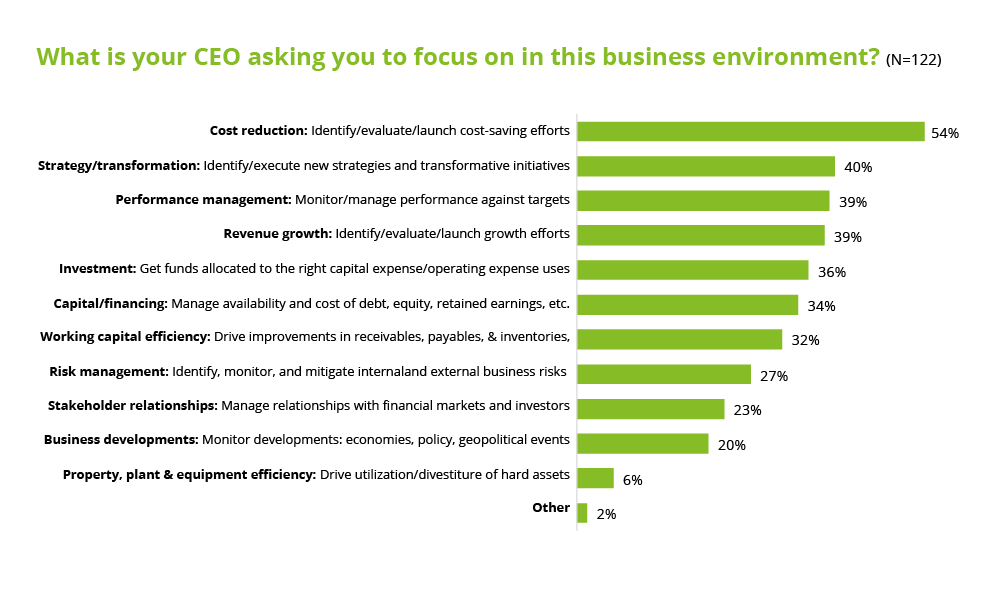

Slightly more than half of the surveyed CFOs report that their CEOs are asking them to focus on cost reduction. More than one-third of CFOs say their CEOs want them focused on strategy/transformation, performance management, revenue growth, investment, and capital/financing. And more than one-quarter of CFOs indicate their CEOs are asking them to focus on working capital efficiency and risk management.

Other areas CFOs cited are stakeholder relationships; business developments; property, plant and equipment; and talent management and systems. The focus on cost reduction, strategy/transformation, performance management, and revenue growth are in line with CFOs’ top priorities for 2023. (See Deloitte’s 4Q22 CFO Signals survey.)

External and internal risks

Economic/financial market risks stand at the top of surveyed CFOs’ five most worrisome external risks, cited by more than three-quarters (81%) of CFOs. Geopolitical risks (57% of CFOs), cyber and social media risks (56%), regulatory risks (45%), and competitor-related risks (44%) round out the remaining top five external risks that worry CFOs most. These risks might partially explain the decline in CFOs’ assessments of regional economies and their overall optimism for their companies’ financial prospects.

Looking at CFOs’ top five most worrisome internal risks, execution risks to strategies and/or transformations and talent risks are neck and neck, at 81% and 80%, respectively. Performance and strategy risks (71% of CFOs), data risks (42%), and digitalization (33%) follow among CFOs’ top five most worrisome internal risks. More than one-fifth of CFOs cite shareholder value or missed earnings guidance, business continuity disruption, and reputational and other social media risks each as their most worrisome internal risks.

Managing enterprise risk and regulatory challenges

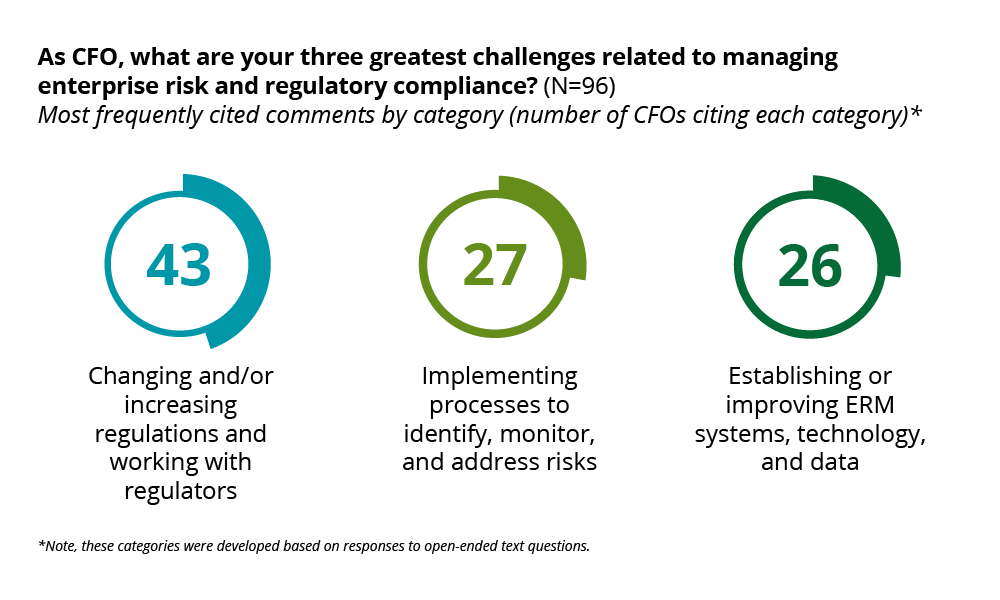

CFOs indicate changing and/or increasing regulations and working with regulators; implementing processes to identify, monitor, and address risks; and managing resources, costs, and business constraints as their top three greatest challenges in managing enterprise risk and regulatory compliance. Other challenges mentioned less frequently are managing macroeconomic risks, their impact, and uncertainty, and recruiting and retaining the right talent to manage risks.

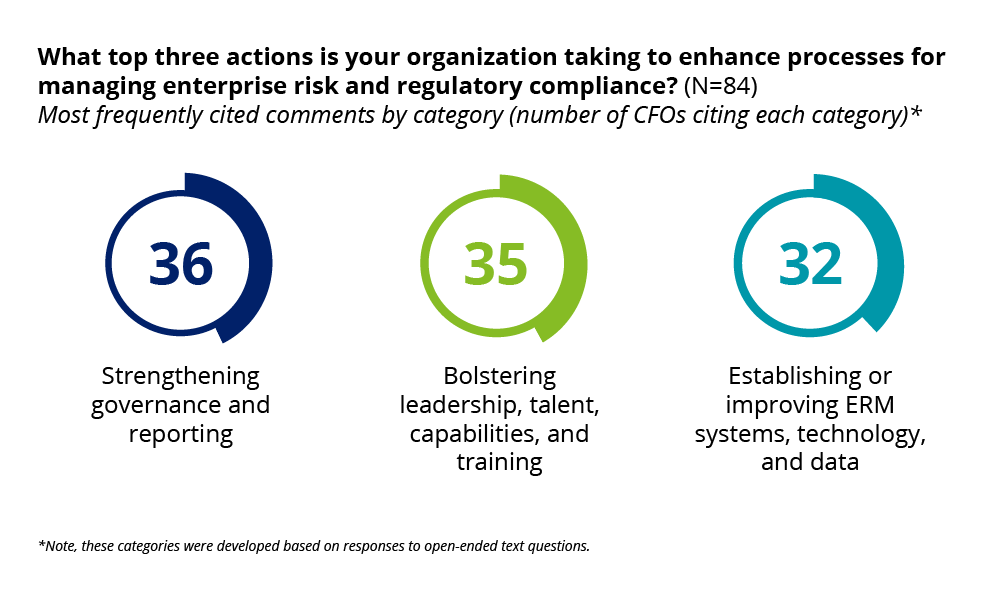

When asked for the top three actions their organizations are taking to enhance processes for managing enterprise risk and regulatory compliance, CFOs most frequently mention strengthening governance and reporting; bolstering leadership, talent, capabilities, and training; and establishing or improving ERM systems, technology, and data.

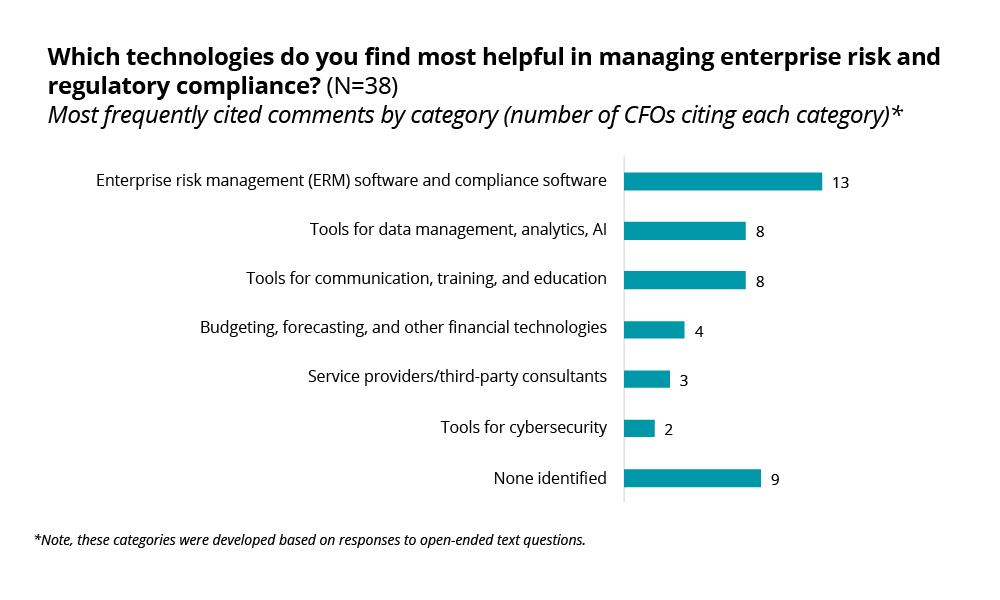

CFOs frequently cite enterprise risk management and compliance software as the most helpful technologies for managing enterprise risk and regulatory compliance. Several CFOs also mention analytics, AI, communication and training tools, and financial technologies as helpful. Still, some CFOs indicate difficulty in finding effective tools and technology to manage risk effectively.

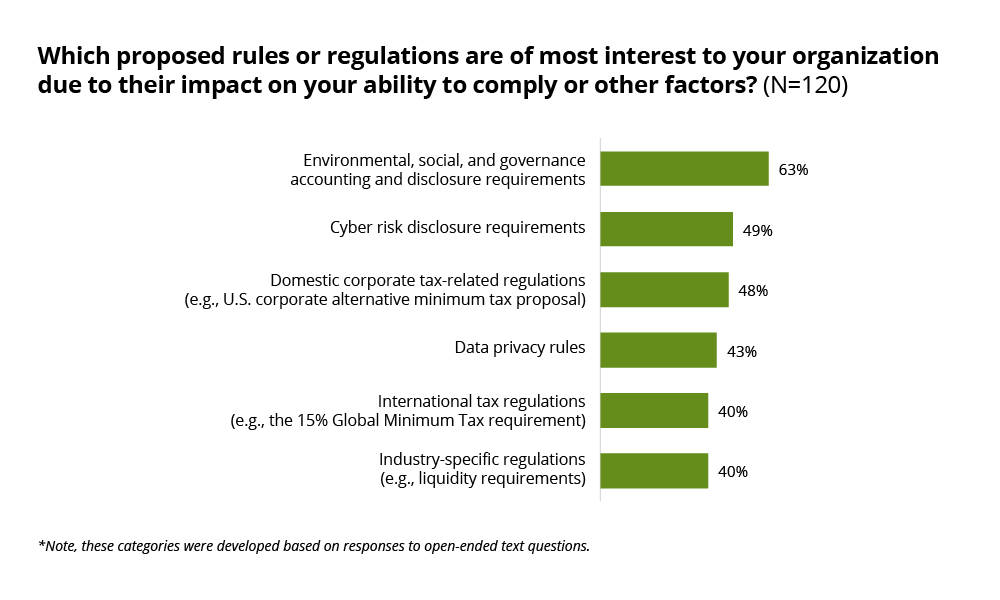

For nearly two-thirds (63%) of surveyed CFOs, environmental, social, and governance (ESG) accounting and disclosure requirements are of most interest to their organizations due to the impact on their ability to comply or other factors. Nearly half (49%) of CFOs indicate that cyber risk disclosure requirements are of most interest, followed by domestic corporate tax-related regulations and data privacy rules. Interestingly, only 25% of CFOs say AI management and ethics proposed rules and regulations are of most interest, but that could be due to the early stage of regulation over these matters.