CFO Signals™: 3Q 2021 has been saved

Perspectives

CFO Signals™: 3Q 2021

Supply chain disruptions increase costs for 44% of CFOs’ companies and reduce sales for 60%, amid significant talent challenges.

What North America’s top finance executives are thinking—and doing.

Labor shortages, talent recruiting and retention, burnout, morale, potential delays in return-to-work, and rising wages are the internal risks CFOs cited most frequently in this quarter’s survey. Of course, other challenges are adding to their stress, including the pressure to grow their organizations and to deliver products and services in a timely manner amid supply chain disruptions.

Those challenges, and CFO perspectives on the economy, are highlighted in the 3Q 2021 CFO Signals™ survey report. Highlights this quarter include:

- CFOs’ views of regional economies: From an economic perspective, the majority of CFOs remain positive overall and more so than in many pre-pandemic quarters. But the percentage of CFOs expecting future economic conditions to be better varies by region.

- Own-company financial prospects and growth expectations: Regarding their own company financial prospects, CFOs remain positive, but tempered.

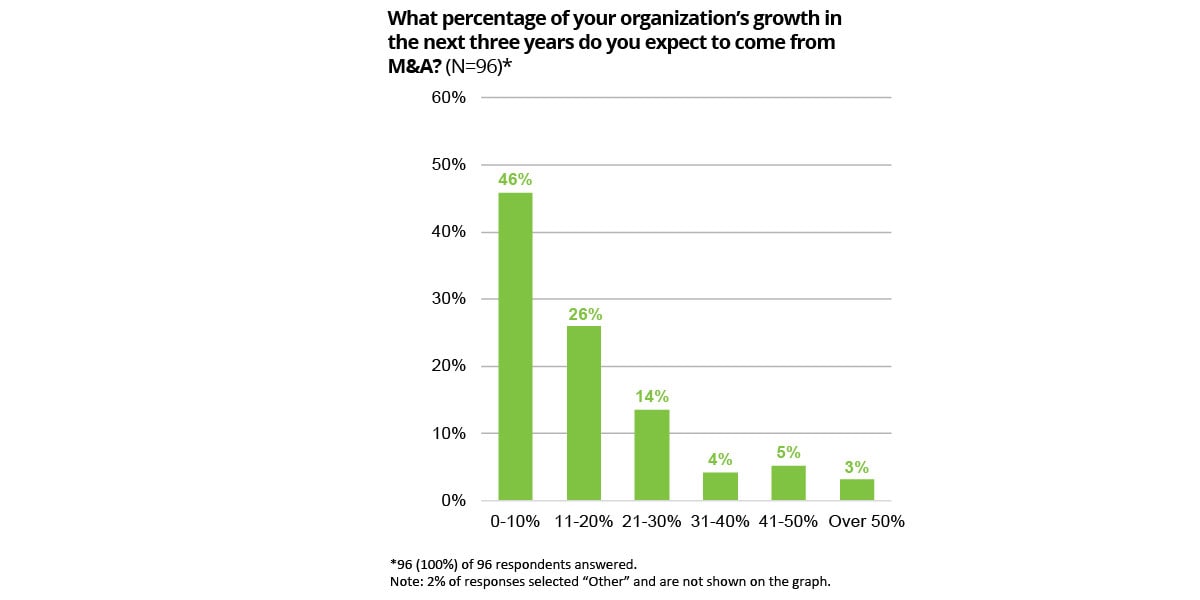

- M&A plans: M&A is on CFOs’ agendas, especially in light of the difficulty of growing organically. Slightly more than one-quarter said M&A will fuel 11% to 20% of their companies’ growth, and another 14% of CFOs expect deals to create 21% to 30% of their growth in the next three years.

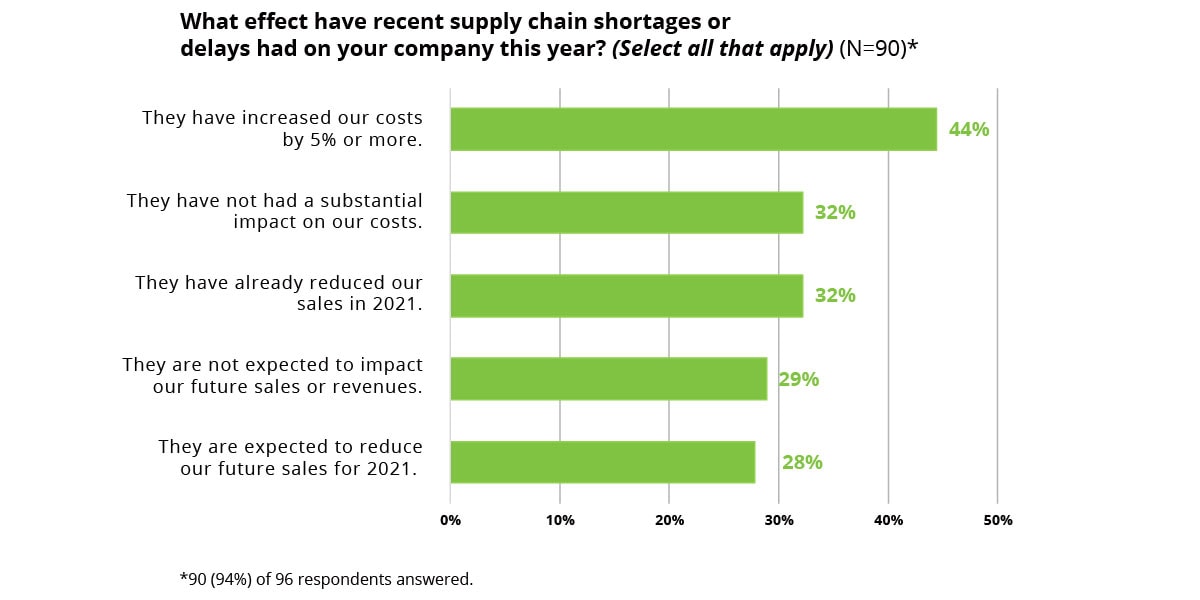

- Supply chains: Forty-four percent of CFOs said supply chain shortages or delays have increased their companies’ costs by 5% or more, and 32% reported their 2021 sales already have fallen, while 28% expect future sales to suffer this year as a result. Add to this their top three supply chain risks: cyber risk, operational risk, and geopolitical risk.

Here's how survey respondets answerd other specific quistions this quarter:

Assessments of the business environment and capital markets

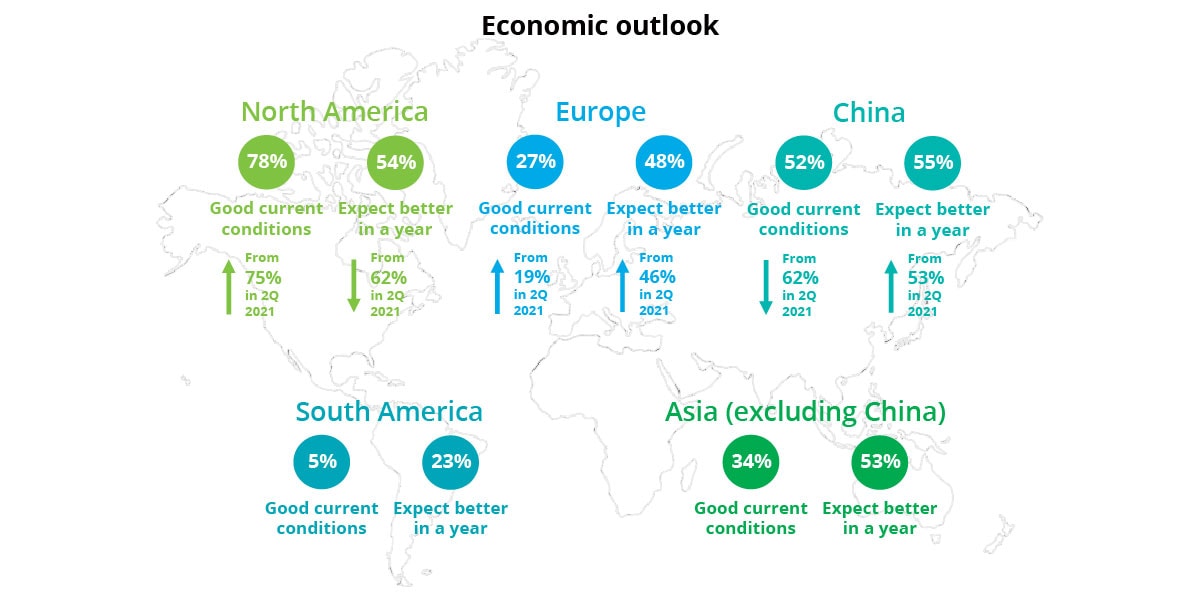

How do you regard the current and future status of the following economies—North America, Europe, China, Asia (other than China), and South America? When assessing the current status of the five regional economies,78% of CFOs ranked North America as good or very good, up from 75% in 2Q21. More than half (52%) said the same for China, a decline from 62% in the previous quarter. CFOs raised their sentiment toward Europe’s economy, with 27% citing it as good or very good, an increase from 19% in 2Q21. For the first time in the survey’s history, we asked CFOs to assess the economy of Asia, excluding China, and about one-third of CFOs (34%) consider it to be good or very good. We also asked CFOs to assess South America’s economy, again for the first time, with 5% viewing it as good or very good.

Considering the regional economies 12 months out, CFOs had mixed views. Fifty-four percent of CFOs expect North America’s economy to be better or much better a year from now, down from 62% in the prior quarter. Almost half (48%) believe Europe’s economy will be better in 12 months, a slight improvement from 46% in 2Q21. CFOs’ assessment of China’s economy a year out also improved slightly, with 55% expecting it to be better or much better, compared to 53% in the prior quarter. In terms of Asia’s economy, excluding China, 53% of CFOs expect it to be better or much better in 12 months, and 23% believe South America’s economy to improve in the same time period.

What is your perception of the capital markets? Eighty-two percent of CFOs viewed US equity markets as overvalued, down from the survey high of 86%, in the prior quarter. Ninety-two percent of CFOs say debt financing is attractive, consistent with 2Q21. Equity financing’s attractiveness dipped to 55% from 56% in the prior quarter.

CFOs’ expectations for growth

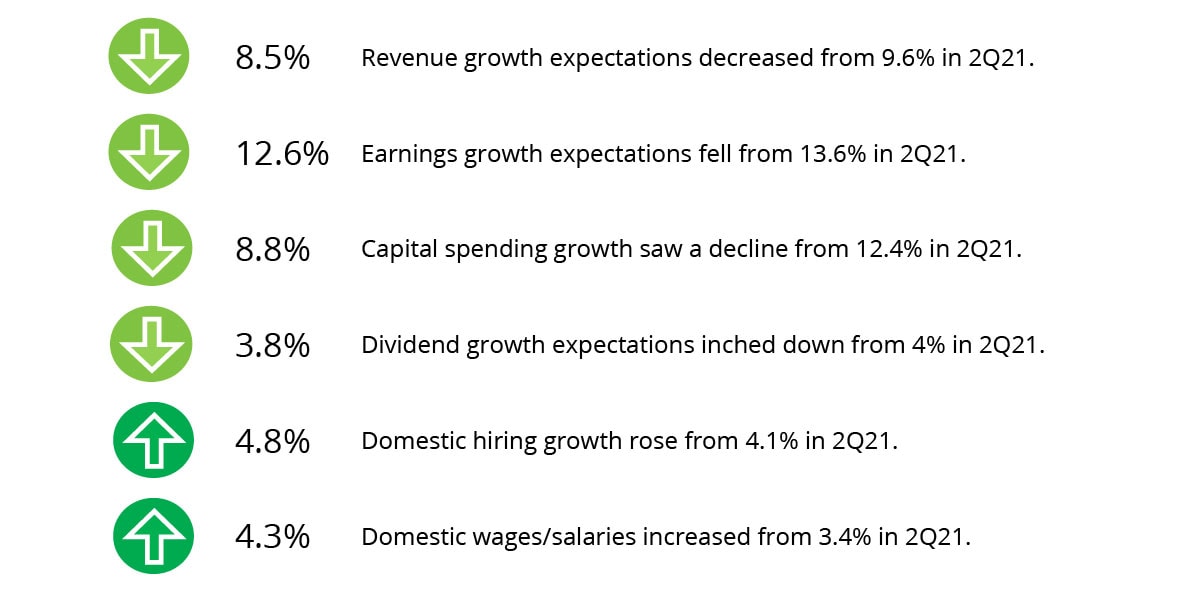

How do you expect your key operating metrics to change over the next 12 months? CFOs lowered their expectations for year-over-year growth for revenue, earnings, capital spending, and dividends, compared to the prior quarter. Meanwhile, they raised their YOY growth expectations for domestic hiring and domestic wages and salaries:

Compared to three months ago, how do you feel about your company’s financial prospects? The optimism index declined to +59 from last quarter’s +70 as a smaller percentage of CFOs (66%) expressed rising optimism, compared to 75% in 2Q21. CFOs in the Retail/Wholesale (89%) and Technology (86%) industries were the most positive. No one expressed significantly less optimism; however, some CFOs were somewhat less optimistic, specifically those in Telecom/Media/ Entertainment (T/M/E) (33%), Energy/Resources (25%), Services (15%), Retail/Wholesale (11%), Financial Services (5%), and Manufacturing (3%).

In the next year, will your capital allocation to North America, Europe, China, Asia (other than China), and South America increase, stay the same, or decrease? Some 45% of CFOs said they would increase their capital allocation for North America, while 23% expect to increase it for Europe, 19% China, 15% Asia other than China, and 6% South America. Eleven percent of CFOs said they plan to decrease their capital allocation for South America, while 10% said the same for China, 6% for Asia other than China, 5% for Europe, and 3% for North America. Yet, most CFOs expect their capital allocation to the five regions to stay about the same: 83% indicated so for South America; 79% for Asia, excluding China; 73% Europe; 71% China; and 52% North America.

Is this a good time to be taking greater risks? Sixty-five percent of CFOs indicated now is a good time to be taking greater risks, flat compared to last quarter’s 65%.

What internal risk worries you the most? Once again, talent from various perspectives—retention, morale, burnout, return-to-work challenges, and others—ranked highest among CFOs’ internal risk worries. CFOs also cited rising costs and wage inflation, among other concerns.

What external risk worries you the most? By far, CFOs cited COVID-19, along with its variants, resurgence, and impact on return-to-work on-site and normal operations most frequently. Inflation, changes in regulations, supply chain challenges, and cybersecurity were also high on their list of external worries.

M&A plans

What percentage of your organization’s growth in the next three years do you expect to come from M&A? Some 46% of CFOs noted they expect as much as 10% of their organizations’ growth in the next three years to come from M&A, while more than one-quarter (26%) of CFOs said M&A will fuel 11% to 20% of their companies’ growth. Fourteen percent of CFOs indicated M&A will drive 21% to 30% of their organizations’ growth in the next three years. Meanwhile, 4% of CFOs noted that M&A will account for 31% to 40% of their organizations’ growth, while 5% indicated 41% to 50% of their growth will come from M&A. And 3% of CFOs said M&A could generate more than 50% of their companies’ growth in the next three years.

What percentage of your company’s M&A activities do you expect to occur outside your traditional/core industry? CFOs were divided on this question: Slightly more than half of CFOs expect less than 1% of their companies’ M&A activities to occur outside their traditional/core industry, while the remaining CFOs expect anywhere from 1% to more than 30% of their M&A efforts to fall outside their traditional/core industry.

Which most accurately describes your finance support model for M&A? More than half of CFOs (58%) noted they use a subset of finance team members who are named, trained, and prepped for acquisitions to support their organizations’ M&A activities; 36% have a dedicated M&A finance function; and 34% identify part-time leaders for their companies’ M&A deals. Some 46% of CFOs access on-call advisors or M&A as a service, and 30% use standard M&A templates and playbooks.

What are your organization’s areas of focus with respect to potential M&A transactions? More than half (52%) of CFOs indicated selectively considering acquisitions only if price and fit are favorable as their top area of focus when considering possible M&A deals, while 49% noted seeking inorganic growth and 46% indicated maintaining competitive positioning as their top focus. For 41% of CFOs, taking advantage of disruptive opportunities to secure their future positioning was their top choice, followed by divesting of non-core assets/underperforming units, mentioned by 32% of CFOs; 28% are considering alternatives to M&A, including alliances and joint ventures.

What do you feel are your organization’s biggest challenges to delivering an M&A deal? Fifty-eight percent of CFOs singled out valuation of assets/difficulty of financing as their biggest challenge to delivering an M&A deal, while 55% noted integration/divestiture execution, and 44% indicated translating business strategic needs into an effective M&A strategy.

Supply chains

Approximately what percentage of your supply chain sources comes from the following regions? North America is the dominant supply chain source on average among respondents, although there are variations by company and industry. The next levels of concentration of supply chain sources are in Europe and China, but to a far lesser degree. The breakdown in concentrations by region most likely reflect the North American base of respondents.

Approximately what percentage of revenue does your company currently derive from the following regions? The concentration of companies’ revenue by region also shows North America as the dominant source, although the percentage of companies’ revenue sources varied from company to company and industry. Manufacturing and Technology companies derived a higher percentage of revenue (24% each) from Europe than other industries. Again, the results most likely reflect the North American base of respondents.

What effect have recent supply chain shortages or delays had on your company this year? For 44% of CFOs, supply chain shortages or delays increased their companies’ costs by 5% or more. Almost one-third (32%) noted that their 2021 sales have fallen due to delays or shortages, with 28% expecting future sales this year to suffer. In contrast, 32% of CFOs said that supply chain shortages or delays have not had a substantial impact on their costs, and 29% noted they do not expect future sales or revenue to be affected this year.

How will your supply chains change within the next three years? More than two-thirds of CFOs (69%) indicated their supply sources will become more diversified, with 23% expecting greater vertical integration of their supply chains. Thirty-nine percent of CFOs said sourcing from North America will increase, while 22% expect sourcing from Asia other than China to expand. In addition, 13% of CFOs said their supply chains would increase sourcing from Europe, 9% from China, and 6% from South America. Nearly one-third of CFOs (32%) indicated their sourcing from China would decrease, while 11% expect to reduce their sourcing from Asia outside of China. A smaller percentage of CFOs expect decreases in their supply sources from South America (9%) and Europe (8%).

Which supply chain risks concern you the most? CFOs cited cyber risk (69% of CFOs), operational risk (60%), and geopolitical risk (56%) as their top three risk concerns when it comes to their supply chains. To a much lesser extent, they indicated environmental risk (19% of CFOs), financial risk (15%), and legal risk (9%).