Underwriting Earth: Nature-positive insurance has been saved

Perspectives

Underwriting Earth: Nature-positive insurance

Environmental factors affecting insurance companies

Insurers recognize the urgent need to address the implications of climate change and property insurance. However, the industry lags in its efforts to mitigate risk associated with the loss of biodiversity and natural resources. Explore five ways the industry can help protect natural capital through investment, product innovation, and increased engagement.

Climate change and property insurance

Around the world, there is nearly unanimous concern among insurers about the implications of climate risk on their business. Increasingly, they have begun to act on those concerns through innovation and investment. However, the industry overall has done little to acknowledge, quantify, and help mitigate losses tied to nature risk. The fact is, the natural systems on which our society relies are being challenged, marked by the precipitous decline of terrestrial and aquatic biodiversity.

At stake for the insurance industry is the potential loss of what is called “natural capital”—the natural resources that are grown, harvested, or extracted that enable economic growth. Such losses can not only exacerbate global warming and intensify the impacts of climate change but also can generate financial losses from economic activities that depend on nature for their operations.

This makes nature risk the other side of the environmental risk coin, posing a significant challenge to insurers through their investments and liabilities. As underwriters, insurers will likely be affected by changes in climate and biodiversity and also by transition risks affecting the risks they insure.

A more proactive stance

The costs of these risks can quickly add up through increased claims, higher premiums, less profitability, lower demand for insurance products, and negative returns from investments. But while more than half of global insurers and re-insurers believe that nature-related risk is material to their underwriting business, nature risk is not yet being widely assessed by underwriters.

The industry should adopt a more proactive stance—one that positions insurers as enablers rather than dissuaders. The insurance industry has already laid some of the groundwork for addressing nature risk, through many of the very same investments it has made in teams, frameworks, and processes to deal with climate risk.

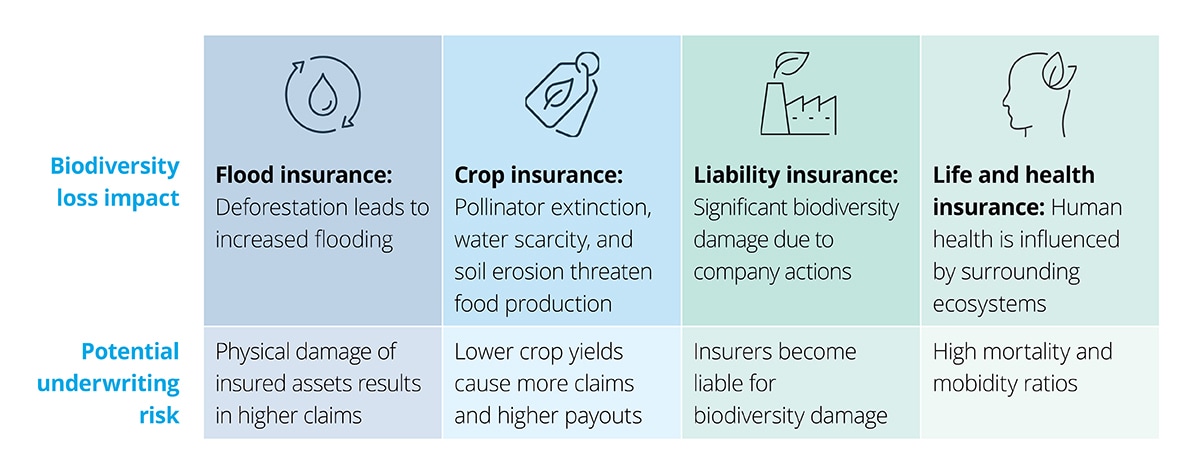

Figure 1: Insurance impacts from biodiversity loss

A natural path forward

Insurers will likely need to work through some major challenges as they seek to adjust for nature risk in their underwriting and client relationships. Biodiversity-related risks are often systemic risks that are difficult to measure and come saddled with potential knock-on effects that can vastly increase financial losses—and may render standard insurance practices ineffective.

Despite these obstacles, the industry likely has the capacity to innovate and evolve—much in the same way that it appears to be transforming to help address climate risks. Most insurers have built teams, risk-identification processes, and other frameworks and processes focused on climate risk.

These resources and approaches can be extended to nature risk with the appropriate guidance—which now exists due to the Taskforce on Nature-related Financial Disclosures (TNFD) and others. Informed by this work, there are five important ways that insurers can promote investment in biodiversity: natural capital valuation, asset protection, liability reduction, facilitating capital flows from financial markets, and policy advocacy.

For decades, the insurance industry has used catastrophe risk models, which use past events and historical data to estimate what future losses could look like, but many of these do not take nature risk into account.

Technological advances are already helping to resolve data-related problems in agricultural insurance. Remote sensing, advanced modeling, and picture-based recognition solutions have enabled the underwriting of groundwater and soil quality as metrics for crop insurance.

Several frameworks also now exist to account for the economic value of natural assets. One is the Natural Capital Protocol, which enables organizations to identify, measure, and value their direct and indirect impacts and dependencies on natural capital.

Property insurance is already being used to protect and regenerate natural assets such as forests and mangroves or to mitigate the risks of projects, including those designed to protect against climate change or promote biodiversity.

This approach to protecting natural assets could be emulated in the American heartland. For example, insurers could offer financial incentives to farmers who adopt nature-based solutions (NBS) to help restore wetlands and improve the resilience of agricultural land.

Rather than pull back from insuring challenging sectors such as agriculture, the industry can tap existing relationships to catalyze meaningful change and reduce the potential for claims through policy incentives that support the protection of natural capital.

Policy innovation has introduced parametric techniques to link liabilities to the severity of weather events—the same opportunity to innovate exists to bring capital market investors into the fold in the biodiversity space.

In the agriculture sector, US insurers can look to provide incentives for farmers who take steps to promote soil quality, much in the way that some providers in the country are now offering discounts for homeowners in fire-prone states who take steps to protect their houses from wildfires.

Insurers can be instrumental in redirecting financial flows toward both climate objectives and the protection and restoration of nature. However, for that to be able to happen, the value of nature needs to be integrated into underwriting.

In Europe, insurers are offering environmental impairment liability (EIL) coverage for preventive environmental measures, expanding their purview beyond instances of pollution. Such policies have emerged as a hybrid insurance solution that covers gaps in most third-party liability insurance that excludes impacts such as biodiversity loss. Studies have shown these approaches could be improved further to incorporate a broader range of sustainability risks, such as ecosystems degradation or destruction.

New forms of policies the US agriculture sector could employ include carbon credit insurance—an emerging mechanism that could be used to insure farmers against shortfalls in expected carbon sequestration yields from improved soil health or no-till agriculture. Another example is supply chain disruption insurance, which could be used to cover farmers in the event of unforeseen breaks in the supply chain caused by environmental events or outbreaks of disease.

Insurers have a pivotal role to play in protecting and rehabilitating natural capital, but policies and regulations can help to incentivize market participation in insurance solutions. Industry members should be more involved in developing the taxonomies and reporting requirements for measuring biodiversity.

They can also lend their voice to advocating for policies that support the adoption of nature-based solutions, promote risk-sharing mechanisms such as public-private partnerships where governments would share the burden for nature-related losses, and incentivize sustainable practices through tax breaks for adopting regenerative agriculture methods or implementing biodiversity-friendly practices like cover cropping.

Climate insurance as a catalyst for change

Erosion of natural capital presents a challenge: Unlike climate risk, these challenges are systemic and long term, with potentially significant cascading effects that tend to be difficult to quantify and price effectively.

The insurance industry, however, appears positioned to play a pivotal part in unearthing the complexities of nature risk. Time and again it has been involved in fostering financial resilience and aiding communities to recover, adapt, and evolve from catastrophic events. Leveraging its deep-rooted expertise in the agriculture sector, and by honing its risk assessment and pricing responsibilities, the insurance industry can become a forerunner and ambassador for sustainability.

Recommendations

Climate Change and Financial Risk Digest

A monthly look at the regulatory trends shaping the management of climate change risks in financial services in the United States, now and in the coming decade.

Strategic climate risk management

Addressing the financial risks posed by climate change