2025 insurance M&A outlook has been saved

Perspectives

2025 insurance M&A outlook

Explore emerging trends in the insurance sector

In 2024, deal count was down across all sectors of the insurance industry. Transitioning from retrenchment to growth necessitates a formal reset of strategy and mindset, and in 2025, it also involves considering the new US administration. Learn more about regulatory developments and modeling potential policy outcomes.

Looking back at 2024

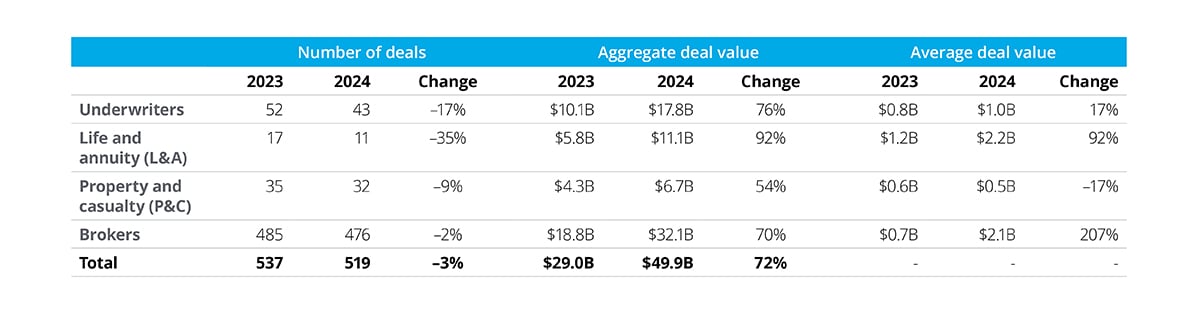

In this political climate, insurance M&A in 2025 faces uncertainty despite hopes for increased activity. In 2024, the number of deals decreased across all sectors of the insurance industry, but the aggregate value increased due to a few transformative deals. On the other hand, private equity was less active, and many deals took longer to finalize, adding to the uncertainty.

Though nuanced and specific to certain segments and dynamics, market indicators offer a more encouraging, increasingly active expectation for insurance M&A in 2025. This year’s outlook explores five trends, stretching from stronger fundamentals to assessing risks and evaluating uncertainties.

Figure 1. Insurance sector M&A activity, 2023-2024 (United States and Bermuda)

Source: Deloitte analysis utilizing SNL Financial M&A database as of December 31, 2024; accessed January 11, 2025.

Five trends for 2025 insurance M&A

1. Focusing on fundamentals

Nine out of ten insurance companies surveyed anticipate closing more deals this year compared to 2024. The same proportion have either recently undergone restructuring or are contemplating it soon. Additionally, 81% of respondents indicate that the value of most of their company’s transactions is moderately or highly dependent on successful transformations.

These findings highlight the importance of considering the balance sheet impacts of any potential transactions and the desire for carriers to rebalance their portfolios for capital optimization. To achieve this, many may need to rethink their forecasting methods.

2. Mitigating losses and strategic business risk

Sustainability may no longer be a corporate priority, but climate concerns persist. A 2024 Deloitte survey shows 52% of financial services firms expect climate change to significantly impact operations, and 69% consider ESG issues crucial to their M&A strategy.

In insurance, climate risks may require higher capital reserves and location-based underwriting adjustments. Consolidation could strengthen balance sheets by spreading risks geographically. In 2025, sustainability is expected to drive significant interest in acquisitions within the L&A and P&C sectors, particularly for foreign targets.

3. Assessing the environment and timing transactions

Numerous provisions of the TCJA are set to expire at the end of 2025. The renewal or adjustment of these provisions could significantly impact the timing of transactions. While Republicans generally support extending the TCJA and further tax cuts, their thin majorities mean changes may only occur later in 2025, necessitating quick action on transaction opportunities.

Preparedness is crucial. Year-end forecasting might take a large carrier 40-45 days, which is impractical for ongoing pro forma updates. Effective forecasting requires moving historical cash flow data from actuarial spreadsheets to an enterprise performance system for better driver-based modeling.

4. Technology remains a strategic priority

In recent years, many carriers have focused on internal restructuring to improve costs and margins. However, in 2025, some insurance companies may have available capital from reserves and underwriting earnings, allowing them to consider expansion and profitable growth. This could make insurtech companies attractive acquisition targets for modernization and innovation.

For those aiming to return to growth in 2025, priorities may include scaling enterprise technology solutions or adding niche capabilities through insurtech acquisitions. As insurtech companies mature, they may offer specialized solutions, creating an acquisition marketplace. Early acquirers may benefit from favorable valuations of late 2024. Will holdouts miss the bottom? Stay tuned.

5. Tax planning and structuring amid uncertainty

Insurers considering M&A activity in 2025, especially with cross-border entities, should be aware of the rapidly shifting global tax environment. Modeling will be complex, considering new tax laws like the global minimum tax (GMT), Bermuda corporate income tax (BCIT), and the US corporate alternative minimum tax (CAMT). Changes in US corporate tax policies could also affect BEAT and GILTI regimes, so insurers should model tax implications and ensure due diligence considers these complications.

A beacon of opportunity

At the deal level, effective diligence requires clarity on both strategy and integration. It's important not to focus solely on past performance during diligence but to rigorously evaluate forward-looking assumptions. Pressure testing these assumptions can help manage expectations with the board and senior leadership and establish guidelines for integration.

Get in touch

Have questions? Contact one of us below.

Recommendations

2025 banking and capital markets M&A outlook

Explore the trends reshaping banking M&A

Insurance

See how Deloitte can help you solve existing problems and create new opportunities in the insurance, ESG, and mergers and acquisitions spheres.