Accounting for business combinations has been saved

Perspectives

Accounting for business combinations

Acquisitions that qualify for accounting under ASC 805

For business combinations, the accounting complexity starts before the beginning. Not all acquisitions meet the definition of a business combination under ASC 805—but for those that do, the acquisition method of accounting comes into play.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

The basics of accounting for business combinations

Entities engage in acquisitions for various reasons. For example, they may be looking to grow in size, diversify their product offerings, or expand into new markets or geographies. The accounting for acquisitions can be complex and begins with a determination of whether an acquisition should be accounted for as a business combination. ASC 805-10, ASC 805-20, and ASC 805-30 address the accounting for a business combination, which is defined in the ASC master glossary as “[a] transaction or other event in which an acquirer obtains control of one or more businesses.” Typically, a business combination occurs when an entity purchases the equity interests or the net assets of one or more businesses in exchange for cash, equity interests of the acquirer, or other consideration. However, the definition of a business combination applies to more than just purchase transactions; it incorporates all transactions or events in which an entity or individual obtains control of a business.

If the acquisition does not meet the definition of a business combination, the entity must determine whether it should be accounted for as an asset acquisition under ASC 805-50. Distinguishing between the acquisition of a business and the acquisition of an asset or a group of assets is important because there are many differences between the accounting for each. Alternatively, if the assets acquired consist of primarily cash or investments, the substance of the transaction may be a capital transaction (a recapitalization) rather than a business combination or an asset acquisition.

Determining whether an acquisition is a business combination or an asset acquisition

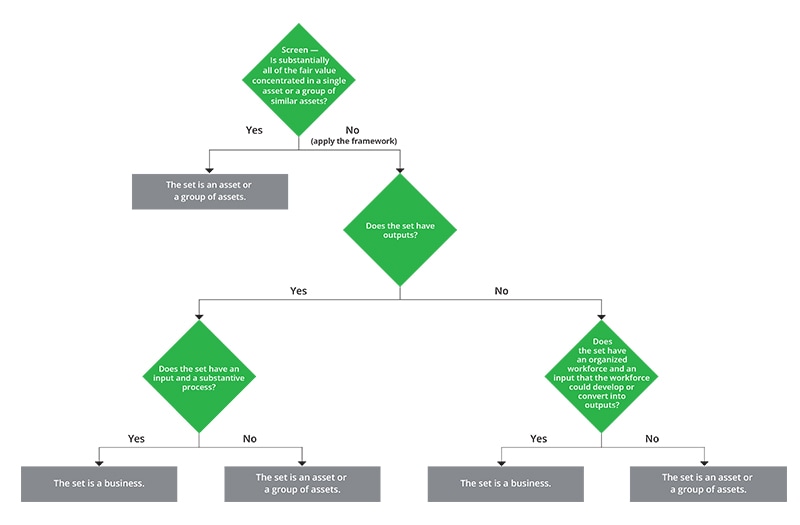

To determine whether an acquisition should be accounted for as a business combination, an entity must evaluate whether the acquired set of assets and activities together meet the definition of a business in ASC 805.

An entity first uses a “screen” to assess whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or group of similar identifiable assets. If the screen is not met, the entity must apply a “framework” for determining whether the acquired set includes, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. If so, the acquired set is a business.

The decision tree below illustrates how to determine whether an acquisition represents a business combination or an asset acquisition.

SEC registrants are required to use the definition of a business in SEC Regulation S-X, Rule 11-01(d), when evaluating the requirements of SEC Regulation S-X, Rule 3-05, and SEC Regulation S-X, Article 11. The definition of a business in Rule 11-01(d) is different from the definition of a business in ASC 805-10.

The first step of applying the acquisition method is identifying the acquirer. ASC 805-10-25-4 requires entities to identify an acquirer in every business combination. The ASC master glossary defines an acquirer as follows:

The entity that obtains control of the acquiree. However, in a business combination in which a variable interest entity (VIE) is acquired, the primary beneficiary of that entity always is the acquirer.

The entity identified as the acquirer for accounting purposes usually is the entity that transfers the consideration (e.g., cash, other assets, or its equity interests) to effect the acquisition. However, in some business combinations, the entity that issues its equity interests (the “legal acquirer”) is determined for accounting purposes to be the acquiree (also called the “accounting acquiree”), while the entity whose equity interests are acquired (the “legal acquiree”) is for accounting purposes the acquirer (also called the “accounting acquirer”). Such transactions are commonly called reverse acquisitions.

In many acquisitions, the identification of the acquirer is straightforward, but in others, it can require significant judgment. If the entity identified as the accounting acquiree meets the definition of a business, the accounting acquirer accounts for the acquisition as a business combination in accordance with ASC 805. If the accounting acquiree does not meet the definition of a business, an entity must assess the nature of the assets and operations acquired. If the accounting acquiree has substantive assets (other than cash and investments), the acquisition generally is accounted for as a reverse asset acquisition. However, if the entity identified as the accounting acquiree has no substantive assets other than cash and investments, the nature of the transaction may be a reverse recapitalization rather than an acquisition.

In special-purpose acquisition company (SPAC) transactions, private operating companies (“targets”) raise capital by merging with SPACs rather than using traditional IPOs or other financing activities. A SPAC is a newly formed company that raises cash in an IPO and uses that cash or the equity of the SPAC, or both, to fund the acquisition of a target. A transaction in which a SPAC acquires an operating company target must be analyzed to determine whether the SPAC or the target is the accounting acquirer. An entity should consider all pertinent facts and circumstances in its evaluation.

In situations in which the target is determined to be the accounting acquirer, typically, the SPAC’s only precombination assets are cash and investments, and the SPAC does not meet the definition of a business in ASC 805. Therefore, the substance of the transaction is a recapitalization of the target (i.e., a reverse recapitalization) rather than a business combination or an asset acquisition. In such cases, the transaction would be accounted for as though the target issued its equity for the net assets of the SPAC and, since a business combination has not occurred, no goodwill or intangible assets would be recorded.

On January 24, 2024, the SEC issued a final rule on financial reporting and disclosures for SPACs that aims to “enhance investor protections in [IPOs] by [SPACs] and in subsequent business combination transactions between SPACs and [target] companies.”

The second step of applying the acquisition method is determining the acquisition date. The acquisition date is the date on which control of the business transfers to the acquirer and generally coincides with the date on which the acquirer legally transfers the consideration to the seller, receives the assets, and incurs or assumes the liabilities (i.e., the closing date). However, in unusual circumstances, the acquisition date can be before or after the closing date.

Determining the acquisition date is important because on this date:

● The consideration transferred is measured at fair value as the sum of (1) the assets transferred by the acquirer, (2) the liabilities incurred by the acquirer to former owners of the acquiree (e.g., contingent consideration), and (3) the equity interests issued by the acquirer.

● The assets acquired, liabilities assumed, and any noncontrolling interests are identified and measured.

● The acquirer begins consolidating the acquiree, if required.

The third step of applying the acquisition method is recognizing and measuring the identifiable assets acquired, liabilities assumed, and any noncontrolling interests in the acquiree. Step three is based on two key principles, which ASC 805 calls the recognition principle and the measurement principle. Under the recognition principle in ASC 805-20-25-1, an acquirer must “recognize, separately from goodwill, the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree.” As a result of applying the recognition principle, an acquirer may recognize certain assets and liabilities that were not previously recognized in the acquiree’s financial statements, such as certain intangible assets.

Under the measurement principle in ASC 805-20-30-1, an acquirer is required to measure “the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at their acquisition-date fair values.” Thus, most assets and liabilities and items of consideration are measured at fair value in accordance with the principles of ASC 820.

Recently issued guidance

In October 2021, the FASB issued ASU 2021-08, which amends ASC 805 to add contract assets and contract liabilities to the list of exceptions to the recognition and measurement principles that apply to business combinations and to “require that an entity (acquirer) recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606.” While primarily related to contract assets and contract liabilities that were accounted for by the acquiree in accordance with ASC 606, “the amendments also apply to contract assets and contract liabilities from other contracts to which the provisions of Topic 606 apply, such as contract liabilities from the sale of nonfinancial assets within the scope of Subtopic 610-20.” Before adopting the amendments, an acquirer generally recognizes contract assets and contract liabilities at fair value on the acquisition date.

As a result of the amendments made by ASU 2021-08, it is expected that an acquirer will generally recognize and measure acquired contract assets and contract liabilities in a manner consistent with how the acquiree recognized and measured them in its preacquisition financial statements. However, the Board acknowledges that:

“[T]here may be circumstances in which the acquirer is unable to assess or rely on how the acquiree applied Topic 606, such as if the acquiree does not follow GAAP, if there were errors identified in the acquiree’s accounting, or if there were changes identified to conform with the acquirer’s accounting policies. In those circumstances, the acquirer should consider the terms of the acquired contracts, such as timing of payment, identify each performance obligation in the contracts, and allocate the total transaction price to each identified performance obligation on a relative standalone selling price basis as of contract inception (that is, the date the acquiree entered into the contracts) or contract modification to determine what should be recorded at the acquisition date.”

Therefore, the Board notes that “the amendments may not always be as simple as recording the same contract assets and contract liabilities that were recorded by the acquiree before the acquisition and that there may be additional effort required to evaluate how the acquiree applied Topic 606.”

In addition, ASU 2021-08 indicates that the amendments “do not affect the accounting for other assets or liabilities that may arise from revenue contracts with customers in accordance with Topic 606, such as refund liabilities, or in a business combination, such as customer-related intangible assets and contract-based intangible assets. For example, if acquired revenue contracts are considered to have terms that are unfavorable or favorable relative to market terms, the acquirer should recognize a liability or asset for the off-market contract terms at the acquisition date.”

The ASU’s amendments are effective as follows:

● For public business entities — Fiscal years beginning after December 15, 2022, including interim periods within those fiscal years.

● For all other entities — Fiscal years beginning after December 15, 2023, including interim periods within those fiscal years.

The amendments should be applied prospectively to business combinations occurring on or after the effective date of the amendments.

The ASU clarifies that “[e]arly adoption of the amendments is permitted, including adoption in an interim period. An entity that early adopts in an interim period should apply the amendments (1) retrospectively to all business combinations for which the acquisition date occurs on or after the beginning of the fiscal year that includes the interim period of early application and (2) prospectively to all business combinations that occur on or after the date of initial application.” For example, assume that an entity with a calendar year-end had one business combination in the second quarter of 2020 and another business combination in the third quarter of 2021. If the entity adopts the amendments in the fourth quarter of 2021, it would apply the amendments retrospectively to the acquisition that occurred in the third quarter of 2021 but would not apply the amendments retrospectively to the acquisition that occurred in the second quarter of 2020 even if it had not yet issued financial statements for the year ended December 31, 2020.

The fourth and final step in applying the acquisition method is recognizing and measuring goodwill or a gain from a bargain purchase. The ASC master glossary, as amended by ASU 2023-05, defines goodwill as “[a]n asset representing the future economic benefits arising from other assets acquired in a business combination, acquired in an acquisition by a not-for-profit entity, or recognized by a joint venture upon formation that are not individually identified and separately recognized.” Because goodwill is not a separately identifiable asset, it cannot be measured directly. It is therefore measured as a residual and calculated as the excess of the sum of the following items over the net of the acquisition-date values of the identifiable assets acquired and the liabilities assumed: (1) the consideration transferred, (2) the fair value of any noncontrolling interest in the acquiree if a less than 100 percent interest in the acquiree is acquired, and (3) the fair value of the acquirer’s previously held equity interest in the acquiree if the acquirer had a noncontrolling equity interest in the acquiree before the acquisition. Occasionally, the sum of (1) through (3) above is less than the net of the acquisition-date fair values of the identifiable assets acquired and the liabilities assumed. In such a case, the acquirer recognizes a gain, referred to as a bargain purchase gain, in earnings on the acquisition date.

Because it may take time for an entity to obtain the information necessary to recognize and measure all the items exchanged in a business combination, the acquirer is allowed a period in which to complete its accounting for the acquisition. That period—referred to as the measurement period—ends as soon as the acquirer (1) receives the information it had been seeking about facts and circumstances that existed as of the acquisition date or (2) learns that it cannot obtain further information. However, the measurement period cannot be more than one year after the acquisition date. During the measurement period, the acquirer recognizes provisional amounts for the items for which the accounting is incomplete.

Under ASC 805-10-55-16, the acquirer is required to recognize any adjustments to the provisional amounts that were recognized during the measurement period “in the reporting period the adjustments are determined.” The adjustments are calculated as if the accounting had been completed on the acquisition date. When an acquirer adjusts a provisional amount, the offsetting entry generally increases or decreases goodwill but may also result in adjustments to other assets and liabilities. Measurement-period adjustments may also affect the income statement. In accordance with ASC 805-10-25-17, an acquirer must recognize, in the reporting period in which the adjustment amounts are determined (rather than retrospectively), the “effect [on earnings] of changes in depreciation, amortization, or other income effects . . . if any, as a result of the change to the provisional amounts calculated as if the accounting had been completed at the acquisition date.”

Other related issues

Pushdown accounting

When an entity obtains control of a business, a new basis of accounting is established in the acquirer’s financial statements for the assets acquired and liabilities assumed. ASC 805-10, ASC 805-20, and ASC 805-30 provide guidance on accounting for an acquisition of a business in the acquirer’s consolidated financial statements. Sometimes the acquiree in a business combination will prepare separate financial statements after the acquisition. In such cases, the acquiree has the option of whether to use the parent’s basis of accounting or the acquiree’s historical carrying amounts for the assets acquired and liabilities assumed in its separate financial statements. Use of the acquirer’s basis of accounting in the preparation of an acquiree’s separate financial statements is called “pushdown accounting.”

An acquiree can elect to apply pushdown accounting in its separate financial statements each time another entity or individual obtains control of it. If it does not elect to apply pushdown accounting before the financial statements are issued (SEC filer) or are available to be issued (other entities), it may subsequently elect to apply pushdown accounting to its most recent change-in-control event in a later reporting period. However, such a later election would be a change in accounting principle and the acquiree would be required to apply the guidance on a change in accounting principle in ASC 250 in such circumstances, including all relevant disclosure requirements.

ASC 250-10-45-5 requires that an entity “report a change in accounting principle through retrospective application . . . to all prior periods” unless doing so would be impracticable. We would expect entities that elect pushdown accounting on a later date to apply it retroactively to the acquisition date since the parent generally would be expected to have maintained the records for all prior periods. Further, an SEC registrant that elects a voluntary change in accounting principle must file a preferability letter with the SEC.

While an entity can elect to apply pushdown accounting in a subsequent reporting period, it cannot reverse the application of pushdown accounting in financial statements that have been issued (SEC filer) or are available to be issued (other entities).

Common-control transactions

A common-control transaction is typically a transfer of net assets or an exchange of equity interests between entities under the control of the same parent. While a common-control transaction is similar to a business combination for the entity that receives the net assets or equity interests, such a transaction does not meet the definition of a business combination because there is no change in control over the net assets. Therefore, the accounting and reporting for a transaction between entities under common control is outside the scope of the business combinations guidance in ASC 805-10, ASC 805-20, and ASC 805-30 and is addressed in the “Transactions Between Entities Under Common Control” subsections of ASC 805-50.

Since there is no change in control over the net assets from the parent’s perspective in a common-control transaction, there is no change in basis in the net assets. ASC 805-50 requires the receiving entity to recognize the net assets received at their historical carrying amounts, as reflected in the ultimate parent’s financial statements.

Entities should also be aware that internal reorganizations could trigger a requirement to apply pushdown accounting. While common-control transactions are generally accounted for at historical cost, sometimes the carrying amounts of the transferred assets and liabilities in the ultimate parent’s consolidated financial statements differ from the carrying amounts in the transferring entity’s separate financial statements (e.g., if the transferring entity had not applied pushdown accounting). ASC 805-50-30-5 states that, in such cases, the receiving entity’s financial statements must “reflect the transferred assets and liabilities at the historical cost of the parent of the entities under common control.” We believe that the historical cost of the parent refers to the historical cost of the ultimate parent or controlling shareholder. Therefore, while the application of pushdown accounting is optional in the acquiree’s separate financial statements, it may be required in certain cases after an internal reorganization.

Asset acquisitions

The term “asset acquisition” is used to describe an acquisition of an asset, or a group of assets, that does not meet the definition of a business in ASC 805. An asset acquisition is accounted for in accordance with the “Acquisition of Assets Rather Than a Business” subsections of ASC 805-50 by using a cost accumulation model. In such a model, the cost of the acquisition, including certain transaction costs, is allocated to the assets acquired on a relative fair value basis and no goodwill is recognized. By contrast, in a business combination, the assets acquired are recognized generally at fair value and goodwill is recognized. As a result, there are significant differences between the accounting for an asset acquisition and the accounting for a business combination.

As noted previously, the FASB had a project to improve the accounting for asset acquisitions and business combinations by narrowing the differences between the two accounting models. However, at its June 15, 2022, meeting, the FASB decided to remove this project from its agenda. As a result, the differences between the two acquisition models will continue to exist in practice.

Joint venture formations

In August 2023, the FASB issued ASU 2023-05, under which an entity that qualifies as either a joint venture or a corporate joint venture as defined in the ASC master glossary is required to apply a new basis of accounting upon the formation of the joint venture. Under ASU 2023-05 (codified in ASC 805-60), the formation of a joint venture or a corporate joint venture (collectively, “joint ventures”) results in the “creation of a new reporting entity,” and no accounting acquirer is identified under ASC 805. Accordingly, a new basis of accounting would be established upon the formation date. A joint venture must initially measure its assets and liabilities at fair value on the formation date, which the ASU defines as “the date on which an entity initially meets the definition of a joint venture.” Further, the excess of the fair value of a joint venture as a whole over the net assets of the joint venture is recognized as goodwill.

The amendments in ASU 2023-05 are effective for all joint ventures within the ASU’s scope that are formed on or after January 1, 2025, and early adoption is permitted. Joint ventures formed on or after the effective date of ASU 2023-05 will be required to apply the new guidance prospectively. Joint ventures formed before the ASU’s effective date are permitted to apply the new guidance (1) retrospectively, if they have “sufficient information” to do so, or (2) prospectively, if financial statements have not yet been issued (or made available for issuance). If retrospective application is elected, transition disclosures must be provided in accordance with ASC 250.

Purchased financial assets

In June 2023, the FASB issued a proposed ASU that would amend the guidance in ASU 2016-13 regarding the accounting upon the acquisition of financial assets acquired in (1) a business combination, (2) an asset acquisition, or (3) the consolidation of a VIE that is not a business. The proposed ASU would broaden the population of financial assets that are within the scope of the gross-up approach under ASC 326 by requiring an acquirer to apply the gross-up approach in accordance with ASC 805 to all financial assets acquired in a business combination rather than only to purchased financial assets with credit deterioration. For financial assets acquired as a result of an asset acquisition or through consolidation of a VIE that is not a business, the asset acquirer would apply the gross-up approach to seasoned assets, which are acquired assets unless the asset is deemed akin to an in-substance origination. A seasoned asset is an asset (1) that is acquired more than 90 days after origination and (2) for which the acquirer was not involved with the origination. Practitioners should monitor the proposed ASU for any developments that might change the current accounting.

SEC reporting requirements

To ensure that investors receive relevant financial information about a company’s significant activities, the SEC requires registrants to report financial information about significant acquired or to be acquired businesses or the acquisition of real estate operations (the acquiree) in certain filings under Regulation S-X, Rules 3-05 and 3-14, respectively.

See Deloitte’s Roadmap SEC Reporting Considerations for Business Acquisitions for more information.

Continue your business combinations learning

Deloitte’s Roadmap Business Combinations provides Deloitte’s insights into and interpretations of the guidance in ASC 805 on business combinations, pushdown accounting, common-control transactions, and asset acquisitions as well as an overview of related SEC reporting requirements.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Get in touch for service offerings

|

Emily Matthews |

Recommendations

A guide to consolidation accounting

On the Radar: Identifying a controlling financial interest

Guidance on the SEC requirements for acquisitions

On the Radar: Business acquisitions—SEC reporting considerations