What to know about the functional currency approach has been saved

Perspectives

What to know about the functional currency approach

On the Radar: Foreign currency accounting

When an entity’s financial statements include foreign operations, it must consolidate those foreign entities and present them as if they were one. This edition of On the Radar offers guidance for translating the accounts of foreign entities as advised under ASC 830, otherwise known as the "functional currency approach."

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

Foreign currency matters

Many entities operate in multiple countries. When an entity’s financial statements include foreign operations, the entity must consolidate those foreign entities and present them as though they were the financial statements of a single reporting entity. This process of translating the accounts of foreign entities is addressed in ASC 830, which has existed for decades without recent substantial changes, and is known as the "functional currency approach."

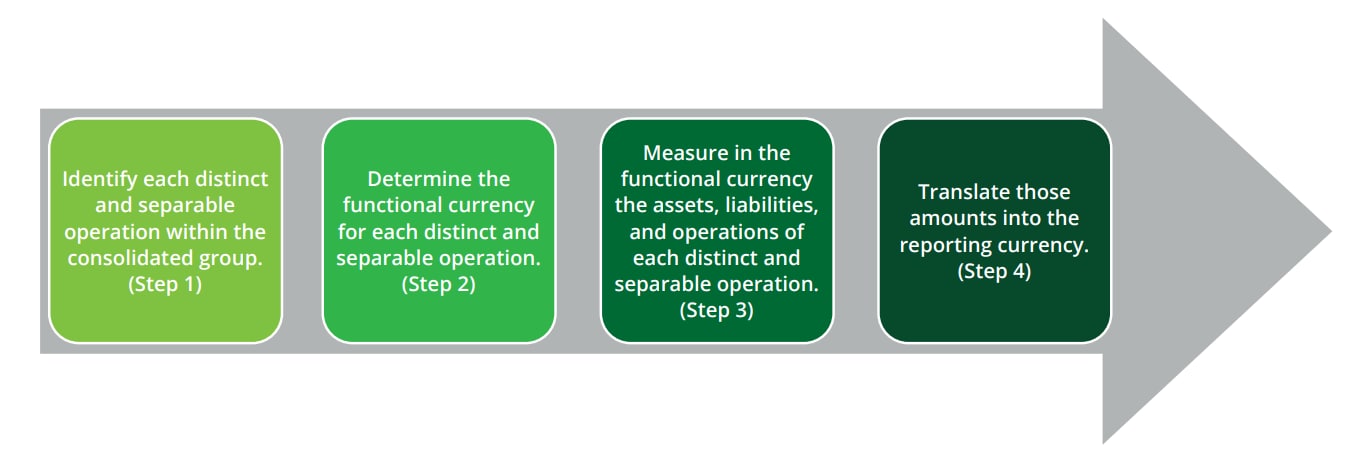

Under the functional currency approach, a reporting entity must perform four steps:

Continue your foreign currency learning

Deloitte’s Roadmap Foreign Currency Matters comprehensively discusses the scope, measurement, and disclosure guidance in ASC 830.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

Accounting & financial reporting roadmap

Find comprehensive guides to help you face your most pressing accounting and reporting challenges with clarity and confidence.

Understanding IFRS and US GAAP

On the Radar: Comparing IFRS accounting standards and US GAAP: Bridging the differences