Issuer’s accounting for debt has been saved

Perspectives

Issuer’s accounting for debt

On the Radar: Debt and equity securities under ASC 470

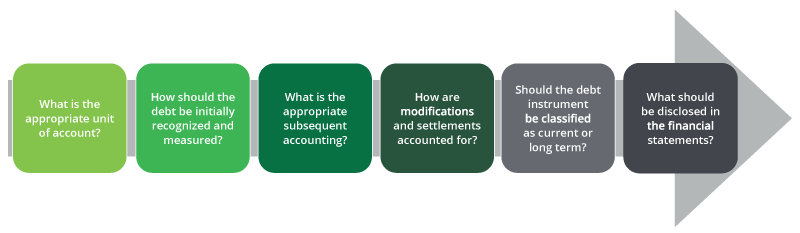

Issuers that account for debt instruments under ASC 470 need to analyze the fine print. In our latest On the Radar, we walk through six key considerations for classifying and disclosing information about highly scrutinized debt and equity securities.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

Unpacking an entity’s capital structure

Entities raising capital by issuing debt instruments must account for those instruments by applying ASC 470 as well as other applicable US GAAP. Key questions to consider when determining the appropriate accounting include:

All entities are capitalized with debt or equity. The nature and mix of debt and equity securities that comprise an entity’s capital structure, and its decisions about the types of securities to issue when raising capital, may depend on the stage of the entity’s life cycle, the cost of capital, the need to comply with regulatory capital requirements or debt covenants (e.g., capital or leverage ratios), and the financial reporting implications. The complexity of the terms and characteristics of debt instruments is often influenced by factors such as the entity’s size, age, or creditworthiness. For example, early-stage and smaller growth companies are often financed with capital securities that contain complex and unusual features, whereas larger, more mature entities often have a mix of debt and equity securities with largely plain-vanilla characteristics. The complexity of the accounting for debt generally depends on the intricacy of the instrument’s terms.

Financial instruments that are debt in legal form must always be classified by the issuer as liabilities. In addition, some legal-form equity shares also require liability classification under ASC 480. An entity must reach a conclusion about the classification of an obligation or equity share before it can appropriately apply US GAAP to account for the instrument.

The SEC staff closely scrutinizes the manner in which entities classify and disclose information about debt instruments. For example, the staff frequently comments on (1) an entity’s classification of instruments as equity rather than debt, (2) restrictions in debt agreements that limit an entity’s ability to pay dividends, and (3) a registrant’s compliance with debt covenants, including the impact of any noncompliance on its liquidity and capital resources and the classification of debt as current versus long term.

Financial reporting considerations

While ASC 470 applies to an issuer’s accounting for debt, it does not address the accounting for other freestanding financial instruments issued in conjunction with debt. In some cases (e.g., debt issued on a stand-alone basis), it is readily apparent that there is only one unit of account. However, other financing transactions may involve two or more components that individually represent separate units of account (e.g., debt issued with detachable warrants). Instruments that can be legally detached and exercised independently from the issued debt are separate freestanding financial instruments, and US GAAP must be applied to them individually.

Debt instruments may also contain embedded features that must be separately accounted for as derivatives under ASC 815-15. These may include equity conversion options, put and call options, and interest payment features. Entities must often use judgment when determining the unit of account for such embedded features and whether to separately account for them. Applying the derivative accounting guidance in ASC 815-15 is extremely complex and often requires the involvement of accounting advisers.

When debt is issued with other freestanding financial instruments or includes an embedded derivative that requires separate accounting, the entity must appropriately allocate the proceeds between the debt instrument and the other features that are separately accounted for. The entity must also identify which costs and fees qualify as debt issuance costs. Such amounts that are applicable to the debt instrument must be capitalized into the initial carrying amount of the debt. If the financing transaction includes other freestanding financial instruments or if the debt contains an embedded feature that requires bifurcation as a derivative, those costs and fees must be appropriately allocated to the various instruments.

While debt is generally initially recognized on the basis of the proceeds received, special considerations are necessary in certain situations such as those in which:

• The stated interest rate on the debt differs from the market rate of interest.

• Convertible debt is issued at a substantial premium.

• The debt is subsequently accounted for at fair value under the fair value option.

If an entity issues debt in a cash transaction that does not include any other elements for which separate accounting recognition is required (e.g., freestanding financial instruments or other stated or unstated rights or privileges that warrant separate accounting recognition) and the entity has not elected the fair value option, a presumption exists that the debt should be initially measured at the amount of cash proceeds received from the holder, adjusted for debt issuance costs. Any difference between the stated principal amount and the amount of the cash proceeds received, net of debt issuance costs, is presented as a discount or premium. However, this presumption may not always be appropriate (e.g., debt issued at a substantial premium). Further, when debt is issued in exchange for property, goods, or services, there is no cash amount to use as the basis for the initial carrying amount of the debt. In these circumstances, an entity must initially measure the debt instrument at an amount that equals the present value of the instrument’s future cash flows, discounted at an appropriate rate. If, however, the entity elects the fair value option for the debt, the instrument is instead initially recognized at its fair value, and any difference between the proceeds and the fair value of the debt is recognized immediately in earnings (e.g., debt issuance costs are expensed as incurred).

Most debt instruments, including convertible debt instruments, are subsequently accounted for by using the interest method. Under this approach, an entity uses present value techniques to determine the net carrying amount of the debt and the amount of periodic interest cost. The difference between the initial carrying amount of the debt and the aggregate undiscounted amount of future principal and interest payments over the debt’s life represents the total interest cost on the debt. The total interest cost over the debt’s life is allocated to individual reporting periods by using the effective yield implicit in the debt’s contractual cash flows (i.e., by recognizing a constant effective interest rate). Through this allocation, any premium or discount and debt issuance costs are amortized as interest cost over the debt’s life.

When a debt instrument contains an embedded derivative that must be bifurcated, the interest method is applied only to the host contract. The embedded derivative is subsequently measured at fair value, with changes in fair value reported in earnings. The effective interest rate for the host debt contract will be affected by the discount created from initially recognizing the embedded derivative at fair value. Furthermore, any potential cash flows associated with the bifurcated embedded derivative are excluded from the undiscounted cash flows used to impute the effective yield on the debt.

Special applications of the interest method are used for sales of future revenues, participating mortgages, and indexed debt instruments, and there is a separate accounting model for joint and several liability arrangements.

When the fair value option is elected, the debt instrument is subsequently measured at fair value, with changes in fair value reported in earnings and other comprehensive income. Entities that separately present interest expense must apply the interest method under an assumption that the debt instrument is not subsequently reported at fair value. The calculations necessary in these circumstances can be complex.

There is extensive guidance in US GAAP on the accounting for modifications and settlements of debt instruments. For example, entities must consider:

• Extinguishments of debt (1) for cash, noncash financial assets, equity shares, or goods or services or (2) as a result of a legal release (ASC 405-20).

• Modifications and exchanges of debt (ASC 470-50). Specific guidance applies to convertible debt instruments.

• Troubled debt restructurings (ASC 470-60).

• Conversions of debt into equity shares, including induced conversions (ASC 470-20).

The guidance consists of a mix of principles and rules and can be complex to apply. Significant judgment and consultation with accounting advisers are often necessary.

Many entities present classified balance sheets in which they must categorize each liability as either current or long term. While ASC 210-20 provides general guidance on the classification of liabilities as current or long term, entities must also consider the specific balance sheet classification guidance in ASC 470-10.

ASC 470-10 does not establish a uniform principle for classifying debt as current or long term; instead, it consists of a patchwork of rules and exceptions. One requirement, which is subject to exceptions, is that liabilities that are scheduled to mature or that the creditor could force the debtor to repay within one year (or the operating cycle, if longer) after the balance sheet date should be treated as short-term obligations even if they are not expected to be settled within that period. However, some short-term obligations are classified as long-term liabilities because the debtor has the ability and intent to refinance those obligations on a long-term basis. Other debt instruments that are contractually due in more than one year must be classified as current liabilities because the debtor is in violation of a debt covenant or the debt instrument contains a subjective acceleration clause. When determining how to classify debt for which a covenant has been violated as of the balance sheet date, or after the balance sheet date but before the financial statements are issued or available to be issued, entities must use significant judgment and may need to engage accounting advisers to assist in the analysis.

Special considerations are necessary for convertible debt instruments, revolving-debt arrangements, and increasing-rate debt.

Certain information must be disclosed about all debt instruments. For example, entities must disclose significant debt terms, the face amount and effective interest rate, pledged assets and restrictive covenants, and a five-year table of debt maturities. Additional disclosures are required for specific types of debt, including:

• Debt that becomes callable because the debtor fails to comply with a covenant.

• Convertible debt.

• Debt that is subsequently measured at fair value.

• Debt that is designated in a hedging relationship under ASC 815-20.

• Debt that is guaranteed or collateralized by an entity other than the primary obligor.

• Structured trade payable arrangements.

In addition to disclosures, entities must consider the effect of debt instruments on the calculation of EPS. Debt instruments that are participating securities will affect the calculation of basic EPS, whereas those that may be settled in the issuer’s stock will affect diluted EPS. Note that if either the entity or the creditor can elect stock or cash settlement of a debt instrument, share settlement is assumed for diluted EPS purposes and the if-converted calculation must be used to determine the dilution.

Continue your issuer’s accounting debt learning

This Roadmap provides a comprehensive discussion of the classification, initial and subsequent measurement, and presentation and disclosure of debt, including convertible debt.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

Accounting Newsletters

Stay informed with Deloitte’s accounting and financial reporting publications and resources.

Accounting & financial reporting roadmap

Find comprehensive guides to help you face your most pressing accounting and reporting challenges with clarity and confidence.