Breaking down accounting for convertible debt issuers has been saved

Perspectives

Breaking down accounting for convertible debt issuers

On the Radar: An accounting roadmap for convertible debt instruments

Determining the appropriate accounting model for convertible debt instruments can be complex. This roadmap offers guidance for convertible debt issuers who have not adopted ASU 2020-06 on which accounting model applies to the convertible debt instrument, how that instrument is subsequently measured, and more.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

Convertible debt 101

An entity raising capital by issuing a convertible debt instrument must apply complex financial reporting requirements in US GAAP. To properly account for such an instrument, an entity must consider the following: Entities often issue convertible debt because it has a lower interest cost than other debt instruments. For example, if an entity is in the growth stage of its life cycle and expects its common stock to increase in fair value, it may issue convertible debt after considering the cost of capital, potential share dilution, and investor demand.

Entities often issue convertible debt because it has a lower interest cost than other debt instruments. For example, if an entity is in the growth stage of its life cycle and expects its common stock to increase in fair value, it may issue convertible debt after considering the cost of capital, potential share dilution, and investor demand.

In some cases, an entity may issue convertible debt and simultaneously enter into derivatives (e.g., purchased or written call options on its common stock) to offset the potential share dilution that will occur if the debt instrument is converted into common stock. Although such derivatives generally raise the cost of capital, it may still be more favorable for the entity to issue a combination of convertible debt and derivatives than to issue nonconvertible debt (e.g., lower overall cost of capital or favorable tax benefits). When an entity issues freestanding derivatives on its common stock, the financial reporting and compliance risks increase because of the need to apply complex, rules-based accounting guidance to these instruments. Entities should ensure that they have the appropriate internal controls in place to properly account for and disclose convertible debt instruments and any related derivatives.

Questions to consider

ASC 470-20 provides general guidance on the accounting for convertible debt. However, numerous other sections in US GAAP must also be considered. While the relevant accounting guidance has existed for a number of years, it will change significantly upon an entity’s adoption of ASU 2020-06, which amends US GAAP to eliminate the cash conversion feature (CCF) and beneficial conversion feature (BCF) accounting models (see below for further discussion of the accounting models).

As noted above, to determine the appropriate accounting for convertible debt, entities must consider five key questions:

In some cases, convertible debt is issued on a stand-alone basis and it is readily apparent that there is only one unit of account. In other financing transactions, convertible debt is issued with detachable warrants or other derivatives intended to offset share dilution. If these other instruments are legally detachable and separately exercisable, they must be accounted for separately from the convertible debt in accordance with other applicable US GAAP. An entity must appropriately allocate the proceeds to each separate unit of account.

To select an appropriate accounting model, an entity must first consider whether the embedded conversion feature requires separate accounting as a derivative liability. It must also consider whether other embedded features in the instrument (e.g., put or call options, interest rate adjustments) require separate accounting as derivatives. The allocation of proceeds to a convertible debt instrument may affect whether an embedded derivative feature requires bifurcation.

The evaluation of whether an embedded conversion option requires separate accounting as a derivative liability is performed in accordance with ASC 815; it can be time-consuming and complex. The more unique the terms of a convertible debt instrument, the more likely that the embedded derivative requires bifurcation. The embedded conversion option will require separate accounting as a derivative liability if there are nontraditional adjustments to the conversion rate (e.g., certain make-whole features) or the issuer does not control the ability to settle the conversion option in its common shares.

If the embedded conversion option does not require bifurcation, the entity must consider whether the CCF, BCF, or substantial premium guidance applies. This determination, and the application of this guidance, can be difficult and may require the assistance of accounting advisers. Only if the convertible debt instrument is not within the scope of the CCF, BCF, or substantial premium guidance is the instrument accounted for as a single liability in accordance with the accounting model for traditional convertible debt. See below for further discussion of the accounting models that apply to convertible debt.

The subsequent measurement of convertible debt depends on which accounting model applies. For example, if the conversion option must be accounted for as a derivative instrument, the entity must periodically measure its fair value in accordance with ASC 820, which may require a complex valuation model. In addition, the periodic calculation of interest cost under the interest method will be affected by the amount of proceeds allocated to the convertible debt instrument and the accounting model applied. While some interest calculations are relatively simple, others may be quite complex (e.g., convertible debt with a CCF or BCF). In general, an entity does not subsequently remeasure an equity component that is separately recognized under the CCF, BCF, or substantial premium model.

The balance sheet classification of convertible debt as either current or long term also depends on the accounting model applied to the instrument. Entities may unexpectedly need to reclassify an instrument’s liability component as a current liability on the basis of the investor’s ability to convert the instrument (e.g., if the principal amount would be settled in cash upon conversion).

A modification of a convertible debt instrument may represent an extinguishment or require an amount to be recognized in equity. It may also change the accounting model that is applied. Settlements are complex because they may be reflected as extinguishments or conversions depending on the circumstances. Some settlements may reflect induced conversions, which require special accounting considerations.

ASC 470-20 specifies the disclosures required for convertible debt. The nature of the required disclosures depends on which accounting model is applied. In addition, the disclosure requirements in other GAAP—such as ASC 405-10, ASC 505-10, ASC 815-10, ASC 815-40, and ASC 820—may apply, depending on which accounting model is applied to a convertible debt instrument.

Accounting models for convertible debt

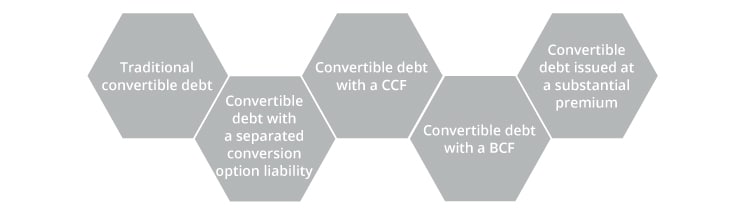

Under US GAAP before the adoption of ASU 2020-06, there are five different accounting models for convertible debt instruments that are issued in financing transactions:

The SEC staff closely scrutinizes the appropriate accounting for convertible debt instruments. This is evident in comment letters on registrants’ filings and the number of restatements arising from the application of an inappropriate accounting model to convertible debt.

Scope

- Convertible debt that does not contain a separated conversion option liability, CCF, BCF, or substantial premium.

Accounting: Single liability

- Initial accounting — Recognize the instrument as a single liability.

- Subsequent accounting — Recognize the liability at amortized cost if the fair value option (FVO) is not elected.

Compliance and financial reporting considerations

- Decreased reported interest cost.

- Increased liability amount on the balance sheet.

- Less complex accounting.

Continue your convertible debt learning

Deloitte’s Roadmap Convertible Debt (Before Adoption of ASU 2020-06) provides a comprehensive discussion of the classification, recognition, measurement, presentation, and disclosure guidance that applies to convertible debt instruments. This Roadmap will not be updated after 2023 because ASU 2020-06 is effective for all entities for fiscal years beginning after December 15, 2023. Entities that have adopted ASU 2020-06 should consider Deloitte’s Roadmap Issuer’s Accounting for Debt, which discusses the classification, initial and subsequent measurement, and presentation and disclosure of debt, including convertible debt.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

A guide for equity-linked financial instruments

On the Radar: Contracts on an entity’s own equity

Issuer’s accounting for debt

On the Radar: Debt and equity securities under ASC 470