The future of retail metrics has been saved

Analysis

The future of retail metrics

Convergence in retail moving to channel-agnostic approaches

Over the past decade, traditional retail has faced unprecedented disruption. Consumers have more choice, competition is increasing, and convergence across industries has changed business dynamics. As retailers shift strategies to remain competitive, measures of success should also change with the times.

Explore content

- Retail metrics: Measuring success in a shifting marketplace

- Defining value with channel-agnostic retail metrics

- Defining the new retail metrics

- Developing a comprehensive big-picture perspective

- Get in touch

Retail metrics: Measuring success in a shifting marketplace

Traditional retail success metrics are becoming obsolete in today’s digitally enabled economy. The impact of digital is amplified by the sheer number and diversity of companies competing for the same wallet share, shifting the focus from where transactions take place to issues such as revenue growth, profitability, unique consumers, capital deployment, and cash management.

Taking this into account, industry stakeholders should develop new ways to measure performance and define marketplace success. Traditional retail key operational metrics, particularly those reported externally, focus on two main areas:

- Same-store sales: Success of an individual store over a set time frame to determine whether it is performing above or below expectations

- Sales per square foot: Measure of the efficiency of sales considering the size of a store

In a recent survey of retail CFOs and finance executives, 88 percent said they are rethinking metrics to accurately align to cross-channel operations, only 32 percent said their internal metrics “really align” with how they measure themselves externally, and just 8 percent believe their metrics are properly positioned to address changes in the retail environment.

If today’s metrics aren’t painting an accurate picture of the businesses we’re trying to measure, then the logical move is to change our perspective. Companies should make fundamental changes to how they define success and to what they measure.

Defining value with channel-agnostic retail metrics

We’ve witnessed a proliferation of new business and profit models focused on enabling consumer choice and fulfilling demand. Retailers and competitors from other consumer-focused companies have developed variations on subscriptions, marketplaces, fulfillment as a service, in-house ad and media networks, web and cloud services, licensing internal technologies, and venture funds.

In many cases, these additional profit models can help businesses improve their bottom line and maintain their customer base, but determining their true value is extremely difficult with traditional retail metrics.

If competing companies—no matter where they are in their growth cycle—are playing the same game and vying for the same wallet share, then performance metrics should use the same set of rules and methodologies.

Rather than measuring these companies differently, what if we held all competitors to a similarly high standard? What if we looked at how all companies leverage their consumer base, deliver on their core business, and create a sustainable profit model? What if we use metrics to see how companies drive relevance, top-line growth, and solid returns on capital?

Retail models have evolved, creating a variety of profit drivers

Retail profit models

Defining the new retail metrics

To successfully redefine retailer performance measurement, the industry needs a series of new metrics that complement one another, not a single “silver bullet” metric. Based on our surveys and research, retailers across all sectors and channels are less interested in traditional financial metrics and are more focused on a few common themes: growth potential, the consumer, profitability, investment thesis, and ability to invest in the business.

Our findings indicate that retail businesses should consider adopting new, more comprehensive metrics that better reflect current challenges and are:

- Holistic

- Inclusive

- Value-driving

- Operational

- Balanced

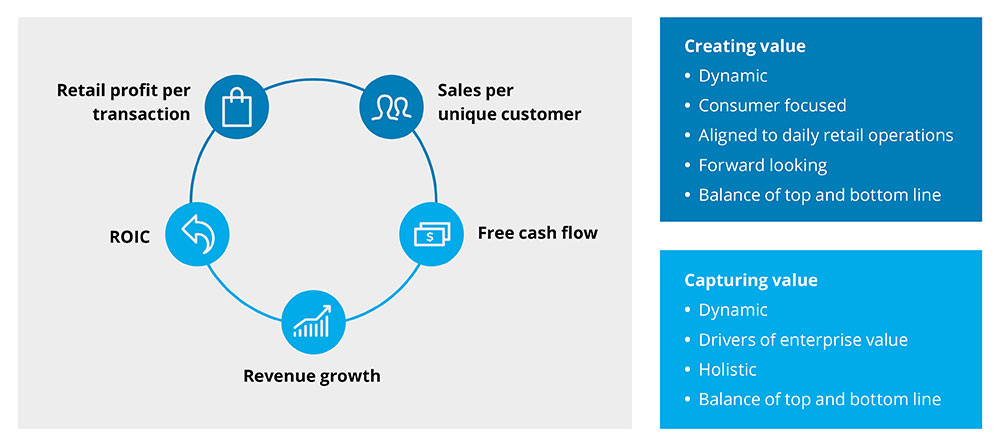

To achieve these goals, we believe businesses should focus on a balance of creating and capturing value:

Creating value. Similar to customer lifetime value, which measures how retailers create value by acquiring customers and capture value by sustaining profitable relationships, two new metrics we developed addresses the heart of retailer performance:

- Retail profit per transaction. This metric captures how profitable companies’ retail operations are, on a per-transaction basis. It is channel-agnostic and applies for all methods of fulfillment. This measurement allows for a like-to-like comparison across companies to see which organizations are most and least efficient in managing retail profitability in each consumer interaction.

- Sales per unique customer. Addresses how much wallet share retailers can drive across their consumer base, through multiple purchases per year or less-frequent, large-scale purchases.

Capturing value. From the core components of a traditional company enterprise valuation (using a discounted free cash flow), we identified three metrics that balance top-and bottom-line performance with investment efficiency:

- Revenue growth. This provides a top-line view that accounts for how a company is growing across its various operations and revenue streams, including both core retailing and ancillary models.

- Return on invested capital. This focuses on the importance of investing in modernization of current operations to keep pace with changes in the industry.

- Free cash flow. Provides insight into an organization’s controllable cash flow reflective of its current investments. This helps identify how much money is available to return to stakeholders and invest in future operations.

Creating a series of holistic and balanced metrics includes a necessary and beneficial tension. Each metric is important, but not enough by itself. They work together to provide a comprehensive view of performance.

Value creation and capture metrics

Developing a comprehensive big-picture perspective

Stakeholders should encourage the industry to develop, implement, and apply new, more detailed, performance-oriented metrics that can provide a holistic and channel-agnostic view of their operations.

By adopting new comprehensive metrics, companies can more effectively determine their strengths and weaknesses and take the necessary steps to build on success and shore up any competitive disadvantage. Further, by taking a more critical look at the foundations of their business, executives can develop new plans for future growth and success that will move the needle.

Convergence in retail is very real. Traditional and new entrants to retail are embracing innovative revenue and profit streams. As a result, the consumer has unparalleled choices, stretching far past our traditional definition of retail. Implementing and holding true to a new set of metrics should allow the entire industry to more effectively assess value creation and value capture.

Recommendations

2024 retail industry outlook

Looking for loyalty in all the right places