Blockchain technology for investment management firms has been saved

Analysis

Blockchain technology for investment management firms

Advancing asset management technology

Blockchain technology has the power to transform the asset management value chain—and the firms that adopt it early will reap the rewards. This report examines unique blockchain developments and provides a six-step guide to implementing blockchain. Position your firm for the future by advancing asset management technology.

Blockchain and asset management

Investment management (IM) leaders have responsibilities beyond managing the issues of the day—they should also position their firms for the future. Blockchain is one new technology that should demand IM leadership attention for two reasons. First, this technology has the potential to transform and extend asset management business value chains. Secondly, it is in early stages of development, signaling opportunity.

Imagine a world where customers carried a trusted digital identity that is linked to their financial records and transaction history. Their digital approval of a new account registration triggers a smart contract. The technology then executes a records search and returns an authorization to open (or not) the kind of account proposed by the financial institution. Upon completion of the eligibility review, digital account opening documentation is securely presented to the new customer on a personal smartphone app. The time, location, and electronic signature characteristics for each component of the new financial relationship are captured and secured. The app then secures the funding of the new financial relationship through an automated payment system, or an automated securities transfer. This approach equally applies to the private equity fund administration where blockchain and smart contracts can manage raising and calling capital, thereby tightening the process and removing some of the risk. Smart contracts and blockchain technology have the potential to provide a selectively automated process, with a person-in-the-loop as applicable or desired.

Learn how to go from imagination to implementation by downloading the PDF.

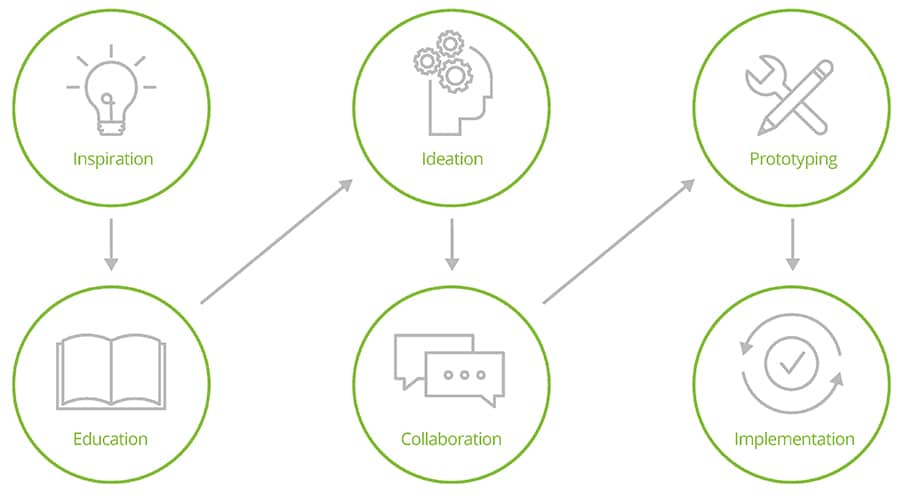

Six-step guide to getting started with blockchain technology

While the hype around this revolutionary technology is strong, asset management firms considering it for their business processes can take a deliberate path to getting started. With this path, they can select a transformative implementation while mitigating the risks.

Six key steps, if performed effectively, can take a firm into blockchain:

- Inspiration

One of the primary ways to get inspired about blockchain is to visit and interact with active think tanks and laboratories where students and PhDs alike are testing blockchain related ideas—often times well before they are commercially viable. - Education

In the education phase, creativity gives way to information gathering and assimilation. While the inspiration phase activates the imagination, the education phase considers the practical. - Ideation

When a critical mass of personnel is inspired and educated on blockchain, organizations can effectively move into ideation. The leading ideation processes have engaged participants and cultivate outside-the-box ideas as well as incremental improvements. Effective ideation also yields action. Effective ideation brings order to chaos without stifling or overlooking good ideas that may arise.

- Collaboration

After ideas are tested, asset management firms can progress to the collaboration stage. Firms often make connections with industry consortia and blockchain developers in this phase. With these connections, investment managers can continue their education process for targeted projects.

- Prototyping

With the knowledge and relationships gathered at this point in the process, investment management firms building a custom solution are ready to develop a working prototype of leading projects. A prototype is effectively a scale model of the process. In order to build a good prototype, the requirements of the process have to be gathered from key stakeholders and experts within the organization. - Implementation

Implementation of a blockchain solution is where the rubber meets the road. The risk to an organization exploring, testing, and prototyping is very limited compared to the potential risk associated with some implementations. Firms should be prepared to invest in security and risk mitigation throughout the process of the development and launch of a solution. Verification and validation of the system, prior to launch are critical components in the implementation process. There is also a wide range of appropriate implementation requirements, dependent on the blockchain use case being implemented.

To see the detailed six-step process, download the PDF.

Recommendations

2019 Investment Management Industry Outlook

Asset management trends indicate another year of challenges

Impact investing and hedge funds

A sustainable strategy