Current expected credit losses has been saved

Perspectives

Current expected credit losses

On the Radar: Insights on implementing the CECL model

The current expected credit loss (CECL) model under Accounting Standards Update (ASU) 2016-13 aims to simplify US GAAP and provide for more timely recognition of credit losses. In recent years, the Financial Accounting Standards Board (FASB) has issued a number of final and proposed amendments to the standard. What is the practical effect of the guidance as it stands today? Get the highlights in this summary.

On the Radar series

High-level summaries of emerging issues and trends related to the accounting and financial reporting topics addressed in our Roadmap series, bringing the latest developments into focus.

The basics of CECL accounting

The approach used to recognize impairment losses on financial assets has long been identified as a major weakness in current US GAAP, resulting in delayed recognition of such losses and leading to increased scrutiny. Accordingly, the FASB issued ASU 2016-13 to amend its guidance on the impairment of financial instruments. The ASU adds to US GAAP an impairment model known as the current expected credit loss (CECL) model, which is based on expected losses rather than incurred losses. The objectives of the CECL model are to:

- Reduce the complexity in US GAAP by decreasing the number of credit impairment models that entities use to account for debt instruments

- Eliminate the barrier to timely recognition of credit losses by using an expected loss model instead of an incurred loss model

- Require an entity to recognize an allowance of lifetime expected credit losses

- Not require a specific method for entities to use in estimating expected credit losses

Guidance applies to more than just banks

The ASU significantly changes the accounting for credit impairment. Although the CECL standard has a greater impact on banks, most nonbanks have financial instruments or other assets (e.g., trade receivables, contract assets, lease receivables, financial guarantees, loans and loan commitments, and held-to-maturity [HTM] debt securities) that are subject to the CECL model. While banks and other financial institutions (e.g., credit unions and certain asset portfolio companies) have been closely following standard-setting activities related to the CECL standard, are actively engaged in discussions with the FASB and the transition resource group (TDR), and are far along in the implementation process, many nonbanks may not have started evaluating the effect of the CECL model. Nonbanks that have yet to adopt the guidance should (1) focus on identifying which financial instruments and other assets are subject to the CECL model and (2) evaluate whether they need to make changes to existing credit impairment models to comply with the new standard.

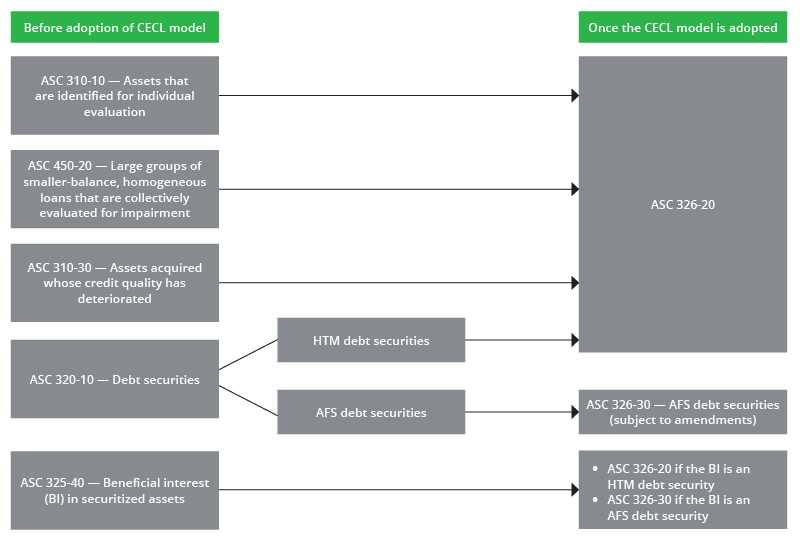

Reduction in impairment models

The FASB set out to establish a one-size-fits-all model for measuring expected credit losses on financial assets that have contractual cash flows. Ultimately, however, the FASB determined that the CECL model would not apply to available-for-sale (AFS) debt securities, which will continue to be assessed for impairment under ASC 320.

No impairment model is needed for financial assets measured at fair value (e.g., trading securities or other assets measured at fair value by using the fair value option) because the assets are measured at fair value in every reporting period.

The diagram below depicts the impairment models in US GAAP that were replaced by the CECL model.

Although the FASB was not able to develop a single impairment model for all financial assets, it did achieve its objective of reducing the number of impairment models in US GAAP.

Unlike the incurred loss models in previous US GAAP, the CECL model does not specify a threshold for recognizing an impairment allowance. Rather, an entity recognizes its estimate of expected credit losses for financial assets as of the end of the reporting period. Credit impairment is recognized as an allowance — or contra-asset — rather than as a direct write-down of the amortized cost basis of a financial asset.

An entity’s estimate of expected credit losses should reflect the losses that occur over the contractual life of the financial asset. When determining the contractual life of a financial asset, an entity is required to consider expected prepayments either as a separate input in the method used to estimate expected credit losses or as an amount embedded in the credit loss experience that it uses to estimate such losses. The entity is not allowed to consider expected extensions of the contractual life unless (1) extensions are a contractual right of the borrower or (2) the entity has a reasonable expectation as of the reporting date that it will execute a TDR with the borrower.¹

An entity must consider all available relevant information when estimating expected credit losses, including details about past events, current conditions, and reasonable and supportable forecasts and their implications with respect to expected credit losses. That is, while the entity can use historical charge-off rates as a starting point for determining expected credit losses, it has to evaluate how conditions that existed during the historical charge-off period may differ from its current expectations and accordingly revise its estimate of expected credit losses. However, the entity is not required to forecast conditions over the contractual life of the asset. Rather, for the period beyond the period for which the entity can make reasonable and supportable forecasts, the entity reverts to historical credit loss experience.

1 ASU 2022-02, issued in March 2022, eliminates the concept of a TDR from the creditor's accounting. As a result, an entity that has adopted ASU 2022-02 will no longer be able to extend the contractual term for expected extensions, renewels, and modifications when it reasonably expects, as of the reporting date, that a TDR will be executed with the borrower.

The FASB believes that the impairment allowance should reflect management’s expectations regarding the net amounts expected to be collected on a financial asset and that, because entities manage credit risk differently, they should have flexibility when reporting those expectations. As a result, the FASB did not require entities to use a specific method when measuring their estimate of expected credit losses. Accordingly, an entity can select from a number of measurement approaches to determine the allowance for expected credit losses. Some approaches project future principal and interest cash flows (i.e., a discounted cash flow [DCF] method), while others project only future principal losses. ASU 2016-13 emphasizes that an entity should use methods that are “practical and relevant” given the specific facts and circumstances and that “[t]he method(s) used to estimate expected credit losses may vary on the basis of the type of financial asset, the entity’s ability to predict the timing of cash flows, and the information available to the entity.”

Although the method used to measure expected credit losses may vary for different types of financial assets, the method used for a particular financial asset should be consistently applied to similar financial assets.

Ways to measure expected credit losses

The table below summarizes various measurement approaches that an entity could use to estimate expected credit losses under ASU 2016-13.

Measurement approach |

High-level description |

DCF method |

Expected credit losses are determined by comparing the asset’s amortized cost with the present value of the estimated future principal and interest cash flows. |

Loss-rate method |

Expected credit losses are determined by applying an estimated loss rate to the asset’s amortized cost basis. |

Roll-rate method |

Expected credit losses are determined by using historical trends in credit quality indicators (e.g., delinquency, risk ratings). |

Probability-of-default method |

Expected credit losses are determined by multiplying the probability of default (i.e., the probability the asset will default within the given time frame) by the loss given default (the percentage of the asset not expected to be collected because of default). |

Aging schedule |

Expected credit losses are determined on the basis of how long a receivable has been outstanding (e.g., under 30 days, 31–60 days). This method is commonly used to estimate the allowance for bad debts on trade receivables. |

Looking Ahead

Although the FASB has issued several ASUs that amend certain aspects of ASU 2016-13, the Board continues to seek feedback on the new guidance. As a result of that feedback, in March 2022, the FASB issued ASU 2022-02, which eliminates the accounting guidance on TDRs for creditors in ASC 310-40 and amends the guidance on “vintage disclosures” to require disclosure of current-period gross write-offs by year of origination. For entities that had already adopted ASU 2016-13, the amendments in ASU 2022-02 became effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. For entities that had not yet adopted ASU 2016-13, the amendments in ASU 2022-02 became effective upon adoption of ASU 2016-13. Early adoption was permitted in certain circumstances.

In addition, on June 27, 2023, the FASB issued a proposed ASU that would broaden the population of financial assets that are within the scope of the gross-up approach currently applied to purchased credit-deteriorated (PCD) assets under ASC 326. Accordingly, an asset acquirer would apply the gross-up approach to all financial assets acquired in a business combination in accordance with ASC 805 rather than first determining whether an acquired financial asset is a PCD asset or a non-PCD asset. For financial assets acquired as a result of an asset acquisition or through consolidation of a variable interest entity (VIE) that is not a business, the asset acquirer would apply the gross-up approach to seasoned assets, which are acquired assets unless the asset is deemed akin to an in-substance origination. A seasoned asset is an asset (1) that is acquired more than 90 days after origination and (2) for which the asset acquirer was not involved with the origination. In addition, the gross-up approach would no longer apply to AFS debt securities. Comments on the proposed ASU were due by August 28, 2023. The Board will determine the effective date, as well as whether to permit early adoption, after considering stakeholder feedback on the proposed ASU.

Continue your current expected credit loss learning

See Deloitte’s Roadmap Current Expected Credit Losses for comprehensive discussions related to ASU 2016-13, including the highlights of the recently issued ASU 2022-02 that eliminates the accounting guidance on TDRs for creditors and amends the guidance on vintage disclosures.

Subscribe to the Deloitte Roadmap Series

The Roadmap series provides comprehensive, easy-to-understand guides on applying FASB and SEC accounting and financial reporting requirements.

Explore the Roadmap library in the Deloitte Accounting Research Tool (DART), and subscribe to receive new publications via email.

Let's talk!

Recommendations

Guidance on ASC 450 and ASC 460

On the Radar: Contingencies, loss recoveries, and guarantees

Using the equity method of accounting

On the Radar: Equity method investments and joint ventures